How To Trade Trump’s Tweets

Posted onIf you are an auto maker, defense contractor or other major U.S. manufacturer you’ve probably already been consulting with your PR firm on how to handle potential Twitter talk from President-elect Trump.

Individual investors are getting in on the game too.

Brokerage firms have seen an increase in trading activity and companies that have been called out by President-elect Trump have seen trading volumes surge.

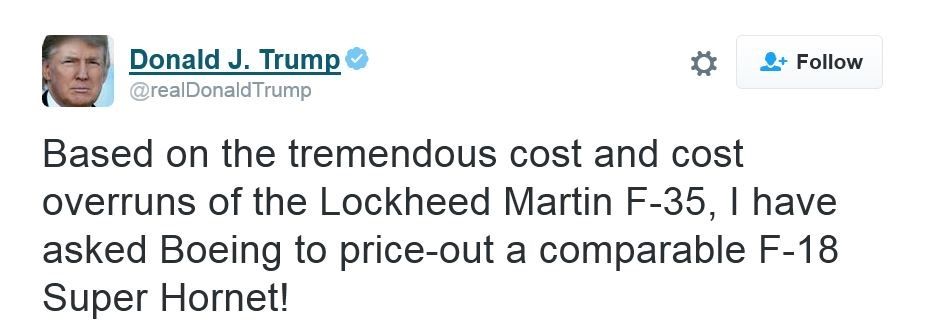

Here’s just one example:

Market reaction: This particular Twitter message drove Lockheed’s stock price into a nosedive in after-hours trading, and triggered a jump in Boeing’s

In an interview with the Wall Street Journal, TD Ameritrade Chief Executive Tim Hockey said trading surged following Mr. Trump’s win and continued to pick up whenever the president-elect targeted his tweeting at a specific company. TD Ameritrade said its average daily client trades surged 11% in the quarter ended Dec. 31.

The Tweets Are Moving Markets

A new ETRADE survey found that three-fifths of those between 25 to 34 had traded based on a tweet by President-elect Trump. The survey included more than 900 active investors, who had a minimum of $10,000 in an online-brokerage account.

How can investors trade Trump tweets?

The answer may well lie in buying physical gold as a hedge and safe-haven against broader stock market volatility and the greater unknowns of what could develop on the world political stage in the months ahead.

Some market strategists concede that investors really don’t have a choice – but must monitor the Trump twitter account – simply because the tweets are moving market. The President-elect is also making views known in the international arena regarding potential trade issues with China via the social media platform.

Rising Gold Demand Seen Ahead

The World Gold Council outlined 6 major trends in the global economy that will support gold prices in 2017. Part one of the Blanchard analysis focused on the first three factors. Read more on that here.

The second three factors – could well be triggered by the Trump twitter feed as well as new developments from the upcoming administration’s policies. Here’s a close look at them now.

Inflated Stock Market Valuation

The U.S. stock market is trading at all–time highs and, by most traditional measures, is overvalued. The current bull cycle in stocks is old – it started in March 2009 – and is vulnerable to a correction or cycle turn at any time. Bull markets don’t last forever.

Long-Term Asian Growth

Chinese and Indian investors have long shown an affinity to buying and holding physical gold. It is a cultural phenomenon backed by hundreds of years of action. The continued rise in the middle class of these growing global powerhouses means more money that can be funneled to their investment of choice – gold.

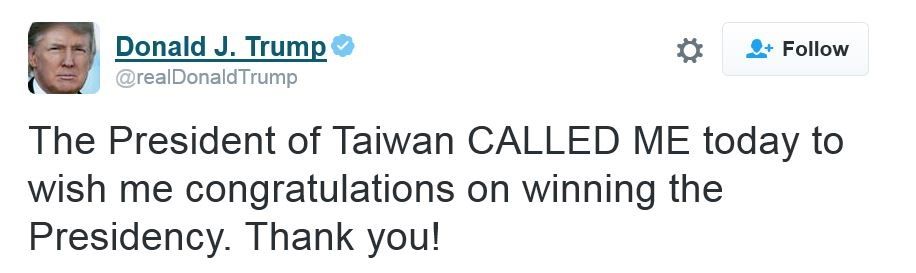

Trump’s twitter feed upset official diplomatic channels back in early December – when he messaged about his call with the Taiwanese president. He broke decades of precedent and said the “One China” policy was up for negotiation. China considers Taiwan a breakaway province, with no rights to any kind of diplomatic relations with other countries.

Tensions are running high at the start of the new Administration.

The Chinese president has already been making public statements and is poised to enter what may be a global void of leadership as the United States backs away from globalization. Look the Chinese to continue to grow their economy and to seize a greater footing on the global power stage in the months ahead. The global economy is shifting from West to the East and Trump’s policies may help speed that along.

“Macroeconomic trends in Asia will support economic

growth over the coming years and, in our view, this will

drive gold demand. In Asian economies, gold demand is

generally closely correlated to increasing wealth. And as

Asian countries have become richer, their demand for gold

has increased. The combined share of world gold demand

for India and China grew from 25% in the early 1990s to

more than 50% by 2016. And other markets such as

Vietnam, Thailand and South Korea have vibrant gold

markets too. “World Gold Council Report.

Opening of New Markets

Gold is becoming more mainstream, the World Gold Council says. While day traders may get bogged down by individual company-specific tweets, the better strategy may well be to build a physical gold position that can protect your wealth and your portfolio against a variety of risks.

What’s in your portfolio now? Call Blanchard today for a private consultation with a portfolio manager at 1-800-880-4653.