Top-5 Discoveries from the SS Gairsoppa: Silver Bars, Coins and More

Posted onThroughout history, hidden gems often emerge in the aftermath of significant historical events. A prime example lies in shipwrecks, like the SS Gairsoppa. This ill-fated vessel became a testament to an intriguing chapter for coin and history enthusiasts alike. Investigating the findings following the ship’s sinking, this article explores the iconic SS Gairsoppa silver coins and bars born from the discoveries made, focusing on:

- The SS Gairsoppa’s dramatic history.

- A comprehensive catalog of the ship’s silver findings.

- Where to source salvaged SS Gairsoppa silver.

Watch this incredible video for an in-depth look into the Gairsoppa wreck:

https://www.youtube.com/watch?v=g4vV9I21ib4

A brief history of the S S Gairsoppa shipwreck

The SS Gairsoppa was a British cargo steamship. Commissioned in 1919, it was initially operated by the British India Steam Navigation Company. Its construction, with a gross tonnage of approximately 5,237 tons, reflected the maritime standards of its era. The vessel, with a sleek length of 412 feet and a substantial breadth of 53 feet, embodied both elegance and functionality.

The Gairsoppa began its maritime journey serving as a merchant vessel. For over two decades, it traversed the seas, transporting cargo and passengers between ports, significantly contributing to the global commerce of its time.

As the clouds of World War II gathered, the Gairsoppa found itself conscripted into service under the British Ministry of War Transport. Its role evolved from that of a commercial vessel to a vital cog in the war effort, tasked with transporting essential supplies, including iron ore, from India to Britain.

In February 1941, the SS Gairsoppa set sail from Calcutta, India, as part of a convoy bound for Liverpool, England. Sailing as part of a group of vessels, navigating together for mutual protection, was a common wartime practice to ensure safe passage across the treacherous North Atlantic.

However, misfortune struck when adverse weather conditions forced the Gairsoppa to veer off course, inadvertently separating it from the convoy’s protective shield. Alone and vulnerable, the vessel fell victim to a German U-boat lurking beneath the turbulent waves, the U-101, commanded by Captain Ernst Mengersen. A torpedo fired by the U-boat found its mark, and the Gairsoppa succumbed to the icy depths of the Atlantic, approximately 300 miles southwest of Ireland.

The sinking claimed the lives of the majority of the crew, with only one survivor, Second Officer Richard Ayres, managing to endure the harsh conditions of the open sea and reach the Irish coast after days adrift on a lifeboat. Despite Ayres’ survival, the fate of the Gairsoppa remained shrouded in mystery for decades, lost in the vast expanse of the ocean. It wasn’t until the early 21st century that the ship’s story experienced a resurgence, sparking renewed interest and exploration, particularly in the realm of Gairsoppa salvage, as the wreckage was discovered and efforts were made to recover valuable cargo from the ocean depths.

In 2010, a team led by the American exploration company Odyssey Marine Exploration located the wreckage of the Gairsoppa at a depth of nearly 15,000 feet. The discovery reignited interest in the ship’s history, shedding light on the circumstances surrounding its demise and the valuable cargo it carried, namely an estimated 7 million ounces of SS Gairsoppa shipwreck silver. This revelation sparked a salvage operation, marking one of the deepest and most challenging recovery efforts in maritime history.

Photo Courtesy of Library of Contemporary History, Stuttgart

Gairsoppa silver recovery

The recovery of the SS Gairsoppa’s silver from the ocean bottom was a formidable undertaking that required cutting-edge technology and meticulous planning. The first step in the recovery process involved the utilization of remotely operated vehicles (ROVs) equipped with advanced sonar and imaging technology. These ROVs descended to the ocean floor, providing a detailed survey of the wreckage site. This crucial step allowed the salvage team to assess the condition of the ship and the distribution of the cargo, particularly the S.S. Gairsoppa shipwreck silver that held historical and monetary significance.

Upon completion of the survey, the salvage team employed specialized robotic arms attached to the ROVs for the delicate task of lifting the silver from the ocean bottom. The challenging underwater conditions, marked by extreme pressure and darkness, necessitated precision and expertise in maneuvering the robotic arms to handle the valuable metal.

To ensure the safe recovery of the vessel’s silver cargo, Odyssey Marine Exploration implemented state-of-the-art techniques for retrieval. The use of specialized equipment, such as specially designed baskets and containers, facilitated the careful lifting of the precious metal from the ocean floor. These containers were then secured to the ROVs and slowly hoisted to the surface, minimizing the risk of damage to the valuable cargo during ascent.

The recovered silver, totaling millions of ounces, marked a historic achievement in maritime salvage. Found in the form of large ingots rather than Gairsoppa coins, these substantial pieces of silver added to the complexity of the salvage operation. The Gairsoppa silver’s extraction from the ocean depths not only brought closure to the story of the iconic vessel but also showcased the capabilities of modern underwater exploration and recovery technology.

Photo by Postal Museum

SS Gairsoppa silver bar findings

The silver recovered from the Gairsoppa shipwreck took the form of large ingots. More specifically, a total of 2,792 silver bars, each containing nearly 1,100 ounces of .999 pure silver, were salvaged. Today, collectors and silver investors keen on possessing a tangible piece of maritime history can acquire the following SS Gairsoppa silver bars.

1. Original SS Gairsoppa 1000 oz bar

Remarkably, contemporary silver collectors have the unique opportunity to acquire original ingots salvaged from the SS Gairsoppa, forging a tangible link to the wartime era. Among the 2,792 silver ingots recovered by Odyssey Marine Exploration, a select 462 were made available to the public, transforming them into authentic and coveted rarities.

Minted at His Majesty’s Mint in Bombay, each original Gairsoppa silver bar is distinguished by a unique serial number and the official stamp “HM Mint Bombay,” echoing the craftsmanship of a bygone era. While the ingots do not feature a date on them, their estimated production date falls between 1829 and 1919, i.e. the dates of the HM Mint Bombay’s operation.

A particularly intriguing facet of these large bars is the discrepancy in their marked and actual weight. Although stamped as 1,041.1 ounces, the average “SS Gairsoppa silver ingot 1000 oz” has a slightly lesser recovered weight, resulting from the impact of corrosion during the silver bars’ prolonged submersion in the ocean. This natural consequence, common in shipwreck recoveries, contributes to their deeply toned condition, enhancing their authentic charm. Collectors appreciate this nuanced history, reinforcing the allure of these Gairsoppa ingots as genuine artifacts from a significant maritime chapter.

S.S. Gairsoppa Shipwreck 1,036.6 Ounce Ingot

- Metal: Silver

- Year: Between 1829 – 1919

Photo by Great Collections

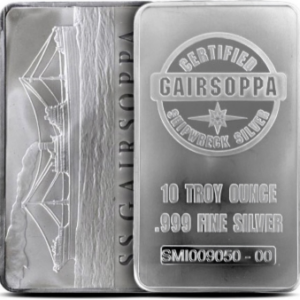

2. 10 oz Gairsoppa silver bar

Crafted as a tribute to the significance of the historic vessel, commemorative SS Gairsoppa 10 oz silver bars were made from the remaining 2,330 ingots that were not distributed to the public, offering a unique and affordable silver investment opportunity.

Meticulously produced by Sunshine Minting, a reputable private mint, each of these bars encapsulates approximately 10 ounces of .999 pure silver and bears distinctive markings attesting to its special origin. On one side, the “Gairsoppa silver bar 10 oz” features an intricate engraving of the SS Gairsoppa along the date of the shipwreck. On the other, it bears a detailed stamp indicating its weight and certification as recovered GAIRSOPPA silver. Combining a unique fusion of historical context, craftsmanship and intrinsic value, these bars constitute a prized addition to any collector’s portfolio.

10 oz. S.S. Gairsoppa Commemorative Bar

- Metal: Silver

- Year: 2013

To explore a broader array of silver options, beyond the offerings of Gairsoppa silver bars for sale, browse Blanchard’s extensive silver selection here.

SS Gairsoppa silver coin commemoratives

Unlike other famous shipwrecks, the Gairsoppa ship yielded no coins in its recovered cargo. However, following its legendary salvage operation, commemorative coins were produced to honor the historic vessel. These numismatic treasures stand as enduring tributes to the SS Gairsoppa’s unique legacy and are cherished by collectors looking for SS Gairsoppa shipwreck silver for sale.

1. 2013 50p Britannia – SS Gairsoppa silver coin

Shortly after Odyssey Marine Exploration’s salvage operation, the Royal Mint decided to issue commemorative SS Gairsoppa coins. The 2013 50p Britannia is a limited edition coin crafted with precision, featuring a quarter-ounce of pure .999 silver recovered from the sunken vessel. Its iconic obverse design by Philip Nathan showcases Britannia standing proudly with a shield, symbolizing the resilience of the British spirit. On the reverse, Ian Rank Broadley’s portrait of Her Majesty Queen Elizabeth II graces the coin.

Weighing 7.86 grams and measuring 22.00 mm in diameter, this SS Gairsoppa Royal Mint bullion coin bears a unique inscription, “S.S. Gairsoppa,” on its rim, paying homage to the ship and its crew. Limited in mintage and finished to the Royal Mint’s exacting standards, it serves as a tangible connection to the maritime history of the SS Gairsoppa, making it a prized addition to numismatic collections worldwide.

2013 50p Britannia – SS Gairsoppa

- Metal: Silver

- Year: 2013

Photo by PCGS

2. 2014 50p Britannia – SS Gairsoppa coin

Following the success of the 2013 Britannia 50p Gairsoppa coin, the Royal Mint continued this numismatic tribute in 2014. This limited edition coin, also weighing one quarter of an ounce of pure .999 silver recovered from the Gairsoppa shipwreck, features the iconic design of Britannia by Philip Nathan and Ian Rank Broadley’s portrait of Queen Elizabeth II as well.

When paired with the preceding year’s coin, Gairsoppa coins for sale offer collectors a compelling narrative of historical significance and artistic elegance, enhancing the completeness of a numismatic collection.

2014 50p Britannia – SS Gairsoppa

- Metal: Silver

- Year: 2014

Photo by PCGS

3. 1 oz S.S. Gairsoppa shipwreck silver round

First manufactured in 2014 by the Sunshine Mint in the United States, the Gairsoppa 1 oz silver round was also struck from silver salvaged from the Gairsoppa. A strikingly beautiful piece, it features a unique obverse design of the iconic ship cruising on calm waters, with a bright silver finish accentuating the scene and contrasting darker areas adding depth. Its reverse displays inscriptions for weight and purity, including “Certified Shipwreck Silver” around the central “Gairsoppa”, making it a prized collector’s item for those seeking an authentic Gairsoppa shipwreck silver round.

1 oz. S.S. Gairsoppa Shipwreck Round

- Metal: Silver

- Year: 2014

Photo by Canadian Coin Blog

Where to buy historically valuable silver coins and bars

The storied legacy of the S.S. Gairsoppa and the precious silver recovered from its depths offer not just historical value but a tangible investment in the enduring value of precious metals. To embark on this journey of acquiring a piece of SS Gairsoppa silver bars for sale, consider using Blanchard. The company’s unparalleled expertise, commitment to customer satisfaction, and comprehensive guidance make Blanchard a trusted and outstanding choice for navigating the intricate world of precious metals and rare coins. Contact Blanchard’s team of experts to explore the world of Gairsoppa shipwreck silver and other historic silver, where every piece tells a captivating tale and holds the potential for lasting investment value.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Connection between Risk Tolerance and Gold

Posted onOne of the most important questions for any investor is how much risk are you comfortable with? In investing, risk can be defined as:

- The permanent loss of your money or

- Not having money when you need it.

Both outcomes are undesirable to say the least.

Stocks are considered one of the most risky asset classes. Stocks tend to be more volatile than bonds and can deliver a higher expected return. But in exchange, stock investors take on a greater risk of loss. So, if you have 80% of your portfolio invested in stocks that is considered to be a fairly aggressive or highly risky level.

Risk tolerance measures how much risk you are willing to take on. To consider your own risk tolerance level ask yourself these questions:

- What are your investing goals?

- How soon will you need your money?

- How comfortable are you with losses?

Considering your feelings around portfolio losses is an important consideration. There have been 28 bear markets since 1928, with an average stock market decline of 36%.

However, some bear markets in stocks have been much worse—for example, the 2008 financial crisis saw a 51.93% decline in the stock market. That means if you had a one million dollar portfolio you’d have lost roughly half of your total investments. You’d have watched your million dollar portfolio sink down to $500,000 during the 2008 stock market crash.

While you can’t control the stock market, you can mitigate some of your risk with an allocation to gold.

Gold serves investors well on three key fronts. Gold provides risk management, capital appreciation and wealth preservation. Indeed, gold doesn’t just diversify your portfolio and protect your wealth—it can also help you grow your wealth. Over the past twenty years, gold has returned an average of 8.34% annually.

How much gold should you own? This depends on your risk tolerance level, your investing goals and your time horizon. But, research shows that holding between 2% and 10% of your total portfolio in gold improves portfolio performance (better returns) and reduces total portfolio losses (lower drawdowns) compared to a portfolio that doesn’t hold any gold.

Best Returns for Portfolios with 10% Allocation to Gold

Portfolios containing a 10% allocation to gold saw the largest annualized and cumulative returns, with the lowest maximum drawdown, according to State Street Global Advisors.

Today, amid warnings of an overvalued and frothy stock market, it’s worth considering if you have enough wealth protection right now. If not, the research shows that adding more gold to your portfolio is a proven solution and can help you take some of the investing risk off the table.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Could Gold Hit $3,000? Citi Analysts Say It’s Possible in 2025

Posted onGold at $3,000 an ounce? From current levels, that would mark a nearly 50% increase in price. While it’s not their base case, the global banking giant—Citi—highlighted economic scenarios which would support a massive increase in the price of gold to $3,000 in 2025.

So what could push price gold to $3,000? Aggressive central bank purchases, stagflation, and a global recession are all triggers that could drive the price of the yellow metal to $3,000 an ounce, Aakash Doshi, Citi’s North America head of commodities research, told CNBC. What are the dynamics around these three potential triggers? Let’s explore.

Central bank purchases

It’s no secret that central banks have been on a gold buying spree, with gold purchases hitting record levels in the last two years.

Why are they buying? For central banks, gold is increasingly being considered an alternative to fiat reserve currencies like the U.S. dollar, euro, and Japanese yen—and central banks are stocking up. They also see gold as a way to diversify geopolitical risk and ensure access to liquidity without credit risk.

In the first nine months of 2023, central banks bought an astonishing net 800 tonnes of gold, 14% higher than the same period last year, according to the World Gold Council.

Citi weighs in on what how that trend could support gold prices ahead: “The most likely wildcard path to $3,000/oz. gold is a rapid acceleration of an existing but slow-moving trend: de-dollarization across Emerging Markets central banks that in turn leads to a crisis of confidence in the U.S. dollar,” Citi analysts wrote in a recent note.

Stagflation

Citi’s Doshi called a stagflation scenario a “low probability”— nonetheless, gold would benefit if this were to unfold.

What is stagflation? It’s a mix of high inflation and slow economic growth. The U.S. experienced this—painfully—in the 1970’s. It’s interesting to look at how gold performed in that period.

- Between 1973 and 1979, gold produced an astonishing 35% annual return.

- In six of the last eight recessions, gold outperformed the S&P 500 by 37% on average.

These numbers demonstrate the extraordinary diversification power that gold can generate for your portfolio—especially in uncertain macroeconomic times.

Global recession

Last but not least, the last trigger that could send gold to $3,000 according to Citi is a global recession. This scenario also seen as “low probability” would force the Federal Reserve to cut interest rates quickly to help support economic growth. Typically, gold reveals an inverse relationship with interest rates, meaning as interest rates fall—gold climbs. A rapid cut in rates would be very beneficial to gold.

The bottom line

While these scenarios may or may not come to pass, what is certain is that gold continues to provide investor’s a bedrock of safety. Gold is a safe haven and performs well during economic uncertainty, stock market declines, recessions and financial crises. Gold is a dependable insurance policy for your wealth. Do you own enough to protect and grow your wealth in the months and years ahead? Even if these three scenarios don’t come to pass, Citi still forecasts a new record high for gold by the end of 2024. That will make today’s gold prices seem like a bargain.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The 1893 Queen Isabella Quarter: First U.S. Coin to Feature a Real Woman

Posted onThe 1893 Queen Isabella quarter boasts a lot of “firsts” attached to its name.

The silver commemorative coin was the first U.S. coin to feature a real woman, as opposed to the mythical Lady Liberty. The silver quarter features Queen Isabella of Spain – to honor her role in supporting Christopher Columbus’ voyage to the Americas in 1492.

The 1893 Queen Isabella quarter is also the first legal tender U.S. coin to feature a foreign monarch. Last but not least, it is also the first and only U.S. commemorative quarter dollar not intended for circulation.

The 1893 Queen Isabella quarter was minted for the World’s Columbian Exposition, which celebrated the 400th anniversary of Columbus’ journey to America. However, Queen Isabella wasn’t the only woman that is remembered today in relation to this beautiful and rare coin. The story behind the coin’s creation adds an aura of intrigue and excitement to this silver coin with a tiny mintage at 24,214.

During this period in American history, the woman’s suffrage movement was beginning to gain steam, even though it wasn’t until 1920 when the right for women to vote was granted nationally. Perhaps in a nod to that movement, the U.S. Congress authorized the formation of a “Board of Lady Managers” to help plan the 1893 World Columbian Exposition, also known as Chicago’s World Fair.

Bertha Palmer, a Chicago socialite and wife of prominent local businessman Potter Palmer, owner of the legendary Chicago Palmer House hotel was named President of the Board of Lady Managers.

Palmer worked tirelessly to help the Chicago Fair become a major success. And, it was under Palmer’s leadership and suggestion that the U.S. mint a commemorative coin with a woman on it, specifically Queen Isabella.

The Board of Lady Managers took complete charge of the quarter-dollar project and decided that the coins would feature a female motif. A depiction of Queen Isabella of Spain was chosen since it was King Ferdinand and Queen Isabella who provided the financing for Columbus’ journey to the Americas, with Isabella reportedly offering her crown and jewels if necessary to help pay for the expedition. Production of the Isabella quarter dollars began at the Philadelphia Mint on June 13, 1893.

At the Chicago Fair, sales of the Isabella quarter didn’t see huge demand. A key reason was that fair goers saw better value in the Columbian half dollar. Both the half dollar and quarter were sold for $1. Buyers preferred to go home with a 50 cent coin for their dollar instead of quarter worth 25 cents back then. It was said that Mrs. Potter herself bought as many as 10,000 of the Isabella quarters in an attempt to boost sales.

Isabella quarters were never released into circulation. And, nearly 16,000 Isabella quarters were sent back to the U.S Mint and melted down.

Despite the rocky sales at the World Fair, today, Isabellas are highly desired and strong collector demand is seen for this coin with many “firsts” and a unique back story. Collectors seek to acquire the 1893 Isabella quarter as a part of commemorative series and also seek to acquire this coin as a “type” quarter.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

5 Most Controversial Rare Coins from the US Mint

Posted on- Type 1 Standing Liberty Quarter

- 1909-S VDB Cent

- 1964-D Peace Dollar

- 1946 Roosevelt Dime

- $1,000,000,000,000 Platinum Coin

From illegal to immoral to outrageous, it turns out there’s plenty of ways for a U.S. rare coin to be controversial. Today, we explore five of the most controversial coins produced by the U.S. Mint, many of which are highly coveted by collectors in large part due to their controversy!

1. Type 1 Standing Liberty Quarter

The classic Type 1 Standing Liberty Quarter was minted in 1916 and 1917 featuring one of the most elaborate designs on any U.S. coin. Sculptor Hermon MacNeil designed this coin depicted Lady Liberty standing between to pedestals wearing a flowing gown.

The controversy? Lady Liberty’s right breast was not covered. There was an immediate public outcry over public nudity when these coins were released into circulation! The Society for the Suppression of Vice began a campaign urging the U.S. government to halt production of the coin they called “immoral” and also asked for a recall for the coins already in circulation.

The U.S. mint produced and released into circulation 55,230,000 coins before production of the Type I design was halted. In 1917, without input from MacNeil, the Liberty Quarter was restruck with a covering over her upper torso that resembled chain mail—returning dignity to Lady Liberty.

The Type 1 Standing Liberty Quarter is an early classic, highly collectable and demands a large premium over the Type II Standing Liberty quarters.

2. 1909 VDB Cent

Throughout history only a few men rose to such prominence to be instantly recognized by their initials. There’s a few: like FDR, JFK and LBJ. However, within the numismatic world, expert collectors instantly recognize the initials VDB.

Who is VDB you may wonder? Born Viktoras Barnauskas on June 12, 1871 in Shavli, Lithuania, Brenner immigrated to America arriving in 1890. Eventually, Brenner became a New York City jewelry engraver. However, his true passion was medals, sculpting and numismatics.

In 1908, President Roosevelt wanted a new coin to honor the 100th anniversary of Abraham Lincoln’s birth. Roosevelt explored the idea of featuring an image of Lincoln on the coin as he considered and ultimately accepted the proposal submitted by Victor David Brenner.

The public eagerly anticipated the release of the new Lincoln cent in 1909 as this was the first ever regular issue coin in American history to feature a real person! On August 2, 1909, the police were called in to keep the crowds in order, as the coin was distributed for the first time at a Treasury building on Wall Street.

Within a few short days, controversy and scandal broke out over Brenner’s initials V.D.B on the reverse. Public outcry and complaints emerged over the size and placement of the initials.

As the controversy swirled, only a few days after production began, Treasury Secretary Franklin MacVeagh sent a message: Stop the mints! He halted production of the coin and ordered the initials removed. In that short time, however, almost 28 million cents were struck in Philadelphia and 484,000 at the San Francisco Mint.

The Lincoln cent was the only coin ever designed by Brenner, but his tribute lives on as one of the most popular and widely used coins in American history.

3. 1964-D Peace Dollar

U.S. Mint records state that 316,076 silver Peace dollars were struck at the Denver Mint in May of 1965 (though they were backdated to 1964).

At the time, a massive silver shortage made these Peace dollars significantly more valuable for their silver content than their $1 face value. Indeed before these coins were even released to the public, private collectors were advertising offers of $7.50 each to buy the coins. Amid concerns of public hoarding, the silver Peace dollar program was cancelled and the coins were condemned to the melting pot. The 1964 Peace Dollars were never released to the public.

And, notably, today, it is illegal to possess a 1964-dated Peace dollar.

So do any still exist today? According the official story, at the time, all but two of the 1964 Peace Dollars were melted down for their silver content. The two survivors were reportedly sent to Washington, D.C., where they remained until 1970 when Mint records say they too were melted in the presence of a destruction committee.

Legend has it that there may be a survivors. There are rumors that every employee in the Denver Mint received two coins each, and it’s possible that Mint employees could have pocketed one without anyone looking. But even if a 1964 Peace Dollar were found today, it would be illegal to own since the coin was never officially monetized.

4. 1946 Roosevelt Dime

In 1946, the U.S. Treasury introduced the Roosevelt dime to honor the recently deceased president. At this point in history, the public mood of the nation was cautious. The Cold War was just beginning and Senator McCarthy had launched his anti-Communist movement.

On the dime’s design, below Roosevelt’s neck and to the left of the date a small JS is featured, the designer’s initials.

A conspiracy theory quickly spread across the nation like wildfire that accused U.S. Mint workers of being Communists, and the JS was a secret message to honor Soviet dictator Joseph Stalin. The Mint received a huge number of letters accusing them of promoting Communism with the release of the new dime. The rumors were so pervasive that the U.S. Mint had to issue a press release to dispel the controversy, but they kept the initials on the dime.

5. $1,000,000,000,000 Platinum Coin

This last controversial coin has not yet been minted. It is a proposed trillion dollar platinum coin that has been bandied about at times as a solution to the various debt limit crisis that the U.S. government has faced. On numerous occasions in recent years, the U.S. government has come up against the deadline where it would run out of money to pay its bills. In 2001, Congress passed a law that allows the U.S. Treasury to mint platinum coins of any value without Congressional approval. According to that law, the U.S. Treasury could set the coin’s value at anything, they choose. But, the coin would need to be struck in platinum, not gold or silver, nickel, bronze or copper, which are under Congress’ control.

In theory, a U.S. President could order the Treasury Secretary mint a coin with the value of $1 trillion and then deposit it into the Treasury, giving the government an extra trillion dollars to cover debts and prevent default.

The proposal has resurfaced from time to time over the years as Congress has several times faced debt limit battles. However, the proposal has been called a “gimmick” and has been met with controversy over concerns it would debase “the full faith and credit” that is currently entrusted into our nation’s currency. But, could it be done? Technically it appears yes.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Is Inflation Over Yet? Nope, CPI Data Reveals Still Hotter Than Expected

Posted onWhen you are traveling on a road trip with kids, a question you often hear is: “Are we there yet?”

For Americans tired of the high prices they see every day from food at the grocery store to personal care products, pet food and haircuts, many are asking: “Is inflation over yet?”

The latest Consumer Price Index report shows what you probably already know – inflation is stubborn and still sticking around. Yep, kind of like that house guest who has overstayed their welcome.

In January, the CPI report showed that consumer prices rose 3.1% versus a year ago. That number came in higher-than-the-expected 2.9% reading economists had forecast. The stock market sank on the news with the Dow Jones Industrial Average down more than 500 points, or about 1.4%, its worst one-day decline since March. The hotter-than-expected inflation number triggered speculation that this could hold the Federal Reserve back from cutting interest rates soon.

So, what does this mean for you?

For now, the Fed has not vanquished inflation. Every day, Americans are seeing still-high stubbornly high food prices. It’s not your imagination. Since January 2020, supermarket prices have climbed 25%, while general consumer inflation has surged 19% over that time period. The latest CPI shows that it still costs more to fill up your shopping basket at the grocery store than it did last month.

You’ve seen it firsthand. That package of cookies or crackers is literally smaller than it was two years ago. You know the rub, you pay more, but get less. It’s called “shrinkflation.” The food companies aren’t tricking anyone with that move.

For the economy, this may mean that interest rates stay high for longer than expected, but the Fed is still expected to cut rates in 2024. For many Americans there is so much that feels out of their control. And, it’s true. We can’t control the rate of inflation, we can’t control where the stock market goes and we can’t control when the Fed will cut rates.

Fortunately, as investors, there are many things in your control. That includes how you diversify your portfolio, what assets classes you add savings to and even how you save for retirement. In the midst of the stubbornly high inflation and economic uncertainty, gold continues to shine as a proven safe-haven asset for investors.

Gold gained over 14% last year and is forecast to hit new record-high levels this year. Research consistently shows that adding up to 5% or more of your overall portfolio to gold helps improve your long-term returns by decreasing drawdowns (losses) and smoothing out the ups and downs during big stock market crashes. Throughout history, gold has served as a store of value and has kept pace or outpaced inflation over the years. Wondering what your next move should be? Explore the Top Five Gold Bullion Coins for Investors article and give Blanchard a call if you’d like personalized advice. We’re here to help.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Rare Half Dollars: Coins of Your Dreams

Posted onHalf dollars, America’s 50-cent coins, were introduced in 1794. Since then, they have seamlessly integrated into the nation’s currency, today holding a cherished place in collectors’ hearts. From the classic elegance of the Walking Liberty to the symbolic Franklin and Kennedy designs, each coin serves as a poignant representation of distinct eras. This article will discuss rare half dollar coins worth money, delving into:

- The reasons for their rarity.

- The most valuable half dollars.

- Where to find these sought-after pieces.

For a comprehensive list of the most valuable rare half dollar coins, watch this insightful video:

Why are half dollar coins rare?

Over time, half dollars have evolved into captivating treasures for coin collectors, valued not just for their visual appeal but also for their rarity. Gaining an understanding of the factors that contribute to this rarity is essential for deepening one’s appreciation of these coins.

- Mintages and Production Changes: The rarity of certain half dollars can be traced back to limited mintages and significant production changes over the years. For instance, early issues like the 1794 Flowing Hair Half Dollar had minimal mintage due to the challenges of coin production during that era. Similarly, shifts in coin designs, such as the transition from the Franklin Half Dollar to the Kennedy Half Dollar in 1964, marked distinct periods of production change, influencing the scarcity of specific issues.

- Historical Events and Melted Silver: Several historical events have played a pivotal role in the scarcity of half dollars. During times of economic uncertainty or wars, coins were often melted down for their silver content. The Silver Act of 1963, which led to the elimination of silver from most circulating coins, further impacted the availability of silver half dollars. As a result, coins from these periods are now scarce, with many lost to melting or removal from circulation.

- Hoarding: Intriguingly, half dollars have faced a unique fate at the hands of coin collectors. As certain issues gained recognition for their rarity, a phenomenon of hoarding emerged. Savvy collectors, aware of the potential future value, began accumulating specific half dollars, leading to reduced availability in the market. This deliberate act of preservation has contributed significantly to the scarcity of these coins, creating a fascinating aspect of numismatic history.

- Condition and Survival Rates: The preservation and survival rates of half dollars also play a crucial role in their rarity. Factors such as exposure to harsh environmental conditions, circulation wear, and mishandling impact the overall availability of well-preserved coins. As collectors increasingly prioritize coins in excellent condition, finding rare half dollars in pristine state becomes a greater challenge, elevating the rarity of high-grade specimens.

1938 New Rochelle Silver Commemorative Half PCGS MS66

How rare is a half dollar coin?

The rarity of half dollar coins is highly contingent on factors such as type, historical context, and public reception. Initially introduced in 1794, these coins have been in circulation since the early days of the U.S. Mint and can be categorized by their different designs. These include the early half dollars, namely Flowing Hair, Draped Bust, and Capped Bust, followed by the Seated Liberty, Barber, Walking Liberty, and, lastly, Franklin and Kennedy half dollars. Today, commemorative half dollars contribute to this diverse landscape, featuring unique designs commemorating significant events.

As coin connoisseurs will know, the rarity of half dollar coins varies significantly among the different designs. Early half dollars tend to be rarer due to their age and historical significance:

- Seated Liberty and Barber designs, while still having historical value, are more accessible.

- Walking Liberty and Franklin half dollars, with their appealing designs, strike a balance between rarity and availability.

- The Kennedy half-dollar, introduced in 1964, stands out as one of the most prevalent variants, but its silver content from 1965 to 1970 contributed to its removal from circulation by hoarders. Despite being actively produced, Kennedy halves have encountered difficulties gaining modern public acceptance due to their size and merchants’ reluctance to handle them in transactions. This has contributed to their diminished use and perception of rarity as rare half dollar Kennedy coins.

- Commemorative half dollars are deliberately designed for collectors and not intended for general circulation, contributing to their inherent rarity. Some stand out as exceptionally rare, such as the 1921 Alabama Centennial half dollar.

For more information on the question “How rare is a half dollar coin?” and other pieces, consult Blanchard’s rare coins guide.

1936 Elgin Half Dollar NGC MS66

Rare half dollar coin: value for collectors and investors

Within the extensive history of half dollars, these are some stand-out pieces that have etched their mark in the world of numismatics.

1806/5 Draped Bust: a rare half dollar coin

As collectors marvel at this coin, the question naturally arises: “How rare are half dollar coins?” The 1806/5 Draped Bust Half Dollar stands as a numismatic marvel. As indicated by the absence of a mintmark on the coin, it was produced at the Philadelphia Mint with a mintage of 839,576. Its obverse and reverse design, featuring the Liberty Draped Bust, was created by Robert Scot, the Chief Engraver of the United States Mint during that period.

1806/5 Draped Bust Half NGC AU58 CAC

- Metal: Silver

- Year: 1806

- What makes this coin special: This particular specimen is set apart by its overdate feature, i.e. the digit “6” struck over a “5,” resulting from repurposing leftover dies from 1805. Beyond its minting anomaly, the coin’s well-preserved ‘Almost Uncirculated’ grade and the coveted CAC seal of approval elevate its desirability.

When it comes to rare half dollar coins (1776 to 1976), it is clear that this 1806 gem stands out and you can learn more about it here.

1861 Confederate States of America Restrike: one of the most unique half dollar rare coins

The answer to the question “Are half dollar coins rare?” is clear as far as the 1861 50C Confederate States of America Restrike is concerned. An extraordinary relic from a tumultuous period in American history, this coin was originally crafted during the Civil War by the Confederate States, a testament to their brief venture into minting currency. The obverse, borrowing from the United States Half Dollar, features a Liberty Cap above a shield adorned with seven stars and stripes representing the seceded Southern states.

1861 50C Confederate States of America Restrike NGC MS66

- Metal: Silver

- Year: 1861

- What makes this coin special: The coin’s captivating history contributes to its scarcity. The coin was first minted in very limited numbers, with only four of the original pieces documented, each gifted to notable figures like President Jefferson Davis. With the later restrike of the coin, which marked a numismatic milestone, it entered the collector’s realm. The NGC MS66 grade of this specimen, signifying exceptional preservation, further contributes to its desirability.

- Get our most current price here.

1907 Barber: one of the most sought-after rare US half dollar coins

Answering the question “Are half a dollar coins rare?” would not be complete without mentioning the 1907 Barber Half Dollar. It bears an elegant design by Chief Engraver Charles E. Barber, with Lady Liberty wearing a Phrygian cap gracing the obverse and the reverse showcasing an eagle clutching an olive branch and arrows. Struck at the Philadelphia Mint, it holds historical significance as the last year of the Barber Half Dollar series.

1907 Barber Half Dollar PCGS PR65 CAC

-

- Metal: Silver

- Year: 1907

- What makes this coin special: This coin captivates collectors with its scarcity of high-grade specimens, stemming from irregular minting quality. The irregularities in minting, ranging from striking pressure to planchet preparation, led to variations in surface conditions and details on the coins. These variations contribute to the coin’s allure, as collectors seek specimens that showcase the best possible craftsmanship despite the challenges faced during minting.

- View our most current price here.

To delve deeper into the question “Why are half dollar coins rare?”, read about Barber Halves here.

1794 Flowing Hair Half Dollar: one of the most special rare half dollar coins

The 1794 Flowing Hair Half Dollar represents the first year of the denomination, which makes this early American half dollar coin rare. Inspired by the Spanish dollar in terms of size and weight, the coin was designed by Robert Scot. Its obverse captures Liberty’s bust, encircled by fifteen stars denoting the ratified states, while the reverse presents a majestic eagle surrounded by a wreath.

1794 Flowing Hair Half Dollar

-

- Metal: Silver

- Year: 1794

- What makes this coin special: With a mintage of merely 23,464 pieces, i.e. less than a tenth of the mintage of the following year, the limited circulation of this coin is part of the reason why the 1794 Flowing Hair Half Dollar is considered very rare. With only three coins in mint state and very few well-preserved examples, collectors eagerly vie for the chance to acquire them.

1971-D Kennedy: one of the most intriguing rare Kennedy half dollar coins

For many collectors seeking out rare half dollar coins, 1971 does not stand out as a particularly exciting year. However, the 1971 Kennedy half dollar stands as a captivating exception. Despite its more recent mintage, the 1971-D Kennedy Half, also referred to as 1971- D “No FG”, is a unique variety that captures the attention of savvy numismatists. Notably, this variety is missing the designer Frank Gasparro’s initials on the reverse of the coin, near the tip of the tail feathers of the eagle, due to a minting anomaly caused by a filled die. This oversight makes this coin distinct and particularly fascinating for Kennedy Half Dollar fans.

1971-D Kennedy Half Dollar

- Metal: Copper/nickel

- Year: 1971

- What makes this coin special: What makes this half dollar special extends beyond the missing initials. Its copper-nickel clad composition, distinct from earlier silver issues, adds to its allure, as it represents a transitional phase in coinage history. For knowledgeable enthusiasts, the extremely rare 1971-D mint Kennedy half dollar coin (collector’s item) is hard to resist

1928 Hawaiian Commemorative: one of the most unique rare half dollars coins

With respect to rare coins, half dollar commemoratives, issued to mark special events, hold historical and collectible significance. The 1928 Hawaiian Commemorative Half Dollar, celebrating the 150th anniversary of Captain James Cook’s arrival in Hawaii, stands out with its stunning design. Crafted by sculptor Chester Beach, it features the portrait of Captain James Cook on the obverse and a Hawaiian standing with a spear and cloak on the reverse.

1928 Hawaiian Commemorative Half Dollar

- Metal: Silver

- Year: 1928

- What makes this coin special: This coin provides a definitive “Yes” answer to the question “Is a half dollar coin rare if it’s commemorative?”. In contrast to some other commemorative coins of the era that were issued for speculative or commercial reasons, the 1928 Hawaiian Commemorative was created with the genuine purpose of honoring Captain Cook’s landing in the Hawaiian Islands. With a mintage of approximately 10,000, the coin was an instant hit, selling out swiftly for the price of $2 upon its release. Today, the coin’s rarity adds to its appeal.

Where to buy rare US half dollar coins

In exploring this captivating realm of rare coins, one may naturally wonder, “Is the half dollar coin rare?”. As this piece has demonstrated, the answer is a resounding “yes”. Rare half dollars embody a rich tapestry of history and numismatic intrigue. From the overdated 1806/5 Draped Bust Half to the symbolic 1861 Seated Liberty Confederate States of America Restrike and the culturally significant 1928 Hawaiian Commemorative, each coin tells a unique story.

To navigate this captivating realm of rare coins, consider acquiring them from Blanchard. For insights into rare half dollar coin value and more, Blanchard team’s experts can offer trusted guidance to enhance your collecting journey.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

What Are Some Rare Coins to Look for in Your Grandfather’s Collection?

Posted onThe pursuit of rare coins often involves a combination of exploration and networking. Coin shows, reputable dealers, auctions, and numismatic events can be excellent channels for acquiring unique, valuable pieces. While these avenues are fruitful, rare coins can also be serendipitously found closer to home, namely, within the confines of your family’s history! This article will explore what rare coins to look for in your forebears’ collections, discussing:

- The elements that make a coin rare.

- Rare US coins that can be found tucked away in your family’s heirlooms.

- Foreign rare coins to look out for within your family’s legacy trove.

Watch this video for a list of rare coins to look for: https://www.youtube.com/watch?v=x2ADkijyYmA

What to look for in rare coins

While a coin’s scarcity undoubtedly contributes to its value, it’s essential to note that valuable coins are not exclusively synonymous with rare ones. The rarity of a coin is determined by various attributes. These are the main elements that allow us to classify a coin as “rare”:

- Mintage numbers: Mintage plays a pivotal role in defining a coin’s rarity. When a coin is produced in limited quantities, it becomes inherently scarce. When it comes to what to look for in rare coins, it can generally be argued that the lower the mintage, the higher the likelihood that the coin will be deemed rare and sought after by collectors.

- Age: As coins age, their numbers naturally dwindle due to factors like wear, loss, or destruction. It is important to identify rare coin years to look for. Older coins, particularly those from historically significant periods, become increasingly scarce. Their limited availability over time contributes significantly to their allure among collectors.

- Grading: The condition of a coin is crucial in determining its rarity. Grading involves assessing a coin’s condition and preserving its quality. Numismatists rely on established grading systems to evaluate factors like wear, luster, and overall preservation. A higher grade signifies better condition, adding to a coin’s rarity.

- Varieties and errors: Coins with unusual variations in design or errors not found in the standard issues can be considered rare. Some examples of rare coins to look for include misprints, die breaks, or double strike errors. Collectors often seek these coins due to their distinctiveness.

- Demand: High collector interest in a particular coin can increase its perceived rarity, especially if the demand exceeds the available supply. Coins sought after for their historical significance, unique features, or cultural relevance often become rarer due to heightened demand, contributing to their overall value in the numismatic market.

Rare US coins to look for in your grandfather’s collection

Dedicated coin aficionados will, no doubt, be familiar with the Capped Bust Dime. As the first dime that stated its face value on the coin, the Capped Bust Dime is considered a classic and constitutes one of the most popular American rare valuable coins to look for.

Capped Bust Dimes were designed by engraver John Reich and produced from 1809 to 1837. Featuring the Liberty bust wearing a Phrygian cap, a symbol of freedom, the series’ design is highly regarded for its artistic appeal.

Another noteworthy aspect of Capped Bust Dimes that makes them some of the top rare American coins to look for lies in the fact that they were created during a transitional phase of minting processes. The time of their creation marked a period when the United States Mint in Philadelphia was experimenting with different edge varieties. Notably, the 1834 Capped Bust Dime holds a unique position within the series due to its lettered edge. Adding a layer of uniqueness to the coin, this lettered edge marked a departure from traditional denticles and paved the way for the subsequent move towards plain edges, highlighting the dynamic nature of minting practices.

The 1834 Capped Bust dime is also notable because it represents one of the early years in which steam press technology was utilized. In the early 1830s, the United States Mint was transitioning from using screw presses to steam-powered coining presses. The introduction of steam technology significantly increased the efficiency of the minting process, allowing for higher production volumes and more consistent coin quality. As a result, coins from this period often exhibit sharper details compared to some earlier issues.

While Capped Bust Dimes can be difficult rare US coins to look out for in higher Mint State grades, you can see an exceptional MS64 graded one here:

1834 Capped Bust Dime NGC MS64 CAC

Metal: Silver

Year: 1834

Check our most current price here.

Feel free to reach out to Blanchard’s team for any inquiries or a rare coin look-up; they are readily available to assist you with your numismatic questions.

Circulated rare foreign coins to look for

🇨🇦 Rare Canadian coins to look for

1948 Canada Dollar

1948 Canada DollarCanadian Silver Dollars were minted from 1935 to 1967. First introduced to commemorate the Silver Jubilee of King George V, the coin’s original design featured a portrait of the King on the obverse and a voyageur and Native American on the reverse. Over time, the designs of these coins were updated but always included portraits of reigning monarchs along with symbols of Canadian heritage.

Within the Canadian Silver Dollar series, the 1948 Canadian Silver Dollar edition carries a special and unique status in terms of rare dollar coins to look for. Minted to mark Canada’s centennial celebration of responsible government, a portrait of King George VI by T.H.Paget graces the coin’s obverse, while the reverse boasts a captivating voyageur design by acclaimed artist Emanuel Hahn.

What distinguishes the 1948 Canada Dollar, however, goes beyond its visual appeal. Its allure lies mostly in its historical significance. During World War II, the production of silver coinage came to a halt, as metal resources were redirected toward the war effort. The 1948 Canadian Silver Dollar was the first silver coin issued in Canada post-war, marking a symbolic resumption of normality.

Adding to the coin’s historical significance is the backdrop of India’s independence in August 1947. Preceding this milestone, Canadian silver dollar coins featured the inscription “GEORGIVS VI D:G:REX ET IND:IMP:”, which stood for “George VI By the Grace of God King and Emperor of India.” The transition to new dies reflecting India’s independence resulted in a delay in production in 1948, impacting mintage numbers, which amounted to a mere 18,780 pieces.

The above factors combined enhance the desirability of this iconic coin, making it one of the most special Canadian rare coins to look out for.

🇬🇧 Rare UK coins to look out for

1933 George V ½ Penny

1933 George V ½ PennyBritain stands as a veritable treasure trove for numismatists, offering a rich and diverse array of historical coins that span centuries. Historical British coins tell a tale, reflecting the socio-political changes, cultural shifts, and artistic evolution that have shaped the nation over time.

The 1933 George V Half Penny is no exception. It is a prime example of what makes British numismatics a fascinating field and one of the most rare English coins to look out for if your forefathers had connections to the country.

This special coin was struck in a year that holds a special significance in British numismatics. More specifically, in 1933, the United Kingdom transitioned from using bronze for its coinage to a more cost-effective composition of copper-plated steel. This was due to economic challenges brought on by the Great Depression, which prompted a reassessment of coinage materials and costs.

The change in coinage materials and the general global economic downturn of the times also led to limited mintage numbers, which contributes to the rarity of these coins and makes them valuable for collectors today.

Nevertheless, it is important to note that the halfpenny was demonetized in 1984, and has not been used as legal tender since. This means that, while it may not be one of the most commonly encountered rare British coins to look out for, finding it would take a stroke of extraordinary luck, rendering the discovery exceptionally special.

🇦🇺 Rare Australian coins to look out for

1966 Australian Wavy “2” 20-Cent

1966 Australian Wavy “2” 20-CentCollectors of modern coins and those intrigued by pieces with a distinctive origin may already be familiar with the remarkable and elusive piece that is the 1966 Australian Wavy “2” 20-Cent. A variety of the 1966 London Mint Australian 20 Cent, the Wavy “2” is distinguished by the presence of a wavy baseline beneath the numeral “2”, setting it apart from the standard version of the coin produced that same year.

The distinctive wavy baseline on the 1966 Wavy “2” 20-cent coin emerged during the minting process at the London Mint. While the origin of this peculiar feature is unconfirmed, it is speculated to be a result of an experiment or anomaly in the die preparation. And, as is often the case in numismatics, it is this unexpected and fascinating element to the coin’s design that drives its allure among collectors.

What further contributes to the coin’s “Rare coins to look out for: Australia edition” status is its mintage numbers. Whilst its exact mintage is not precisely known, it is believed to be relatively low compared to the regular 1966 20-cent coins.

The Wavy “2”’s accidental creation, distinct design error, and undisclosed mintage quantity make it a thrilling rare coin to look for in your family’s ancestral vaults.

🇨🇭 Rare coins to look for in Switzerland

1855 Swiss 5 Francs issued by Solothurn

1855 Swiss 5 Francs issued by SolothurnAs far as rare world coins to look for are concerned, numismatists are bound to be drawn to the allure of Swiss 5 Franc Shooting Thalers. Crafted from the early to mid-1800s through the early 1900s, during a period when shooting festivals held great cultural significance in Switzerland, these coins encapsulate a unique blend of artistic expression and historical context.

Designed by various distinguished engravers, including Antoine Bovy, Friedrich Fisch, and Karl Schwenzer, Swiss Shooting Thalers were crafted to commemorate marksmanship. This is evident by the designs they bear, typically featuring rifles, crossbows, and other imagery related to shooting sports, along with symbols representing the specific canton or region hosting the shooting festival.

Among Swiss Shooting Thalers, the 1855 5 Francs issued by the town of Solothurn is a very special piece, as it held the distinction of being the sole Shooting Festival commemorative coin officially recognized as legal tender. This means that collectors who have a familial connection to Switzerland and are interested in rare silver coins to look for have a chance of coming across one, albeit given exceptional luck.

Another important thing to note about the 1855 5 Francs by Solothurn is that its edge lettering contains a spelling mistake in the word “Freischiesen”. The correct spelling of the word, which translates to “Shooting festival”, is “Freischiessen”. As tends to be the case in the world of numismatics, however, this error only adds to the appeal of this remarkable piece.

How to look for rare coins on Blanchard

While it doesn’t happen often, it is not unheard of for rare coins to hide in plain sight, going unnoticed within the confines of our ancestors’ collections. This adds an intriguing layer to the pursuit of rare pieces and underscores the importance of a discerning eye.

Notwithstanding, collectors do not have to rely on luck but, rather, can look up rare coins and source extraordinary pieces on Blanchard. Refer to Blanchard’s Rare Coins section for further insights into more valuable rare coins.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The Truth about Bank Bail-Ins: How Safe Is Your Money

Posted onKey Points

- Many big financial companies were deemed “too big to fail” during the 2008 financial crisis. This led to $700 billion in government bank bailouts at taxpayer expense.

- The 2010 Dodd-Frank Act created the framework for bank bail-ins.

- In a bail-in, a bank can take money from their depositors and bondholders to raise capital requirements and keep the bank afloat.

Bank failures – both big and small – are more common that you think. There were 566 bank failures from 2001 through 2024, according to the FDIC.

Bank failures – both big and small – are more common that you think. There were 566 bank failures from 2001 through 2024, according to the FDIC.

It begs the questions, just how safe is your money in the bank?

While government bank bail-outs were common in the past, policymakers are now turning to a new tactic called the “bail-in,” which allows banks to tap depositor’s funds to increase their capital requirements in a crisis.

What’s the difference: a bail-out vs. a bail-in?

In a bail-out, the government gives money to banks to allow them to continue operations. During the 2008 global financial crisis, the U.S. government bailed out financial firms deemed “too big to fail” like Bank of America, Citigroup and AIG, using a whopping $700 billion of taxpayer dollars.

A bail-in is the opposite. Instead of using taxpayer money, the banks can seize money from their depositors and bondholders to raise capital requirements and keep the bank afloat.

The key difference is who is responsible to keep the bank doors open. Is it the government—using taxpayer money? Or is it the bank—relying on “unsecured creditors,” aka: depositor’s money held in the bank.

Are bank bail-ins legal in the U.S.?

Yes. In 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Act, which created legal provisions for bank bail-ins. As part of that legislation, bank depositors are named “unsecured creditors,” meaning their money can be seized to increase a bank’s capital requirements. The goal? To limit the responsibility of the government to bail-out large banks if they fail.

What happened during the 2023 banking crisis?

In March 2023, Americans watched as panicked Silicon Valley Bank depositors rushed to pull their money out of the failing bank. Within 48 hours, Silicon Valley Bank collapsed, marking the second largest bank failure in U.S. history. Soon after, four other U.S. banks went under in a mini-banking crisis for a total of five U.S. banks failures in 2023.

While we didn’t see bank bail-ins happen in 2023, the use of this tactic is being debated for use in the future.

Here’s what the Yale School of Management July 2023 research paper said about the 2023 bank failures: “The FDIC could have saved $13.6 billion in the recent failures of three large banks if regulators had earlier held the banks to the total loss-absorbing capacity”

The tide is turning. And, banks may be forced to do to bail-ins if they face financial trouble ahead.

How you can avoid becoming a victim of the next bank failure.

- Don’t put more than $250,000 in any one bank. FDIC insurance protects the first $250,000 in an account. So, spread your money around between different banks.

- Monitor your bank’s financial situation. If a bank is publicly traded, review the bank’s financial statements on the investor’s relations page. The balance sheet will reveal the bank’s assets/liabilities and whether or not the bank is profitable.

- Keep some of your money out of the banking system. Consider keeping cash in safe deposit boxes or home safes.

- Diversify with physical gold and silver. Owning and diversifying your wealth with physical gold and silver is an avenue to keep a portion of your wealth outside of the banking system. It’s easy to purchase precious metals bars and coins, they are easily transportable, and can be turned into paper money in any country around the world.

Gold and silver have been a store of value for 5,000 years and these highly valued precious metals continue to offers investors today a time-honored vehicle to protect and growth your wealth. It’s no surprise that more and more Americans are turning to the safety of gold today. Have you considered if you own enough?

Read more

Silicon Valley Bank Failure Reminds Us of the Security Gold Provides

Gold Soars As Bank Failures Spark Worries of Larger Crisis

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

4 Unique Pattern Coins Housed at the Smithsonian

Posted on- 5 Dollars, Pattern, United States, 1865

- 50 Dollars, Pattern, United States, 1877 – The “Half Union”

- 50 Cents, Pattern, United States, 1891

- 5 Cents, Pattern, United States, 1913 – The Buffalo Nickel

The Smithsonian is the largest museum complex on the planet. The United States’ treasured National Numismatic Collection lives within this impressive center at the Smithsonian’s National Museum of American History in Washington D.C.

The National Numismatic Collection includes roughly 1.6 million monetary objects and is believed to be the biggest money collection in the entire world and is unrivaled in its extraordinary collections. Many of its legendary coins are rarely seen.

Some of our nation’s most unique and celebrated pattern coins are protected at the Smithsonian for current and future generations. Pattern coins are those in which the design is struck for the purpose of evaluation only. If the design is approved, only then will the coin be produced for circulation.

All four of the below historic rarities are nestled among the greatest numismatic treasures in the Smithsonian collection in our nation’s capital. Let’s take a look.

1) $5 Dollar, Pattern, United States, 1865

Christian Gobrecht designed the stunning 1865 Half Eagle Gold $5 pattern coin. The obverse features the Lady Liberty facing left. She wears a coronet inscribed LIBERTY. Thirteen stars encircle the coin with the date: 1865 below the bust. The reverse showcases a dramatic eagle with its wings stretched wide with a protective shield covering its breast. The eagle carries three arrows and an olive branch with its talons. The motto IN GOD WE TRUST is on a scroll above the eagle’s head. Only two examples of this pattern were struck and one of them is housed at the Smithsonian.

2) $50 Dollar, Pattern, United States, 1877 – The “Half Union”

The gold rush in California prompted San Francisco business leaders to lobby congress for gold pieces with high denominations so bankers could quickly count the coins. There were more U.S. pattern coins produced in 1877 than any other year in American history!

Chief Engraver of the mint at the time, William Barber, designed the 1877 $50 Gold Pattern Coin, which is the largest U.S. pattern coin ever struck. This legendary coin was never struck for circulation and the pattern is safely ensconced at the Smithsonian museum for posterity.

3) 50-Cent, Pattern, United States, 1891

Charles E. Barber, the sixth chief engraver at the U.S. Mint, designed some of America’s most famous and best-loved coins. Barber worked at the U.S. Mint from 1879 to 1917, where he created numerous patterns including two unique 50-Cent Pattern coins in 1891, which are both housed at the Smithsonian’s National Museum of American History.

On the first 50-cent pattern, the obverse features a Capped head of Liberty facing right encircled by stars with the date below. The reverse highlights an Eagle, with stars and clouds above, encircled by an elaborate wreath. On the second 50 cent pattern, the obverse features a full length Lady Liberty facing left, with an imposing Eagle in the background. Rays are seen on the top half of the coin radiating from the center. Notably, some called Barber’s design “cluttered.”

4) 5-Cent, Pattern, United States, 1913 – The Buffalo Nickel

The 1913 Indian Head 5-cent piece pattern is a beloved rarity in the numismatic community, fondly known as the “Buffalo nickel.” Designed by James E. Fraser, the magnificent design on the reverse is instantly recognizable right-facing profile of a Native American man, with a Buffalo on the reverse with UNITED STATES OF AMERICA around the top and FIVE CENTS at bottom.

The memorable Buffalo nickel design was almost abandoned amid protests from the American vending machine industry, who thought the coin wouldn’t work within their machines properly. Fortunately, their concerns were unfounded. The Philadelphia Mint produced this arresting pattern coin in 1913 and while it is currently not on view, it is stored safely at the Smithsonian Museum.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.