The Hidden Risk of Money Market Funds

Posted onIf you are parking your sidelined cash in a money market fund, caveat emptor.

That’s Latin, of course, for let the buyer beware.

Long thought to be a safe harbor in turbulent times, money market funds are showing their true stripes these days. Few investors read the fine print on their investment company’s website or obscure SEC documents, so we are detailing current issues you need to understand here.

Long gone are the days when you can earn even 1% on a money market fund.

Today, the national average for a money market yield is 0.09%.

In fact, business is so bad in the money fund industry, Fidelity liquidated and closed two of its prime money market funds this month (June 2020).

A little history – breaking the buck

Investors’ park cash in money market funds that they want to keep safe. Investors believe that these accounts are secure, safe and can’t lose money.

Yet, that is not true.

Money market funds seek to keep the net asset value (NAV) at $1. There is a phrase called, “breaking the buck,” which means if the NAV falls below $1, investors will lose money.

In the midst of the 2008 financial crisis, a major money market fund – The Primary Fund, which had about $65 billion in assets – broke the buck. Initially, The Primary Fund reported that, until further notice, it would delay paying redemptions to customers for up to seven days, as permitted under mutual fund law. Source (NY Times)

Eventually, because the value of investments fell (the fund held a lot of debt from bankrupt Lehman Brothers) – it was forced to liquidate and investors in that money market fund only received 97 cents for each dollar invested.

What is going on with money markets?

The current zero interest rate environment and the specter of negative interest rates is making these funds even more risky now.

A money market fund generally holds investment-grade short-term government bonds that mature somewhere between 30 and 90 days. Some money market funds also hold triple A–rated corporate debt.

What happens when interest rates are zero or negative?

They lose money.

It’s important to remember that money market funds are not insured against loss by the FDIC. Here’s what the Consumer Financial Protection Bureau (CFPB) says:

“Money market funds are offered by investment companies and others. Money market funds are not insured by the FDIC or the NCUA, which means you could possibly lose money investing in a money market fund.” (Source: CFPB)

What will happen to your money?

Major investment companies are addressing the issue of negative interest rates and the impact on money markets funds on their websites – if you look for it. That shows that investors are asking questions about this – and the funds are tacitly acknowledging that that negative rates may cause a run on the funds.

Will you be able to withdraw your funds with these restrictions in place?

You may need to wait up to 10 business days to withdraw your funds from a money market fund and pay a “liquidity fee” to get it. And, these accounts have ‘broken the buck’ in the past – which means you may get back less than you initially deposited.

Charles Schwab notes it is permitted to impose a liquidity fee up to 2% on redemptions.

Here’s the info straight from the SEC’s documents:

“The SEC also is adopting amendments that will give the boards of directors of money market funds new tools to stem heavy redemptions by giving them discretion to impose a liquidity fee if a fund’s weekly liquidity level falls below the required regulatory threshold, and giving them discretion to suspend redemptions temporarily, i.e., to “gate” funds, under the same circumstances. These amendments will require all non-government money market funds to impose a liquidity fee if the fund’s weekly liquidity level falls below a designated threshold.” (Source: SEC rules).

Negative rates could cause a run on money market funds, which could send these funds spiraling lower fast.

Here’s the hard truth.

- You aren’t making any money holding funds in a money market fund (0.09% interest rate).

- The NAV of your money market fund could go below $1.

- You may have to pay up to a 2% liquidity fee to get your money back.

- You may have to wait up to 10 days to get your money back.

Where can investors park assets to ride out the pandemic in safety?

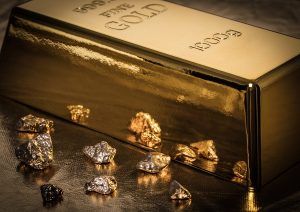

Gold and silver.

- Gold and silver are a tangible assets.

- They are highly liquid. Gold and silver can be quickly sold for cash on the spot – in any country around the world. Gold is one of the most liquid financial assets in the world.

- Gold is rising in value. In fact, gold is up 16% year to date!

- It is non-correlated to stocks – when stocks go down, gold rises.

Consider increasing your allocation to gold now. Get asset preservation, liquidity and rising value all in one golden package.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.