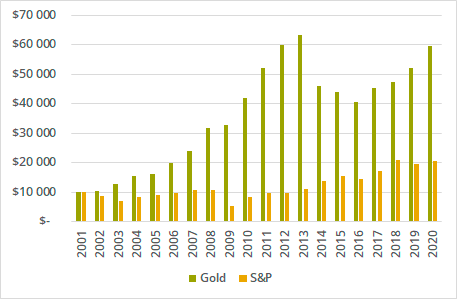

Gold: The Ideal Complement to Stocks

Moves Independently from Traditional Securities

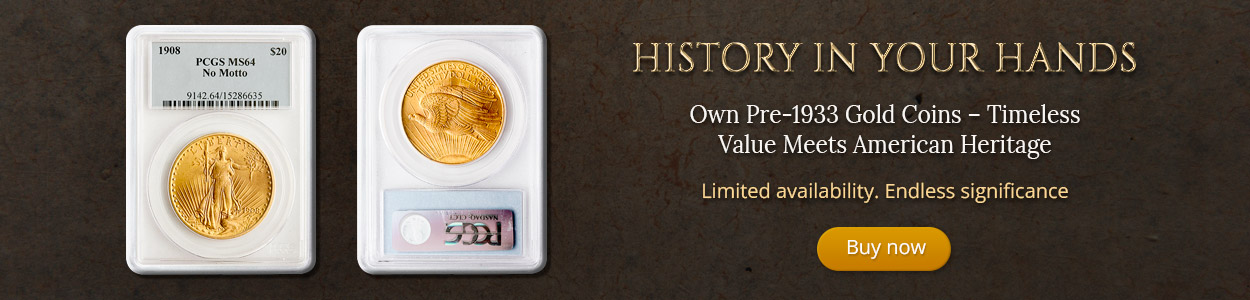

Gold is a physical asset, meaning you own something you can hold that has inherent value. In contrast, stocks are equities that signify partial ownership in the issuing company, with no inherent value.

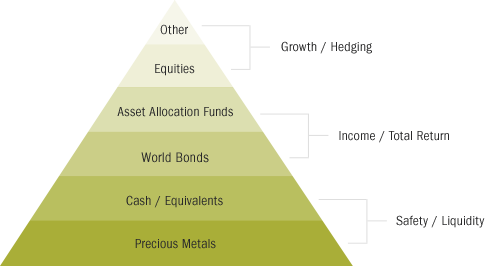

Gold is also among the most negatively correlated assets to stocks -when stocks go down, gold prices go up. That is why we strongly recommend allocating up to 20% of your overall financial portfolio to precious metals and rare coins.

Gold, ETFs and Mining Shares: A Comparison

Gold

Strengths

- A physical holding with inherent value

- Hedges against paper stocks volatility

- Balances portfolio performance

- Protects against bank failures

- Private, with minimal reporting requirements

- Great liquidity; considered a currency

- Nominal spreads

Considerations

- Must be physically held, stored and secured

- Must be purchased from reputable vendor to ensure quality and security

ETFs

Strengths

- Easy way to trade on gold prices

- Can be part of a larger account for diversification purposes

- Can buy and sell quickly

- Good choice for short investment horizons

- Private with minimal reporting requirements

- Great liquidity; considered a currency

- Nominal spreads

Considerations

- A paper stock; holds no inherent value

- Susceptible to exploration risks and geological/meteorological challenges

Mining Shares

Strengths

- High risk, with high potential rewards

- Can buy and sell quickly

Considerations

- A paper stock; holds no inherent value

- Susceptible to exploration risks and geological/meteorological challenges

- High reporting requirements

- Prone to leadership or human resources issues