Blanchard Index

Exclusive Precious Metals Market Outlook and Recommendations

Index updated October 1, 2024

The Blanchard Monthly Index is a roll-up of industry news and economic trends affecting the precious metals market and trading world.

Check back each month for insights and commentary from our leading experts and contributors.

The Blanchard Economic Report

Fed Kicks off Rate Cut Cycle: Gold Sets New Record High in September

For many Americans it’s been a long wait. In September, the Federal Reserve finally cut interest rates and provided relief to millions of Americans who have been wanting to buy homes, cars and big-ticket items but high interest rates have stood in the way. Last month, Fed policy makers pulled the trigger on the first interest rate cut in four years.

In the precious metals markets, the reaction was immediate.

Investors bought gold which pushed the precious metal to another new record high. In September, gold soared to a record high at $2,670 an ounce, while silver soared to a 12-year high at $32.00 an ounce. Gold is up 24% since the start of the year and silver has gained 28% amid a voracious appetite for the safety of precious metals.

The Fed went big with its first interest rate cut of this cycle with a jumbo sized half percent cut, bringing the Fed’s benchmark rate to 4.75% to 5.00%.

What does this mean for metals investors? Gold trends higher for nearly two years once the Fed begins cutting interest rates. Research from the Wells Fargo Investment Institute reveals that the start of Fed rate cutting cycles are extremely positive for gold ahead: “The average price of gold has tended to rise quite nicely and for nearly 21 months, following the start of past Fed interest-rate easing cycles.”

Expect lower rates ahead. The September Fed rate cut is thought to be the first of many. In fact, fourteen of the 19 of central bankers expect interest rate cuts of at least 2 full percentage points by the end of 2025, according to the latest Fed meeting results.

What about the Economy and Jobs?

The latest government data reveals that job growth is slowing. Over the past three months, the number of new non-farm jobs fell from an average of 250,000 per month in 2023 to just 116,000 new jobs per month.

The high level of interest rates has been one factor weighing on job growth and is slowing the overall economy.

Employers have pulled back on hiring as high interest rates has slowed consumer buying of big-ticket items from homes to cars to furniture. The slower consumer demand hurts profit margins, so employers pull back on new job creation. This adds fuel to speculation that the Fed may need to continue to go big with future interest rate cuts and may need to slash rates by another half percent at its meeting on November 6-7.

Market Volatility and Uncertainty Ahead of Presidential Election

Another factor injecting uncertainty into the financial environment is the November presidential election. Polls reveal a near dead heat between Donald Trump and Kamala Harris. And investors and Wall Street are bracing for what could be two extremely different policy directions on issues like taxes and trade and what that could mean for the economy ahead.

This all adds up to a stock market vulnerable to big swings up and down. That’s another reason that investors have been piling into gold this year. Gold is a proven hedge against declines in the stock market. Consider this.

- During the 2001 dot.com stock market crash, the S&P 500 was down 47% and gold was up 16%.

- During the 2008 global financial crisis, the S&P 500 was down 55% and gold was up 21%.

Key Takeaways

The start of the Fed easing cycle is positive for the precious metals complex and will help gold continue to power higher in the months ahead. New forecasts from Citi Research reveal analysts there say gold could reach $3,000 an ounce by mid-2025 amid the interest rate cutting cycle and strong physical demand.

These forecasts reveal lots of performance gains ahead, meaning it is still an optimal time to increase your allocation to gold.

How much is enough? Research from the well-respected CPM Group stated that over the past 50 years, the best return of a portfolio including stocks, bonds, and gold was for portfolios that had around 25% – 30% of their value in gold. This new phase in the gold rally is just getting started, with $3,000 as the next major target. If you’ve been considering buying gold, this is the perfect time to make your move.

Our Recommendations

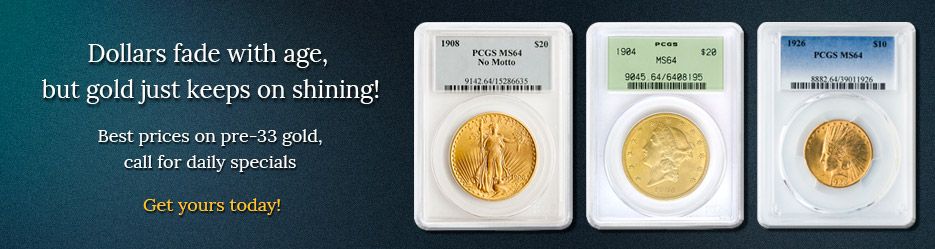

The high-end rare coin market remains an attractive buying opportunity for long-term investors. Rare coins offer investors an opportunity for significant price appreciation in the current environment.

The appeal of rare coins to investors is their impressive historical price appreciation, which has outpaced the level of the underlying precious metal.

Buying Rare Coins

For investors able to hold 5–10 years, ultra-rare acquisitions offer the safest store of wealth and the strongest growth potential. Accumulate the highest-quality coins that you can afford. This strategy will pay off handsomely as rarity tends to appreciate the fastest.

Buying Precious Metals

An accumulation strategy is probably the best option for clients wishing to add to holdings.

Trading Precious Metals

Silver continues to offer a better value than gold. Generally, readings above 65 signal that silver is undervalued and is a strong buy signal for the metal.

The gold/silver ratio is a way for investors to measure the relative value of these two metals. The ratio indicates the number of ounces needed to buy one ounce of gold. Investors have long turned to this ratio to identify attractive long-term entry points for precious metals purchases. A high ratio is generally viewed as a signal that silver is undervalued relative to gold. That is what we’re seeing now.

Current Ratio: 83 oz. silver = 1 oz. gold

You may want to consider converting some gold holdings into silver.

Popular silver products: 10 oz. & 100 oz. silver bars, Silver American Eagles in monster boxes.