Rare Coin Guide

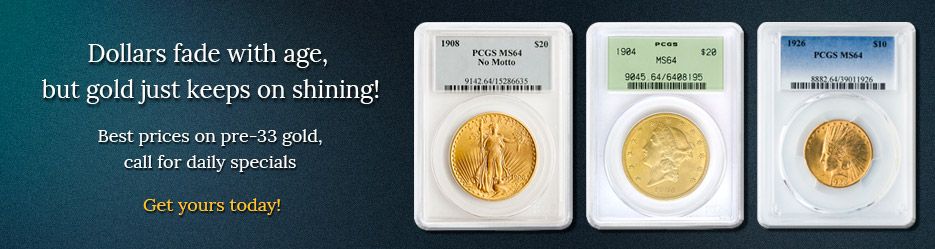

U.S. GOLD COINS

U.S. SILVER COINS

U.S. NICKEL &

COPPER COINS

COMMEMORATIVES

KEY DATE

PROOF

SHIPWRECK

ROMAN

6 Tips for Smart & Profitable Rare Coin Investing

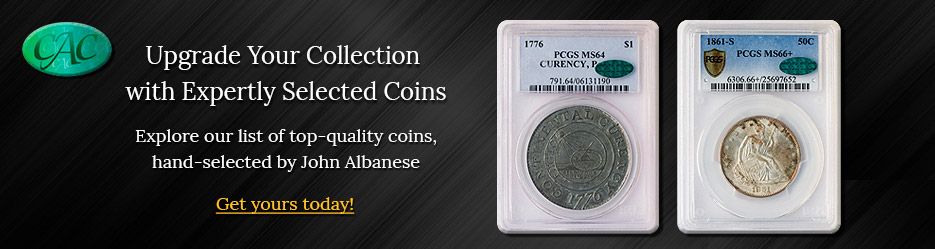

Choose quality over quantity.

The value of a few high-quality rare coins will far surpass the value of lower-quality coins in greater numbers — especially if those high-quality coins comprise a complete coin set.

Look for low survival rates.

According to the Professional Coin Grading Service (PCGS) and Numismatic Guaranty Corporation (NGC), coin issues with the fewest coins in existence are the most scarce. Scarcity creates ongoing demand and keeps coin values high regardless of economic conditions.

Target “sleepers” and “stoppers.”

Sleepers are rare coins considered to be undervalued in terms of their relative rarity. Stoppers are the coins that have historically presented the greatest difficulty in completing a set. Acquire either and the potential return will be tremendous.

Get experienced professionals working for you.

Unlike bullion coins that are bought in bulk, rare coins must be carefully chosen on a one-by-one basis, and this requires a highly trained eye to spot opportunities. Our job is to help you.

Buy certified only.

Insist on investing in rare coins that have been graded, certified, and “slabbed” (sealed in a plastic case) by either PCGS or NGC. This not only ensures quality and authenticity but also enhances a rare coin’s value and makes it easier to sell.

Contact Blanchard today.

Are you just getting started with rare coin investing? Are you a seasoned collector looking for that final piece to complete a set? Either way, we can help you find what you need with the highest levels of speed, confidence, and personalized service. Contact us today to get started.