Rare Coins Guide

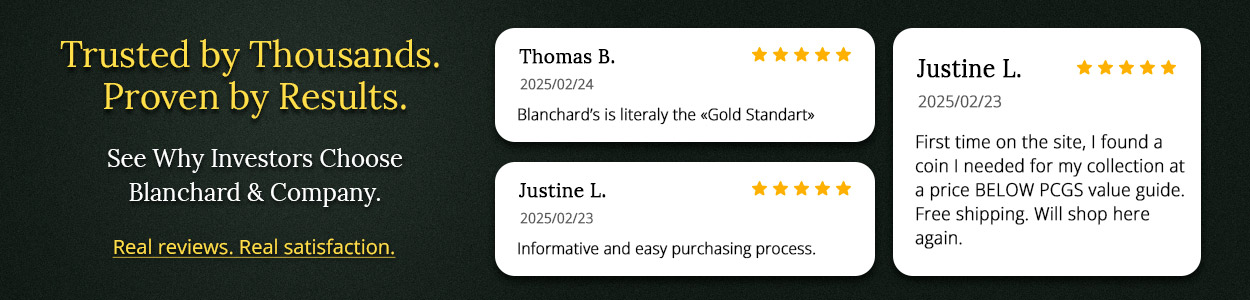

Blanchard proudly offers the finest selection of quality graded rare coins available for online purchase. Our coins are handpicked by the top numismatist in the industry. We have thousands of rare gold and silver coins in inventory, if you do not see what you are looking for below, please call us today. Learn more

SMALL CENTS

Lincoln, Wheat Rev (1909-1958) [2]

NICKELS

HALF DIMES

QUARTERS

Proof Barber Quarter [1]

DOLLARS

Draped Bust Small Eagle (1795-1798) [1]

Draped Bust Large Eagle (1798-1804) [4]

Proof Liberty Seated, No Motto [2]

Morgan Dollars (1878-1921) [240]

Peace Dollars (1921-1935) [40]

GOLD DOLLARS

Proof Gold Dollars Type 3 [1]

THREE DOLLAR GOLD

QUARTER EAGLES

Classic Head (1834-1839) [1]

Liberty Head (1840-1907) [3]

Proof Liberty Head [3]

Indian Head (1908-1929) [7]

HALF EAGLES

Draped Bust Large Eagle (1795-1807) [4]

Capped Draped Bust Ty 1 (1807-1812) [3]

Classic Head (1834-1838) [1]

Liberty Head No Motto (1839-1866) [4]

Liberty Head W/ Motto (1866-1908) [5]

Proof Liberty Head W/ Motto [1]

Indian Head (1908-1929) [6]

EAGLES

Liberty Head NM Cov Ear (1838-1839) [1]

Liberty Head No Motto (1839-1866) [3]

Liberty Head W/ Motto (1866-1907) [6]

Proof Liberty Head W/ Motto [1]

Indian Head No Motto (1907-1908) [4]

Indian Head W/ Motto (1908-1933) [6]

DOUBLE EAGLES

Liberty Head Type 2 (1866-1876) [6]

Liberty Head Type 3 (1877-1907) [15]

St Gaudens High Relief (1907) [3]

St Gaudens No Motto (1907-1908) [2]

St Gaudens W/ Motto (1908-1933) [11]

GOLD COMMEMORATIVES

Gold Commemorative $2.50 [2]

SILVER COMMEMORATIVES

Roanoke [1]

TERRITORIALS

Colorado [2]

COLONIAL ISSUES