6 Trends That Support 2017 Gold Demand

Posted onIn a new report, the World Gold Council has identified six key trends that will support continued gold demand in 2017. These include:

- Heightened political and geopolitical risks

- Currency depreciation

- Rising inflation expectations

- Inflated stock market valuation

- Long-term Asian growth

- Opening of new markets

GEOPOLITICAL RISK

Political risk is rising around the globe. The World Gold Council pointed to a number of upcoming elections in Europe in 2017, including Netherlands, France and Germany.

Some market watchers have warned that the outcome of these elections could prove to be a destabilizing force for the European Union, depending on the votes. Rising waves are populism are seen in Europe and there is speculation that Russia could attempt to influence the European elections.

The Eurasia Group outlined top geopolitical risks in its 2017 outlook report > Read it here.

Closer to home, one of the worries for financial markets are trade policies. There is “a meaningful risk that negotiations on trade will turn belligerent” and suggests that “confidence in markets could be affected by geopolitical tensions triggered by the new administration,” says Jim O’Sullivan, Chief US Economist at High Frequency Economics, in the World Gold Council Report.

As a high-quality, liquid asset, gold benefits from safe-haven inflows, which could emerge from rising geopolitical risks in 2017.

CURRENCY DEPRECIATION

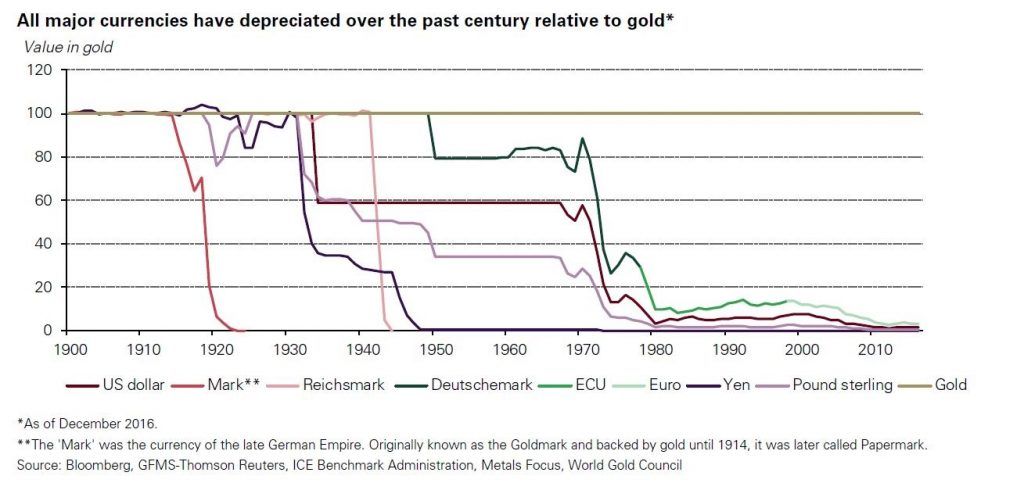

Paper (or fiat) money has fallen in value over the last century, while gold has vastly outperformed. See Figure 1 below.

Over the past century, gold has vastly outperformed all major world currencies as a means of exchange, the World Gold Council says.

A key reason for this is:

- The available supply of gold changes little over time, growing about 2% per year through mine production

- That compares to paper money, which can be printed in unlimited quantities to support monetary policies.

Since the global financial crisis, central banks around the globe have turned to quantitative easing or “money-printing” policies in an attempt to stimulate economic growth. At its heart – that devalues the paper money. It is simple economics – more supply of anything decreases its value.

Investors have turned to physical gold investments in recent years in an attempt to preserve the wealth and protect it from depreciating paper money values.

RISING INFLATION EXPECTATIONS

The World Gold Council points to expectations that inflation will rise in 2017 as another factor that is supportive to gold demand.

“An upward inflationary trend is likely to support demand for gold for three reasons. First, gold is historically seen as an inflation hedge. Second, higher inflation will keep real interest rates low, which in turn makes gold more attractive. And third, inflation makes bonds and other fixed income assets less appealing to long-term investors.” – World Gold Council report

It is well known that gold holds its value and often increases significantly during inflationary periods. What is not as well known is that rare coins are an even better hedge and tend to rise in price even faster than gold during inflationary periods.

Read more: Rare Coins Are An Excellent Hedge Against Inflation

Stay updated with the latest gold market news: Subscribe to the Blanchard Newsletter (scroll to bottom of the page).

Check back here on Thursday for part 2 of this report and a look at the final 3 factors that the World Gold Council believes will support gold demand in 2017.

Blanchard and Company has was founded in 1975 and has a rich legacy of helping individual investors access the gold and rare coin market. We believe that gold and silver bullion in physical form is an appropriate asset for a small portion of any properly diversified investment portfolio. Contact Blanchard at 1-800-880-4653.