Feeling a Bit “Flat”? Here’s Why

Posted onDespite surging GDP growth and a strong employment picture, some analysts are starting to feel a little “flat.”

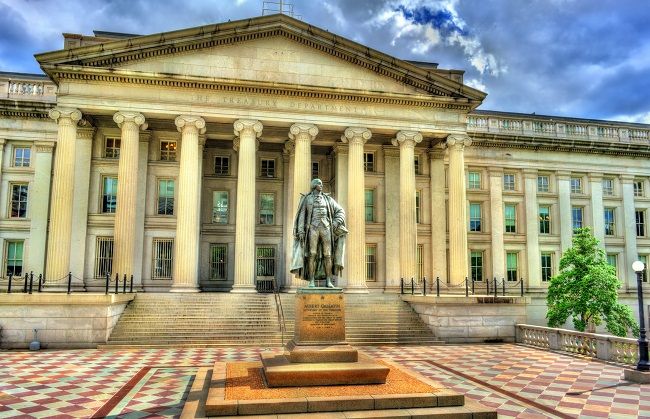

The yield curve is the yield spread between long-term and short-term U.S. Treasury bonds. This graphed line has long been a popular economic indicator. Today, the curve is starting to flatten, and that has some worried. The reason: a flat yield curve brings us closer to an inverted yield curve, which, historically, has been followed by a recession.

The pattern unfolded during the dot com bust of 2000 and again during the global financial crisis starting in 2008. Financial forecasters call this “economic deceleration.” The rest of us call it “hard times.”

One fact is clear; the curve is not invented yet. It’s starting to get closer to that position, but for now, we aren’t there. The bending, and flexing of the curve has implications for gold investors because “investors have generally benefited from holding gold during periods of economic deceleration,” according to The World Gold Council.

However, some, like those at Morgan Stanley, are taking a contrarian position and explaining that the flattening curve “sends a weaker predictive signal about the future state of the U.S. economy than it has in the past. They continue, explaining that “we’re not worried about an impending recession since we believe that today the slope of the yield curve sends a weaker signal and it would therefore take more flattening than ordinary to have the same impact on future growth than it had in the past.”

Even if the “danger” signal isn’t blinking yet, gold investors may want to take note because historically, gold has experienced an upswing in value during periods of rising inflation. Recently, inflation has ascended to target levels with the US hovering around 2.5 percent and the Eurozone at about 1.9 percent. This upward movement has been long in coming. In recent years inflation has remained stubbornly low.

The World Gold Council suggests that recent decreases in gold’s value might increase customer demand given that lower prices support jewelry purchases. Simultaneously, they illustrate a historical seasonality to gold as illustrated by softer demand and diminished trading in the summer months with a clear uptick in September. This data, coupled with rising concerns of an inverted yield curve, might leave gold enthusiasts positioned for a window of opportunity.

As always, the appropriate plan is one with a long-term perspective. Whichever way the yield curve bends, gold has a place as a diversifier in any portfolio. Moreover, as future expectations for long-term equity returns start to cool, investors will need new ways to find growth. Consider that in the most recent, incomplete cycle, equities have returned only 5% annually, and “JPMorgan predicts returns of 3.3% for the S&P 500 over the next decade,” according to The Wall Street Journal.

Part of the reason for this tepid outlook is the currently high valuations. Companies will need to boost their already strong performance to validate and surpass these valuations. The yield curve, seasonality, and easing equity returns all give investors reason to consider gold.