Gold Alert: Fed Meeting, Jobs Data This Week

Posted onGold prices gained modestly on Friday, boosted by news that the U.S. economy registered its slowest economic growth reading in three years, which triggered doubts over the health of the current expansion phase.

Spot gold traded up to $1,268.80 an ounce on Friday after the government reported first quarter GDP rose a weaker-than-expected 0.7%.

No government shut-down, this week: Congress on Friday passed a one-week stop-gap spending bill to avoid a partial government shutdown. The stop-gap measure keeps the government open until May 5, so fresh solutions will need to emerge this week.

Gold Market News

A number of key events lie on the docket this week that could impact the gold market including the Federal Reserve’s meeting and Friday’s release of the monthly U.S. jobs report.

1. Fed Meeting This Week

The Fed’s two-day policy setting meeting begins on Tuesday and concludes on Wednesday when the committee will release its policy statement at 2 pm.

The current Fed funds rate stands at 0.75-1.00%.

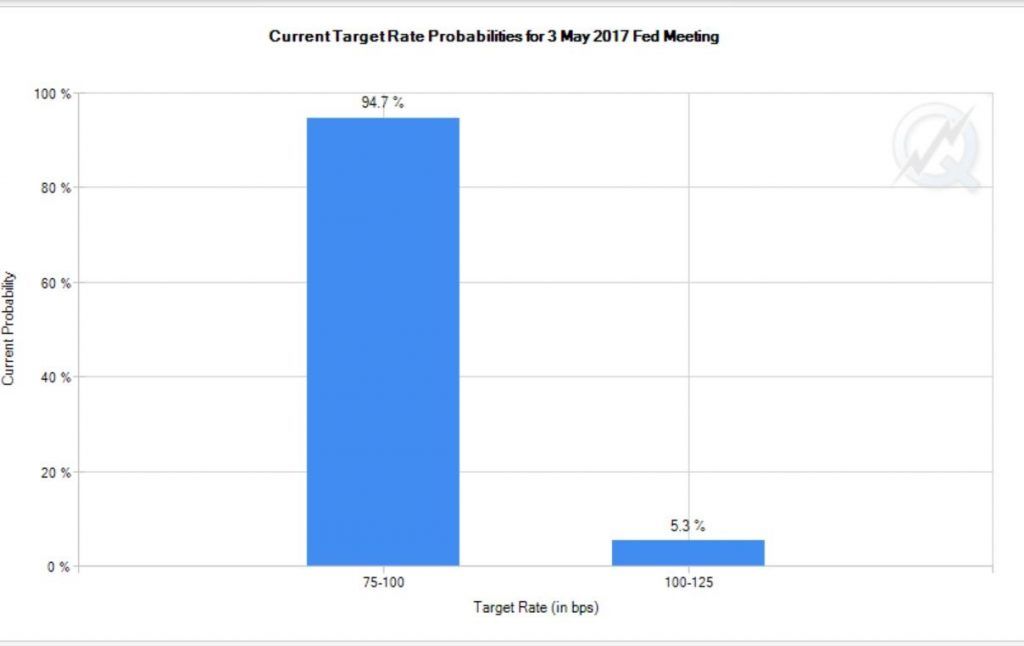

The CME FedWatch tool is a handy guide to show what the market expects to happen at Fed meetings. The chart below shows only 5.3% odds the Fed will hike interest rates to 1.00-1.25% on Wednesday.

Yes, Wall Street expects the Fed to keep policy on hold at this week’s meeting. There is no press conference scheduled or updated economic projections expected with this meeting. Economic growth and inflation data have been sluggish lately and traders will be watching for clues regarding the Fed’s next moves in the statement on Wednesday afternoon.

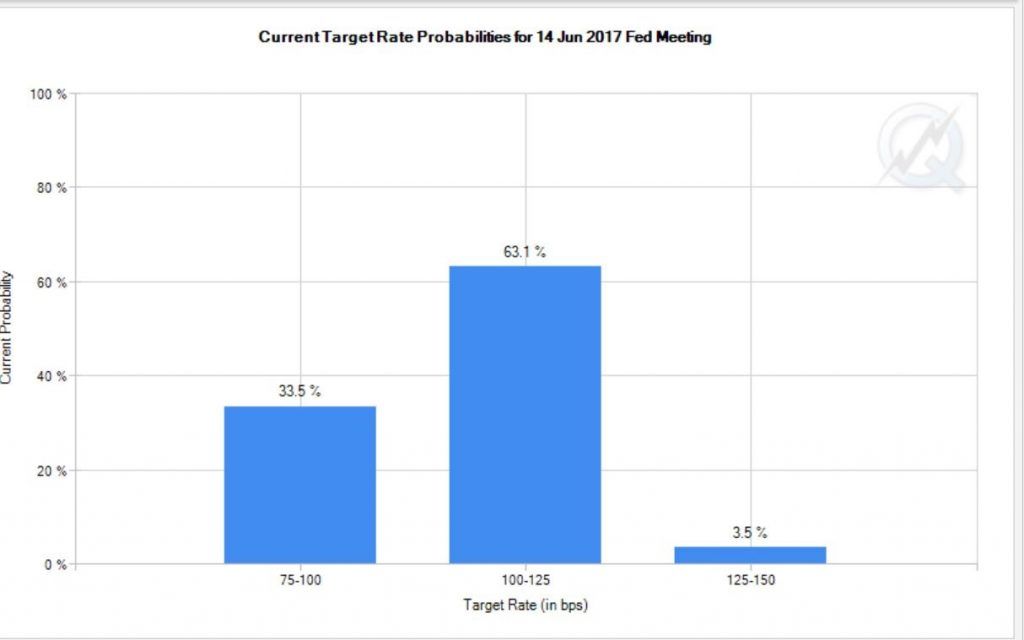

Looking ahead: the Fed meets next on June 13-14, and that meeting will be accompanied with a Summary of Economic Projections and a press conference with Fed Chair Yellen.

The picture looks very different for expectations in June. The CME FedWatch chart below shows the market is currently pricing in 63.1% odds of a rate hike next month.

2. Friday’s release of the April U.S. jobs report

After financial markets have digested any fresh news from this week’s Fed meeting, focus will turn swiftly to Friday’s release of the key U.S. employment report for April. After the surprising slowdown in March, Wall Street will be looking for payroll gains to bounce back in April. Credit Suisse forecasts a 210,000 increase in new non-farm jobs created in April.

Investor alert: If that fails to occur, it could weigh on stocks and boost gold prices.

China, Indian Buyers Scooping Up Gold Bargains

Gold investors around the globe are using current price levels in the yellow metal as a buying opportunity.

“China’s imports of gold via Hong Kong and Switzerland, surged in March. Chinese buyers tend to be price-sensitive and could have seen the correction in the price of gold at the start of March as a buying opportunity. At the same time, India’s imports of gold reached the highest level since December 2015,” according to a Capital Economics commodities note on April 28.

Current levels offer good buying opportunity: At its current $1,268 an ounce level, gold is well off its 2016 highs around $1,375 an ounce. The price trend is bullish for gold and higher prices are forecast for year-end. Now may be the best time of 2017 to scoop up gold or silver at relative bargain prices. If you are looking to diversify your portfolio with tangible assets, act now before prices move significantly higher.