Inflation and “Good” Money

Posted on — 2 CommentsIn early societies items like shells, beads and even clay tokens were used as money.

Ancient societies then advanced to using precious metals including bronze, gold and silver as the basis for their monetary systems.

What defines “good” money?

The key element that is essential to good money is something that maintains its purchasing power over time.

Whether it’s a shell or a dollar bill, good currencies retain their value against a basket of consumer goods over time.

That’s important – because inflation – or the steady increase in goods and services has climbed higher over the past 50 years.

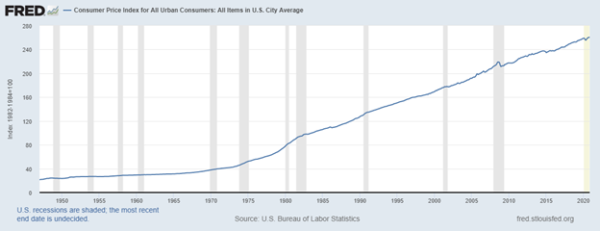

Figure 1 below represents the Consumer Price Index for city dwellers for items in U.S. cities.

There’s no getting around it – prices of everything simply rise over time.

If you think inflation won’t impact you, we’d like to walk you through some important charts to reveal what is happening in today’s unprecedented times and how inflation and decreased purchasing power could severely impact what you can buy in the future.

Declining purchasing power

When the currency you are paying for your goods and services falls in value – and prices rise – you can buy even less with the same dollar.

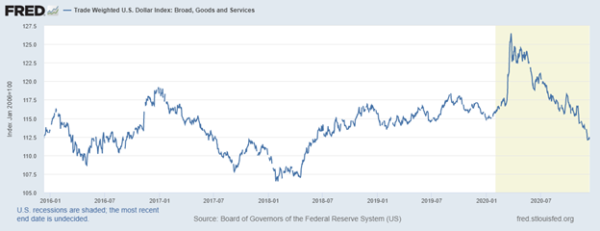

Figure 2 shows the U.S. Dollar Index. Note its spotty performance over time – and how the value of the U.S. dollar plunged lower throughout 2020 (shaded in yellow on right side).

Gold and silver are currencies too.

Central banks around the globe still hold and actively purchase gold for their vaults. Why? Because it is a currency. Precious metals have recognized value in every corner of the globe.

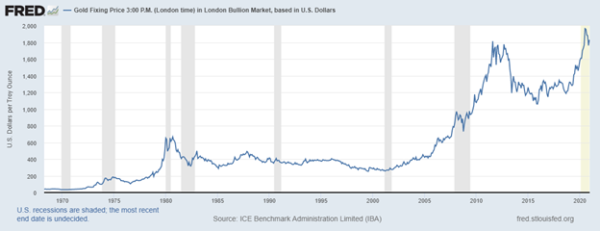

Figure 3 below shows the value of gold. Note especially the sharp rise in value over the past 20 years. Gold hit new all-time highs in 2020 and many firms forecast more new all-time highs next year as well.

Gold is in rising or bull market.

Why is gold rising?

One of the drivers of the bull market in gold are policies from the U.S. government – that includes Congress, the Treasury and the Federal Reserve.

Chart 4 below shows the U.S. national debt – which hit a new all-time record high in 2020 –above $27 trillion!

You’ve heard about our record levels of government debt, right?

You can see the most recent debt statement from the Treasury here – yes, over $27 trillion.

That’s one big credit card bill.

Sadly, as we mentioned last week – foreigners no longer have the appetite to buy as much of our Treasury debt. Foreign buyers used to hold more than half of outstanding U.S. Treasury debt.

Now, the Federal Reserve has had to step in and buy Treasury debt.

If this reminds you of a pyramid scheme – you wouldn’t be too far off.

This is how it works. Congress spends the money. The Treasury issues debt like 30-year bonds, 10-year notes and 1-year T-bills to pay for the spending.

If foreigners and Americans don’t buy enough of this debt in the weekly Treasury auctions – the Federal Reserve steps in and buys the debt.

How does the Fed pay for the debt? With its newly printed money.

In fact the Fed has printed over $1 trillion in new money in 2020 to purchase Treasuries, according to USA Today.

It’s just like when someone moves personal debt from one credit card to a new 0% APR card, runs up the bill on that one then does the same thing over again. The government is just moving the debt around and it doesn’t actually get it paid off.

If this worries you, you aren’t alone.

These policies set the stage for dramatically higher inflation ahead here in the United States – while the value of our dollar decreases with ever-more money printing.

Why are investors turning to gold and silver today?

It’s simple. The purchasing power of precious metals is rising.

Consider this.

In 1921 a 1 ounce silver Morgan Dollar would put about half a tank of gas in a car. Today that same Morgan dollar would FILL your gas tank! A paper dollar bill today barely would put enough gas in the car to get you from the gas station to the grocery and back home.

The purchasing power of gold and silver is increasing, while the value of fiat – or paper money – is decreasing due to rising government debt and money printing.

What’s in your portfolio?

Many American investors and savers have limited currency diversification – meaning the majority of your assets are held in the U.S. dollar – through stocks, bonds and savings accounts.

Yet, very few savvy investors would hold a portfolio with 100% exposure to a single stock. Yet, in essence – when you hold a portfolio with just one type of money – U.S. dollars – you are in fact doing just that.

Here’s what one economist says:

“There is a lot of heated debate about governments’ inability to keep the money safe. But many investors/savers nevertheless have one-sided exposure to their own country’s money. The US is the most extreme example of that, with a large proportion of investors only holding USD assets.

This is odd (and different to how investors handle currency risk in emerging markets). Very few prudent investors would hold a portfolio with 100% exposure to one stock. But at the same time, they are happy (or not sufficiently concerned) about holding a portfolio with just one type of money, such as dollars. This is a particularly risky proposition in a time with historically large fiscal deficits, and increasingly experimental monetary policy,” said Jens Nordvig, founder & CEO at Exante Data Inc.

The time is right to increase your diversification to gold and silver.

Precious metals are commonly known as hedges against inflation. And, these tangible assets will benefit from the skyrocketing government debt. The current environment makes gold and silver important choices to protect a portfolio.

What are you doing to protect your financial future?

Follow Our 3-Part Series

Read Part 1 of our inflation series here:

Are You Prepared for the Inflation Tax?

Check back next week for the third installment of our inflation series. We will discuss how much debt our country could have in the future, what will happen to hard assets, other assets and interest rates and what happens to your money in the bank?

2 thoughts on “Inflation and “Good” Money”

Comments are closed.

I am wondering if Michael Heglund is still with your company. I worked with hime many years ago and would appreciate updates on gold and silver prices..

Yes we are all far to dependent on dollars.

What’s unusual today is that we are a world based on dollars.

Greece us to big to fail so goes the USA.

Gold is a traditional inflation hedge yet with improved communication we quickly fill and empty supply chains to adjust for to few goods – leaving more liquidity in a world hungry for US dollars .

The jury is still out on the value of gold in a modern economy in relationship to supply and demand.

Past performance is no guarantee for future return.

Superior to crypto currency due to its history, gold is not the store of value that it once was.

All that being said, it’s undervalued against the dollar.