Investment Grade Bonds Heading for Third Year of Decline

Posted on — 1 CommentFor decades, the standard advice from investment professionals was to invest a portion of your portfolio in bonds – for safety and security. The general investment idea was that if the stock portion of your portfolio goes down, bonds will go up. In recent years that correlation has failed—leaving investors with big losses on both the stock and bond sides of their portfolio.

Looking back

In 2022, the S&P 500 fell 18.01%. That’s when bonds were supposed to shine. Instead, the bond market also posted double-digit losses. The Bloomberg U.S. Aggregate Bond Index represents the government and high-grade corporate bond market, and the $92 billion iShares Core U.S. Aggregate Bond ETF which represents that index plunged –13.06% in 2022.

Bonds are heading for a third year of declines

In fact, the billion iShares Core U.S. Aggregate Bond ETF, known by its ticker symbol AGG, fell by -1.67% in 2021, -13.06% in 2022 and is now heading for its third straight year of losses in 2023, with a -1.01% market return.

In hindsight, this was a good recommendation.

Looking back, this 2019 Gold Hub research report accurately warned investors of this coming shift:

“Central banks have shifted to a new regime of easy monetary policy, thus reducing expected bond returns. As negative yielding debt increases alongside stock-to-yield valuations to all-time highs, gold may become an attractive and more effective diversifier than bonds, justifying a higher portfolio allocation than historical performance suggests.”

It is evident that, following the pandemic, bonds have become a less reliable portfolio diversifier than in recent decades.

What’s an investor to do?

When seeking replacements, money managers pursue a strategy called “security dispersion” which allows investors to capture an alternative source of return. Security dispersion relates to the difference between winners and losers in the market.

When you are looking for an alternative investment, consider the three D’s of alternative diversifiers:

- Is diversifying to your portfolio,

- Is a durable source of return, and

- Is defensive when you need it

How do gold bullion and rare coins stack up?

Diversification: Gold is a proven stock portfolio diversifier because it negatively correlates to stocks — simply put: when stocks go down, gold goes up. Precious metals and rare coins also react to different market conditions than stocks and bonds, making them efficient asset classes to keep portfolios balanced through economic cycles.

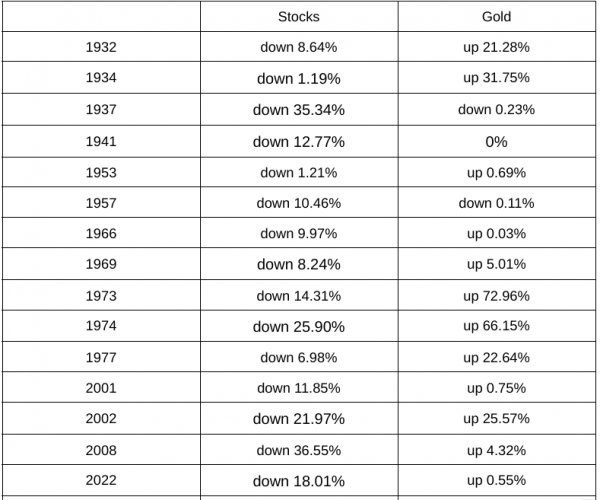

Here’s a snapshot of market performance to show the non-correlation between stocks and gold:

Stocks represent S&P 500, data from NYU Stern School of Business

Durability: Gold and rare coins produce a durable and reliable source of long-term returns. The average annual return of gold bullion from 1979-2022 stands at 5.6%*. For those who invest in rare coins (all types), the average annual return for that time period is even better at 9.5%.

Defensive: Both gold and rare coins act as defensive elements in your portfolio, especially during inflationary environments like we see now. When you evaluate investments to add to your portfolio to hedge against inflation, you want asset classes with the highest positive correlation level.

Here’s a snapshot of the correlation with inflation from 1979-2022*:

- Stocks: .10

- Treasury bonds: -.18

- Gold: .21

- Coins: .57

Both gold and coins have the highest positive correlation, which provides investors the best defensive hedge during inflationary times.

The bottom line

“For investors concerned with downside risk, it makes sense not to solely rely on bonds as stock market diversifiers,” said a Russell Investments research report. “Unlike bonds, the price upside for gold is not limited. In addition, the gold market is sufficiently large for investors to make significant allocations to [it.]”

If you’ve been disappointed in the bond returns in your portfolio, it’s time to explore worthwhile alternatives like gold and rare coins. Increasing your allocation to tangible assets is a proven strategy to help build and protect your wealth, especially during inflationary environments like the one we are mired in now.

*Data from February 2023 research report titled: The Investment Performance of Rare U.S. Coins by Raymond E. Lombra, Ph.D.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

1 thought on “Investment Grade Bonds Heading for Third Year of Decline”

Comments are closed.

I could not agree more. The recent auction sales of rare coins has gone parabolic. Gold has out performed the S and P for the last 10 out of 12 years.

i would say 10 to 20 % in a portfolio is sound money.