Presidential Election 2024: It’s the Economy, Stupid

Posted onBack in 1992, the U.S. was mired in a recession. Bill Clinton was mounting a presidential campaign to take the White House. And, incumbent president George HW Bush was seen as out of touch with the needs of everyday Americans.

Americans.

A Clinton advisor became famous for the phrase: “It’s the economy, stupid.” Indeed, the Clinton campaign highlighted the failing economy at every turn and won the White House, perhaps in part due to that strategy.

Fast forward to the 2024 presidential race. The election season is heating up fast, with an expected replay of the 2020 contenders: Joe Biden versus Donald Trump.

So, if it really is all about the economy, how is it doing today? Let’s take a look, explore the numbers, and what it could mean for gold.

Economic Growth

Despite widespread expectations for a recession in 2023, the U.S. economy is growing and Wall Street increasingly expects that the Fed could achieve a so-called “soft-landing” this year.

- In 2024, the United States economy is forecast to grow at a 2.4% pace.

- Compare that to 2024 economic growth forecasts of 0.7% for the Eurozone, 0.3% for the United Kingdom, 0.9% for Canada and 0.4% for Sweden.

Key takeaway: It may not feel like the economy is strong to some Americans. But our nation is leading the pack against other advanced economies in terms of economic growth. We are growing twice as fast or more than other advanced economies.

Job Market

The U.S. economy is creating new jobs at a fairly brisk pace. In February, employers created a total of 275,000 new jobs for Americans. The overall unemployment rate stood at 3.9%.

What kind of job creation did we see in February?

- Health care: 67,000 new jobs.

- Government: 52,000 new jobs.

- Restaurants and bars: 42,000 new jobs.

- Construction: 23,000 new jobs.

- Transportation and warehousing: 20,000 new jobs.

- Retail: 19,000 new jobs.

Key takeaway: U.S. employers have been creating a steady drumbeat of new jobs for Americans to fill. Over the last twelve months, new jobs have been created in every month ranging from 303,000 (May 2023) to as low as 146,000 (March 2023), according to the Bureau of Labor Statistics. If you want a new job, there’s a good chance you can find one.

Interest Rates

The Federal Reserve is holding its benchmark interest rate at a 23-year high in early 2024, as it maintains tighter monetary conditions in an attempt to battle back against inflation.

Key takeaway: The higher interest rates hurts American borrowers. This includes anyone who carries credit card debt, or wants to get a new car loan or mortgage. Would-be home buyers face a 6.9% 30-year fixed mortgage rate, according to Freddie Mac, which has priced some out of the housing market for now.

Inflation

The February core consumer price index (CPI) posted a hotter-than-expected reading, up 3.8% annually. The rising prices of rent, auto insurance, car repairs and airline tickets contributed to the stronger-than-expected inflation reading. Prices for used cars and clothing also climbed.

Inflation has fallen from its 2022 high at 9.1%. However, the February data shows that the Fed’s battle to rein in inflation is not over yet.

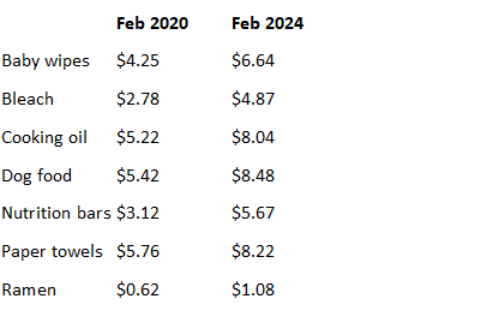

Prices are higher for everyday items and that sticks in Americans minds. Here’s a few price comparisons pre- and post-pandemic, from NielsenIQ.

Key takeaway: While inflation has dropped from over 9% to the latest 3.8% core reading, this still feels painful for many Americans. Prices on key everyday goods are sharply higher than before the pandemic and that “reference” point creates dissonance between the generally good economic data (strong labor market, growing economy) and what they pay for everyday items.

The Fed’s target rate of 2% inflation per year, means that prices would rise 2% every year. Instead we saw prices rise 9% on an annual rate in June 2022. That’s huge. Prices aren’t likely ever going to return to those levels, the Fed is just trying to keep annual price gains to a 2% pace.

What does this mean for gold?

These macroeconomic conditions created a perfect storm for gold. The price of gold has been climbing to a series of historic all-time new highs in recent months. Gold is up 30% over the past 16 months!

Inflation remains higher than the Fed’s target, which is supportive to gold. Yet the central bank is expected to cut interest rates three times in 2024, which will also boost gold even more and weaken the dollar. The stock market is climbing in bubble-like conditions that are being compared to the 2001 dot.com era. Only this time it is Artificial Intelligence stocks that are driving the stock market higher. This is creating new safe-haven buying in gold to diversify and protect portfolios.

Wall Street says gold can keep going higher. There are a series of gold price forecasts for 2024 that include $2,300 and $2,500 an ounce with a wildcard projection for $3,000 over the next 12 to 16 months.

The presidential election around the corner in November, will only increase economic, political and market uncertainty. While that political story has yet to unfold, one thing is certain, this historic run in gold is just getting started.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.