The Gold – U.S. Dollar Connection

Posted onInvesting in gold may have felt like a roller coaster ride this year.

Gold began 2021 just above the $1,900 an ounce level. Then, gold retreated to around $1,680 in late March. By late May, gold prices surged back above $1,900 an ounce. Recently, gold dipped to about $1,800 an ounce.

The price of gold is influenced by many factors. Key drivers of gold include interest rates, inflation, the amount of U.S. dollars in circulation (money supply), U.S. debt levels, political and economic stability and many other factors including the level of the U.S. dollar.

Today, we’ll focus in on a recent influence that has pressured gold lower lately – the U.S. dollar.

Economists like to call the connection between the U.S. dollar and gold – an inverse correlation. In simple terms, that means when the U.S. dollar climbs – gold tends to fall and the opposite is true as well. When the U.S. dollar falls, gold tends to increase in price.

As of early July, the U.S. Dollar index is 3% higher on the year, while gold is about 5% lower on the year.

The surprise strength in the U.S. dollar has weighed on gold in recent weeks.

Looking back 20 years – what’s the long-term dollar trend?

Let’s look at current levels in historical context. In June 2001, or 20 years ago, the U.S. dollar index stood at nearly 119.00.

Today? The U.S. dollar index stands at 91.46.

The long-term trend of the U.S. dollar is down. There are many reasons for this – including the gigantic amount of U.S. government debt – which now stands at a historic all-time high at $28.4 trillion.

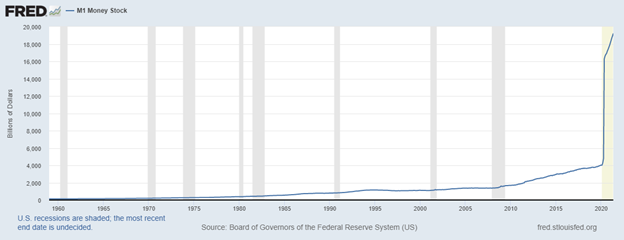

Another reason for the downtrend in the U.S. dollar? The Federal Reserve keeps expanding the money supply – or printing more dollars for circulation. Take a look at this chart from the St. Louis Federal Reserve (FRED). The amount of M1 money stock has literally gone straight up in recent years.

The long-term downtrend in the U.S. dollar is an important positive factor for gold investors in the years ahead, and is one of the key drivers that is expected to push gold to new all-time highs.

As the Federal Reserve continues to devalue our dollar by printing more, and the U.S. government continues to put our credit at risk by taking on more debt – gold will continue to increase in value.

What does all this mean for gold ahead?

The Wells Fargo Investment Institute published a new investment strategy report on July 6. Here’s what they said.

“Gold has had a rough 2021 because the U.S. dollar has surprisingly rallied.”

What else did they say?

“We think gold represents good value at today’s levels. Investor sentiment appears overly negative and we are expecting the U.S. dollar to fade and real interest rates to remain low through 2021.”

By year-end, the Wells Fargo Investment Institute targets gold in the $2,000-$2,100 range.

That represents a 16% increase from gold’s level today.

The long-term drivers to push the U.S. dollar lower remain in place. The U.S. debt and the massive dollar money supply aren’t going away anytime soon.

That means today’s gold market offers you, the long-term investor, a tremendous opportunity. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.