What Research Says About Using Gold to Mitigate Downside Risk in a Portfolio

Posted on — 1 CommentMany investors use gold as a way to limit portfolio losses during down markets. This approach, however, begs one question: What portion of the holdings should be gold in order to provide protection without sacrificing a return? Researchers at the Lancaster University Management School decided to find out.

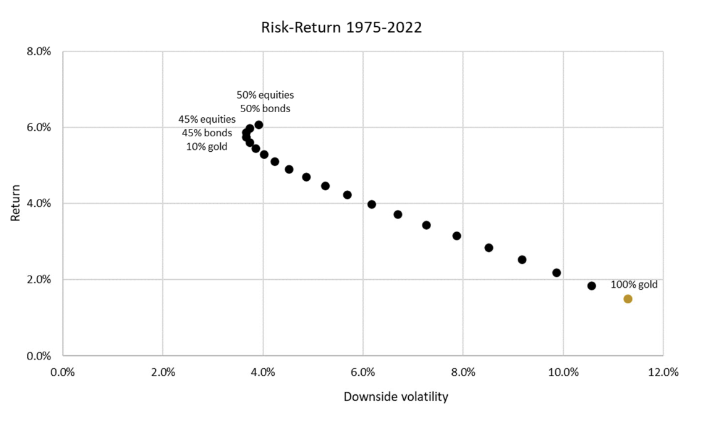

The researchers examined annual real returns for hypothetical portfolios consisting of equities, bonds, and gold. Their analysis was designed to allow all three investments to compete “head-to-head in a multi-asset portfolio context to empirically examine their ability to serve investors’ need for downside risk protection.”

They started their research with a review of gold’s performance as a safe haven asset and concluded that “gold would have served as a safe haven in some 76% of the observed down markets in equities.” However, they are quick to remind investors that this protection carries a cost because gold is down half of the time that stocks are up.

Nevertheless, data going back to 1975 shows that even a small allocation to gold within a portfolio of equities and bonds lessens the risk of capital losses by about 10% across many different equity-bond allocations. Moreover, the researchers discovered that downside risk can be mitigated even further when investors choose low-volatility equities to replace part of their bond allocation. This defensive mix consists of 10% gold and 45% low-volatility equities and bonds. This allocation represents the “nose” of the efficiency frontier resulting in a downside volatility to 3.7%.

Source: SSRN

These results were based on a 12-month investing timeline but the researchers also wanted to know how effective these allocations are over a wider range of periods. They analyzed results ranging from 1 month up to 36 months. They learned that the downside risk mitigation is stronger during longer time horizons. They also found that a 30/70 equity-bond portfolio generated an average return of 5.0% while the 45/45/10 defensive mix portfolio generated an average return of 6.2%.

The key takeaway for investors is that empirical research shows that the expected loss and downside volatility of a portfolio can be reduced with a small allocation to gold. Investors can further benefit from this approach by choosing low-volatility stocks for the equity portion of their holdings and setting their sights on a lengthy time horizon.

What makes this research so beneficial is the fact that it is so easy to execute. Most investors can easily update their allocations to match the recommended 45/45/10 blend. However, it is also important to note that these results were based on the assumption that the investor holds real gold rather than gold ETFs. As explored in other articles, gold ETFs fail to offer some of the basic characteristics that make gold such an attractive investment for so many. For example, gold ETFs introduce counterparty risk into the equation.

As uncertainty weighs on so many investors, it is important to remember that just one small adjustment to a portfolio can have protective effects over the long term.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

1 thought on “What Research Says About Using Gold to Mitigate Downside Risk in a Portfolio”

Comments are closed.

A 1 oz piece of gold bought a suit of armor in Roman times. Also a knights armor as well. In todays society it buys a well made suit.

Gold holds its value through time. I believe it also returns interest as well. The Feds 2 % tax! Look how it performed against the S & P

over the last decade. The real price of gold is decreased by paper gold ETFs. 1900+ is not the true value of gold. I agree with you to

own physical gold, probably 5-10 % in your portfolio.