Why Gold? Because Diversifiable Risk is Going Away.

Posted onThe diversification game used to be a whole lot easier. Investors only had to choose a few stocks. Exposure to a few sectors across a dozen holdings was enough to be properly diversified. Today, the picture is different. The world is smaller.

Thomas Friedman, author of The World is Flat illustrated this phenomenon explaining, “In Globalization 1.0, which began around 1492, the world went from size large to size medium. In Globalization 2.0, the era that introduced us to multinational companies, it went from size medium to size small. And then around 2000 came Globalization 3.0, in which the world went from being small to tiny.” This concept is the reason diversification is becoming more difficult to achieve. As the world shrinks the interconnectedness of our industries increases. What impacts one, impacts another.

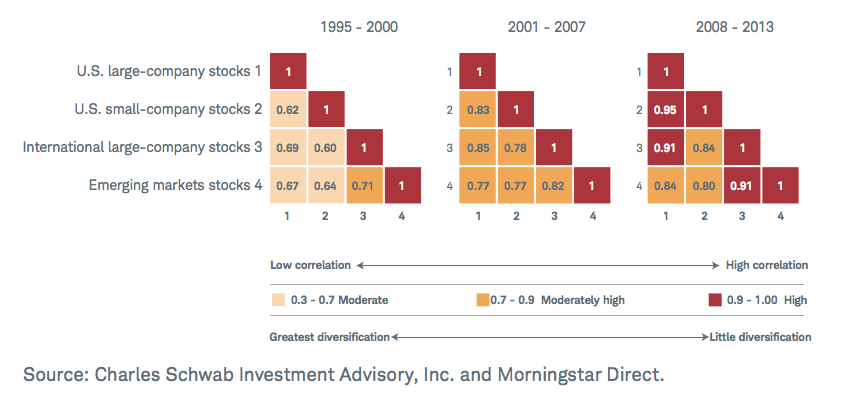

Many of the largest corporations in the U.S. have turned to emerging markets abroad for growth opportunities. This is a symbiotic relationship as these emerging markets depend on U.S. demand in their manufacturing arena. Data from Charles Schwab shows that equity correlations have been rising since 1995. This trend has prompted savvy investors to abandon the long-held notion that stocks, bonds and cash are the only tools available to the diversified investor.

Today, investors are learning that they can become diversified by expanding into international holdings, real estate and commodities like gold. The same body of research from Schwab explains that “commodities tend to perform differently in various market conditions than stocks and bonds – making them desirable from a diversification perspective.” This diversification, not seen with a traditional stock/bond portfolio, is critical in certain situations. For example, between 1973 and 2013 “commodity returns increased as inflation increased.” This dynamic is not true for stocks.

Detractors may cite that gold is a more volatile asset. However, it’s important for investors to consider this characteristic in relative terms. That is, gold, should represent one piece of a larger portfolio strategy that includes a variety of assets. The concept of viewing the risk profile of an investment (e.g. gold) within the broader context of a complete portfolio is the underpinning to Modern Portfolio Theory. The ideas behind this theory were first explored in 1952 when Harry Markowitz published his seminal work. He argued that the key to making this approach work is selecting a group of investments that, in aggregate, represent less risk than any of the assets alone. The key: the risks of these different holdings cannot be related.

As outlined earlier, culling a group of investments that have differentiated risks is more challenging than ever thereby putting the tenets of MPT further out of reach. Gold helps investors get closer to true diversification in the midst of our narrowing world. Why? Because there’s only about 183,000 tons of gold above ground. That total is unlikely to increase as mining operations are forced to work harder and spend more to extract the increasingly scarce resource. Corporate boards cannot simply issue more shares or split the stock.

Give consideration to what amount of gold is the right proportion for your portfolio.