What Drives Your Own Personal Success?

Posted on — Leave a commentAn article by Entrepreneur magazine listed 14 Things Ridiculously Successful People Do Every Day. The secrets to success according to the article?

They include:

- Focusing on minutes, not hours

- Focusing on only one thing

- Using a notebook – and writing everything down

- Following the 80/20 rule (80 percent of results comes from 20 percent of activities).

Let’s see how this applies to traders this week.

- Wall Street traders this week will be focusing on the minutes leading up to a number of big events.

- On Monday, they will be focusing on one thing: the PCE Price Index report.

- Many traders use a notebook to record big market events and they realize that a big portion of their profits (maybe 80 percent come from 20 percent of their trades).

Wall Street traders are bracing for a busy week. Here are three things big events that will drive gold prices this week.

- Monday – The December Personal Income and Spending data is released 8:30 am ET.

Why this matters to markets? The answer is one simple word – inflation.

Tucked inside Monday’s economic report is the Federal Reserve’s “preferred” inflation indicator known as the PCE Price index. The Fed has valiantly been attempting to stimulate inflation in recent years and there are signs that price pressures are starting to kick higher. The Fed’s target for inflation is 2.0 percent.

There are numerous signs that inflation is moving higher these include:

- Medical costs are not under control and continue to increase

- Housing costs are rising at the fastest pace in nearly 10 years

- Energy prices are on the rise

- After years of no raises – wages are finally increasing

Sharper than expected gains in inflation numbers this week would be gold-bullish.

- Wednesday – The Federal Open Market Committee (FOMC) will release its interest rate decision at 2 pm ET.

Why this matters? The Federal Reserve has broadcast its intentions to hike interest rates – perhaps several times this year. A trend toward higher interest rates is generally a negative for gold and other precious metals, which pay no interest.

Right now, Wall Street does not expect the Fed to hike rates at its January meeting. If they did – it would be a surprise and would rock markets. Traders will be reading the post-meeting announcement closely for clues on what may lie ahead for 2017.

- Friday – The Labor department releases its monthly non-farm payrolls and unemployment rate data for January at 8:30 am ET.

Why this matters? The jobs data is one of the biggest economic data market movers of the month and can trigger fireworks if the numbers come out higher or lower than expected. The December jobs report showed that job growth is slowing, but that wages are rising. In December, non-farm payrolls jumped by 156,000 and the overall unemployment rate stood at 4.7 percent.

Economists will be watching this closely for signs if the labor market is beginning to fizzle and how much wages are increasing.

Now is a good time to conduct your annual portfolio review if you haven’t already re-balanced your assets. Market fireworks beginning to heat up. The precious metals complex has started off the year strong and many Wall Street analysts believe it is just the beginning of a bigger rally move. Gold and other precious metals are already beating returns in stocks since the start of the year. Blanchard and Company has been helping individual investors for over 40 years to build a tangible asset allocation for portfolio diversification. Learn more about us here.

Owning an ETF Isn’t the Same as Owning Gold

Posted on — Leave a commentTechnology enables instant gratification among investors all around the world. In minutes you can own ETFs holding assets ranging from livestock to carbon emissions credits. This easy accessibility in the market enables fast transactions, and as a result investors seeking to bolster their portfolio with gold often resort to the ease of a precious-metal ETF. However, the problem is these investors don’t own gold; they own paper.

First, consider the cost of owning ETF shares. A review of 22 popular precious-metal ETFs reveals that the average expense ratio is 0.58. This cost is in perpetuity, and every year you will pay managers to oversee the fund. While this fee doesn’t sound like much, the compounding effect equals a total cost of $1,666 over a 20-year period, assuming 6% annual growth. The discrepancy between the initial costs of purchasing gold versus an ETF grows as the burden of the expense ratio increases over time. This cost means the ETF will always underperform the market price of precious metals. Furthermore, this expense also represents an opportunity cost. If this $1,666 total were put to use as an investment (again, at a 6% annual return over 20 years) it would grow to $5,343. The ones making the real money here are the fund managers. Investors face inflation, market downturns, and political upheaval; we don’t need the headwind of onerous expense ratios added to the list.

Second, holding shares in a precious-metal ETF gives you no claim to the physical asset. Many of these funds hold gold, silver, and platinum in large, industrial bars that exceed the value of the average holder’s shares, making liquidation impossible. Even those with more substantial holdings might be surprised by the fine print. Many of these ETFs include language in their prospectus stating that the fund has the option to settle in cash rather than physical gold. In other words, the prospectus governs the terms and conditions. This document was written to benefit the fund managers and the underlying institution, not the investor. Though many cite the simplicity of an ETF solution, there is nothing simple about teasing apart the esoteric language of such a report.

Finally, the spectrum of risk widens with the ETF option due to “counterparty risk.” This risk comes from the decision to engage financially with another party. When the other party defaults or fails in any way to meet their obligations, you have succumbed to counterparty risk. Such risks are not hypothetical. The most recent example of counterparty risk occurred during the financial crisis sparked by defaulted collateralized debt obligations. With the purchase of a physical asset, the relationship is between you and the precious metal. Conversely, the decisions of the fund managers, rather than pure market movements, influence the ultimate value of the ETF. For many investors owning gold is about gaining control of their assets. This goal becomes difficult when it is dependent on unseen managers who are often not liable for damaged or stolen property.

If you want to own gold, then you must own gold. ETFs merely serve as an indirect and costly alternative to having the asset in hand.

Inflation Climbs at Fastest Pace in 5 Years

Posted on — Leave a commentData released last week showed that inflation, or the rate of price increases for goods and services in the US, climbed at its fastest pace in 5 years.

Rising gas prices, higher rent and medical care costs boosted the official Consumer Price Index for December, the government reported.

Most motorists have probably already noticed an increase in gasoline prices at the pump, and that trend is expected to continue. Motorists may get sticker shock in 2017, Gasbuddy.com warns. They predict that motorists will spend $52 billion more at the pump in 2017, as the yearly average for a gallon of gasoline rises 36 cents to $2.49 a gallon.

“Unfortunately, as OPEC tightened their grip on oil prices, Americans will be spending over $50 billion more on gasoline versus last, and unlike the Cubs winning the World Series, it may be years before some of the low prices we saw in 2016 come back.” – Patrick DeHaan, senior petroleum analyst at Gasbuddy.com.

Energy prices have a spill-over impact resulting in higher prices for all goods and services throughout the economy. (Example: Rising transportation costs for the gallon of milk to be delivered to the local grocery story will be passed along to consumers.)

There are other factors that will put upward pressure on consumer goods and services in 2017, including the following:

- A tight labor market is already putting upward pressure on wages.

- Many economists warn that the fiscal stimulus and spending proposals by President Trump will push inflation even higher.

- The high levels of liquidity in the economy after years of government money-printing leave the economy ripe for runaway inflation.

The federal government has been trying to spark inflation for the past several years by keeping official interest rates near zero. However, once inflation begins to surge throughout the economy it can become very difficult to control.

Inflation is a wealth-killer, and erodes individual purchasing power.

One way investors can prepare for its inevitable arrival is to invest in precious metals. It is well known that gold is a time-honored inflation hedge, and tends to rise as inflation creeps through the economy. What is less well known is that rare coins are an even better hedge as they tend to rise in price even faster than gold during inflationary periods.

According to the World Gold Council, “Inflation rates in major developed and developing economies are expected to rise, in part as a consequence of the financial crisis and subsequent mitigating actions such as quantitative easing. Historically, gold has been a hedge against inflation. It has retained its value through geopolitical shifts and market turbulence, outperforming most major currencies and many real assets.”

Diversifying your portfolio with even small amounts of gold can help hedge against inflation and protect your individual purchasing power in the future. Gold is a physical asset that individual investors can own outright. It is a highly liquid investment that is recognized and traded around the world. Unlike paper assets, holding physical gold has no credit- or counter-party risk. Protect your portfolio with gold now.

Contact Blanchard at 1-800-880-4653. We are a family-owned company that has helped clients protect and grow their wealth for over 40 years through investments in American numismatic rarities, and gold, silver, platinum, and palladium bullion.

Rare Coins – The Journey from Disinflation to Inflation

Posted on — Leave a commentInflation will rise with Donald Trump as the President of the United States. The rare coin market typically rises during times when there is inflation. Because of this, rare coins are the best hedge against inflation.

In its report on December 16, 2016, the influential Bank Credit Analyst had the following to say about inflation:

“The 35-year bond bull market is over. Deep-seated political and economic forces will conspire to lift inflation over the coming year.”

Perhaps most importantly, tax cuts and infrastructure spending planned by President-elect Donald Trump will constitute a major fiscal stimulus that will lift economic growth and inflation. Mr. Trump campaigned on promises to cut taxes, increase infrastructure spending and roll back financial regulations. Higher stock prices, rising longer-term interest rates and the strengthening of the dollar since his election signaled that the markets expect his administration to spur faster expansion. Moreover, inflation rose at the fastest rate in more than three years in December.

Inflationary pressures are already showing themselves, including a significant rebound in some commodity prices. For example, the sharp rise in coal and iron-ore prices has altered the fortunes of the mining industry significantly.

Central banks around the world are actively trying to push inflation higher. As a result, markets have begun shifting their focus toward the risk of rising prices, after several years – eight to be exact – dominated by fears of falling prices, or deflation.

According to a recent article in The Wall Street Journal, demand is rising for a broad swath of financial assets that typically gain ground when consumer prices are rising or expected to rise. Central banks are now openly entertaining, and even welcoming, inflation bubbling over 2%, which isn’t bad news. To the contrary, markets and central banks alike will be relieved that the world is no longer skirting a deflationary abyss.

How certain can you be about the relationship between fiscal stimulus to come and a robust rare coin market? “After several years of higher prices and the spectacular sales of several legendary coin collections, the U.S. rare coin market softened in 2016. But, after the November election, there was a notable increase in demand for high-quality rare coins, including those priced at $100,000 or more.” (PNG Market Survey)

“The correlation between the return on coins with inflation over the last 37 years is well above that of other assets considered including gold…When inflation turns up, the responsive increase in rare coin prices could well be quicker and larger than the returns of most other assets.”(“The Investment Performance of U.S. Rare Coins by Raymond E. Lombra, Ph.D.”)

Remember also, that the Trump presidency is likely to be very favorable to the tax rates of high net worth individuals, constituting a huge part of our market. Gold is good, but rare coins are an even better hedge against inflation than gold and much better than stocks and Treasury Bonds.(“The Investment Performance of U.S. Rare Coins by Raymond E. Lombra, Ph.D.”)

Gold is good, but collectibles such as rare coins are doing an even better job of preserving and growing wealth. The latest Knight Frank Wealth Report for 2016 confirms that ultra-high-net worth individuals prefer collectibles to bullion.

How have the rare coin assets reacted during the past eight years, when inflation has been only a distant memory? Rare coins have increased in value in nine of the last ten years, despite the fact that, from an investment standpoint, rare coins are considered to be primarily a hedge against inflation. Rare coins’ performance throughout this eight-year period shows the strength of a market that can flourish even under adverse circumstances, in large part because of the strength of its collector base.

Moving forward, for those clients who believe that gold and rare coins always act in lockstep, an example given by the Lombra Report shows the sharp, cumulative drop in gold prices in 2013-15 (approximately 40%) as opposed to the 6% gain in value in rare coins during that same period. After several years dominated by fears of falling prices, or deflation, there are signs we are finally going to experience significant inflation again. With inflation comes higher rare coin values.

Gold Outperforms Stocks in Inauguration Years

Posted on — Leave a comment

With a new president of the United States and his fresh appointees having just stepped into office on Friday, exactly what the next 4 years hold in store for global markets it a bit of a toss-up.

Famous billionaire investor George Soros holds rather gloomy and pessimistic views about a Trump presidency: “I don’t think the markets are going to do very well,” said Soros. “Right now they’re still celebrating. But when reality comes, it will prevail,” referring to the near 6% rally in the S&P 500 since Trump’s election.

Regardless of political and economic prognostications, the common denominator of a Trump presidency seems to be uncertainty.

“Uncertainty is at a peak, and actually uncertainty is the enemy of long-term investment,” said Soros. This uncertainty and fear of unprecedented political change is definitely a contributing factor to the recent rally in safe-haven assets such as gold and silver.

Interestingly enough, in inauguration years dating back to Gerald Ford, gold tends to perform extremely well when new leadership is in the White House. Of the past seven inauguration years since 1974, gold has only seen a decline twice: once in 1981 with Reagan and once in 1989 with H.W. Bush.

All other inauguration years, including the year Obama took office when he inherited a tumultuous financial crisis, were a boon for gold owners. The biggest gain for the precious metal during an inauguration year was a whopping 72% in 1974 when Ford took over after Nixon resigned due to a mounting political scandal.

Moreover, for the most part, gold appreciating in inauguration years makes sense, because investors are naturally cautious about the slightest policy changes that could affect their investment returns or overall financial wellbeing during times of significant political change.

Axel Merk, who manages roughly $300 million in client assets, said “We have no idea what’s going to happen with some of Trump’s policies – everybody is a little nervous.” It is this fear that leads Alex, and may other investment managers, to make the claim that “Gold is relatively undervalued and will push higher.”

Despite all of this talk about politics, there are more macroeconomic events than a new president and cabinet positions: namely possible imminent interest rate increases. At a recent Commonwealth event in San Francisco, Federal Reserve Chair Janet Yellen said “It is fair to say the economy is near maximum employment and inflation is moving toward our goal.”

Yellen and fellow members of the FOMC therefore expect to raise interest rates three separate times by a quarter of a percentage point per year until 2019. Of course, this greatly depends on the overall strength of the economy and the labor market.

Generally speaking, higher interest rates are seen as unfavorable to gold, simply because the increase in borrowing costs results in a higher cost to hold the precious metal when compared to other yield-bearing assets. Nevertheless, gold continues to rally directly in the face of rising interest rates, so brushing off talks of future rate hikes; and this, in combination with an inauguration year, should be seen as extremely bullish for gold owners.

Prominent Gold Watcher Forecasts Gold at $2,000 an Ounce

Posted on — Leave a commentAs a new administration settles into the nation’s capital, the winds of economic change are blowing hard, which opens the door for significant moves in the financial markets ahead.

Gold is already on the move – as February Comex gold futures climbed 8.4% from Dec 15–Jan 17.

Is this the start of something big for gold?

A prominent gold analyst – Jeffrey Christian, managing director at New York-based CPM Group – forecasts record highs ahead for gold at $2,000 within the next decade. Christian is widely regarded as one of the most knowledgeable experts on precious metals markets, and has advised the World Bank, United Nations, International Monetary Fund, and numerous governments.

Equity Market Gains Are Not Sustainable

In a recent interview with the Canadian Financial Post, Christian called the recent stock market rally a “sugar high” and warned that many questions and uncertainties lie ahead regarding the actions of the new U.S. president.

Christian doesn’t believe Trump will be a major infrastructure investor, and instead will focus on easy-to-pass tax cuts for corporations and wealthy people, who are more likely to reinvest the gains in the stock market rather than spending in the economy, the Financial Post reported.

Overall, in the longer term that is a negative factor for long-term economic growth, and will add to the U.S. deficit and debt. That means the macro and long-term picture is bullish for gold.

Christian outlined three major bullish factors for the gold market ahead. These include:

- Investor demand – Investment demand for gold will return to between 30 and 40 million ounces per year, levels not seen since 2005, he projects.

- Continued strong central bank buying – Central banks will continue their recent strong buying trends of between 9 and 10 million ounces per year.

- Fall in mine production – Christian believes that supply will “plateau in the next 3 years and begin to drop off by 2020, due to a lack of investment in exploration and expansion,” the Financial Post reported.

Looking ahead, there are many more reasons to be bullish than bearish on gold. The World Gold Council recently issued a report outlining six major factors that will support rising gold prices in 2017:

Build Your Tangible Assets Position Now

On a relative basis, the current $1,200 per ounce for gold is “cheap” by historical comparisons. Gold traded above the $1,900 per ounce level in 2011. Silver currently offers a good buying opportunity as well – and offers many of the same portfolio diversification factors as gold. Silver currently trades at around $17.00 per ounce.

Blanchard portfolio managers follow the metals market closely each day, and are well positioned to offer you individualized investment advice to help you meet your long-term financial goals. Call for a free confidential consultation today at 1-800-880-4653.

How To Trade Trump’s Tweets

Posted on — Leave a commentIf you are an auto maker, defense contractor or other major U.S. manufacturer you’ve probably already been consulting with your PR firm on how to handle potential Twitter talk from President-elect Trump.

Individual investors are getting in on the game too.

Brokerage firms have seen an increase in trading activity and companies that have been called out by President-elect Trump have seen trading volumes surge.

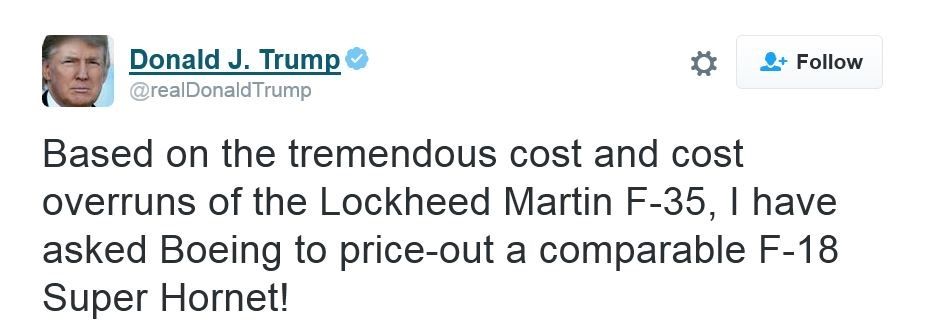

Here’s just one example:

Market reaction: This particular Twitter message drove Lockheed’s stock price into a nosedive in after-hours trading, and triggered a jump in Boeing’s

In an interview with the Wall Street Journal, TD Ameritrade Chief Executive Tim Hockey said trading surged following Mr. Trump’s win and continued to pick up whenever the president-elect targeted his tweeting at a specific company. TD Ameritrade said its average daily client trades surged 11% in the quarter ended Dec. 31.

The Tweets Are Moving Markets

A new ETRADE survey found that three-fifths of those between 25 to 34 had traded based on a tweet by President-elect Trump. The survey included more than 900 active investors, who had a minimum of $10,000 in an online-brokerage account.

How can investors trade Trump tweets?

The answer may well lie in buying physical gold as a hedge and safe-haven against broader stock market volatility and the greater unknowns of what could develop on the world political stage in the months ahead.

Some market strategists concede that investors really don’t have a choice – but must monitor the Trump twitter account – simply because the tweets are moving market. The President-elect is also making views known in the international arena regarding potential trade issues with China via the social media platform.

Rising Gold Demand Seen Ahead

The World Gold Council outlined 6 major trends in the global economy that will support gold prices in 2017. Part one of the Blanchard analysis focused on the first three factors. Read more on that here.

The second three factors – could well be triggered by the Trump twitter feed as well as new developments from the upcoming administration’s policies. Here’s a close look at them now.

Inflated Stock Market Valuation

The U.S. stock market is trading at all–time highs and, by most traditional measures, is overvalued. The current bull cycle in stocks is old – it started in March 2009 – and is vulnerable to a correction or cycle turn at any time. Bull markets don’t last forever.

Long-Term Asian Growth

Chinese and Indian investors have long shown an affinity to buying and holding physical gold. It is a cultural phenomenon backed by hundreds of years of action. The continued rise in the middle class of these growing global powerhouses means more money that can be funneled to their investment of choice – gold.

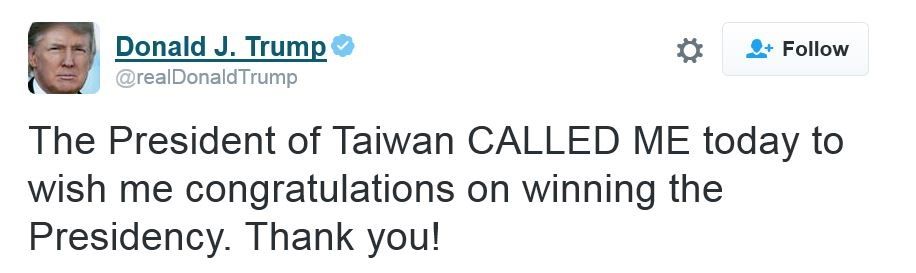

Trump’s twitter feed upset official diplomatic channels back in early December – when he messaged about his call with the Taiwanese president. He broke decades of precedent and said the “One China” policy was up for negotiation. China considers Taiwan a breakaway province, with no rights to any kind of diplomatic relations with other countries.

Tensions are running high at the start of the new Administration.

The Chinese president has already been making public statements and is poised to enter what may be a global void of leadership as the United States backs away from globalization. Look the Chinese to continue to grow their economy and to seize a greater footing on the global power stage in the months ahead. The global economy is shifting from West to the East and Trump’s policies may help speed that along.

“Macroeconomic trends in Asia will support economic

growth over the coming years and, in our view, this will

drive gold demand. In Asian economies, gold demand is

generally closely correlated to increasing wealth. And as

Asian countries have become richer, their demand for gold

has increased. The combined share of world gold demand

for India and China grew from 25% in the early 1990s to

more than 50% by 2016. And other markets such as

Vietnam, Thailand and South Korea have vibrant gold

markets too. “World Gold Council Report.

Opening of New Markets

Gold is becoming more mainstream, the World Gold Council says. While day traders may get bogged down by individual company-specific tweets, the better strategy may well be to build a physical gold position that can protect your wealth and your portfolio against a variety of risks.

What’s in your portfolio now? Call Blanchard today for a private consultation with a portfolio manager at 1-800-880-4653.

Stocks Pare Losses as Oil Jumps and Precious Metals Surge

Posted on — Leave a commentYet again, U.S. equities managed to bounce back from a decline shortly after the opening of the market. Thursday’s strong rebound came amid a week-long string of sharp intraday sell-offs that made investors begin to question the vigor of the stock market after a prolonged multi-month rally. In fact, many analysts and investors thought the high point of the market had been reached, due to the fact that major indices were down almost 1% around noon.

Thursday’s scary stock slide didn’t last long, though. The Nasdaq and S&P rallied all the way back by the market close, consequentially evaporating volatility from the market. Since Trump’s unexpected victory on November 8, the S&P 500 has rallied about 6%, and most of the daily pullbacks along the way have been viewed as buying opportunities, and gobbled up by investors.

Although it may not seem like it, “Risk is to the upside [in stocks],” said Mark Connors, Credit Suisse’s global head of risk advisory in New York. “People want to get involved.” This certainly seems to be the case, because thus far, every decline in stocks has evidently been met with lots of purchasing.

This is not overly surprising, however. According to Credit Suisse, long positions among institutional money managers are 20% less than the 5-year average, so there is plenty of cash sitting on the sidelines waiting to be put to work – even at all-time market highs.

What is also likely contributing to the broader market resilience is the recent uptick in crude oil. Crude posted its biggest 2-day winning streak in 6 weeks as the Saudi Arabian Energy Minister, Khalid al-Falih, announced a reduction in oil production down to no more than 10 million barrels per day. Generally, higher oil prices are better for the economy, as foreign wealth inflows tend to increase, and energy companies in the US turn a bigger profit.

With all of this said, from energy to stocks and everything in between, there is one asset class that has undeniably stolen the spotlight since the beginning of 2017: precious metals.

Gold and silver are off to a tremendous start this year, and they are both outperforming virtually every other asset class, especially currencies. The U.S. dollar has had a pretty rocky start to the year so far, and this is one of the many reasons that investors are moving their assets into precious metals. For the year, gold futures have risen about 4%, and silver futures have risen about 5%.

Moving forward, January is peak-earnings season, with blue-chip companies reporting their financial results in the next few weeks. In addition to earnings catalysts, there are FOMC member speeches, overseas economic data that is due to be reported, and, of course, the biggest macroeconomic event in the past 4 years that’s set to make place on January 20 – a new president of the United States.

6 Trends That Support 2017 Gold Demand

Posted on — Leave a commentIn a new report, the World Gold Council has identified six key trends that will support continued gold demand in 2017. These include:

- Heightened political and geopolitical risks

- Currency depreciation

- Rising inflation expectations

- Inflated stock market valuation

- Long-term Asian growth

- Opening of new markets

GEOPOLITICAL RISK

Political risk is rising around the globe. The World Gold Council pointed to a number of upcoming elections in Europe in 2017, including Netherlands, France and Germany.

Some market watchers have warned that the outcome of these elections could prove to be a destabilizing force for the European Union, depending on the votes. Rising waves are populism are seen in Europe and there is speculation that Russia could attempt to influence the European elections.

The Eurasia Group outlined top geopolitical risks in its 2017 outlook report > Read it here.

Closer to home, one of the worries for financial markets are trade policies. There is “a meaningful risk that negotiations on trade will turn belligerent” and suggests that “confidence in markets could be affected by geopolitical tensions triggered by the new administration,” says Jim O’Sullivan, Chief US Economist at High Frequency Economics, in the World Gold Council Report.

As a high-quality, liquid asset, gold benefits from safe-haven inflows, which could emerge from rising geopolitical risks in 2017.

CURRENCY DEPRECIATION

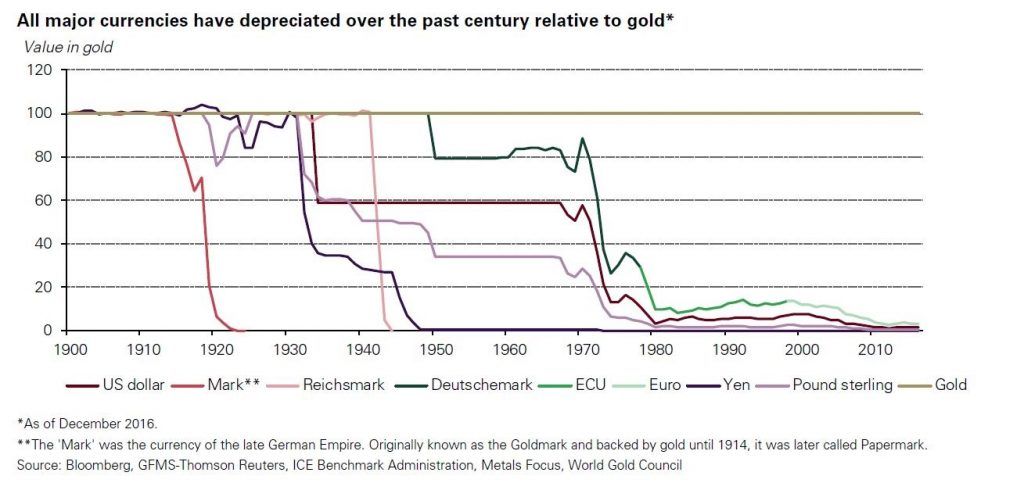

Paper (or fiat) money has fallen in value over the last century, while gold has vastly outperformed. See Figure 1 below.

Over the past century, gold has vastly outperformed all major world currencies as a means of exchange, the World Gold Council says.

A key reason for this is:

- The available supply of gold changes little over time, growing about 2% per year through mine production

- That compares to paper money, which can be printed in unlimited quantities to support monetary policies.

Since the global financial crisis, central banks around the globe have turned to quantitative easing or “money-printing” policies in an attempt to stimulate economic growth. At its heart – that devalues the paper money. It is simple economics – more supply of anything decreases its value.

Investors have turned to physical gold investments in recent years in an attempt to preserve the wealth and protect it from depreciating paper money values.

RISING INFLATION EXPECTATIONS

The World Gold Council points to expectations that inflation will rise in 2017 as another factor that is supportive to gold demand.

“An upward inflationary trend is likely to support demand for gold for three reasons. First, gold is historically seen as an inflation hedge. Second, higher inflation will keep real interest rates low, which in turn makes gold more attractive. And third, inflation makes bonds and other fixed income assets less appealing to long-term investors.” – World Gold Council report

It is well known that gold holds its value and often increases significantly during inflationary periods. What is not as well known is that rare coins are an even better hedge and tend to rise in price even faster than gold during inflationary periods.

Read more: Rare Coins Are An Excellent Hedge Against Inflation

Stay updated with the latest gold market news: Subscribe to the Blanchard Newsletter (scroll to bottom of the page).

Check back here on Thursday for part 2 of this report and a look at the final 3 factors that the World Gold Council believes will support gold demand in 2017.

Blanchard and Company has was founded in 1975 and has a rich legacy of helping individual investors access the gold and rare coin market. We believe that gold and silver bullion in physical form is an appropriate asset for a small portion of any properly diversified investment portfolio. Contact Blanchard at 1-800-880-4653.

Could Trump’s Inauguration Mean A Top For Stocks?

Posted on — Leave a commentThe stock market has soared to new all-time highs following the election of Donald Trump to the White House. In the now infamous Trump Bump –traders have priced in a spate of good news including tax cuts, deregulation and massive infrastructure spending.

Wednesday’s press conference and the inauguration will see a switch in market drivers from speculation on what Trump may do to what he actually does.

Buy The Rumor, Sell The Fact

The stock market is notorious for a phenomenon called “Buy the rumor, sell the fact” in which traders price in news before it has happened and then dump stocks once it occurs. There are growing rumblings among market watchers and traders that Inauguration Day could mark a top in the stock market.

Analysts are warning that the stock rally and the massive gains in the U.S. Dollar have hit an “exhaustion phase” and are vulnerable to a correction. The recent rally in stocks has been accompanied by weakening stock market breadth, as the number of declining stocks outnumbers gainers. That is a weak signal for the stock market overall.

Gold Is Starting To Move Higher

Gold prices have been climbing in recent weeks as a small bottom has formed on the daily chart at $1,124.30 for Comex February gold futures. Gold hit a high at $1,190.50 in early trading Tuesday – a $66 per ounce move in just three weeks.

If you are a first-time gold buyer, or if you are looking to add to

your existing position, you may not want to wait any longer. Gold

prices are rising again, with higher levels seen throughout the year.

“We forecast gold prices to average $1,420 in 2017,” says Thomson

Reuters in their Gold Survey 2016 Q3 Update and Outlook

Call Blanchard at 1-800-880-4653 to discuss your investment goals

with one of our portfolio managers now.

Politics – The Next Big Trigger For Gold?

“As Mr. Trump’s inauguration date nears, we suspect gold investors will monitor political developments more closely. Any significant ratcheting higher in geopolitical tensions could help trigger safe-haven bullion demand. The market may be more sensitive than usual to political developments in the early days of a Trump Administration,” according to a January 9 HSBC research report.

Blanchard is the premiere tangible assets adviser in the United States for serious investors and serious collectors. Learn more about our firm here.