Diversifying Within Gold: Our Proven Strategy

Realize the Highest Long-Term Return on Investment

Through decades of research and experience helping clients invest wisely in gold, we’ve identified an asset allocation strategy within gold that offers the best performance after five years.

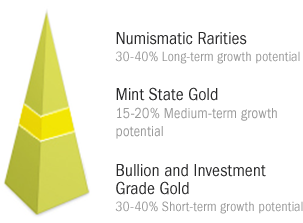

The Ideal Gold Assets Balance

The typical Blanchard investor begins with a short-term gold bullion investment. Next, most eventually step up to more aggressive gold holdings with higher long-term profit potential. After you set aside approximately 20% of your portfolio for tangible assets, we strongly recommend you begin working toward this ideal asset balance within your gold holdings:

Gold Bullion Coins or Investment Grade Gold: 30% – 40%

This conservative investment offers the highest short-term returns. One-ounce gold bullion coins minted by the U.S. Mint move dollar-for-dollar with the spot gold price. Investment grade gold, also known as “bullion with muscle,” offers the same benefits as bullion but with higher profit potential.

Mint State Gold: 15% – 20%

This moderately aggressive investment offers fast growth potential and high returns over the medium term. U.S. Gold coins minted between 1890 and 1933 bridge the gap between bullion/investment grade coins and rare coins.

Rare Coins: 30% – 40%

This aggressive investment has historically produced the highest long-term investor returns. Very limited supply means demand can catapult prices at any time.