Bitcoin at All Time Highs – What’s Next?

Posted onBitcoin climbed nearly 40% since the start of 2021 – breaking through the $40,000 mark. That was followed by a quick 10% slip the last two days, falling below the $32,000 level. This highlights the wild volatility of cryptocurrencies.

The escalating, hyperbolic, surge in Bitcoin has all the markings of a FOMO rally. That’s a term otherwise known as the ” fear of missing out.”

Yes, FOMO is running on full steam.

Are you thinking of investing in Bitcoin now?

Before you do, consider this.

“Bitcoin crashed hard in 2018, losing about 80% of its value. Investors still don’t really know why,” according to a Dec. 17, 2020 Bloomberg article.

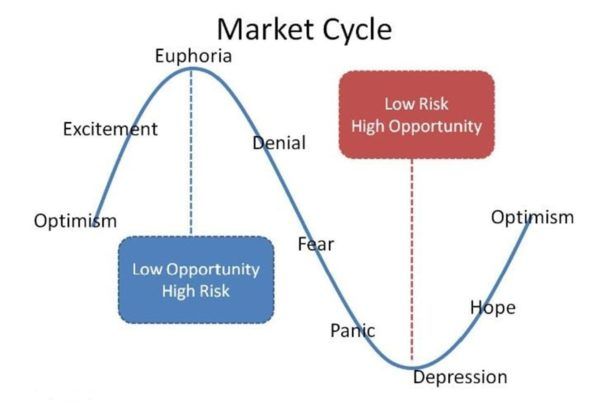

There’s an excellent chance that the Bitcoin boom is at a euphoric top. See the chart below.

Investors who buy into any market mania at this point in the cycle – often lose it all.

We’ve seen this before. And, no doubt we’ll see it again.

Tulip bulbs in 1637 in Holland. The South Seas bubble in 1720. The Dot.com bubble of the 1990’s which saw U.S. tech stocks crash 80% by October 2002. And the U.S. housing bubble which saw home prices nearly double from 1996 into 2006 and then crash in value by over 30% leading to the Great Recession of 2008.

What lies ahead for Bitcoin?

No one really knows.

Yet, we do know that smart investors take profits. There is an old market adage: “You can never go broke taking a profit.”

It’s not a true profit however, until you liquidate the position, sell it and get your money.

Don’t fall prey to recency bias

It is very common for investors to assume what has happened recently will continue to happen in the future.

Psychologists call this “recency bias.” It refers to the phenomenon where an individual more easily remembers recent events, compared to something that occurred in the past.

If you own Bitcoin right now, it could be easy to allow recency bias to impact your investing decisions. Beware. Simply put, the recency bias makes it easier for you to remember Bitcoin’s blistering rally in the first few days or 2021 versus the 2018 Bitcoin crash – where it lost 80% of its value.

Here’s the rub. Investors often mistakenly rely on recency bias to make investing decisions.

Don’t assume Bitcoin will continue to rise in value simply because it was soaring a few days ago.

There’s fear of missing out. There’s greed – hoping the price will go higher. There’s recency bias. None of these emotionally driven investing decisions usually work out well for investors.

It’s time to liquidate some or all of your Bitcoin position and move to gold. Take those profits as a gift – and turn them into something that can never disappear into thin air, get hacked, or crash to zero.

While there may be wild predictions for how high Bitcoin can climb, beware. There is still a significant lack of understanding on how the technology actually works, or how it could ever be used in commerce. And there are over 2,000 other cryptocurrencies – which means Bitcoin might not even be the right horse to bet on in the race.

Check back soon for our final installment in our Bitcoin series –where we will dig deeper into the regulatory environment which may trap investors in the future. And the solution that central banks see that could render Bitcoin useless. Please leave a comment or question below – we value your opinion!

Missed Article 1? Read it here: Bitcoin Captures Imagination of Future Space Tourists

We’d love to hear your comments and questions about Bitcoin below. Our portfolio managers are experts in the tangible assets field and are available to answer your questions and discuss the market outlook for gold and Bitcoin ahead. Please call Blanchard today at 1-800-880-4653.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.