Why Investors Are Turning to Alternative Stores of Value

Posted on — 1 CommentWith the U.S. dollar index down 10% this year and inflation stirring, it’s a great time to diversify investments with blue chip rare gold.

A generation ago, it was common to find rare coins, collectible books, art masterpieces and extensive wine collections only in the homes of the wealthy upper class.

Today, investor movement toward alternative stores of value has exploded.

In fact, middle class investors want in on these smart money tangible investments too – as a method to diversify their portfolios, protect their assets and grow their wealth. Interestingly, technology plays a part in opening access to these asset classes to middle class investors.

For example, there are start-up companies that now allow investors to buy small portions (shares) of art masterpieces, or a wine investing platform that allows you to invest in wine without having to store it yourself.

So why the rush into alternative investments?

Inflation is pushing investors into alternative stores of value.

Zero interest rates mean bond investors lose money on their investments after inflation. Even worse, the U.S. dollar index has tumbled 10% in 2020 alone. This comes as “real concerns around the longevity of the U.S. dollar as a reserve currency have started to emerge,” wrote Goldman Sachs analysts in a recent research note.

The Federal Reserve is devaluing the U.S. dollar by printing trillions of new dollars this year alone, as it pumps unprecedented amounts of cash into the economy.

While the pandemic rages on in 2020, the precious metals and rare coin sector is glittering. Gold hit a new all-time high above $2,000 an ounce earlier this year. The rare coin values index hit new all-time highs throughout the summer months. Indeed, history shows us we are just at the starting point. We are on the cusp of a new multi-year bull market in rare coins, thanks to building inflation pressures.

Gold is off its highs but is still up 23% for the year. Silver is up 34%. That compares to a 5% gain in the S&P 500 index and a 0.80% yield on U.S. Treasury notes.

Simply put, investors are diversifying with alternative investments like numismatics, gold bullion, cars, art, sports memorabilia, wine, and whisky because inflation is on the rise and the U.S. dollar is weakening.

The Fed let the inflation genie out of the bottle

In order to have inflation you must have a huge amount of money that has been created out of thin air by the Fed. Of course, the Fed has already done this. Never before in history has there been so much excess cash sloshing around in the U.S. financial system.

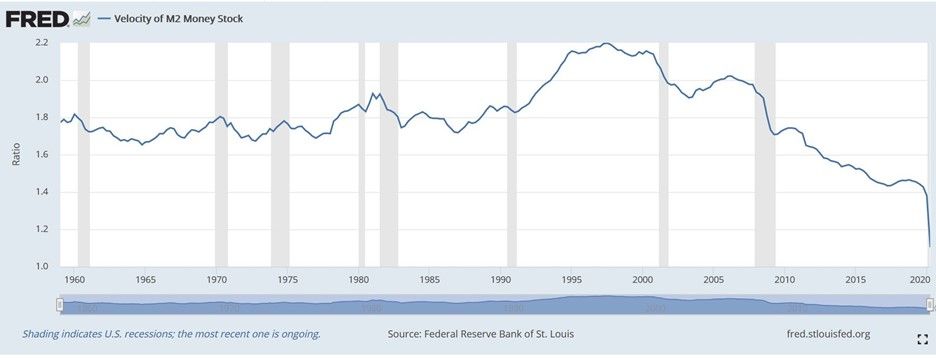

Second, you need that money to change hands and the faster it changes hands, the more inflation rises. If you look at the following chart from the St. Louis Federal Reserve, you see that the velocity of money has never been lower. The velocity of money simply means the number of times one dollar can be used to purchase final goods and services included in GDP.

Money velocity is going to change. As you can see, the drop off in 2020 has been huge and quick. That can go the other way as well.

For investors, now is the time for you to prepare for wealth storage and preservation. Because if you wait, it could be too late.

Some may ask, if inflation is an increase in money and credit beyond the growth requirements of the economy, then why don’t we see inflation, or hyperinflation, today?

Step one is increase the money supply as much as you can. Of course, we have witnessed that over the last several years with the massive Fed money printing. What we have not seen is the turnover of that money. Once that increases, inflation will move upwards very quickly.

Inflation starts slow, but then heats up fast

Think about inflation as the oven you just turned on to 500 degrees. At first you can put your hand inside and feel a little heat. Ten minutes later it is 500 degrees. It happens very slowly at first. Then very fast. Well, the oven has been on for a long time and the Fed just keeps turning the oven up. Its warm right now but it will be too hot to touch in the very near future.

The Fed has set the stage for a new bull market in rare coins. We are on the cusp of that now.

Here is another chart – the PCGS Key Dates and Rarities Index from 1970-2019. This shows you how significant the 2001-2008 rare coin bull market truly was. Today, we are in the early stages of another rare coin bull market just like we saw begin in 2001.

Rare coin market tightens as investor demand grows

Here at Blanchard, 2020 has seen numismatic investor interest shift from mid-level rare coins, to ultra-rarities. Indeed, the high end of the rare coin market is tighter than its been in over a decade.

Not long ago, clients had their pick of coins in the $10,000 to $30,000 level. Now, coins in that price range have become nearly nonexistent and those that are located are placed immediately.

For instance, CAC graded rarities are extremely scarce and hard to come by right now. That compares to this same time last year, and we could source almost any coin with a CAC sticker.

Here are some rare coins that are on the cusp of a multi-year bull run that we’ve recently sold. We can’t keep them in inventory – they sell as soon as we are able to source them.

- 1854-O $20 Liberty

- 1907 $20 Saint GaudensFlat Edge High Relief HI FLT

- 1866-S $20 Liberty

- 1931-D $20 Saint Gaudens

- 1920-S $10 Indian

- 1907 $10 Indian Wire Edge

- 1911-D $2 1/2 Indian

- 1863 $1 Gold Deep Cameo

Weaker dollar, rising inflation impacts all alternative asset classes

It’s no surprise the ultra-rich still favor alternative stores of value.

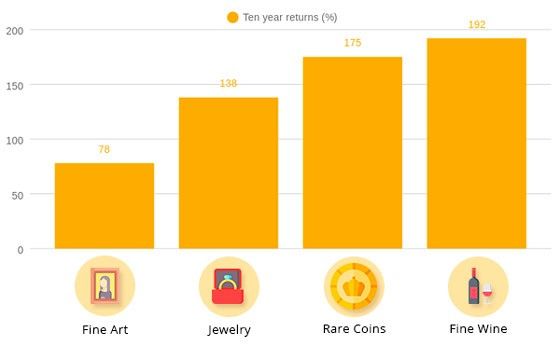

The results of the 2020 Knight Frank Luxury Investment Index revealed that ultra-high net worth individuals, or those with a net worth of over $30 million, continue to favor cars, wine, coins, rare whisky, and art as alternative investments. And those categories outpaced luxury investments (like stamps, colored diamonds, watches and handbags) over a 10-year period.

The report found that rare coins are up 175% in past decade.

How are other assets classes doing now?

In a Knight Frank Luxury Investment update last week, the firm found that the art market has been reined in by COVID-19 and the classic car sale market has also slowed.

The top end of the art market has been particularly badly affected by the pandemic.. According to a report by analyst Clare McAndrew, published by Art Basel and UBS, gallery sales dropped by 36% in the first half of the year compared with the same period in 2019.

Meanwhile, the auction market for classic car sales has downsized. “In terms of [classic car] prices you could probably say the market has plateaued for now,” says Dietrich Hatlapa of HAGI.

Meanwhile, in 2020 the rare coin market is red hot. Numismatics offers you the best alternative store of value among tangible asset collectibles.

We are in the early stages of rare coin bull market

Remember, in 2001-2008 coin values went up by a lot. We are in the beginning of that phase now.

How do rare coins fit into your financial picture?

Blue-chip rare gold is the place to park your dollars right now.

Look for proof gold, early gold, early silver, branch mint gold, high reliefs, and world-class rarities. It’s a great strategy at the right time. Independent research confirms it. Professor Lombra’s data is solid, and the findings are very clear: allocate toward high-end rare coins. If you haven’t read the report, please read the details now.

Why you should consider blue chip rare gold now

Sadly, the decline of a once-great economic power is well underway. This pandemic has only increased the fall…

The government has killed the golden goose and, in an attempt to hide the obvious, it is devaluing the U.S. dollar, fast. This ultimately will lead to inflation.

It’s Economics 101.

Inflation is on the way. Right now, gold and rare coins are in the beginning of what could prove to be the strongest bull market for gold and rarities on record. In all likelihood, there are years of growth ahead in these markets.

The Great Inflation period from the 1970’s and early 1980’s shows us when inflation becomes institutionalized, collectibles that tend to appreciate in value the fastest are those that are portable and private – like numismatics.

In late 1970’s values of collectible stamps and coins rose at a rate of 20 percent a year on average.

Looking ahead, there is no end to future inflation in America. Our country has created a noose around our economy’s neck. The long-term outlook is for continued debasement of the U.S. dollar’s buying power.

To strategize for such a time, it becomes prudent for you to develop a game plan based upon solid information. We will say it again: blue-chip rare gold is the place to park your dollars right now.

If you need assistance identifying and sourcing coins, please call a Blanchard portfolio manager today. Inflation is a clear and present danger to our economy and your future wealth. Yet if you act now, you can protect your wealth in a proven asset class – numismatics. We are happy to answer any questions you may have and can guide you through the process to identify what coins are best suited to help you meet your long-term financial goals.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

1 thought on “Why Investors Are Turning to Alternative Stores of Value”

Comments are closed.

Please define “BLUE CHIP RARE GOLD

T.Y