Zero Hour: Three Reasons to Consider Gold During a Federal Reserve Rate Cut

Posted onOn Sunday the Federal Reserve cut the benchmark interest rate by one percentage point. The result is a near zero rate representing a new economic reality characterized by diminished confidence and near-term fears.

This move is just one of several actions designed to buoy financial support and confidence as global health concerns rise. Less than two weeks ago the Federal Reserve cut rates by half of one percent. Additionally, there are no reserve requirements for banks at the moment. This move is intended to encourage banks to lend money rather than hold it to meet regulatory mandates.

Equity markets have been largely discouraged by these actions. The S&P 500 is now experiencing double digit losses from recent highs. Moreover, Federal Reserve Chair Powell remarked that additional actions are “going to depend on how widely the virus spreads, which is something highly uncertain and I would say unknowable.” In this unknowable time, investors must reassess their positions.

Many are looking to gold. Here are three reasons why:

Gold and Interest Rates Have a Unique Relationship

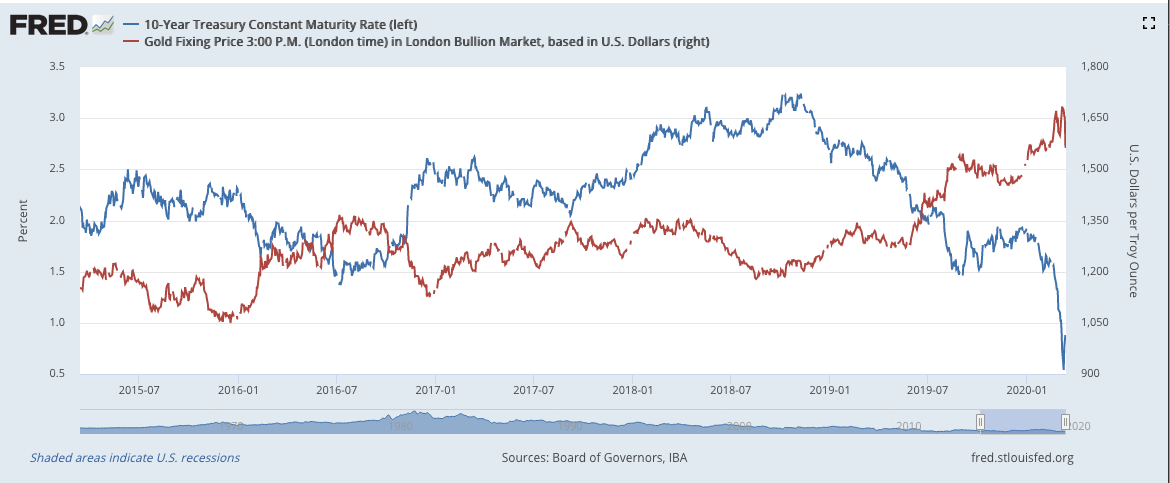

The below chart shows the inverse relationship between the price of gold and the 10-year treasury rate over the last five years. This data serves as an example of the opportunities that can be present during a period of economic shock. Moreover, this relationship has appeared to intensify over recent months. The data suggests that gold could be a stabilizing force in an otherwise fiercely volatile portfolio of stocks and bonds.

Frequently, analysts gauge this relationship by examining a statistical measurement called r-squared. This number represents the degree to which the change in one thing (e.g. the 10-year Treasury rate) can be explained by the change in another thing (e.g. the price of gold). Over the last 10 years the r-squared of 10-year Treasury rates and gold prices has hovered around 31%. However, in 2020 this figure has increased to approximately 68%. This figure seems to indicate that the interest rate changes are exacting a greater influence on the price of gold in recent months.

The Value of Gold is Likely Less Influenced by Closures

Every day governors are issuing statewide closures of bars, nightclubs, and restaurants. More Americans are working from home and staying away from retail stores. The net effect of these mandated, and self-imposed measures is decreased economic activity. This trend will continue for an unknown period of time as coronavirus concerns spread.

The nature of this threat is unique in that it affects all people and nearly all businesses. Put simply, coronavirus can reach anyone. As a result, investors face a future with fewer haven investments. Gold, however, represents a possible exception in that the metal’s value is not dependent on patrons enjoying a nice meal out, or customers going to the store to buy a new set of clothes, or movie goers hitting the local cinema. The value is based on a worldwide acceptance that gold is a store of wealth. This value is also underpinned by its rarity and finite nature.

Gold is Free From Counterparty Risk

Counterparty risk is a term used to describe the risk associated with a business’s ability to meet their debt obligations. When an investor sees the value of their shares plummet because a publicly traded company is no longer able to remain solvent, the investor is suffering from counterparty risk.

Physical gold is free from counterparty risk because the asset does not require any individuals to meet debt payments or remain profitable. Counterparty risk becomes an escalating threat in an unstable economy because weakened business conditions make it difficult for companies to drive revenue which, in turn, creates difficulty in servicing debt. Too often the investors suffer from this scenario in the form of decreased share value.

Despite health concerns and pervasive uncertainty, forward-thinking investors are seizing unprecedented opportunities to strengthen their portfolio.

Subscribe to our newsletter! Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.