1975 No-S Roosevelt Dime (Proof): The Modern Rarity That Changed the Conversation

Posted on — Leave a commentIn numismatics, we tend to associate true rarities with the 19th century, early silver, classic gold, coins shaped by circulation and time. But every so often, a modern issue forces collectors to rethink that assumption. The 1975 No-S Roosevelt Dime (Proof) is one of those coins.

At first glance, it’s just an ordinary dime from the 1970s. But look closer, and understand what you’re looking at, and it becomes one of the most elusive modern rarities in U.S. coinage. Only two examples are known. One sold for $456,000 in 2019. A 2024 appearance pushed the number beyond $500,000.

Not because of silver content. Not because of age. Because of a missing mint mark.

The Detail That Changes Everything

Let’s start with the most important distinction: this is a Proof coin, not a circulated one.

In 1975, the United States Mint struck hundreds of millions of Roosevelt Dimes for circulation. Denver coins carry a “D” mint mark. Philadelphia coins carry no mint mark, that was standard practice at the time. In fact, Philadelphia produced 585,673,900 dimes in 1975 without a mint mark. Every one of those is completely normal.

The rarity comes from the San Francisco Proof issue. Since 1968, all Proof versions of circulating U.S. coinage were struck in San Francisco and carry an “S” mint mark. Proofs were made differently, polished planchets, specially prepared dies, and individually handled strikes. They display deep mirrored fields and sharp detail that immediately separate them from circulated strikes.

The 1975 No-S dime is a San Francisco Proof struck without the “S” mint mark.

This tiny detail turns a standard Proof into a six-figure coin.

How Does That Even Happen?

During this period, Proof dies were prepared in Philadelphia. An “S” mint mark was punched into each die before it was shipped to San Francisco. Occasionally, a die escaped that step. When it did, coins were struck without a mint mark, even though they were intended to be San Francisco Proofs.

Similar No-mint mark Proof errors exist for other years, including 1968, 1970, and 1983 Roosevelt Dimes, along with a few others. But those have populations in the dozens or even hundreds.

1975 has two known examples. That’s what changes the story from interesting to legendary.

The Discovery, The Grades, and The Prices

The first example was discovered in 1977 inside a 1975 Proof Set. The second surfaced several years later. For decades, neither coin appeared publicly at auction.

Today, both coins are certified by Professional Coin Grading Service.

One example is graded PR68. It first hit auctions in 2011, selling for $349,600. It later sold in 2019 for $456,000. The coin is fully brilliant and lacks cameo contrast.

The second example, the discovery coin, is graded PR67. After years in private hands, it appeared in an auction in October 2024, selling for $506,250. This piece shows attractive blue-gold toning, giving it a distinctive appearance compared to its pair.

The Ongoing Mystery

There are two leading theories. The first, and most likely, is that the mistake was caught early and only a handful escaped. The second, more speculative theory, suggests the coins may have been intentionally produced. Given other unusual San Francisco Proof errors from the era, some collectors continue to debate the possibility.

What makes the conversation even more compelling is that both known coins are brilliant Proofs without cameo contrast. If a third example were discovered with strong cameo frost, it would raise new questions about how many dies were involved. But it has been half a century, and no additional coins have surfaced.

What To Know If You Think You’ve Found One

A worn 1975 dime with no mint mark is simply a Philadelphia circulated coin, one of more than half a billion made. This coin was never supposed to have a mint mark in the first place.

A 1975 No-S rarity will show:

- Deep mirrored Proof fields

- Sharp, squared rims

- Proof fabrication, not circulation texture

- No “S” mint mark beneath the date

If a coin checks those boxes, expert grading will be need, but the odds of finding one are extremely small.

Why This Coin Matters

The 1975 No-S Roosevelt Dime is rare not because of circulation, melt, or survival. It is rare because almost none were made. It represents a moment where human oversight or maybe something more deliberate intersected with modern minting processes ,and coins slipped through.

For collectors, that’s part of the appeal. It challenges the idea that meaningful rarities must be centuries old. It reminds us that even in an era of precision, anomalies can occur, and when they do, they can reshape the market.

Conclusion

With only two known examples, auction results exceeding half a million dollars, and questions about its origin, the 1975 No-S Roosevelt Dime has secured an extraordinary legacy.

For a modern dime, it stands as a testament to the unexpected and captivating surprises that keep collectors searching and the hobby alive.

Italian Coins: The 20 Lira Gold Standard That Tied Rome to the Latin Monetary Union

Posted on — Leave a commentFor centuries, Italian money reflected division: dozens of city-states, dozens of currencies, no shared identity. Then modern Italy struck the coins that finally ended the fragmentation. In the late 19th century, the newly unified Kingdom of Italy signaled its arrival on the European stage with the 20 lira gold coin. More than currency, it was a declaration: Italy was now part of the continent’s gold-based economy and a full participant in the Latin Monetary Union. From the denarius to the euro, Italian coins have chronicled the country’s shifting power, politics, and aspirations. This article follows that evolution, revealing how the 20 lira became Italy’s benchmark of monetary stability and why Italian issues remain essential to both seasoned collectors and precious-metal investors.

Ancient Italian Coins: The Roman Foundation

The story of Italian coinage begins with Rome, whose monetary innovations established standards that would endure long after the empire’s collapse.

Pre-Unification Context

Roman Monetary Legacy (c. 300 BCE – 476 CE)

Ancient Rome established the monetary framework that would influence Western coinage for millennia. The silver denarius served as the empire’s primary currency, while the gold aureus represented high-value transactions and the bronze sestertius handled everyday commerce. These coins didn’t just facilitate trade: they set standards for weight, purity, and design that subsequent Italian states would reference when creating their own monetary systems centuries later. Today, these old Italian coins from the Roman era remain highly collectible, with values determined by rarity, condition, and historical significance.

Image: Ancient Roman denarius showing the classical design that influenced Italian coinage for centuries.

Image source: Coin World

Medieval City-State Independence (c. 1000-1861)

After Rome’s fall, the Italian peninsula fractured into competing city-states, each asserting independence through its own coinage. Venice, Florence, Genoa, and Milan operated independent mints from the medieval period forward, producing distinctive coins that reflected their commercial power and political autonomy. A merchant traveling from Venice to Florence in the 1400s needed to exchange currency at every border, with rates determined by precious metal content and the political relationships between competing city-states. This monetary fragmentation would persist for centuries, with Italian mint coins from each city-state developing unique designs and specifications.

Image: Pre-unification Tuscan silver coin from the Grand Duchy of Tuscany.

Image source: NGC

Papal States and Vatican Authority (756-1870)

Throughout this same period, the Papal States maintained separate coinage, striking coins that combined religious imagery with temporal political power. These papal issues circulated within Vatican-controlled territories and carried unique status as currency issued by ecclesiastical rather than secular authority, making them particularly distinctive within the broader Italian monetary landscape.

The Kingdom of Italy Era (1861-1946)

Italy’s unification in 1861 demanded more than political consolidation: it required a single, standardized monetary system to replace centuries of regional fragmentation.

Unification and Monetary Standardization

From Risorgimento to Common Currency

Italian unification, known as the Risorgimento, culminated in 1861 when most of the peninsula united under the Kingdom of Italy. This political achievement created an immediate practical problem: how to merge the disparate currencies of formerly independent states into a coherent national system. The new Kingdom adopted the decimal lira, subdivided into 100 centesimi, as its official currency in 1862. This system replaced the bewildering array of regional monies – Venetian lire, Tuscan fiorini, Neapolitan ducati – with a unified standard that could facilitate trade across the newly connected nation.

Royal Portraits and National Identity

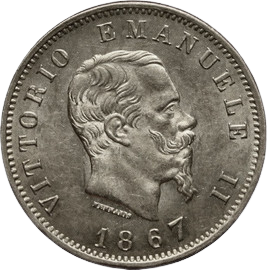

Italian coins now bore the profiles of the House of Savoy monarchs who had unified the peninsula. Vittorio Emanuele II, Italy’s first king, appeared on the earliest issues, followed by his successors Umberto I and Vittorio Emanuele III. These royal portraits served a purpose beyond identification: they visually reinforced the new national identity, replacing the diverse imagery of city-states and papal authority with a single, recognizable sovereign. The Rome and Milan mints became the primary facilities for producing this national coinage, with Rome handling the bulk of precious metal issues.

Image: Early Kingdom of Italy coin featuring Victor Emmanuel II from the year of unification.

Image source: Numista

The Latin Monetary Union Connection

Italy’s monetary ambitions extended beyond national borders through participation in Europe’s most ambitious 19th-century currency experiment.

The 1865 Agreement and Cross-Border Currency

France, Belgium, Italy, and Switzerland formalized the Latin Monetary Union in 1865, creating Europe’s first major currency standardization zone. The agreement established common specifications for precious metal coinage: Italy’s 20 lira gold matched France’s 20 franc and Switzerland’s 20 franc in weight and fineness, i.e. 6.45 grams of .900 fine gold. The union operated on a bimetallic standard where both silver and Italian gold coins served as legal tender with fixed exchange relationships. An Italian merchant could pay with 20 lira gold in Paris or Geneva, accepted at face value just like domestic coinage, facilitating trade and travel across member states decades before the Italian euro coins.

Collapse After World War I

The First World War destroyed the economic foundations that kept the Latin Monetary Union functioning. Member states suspended gold convertibility to finance military spending, silver prices collapsed relative to gold, and governments began issuing paper money that no longer matched the union’s fixed metal ratios. With the bimetallic balance broken and inflation surging across Europe, the LMU’s standardized coinage system could no longer operate. The union was formally dissolved in 1927, though in practice it had stopped functioning during the war, leaving Italy’s 20 lira gold as a vestige of Europe’s first attempt at monetary integration.

Watch this video for a comprehensive look at Italian lira coins from their 1861 introduction through the 2002 euro transition.

Italian Gold and Silver Coins: The Kingdom’s Precious Metal Standards

Italy’s adherence to the Latin Monetary Union resulted in a standardized series of Italian gold coins and silver issues that defined the Kingdom’s monetary identity and remain cornerstones of Italian numismatics.

The 20 Lire Gold: Italy’s Monetary Benchmark

Specifications and Design

The 20 lire gold coin established Italy’s monetary credibility on the international stage. Each piece contained exactly 6.45 grams of .900 fine gold (0.1867 troy ounces actual gold weight), with a diameter of 21mm and a reeded edge. The obverse featured the reigning monarch’s profile (first Vittorio Emanuele II, then Umberto I, and finally Vittorio Emanuele III), while the reverse displayed the Italian coat of arms with value denomination. Design variations occurred with each monarch, making the coins readily identifiable by period.

Image: Italian 20 lire gold coin from the Kingdom era showing King Victor Emmanuel II.

Image source: Numista

Production and Collectability

Rome and Milan mints produced 20 lire gold throughout the Kingdom period, with production concentrated in years of economic stability and international trade. Certain dates command premiums due to lower mintages or historical significance, while common dates remain accessible to collectors seeking Italian gold coins at prices near precious metal value. The coins’ Latin Monetary Union status means they circulated widely across Europe, resulting in survival rates that keep them available in today’s market.

Other Gold Denominations

Italy struck additional gold denominations within the Latin Monetary Union framework. The 100 lire gold, containing five times the gold of the 20 lire, served large transactions and wealth storage. Mid-range denominations included 50 lire and 10 lire gold pieces, while the compact 5 lire gold provided the series’ smallest precious metal option. These denominations saw more limited production than the 20 lire, making them scarcer in today’s collector market.

Italian Silver Coins of the Kingdom

The 5 Lire Silver Crown

Italy’s largest silver coin, the 5 lire, matched the dimensions and weight standards common to European crown-sized silver pieces. Containing 25 grams of .900 fine silver in a 37mm diameter, these substantial coins featured royal portraits on the obverse with various reverse designs celebrating Italian unity and heritage. High survival rates, particularly for later issues, keep 5 lire silver crowns accessible to collectors, making them popular type coins for world crown specialists.

Smaller Silver Denominations

The Kingdom produced fractional silver in 2 lire, 1 lira, 50 centesimi, and 20 centesimi denominations, all maintaining the .900 fineness standard during the precious metal era. These mid-range coins facilitated everyday commerce while providing meaningful silver content. As Italy faced economic pressures in the early 20th century, silver gradually gave way to base metals like nickel for smaller denominations, marking the transition from precious metal to token coinage that would accelerate after World War I.

Republican Era Coinage (1946-2001)

The Kingdom of Italy continued producing lira coinage through the interwar period and World War II, but the monarchy itself would not survive the war’s aftermath. Italy’s 1946 constitutional referendum abolished the monarchy by a narrow margin, transforming the nation’s coinage along with its government.

Post-Monarchy Transition: New Designs for a New Republic

Royal portraits disappeared from Italian coins, replaced by allegorical figures, agricultural imagery, and symbols of Italian culture and industry. The lira remained Italy’s currency, but its buying power eroded steadily through decades of inflation. This economic reality forced Italy to introduce increasingly large denominations: 1,000, 2,000, 5,000, and even 10,000 Italian lira coins by the 1990s. Precious metals gave way to practical base metals: aluminum for small change, stainless steel and aluminum-bronze for mid-range denominations, and eventually bi-metallic constructions for high-value pieces.

Notable Collector Issues

Despite the shift to base metal, Italy maintained its artistic coinage tradition through 500 lire silver commemoratives starting in 1958. These large Italian silver coins marked national events and anniversaries, offering collectors accessible precious metal pieces with attractive designs. Certain low-mintage years and proof sets command premiums, while the final Italian coins before euro conversion, i.e. the 2001 lira issues, attract collectors seeking the currency’s concluding chapter.

Italian Euro Coins (2002-Present)

On January 1, 2002, Italy abandoned the lira after 140 years and adopted the euro as part of the European Union’s common currency initiative.

Euro Transition and Italian Designs

Italian euro coins feature unique national designs on their reverse sides while maintaining standard European obverse specifications. The Italian Mint chose iconic cultural symbols for its denominations: the Colosseum for the 5-cent piece, Botticelli’s Birth of Venus for the 10-cent, and Dante Alighieri for the 2-euro. These designs ensure Italian euro coins remain distinctively identifiable even within the standardized European monetary system.

Collector Interest and Special Issues

First-year 2002 euros attract type collectors seeking the currency’s inaugural issues. Italy regularly produces commemorative 2-euro coins celebrating national events, artistic anniversaries, and historical milestones, with certain low-mintage releases commanding premiums. Current Italian coins in circulation use the euro system, but collectors particularly prize Vatican City and San Marino microstate variants produced with severely limited mintages, making these parallel series especially valuable. Vatican euros command strong premiums due to their ecclesiastical imagery and the territory’s unique status as an independent state within Rome.

Image: Modern Vatican euro coin featuring Pope Francis from the microstate’s limited-mintage series.

Image source: European Central Bank

Building an Italian Coin Collection

Italian coinage offers collectors multiple pathways, from affordable Italian gold coins to specialized historical sets, with the 20 lire gold serving as the natural entry point

Starting with the 20 Lire Gold

The Accessible Gold Standard

For collectors new to Italian coinage or European gold, the 20 lire represents an ideal starting point. Struck in substantial quantities during the Kingdom period, these coins remain readily available at prices close to their gold content value. With 0.1867 troy ounces of pure gold, they offer meaningful precious metal weight in a compact, historically significant format. Various dates and monarchs appear in Italian coins for sale from dealer inventories (Victor Emmanuel II, Umberto I, and Victor Emmanuel III), allowing collectors to select based on personal preference or historical interest without confronting prohibitive scarcity premiums.

Latin Monetary Union Cross-Collecting

The 20 lire’s identical gold content to French 20 francs, Swiss 20 francs, and Belgian 20 francs creates natural collecting synergies. Assembling a Latin Monetary Union gold set, i.e. one coin from each member nation, demonstrates the 19th-century monetary integration experiment while building a diversified European gold portfolio. This approach combines historical narrative with precious metal accumulation. Collectors seeking rare Italian coins should focus on low-mintage Kingdom dates or exceptional condition examples that command premiums beyond standard issues.

Specialized Collection Strategies

Type Set Approaches

Collectors can pursue Italian coinage by historical period, i.e. one coin representing ancient Rome, medieval city-states, Kingdom era, Republic, and modern euro. Alternatively, focusing on a single monarch like Victor Emmanuel II or Umberto I creates a manageable specialized collection. Denominational type sets, assembling one example of each Kingdom gold or silver value, offer another coherent approach.

Silver and Commemorative Focus

The 5 lire silver crowns provide large-format coins at accessible prices, particularly for common Kingdom dates. When searching for valuable Italian coins, both Kingdom-era precious metal issues and select Republican commemoratives offer strong opportunities. Republican-era 500 lire silver commemoratives from 1958 onward combine artistic merit with silver content, offering modern Italian numismatics without Kingdom-era price points.

Budget Considerations

Italian coins value spans a wide spectrum depending on era, metal content, and rarity. Entry-level collectors can acquire common-date 20 lire gold or 5 lire silver crowns near precious metal value. Mid-range budgets open access to scarcer dates, better-preserved examples, and multiple denominations. Investment-grade collectors pursue key-date rarities, medieval city-state gold, or exceptional condition Kingdom pieces where scarcity and historical importance drive substantial premiums. Italian coins fit within a broader precious metal investment strategy that can include both bullion and numismatic pieces across different asset categories. Complete set assembly faces its greatest challenge with early Renaissance gold ducats and specific low-mintage Kingdom dates, though most Italian collecting goals remain achievable without confronting unobtainable rarities.

Conclusion

Italian coinage chronicles more than two thousand years of monetary evolution, from Rome’s foundational denarius through the Latin Monetary Union’s 20 lira gold standard to today’s euro. This extraordinary span offers collectors accessible entry points, such as common-date 20 lire gold coins available near precious metal value, alongside specialized pursuits like medieval city-state ducats or complete Kingdom sets. Italian coins uniquely combine artistic excellence with substantial precious metal content and deep historical significance, appealing equally to world coin collectors and precious metals investors seeking tangible assets rooted in European monetary history. Explore Blanchard’s selection of Italian and other world coins to build a collection grounded in enduring monetary legacy, backed by precious metal content and centuries of numismatic tradition.

FAQs

1. What are Italian coins called?

Italian coins have carried different names throughout history, including the denarius in ancient Rome, ducats and florins in the medieval city-states, and the lira from 1861 until Italy adopted the euro in 2002.

2. What are Italian lira coins made of?

Italian lira coinage varied by era and denomination. Kingdom-era issues were struck in gold or silver, while most Republican-era coins used base metals such as aluminum, stainless steel, and aluminum-bronze.

3. Are Italian lira coins worth anything?

Italian lira coins value varies significantly by era: Kingdom precious metal issues command premiums while Republican-era base metal lira have minimal monetary value, though certain commemorative silver issues and low-mintage dates attract collector interest.

U.S. Manufacturing Sector Shows New Signs of Life, Gold Trades at $5,000

Posted on — 1 CommentActivity at factories and mines in the United States cranked up in January. U.S. industrial production rose 0.7% last month, the biggest jump in nearly a year, the Federal Reserve reported. Gold traded around $5,000, and silver traded around $78 as precious metals continue to tread water in a quiet, sideways, orderly market trading.

as precious metals continue to tread water in a quiet, sideways, orderly market trading.

Digging deeper into the economic news, U.S. factories produced more computers, electronic products, machinery, and cars in January.

Bigger picture, the climb in factory production reveals early signs of a potential recovery in the manufacturing sector, something the Trump Administration has tried to engineer with official U.S. trade policy over the past year.

The latest manufacturing news suggests some U.S. companies may be taking advantage of tax incentives and moving forward with capital spending plans.

Other economic reports also show there may be progress toward a pick-up in the manufacturing sector. These include:

- The January employment report showed a 5,000 increase in manufacturing jobs, according to the Bureau of Labor Statistics. That reversed a negative trend of 13 consecutive months of U.S. manufacturing job losses.

- The Institute for Supply Management’s manufacturing index rose to 52.6 in January, marking the fastest pace of growth since 2022. New orders and production drove the increase. The ISM index jumped over 50 in January, after December’s 47.9 reading. Readings over 50 indicate expansion in the manufacturing sector.

- In January, capacity utilization at factories (which measures the percentage of available industrial capacity, specifically in manufacturing, mining, and electric/gas utilities, that is actually in use) rose to 75.6%, the highest level since September.

Precious Metals Action Turns Sideways As Market Consolidates Big January Gains

Gold etched an extraordinary month in the history books in January, climbing above $5,560 for the first time. In February, gold and silver action have languished in a quiet, sideways range.

Slight dips in price have been met with fresh buying action. Gold has generally traded between $5,090 and $4,888 an ounce in recent weeks. Silver is consolidating between $74 and $85. The long-term uptrends in precious metals remain strong. It’s not uncommon for markets to trade quietly in neutral patterns after big up moves.

The Next Catalyst for Precious Metals?

Investors are watching Federal Reserve officials for clues on when the central bank might cut interest rates next. Ideas that the Fed will begin cutting rates soon could unleash a fresh buying wave in metals, which don’t offer any interest or yield. Lower interest rates historically boost precious metals for months during central bank easing cycles. The Fed is scheduled to meet next on March 17-18.

Walking Liberty Half Dollar: The 1916 Art Experiment That Redefined U.S. Coin Design

Posted on — Leave a commentIn 1916, the U.S. Treasury held a competition to redesign America’s silver coins, inviting artists outside the Mint for the first time in decades. Sculptor Adolph A. Weinman seized the opportunity and created a half dollar unlike anything before it. His Liberty didn’t stand still: she walked, flag flowing behind her, striding toward the sunrise. Mint officials questioned whether the ambitious design could be produced reliably, and early strikes confirmed their concerns. Refinements in striking technique eventually made consistent production viable, and the result became one of America’s most admired coins. This article examines the origins of the Walking Liberty Half Dollar, production challenges, and key dates, explaining why it remains a cornerstone of American numismatics.

Walking Liberty Half Dollar: Historical Context and Design Origins

The silver Walking Liberty Half Dollar emerged from a pivotal moment when American coinage underwent its most significant aesthetic transformation since the nation’s founding.

The Competition That Changed American Coinage

In 1916, the U.S. Treasury launched an initiative to revitalize American coin design, marking a decisive break from decades of conservative artistic choices.

The MacNeil Competition and Treasury Vision

The Treasury Department’s 1916 design competition specifically sought to replace the aging Barber coinage series, which had circulated since 1892. Officials recognized that American coins lagged behind European counterparts in artistic merit, prompting them to invite established sculptors to submit designs. This open competition represented a fundamental shift in how the nation approached coinage aesthetics.

Adolph A. Weinman’s Artistic Background

Weinman brought exceptional credentials to the competition. A student of the renowned sculptor Augustus Saint-Gaudens – designer of the celebrated $20 gold piece – Weinman had already established himself through major commissions including architectural work for the Wisconsin State Capitol and the Panama-Pacific Exposition. His sculptural philosophy rejected the stiff, medallion-style portraiture that dominated 19th-century coinage, instead favoring dynamic compositions where figures interacted with their environment. Weinman believed coins should capture moments of action rather than frozen poses, a radical departure that positioned him perfectly to revolutionize American coinage design for the 20th century.

Image: Photograph of sculptor Adolph A. Weinman, known for designing the Walking Liberty Half Dollar and the Mercury dime.

Source: USA Coin Book

Dual Commission Achievement

Weinman’s talent impressed officials so thoroughly that he received commissions for both the half dollar and dime, an unprecedented achievement for a single artist. While his Walking Liberty Half Dollar captured public imagination with its dramatic imagery, his Mercury dime design proved equally revolutionary, creating a matched pair that defined American silver coinage for three decades

Public Reception and Barber Series Departure

Contemporary reactions ranged from enthusiastic praise to skeptical concern. The dramatic shift from Charles Barber’s austere designs sparked debate among collectors and the public alike. Some celebrated the artistic ambition, while practical-minded critics questioned whether such detailed designs could withstand the rigors of circulation. Time would vindicate Weinman’s vision, as both designs gained widespread appreciation.

Design Elements and Symbolism

Weinman’s Liberty Walking Half Dollar design incorporated rich symbolism and classical influences that elevated it beyond mere currency.

Obverse Imagery and Meaning

The coin’s obverse features Liberty striding confidently toward the sunrise, her right hand extended in invitation while her left carries laurel and oak branches symbolizing peace and strength. The American flag drapes across her body, billowing dramatically as she moves. This dynamic composition broke from static portrait traditions, capturing Liberty as an active force rather than a passive symbol.

Image: 1917-S Walking Liberty Half Dollar obverse.

Source: NGC

Reverse Eagle Design

The reverse depicts a majestic American eagle perched on a mountain crag, wings partially spread as if preparing for flight. A mountain pine sapling grows from the rocky perch, symbolizing America’s strength rooted in natural foundations. The design balances power with grace, complementing the obverse’s forward motion with stability and watchfulness.

Image: 1917-S Walking Liberty Half Dollar reverse.

Source: NGC

Classical Artistic Influences

Weinman drew heavily from Greco-Roman sculptural traditions, particularly the Nike (Victory) figures of ancient Greek art. The flowing drapery and contrapposto stance echo classical techniques, while the naturalistic rendering reflects Renaissance influence. This synthesis of classical and modern approaches created a timeless quality that transcends the coin’s production era.

American Silver Eagle Legacy

In 1986, when the U.S. Mint launched its modern bullion program, officials chose Weinman’s Liberty Walking Half Dollar design for the American Silver Eagle’s obverse. This decision recognized the design’s enduring appeal and established a direct lineage between classic and contemporary American silver coinage, ensuring Weinman’s vision continues reaching new generations of collectors and investors.

Image: 2008 American Silver Eagle bullion coin, obverse and reverse.

Source: USA Coin Book

Production History and Mintage Overview

Walking Liberty Half Dollars were struck at three U.S. Mint facilities over 32 years, with each mint contributing distinct characteristics to the series.

For a visual overview of the most valuable varieties and what sets them apart in the marketplace, watch this video on the Walking Liberty half-dollar series.

Mint Facilities and Production Spans

Philadelphia Mint Production

The Philadelphia Mint produced these coins continuously from 1916 through 1947, with coins bearing no Walking Liberty Half Dollar mint mark. Philadelphia strikes generally exhibit superior quality compared to branch mints, particularly in later years when die preparation techniques had been refined. The facility’s central role and experienced staff resulted in more consistent striking, making Philadelphia issues the benchmark for the series.

Denver Mint Contributions

Denver struck Liberty Walking Half Dollar coins intermittently from 1916 through 1947, with the “D” mint mark appearing on the obverse through mid-1917, then shifting to the reverse below the pine branch for subsequent years. Denver’s production was often characterized by weaker strikes, particularly on Liberty’s head and the eagle’s breast feathers, making well-struck Denver coins especially desirable.

San Francisco Mint Role

San Francisco produced coins from 1916 through 1947, with the “S” Walking Liberty Half Dollar mint mark following the same placement pattern as Denver. San Francisco strikes varied considerably in quality, with some years producing exceptionally sharp coins while others showed chronic weakness, making date-by-date evaluation essential for collectors pursuing this mint’s output.

Production Challenges and Characteristics

High Relief Striking Difficulties

Weinman’s artistic vision created immediate production problems. The design’s high relief required exceptional striking pressure to bring up full details, particularly on Liberty’s head and hand, and the eagle’s breast feathers. Early 1916 production proved so problematic that the Mint made subtle modifications to reduce relief, though striking challenges persisted throughout the series.

Die Life and Wear Issues

The intricate design details caused dies to wear rapidly compared to simpler designs. This accelerated wear meant dies had to be replaced more frequently, increasing production costs and creating strike quality variations even within single production runs. As dies wore, fine details disappeared first, particularly the head, hand, and skirt lines on the obverse.

Wartime Silver Priorities

World War II dramatically affected Walking Liberty production. Mintages surged as silver demand increased for wartime industrial uses, resulting in some of the series’ highest production years between 1942-1945. However, wartime urgency sometimes compromised quality control, with more weakly struck examples entering circulation during this period.

Walking Liberty Half Dollar Key Dates and Rare Varieties

This Half Dollar series presents collectors with everything from legendary rarities to affordable common dates, creating opportunities across all budget levels.

The Holy Grail: 1921 Issues

The 1921 production year produced the series’ three scarcest coins, with post-World War I economic conditions resulting in severely limited mintages across all three mints.

1921-D: The Series King

The 1921-D stands as the Walking Liberty Half Dollar’s undisputed key date, with only 208,000 pieces produced, the lowest mintage in the entire series. Denver’s minimal production, combined with heavy circulation of surviving examples, makes this coin genuinely rare in all grades. Even heavily worn examples command substantial premiums, while choice uncirculated specimens rank among American numismatics’ most valuable regular-issue half dollars.

Image: 1921-D Walking Liberty Half Dollar obverse and reverse.

Source: PCGS

1921 Philadelphia

The Philadelphia Mint’s 246,000-piece production makes the 1921 the second-scarcest date in the series. This low mintage resulted from post-war economic contraction and reduced demand for silver coinage. The 1921 Philadelphia issue remains a major challenge for date collectors.

1921-S: Completing the Trio

San Francisco’s 548,000-piece mintage makes the 1921-S the most available of the three 1921 dates, yet it still qualifies as a significant rarity. The 1921-S serves as a more attainable alternative to the Denver and Philadelphia issues for collectors building complete sets.

Early Series Rarities: 1916-1917 Issues

The series’ first two years produced several important dates that command strong collector demand.

1916 First-Year Issues

The inaugural 1916 Walking Liberty Half Dollar production created three collectible dates, though none approach the rarity of the 1921 issues. The 1916 Philadelphia (608,000 mintage), 1916-D (1,014,400 mintage), and 1916-S (508,000 mintage) all attract premium interest as first-year issues. The 1916-S proves particularly challenging to locate in high grades due to typically weak strikes and heavy circulation.

1917 Obverse Mintmark Varieties

Both Denver and San Francisco struck 1917 Half Dollars with mint marks on the obverse (below “In God We Trust”) before mid-year standardization moved marks to the reverse. The 1917-D obverse and 1917-S obverse varieties are considerably scarcer than their reverse mintmark counterparts, representing important transitional issues that advanced collectors pursue intensely.

1938-D: Depression Era Rarity

The 1938-D’s 491,600 mintage makes it one of only nine Walking Liberty dates with production under one million pieces. Depression-era economic conditions limited output, creating a late-series rarity that often surprises collectors unfamiliar with 1930s mintage figures.

Common Date Opportunities

Abundant survivors from certain years provide accessible entry points for beginning collectors and bullion-focused buyers looking for a Walking Liberty Half Dollar for sale.

1940s Philadelphia Production

High-mintage Philadelphia issues from 1940-1947 remain readily available in circulated and lower mint state grades. These coins offer affordable exposure to Weinman’s design while providing substantial silver content near melt value.

Wartime Hoarding Effect

The 1942-1945 production years saw extensive public hoarding driven by wartime uncertainty and silver’s perceived value. This hoarding preserved millions of coins in above-average condition, creating unusual availability for dates that would otherwise show typical circulation wear patterns. Collectors can still occasionally find an original bank-wrapped Walking Liberty Half Dollar roll from this period, offering affordable opportunities to acquire multiple high-grade examples.

Walking Liberty Half Dollar Silver Content and Melt Value Analysis

These coins contain substantial precious metal content that provides intrinsic Walking Liberty Half Dollar value independent of numismatic considerations.

Composition Specifications

Each Walking Liberty Half Dollar consists of 90% silver and 10% copper, the standard composition for U.S. silver coinage from 1916 through 1964. This alloy balances durability with precious metal content, creating coins that could withstand circulation while maintaining significant silver weight.

Precious Metal Content

Every coin contains exactly 0.36169 troy ounces of pure silver, with a total weight of 12.5 grams (0.4019 troy ounces). The coins measure 30.6mm in diameter with reeded edges, specifications that remained consistent throughout the 1916-1947 production span.

Understanding Walking Liberty Half Dollar Melt Value

Calculating Current Worth

Determining a Walking Liberty Half Dollar’s melt value requires multiplying 0.36169 troy ounces by the current spot silver price. This calculation establishes the minimum value for any silver Walking Liberty Half Dollar regardless of condition or date.

Numismatic Premiums vs. Bullion Value

Common-date Walking Liberty Half Dollars in worn condition typically trade near melt value, attracting buyers primarily interested in silver content. However, better dates, higher grades, and coins with strong strikes command substantial premiums above their precious metal worth. The key dates discussed earlier trade at multiples of Walking Liberty Half Dollar melt value even in lower grades, while common dates in choice uncirculated condition may bring 50-100% premiums over silver content.

Market Floor Protection

The substantial Walking Liberty Half Dollar silver content provides downside protection rare among collectible coins. Even during periods of declining numismatic interest, Walking Liberty Half Dollars retain value tied to precious metal markets. This metal content floor makes them appealing to both traditional coin collectors and precious metals investors seeking tangible assets with historical significance. To learn more about diversifying with tangible assets, explore Blanchard’s Asset Options.

Date and Mint Mark Collecting Strategies

Walking Liberty Half Dollars offer multiple collecting approaches suited to different budgets and interests, from comprehensive date sets to focused type collecting.

Complete Set Assembly

Full Set Scope and Challenge

A complete Walking Liberty Half Dollar collection comprises 65 regular-issue coins spanning three mints across 32 years. This includes all Philadelphia, Denver, and San Francisco issues from 1916 through 1947, plus the scarce 1917 obverse mintmark varieties from Denver and San Francisco. Completing this set represents a significant achievement in American numismatics, requiring patience, knowledge, and substantial financial commitment for the Walking Liberty Half Dollar key dates.

Budget Considerations Across Grade Levels

Building a complete set in circulated grades (Good through Very Fine) remains achievable for dedicated collectors, though the 1921-D, 1921, and key 1916 issues will still demand four-figure investments even in worn condition. Mid-grade sets (Fine through Extremely Fine) require significantly larger budgets, with total costs reaching five figures when quality examples of scarce dates are included. Mint state sets enter serious investment territory, with gem examples of Walking Liberty Half Dollar key dates commanding premium prices that make complete uncirculated sets accessible only to advanced collectors with substantial resources.

Short Set Alternatives

Accessible Date Runs

Many collectors focus on 1934-1947 dates, which remain relatively affordable across all three mints while still presenting modest challenges. This 14-year span eliminates the problematic early dates while preserving the satisfaction of building a multi-mint collection. Another popular approach targets 1940s issues exclusively, offering high-quality coins at prices near silver melt value with minimal numismatic premiums.

Type Collecting Appeal

Walking Liberty Half Dollars serve as ideal representatives of early 20th-century U.S. silver coinage in type sets. A single high-grade common date – typically a 1940s Philadelphia issue – provides exposure to Weinman’s celebrated design without the expense of pursuing scarce dates. Type collectors often select examples with attractive toning or exceptional strikes, prioritizing aesthetic appeal over specific date requirements.

Conclusion

The silver Walking Liberty Half Dollar is one of America’s most admired coins: an enduring blend of artistry, history, and intrinsic value. Adolph A. Weinman’s dynamic design transformed U.S. coinage, while the series’ broad range continues to captivate collectors. Struck in 90 percent silver, these coins offer both tangible worth and lasting beauty. Whether beginning a collection or refining an advanced set, the Walking Liberty Half Dollar remains a cornerstone of classic U.S. coinage. Explore Blanchard’s selection of junk silver coins, including Walking Liberty Half Dollars and other classic U.S. issues, to start or expand your tangible precious-metal holdings today.

FAQs

1. How much is a Walking Liberty Half Dollar worth?

Walking Liberty Half Dollar value depends on condition, rarity, and collector demand. Common dates trade close to their silver value, while scarce or high-grade examples command significant premiums.

2. What is the rarest Walking Liberty Half Dollar?

The 1921-D is generally considered the key date of the series, prized for its low mintage and rarity in all grades.

3. How much silver is in a Walking Liberty Half Dollar?

Each coin contains roughly one-third of a troy ounce of silver, giving it intrinsic value regardless of condition.

4. How do you grade a Walking Liberty Half Dollar?

Grading focuses on strike sharpness and wear, particularly on Liberty’s head, hand, and gown lines, and the eagle’s breast feathers on the reverse. For a deeper explanation of coin grading principles and terminology, see Blanchard’s Numismatic Coin Grading Guide.

5. How much does a Walking Liberty Half Dollar weigh?

Each coin weighs 12.5 grams, which equals 0.4019 troy ounces.

Existing Home Sales Plunge 8.4%, Gold Trades In Range

Posted on — Leave a commentWhile some parts of the country are seeing an early spring thaw, the U.S. housing market is still on ice.

U.S. existing home sales tumbled 8.4% to a seasonally adjusted annual rate of 3.91 million in January, the National Association of Realtors (NAR) announced Thursday. The news was far worse than expected and marked the biggest monthly decline in nearly four years.

High home prices, falling consumer confidence and a shrinking housing inventory are all factors pressuring the housing market. “The decrease in sales is disappointing,” said NAR Chief Economist Dr. Lawrence Yun.

Why The Housing Report Matters

If the weakness in the housing market continues, it could have a major impact on investor psychology and broader financial markets.

Real estate and the housing market play a major role in the U.S. economy, estimated at 15-18% of total gross domestic product (GDP).

From construction jobs for new housing to home renovations to new consumer expenditures when people buy a home, there is a huge ripple affect on the economy from the housing market. New homeowners typically buy a slew of goods and services like new furniture, appliances and lawn care services when they buy a home, all adding to GDP growth.

A slowdown in the housing market has the opposite impact on the broader economy. The coming months will be key for the housing market as the spring is typically the most active time of the year for home sales.

Gold Reacts as Stocks Sell Off

Gold traded mostly steady as the housing news broke, but slipped slightly lower later in the day. Wall Street analysts attributed the modest dip in gold more likely to the sharp sell-off in stocks. Some traders had to exit positions in commodities like gold to raise liquidity in the face of margin calls on losing stock positions.

Recent Action in Gold Has Turned Sideways

Since the start of February, gold has stabilized and traded quietly in an orderly range between roughly $5,090 and $4,897.

Buyers quickly entered the precious metals market on a late January dip in gold toward $4,544 and the yellow metal quickly rebounded to the $5,000 area.

Stocks are selling off on fresh concerns over whether the massive investments in artificial intelligence will turn into big profits for companies in the months ahead. The abrupt and sharp sell-off in stocks forced some traders to raise cash by selling gold to exit their losing equity positions.

The long-term uptrend in gold remains intact. A period of consolidation is healthy for the gold market following the strong gains throughout 2025 and 2026.

Big Picture for Gold Remains Positive

Analysts including Goldman Sachs Group and Deutsche Bank AG remain broadly positive on the outlook for gold this year. BNP Paribas recently predicted gold may climb to $6,000 an ounce by the end of the year as macroeconomic and geopolitical risks remain.

The Mexican Mint Legacy: Casa de Moneda’s Journey from 8 Reales to Modern Libertads

Posted on — Leave a commentBefore the U.S. dollar dominated global trade, Spanish colonial 8 reales struck at Mexico City circulated from Manila to London as the world’s most trusted currency standard. Casa de Moneda de México was established in 1535, producing these silver coins for nearly three centuries. The history of the Mexican Mint spans Spanish colonial silver that defined global trade, revolutionary independence coinage, and modern Libertad bullion. This article traces Casa de Moneda’s evolution from a colonial supplier to a modern bullion producer.

Casa de Moneda de México: The Americas’ First Mint

Spain’s King Charles V granted royal authorization in 1535 to establish the Western Hemisphere’s first official minting operation, positioning Mexico City as the center of New World silver coinage production.

Foundation and Colonial Era (1535-1821)

Spanish Colonial Establishment

Viceroy Antonio de Mendoza, i.e. Spain’s appointed colonial governor in New Spain, established Casa de Moneda de México following discoveries of massive silver deposits at Zacatecas and Guanajuato. Spain needed local minting capacity to convert New World silver into standardized coinage rather than shipping raw metal across the Atlantic. The Mexican Mint received royal authorization from Charles V, operating as an extension of Spanish Crown authority in the colonies.

Image: 1538 Charles and Johanna 8 reales obverse and reverse showing Pillars of Hercules and Spanish coat of arms

Source: Antiques and the Arts

Strategic Location and Production Scale

Mexico City’s position near New Spain’s primary silver mining districts made it the logical choice for centralized minting operations. Proximity to Zacatecas, Guanajuato, and other major silver sources reduced transportation costs and security risks. By the 1600s, Casa de Moneda de México had become the New World’s largest coin producer, striking more silver coinage than all other colonial mints combined. The facility operated under strict Spanish oversight, with royal officials monitoring production to ensure proper silver content and prevent fraud.

Technical Innovation Across Centuries

Cob Coinage Methods

Early colonial production used cob (from Spanish “cabo de barra” meaning “end of bar”) techniques. Workers cut silver bar segments to approximate weight, then hand-struck them between dies. This created irregular, often incomplete designs where portions of legends or images fell outside the planchet. Cob coins varied in shape (some nearly round, others distinctly irregular), but met weight standards for commerce.

Transition to Milled Coinage

In 1732, Casa de Moneda de México introduced milled coinage using screw presses that produced uniformly round coins with complete, centered designs. This technological shift aligned Mexican production with European minting standards. The pillar dollar design debuted with this transition, featuring the Pillars of Hercules that would become synonymous with Spanish colonial silver.

Quality Control Systems

Assayer marks identified officials responsible for verifying silver fineness and weight standards. Each assayer’s initials appeared on Mexican coins struck during their tenure, creating accountability and enabling modern collectors to date pieces precisely. This system continued through Mexican independence into the republican era.

Modern Advancement

The 20th century brought electronic refining, automated striking equipment, and computerized quality control. Today’s facility produces bullion to specifications that would have seemed impossible to colonial mint masters.

Image: Modern Casa de Moneda de México facility in San Luis Potosí

Source: Milenio

The 8 Reales Coin: Silver Dollar of the Colonial World

The 8 reales silver coin became the most widely circulated currency in world history, serving as the de facto international trade standard for over two centuries. Watch this CoinWeek video to see collectors and dealers discussing historic Mexican coins.

Historical Significance

“Pieces of Eight” Legacy

The term “pieces of eight” originated from the coin’s denomination: eight reales equaling one Spanish dollar. This silver piece circulated across every major trading port from Canton to London to Boston, accepted universally based on its consistent silver content and recognizable design. Pirates and merchants alike preferred 8 reales over any other currency due to its reliable weight and purity. Spanish treasure fleets transported these Mexican coins across the Atlantic, with shipwrecks like the Nuestra Señora de la Concepción preserving thousands of these pieces for modern discovery.

Legal Tender in Early America

The United States Congress declared Spanish 8 reales legal tender from 1792 until 1857, longer than some early U.S. coinage circulated. American merchants sometimes cut these Mexican Mint coins into smaller pieces for making change, establishing the “two bits” terminology that persists today for a quarter dollar. The U.S. dollar’s weight and fineness specifications were modeled closely on the 8 reales coin standard when Congress designed American coinage.

Image: Spanish colonial 8 reales bust type with royal portrait and date 1792

Source: PCGS

Physical Specifications

Silver Content and Weight

Each 8 reales weighed 27.07 grams at .903 fine silver (90.3% pure), yielding approximately 0.786 troy ounces of pure silver per coin. This specification remained remarkably consistent across nearly three centuries of production, enabling global merchants to accept these Mexican Mint silver coins without individual testing. The copper alloy added for durability comprised the remaining 9.7%.

Design Elements and Diameter

Coins measured 38-40mm in diameter depending on striking method and production era. Design elements evolved significantly but typically featured the Pillars of Hercules with “PLUS ULTRA” banners, Spanish coat of arms, or royal portraits, accompanied by denomination and mint marks. Colonial cob pieces showed partial, off-center designs, while later milled coins displayed complete, centered imagery.

Mexican Independence and Republican Coinage 0

Mexico’s break from Spanish rule created new coinage reflecting national identity while maintaining silver standards that preserved international trade acceptance.

Transitional Period (1810s-1820s)

Revolutionary Coinage

Independence insurgents operated makeshift mints in territories they controlled, striking crude coins that funded the revolution. These pieces, often produced in Zacatecas and other rebel-held regions, featured simplified designs and irregular quality but maintained approximate silver content to ensure circulation. Revolutionary coinage represented Mexico’s first assertion of monetary sovereignty.

First Empire Issues

Agustín de Iturbide declared himself Emperor of Mexico in 1822, briefly ruling until 1823. His imperial Mexican Mint coin pieces featured his portrait and title, mimicking European monarchical traditions. These pieces remain scarce due to the empire’s short duration, making them sought after by collectors despite being quickly superseded by republican issues.

Republican Standards and Symbolism

The established Mexican Republic replaced Spanish royal imagery with the eagle-and-snake motif drawn from Aztec legend. This design showed an eagle perched on a cactus devouring a serpent, symbolizing the founding of Tenochtitlan and Mexican heritage. Republican coinage maintained .903 fine silver to preserve acceptance in international commerce where Spanish colonial pieces still dominated.

Image: Mexican republican 8 reales with Hook Neck Eagle design from 1823

Source: Numista

19th Century Silver Peso Development

Cap and Rays Design

Early republican silver pesos (1823-1897) featured the distinctive “Cap and Rays” design with a Phrygian liberty cap surrounded by radiating beams. This imagery echoed revolutionary themes while establishing visual distinction from colonial predecessors.

Hook Neck Eagles and Regional Production

The “Hook Neck Eagle” varieties, named for the bird’s curved neck profile, spanned multiple design iterations across decades. Zacatecas, Guanajuato, and other regional mints operated simultaneously under federal authority, each adding mint marks that create collecting varieties. These regional facilities ensured adequate coinage supply across Mexico’s large territory while maintaining consistent silver fineness for trade purposes.

Modern Mexican Mint Production

Casa de Moneda de México transitioned from circulation coinage to bullion production in the late 20th century, establishing the Libertad series as Mexico’s flagship precious metals offering.

Contemporary Bullion Program

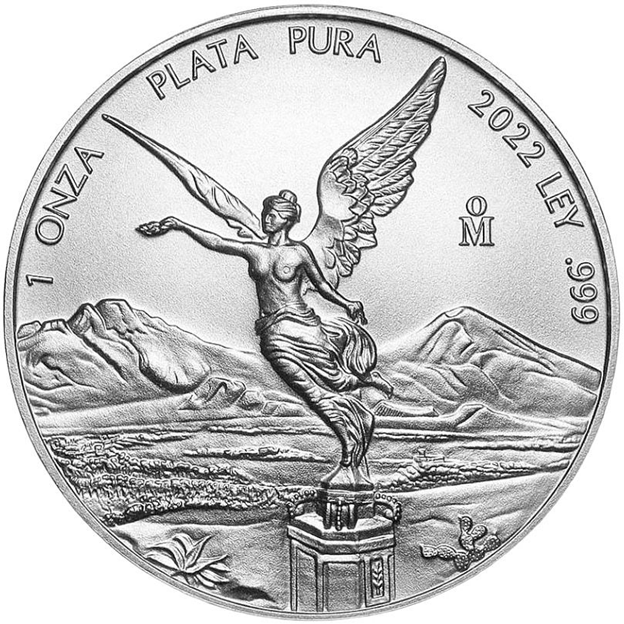

Silver Libertad Launch and Design

The Mexican government introduced the Silver Libertad in 1982 as the nation’s official bullion coin. The obverse features the Winged Victory statue (El Ángel de la Independencia) that stands on Mexico City’s Paseo de la Reforma, while the reverse displays the Mexican coat of arms surrounded by historical versions of the national eagle design. This imagery connects modern bullion to Mexico’s numismatic heritage.

Image: 2022 Mexican Silver Libertad obverse featuring Winged Victory with volcanoes Popocatépetl and Iztaccíhuatl

Source: Numista

Gold and Platinum Offerings

Gold Libertads debuted in 1981, one year before their silver counterparts. These coins mirror the silver design but in multiple fractional weights catering to different investment levels. La Casa de Moneda de México also produced limited platinum Libertads, though these remain far less common than gold and silver issues.

Collector Versions

Beyond standard bullion strikes, the Mexican Mint produces proof Libertads with mirror fields and frosted designs, plus reverse proof and antique finish variations. These collector versions carry substantially higher premiums than bullion strikes due to lower production numbers and enhanced visual appeal.

Technical Specifications of Modern Issues

Silver Libertad Range

Silver Libertads contain .999 fine silver (99.9% pure) in seven standard weights: 1/20 oz, 1/10 oz, 1/4 oz, 1/2 oz, 1 oz, 2 oz, and 5 oz. The mint also strikes large format 1 kilo and 5 kilo versions, though these command significant premiums and see limited production.

Gold Sizes and Mintage Considerations

Gold Libertads are available in 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and 1/20 oz denominations, all struck in .999 fine gold. Annual mintage figures vary considerably: proof versions typically number only a few thousand pieces, while bullion strikes reach tens of thousands in popular sizes. Lower mintages create collector premiums that exceed bullion value, particularly for proof gold Libertads from early production years.

Collecting Mexican Coins

Mexican coinage spans nearly five centuries, offering collectors both historic silver from colonial and republican eras and modern bullion with numismatic appeal.

Mexican coinage spans nearly five centuries, offering collectors both historic silver from colonial and republican eras and modern bullion with numismatic appeal.

Colonial 8 Reales Pricing

Condition, date, and type determine colonial 8 reales coin value. Cob coinage from the 1500s-1600s trades based primarily on silver content unless exceptionally well-struck or rare. Pillar dollars (1732-1771) and bust types (1772-1821) command premiums for sharp strikes and visible dates. Key dates or low-mintage years can multiply values significantly above silver weight, while common dates in worn condition trade near bullion prices.

Republican Era Rarities and Authentication

Nineteenth-century Mexican silver pesos include numerous scarce dates and mint mark combinations. Hook Neck Eagle varieties from smaller regional mints often carry substantial premiums when properly attributed. Authentication challenges include modern replicas, alterations, and outright counterfeits. Genuine colonial pieces display appropriate weight, correct silver fineness when tested, and die characteristics matching known authentic examples. Replicas often show incorrect dimensions or suspiciously perfect condition for their purported age.

Modern Libertad Investment

Bullion Versus Numismatic Mexican Coins Value

Standard bullion Libertads trade at modest premiums over spot silver or gold prices, typically comparable to other government-issued bullion. Proof versions, low-mintage years, and early-date Libertads (particularly 1980s issues) command numismatic premiums well above metal value. Collectors seek complete date runs or specific finishes, creating demand independent of precious metal prices.

Storage and Liquidity

Modern Libertads tone readily when exposed to air due to .999 fine silver purity. Capsule storage prevents surface oxidation while allowing display. International dealers recognize Libertads, though they may not be as universally liquid as American Eagles or Canadian Maples. Mexican precious metals enjoy strong demand in North American markets but may face buyback spreads in regions where they’re less common.

Authentication and Grading

Professional Certification

Third-party grading services like PCGS and NGC certify both historic Mexican coins and modern proof Libertads. Certification provides authentication and condition assessment, particularly valuable for high-grade proofs or rare colonial pieces where counterfeits exist. Raw (uncertified) colonial coins require dealer expertise to verify authenticity through weight, dimensions, strike characteristics, and silver content testing.

Dealer Selection

Reputable precious metals dealers maintain authentication standards and offer reasonable buyback policies. Established dealers can identify common Mexican counterfeits, including cast fakes of colonial pieces and struck copies of key-date republican silver, protecting buyers from purchasing problematic pieces.

Conclusion

Casa de Moneda de México’s nearly 500-year history encompasses the Mexican 8 reales silver coins that dominated global trade for centuries and modern Libertad bullion serving today’s precious metals investors. Historic 8 reales connect collectors to the currency that financed international commerce across three continents, containing substantial silver content that retains value independent of numismatic premiums. Modern Libertads deliver .999 fine silver and gold in distinctive designs featuring Mexican iconography, trading at modest premiums over spot prices while maintaining international recognition. Explore Blanchard’s selection of Mexican Mint coins to add pieces from the Americas’ oldest mint to your precious metals holdings.

FAQs

1. What is the Mexican Mint called?

The official name is Casa de Moneda de México (Mint of Mexico), established in 1535 as the Americas’ first mint and still operating today.

2. Are Mexican coins worth anything?

Historic Mexican silver coins like 8 reales contain substantial silver content and may carry additional numismatic premiums based on rarity and condition, while modern Libertads trade based on their precious metal content plus modest premiums.

3. Where to buy Mexican Mint coins?

Mexican coins are available through reputable precious metals dealers like Blanchard.

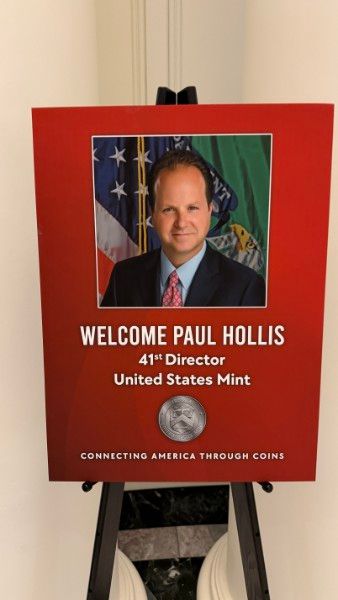

Paul Hollis Appointed Director of the United States Mint

Posted on — Leave a comment

On January 30, 2026, Paul Bryan Hollis was officially sworn in as the 41st Director of the United States Mint, following Senate confirmation in December. L. Craig Baudot, Executive Vice President of Sales, flew to Washington, D.C., to personally give the Blanchard families heartfelt congratulations to Paul on this significant appointment. This places a longtime numismatist and precious metals professional at the head of the nation’s coin-producing institution during a particularly meaningful period, as the Mint prepares for the United States’ 250th anniversary.

Paul’s love affair with coins began early. At age six, he received a Peace dollar from his grandmother, a gift that ignited his lifelong passion for numismatics. Hollis’ path is rooted in hands-on experience with coins and collectors. After graduating from Louisiana State University with a degree in political science, he began his professional career in the rare coin industry at Blanchard and Company. Over more than a decade with us, Hollis worked his way from early sales roles to rare coin specialist, gaining deep exposure to coin grading, valuation, precious metals markets, and collector education.

Those formative years at Blanchard helped shape his understanding of both the technical and human sides of numismatics. He worked closely with collectors and investors, developed a practical understanding of market dynamics, and built an appreciation for the responsibility that comes with stewarding historic assets. These experiences laid the foundation for a career that has consistently bridged business and public service.

After leaving Blanchard, Hollis founded his own rare coin business and remained active in the numismatic community through writing, public exhibits, and educational efforts designed to broaden interest in coin collecting. In parallel, he entered public service, serving twelve years in the Louisiana House of Representatives and later, on the Louisiana State Board of Elementary and Secondary Education. Throughout these roles, he brought the same perspective shaped by decades in the private sector and the coin industry.

As Director of the U.S. Mint, Hollis will oversee the production of circulating coinage, bullion products, medals, and numismatic programs. His appointment is notable for placing someone with real-world experience in the coin and precious metals industry into a role often held by career administrators or economists.

We congratulate Paul Hollis on this well-earned appointment and wish him success as he leads the U.S. Mint into its next chapter. For collectors, dealers, and the broader numismatic community, his leadership represents a meaningful connection between the Mint and the people who study, collect, and preserve America’s coinage.

Three-Cent Silver Coins: The Trime’s Legacy from 1851 to 1873

Posted on — Leave a commentAt just 0.80 grams, the three-cent silver piece was the lightest and thinnest coin ever struck for circulation by the United States Mint. Created in 1851 to address everyday commerce challenges – most notably the need to purchase three-cent postage stamps without making change – this unusual denomination circulated for more than two decades before its discontinuation. During that time, the three-cent silver passed through multiple design changes, creating distinct collecting categories that range from common to exceptionally rare. This article examines why the 3 cent coin was created, how its designs evolved, which dates and varieties matter most, and what drives values in today’s numismatic market.

Why America Needed a 3 Cent Coin

The 3 cent piece emerged from a convergence of postal reform and economic disruption that made existing denominations impractical for everyday commerce.

Postal Rate Changes of 1851

The Five-Cent Problem

Before 1851, mailing a first-class letter cost five cents. This rate forced Americans purchasing stamps to use half dimes (five-cent pieces) or fumble with combinations of larger denominations requiring change. Congress reduced the postal rate to 3 cents on March 3, 1851, immediately creating a problem: no U.S. coin matched the new stamp price.

The California Gold Rush Effect

Simultaneously, the California Gold Rush flooded markets with gold while draining silver eastward to purchase Western goods. Silver coins increasingly disappeared from circulation as their metal value exceeded face value, leaving Americans struggling with large copper cents and scarce silver half dimes as their only small-change options. The gap between a one-cent piece and a five-cent piece left no convenient way to conduct 3 cent transactions.

Congressional Solution

Congress authorized the 3 cent coin on the same day it reduced postal rates, creating America’s smallest silver denomination specifically to facilitate stamp purchases without requiring change.

Watch this video to see examples of three-cent silver coins and learn more about their design symbolism and historical context.

Practical Commerce Solutions

The new US 3 cent coin solved multiple problems beyond postage. Single stamp purchases no longer required making change from larger denominations, speeding transactions at post offices nationwide. The 3 cent piece also filled the awkward gap between large cents and half dimes, making small retail purchases more practical.

Banks welcomed the denomination because it reduced reliance on worn Spanish fractional silver still circulating decades after American independence. The public adapted quickly despite the unusual denomination, as the practical benefits outweighed the oddity of a 3 cent coin. Americans soon nicknamed these tiny silver pieces “trimes,” a collector term formed as a portmanteau of “three” and “dime,” which later helped distinguish them from the three-cent nickel introduced in 1865. Within months of its introduction, millions of three-cent silvers circulated throughout the Eastern states, where postal commerce was most concentrated.

The Three Types of Three-Cent Silver

During its 23-year production run, the 3 cent coin underwent two major design modifications, creating three distinct types that define how collectors organize and value these coins.

Type I (1851-1853): No Outline to Star

Image: 1851 Type I three-cent silver obverse and reverse showing star with shield and Roman numeral III

Source: PCGS

Original Design

The first 3 cent silver coin featured a six-pointed star on the obverse with no border outline surrounding it. The reverse displayed a large “C” enclosing the Roman numeral “III” within a circular border. This design prioritized simplicity for the new denomination.

Reduced Silver Content

Type I coins contained only 75% silver and 25% copper, the lowest fineness of any U.S. silver coin. The Mint intentionally reduced silver content below the standard 90% to discourage melting during the ongoing silver shortage. At 0.80 grams, these coins were deliberately light to keep their metal value below face value.

High Production Numbers

The initial years saw massive mintages as Americans embraced the new denomination. The Mint struck over 36 million Type I 3 cent pieces in 1851-1852 alone, making most dates from this period relatively affordable in circulated grades today.

Type II (1854-1858): Three Outlines to Star

Image: 1855 Type II three-cent silver obverse and reverse showing three outlines around star

Source: PCGS

Design Modification

In 1854, the Mint added three raised lines surrounding the obverse star, creating a more elaborate appearance. This design change coincided with significant composition adjustments.

Increased Silver Standard

Type II examples of the trime 3 cent coin matched the 90% silver, 10% copper standard used in other U.S. silver coinage. The weight decreased slightly to 0.75 grams while maintaining the same diameter. These changes eliminated the melting incentive that had driven the original composition.

Notable Scarcity

Mintages dropped dramatically compared to Type I. The lowest regular circulation issue, the 1855, saw just 139,000 pieces struck. All Type II dates are substantially scarcer than Type I issues, making them the most challenging type for collectors to acquire in any grade.

Type III (1859-1873): Two Outlines to Star

Image: 1865 Type III three-cent silver obverse and reverse showing two outlines around star

Source: PCGS

Final Design Evolution

The Mint simplified the star border to just two lines in 1859, maintaining this design through the denomination’s final year. Specifications remained unchanged from Type II at 90% silver and 0.75 grams.

Civil War and Proof-Only Years

Production of the trime 3 cent coin continued through the Civil War despite silver hoarding that removed most coins from circulation. The years 1863 and 1864 saw no circulation strikes, with only proof coins produced for collectors at approximately 460-470 pieces each year.

Late-Date Rarities

Post-1865 issues carried increasingly low mintages as the denomination fell out of favor. Many late-date Type III coins command significant premiums despite being more available than Type II issues, particularly in higher grades where survival rates were poor.

Key Dates and Varieties

Certain three cent coin issues command substantial premiums due to rarity, while others provide affordable entry points for collectors building type sets or date collections.

Major Rarities

1851-O New Orleans Issue

The only 3 cent piece silver struck outside Philadelphia came from the New Orleans Mint in 1851. The New Orleans facility produced a small trial quantity during the denomination’s first year, but production centralized at Philadelphia afterward as demand concentrated in Eastern postal markets. This issue ranks among the series’ greatest rarities, with fewer than 50 examples believed to survive today. Even heavily worn specimens command five-figure prices.

Image: 1851-O Type I three-cent silver obverse and reverse showing New Orleans Mint mark

Source: PCGS

1855 Low Mintage

The 1855 represents Type II’s scarcest regular circulation strike. Mintage figures indicate approximately 139,000 pieces produced, substantially lower than any other Type II date.

Proof-Only Years

The years 1863 and 1864 saw no circulation strikes. The Mint produced only proof coins for collectors, with mintages around 460-470 pieces each year. These proof-only issues are essential for completing date sets but remain prohibitively expensive for many collectors.

Image: 1863 proof-only Type III three-cent silver obverse and reverse

Source: PCGS

Condition Rarities

High-grade examples of common dates often prove scarcer than low-grade rarities. Type I coins rarely survive in Mint State due to their thin planchets wearing quickly. Any Mint State Type II significantly outvalues Type I in the same grade. Post-1865 Type III dates seldom appear in gem condition, making MS-65 or better specimens genuinely rare.

Affordable Entry Points

Collectors can acquire Type I common dates from 1851-1852 in circulated grades for modest sums. Type III circulation strikes from 1865-1872 offer more availability than Type II issues. Good through Fine grades provide budget-friendly options for building type sets, particularly when focusing on problem-free, original coins rather than cleaned examples.

Understanding 3 Cent Coin Value

3 cent silver coin value depends on multiple factors beyond simple date rarity, with grading challenges and market dynamics creating significant price variations.

Grading Challenges

Thin Planchet Wear Patterns

The exceptionally thin planchets show wear differently than thicker silver coins. High points flatten quickly, making accurate grade assessment difficult. What appears as weak strike detail may actually be circulation wear, requiring expertise to distinguish original production characteristics from damage.

Strike Quality Issues

Many 3 cent silvers left the Mint with incomplete strikes due to the shallow dies and thin planchets. Collectors must differentiate between original strike weakness and post-production wear when evaluating condition.

Cleaning Detection

Improper cleaning dramatically reduces value. The tiny size makes cleaning damage harder to detect in photographs, emphasizing the importance of in-hand examination or professional certification. Third-party grading from PCGS or NGC provides authentication and grade consensus that protects buyers.

Market Price Factors

Type II coins command higher premiums than Type I or Type III in equivalent grades due to their overall scarcity. Key dates within each type carry substantial premiums over common issues. Grade dramatically impacts value, with Mint State examples trading at multiples of circulated pieces. Eye appeal factors including original surfaces, strong strikes, and attractive toning significantly affect prices independent of technical grade.

Building a Three Cent Coin Collection

Collectors approach the 3 cent silver coin through various strategies depending on budget, interest level, and numismatic goals.

Type Set Approach

Three-Type Goal

The most accessible strategy involves acquiring one example of each design type. This approach provides representative coverage of the denomination’s evolution without requiring every date.

Grade Consistency

Matching condition levels across all three types creates aesthetic coherence in a display. Collectors typically aim for similar grades rather than mixing Mint State with heavily circulated examples.

Budget Allocation

Smart collectors spend more on the scarcer Type II while economizing on readily available Type I common dates. This strategy acknowledges scarcity differences while maintaining presentable examples across the set.

Display Considerations

The tiny size requires appropriate holders and presentation methods. Standard coin albums work poorly for 3 cent pieces, making specialized capsules or custom displays necessary to showcase these coins effectively.

Date Set Strategy

Complete Series Challenge

Assembling all dates of the American 3 cent coin from 1851 through 1873 requires significant commitment and resources. The proof-only years 1863-1864 present the greatest obstacles, as these coins carry substantial premiums even in the lowest proof grades.

Long-Term Project

Complete date sets typically require years to assemble as key dates appear infrequently at auction and through dealers. Patient collectors willing to wait for properly graded examples often achieve better results than those rushing to fill holes.

Investing in Key Dates