The Stock Market is A Leading Indicator: It’s Flashing Red

Posted on — Leave a commentFifty days after Inauguration Day, the stock market is registering its worst performance of a new Administration since President Obama’s first term in 2009. Jittery investors have sold stocks at a record pace, following the implementation of President Trump’s tariffs on a wide range of countries including Canada, Mexico, China, and the European Union.

Jittery investors have sold stocks at a record pace, following the implementation of President Trump’s tariffs on a wide range of countries including Canada, Mexico, China, and the European Union.

While stocks crash, gold and silver roar higher. Gold just reached a new record high above $3,000 an ounce.

So what does this mean for your stock portfolio and the economy? Recession risks in the United States are rising fast. In a new Reuter’s survey, 95% of economists polled across Canada, the U.S. and Mexico said recession risks in their economies had increased as a result of the new tariff policy.

While the stock market tumbled, tangible assets like gold and silver have provided investors a safe haven amid market volatility and economic uncertainty.

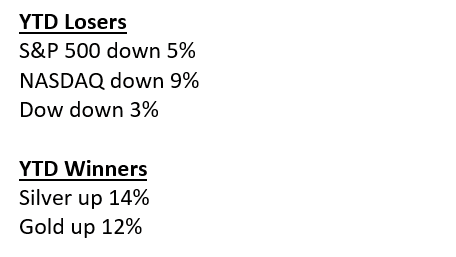

Performance since the start of 2025

The stock market is considered a leading indicator for the economy as it reflects investor sentiment and overall economic health. Worries for a meaningful slowdown in growth or even a recession are on the rise as the trade war continues to unfold on a daily basis.

In the latest move, President Trump threatened the European Union with a 200% tariff on imported wines and champagnes, if the bloc does not remove a duty on whiskey. The EU duties follow Trump’s 25% tariff on European imports of steel and aluminum.

The tit-for-tat tariffs have businesses and the stock market reeling. Businesses dislike uncertainty as it makes planning difficult. The risks for a deeper stock market correction are rising as reciprocal tariffs are expected to slow overall economic growth and hurt corporate profits. And, tariffs are expected to mean higher consumer prices on a range of imported goods, which could boost inflation.

What’s an investor to do? Investors can play defense in the current environment by increasing their allocation to precious metals. Gold is expected to continue to soar in the current environment with fresh investor demand fueled by geopolitical uncertainties, rising inflation expectations, and stock market volatility.

With gold hitting the $3,000 an ounce level, Goldman Sachs has now upped its 2025 gold target to $3,100 an ounce. And, Macquarie Group just issued a research note saying that gold’s safe-haven appeal could push prices to a record high of $3,500 an ounce in the third quarter of this year.

While the stock market tumbles and the economic uncertainty increases, there is safety and peace of mind in precious metals. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The 1879 $4 Flowing Hair Stella: America’s Gilded Age Legacy

Posted on — Leave a commentIn the 1870s, in the wake of the Industrial Revolution, international trade was rapidly expanding. The United States exported cotton, iron, copper, and manufactured goods. However, American businesses faced a major challenge: currency compatibility. While countries like Spain had the 20-peseta, Italy the 20-lire, and Britain the sovereign—all widely recognized in global markets—the U.S. lacked a coin that was similarly accepted in international trade.

In 1879, John A. Kasson, the U.S. envoy to Austria-Hungary, proposed a U.S. $4 gold coin that would state its metallic content in the metric system, making it more simple for Europeans to use.

Some in the U.S. government thought this coin could be the basis for a new international monetary system and could facilitate international trade and travel for U.S. citizens.

Today, that $4 gold coin is reverently known as Stella and the stories around this legendary coin abound in the numismatic community.

To explore the idea of a new $4 gold coin, the U.S. mint developed a pattern coin—never circulated—as an example for the U.S. Congressmen to review. The beautiful $4 gold coin which features a five-pointed star on the reverse was quickly nicknamed Stella. Why? The Latin word for star is stella.

Designed by Charles Barber, the Flowing Hair $4 Stella had a tiny mintage of 425. While never circulated and never offered for sale to the public, these fascinating coins were emerging in the most unlikely places.

Following their release to Congress for review, these coins made with 7 grams of gold, were famously spotted as medallion necklaces hung on madam’s bosoms in high-end brothels in Washington D.C. These brothels were known to serve illustrious clientele – like U.S. Congressmen.

These fancy D.C. brothels were infamous for large oil paintings, fancy red plush parlor furniture, pricey European carpets, and real silver on the table. Guests and residents feasted on gourmet meals. The expensive French champagne was ever-flowing. And in these brothels, Washington’s most famous madams proudly flaunted these exceedingly rare coins. Some Stellas can be found today that reveal traces of the necklace loops.

Congress ultimately rejected the idea of an international coin. Today, the $4 Stella is extremely rare and in high demand as an example of America’s outstanding numismatic art. As a “type” coin, some might call it one of the most influential and sought after 19th century gold coins ever minted. In an unusual twist for American coinage, because Stella was intended for international commerce, the obverse states its metallic content in the metric system and the coin bears an unusual inscription “★6★G★.3★S★.7★C★7★G★R★A★M★S★” on the obverse stating the gold content.

These storied gold coins were minted just over 100 years after America gained independence from England. Our nation’s economy was growing rapidly and part of America’s historic Gilded Age. Wealthy industrialists and businessmen like John D. Rockefeller, Andrew Carnegie, J.P. Morgan, and Cornelius Vanderbilt built storied empires and contributed greatly to society through their philanthropy. The $4 Stella is a historic gem from this exciting time in American history. Oh the stories this coin could tell, if it could only talk.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

True Value of Indian Head Gold Coins: 5 Outstanding Examples

Posted on — Leave a commentRepresenting a significant chapter in American numismatics, Indian Head gold coins were produced from 1907 to 1933. Roosevelt eventually recalled these coins in 1933, leading to their melting and creating a lasting impact on Indian Head gold coin value today. This article will explore their historical significance and highlight the key pieces every serious collector should consider, emphasizing:

- How the gold Indian Head coin evolved from concept to creation

- The unique role of these special coins in shaping American currency

- Where to source an authentic 1910 gold Indian Head coin and other key dates

Watch an amateur collector discuss Indian Head Quarter Eagles in this fascinating video:

Indian Head Gold Coins worth collecting

President Theodore Roosevelt’s vision for more artistic American coinage led to one of the most significant transformations in U.S. Mint history. In 1907, he commissioned renowned sculptor Augustus Saint-Gaudens to redesign the nation’s gold coins. Before his untimely death, Saint-Gaudens managed to create the stunning $10 Eagle which featured Liberty wearing an Indian headdress, a design that would influence all subsequent Indian Head gold pieces.

After Saint-Gaudens’ passing, his former student Bela Lyon Pratt took on the $2.50 Quarter Eagle and $5 Half Eagle designs. Building on the legacy of the first $2.5 Indian Head gold coin, Pratt replaced the allegorical Liberty figure with a realistic Native American portrait. His innovative approach also introduced incuse (sunken) designs, a feature never before seen on American coins.

Production of Indian Head coins continued until 1933 when Franklin Roosevelt’s gold recall brought the era to an end. Many coins were melted, making certain dates particularly rare today. The series spans three denominations: the Quarter Eagle ($2.50), Half Eagle ($5), and Eagle ($10), each with its unique history and varying levels of rarity. Their combination of artistic merit, historical significance, and relative scarcity makes them particularly appealing to modern collectors.

Here are ten exceptional specimens from the Blanchard collection that showcase the series’ finest examples.

1. A beautiful $2.50 1908 gold Indian Head coin

While Saint-Gaudens’ $10 Indian Head designs debuted in 1907, Bela Lyon Pratt’s innovative Quarter Eagle first appeared in 1908. The Philadelphia Mint struck 564,821 pieces, introducing a revolutionary incuse design where both the Native American portrait and eagle are sunken into the coin’s surface. This MS63 1908 Indian Head gold coin showcases the series’ characteristic medium greenish-gold color and frosty luster. While the obverse portrait shows strong detail, the eagle’s wing on the reverse typically lacks full definition due to the original die work, a feature common to this first year of issue. Many examples were preserved by collectors intrigued by the novel design, making this historically significant piece an essential addition to any serious collection.

1908 $2.50 Indian NGC MS63 CAC

- Metal: Gold

- Year: 1908

- Check our most current price here

If you’re interested in other exceptional CAC-verified pieces, beyond this stunning $2.5 Indian Head gold coin, explore Blanchard’s premium CAC collection here.

2. A $2.50 1913 gold Indian Head coin that survived the melting pot

Despite being more available than some dates in the series, this MS63 example showcases the 1913 coin’s distinctive characteristics. The Philadelphia Mint’s output this year featured above-average luster and strong striking detail, evident in this specimen’s light to medium yellow-gold surfaces. While the 2 1/2 dollar Indian Head gold coin value varies widely by condition, this carefully preserved piece offers collectors an excellent entry point into the series.

1913 $2.50 Indian NGC MS63

- Metal: Gold

- Year: 1913

- View our most current price here.

3. A distinctive $2.50 Indian Head gold coin from 1914

The Philadelphia Mint struck just 240,000 of these Quarter Eagles in 1914, creating what would become one of the series’ key dates. This MS65 $2.50 Indian Head gold coin specimen showcases exceptional strike quality and beautiful greenish-yellow gold surfaces with superior luster. Such pristine examples rarely appear (typically only once or twice annually at auction) making this CAC-verified piece especially desirable for seasoned collectors.

1914 $2.50 Indian PCGS MS65 CAC

- Metal: Gold

- Year: 1914

- Get our most current price here.

4. Another special 1914 $2.50 Indian Head gold coin

While $2.50 Indian Head gold coin value varies significantly by mint mark, this Denver Mint example represents an important variant of 1914 production. Unlike its Philadelphia counterpart, the 1914-D shows characteristics unique to coins struck at the Denver facility. This MS63 specimen exhibits a better-than-typical definition, as many 1914-D pieces show less distinct details on both the obverse and reverse. Though not as widely celebrated as the Philadelphia issue, the 1914-D is more elusive in higher grades, making this well-preserved example particularly noteworthy.

1914-D $2 1/2 Indian NGC MS63

- Metal: Gold

- Year: 1914

- View our most current price here.

5. A $5 1909 Indian Head gold coin that stands the test of time

From a limited mintage of 297,200 pieces, this San Francisco Mint $5 gold Indian Head coin is among the rarest in the series. Most examples entered circulation immediately, making this MS62 CAC-verified specimen particularly significant. The 1909-S typically displays sharp striking detail, including a bold mintmark, and exhibits rich coppery-gold coloring with frosty luster. Of special note is its status among San Francisco issues: it rivals the 1915-S in rarity and surpasses the lower-mintage 1908-S in scarcity.

1909-S $5 Indian PCGS MS62 CAC

- Metal: Gold

- Year: 1909

- See our most current price here.

6. A scarce $5 Indian Head gold coin

With just 72,500 pieces minted, this 1911-D Half Eagle is one of the series’ prime rarities. This AU58 Indian Head gold coin $5 example represents the highest circulated grade, just shy of Mint State condition. The Denver Mint’s characteristic well-defined strike is evident, including a fairly bold mintmark. While most 1911-D pieces entered circulation, this near-mint specimen displays exceptional preservation, retaining much of its original granular surface texture and luster.

1911-D $5 Indian NGC AU58 CAC

- Metal: Gold

- Year: 1911

- Get our most current price here.

7. A $5 1915 Indian Head gold coin in pristine condition

The Philadelphia Mint’s 1915 $5-dollar Indian Head gold coin stands out for its exceptional preservation and visual appeal. This MS64 example showcases the date’s characteristic sharp strike, finely granular surfaces, and vibrant luster. The coin displays rich tangerine-gold and peach-orange tones, particularly visible in the recessed areas of the incuse design. While the 1915 coin is more obtainable than some dates in the series, finding examples this well-preserved remains a significant challenge for collectors.

1915 $5 Indian CACG MS64

- Metal: Gold

- Year: 1915

- Have a look at our most current price here.

8. A magnificent $10 Indian Head gold coin minted in 1907

This first-year Saint-Gaudens design represents the “No Periods” variety, distinguished by the absence of periods before and after the inscription “TEN DOLLARS” on the reverse. This MS63 gold Indian Head coin displays the characteristic satiny surfaces and excellent luster typical of the issue, with rich yellow-gold to greenish-orange toning. While some weaknesses in Liberty’s hair curls and parts of the eagle are common to the date, the stars and legends show bold definition. Many 1907 pieces were preserved as first-year keepsakes, though finding high-grade examples can be challenging.

1907 $10 Indian NGC MS63 CAC

- Metal: Gold

- Year: 1907

- Check our most current price here.

9. A remarkable $10 Indian Head gold coin from 1908

This coin represents a pivotal design change in the series, i.e. the addition of “IN GOD WE TRUST” to the reverse, mandated by Congress after public outcry over its omission from Saint-Gaudens’ original 1907 design. While Indian Head gold coin value varies by date and condition, this MS62 example shows the typical sharp strike and excellent luster characteristic of the date, with satiny surfaces displaying rich yellow-gold to greenish-yellow coloring. Collectors particularly value this transitional year for its historical significance in the evolution of American coinage design.

1908 $10 Indian With Motto PCGS MS62 CAC

- Metal: Gold

- Year: 1908

- See our most current price here.

10. Another exceptional $10 1910 gold Indian Head coin

This MS63 Indian Head gold coin features the exceptional strike quality that makes 1910 Eagles stand out in the series. Most coins from this year display a distinctive frosty finish with finely granular surfaces, showing attractive orange and greenish-gold coloring. Some specimens, like this one, retain their original satiny luster with light to medium yellow-gold tones. This date represents an excellent opportunity for collectors seeking a high-quality example of Saint-Gaudens’ classic design.

1910 $10 Indian CACG MS63

- Metal: Gold

- Year: 1910

- Have a look at our most current price here.

Discover more exceptional $10 Indian Head gold coin specimens and other rare collectibles in Blanchard’s premium rare coin collection here.

Where to find Indian Head Gold Coins

The Indian Head gold coin series represents one of the most artistic and innovative periods in American coinage. These pieces combine historical significance, artistic merit, and genuine rarity, particularly in higher grades. For collectors seeking to acquire such important numismatic treasures, working with an established dealer like Blanchard ensures authenticity and quality. Trust Blanchard to help you build a distinguished collection of these historic American coins and more.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

A 1916 Gold Coin Honoring McKinley, Our Nation’s 25th President

Posted on — Leave a commentPresident William McKinley, the 25th president of our nation, has been in the news recently. History buffs will recall that McKinley was president from 1897 until his assassination in 1901. He is known for leading America during a period of expansionism, which included the Spanish-American War, the annexation of Puerto Rico, Guam, the Philippines and Hawaii.

1897 until his assassination in 1901. He is known for leading America during a period of expansionism, which included the Spanish-American War, the annexation of Puerto Rico, Guam, the Philippines and Hawaii.

Recently, President Donald Trump has bestowed fresh honors upon McKinley.

President Trump signed an executive order to rename North America’s tallest peak, known as Denali in Alaska, after President William McKinley. The U.S. had originally named it Mount McKinley in 1917, which followed centuries of Indigenous groups calling it Denali, which means “the tall one” in the language of the Athabascan people. In 2015, the Obama administration formally recognized the mountain as Denali.

Beyond mountain names, President Trump has praised McKinley’s use of tariffs during his time in office. President Trump has already initiated a series of tariffs on several nations and says there will be more to come.

As our current president shines a fresh light on President McKinley’s tenure and accomplishments, a new rare coin offering has emerged, that is prized by numismatic collectors: the 1916 McKinley $1 gold coin.

The sale of the McKinley gold dollars helped pay for a memorial building for the fallen president at Niles, Ohio, which is featured on the commemorative gold coin’s reverse. The Memorial building design was created by George T. Morgan. The obverse of this handsome coin features a profile of McKinley facing left, and was designed by Charles E Barber.

These commemorative gold coins were minted in 1916 and 1917, with a total of 20,000 coins produced over that two year period.

Commemorative coins have a rich history and have been created for centuries. Popularized by the ancient Greeks and Romans, these coins record and honor important events. Today, commemorative coins are prized by collectors who typically seek to acquire and own by major types or in sets with mintmark varieties.

This offering reveals an opportunity for a collector to own not only a significant piece of history honoring a president with numerous accomplishments, but a president from our past with fresh ties to the present. See it here.

Dot.com Stock Boom Crashed 25 Years Ago: What Gold Investors Need to Know

Posted on — Leave a commentHappy anniversary. Twenty-five years ago in March 2000, the dot.com stock market bubble began to burst. Looking back, in the mid-1990s, the dot.com era ushered in a period of explosive growth in information technology and the internet.

Depending on your age, you may not recall when Google didn’t exist for your everyday questions. For reference, Google was founded in 1998 and its search engine became popular in 2000. Before then, if you had a question, people went to the library and used Encyclopedias.

Any new start-up companies searching for capital simply had to add “.com” to the end of their firm name, and they quickly attracted generous venture capital. Many high-flying dot.com stocks never generated any revenue or became profitable, yet their stock prices soared wildly during the build-up to the stock market bubble top.

In 1999 alone, the NASDAQ grew an astonishing 86%. What happens next isn’t so pretty.

From the March 2000 top, over the next two years, the NASDAQ index crashed 77%, bottoming in October 2002. Ouch. That’s a big bust. The dot-com bubble burst opened the door to the economic recession in 2001.

What happened to gold during this time?

Historically, when the stock market plunges, gold prices rise – often substantially. During the dot-com crash years, investors piled into the safety of gold as their investments in the stock market deteriorated sharply and stayed low for over a decade.

From the NASDAQ’s October 2002 low, it took a long fifteen years, before that index set a new all-time high in April 2015. That’s a long time for stock market investors to wait.

Today, there are more than a few on Wall Street who point to the Magnificent Seven technology stocks and see parallels between the current artificial intelligence boom and the 2000 dot.com crash. The huge amount of speculative AI investment, the rapid growth and expansion, and the hype and high expectations around the outcome of future AI tools are eerily

similar. After all, despite billions of dollars of investment into big-tech AI tools, very few of them are profitable and many of these companies stock prices are climbing based on ideas of future potential profit—not actual revenue today.

For investors chasing the AI stock market boom, it’s worth considering the Latin phrase “caveat emptor” which simply means “let the buyer beware.”

Investors may also want to consider bolstering their allocation to gold today. That 77% decline in technology stocks during the dot.com crash was a tough pill for investors to swallow. Gold offers you protection for your wealth and an opportunity to grow your money even if the stock market turns down.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The Full Report: Blanchard’s Exclusive Interview with Peter Boockvar

Posted on — Leave a commentAs gold climbs to record highs, inflation rears its ugly head again and the Trump Administration makes big changes to government, trade and geopolitics, Blanchard spoke with esteemed money manager Peter Boockvar to help you make sense of the current investing environment.

and geopolitics, Blanchard spoke with esteemed money manager Peter Boockvar to help you make sense of the current investing environment.

Peter is the Chief Investment Officer at Bleakley Financial Group, a $10 billion wealth management firm and author of The Boock Report, which can be found on Substack. CNBC Fast Money viewers will recognize him as a frequent contributor where he offers his widely followed insights on stocks, the economy, gold and more.

In the wide-ranging discussion below, we uncover a plethora of important investing insights for you to consider now.

___________________________________________________________________________________________

Blanchard: What are the top three risks you see for the U.S. stock market and economy in 2025?

Peter Boockvar: I see three key risks right now. First, the Magnificent 7 stocks lose their dominance as investors question all their artificial intelligence spend and Apple loses its premium valuation because of little growth. Second, the bear market in bonds gets worse as interest rates continue to move higher. Lastly, high valuations in the U.S. leave little room for error.

Blanchard: Do you see risks for expanding military conflict over the next several years?

Peter: We do hope that the Russia/Ukraine war ends as well as the Israel/Hamas war, which could mean a potential downshift in active military conflicts. That said, Iran will remain a threat. And, we’ll be watching China and Taiwan closely.

Blanchard: What are your thoughts on gold’s role in a portfolio today?

Peter: Gold is an important investment asset to own because it’s a form of money. And notably, investors and foreign central banks around the world today want to own less dollars.

Blanchard: How might President Trump’s administration impact the price of gold?

Peter: They are discussing a possible revaluation from how the government currently marks gold reservesto the market price. The current government market value stands at $42, which is significantly lower than the market value of an ounce of gold around $2,926. This action could create a floor under the price of gold at whatever price the Trump Administration chooses to mark our nation’s gold reserves at.

Blanchard: How will the growing consumer demand for gold in India and China impact global gold prices?

Peter: The evidence of the impact is obvious with gold rallying in the face of higher interest rates and the U.S. dollars.

Blanchard: How is the ongoing central bank buying trend, particularly from developing countries, influencing gold prices?

Peter: Central banks should remain persistent gold buyers as they choose to reduce the percentage of their assets in U.S. dollars.

Blanchard: We just saw U.S. CPI jump higher to a 3.0% annual rate. Is gold an effective hedge against inflation?

Peter: Yes. Gold has maintained people’s purchasing power over the history of time much better than fiat currencies have.

Blanchard: How might the U.S. fiscal deficit and growing national debt influence gold prices in 2025?

Peter: Excessive U.S. debts and deficits have definitely caught the attention of the rest of the world. This is one reason why foreigners want to own less U.S. Treasuries and more gold.

Blanchard: What is your outlook for the U.S. economy this year and what could it mean for gold?

Peter: Currently, the U.S. economic outlook is mixed and uneven. There are three main factors powering the economic growth that we have seen. The first driver is high income spending, the second is artificial intelligence spending and thirdly, anything related to government spending. Notably, everything else has been weaker. Gold performs well in the stagflationary environment that we seem to be mired in.

Blanchard: After making 41 new record closing highs in 2024, gold has continued to set new records in early 2025. What does this trend suggest for gold in 2025?

Peter: In the short-term, gold is likely getting overbought. But I’m still positive on the outlook for the price of gold this year.

Blanchard: What are some of the factors that could push gold higher this year?

Peter: A continuation of current trends will continue to drive gold.

Blanchard: How do you see gold performing relative to other precious metals like silver and platinum this year?

Peter: Silver and platinum could catch up in performance.

Blanchard: Is now a good time to buy gold?

Peter: Yes.

Blanchard: If American investors don’t currently have an allocation to gold right now, what is your advice for them?

Peter: Get some.

If you’d like to discuss the content of this report with a Blanchard senior portfolio manager please give us a call today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The 1878 $3 Gold Coin: A Gem from the Industrial Revolution

Posted on — Leave a commentIn 1878, the United States of America was in the midst of a major transformation from an agricultural society to an industrialized society—ushering in the Industrial Revolution. Collectors who own a coin from this period connect tangibly to this historical time when America emerged as an industrial giant and major economic power on the global stage.

Revolution. Collectors who own a coin from this period connect tangibly to this historical time when America emerged as an industrial giant and major economic power on the global stage.

The rapid construction of railroads opened up new parts of our nation for people to live and work and ushered in significant economic growth. Manufacturing and new inventions developed quickly, leading to the expansion of city living and urbanization.

During this period, the U.S. Mint in Philadelphia produced $3 gold pieces known as the Indian Princess Head. Many people are not even aware there was a three-dollar gold piece. It is a hidden gem in gold numismatics indeed. The Indian Princess Head $3 gold coin was minted from 1854 through 1889

If you are wondering why the U.S. Mint chose to produce a $3 coin, you aren’t alone. It is an odd number after all. Numismatic experts believe the reason can be found at the post office. When this coin was first minted a U.S. postal stamp cost 3 cents. The $3 coin created a convenient way for businesses to purchase 100 stamps in a single transaction!

The handsome design of this coin is memorable for anyone who has ever seen it in person or held it in their hand. Many consider the $3 Indian Princess one of the most beautiful gold coins struck in the 19th century. See the rich frosty luster and sparkling patina that comes with this 147-year-old masterpiece here.

James B. Longacre, the U.S. Mint’s chief engraver, designed the coin. Longacre was, for the first time, given the freedom to create a design of his own imagination. Previously, he had been instructed to rely on Roman or Greek features in U.S. coins. For the $3 gold coin, Longacre was determined to create something uniquely American.

Longacre chose to highlight an American “Indian Princess” on the obverse. A lustrous orange-gold color, the coin shows a lovely Indian Princess adorned with a feathered headdress, with the words UNITED STATES OF AMERICA circling her. On the reverse, the date and denomination are surrounded by an agricultural wreath celebrating corn, tobacco, cotton, and wheat.

Minted in Philadelphia of 90% gold and 10% copper, the total mintage came in at 82,304 coins. Survival estimates for all grades total 25,000, yet for grades 60 or better only 6,000.

In recent years, collector interest in three-dollar gold pieces has surged. Are you Interested in building a set? One idea is to aim to collect a four-mint set, which would include from each of the U.S. Mint facilities that struck the $3 gold coin: Philadelphia, Dahlonega, New Orleans, and San Francisco. You could start today with this 1878 $3 gold coin MS65 struck in Philadelphia. See it here.

Gold Revaluation Ideas Jump from Fringe to Mainstream

Posted on — Leave a commentThe idea of gold revaluation has been on the perimeter of the gold community for decades. But, recent comments from U.S. Treasury Secretary Scott Bessent who said “We’re going to monetize the asset side of the U.S. balance sheet” moved the idea of valuing gold at current market price into the mainstream in a hurry.

a hurry.

What is gold revaluation?

Currently, the U.S. Treasury’s gold reserves are valued at about $11 billion—but that’s based on a legacy Bretton Woods gold price of $42.22 per ounce. The gold valuation price on the books is dramatically less than the current price of gold around $2,900 an ounce.

A revaluation would simply involve marking the price of U.S. government gold to the market price of around $2,900 an ounce (or whatever price the government decides).

With the simple push of an accounting pen, a revaluation to current market prices would instantly increase the value of the Treasury’s gold reserves to about $750 billion. The Treasury would essentially record on the books its unrealized gains of American government gold assets.

What could revaluation mean for the gold market?

This would instantly create a floor underneath the price of gold – in effect bringing us back toward a type of gold standard. A revaluation would also reinforce gold’s role in the global financial system – elevating it on equal standing of fiat currency.

What could this mean for the U.S. debt?

One of the benefits of gold revaluation for politicians is that it would instantly add money into the U.S. financial system without having to issue new Treasury bills, notes or bonds. This could be considered another form of quantitative easing and it would dramatically increase the size of the U.S. balance sheet.

For politicians struggling over the deficit and the upcoming debt ceiling challenge that means the Treasury has more money to pay the government’s bills – as the revaluation would in a sense – create new money out of thin air.

Bottom line? This would allow the U.S. Treasury to spend hundreds of billions of dollars without an increase to the national debt. Some on Wall Street warn this could be an inflationary move in and of itself. But, for gold investors that would continue to support rising trend in gold prices not only in the short-term, but over the medium and long-run as well.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

CPI Inflation Jumps, Eggs Prices up 15.2%. Gold Hits New Record Near $3,000

Posted on — Leave a commentSpace enthusiasts will recall astronaut Jack Swigert’s famous message to NASA after an oxygen tank explosion rocked Apollo 13 while traveling to the moon in 1970:

“Houston, we have a problem.”

The same can be said for the Federal Reserve in 2025—when inflation moved in the wrong direction—jumping 0.5% to 3.0% in January, its biggest gain since August 2023.

August 2023.

The Federal Reserve has an inflation problem that won’t go away.

And, while egg prices soared 15.2% last month, the inflation jump isn’t just from eggs. Price increases on shelter, gasoline, and food (including meats, dairy, and fish) and higher used car and truck prices contributed to a broad rise in American consumer goods prices. Prescription medication and car insurance also saw big price jumps last month.

What’s more, these consumer price increases were recorded before the impact of any of President Trump’s new tariffs took effect. That means, there could be more jumps in inflation in the months ahead.

Markets react.

Stocks slumped on the news. Gold climbed to another record high. The precious metal has marched steadily higher since the beginning of the year and is already logging an impressive 11.2% gain as gold approaches the $3,000 an-ounce level. Silver is up 13% since the start of the year.

The surprise 3.0% CPI reading has many on Wall Street rethinking interest rate cuts this year. Many say Federal Reserve rate cuts have now moved to the back burner.

Bottom line?

Inflationary pressures are bubbling hot. Tariff policy could worsen the outlook in the months ahead. Investors should brace for higher volatility in the equity markets and the inflation trend will keep a strong bid under the gold market.

Gold has a rock-solid track record as a store of wealth and is an enduring form of money recognized in every country on the planet. Before stocks tumble more, have you considered rebalancing your portfolio and increasing your allocation to gold? Once stocks start crashing, it will be too late to get your money back.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Will Elon Musk’s DOGE Get Rid of the Penny?

Posted on — Leave a commentPresident Donald Trump signed an executive order on January 20, 2025 to establish DOGE: the Department of Government Efficiency, led by Elon Musk, with a goal to cut spending.

A number of programs, from diversity, equity, and inclusion (DEI) to Daylight Saving Time to the venerable one-cent piece—yes, the penny—are on the potential chopping block.

In an X post, DOGE wrote that it costs more than 3 cents to make a penny, which cost taxpayers over $179 million through 2023.

It’s true. The cost to make a penny jumped to 3.69 cents, according to the 2024 U.S. Mint annual report. That marks the 19th consecutive year that penny production costs have “remained above face value.” In 2024, the U.S. produced about 3.23 billion new pennies, according to the U.S. Mint. Pennies were the most produced coin in both 2023 and 2024.

In an increasingly cashless world, could Elon Musk be right? Is it time to ditch the penny? Cash usage has been declining due to the prevalence of credit cards, and debit cards, and the rise of mobile payment apps.

But, Americans still carry cash and use it. Forty-four percent of Americans say they use cash for some of their purchases, while 14% say they use it for all their purchases, according to a Pew Research Center study.

3 reasons DOGE may not be able to get rid of the penny

- To make change. For those Americans who do pay in cash, the penny is an essential tool to make change. How would you make change for an $11.97 purchase if you pay with a $20 bill without the penny?

- Getting rid of the penny could make things more expensive. Canada did away with its penny in the early 2010s—and now purchases there are rounded to the nearest nickel. For example, a $11.83 purchase becomes $11.85 in Canada now.

- Congress oversees our money. According to the U.S. Constitution, it is Congress (not DOGE) that is responsible for overseeing our money and coinage.

How much could the U.S. save if it got rid of the penny? Stopping production of the 1-cent piece could save taxpayers up to $100 million annually, according to a 2022 Federal Reserve report. Whether or not DOGE takes action to discontinue it, collectors will always prize and covet many special American 1-cent pieces. Halting future production of the penny could increase numismatic demand for existing rare pennies. Check out Blanchard’s current inventory of small cents here.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.