Silver Maple Leaf: Complete Guide to Canada’s Most Trusted Silver Bullion Coin

Posted on — Leave a commentIn 1988, the silver bullion world changed because of Canada’s Royal Mint. After its success with the world’s first .9999 pure gold coin in 1982, the mint repeated this winning formula with the Silver Maple Leaf. Since then, competitors have followed suit with their own high-purity coins, but Canada remains the pioneer, constantly evolving their product with advanced features. Over four decades later, Silver Maple Leafs still dominate dealer inventories and investor portfolios worldwide. This article explains the specifications, authentication features, and investment advantages that keep Canada’s flagship silver coin at the top of the precious metals market.

What Is a Silver Maple Leaf?

The Silver Maple Leaf is Canada’s most recognizable contribution to the international bullion market.

Royal Canadian Mint origins

Canada launched this coin in 1988 specifically to compete with the American Silver Eagle, which had monopolized investor demand since 1986. The Royal Canadian Mint recognized that American coins used only .999 fine silver, creating an opportunity to capture market share with superior purity. This strategy is built on the success of the Gold Maple Leaf, which ranks among the top bullion coins for investors and established Canada’s reputation for ultra-pure precious metals.

Image: Both sides of a 1988 Canadian Silver Maple Leaf coin showing the obverse with Queen Elizabeth II’s portrait by Arnold Machin.

Source: PCGS

Design significance

The Silver Maple Leaf coin features two carefully crafted sides that tell Canada’s story through imagery. The obverse displays portraits of the reigning British monarch, reflecting Canada’s status as a Commonwealth nation where the Crown serves as head of state. Queen Elizabeth II appeared on Silver Maple Leafs from 1988 until her passing in 2022, with her portrait evolving through four distinct designs. As demonstrated in this video, many collectors focus on building sets that showcase these different portrait variations across the years. Since 2024, King Charles III’s portrait has appeared on new issues.

The reverse showcases Walter Ott’s iconic sugar maple leaf design, created originally for the 1979 gold maple leaf and adapted for silver, making it one of the most recognizable symbols in precious metals.

Purity breakthrough

Before 1988, silver bullion coins typically contained .999 fine silver, which was considered the industry standard for investment-grade purity. The Royal Canadian Mint pushed this boundary further by achieving .9999 fine silver content, requiring advanced refining techniques that remove virtually all base metals and impurities. This four-nines purity created immediate market advantages – cleaner strike quality, reduced tarnishing, and higher melt values compared to .999 competitors.

Global recognition

Major dealers and exchanges prefer the Canadian Maple Leaf silver coin for liquidity because its consistent purity and government backing guarantee instant recognition. The Royal Canadian Mint’s reputation for precision manufacturing means these coins trade at predictable premiums worldwide. Unlike lesser-known government coins that require verification or explanation, the Canadian Maple Leaf silver coin commands immediate bid prices globally. This universal acceptance stems from over four decades of consistent quality and the coin’s status as legal tender backed by the Canadian government.

Silver Maple Leaf Coin Specifications and Technical Details

Silver Maple Leafs adhere to dimensional standards that have remained constant throughout their production history.

Physical characteristics

Each Canadian Silver Maple Leaf weighs exactly 31.1035 grams (one troy ounce) with a 38mm diameter and 3.29mm thickness. These specifications match international standards for one troy ounce silver coins, ensuring compatibility with storage tubes and capsules worldwide.

Silver content

Each coin contains exactly one troy ounce of .9999 fine silver. This four-nines purity means 99.99% of the coin’s weight consists of pure silver, with only minimal other elements required for structural integrity and proper striking characteristics.

Manufacturing standards

The Royal Canadian Mint maintains strict quality control protocols that produce consistent weight, thickness, and surface finish across millions of coins. Each blank undergoes multiple inspections before striking to ensure uniform precious metal content.

Image: The Royal Canadian Mint building in Ottawa.

Source: Royal Canadian Mint

Edge design

The coin features raised ridges around its entire circumference, known as reeding. These grooves prevent people from secretly filing or shaving silver from the edges, which would reduce the coin’s metal content and value. The reeding also acts as an anti-counterfeiting feature since reproducing the exact ridge specifications requires sophisticated minting equipment that counterfeiters typically cannot access.

Security Features and Anti-Counterfeiting Technology

The Royal Canadian Mint introduced groundbreaking security features in 2014 to combat the rising threat of sophisticated counterfeiting that was plaguing the global bullion market.

Radial Lines

The coin features precise lines extending outward from the center like spokes on a wheel as its most visible security feature. These patterns are machined within microns on both surfaces, extending from the central maple leaf design to the edge with mathematical precision. When tilted under light, they create distinctive shimmering effects that change appearance, allowing instant visual Silver Maple Leaf identification without special equipment. This technology revolutionized bullion security because replicating these microscopic patterns requires the same specialized laser engraving equipment used by the Royal Canadian Mint, making counterfeiting prohibitively expensive.

Maple Leaf Privy Marks

Some Silver Maple Leafs feature small additional symbols or designs alongside the standard maple leaf as both commemorative features and security elements. The Royal Canadian Mint occasionally adds these special marks to celebrate events, anniversaries, or cultural themes – examples include pandas, monkeys for lunar years, or Olympic symbols. Each privy mark requires specific dies manufactured exclusively by the mint, making them impossible for counterfeiters to replicate accurately. The restricted mintages of privy mark coins, typically ranging from hundreds of thousands to low millions, create scarcity that commands higher premiums while providing collectors with an additional authentication method since fake coins cannot reproduce the precise details and positioning of genuine privy marks.

Image: A graded 2016 Canadian Silver Maple Leaf coin in an NGC protective holder. The coin features a small panda privy mark and is graded PF 70 (Perfect Proof 70).

Source: PCGS

Laser Micro-Engraving

Every Canadian Silver Maple Leaf contains a hidden security feature that requires magnification to detect, serving as a covert authentication method. A microscopic maple leaf symbol appears in the reverse field background, completely invisible during normal handling and viewing, creating a security element that most people never notice. Within this tiny symbol, the micro-engraved year must match the coin’s official production date, creating a dual verification system that prevents date manipulation and confirms authentic Royal Canadian Mint production. Standard jeweler’s loupes or magnifying glasses with 10x power easily reveal the crisp micro-engraving on genuine coins, while counterfeit attempts show blurred or missing details under magnification, immediately exposing fraudulent coins to anyone performing proper authentication checks.

Image: Royal Canadian Mint 1 oz Silver Maple Leaf bullion coin featuring the iconic maple leaf design, new radial line background, and micro-engraved security feature introduced in 2014.

Source: Newswire Canada

Fractional Silver Maple Leafs

The Royal Canadian Mint produces smaller denominations of the Silver Maple Leaf coin for investors seeking affordable entry points into precious metals.

Size variations

The Mint offers 1/2 oz and 1/4 oz Silver Maple Leafs alongside the standard 1 oz Silver Maple Leaf coin. These fractional sizes maintain the same .9999 fine silver purity and security features as their larger counterpart, with proportionally smaller dimensions and face values.

Image: 2022 Canada $3 Silver Maple Leaf fractional coin graded NGC Reverse PF 70 First Releases.

Source: PCGS

Premium structure

Smaller coins typically carry higher premiums per ounce of silver content due to increased manufacturing costs relative to their size. The 1/4 oz coins command the highest premiums, followed by 1/2 oz pieces, making the 1 oz Silver Maple Leaf version the most cost-effective for pure silver acquisition.

Collecting appeal

Fractional Maple Leafs allow collectors to build complete sets across different weights and years. Many collectors enjoy assembling matched sets that showcase the consistent design elements scaled across various sizes.

Gift potential

These smaller coins work perfectly for introducing newcomers to precious metals investing without requiring large initial purchases. Their lower individual cost makes them ideal for graduations, birthdays, or holiday gifts.

Silver Maple Leaf vs. Competitors

Silver Maple Leafs face intense competition from American Silver Eagles and European alternatives, but their superior purity and consistent quality give them distinct market advantages.

American Silver Eagle Comparison

The Silver Maple Leaf’s closest competitor is the American Silver Eagle, the flagship bullion coin of the United States. Both guarantee investors a full troy ounce of fine silver, though they achieve this differently: the Eagle is struck to .999 fineness with a slightly higher gross weight to ensure 1.000 oz of pure silver, while the Maple Leaf achieves the same standard with .9999 purity and virtually no alloy content.

Premiums, rather than purity, are where the two coins diverge most. Silver Eagles usually trade at higher markups in the U.S. thanks to strong domestic demand and a large collector base, while Maple Leafs often remain more affordable despite their higher stated purity.

Aesthetically, the Eagle leans on classic American symbolism with Adolph Weinman’s Walking Liberty and the heraldic eagle or updated landing eagle reverse, while the Maple Leaf emphasizes clean modern design anchored in Canada’s national emblem.

Both coins enjoy excellent global liquidity: Silver Eagles dominate in U.S. markets, while Maple Leafs perform equally well, and often more competitively, internationally.

Australian Kangaroos and Other World Silver

Beyond the American Eagle, Silver Maple Leafs face strong competition from other world bullion coins. The most direct rival is the Australian Silver Kangaroo, which, like the Maple Leaf, offers .9999 fine silver and has been struck in that purity since 2015. With metal content essentially identical, premiums and local dealer relationships become the main differentiators.

In Europe, Austrian Philharmonics frequently outsell Maple Leafs despite their lower .999 purity, largely because of regional familiarity, euro-denominated pricing, and established distribution networks.

Meanwhile, British Britannias and Chinese Silver Pandas, both minted in .999 silver, maintain global followings but generally lag Maple Leafs in liquidity. Canada’s reputation for high-precision minting, combined with advanced anti-counterfeiting features such as radial lines and micro-engraved privy marks, ensures the Maple Leaf remains one of the most trusted and widely recognized silver coins in international trade.

Canadian Silver Maple Leaf Investment Advantages in 2025

For investors considering why precious metals belong in investment portfolios, Silver Maple Leafs provide an ideal combination of purity, security, and liquidity.

Global recognition

Dealers worldwide accept Silver Maple Leafs without question, creating instant bid opportunities in any major precious metals market. This universal acceptance stems from Canada’s consistent quality standards, the coin’s established reputation since 1988, and the Canadian government guarantee that adds institutional credibility private mints cannot match. This backing reassures both individual investors and institutional buyers about authenticity and silver content.

Easy verification

Advanced security features like radial lines and micro-engraving allow quick authentication without expensive testing equipment, reducing transaction friction for both buyers and sellers. Dealers can instantly verify genuine coins using basic lighting and magnification, eliminating the need for costly electronic testing or acid tests that damage other silver products.

The visual security features also give individual investors confidence when purchasing from unfamiliar sources, as counterfeit coins cannot replicate the precise laser engraving and radial line patterns that require Royal Canadian Mint’s specialized equipment.

Storage efficiency

The coin’s standardized 38mm diameter optimizes safe deposit box space and ensures compatibility with protective tubes and storage systems worldwide. Silver Maple Leafs stack perfectly in industry-standard tubes of 25 coins, maximizing storage density while protecting individual coins from damage.

The uniform dimensions also work seamlessly with popular storage solutions like monster boxes, coin capsules, and vault storage systems, allowing investors to efficiently organize large quantities without wasted space or compatibility issues.

Insurance recognition

Insurance companies prefer government-minted coins for coverage purposes, often requiring less documentation and offering better replacement terms than generic silver products. Silver Maple Leafs’ legal tender status and government backing simplify the claims process since insurers can easily verify authenticity and current market values through established dealer networks.

The coins are also eligible for self-directed IRAs, though proper custodial storage requirements must be followed to maintain compliance with IRS regulations.

Many policies also offer higher coverage limits for recognized bullion coins compared to private rounds or bars, providing better protection for substantial precious metals holdings.

Conclusion

The Canadian Silver Maple Leaf remains one of the world’s most trusted silver bullion coins, setting the standard with its .9999 purity, advanced security features, and meticulous quality control. Radial lines, micro-engraved privy marks, and precise specifications not only safeguard investors against counterfeiting but also ensure the coin’s instant recognition in global markets.

For modern investors, the appeal is clear: Silver Maple Leafs provide direct exposure to pure silver without the uncertainties of collectible premiums or authentication risks. They have become a cornerstone of the international bullion trade, valued by dealers and investors alike as a liquid, dependable, and universally accepted asset.

Whether you are building a diversified precious metals portfolio or securing reliable long-term wealth storage, Silver Maple Leafs deliver the purity, security, and global trust that serious investors demand. Explore Blanchard’s Silver Maple Leaf collection alongside other leading bullion products and discover how these exceptional coins can strengthen your holdings today.

FAQs

1. What does a Silver Maple Leaf look like?

A Silver Maple Leaf features Queen Elizabeth II or King Charles III on the obverse (front), depending on the year of issue. The reverse displays Canada’s iconic sugar maple leaf design created by Walter Ott, with “CANADA,” the purity marking “9999,” “FINE SILVER 1 OZ,” and “ARGENT PUR” inscribed around the edges. The coin has a brilliant silver finish with radial lines extending from the center and measures 38mm in diameter.

2. How much is a 1 oz Silver Maple Leaf worth today?

Canadian Maple Leaf silver coin value depends on current silver spot prices plus a small premium for the coin’s government backing and manufacturing costs. Silver Maple Leafs typically trade close to spot silver prices due to their high liquidity and global recognition, making them efficient vehicles for silver investment without significant numismatic premiums.

3. Where to buy Canadian Maple Leaf silver coins?

Trusted precious metals dealers like Blanchard offer the best purchasing experience because they guarantee authenticity and maintain competitive pricing with transparent premiums.

1926-S Buffalo Nickel: Complete Guide to Key Dates and Rarity Factors

Posted on — Leave a commentTo most people, nickels represent pocket change worth five cents. But in April 2008, a single 1926-S Buffalo nickel sold for $322,000 at auction. This was no coincidence, but rather a reflection of the coin’s exceptional rarity and condition. The 1926-S Buffalo nickel is the rarest regular-issue coin in the entire series, with fewer than 1,000 examples surviving today in all grades combined. While some Buffalo nickels trade for face value, others command astronomical premiums. This guide reveals which dates to look for, their key traits, and the history behind their rarity.

What Makes the Buffalo Nickel Special

The Buffalo nickel series combines artistic achievement with inherent design ‘flaws’ that created both beauty and rarity. Watch this brief video to understand how these coins became some of America’s most distinctive currency.

Fraser’s art

James Earle Fraser’s Native American portrait and American bison design replaced the Liberty Head nickel’s classical female profile. Fraser, commissioned to create distinctly American imagery, used living Native American chiefs as models – Iron Tail of the Lakota and Two Moons of the Cheyenne – rather than idealized fictional figures. The reverse featured Black Diamond, an actual bison from New York’s Central Park Zoo. This marked the first time U.S. coinage depicted real American subjects and wildlife instead of mythological goddesses and eagles, creating what Fraser called “truly American” money.

Image: Historical photograph of Iron Tail, one of the Native American chiefs used as a model for Fraser’s Buffalo Nickel design, shown alongside the coin’s obverse.

Source: Dime Library

The date problem

Unlike previous nickels where dates were recessed and protected, Fraser placed the Buffalo nickel’s date in raised relief on the Indian’s shoulder, i.e. one of the coin’s highest points. This positioning made the date the first element to contact surfaces during circulation, causing it to wear away quickly. Within just a few years of use, millions of Buffalo nickels became completely dateless. This design flaw created an unintended rarity scale: coins with sharp, fully readable dates now command significant premiums over their worn counterparts. While Buffalo nickel no date specimens have limited collector value, they represent a fascinating aspect of the series’ design challenges.

Image: Worn Buffalo Nickel showing completely missing date due to circulation wear on the raised relief design.

Source: NGC

Short series, big impact

Unlike series that ran for decades, Buffalo nickel production lasted only 25 years (1913-1938). This compressed timeline created natural scarcity, especially for low-mintage issues from the San Francisco and Denver mints.

The 1926-S: King of Buffalo Nickels

Low mintage, poor survival rates, and decades of collector pursuit have made the 1926-S the undisputed king of Buffalo nickels.

Image: 1926-S Buffalo Nickel obverse and reverse, the key date rarity with only 970,000 minted, showing “S” mint mark.

Source: PCGS

Rarity facts

By 1926, the Buffalo nickel series was winding down, with most mints reducing production significantly. The San Francisco Mint produced only 970,000 Buffalo nickels in 1926, compared to 119,001,420 Philadelphia pieces struck that same year. This makes the 1926-S nearly 123 times scarcer than its common counterpart from the start.

Survival rates

Numismatists estimate fewer than 1,000 examples survive in all grades combined today. Most circulated heavily on the West Coast during the late 1920s and 1930s, with the majority lost to pocket change or melted during metal drives. The typical survivor shows significant wear, with sharp specimens representing perhaps 1-2% of the original mintage.

Grade sensitivity

With so few 1926-S examples surviving, even minor condition differences create dramatic value gaps. A coin that retains sharp design details commands exponentially more than one with worn features. This grade sensitivity exceeds that of common Buffalo nickels, where moving up one or two grade levels might double the value. For the 1926-S, the same grade improvement can increase value by ten times or more.

Complete Key Date Breakdown

Beyond the legendary 1926-S, the Buffalo nickel series contains multiple dates that command significant premiums.

The Big Four Semi-Keys (1924-D, 1924-S, 1925-D, 1925-S)

These four dates represent another tier of Buffalo Nickel rarities, each produced during the series’ declining years when mint output dropped significantly. The 1924-S proves scarcest with only 1,437,000 pieces minted, followed by the 1925-D at 4,450,000, the 1924-D at 5,258,000, and the 1925-S at 6,256,000. While these mintages seem substantial compared to the 1926-S, survival rates remain low due to heavy West Coast and Mountain West circulation patterns that wore most specimens down to Good or Very Good condition.

Denver mint examples from this period often show characteristic weak strikes, particularly in the bison’s shoulder and the Native American’s hair details. San Francisco pieces typically display better overall sharpness but can suffer from die polish lines in the fields. Collectors should examine the area below “FIVE CENTS” carefully, as genuine mint marks show proper depth and positioning that distinguish them from common Philadelphia issues or altered specimens.

The 1935 Semi-Keys (1935-D and 1935-S)

1935-D Production and Characteristics

The Denver Mint struck 12,092,000 Buffalo nickels in 1935, representing a significant drop from earlier 1930s production levels. Denver coins from this year show distinctive die polish lines in the fields and often display weak definition in the bison’s leg muscles due to the facility using older dies longer during this period. The “D” mint mark typically appears slightly smaller and less deeply impressed than on earlier Denver issues.

1935-S Production and Characteristics

San Francisco produced 10,300,000 pieces in 1935, marking the final year of substantial West Coast Buffalo nickel production. These coins typically exhibit superior overall sharpness compared to Denver issues but suffer from characteristic die cracks that run from the rim through the Native American’s shoulder. The “S” mint mark on 1935 issues appears more deeply impressed than on most earlier San Francisco Buffalo nickels.

Strike quality

Both the Denver and San Francisco facilities struggled with die maintenance during 1935, producing coins with notably softer details than their Philadelphia counterparts. This weakness particularly affects the bison’s shoulder fur and the Native American’s hair braids, making well-struck examples especially desirable. Collectors seeking quality 1935 Buffalo nickel specimens should prioritize coins with sharp strikes and full design details over those showing typical mint weaknesses.

The 1936-D: Overlooked Key Date

Mintage reality

While 24,814,000 pieces might seem like a large number, the 1936-D becomes genuinely scarce when compared to the Philadelphia Mint’s massive 119,001,420 production that same year. This nearly 5-to-1 ratio means the Denver issue represents less than 17% of total 1936 Buffalo nickel production, yet many collectors overlook this disparity when focusing on the more famous key dates.

Grade availability

Denver’s characteristic weak strikes during 1936 Buffalo nickel production resulted in coins with soft details from the moment they left the mint. Combined with heavy circulation in western states, finding 1936-D examples in Mint State grades proves exceptionally difficult, with most survivors grading Very Fine or lower. This scarcity in higher grades significantly impacts 1936 Buffalo nickel value, with well-preserved Denver specimens commanding premiums that reflect their true rarity.

The 1937-D 3 Legged Buffalo Nickel

Image: 1937-D Three-Legged Buffalo Nickel obverse and reverse showing the famous error where the buffalo’s front right leg is completely missing.

Source: PCGS

Error story

During 1937 production at the Denver Mint, an overenthusiastic die polisher attempted to remove clash marks from a reverse die by grinding away metal from the surface. This excessive polishing accidentally removed the bison’s right front leg entirely, creating one of the most famous error coins in U.S. Mint history. The damaged die continued striking coins until mint officials discovered the problem, producing several thousand three-legged specimens before replacement. This error dramatically affects 1937 Buffalo nickel value, with three-legged examples commanding substantial premiums over normal strikes.

Identification guide

The genuine 3 legged Buffalo nickel shows complete absence of the bison’s right front leg, with the area appearing as smooth, uninterrupted ground. This differs dramatically from common die wear, which gradually weakens leg details but leaves partial outlines or shadow impressions. The missing leg creates an unnatural gap between the bison’s body and the ground line that cannot be mistaken for normal circulation wear.

1937-D Buffalo Nickel Value breakdown

Even heavily worn three-legged buffalo examples command substantial premiums because the error remains clearly visible regardless of grade. The dramatic visual impact of the missing leg creates instant recognition among collectors, sustaining demand across all condition levels from damaged pieces to pristine mint state examples. This error variety represents the pinnacle of 1937 Buffalo Nickel collecting, with values far exceeding normal Denver strikes from the same year.

Authentication tips

Genuine specimens show specific die markers including a small raised dot below the bison’s belly and characteristic weakness in the “E” of “AMERICA.” The die polishing also created subtle texture differences in the field areas that counterfeiters struggle to replicate convincingly.

Overdate Varieties (1918/7-D, 1914/3)

Technical details

During World War I, the U.S. Mint faced severe cost pressures and material shortages that made die conservation essential. Rather than scrapping 1917-dated dies at year’s end, the Denver Mint repunched them with “8” over the final “7” to create 1918 dies. Similarly, leftover 1913 dies received a “4” punched over the “3” for 1914 production. This wartime economy measure created these distinctive overdate varieties that showcase the mint’s resourcefulness during national crises.

Visual identification

The 1918/7-D shows clear remnants of the underlying “7” beneath the “8,” particularly visible as curved lines extending beyond the “8’s” lower loop. The 1914/3 displays portions of the “3’s” upper and lower curves protruding from behind the “4,” most evident under magnification at the date’s right side. Both overdates require careful examination, as the underlying numerals appear as subtle but definitive shadows.

The 1916 Doubled Die Obverse

Image: 1916 Buffalo Nickel doubled die obverse and reverse showing the dramatic doubling error in the date digits.

Source: PCGS

Doubling locations

A doubled die error occurs when a coin die receives two slightly misaligned impressions during manufacturing, creating overlapping images on the finished coin. The 1916 Buffalo Nickel doubled die shows this defect most clearly in the date, where the final digits – “16” – appear twice: the original numbers plus a second set offset to the right. This creates a shadow or double-vision effect that makes the date appear blurred or duplicated when examined closely.

Grading considerations

Many 1916 doubled die examples circulated for years before collectors recognized the error, meaning most survivors show significant wear. The doubling remains visible even in lower grades, but mint state examples prove exceptionally valuable due to their rarity and the pristine visibility of the error.

Market position

This variety rivals the 1926-S for supremacy among Buffalo nickel rarities because it combines extreme scarcity with the appeal of a dramatic mint error. Error coins attract both specialists and general error coin collectors, expanding the potential buyer base and driving Buffalo nickel value into six-figure territory for high-grade examples.

Modern Times: The 2005 Buffalo Nickel Comeback

Nearly seventy years after the last Buffalo nickel rolled off mint presses, Fraser’s iconic design returned to American coinage.

Westward Journey series

The U.S. Mint revived Fraser’s bison design in 2005 as part of the Westward Journey nickel series commemorating the Lewis and Clark expedition bicentennial. This marked the first time since 1938 that the beloved buffalo appeared on circulating American coins, generating excitement among both collectors and the general public.

Collectible potential

While most of the 2005 Buffalo nickel coins remain common, certain varieties show premium potential including coins with strong strikes, full steps detail, and pristine surfaces. Special mint set examples and first-day-of-issue specimens attract collector interest beyond face value.

Investment Perspective: The Buffalo Nickel in 2025

Buffalo nickels occupy a unique position in today’s collecting market, offering genuine rarity, often at accessible price points, within the broader spectrum of tangible asset investment options.

Advantages

Affordable entry

Key dates like the 1924-S and 1925-D remain accessible to new collectors, with entry-level examples available at modest premiums. This affordability allows collectors to acquire genuine rarities without the substantial financial commitment required for many other classic American series. Following proven rare coin investing strategies helps collectors focus on quality specimens and undervalued opportunities within the Buffalo nickel market.

Artistic appeal

Fraser’s distinctive Native American and bison imagery attracts collectors beyond traditional numismatists, including Western art enthusiasts and history buffs who appreciate the coins’ cultural significance.

Completion potential

The series’ 25-year span makes complete date and mint mark sets achievable goals, unlike longer series that require decades to assemble.

Considerations

Date visibility

The series’ inherent design weakness means many specimens suffer from partial or complete date loss, requiring careful authentication of readable examples.

Grading costs

Professional grading expenses must be weighed against potential Buffalo nickel value increases, particularly for mid-grade specimens. Understanding numismatic grading standards and certification processes helps collectors determine when third-party authentication justifies the expense.

Conclusion

Buffalo nickels transformed American coinage by replacing classical allegory with authentic American subjects: real Native American chiefs and actual wildlife from the frontier. Fraser’s artistic revolution created coins that captured a vanishing way of life, making them culturally significant beyond their numismatic value.

This cultural importance drives sustained collector demand across all economic levels. While key dates like the 1926-S command astronomical prices, the series also offers affordable semi-keys and common dates that allow participation without major financial commitment. The 25-year production span creates a manageable collecting goal compared to series spanning decades.

Understanding rarity factors, from mintage figures to survival rates to authentication markers, separates successful Buffalo nickel collectors from casual buyers. These coins reward knowledge and patience, offering both historical connection and potential appreciation for those who study the market carefully.

Explore Blanchard’s current Buffalo nickel inventory to discover authenticated examples of these remarkable American coins, backed by decades of numismatic expertise and market knowledge.

FAQs

1. How much is a Buffalo nickel worth?

Buffalo nickel value depends entirely on date, mint mark, and condition. Common dates from the 1930s typically trade near face value in worn condition, while key dates like the 1926-S and error coins like the 1937-D 3 legged Buffalo nickel command substantial premiums regardless of grade.

2. How much is a 2005 Buffalo nickel worth?

Most 2005 Buffalo Nickels remain common and trade at face value since they were produced in large quantities for circulation. However, exceptionally well-preserved examples or coins from special mint sets may carry modest collector premiums.

3. Where is the date on a Buffalo nickel?

The date appears on the obverse of the coin, positioned on the Native American’s shoulder below the portrait. This raised placement made the date vulnerable to wear, causing many Buffalo Nickels to become completely dateless through normal circulation.

4. Where is the mint mark on a Buffalo nickel?

The mint mark is located on the reverse, below the words “FIVE CENTS.” Look for a small “D” (Denver) or “S” (San Francisco) in this position. Coins without mint marks were produced at the Philadelphia Mint.

The Fascinating Story of the $4 Stella Gold Coin

Posted on — Leave a commentAn Ambitious Experiment in U.S. Coinage

Among the rarest and most captivating coins in American numismatics is the $4 Stella. Produced only in 1879 and 1880, this short-lived gold piece was never meant for mass circulation. Instead, it represented an ambitious experiment by the U.S. Mint to create an international trade coin that could compete with Europe’s widely used gold standards, like the French 20 Franc and the British Sovereign.

The name “Stella” comes from the star motif that appears on the coin’s reverse, symbolizing its intent to shine as a guiding light in global commerce. Though the project never advanced beyond a few hundred trial pieces, the $4 Stella remains one of the most desirable treasures in American coinage.

Image: USACoinBook

Two Distinct Designs: Flowing Hair and Coiled Hair

The Stella comes in two stunning design types, each carrying its own allure for collectors.

-

Flowing Hair (1879 & 1880): Designed by Charles Barber, this version features Lady Liberty with long, flowing hair and is the more commonly seen variety.

-

Coiled Hair (1879 & 1880): Created by George T. Morgan, the famed designer of the Morgan Silver Dollar, this rarer version depicts Liberty with braided, coiled hair.

Both varieties are breathtaking examples of late 19th-century engraving artistry, but the Coiled Hair version, with fewer survivors, commands even greater prestige and rarity.

Image: USACoinBook

Why the Stella Never Took Hold

Despite its elegant design and practical purpose, the $4 denomination proved awkward for commerce. The coin’s weight and gold content were carefully calibrated to align with international equivalents, yet Congress ultimately rejected the proposal. As a result, only a handful of these coins—roughly 400 Flowing Hair and an even smaller number of Coiled Hair pieces—were ever struck.

This minuscule mintage ensured the Stella’s status as an ultra-high rarity from the moment of its creation. Today, the coin serves as a reminder of America’s attempt to assert itself on the global monetary stage during the late 19th century.

A Collector’s Dream: Rarity and Prestige

The $4 Stella is coveted not only for its rarity but also for its rich backstory. Collectors prize it as a symbol of American innovation, artistry, and ambition. Owning a Stella means holding a tangible piece of an era when the United States was expanding its global reach.

Because of their scarcity, Stellas seldom appear on the open market, and when they do, they command six-figure prices. Their beauty, combined with their historic significance, makes them a cornerstone of advanced numismatic collections.

Blanchard and the $4 Stella: A Legacy of Trust

For over 50 years, Blanchard has been proud to offer collectors access to ultra-rare coins like the $4 Stella. Our firm has built its reputation on helping clients acquire some of the most exclusive treasures in numismatics, guiding generations of collectors in building portfolios that combine history, artistry, and tangible wealth.

When you see a Stella in a Blanchard offering, you’re not just encountering a coin—you’re experiencing a legacy of trust, expertise, and access that few firms can match. Our long-standing relationships in the numismatic community ensure that clients can confidently pursue even the rarest opportunities.

The Enduring Allure of the Stella Gold Coin

The story of the $4 Stella reminds us that not all coins were created merely for everyday use. Some, like this extraordinary piece, were born from visionary ideas that sought to redefine America’s role in the world. Though the experiment never succeeded, its legacy lives on in the form of one of the most coveted rarities in U.S. coinage.

At Blanchard, we know that these coins aren’t just collectibles, they’re tangible links to history. The Stella captures the spirit of American ingenuity, and its rarity ensures that it will remain one of the most talked-about treasures in the world of numismatics.

Frequently Asked Questions About the $4 Stella Gold Coin

Why is the $4 Stella gold coin so rare?

The $4 Stella was struck only in 1879 and 1880 as an experimental international trade coin. With fewer than 500 examples surviving today, its rarity is built into its history, making it one of the most coveted U.S. coins.

How much is a $4 Stella gold coin worth today?

Values for the Stella vary depending on condition and design type, but they regularly achieve six-figure prices at auction. Exceptional examples, such as the Coiled Hair variety, can command even higher premiums due to their extreme scarcity.

Where can I buy a $4 Stella gold coin?

Because of its rarity, the Stella is rarely available on the open market. Blanchard has been proud to offer collectors access to ultra-high rarity coins like the $4 Stella for more than 50 years, making it one of the most trusted firms for acquiring this numismatic treasure.

Begin Your Rare Coin Journey Today

If you’re ready to add an extraordinary piece of history to your collection, the $4 Stella gold coin represents the pinnacle of rarity and prestige. For over 50 years, Blanchard has connected discerning collectors with treasures like the Stella, backed by unmatched expertise and trust. Contact us today to explore current opportunities and secure your place among the few who own this legendary coin.

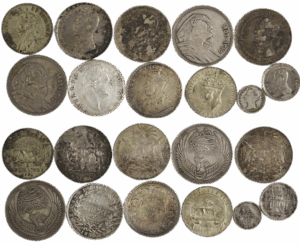

1922 Silver Dollar Value: What it’s Worth and Why

Posted on — 6 CommentsFew coins can claim to embody peace and historical triumph quite like the Peace dollar. Aptly named to honor America’s victory and the restoration of global peace after World War I, this iconic coin was first issued in 1921. The following year saw the Peace dollar reach its production pinnacle with over 84 million coins minted. Today, collectors and investors recognize 1922 as a pivotal year, marking the Peace dollar’s transition from symbolic debut to widespread circulation. This article explains what determines 1922 silver dollar value, how to identify key features, and what to look for when evaluating your coin.

What is the value of a 1922 Peace Silver Dollar: Background and History

The 1922 Peace dollar marked a key shift in American coinage, shaped by wartime policy, public pushback, and design challenges that led to distinctive varieties and enduring collector interest.

Historical Context and Design

The Peace dollar’s origins trace back to World War I and the Pittman Act of 1918. When Britain needed silver to stabilize currency in India and counter German destabilization efforts, Congress authorized melting over 270 million Morgan silver dollars to sell the metal to Britain. The Pittman Act required the Treasury to eventually replace these melted coins with new silver dollars struck from domestically mined silver.

By 1921, the Mint began fulfilling this requirement using the old Morgan dollar design. However, numismatists led by Frank Duffield and Farran Zerbe had been lobbying since 1918 for a new design commemorating America’s victory and the peace that followed. Their persistence paid off when they convinced Treasury officials that a peace-themed coin would be both appropriate and popular, symbolizing America’s hope for lasting peace after WWI. The Treasury announced a design competition in late 1921, inviting established sculptors including previous U.S. coin designers. Anthony de Francisci, at 34 the youngest competitor, won unanimously with his design featuring Liberty modeled after his wife Teresa.

Image: Lady Liberty’s profile on the Peace dollar.

Source: NGC

However, controversy over the design erupted almost immediately. De Francisci’s original reverse design included a broken sword beneath the eagle, symbolizing the end of war. When news leaked to the public, newspapers like the New York Herald attacked the imagery, arguing that a broken sword represented defeat, not victory.

Under intense pressure, Treasury officials hastily ordered the sword removed just days before the scheduled December 28, 1921 first strike. Chief Engraver George Morgan used extremely fine engraving tools to carefully carve the sword from the existing coinage hub, extending the olive branch to cover the modification. Morgan’s precision work was so skillful that numismatists didn’t discover this hand-engraving technique until over 85 years later, having assumed the Mint had created entirely new dies. It’s this level of craftsmanship and historical intrigue that has led some examples to be considered the “holy grail” of Peace dollars.

To see how 1922 Peace silver dollar value can skyrocket for rare examples, watch this nationally televised appraisal.

Mint Mark Variations and Rarity

1922 silver dollar value largely depends on where it was minted, with each facility producing coins bearing distinct characteristics:

Philadelphia Mint (no mint mark)

The Philadelphia facility produced approximately 51.7 million coins, making these the most common 1922 Peace dollars. While abundant, 1922 silver dollar value (no mint mark) can be significant for exceptional examples in high grades.

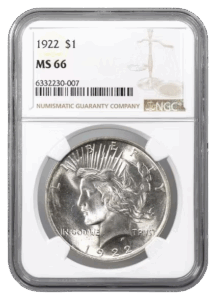

Image: A high-grade example of a Philadelphia Mint 1922 Peace silver dollar, certified MS66 by NGC.

Source: Blanchard Gold

Denver Mint (“D” mint mark)

The Denver Mint struck roughly 15.1 million pieces, making the 1922-D considerably scarcer than Philadelphia issues. As such, 1922 D silver dollar value is typically higher than the more common Philadelphia examples. Denver coins often exhibit weaker strikes due to die spacing issues, making well-struck examples particularly valuable. The “D” mint mark appears on the reverse below the eagle.

San Francisco Mint (“S” mint mark)

San Francisco produced about 17.5 million coins, falling between Philadelphia and Denver in terms of rarity. Despite this middle position in mintage numbers, 1922 S silver dollar value often surprises collectors because San Francisco coins are notorious for weak strikes and bagmarks from rough handling during transport and storage, making pristine examples exceptionally rare and valuable.

These production differences create a clear rarity hierarchy that directly impacts modern 1922 silver dollar value, with Denver and San Francisco examples typically commanding higher prices than their Philadelphia counterparts.

Enduring Market Appeal

The 1922 silver dollar continues to attract both collectors and investors for several reasons. Firstly, its role in commemorating post-World War I peace gives it strong historical appeal. Secondly, its substantial silver content offers intrinsic value tied to precious metals markets. Moreover, its accessibility makes it a popular starting point for new collectors, while seasoned numismatists can seek out high-grade examples and elusive varieties. This blend of historical significance, bullion value, and varying scarcity across mint marks ensures enduring demand.

What Determines 1922 Silver Dollar Value Today?

What a 1922 silver dollar is worth comes down to a mix of condition, mint mark, scarcity, and silver prices. Common examples are valued under $50, but rare varieties and top-grade coins can command five figures.

Condition and Grading Impact on Price

Condition plays a critical role in the value of a 1922 silver dollar, with even slight differences in grade leading to dramatic price variations. Heavily circulated examples in Very Fine condition typically trade near bullion value, while Mint State coins in the MS-63 range command modest premiums. The real appreciation begins at MS-65, where prices increase substantially, and MS-66 examples can reach four-figure values. MS-67 1922 Peace dollars are considered extreme condition rarities, with documented auction sales demonstrating their significant collector premium over lower grades. Learn how professional grading affects the value and collectibility of coins like the 1922 silver dollar.

Mint Mark Influence on Value

As mentioned previously, mint marks create clear value hierarchies. Philadelphia coins (no mint mark) remain most affordable due to their 51.7 million mintage. Denver “D” examples typically sell for 25-50% premiums over Philadelphia coins in similar grades, while San Francisco “S” coins command even higher premiums due to their notorious quality issues, making high-grade examples genuinely scarce.

Special Varieties and Error Coins

Beyond grading and mint marks, certain varieties and errors of the 1922 silver dollar carry substantial premiums due to their rarity and visual distinctiveness. These minting anomalies, caused by production issues such as die cracks and breaks, are highly sought after by advanced collectors. One such example is the “Die Break in Reverse Field,” marked by a noticeable blob of raised metal beneath the eagle, clearly visible without magnification. Another is the so-called “Ear Ring” variety, where a die crack creates a striking metal arc across Liberty’s ear. Even more valuable are high-relief strikes from early 1922 production, issued before the Mint lowered the relief for mass production. When authenticated, these coins can greatly increase the value of a 1922 silver dollar.

Image Description: The highly recognizable and sought-after variety “Ear Ring” 1922 Peace silver dollar variety.

Source: PCGS

Current Market Trends

Silver content also plays a fundamental role in 1922 Peace dollar values, as each coin contains roughly 0.77 ounces of silver. When silver trades at $25 per ounce, the coin’s melt value alone approaches $20. However, 1922 silver dollar value today extends beyond bullion prices: collector demand, interest in certified high-grade coins, and increased recognition of rare varieties all contribute to upward pressure on values.

How to Assess 1922 Peace Silver Dollar Value

Identifying a valuable 1922 silver dollar means looking beyond the date. It involves carefully checking design details, spotting known counterfeits, and knowing when expert authentication is worth the investment.

Checking Key Features and Mint Marks

Evaluating 1922 Peace silver dollar value starts with examining a coin’s key physical characteristics. Authentic examples measure exactly 38.1mm in diameter, weigh 26.73 grams, and feature reeded edges. The obverse displays Lady Liberty in left profile wearing a spiked crown, with “LIBERTY” above, “IN GOD WE TRUST” in smaller text, and “1922” at the bottom. The reverse shows a bald eagle perched on a rock clutching an olive branch, with “UNITED STATES OF AMERICA” and “E PLURIBUS UNUM” above, “ONE DOLLAR” below, and “PEACE” inscribed on the rock.

Strike quality separates valuable examples from common ones. Well-struck coins show distinct hair strands in Liberty’s hair above her ear and crisp lettering throughout. The eagle’s breast feathers and wing details should display clear definition – weak centers are particularly problematic on Denver and San Francisco issues, making sharp examples more valuable.

For mint marks, examine the reverse below the word “ONE” and above the eagle’s tail feathers. Philadelphia coins bear no mint mark and represent the most common variety. Denver coins display a “D” while San Francisco pieces show an “S” – both command premiums over Philadelphia examples. The mint mark should appear sharp and properly centered; weak or misaligned marks may indicate striking problems that affect value.

Image Description: The reverse side of a 1922 Peace silver dollar minted in San Francisco.

Source: NGC

Spotting Counterfeits and Common Fakes

With 1922 Peace dollars being popular targets for counterfeiters, collectors need to recognize warning signs of fake coins. Chinese-made counterfeits represent the most common threat, often identifiable by poor striking details and incorrect silver content. Authentic Peace dollars ring with a clear, sustained tone when gently tapped, while fakes typically produce a dull thud due to different metal composition. Examine the lettering closely – genuine coins display sharp, well-defined text, while counterfeits often show mushy or poorly formed letters. Many fakes exhibit a greasy or artificial luster rather than the natural cartwheel effect of genuine silver. Weight discrepancies are another red flag, as authentic coins maintain consistent specifications.

When Professional Appraisal Becomes Necessary

While many collectors can handle basic identification, certain situations call for expert evaluation. Seek professional authentication for high-grade coins (MS-65 and above), any coin where authenticity seems questionable, and pieces you suspect might be valuable varieties or errors. Professional grading services like PCGS or NGC provide authentication along with condition certification, adding credibility for resale. Consider professional evaluation for coins with unusual characteristics, potential errors, or when significant money is at stake.

Investment Potential: What is the Value of a 1922 Silver Dollar Coin?

The 1922 Peace silver dollar offers both historical appeal and tangible value, making it a compelling option for collectors and investors alike, especially when sourced through trusted dealers like Blanchard.

Investment Pros and Cons

The 1922 silver dollar has several notable investment advantages. Its substantial silver content provides intrinsic value and a degree of protection against inflation. Even 1922 silver dollar ‘no mint mark’ value benefits from this precious metal backing, while the coin’s historical importance and widespread recognition support strong liquidity, making it easier to buy and sell than many less familiar collectibles. What’s more, common-date examples remain relatively affordable, making them ideal for collectors getting started in collecting rare coins on a budget while becoming familiar with the market.

However, investing in 1922 silver dollars also comes with challenges, including storage and insurance costs for physical assets. Additionally, market volatility, impacting both silver prices and numismatic demand, means that realizing strong returns often requires a long-term, patient approach.

Historical Market Performance

Peace dollars have shown consistent resilience through various market cycles since their withdrawal from circulation. During the silver boom of the 1970s, they gained value from both rising bullion prices and renewed collector interest. The coin market surge in the 1980s brought significant appreciation, particularly for higher-grade examples. In the 1990s, the rise of third-party grading services introduced greater transparency and liquidity, further strengthening the market. In recent decades, values for well-preserved coins and rare varieties have continued to rise, consistently outperforming common circulated issues.

Reliable Access to Authenticated Peace Dollars

When investing in Peace dollars, working with a reputable dealer is essential to ensure authenticity, fair pricing, and long-term value. Blanchard offers Peace dollars that are professionally graded and certified by leading third-party services, combining expert authentication with the backing of a trusted name in the industry. In a market where counterfeits are increasingly common, explore Blanchard’s collection of rare and collectible coins, including Peace Dollars and other historic pieces, for the level of assurance that helps protect buyers from costly mistakes.

Frequently Asked Questions

1. What is the value of a 1922 silver dollar?

Most 1922 silver dollars fall into two general categories: those valued primarily for their silver content, and those prized by collectors for their preservation or rarity. While not considered rare overall, certain coins, especially those in exceptional condition, can be highly sought after.

2. What factors affect 1922 silver dollar value?

Several variables determine a 1922 silver dollar’s worth. These include the coin’s grade, mint mark (Philadelphia, Denver, or San Francisco), eye appeal, strike quality, and the presence of die varieties or minting errors. Broader market forces, such as silver prices and collector demand, also play a role, especially for lower-grade coins.

3. What’s the difference in value between 1922 Liberty and Peace silver dollars?

While it’s a common mistake to refer to “1922 Liberty silver dollar value,” it is important to note that there are no 1922 Liberty silver dollars. The Liberty (Morgan) dollar series ended in 1921 when it was replaced by the Peace dollar design. All 1922 silver dollars are Peace dollars, which do feature Liberty’s portrait but represent a completely different design from the earlier Morgan Liberty dollars.

4. How can I identify a valuable 1922 silver dollar coin?

Start by checking the mint mark on the reverse below “ONE” – Denver “D” and San Francisco “S” coins are worth more than Philadelphia examples (no mint mark). Examine strike quality by looking at Liberty’s hair details and the eagle’s feathers for sharp definition. Verify the coin weighs 26.73 grams and measures 38.1mm for authenticity. Look for original luster and minimal bagmarks, as well-preserved coins command significant premiums over worn examples.

5. Can a 1922 silver dollar be a good investment today?

Yes. When it comes to value, 1922 silver dollar coins provide both silver content and numismatic potential. High-grade examples and scarce mint marks have shown consistent appreciation, though common circulated pieces primarily track silver prices.

Conclusion

Assessing the value of a 1922 silver dollar means understanding how condition, mint marks, and scarcity combine to drive prices from simple bullion value to the upper tiers of numismatic demand. With a massive mintage of 51.7 million, Philadelphia coins are the most common and affordable. In contrast, Denver (“D”) and San Francisco (“S”) issues command premiums due to their significantly lower production numbers. The highest premiums emerge in MS‑65 and above, where exceptional strike quality and preservation elevate value far beyond silver content alone.

Accurate identification is essential for determining 1922 silver dollar value. Key steps include checking strike sharpness, confirming mint mark placement, and verifying physical specifications. For advanced collectors, recognizing production anomalies and rare die varieties can reveal pieces with significant added value, though expert authentication is crucial for these high-stakes finds.

Because of the prevalence of counterfeits, buying from a trusted dealer is critical. Blanchard’s expertise in sourcing, authenticating, and certifying Peace dollars provides the assurance collectors and investors need to build meaningful, risk‑managed holdings in these historic coins.

Ready to add authenticated 1922 Peace dollars to your collection? Explore Blanchard’s inventory of Peace dollars and large selection of rare coins to discover opportunities that combine historical significance with long-term value potential.

New U.S. Home Sales Skid: Gold Climbs to 3-Week High

Posted on — Leave a commentAsk any homebuyer these days about how their home search is going, and you are likely to hear a whole lot of frustration. The summer of 2025 turned out to be challenging not only for homebuyers, but home sellers and homebuilders. Call it a perfect storm for the U.S. housing market, and that in turn helped to boost gold.

In July, new home sales skidded 0.6% to a seasonally adjusted rate of 652,000, the Commerce Department said. Economists had forecast new home sales to climb.

Gold climbed to a 3-week high, boosted by the weaker housing news, concerns over Federal Reserve independence, and ongoing safe-haven buying amid geopolitical and economic uncertainty.

So, why has the housing market stalled? What does it mean for gold and for the U.S. economy? Let’s dig deeper.

Homebuyers: High Mortgage Rates, High Home Prices

First-time homebuyers face big challenges when it comes to signing on the dotted line and hiring movers to move into a new home. These include high mortgage rates and high home prices.

In June, the median price for a U.S. existing home soared to a record high of $435,300, according to the National Association of Realtors. That’s up 2% from a year ago and marked the 24th straight month of annual price increases. Add rising mortgage rates into the mix at around 6.70% and that means new homebuyers must pay above $1,200 per month more for a median-priced home than in 2022.

Sellers: Starting to Delist Instead of Lowering Prices

Frustrated home sellers are pushing back against price cuts, and that’s another factor resulting in the stalled housing market. The longer homes sit, the more likely sellers are to delist their homes for sale, Realtor.com said. The rise in delisting has also coincided with a slower pace of new listings.

Builders: Cautious amid Weak Demand and High Prices for Building Materials

It turns out there’s a national shortage of about 4 million homes. Yet, builders are cautious in the current environment, and new single-family construction has slowed. Building permits dropped 4.4% year-over-year in June. Builders point to high financing costs, weak buying demand, and rising prices on building construction materials as factors holding them back. Since 2022, single-family home starts are down 10% while new homes under construction are down 15%.

Big Picture: Home Buying is an Important Engine for U.S. Economic Growth

When the housing market slows, that has a spillover negative impact on the U.S. economy. After all, when you buy a new home, you often buy new furniture, appliances, and start to spend on things like landscaping and maintenance. This has a ripple effect throughout the economy, increasing demand for goods and services, which creates jobs and boosts economic growth.

A slowdown in the housing market has the opposite effect, and that’s what we are seeing now.

Why Gold Climbs on Signs of a Weaker Housing Market

As we saw in late August, when gold climbed to a 3-week high, precious metals benefit from weaker housing market data because it reveals broader economic stress, increased uncertainty about the labor market, and even concerns about a recession, which increases safe-haven demand for gold.

Economists remain sour on the outlook for the housing market ahead, which creates favorable conditions for gold to continue to climb. The worrisome housing data is only one of many reasons investors are piling into gold in 2025, with the precious metal soaring to a record high in the first half of the year. Gold is trading quietly now, but firms from Fidelity to Goldman Sachs and J.P. Morgan forecast a new leg higher with the price of gold expected to exceed $4,000 an ounce. That makes today a great time to consider increasing your allocation to precious metals. Get started with a complimentary portfolio review with a Blanchard portfolio manager today.

Krugerrand: Why This Coin Still Matters in 2025

Posted on — Leave a commentThe South African Krugerrand didn’t just enter the gold market in 1967: it created the modern bullion coin industry. By 1980, this coin commanded 90% of the global gold coin market. Today, the Krugerrand maintains its dominance through unmatched global liquidity and recognition. This article examines the technical specifications, investment advantages, and historical significance that keep the Krugerrand competitive in an increasingly crowded bullion market.

What Is a Krugerrand?

Before exploring its investment potential, here are the basics of what makes a Krugerrand. For additional insights into the fascinating history of the Krugerrand coin, watch this expert discussion from South African numismatic specialists.

Historical Origins

South Africa created the Krugerrand in 1967 to solve its very specific problem of marketing the country’s abundant gold reserves to private investors. At the time, South Africa produced 70% of the world’s gold, but private gold ownership was heavily restricted in most countries, and investors had limited options beyond bars and ingots. The solution was ingenious: create a coin with legal tender status that governments couldn’t easily ban, unlike gold bars which were often prohibited for private ownership.

The South African government, working with Rand Refinery and the South African Mint, designed the Krugerrand as the world’s first modern bullion coin. It was legal tender that could be easily bought, sold, and transported without the regulatory hurdles facing other gold investments. This timing proved perfect, as countries were abandoning the gold standard, where currencies were backed by gold reserves. This left individual investors seeking new ways to own gold directly rather than through government-backed paper money.

Design Significance

The Krugerrand’s visual design was carefully planned to represent South African identity while ensuring global recognition. The coin’s name itself combines “Kruger” (honoring Paul Kruger, the former president of the South African Republic from 1883 to 1900) with “rand” (South Africa’s currency unit). Kruger’s portrait on the obverse aims to represent South African heritage and political independence, while the reverse features a pronking springbok, South Africa’s national animal.

Image: A black and white historical portrait of Paul Kruger

Source: Kapstadt.de

The coin’s designer, Coert Steynberg, wasn’t starting from scratch with the springbok – he had already used this imagery on earlier South African coins, including the five shillings and 50 cents pieces. By adapting this familiar national symbol for the bilingual (English and Afrikaans) Krugerrand coin, it gained instant recognition both domestically and internationally.

Manufacturing Process

The Krugerrand’s manufacturing required several innovative decisions that would influence bullion coin production worldwide. Most importantly, the decision to use 22-karat gold (91.67% pure gold with 8.33% copper) was revolutionary for its time. While pure gold was traditional for bullion, the Krugerrand’s copper alloy made it significantly more durable than pure gold coins, which scratch and dent easily during handling and transport. The copper content also gave the Krugerrand its distinctive orange-reddish hue, making it instantly recognizable. To maintain exactly one troy ounce of pure gold content despite the alloy metals, manufacturers made the total weight slightly higher at 33.93 grams. This approach prioritized practicality without sacrificing the gold content that determines Krugerrand coin value for investors.

Global Impact

The Krugerrand’s success fundamentally changed the precious metals industry. By 1980, it accounted for 90% of global gold coin sales, proving there was massive demand for accessible gold investment vehicles. This success inspired other nations to create their own bullion coins: Canada’s Gold Maple Leaf (1979), China’s Gold Panda (1982), America’s Gold Eagle (1986), and Britain’s Britannia (1987). Each borrowed elements from the Krugerrand model: legal tender status, fractional sizes, and investor-friendly marketing. The Krugerrand’s pioneering role helped establish the modern bullion coin market, which has continued evolving alongside broader changes in global gold markets over recent decades. Even today, with dozens of competing bullion coins available, the Krugerrand’s first-mover advantage and widespread recognition keep it among the most liquid gold investments worldwide.

South African Krugerrand Specifications and Technical Details

The Krugerrand’s precise specifications have remained consistent since 1967, ensuring reliability for investors and dealers worldwide.

Physical Characteristics

The standard one-ounce Krugerrand measures 32.77mm in diameter and 2.84mm thick, with a total weight of 33.93 grams. The coin’s copper content makes it heavier and more durable than pure gold coins, while also creating the distinctive orange-gold color that sets Krugerrands apart from other bullion coins. The edge features 160 fine ridges – called reeded serrations – that help prevent counterfeiting and provide texture for handling. Proof versions have 220 serrations for enhanced detail. The matte finish of the Krugerrand coin helps conceal minor handling marks that would be more visible on highly polished coins.

Gold Content Breakdown

Each Krugerrand contains exactly one troy ounce (31.1 grams) of pure gold within a 22-karat gold alloy composition of 91.67% gold and 8.33% copper. To accommodate the copper while maintaining the full ounce of pure gold, the total coin weight increases to 33.93 grams.

Manufacturing Standards

The Krugerrand’s reputation for reliability stems from the South African Mint’s rigorous manufacturing standards, established over decades of precious metals production. The process begins with the Rand Refinery, one of the world’s largest gold refineries, which supplies gold that undergoes extensive purity testing before reaching the mint. During production, the South African Mint implements multiple quality control checkpoints, including precise weight verification and gold content analysis for every batch. This systematic approach ensures each South African Krugerrand meets exact specifications, which is crucial for maintaining investor confidence and global acceptance.

Size Variations

Beyond the standard one-ounce coin, the gold Krugerrand is available in fractional sizes. The half-ounce weighs 16.97 grams (15.55 grams pure gold), the quarter-ounce weighs 8.48 grams (7.78 grams pure gold), and the tenth-ounce weighs 3.39 grams (3.11 grams pure gold). All fractional sizes maintain the same 22-karat composition and proportional design scaling.

Image: A gold Krugerrand coin reverse showing a leaping springbok

Source: NGC

Understanding Krugerrand Variations

Not all Krugerrands are created equal. Understanding the different types helps investors determine Krugerrand gold coin value today and make informed choices.

Standard vs. Proof Versions

Production Differences

Standard bullion Krugerrands are struck once using regular dies in a mass production process focused on efficiency and metal content accuracy. Proof Krugerrands undergo a completely different manufacturing approach: they’re struck multiple times with specially polished dies that create mirror-like surfaces. The proof production process involves polishing both the coin blanks and the dies to achieve a frosted design against a mirror-smooth background, requiring significantly more time and labor per coin. Since 1995, proof Krugerrands have come with original presentation boxes and certificates of authenticity, adding to their premium positioning.

Visual Distinctions

The most obvious difference between standard and proof versions lies in surface finish. Bullion coins have a standard matte appearance designed for handling and stacking, while proof coins feature highly reflective, mirror-like surfaces with frosted design elements that create a dramatic visual contrast.

Another way to distinguish them is by counting edge serrations: bullion Krugerrands have exactly 160 reeded edges, while proof versions have 220 serrations.

Image: A 1967 proof Krugerrand in a PCGS graded holder with distinctive mirror-like finish and 220 edge serrations.

Source: PCGS

Mintage Numbers

Proof Krugerrands are produced in strictly limited annual quantities, typically ranging from a few thousand to tens of thousands depending on the year and denomination. These small production runs create natural scarcity that appeals to collectors.

In contrast, bullion Krugerrand production fluctuates dramatically based on global gold investment demand, with annual mintages ranging from as low as 24,000 in quiet years to over six million during peak demand periods like the late 1970s. This production flexibility means bullion coins from high-mintage years trade closer to gold spot price, while low-mintage years can command slight premiums even among bullion versions.

Fractional Krugerrands

Introduction Timeline

Fractional Krugerrands were introduced in 1980 in three sizes: half-ounce, quarter-ounce, and tenth-ounce denominations. This expansion aimed to make gold ownership accessible to investors who found the full ounce financially challenging. The smallest tenth-ounce size proved especially popular for gift-giving and as an affordable entry point into gold investing. Due to their accessibility, fractional sizes often achieved substantial mintages, with the tenth-ounce frequently recording some of the highest production numbers in given years. All three fractional sizes helped democratize gold ownership during a period when precious metals investing was gaining mainstream appeal.

Technical Specifications

As mentioned previously, fractional Krugerrands maintain precise proportional weights (the half-ounce at 16.97 grams total, quarter-ounce at 8.48 grams, and tenth-ounce at 3.39 grams), while preserving the exact 22-karat gold-to-copper ratio of the original. This consistency ensures that all sizes share the same durability and distinctive orange hue that makes Krugerrands instantly recognizable. Unlike some coin series where fractional versions compromise on composition, Krugerrands maintain identical characteristics regardless of size, ensuring consistent Krugerrand value today across all denominations.

Design Adaptations

All fractional sizes feature identical designs to the one-ounce coin, with careful scaling to preserve detail clarity even on the smallest 1/10-ounce version. The South African Mint’s precision scaling techniques ensure that Paul Kruger’s portrait and the springbok design remain sharp and recognizable across all denominations.

Krugerrand Investment Potential in 2025

The Krugerrand’s investment appeal in 2025 mainly comes down to proven liquidity advantages versus the practical costs of physical ownership.

Advantages

Global Liquidity and Recognition

The Krugerrand’s 58-year track record has created unmatched worldwide recognition among precious metals dealers. Unlike newer bullion coins that may require verification or face regional acceptance issues, Krugerrands can be bought and sold easily in virtually any gold market globally. This liquidity advantage becomes particularly valuable during economic uncertainty when quick asset conversion may be necessary.

Privacy and Regulatory Benefits

A key advantage of owning physical Krugerrands is the privacy they provide compared to other gold investment options. Physical Krugerrand purchases below certain thresholds typically don’t trigger government reporting requirements in most jurisdictions, unlike gold ETFs or mining stocks that automatically generate tax documents and paper trails. This allows investors to build gold positions privately without the regulatory paperwork that accompanies many financial instruments.

Proven Inflation Protection

Historical data shows Krugerrands have successfully preserved purchasing power during inflationary periods. From 1970 to 1980, when U.S. inflation averaged over 7% annually, gold prices rose from $35 to over $800 per ounce – a gain that far outpaced inflation and protected investors’ real wealth. Krugerrands, containing one full ounce of gold, delivered these same protective returns to holders. As a physical investment, the gold Krugerrand provides direct exposure to gold’s inflation-hedging properties without the management fees or tracking errors that can affect gold-based financial products.

For more details on why gold serves as an ideal portfolio complement and its performance compared to traditional investments, explore Blanchard’s gold investment insights.

Considerations

Storage and Security Requirements

Physical ownership requires secure storage solutions, whether through safe deposit boxes, home safes, or professional vault services. Insurance and security add ongoing costs that don’t exist with other gold investments like ETFs, making storage planning crucial for larger collections.

Market Timing and Premium Cycles

Premium levels fluctuate based on global demand, political uncertainty, and supply constraints. Buying during high-premium periods can reduce returns, making market awareness crucial for optimal entry and exit timing.

How to Buy and Sell Krugerrands

Krugerrands are available through various channels, with established precious metals dealers offering the most reliable combination of authenticity guarantees and competitive pricing. These dealers provide proper documentation and buyback policies, while online auction sites and unverified sellers present higher counterfeit risks.

Authentication Essentials

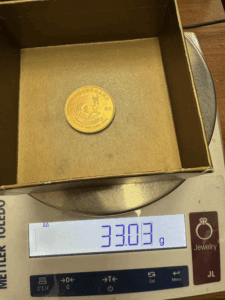

Authentic Krugerrands have specific specifications: 33.93 grams weight, 32.77mm diameter, and the correct edge serrations (160 for bullion, 220 for proof). The distinctive orange-gold color from copper alloy should appear consistent throughout. Professional dealers can verify authenticity using precision scales and testing equipment.

Image Description: A 1983 Krugerrand on digital scale showing 33.03 grams, demonstrating underweight coin that may indicate wear or authenticity concerns.

Source: Reddit

Selling Strategy

Krugerrands maintain strong global liquidity, making them relatively straightforward to sell when needed. Local coin shops, precious metals dealers, and established online platforms all provide viable selling options. Market timing during periods of high Krugerrand price appreciation or increased uncertainty can help maximize returns.

Professional Advantage

Blanchard’s decades of experience in precious metals ensures authenticity verification, competitive pricing, and reliable access to both buying and selling markets. With established relationships throughout the industry and comprehensive market knowledge, Blanchard offers investors the confidence that comes from working with a trusted precious metals specialist.

Conclusion

The Krugerrand’s enduring success stems from practical advantages that remain relevant in 2025: unmatched global liquidity, proven durability through its 22-karat gold composition, and a 58-year track record of market acceptance. Its distinctive design featuring Paul Kruger and the springbok, combined with specific technical specifications like weight and edge serrations, makes authentication straightforward for investors.

For modern portfolios, Krugerrands offer direct gold exposure without the complexities of ETFs or mining stocks, while maintaining the privacy and inflation protection that physical precious metals provide. Whether in standard one-ounce or fractional sizes, Krugerrands continue to represent one of the most liquid and widely recognized gold investments available.

Explore Blanchard’s selection of authentic Krugerrands and other world gold coins and discover how these iconic coins can strengthen your precious metals portfolio.

FAQs

1. How much is a Krugerrand worth today?

Krugerrand value fluctuates daily based on gold spot prices plus a small premium for the coin itself. You can track current gold spot prices to understand the base value of your Krugerrand’s gold content. For the most accurate pricing, contact Blanchard directly.

2. How much does a Krugerrand weigh?

A standard one-ounce Krugerrand weighs exactly 33.93 grams total, containing 31.1 grams of pure gold. The additional weight comes from copper alloy that makes the coin more durable. Fractional sizes maintain proportional weights: half-ounce at 16.97 grams, quarter-ounce at 8.48 grams, and tenth-ounce at 3.39 grams. Verifying these precise weights helps confirm authenticity.

3. What factors affect Krugerrand value?