The Blanchard Economic Report – 5 Questions about Fed Policy and Gold

Posted on — Leave a comment

What do the rate you pay for your car loan, your credit card interest rate and mortgage loan all have in common? They are all based on the Federal Reserve’s benchmark interest rate.

While many investors don’t pay much attention to what goes on behind closed doors at the central bank, its policies affect markets and your pocketbook.

The Fed, currently led by Chair Janet Yellen, continues to show an extremely accommodative monetary policy stance. In plain English – it means interest rates are still really low – well below long-term historical averages.

Janet Yellen, chair of the Federal Reserve took office in February 2014. Her term is set to expire in January 2018.President Trump has said that he will replace Yellen.

That’s generally good news for borrowers, as loan rates tend to be lower. For savers and others who are looking for an income stream off of traditional types of vehicles (such as savings accounts or certificate of deposits) it’s been downright bad news since the global financial crisis hit in 2008.

A Quick History

The Fed’s benchmark rate – the federal funds rate – currently stands at a mere 0.50%-0.75%. That’s low. Looking back in 2006 – the fed funds rate stood at 5.25%. A more historically “normal” or neutral rate is in the 3.5-4.0% range.

- Why are rates so low? Since the global financial crisis and Great Recession hit in 2008, the Federal Reserve flooded the financial system with liquidity – in an effort to encourage lending and spending to get the economy moving again.

- Has it worked? The Fed has certainly come under its fair share of criticism in recent years, but there are some who say that former Fed Chair Ben Bernanke’s actions in the wake of the crisis prevented another Great Depression.

In recent years, Fed Chair Yellen has been attempting to bring interest rates higher – to a more historically normal rate. The goal is to normalize interest rates so if another recession hits, the Fed will be able to stimulate the economy with lower rates.

Various stumbling blocks from concerns over global growth, to uncertainty in the wake of Brexit, to sluggish economic growth and low inflation have all tied the Fed’s hands in recent years and interest rates remain extremely low.

- How does this impact gold? The yellow metal benefited significantly in the years following the global financial crisis from the central bank’s actions. Not only in the U.S. but the European Central Bank and the Bank of Japan initiated so-called “quantitative easing” measures, which in its simplest form has been referred to as money-printing. The Fed has dramatically expanded its balance sheet to all-time record high levels since the global financial crisis. Investors around the world bought gold as a hedge against paper money depreciation and devaluation. After all – the bigger the money supply of paper dollars, the less it is theoretically worth.

- What’s next for the Fed? This year, the Fed has broadcast its intentions to hike interest rates two or three times. For now, the June Fed meeting is the next likely time for an interest rate hike. But, there are a variety of factors that could once again derail the Fed’s best intentions including:

- Unknowns over how Trump Administration policies will impact the economy

- Still sluggish economic growth could hold the Fed back

- Pressure to push the U.S. dollar lower could become a political issue for the Fed.

- What does this mean for gold? Even if the Fed hikes rates one to three times in 2017 – it would still leave interest rates low by historical standards. Fed rate hikes may pose a modest, but minimal headwind for gold this year, considering that rates remain low compared to pre-global financial crisis levels.

Stay tuned for fresh comments from Federal Open Market Committee (FOMC) officials this week:

- Thursday: Louis Fed President Bullard (non-voting member of FOMC) speaks at Washington University at a finance forum on the U.S. economy and monetary policy.

- Thursday: Chicago Fed President Evans (voting member) speaks in Chicago on current economic conditions and monetary policy at the CFA Society of Chicago.

- Saturday: Vice Chair Fischer (voting member) speaks in England to address the Warwick Economics Summit at the University of Warwick.

Monetary policy is only one factor that affects gold prices. There are many more including stock market volatility, rising inflation, geopolitical uncertainty and overall financial conditions.

We at Blanchard and Company believe that most of our clients benefit by talking to one of our Portfolio Managers before they make any purchase. The precious metals market is complicated and in constant flux. We follow it far more closely than the average person, even diehard gold bugs. Getting a second opinion before you buy can dramatically improve your purchasing power and avoid making a bad purchase. We can also help educate you on topics such as IRA’s, inheritance, storage, diversification and more. Contact us at 1-800-880-4653.

Markets Choppy but Climb Higher as Data Suggests Strength

Posted on — Leave a commentUS equities edged higher on Friday to finish a choppy week full of both sharp up and sharp down price moves. A lot of large-cap companies (Apple, Facebook, Amazon) that have significant weight in US indices reported their financial results for the fourth fiscal quarter of 2016.

Apple, the world’s largest company by market capitalization, beat Wall Street’s expectations when it released record earnings of $78.4 billion in revenue, up 3.3% from the same time last year. Naturally, the strong earnings announcement boosted the price of Apple (AAPL) 5.6% intraday and pushed the Nasdaq 100 Index higher as well, since Apple is such a large component of the index.

Facebook and Amazon, two other very popular companies that reported earnings last week, did not fare as well in the market. Both companies had strong financial and user growth but failed to fully impress investors. Despite these two notable earnings letdowns, most other large-cap companies reported robust Q4 earnings that surpassed The Street’s estimates.

Given mostly strong earnings with bullish market reactions, investors were left scratching their heads as they witnessed substantial price swings in the broader equity indices.

Thomas Siomades, head of Hartford Funds Investment Consulting Group noted, “every day there is news explosion that is hijacking airwaves, pushing aside fundamentals that should matter to markets, like earnings.”

He went on to describe how most people “would think markets would be in a good place as earnings are coming stronger than expected and the Fed is not in a rush to raise rates due to some softness in the economy.”

Because there has been more political influence on equity markets in the past three weeks than there has been in the past three years, the only explanation for the bizarre intraday moves seem to stem from mounting investor skepticism over President Trump’s economic influence and plans.

Despite the widespread skepticism and uncertainty in the markets, the US Labor Department said on Friday morning 227,000 jobs were created in the public and private sectors in January, thereby beating the expectation of 175,000 jobs.

Solid job labor data definitely helped stocks finish the week on a positive note, and the minimal hourly wage growth of only 0.10%, which was also part of the labor report, is likely to make the Federal Reserve more cautious about hiking their benchmark lending rate in March.

When interest rates stay low or unchanged, this is generally seen as favorable to stocks and precious metals, like gold and silver. This makes sense, because gold rapidly recouped its losses immediately after all the data was dissected in the labor report.

In trading last week, gold marked its best finish since mid-November amid the usual geopolitical risks and the wavering US dollar. In 2017, investors from all regions of the globe have been flocking to the precious metal to seek refuge in an asset that has a sound logical basis to climb higher in the coming months – and so far, they’ve been handsomely rewarded.

Global Bar and Coin Demand Surged In Fourth Quarter

Posted on — Leave a commentThe World Gold Council released its full-year 2016 Demand Trends report last week and the findings revealed strong global investment demand for gold. Here are some key findings of the report.

Investment demand for gold around the world surged by 70%, hitting its highest level since 2012, the World Gold Council said. When gold prices fell in the October and November it triggered huge bar and coin demand for the fourth quarter – its highest quarterly level of purchases since the second quarter 2013.

Chinese Remain Eager Buyers

Historically, Chinese and Indian consumers are some of the world’s largest physical gold buyers. For centuries, individuals in these countries turned to gold as a method to preserve, save and build wealth. As the middle classes in those two emerging market powerhouses continue to grow –gold demand continues to rise.

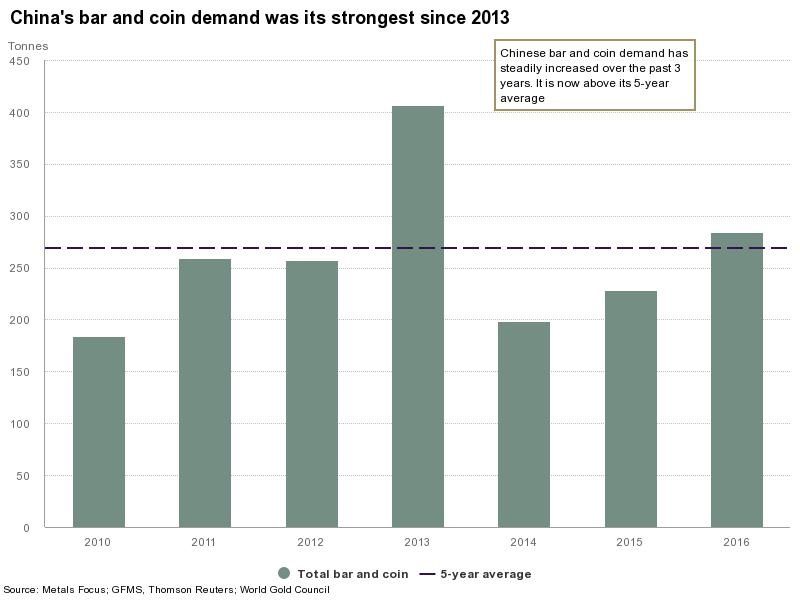

The fourth quarter 2016 ushered in a gangbuster conclusion to the year. Fourth quarter gold demand in China skyrocketed by 86% on a year-over-year level, which propelled annual demand to 284.6 tonnes, its highest level since 2013, the World Gold Council said. (See Figure 1 below, source: World Gold Council.)

4 key factors supported strong Chinese buying in the fourth quarter:

- Chinese investors rushed to buy as gold prices fell in the fourth quarter. The weaker prices were seen as a bargain and buying opportunity.

- Emerging fears of a property bubble in cities across China stimulated demand for physical gold ownership.

- The depreciation of the Chinese currency – versus the U.S. dollar – triggered a run in physical gold buying, especially among high-net worth individuals who were eager to preserve their purchasing power.

- Seasonal buying ahead of the Chinese Lunar New Year on Jan. 28 stimulated fresh physical gold purchases.

Other notable developments in 2016?

U.S. Demand Hit Its Highest Level Since 2010, Family Offices Buy Gold

U.S demand climbed to 93.2 tonnes in 2016, its highest level since 2010, the World Gold Council said. “The atmosphere of uncertainty created by global monetary policies and shifting expectations for US interest rate rises supported demand in H1. Demand in Q4 was boosted by investors who took advantage of the sharp price dip following Trump’s November victory. This was coupled with a healthy degree of interest from family offices motivated by the perceived threat of inflation,” the World Gold Council report said.

Family offices represent savvy high net worth individuals. This group has shown an increasing level of appetite for physical gold and tangible asset diversification in recent months and years.

Gold and other physical metals have proven portfolio diversification benefits. Blanchard and Company has been advising individuals for over 40 years on how to protect their purchasing power and grow their wealth through physical bullion and rare coin investments. Contact Blanchard and Company at 1-800-880-4653.

How Mining Influences Gold Prices

Posted on — Leave a commentWhen we discuss gold, we often consider economic trends, the stock market, inflation, and politics. However, one of the most influential factors goes unnoticed: mining operations. As with any demand/supply market, the output of global mining will enormously impact prices. Investors considering gold as a long-term asset should look to extraction for clues.

Forecasts from BMO Capital Markets have led analysts at Bloomberg to project supplies from existing mines to drop approximately one-third in the next decade. Fewer gold deposit discoveries have compounded this downward movement. “We are having a heck of a time finding gold” lamented Ian Telfer, chairman of Goldcorp late in 2016. Accordingly, consolidation is expected in the industry as firms scramble to acquire other operations and capitalize on dwindling supply.

“Once supply from mines starts to decline, and people start to realize the impact that’s going to have, I think it’s going to be incredibly bullish for gold,” continued Telfer. The problem of sourcing new deposits is global. Discoveries in South Africa in the late 1800’s sparked a boom. Today mining in the country is far less robust. Mining companies are experiencing a 20-year decline in production. Curiously, global gold supply was up 4% in the third quarter of 2016. The reason: Reclaimed materials buoyed supplies. Recycling focuses on sourcing gold from end of life electronics and jewelry. The desperation for supply is evident; recycled gold surged 30% in Q3 of 2016 compared to the same period in 2015.

This data is good news for long-term investors. As output drops, prices will rise. While these price increases may invigorate miners to pull more metal cost, conscious firms are hesitant to overspend. “Producers remain hesitant to loosen the purse strings. Not only are existing mines impacted by this parsimony, but the project pipeline is too, as new projects are contributing less to the amount of gold that is being mined annually,” reported the World Gold Council. New resources are not only difficult to find they’re increasingly difficult to access. As miners are forced to go deeper, costs rise and operations may halt. “Exploration is a very risky business, you have got to have a lot of irons in the fire,” remarked the CEO of Newcrest Mining Limited. The process of commercializing a new project requires, on average, ten years.

The limited nature of gold is the greatest aspect of the asset. Publicly traded companies can issue more shares or even misrepresent earnings. However, the gold supply is rooted in tangible goods that are free from the obscurity of leveraged firms or failures to meet earnings estimates. Reports of attenuated supplies and surges in recycling illustrate the value of maintaining a long-term strategy with gold. Short-term prices will rise and fall on information that has little bearing fundamentals. However, those willing to buy and hold will realize the value of supply downturns.

What does this mean for gold in 2017? In a survey of 26 analysts Bloomberg concluded, “Prices may rally about 13 percent in 2017.” These analysts span the globe with two-thirds citing a bullish stance for the commodity. If these expectations come to fruition investors will reap the largest single year gain since 2010.

Federal Reserve Report – The Real Fed Drama Lies Ahead: Trump and the U.S. Dollar

Posted on — Leave a commentAs expected the Federal Reserve left interest rates unchanged at the conclusion of its two-day meeting on Wednesday. In a unanimous 10-0 vote, the central bankers voted to hold its benchmark interest rate steady in a range between 0.50% and 0.75%.

There were no surprises from the Fed this week, but the real story for investors could unfold in the months ahead surrounding the Trump administration and the level of the U.S. dollar.

Meeting Recap

The general tenor of the post-meeting statement was little changed as the central bank said “job gains remained solid and the unemployment rate stayed near its recent low.” In a new addition to the statement, the central bankers noted that American consumers have a more optimistic view about the economy going forward. “Measures of consumer and business sentiment have improved of late,” the Fed said, noting that household spending “has continued to rise moderately.”

Market Reaction

Gold spot prices edged slightly higher in electronic trading from their Wednesday settlement level after the Fed statement was released. April gold traded up to $1,208.89 an ounce after the statement was released.

Stock Volatility Is Picking Up

Stock market volatility picked up significantly in the past few days, as Wall Street traders were unnerved by some of the new executive orders from the Administration, which left the Fed meeting as a mostly ignored sideshow.

Battle over the Level of the U.S. Dollar

The Trump stock market honeymoon may be fading as traders brace for potential repercussions on a number of fronts, including trade. This week, the Trump administration accused Germany of currency manipulation, adding them to its list which includes China and Japan.

The Trump administration has been complaining about the high level of the dollar – which could leave the central bank as a potential target later this year.

Why? If the Fed hikes interest rates it will strengthen the dollar even further and the Trump administration has already said the dollar is too high.

A higher dollar tends to weigh on gold prices, while a weaker dollar tends to support gold prices.

Timing of Next Rate Hike?

Look at June for the next potential interest rate hike. According to the CME Group Fedwatch tool, the market is pricing in a 17% chance of a rate hike at the March meeting, a 33% chance of a rate hike at the May meeting and a 48% chance of a rate hike at its June meeting.

The real market fireworks of 2017 could emerge if a political battle emerges between the Trump administration and the Federal Reserve. Rising interest rates could dampen economic growth – and that is exactly what President Trump is trying to spur. Interest rates remain near historical lows and there are new pressures building that could keep a lid on how high interest rates climb this year.

Blanchard and Company has been helping individual investors diversify their portfolios with tangible assets for over 40 years. Contact us at 1-800-880-4653.

Could Your Rare Coins Become Legal Tender Currency?

Posted on — Leave a commentHow would you feel if your rare and bullion coin collections became legal tender currency…again?

There is a new movement afoot to “Make Money Great Again.” A petition has been started on WhiteHouse.gov requesting an Executive Order from President Trump to order that gold and silver once again be freely used as money alongside paper currency in our society.

Here is part of the Executive Order that has been drafted:

“The Constitution explicitly recognizes that gold and silver coin

are money. Furthermore, in granting Congress the power “to coin

money and regulate the value thereof,” the Constitution does not

grant either Congress or the President the power to demonetize

gold and silver.”

Any History Buffs Out There?

There are some interesting historical questions here. This request brings to the forefront ideas about what is money and what did America’s founding fathers intend?

Here is a snippet from the United States Constitution Article 1, Section 10:

“No state shall…coin money; emit bills of credit; make anything

but gold and silver coin a tender in payment of debt.”

Article 1, Section 8 gives Congress the power:

“To coin money, regulate the value thereof, and of foreign coin,

and fix the standard of weights and measures.”

Remembering President Nixon

It was, of course, President Nixon who in 1971 ended the convertibility of gold to the dollar. Here’s what Nixon said.

Taking the current petition to make gold legal tender a step further brings up the issue of returning American to the gold standard.

The size of the national debt – at nearly $20 trillion right now – is one of the key stumbling blocks that could prevent that.

So, the U.S. has a lot of gold, but is it enough to back all our debt? Not even close. Speaking with CME OpenMarkets Magazine, CEO David Beahm did some quick back-of-the-envelope math. “One ton equals 2000 pounds. One pound equals 16 ounces. 2000 times sixteen equals 32,000 ounces. With spot gold about $1,760, one ton equals about $56 million,” he says. That equals about $456 billion at current market value, or roughly half a trillion in gold.”

The Rare Coin Outlook

The rare coin market has been strong in recent months as astute investors look to pick up bargains now before inflation drives prices sharply higher. There is a strong correlation between inflation and rising gold prices. But, studies have shown that rare coins tend to appreciate at an even faster pace during inflationary times.

It remains to be seen if the current petition to make gold and silver coins legal tender again gains any traction. Can you imagine what it would mean for the rare coin market if President Trump responded to this initiative favorably? The value of rare coins would skyrocket, as demand increased for gold and bullion coins.

The jury is still out on what might emerge from this petition, but it is fun to think about now, isn’t it?

Blanchard is always sourcing new rare coin collections. Call us today to see what new inventory has come onto the market at 1-800-880-4653.

Gold Slips as Stocks Hit Records

Posted on — Leave a commentGold finished last week with a bit of a whimper as the precious metal entered into it’s longest slump in nearly three months. The stark weekly decline in the yellow metal from its YTD high of $1,220.10 comes amid a distinct switch to a “risk-on” mode in equities.

The Dow Jones Industrial Average closed above the key level of $20,000 for the first time in history; the Nasdaq and S&P made new records as well. “With the Dow Jones touching a fresh high, there’s a new wave of interest in the market,” said Jingyi Pan, a market strategist at IG Group.

From a fundamental standpoint, the fact that equity markets continue to reach new highs is not overly surprising, especially given that only a few months ago investor cash was at its highest level in 16 years.

Copious amounts of investor cash, that’s perfectly ready to be used at a moment’s notice, directly translates into large institutional investors (who have the ability to move markets) chasing rallies and pushing markets to new highs. Simply put, nobody wants to miss out on a good stock market rally, and there’s no shortage of money to keep gobbling up stocks and trying to get in on the action.

However, sidelined cash is definitely not the only explanation of the market rally. Analysts also attribute the strong uptick in stocks to the imminent implementation of President Trump’s new business-friendly policies. Politics aside, markets evidently concur that creating tax incentives for companies to conduct business in America is likely to directly benefit the American economy.

In addition to cash levels and new political measures, solid 4th quarter earnings boosted stocks across the board; 69.2% of the companies that have reported earnings thus far have topped expectations, compared with a 63.3% average since 1994 according to data compiled by Reuters.

Essentially, earnings are growing, valuations seem reasonable, and investors are optimistic about the next four years. Unfortunately, this seems to make other investment instruments, like precious metals, take a back seat to stocks.

In spite of the current downtrend in gold and uptrend in stocks, analysts remain bullish on gold for 2017, because there are still legitimate worries over global growth and political stability.

The Economic Policy Uncertainty Index, which tracks things like media coverage of economic issues and tax code alterations, reached its highest level in over 80 years of analyzed data. With that said, researchers at Thomson Reuters GFMS are calling for gold to average around $1,259 an ounce in 2017.

In the weeks ahead, the Chinese Lunar New Year awaits, and US investors are keeping a close eye on the effect that a week-long market closure in Shanghai will have on US markets. If anything, it is a period of time that only occurs once per year where investment risk from China is greatly diminished. What this means is, because the Chinese markets will be closed for a full week, it is impossible for a sell-off in Chinese stocks to adversely affect US markets (which happed frequently in 2015), and this translates to a larger apatite for risk among US investors.

Therefore, there are fewer and fewer signs that point towards any equity risk reduction among investors, even at all-time market highs, in the near future.

What Drives Your Own Personal Success?

Posted on — Leave a commentAn article by Entrepreneur magazine listed 14 Things Ridiculously Successful People Do Every Day. The secrets to success according to the article?

They include:

- Focusing on minutes, not hours

- Focusing on only one thing

- Using a notebook – and writing everything down

- Following the 80/20 rule (80 percent of results comes from 20 percent of activities).

Let’s see how this applies to traders this week.

- Wall Street traders this week will be focusing on the minutes leading up to a number of big events.

- On Monday, they will be focusing on one thing: the PCE Price Index report.

- Many traders use a notebook to record big market events and they realize that a big portion of their profits (maybe 80 percent come from 20 percent of their trades).

Wall Street traders are bracing for a busy week. Here are three things big events that will drive gold prices this week.

- Monday – The December Personal Income and Spending data is released 8:30 am ET.

Why this matters to markets? The answer is one simple word – inflation.

Tucked inside Monday’s economic report is the Federal Reserve’s “preferred” inflation indicator known as the PCE Price index. The Fed has valiantly been attempting to stimulate inflation in recent years and there are signs that price pressures are starting to kick higher. The Fed’s target for inflation is 2.0 percent.

There are numerous signs that inflation is moving higher these include:

- Medical costs are not under control and continue to increase

- Housing costs are rising at the fastest pace in nearly 10 years

- Energy prices are on the rise

- After years of no raises – wages are finally increasing

Sharper than expected gains in inflation numbers this week would be gold-bullish.

- Wednesday – The Federal Open Market Committee (FOMC) will release its interest rate decision at 2 pm ET.

Why this matters? The Federal Reserve has broadcast its intentions to hike interest rates – perhaps several times this year. A trend toward higher interest rates is generally a negative for gold and other precious metals, which pay no interest.

Right now, Wall Street does not expect the Fed to hike rates at its January meeting. If they did – it would be a surprise and would rock markets. Traders will be reading the post-meeting announcement closely for clues on what may lie ahead for 2017.

- Friday – The Labor department releases its monthly non-farm payrolls and unemployment rate data for January at 8:30 am ET.

Why this matters? The jobs data is one of the biggest economic data market movers of the month and can trigger fireworks if the numbers come out higher or lower than expected. The December jobs report showed that job growth is slowing, but that wages are rising. In December, non-farm payrolls jumped by 156,000 and the overall unemployment rate stood at 4.7 percent.

Economists will be watching this closely for signs if the labor market is beginning to fizzle and how much wages are increasing.

Now is a good time to conduct your annual portfolio review if you haven’t already re-balanced your assets. Market fireworks beginning to heat up. The precious metals complex has started off the year strong and many Wall Street analysts believe it is just the beginning of a bigger rally move. Gold and other precious metals are already beating returns in stocks since the start of the year. Blanchard and Company has been helping individual investors for over 40 years to build a tangible asset allocation for portfolio diversification. Learn more about us here.

Owning an ETF Isn’t the Same as Owning Gold

Posted on — Leave a commentTechnology enables instant gratification among investors all around the world. In minutes you can own ETFs holding assets ranging from livestock to carbon emissions credits. This easy accessibility in the market enables fast transactions, and as a result investors seeking to bolster their portfolio with gold often resort to the ease of a precious-metal ETF. However, the problem is these investors don’t own gold; they own paper.

First, consider the cost of owning ETF shares. A review of 22 popular precious-metal ETFs reveals that the average expense ratio is 0.58. This cost is in perpetuity, and every year you will pay managers to oversee the fund. While this fee doesn’t sound like much, the compounding effect equals a total cost of $1,666 over a 20-year period, assuming 6% annual growth. The discrepancy between the initial costs of purchasing gold versus an ETF grows as the burden of the expense ratio increases over time. This cost means the ETF will always underperform the market price of precious metals. Furthermore, this expense also represents an opportunity cost. If this $1,666 total were put to use as an investment (again, at a 6% annual return over 20 years) it would grow to $5,343. The ones making the real money here are the fund managers. Investors face inflation, market downturns, and political upheaval; we don’t need the headwind of onerous expense ratios added to the list.

Second, holding shares in a precious-metal ETF gives you no claim to the physical asset. Many of these funds hold gold, silver, and platinum in large, industrial bars that exceed the value of the average holder’s shares, making liquidation impossible. Even those with more substantial holdings might be surprised by the fine print. Many of these ETFs include language in their prospectus stating that the fund has the option to settle in cash rather than physical gold. In other words, the prospectus governs the terms and conditions. This document was written to benefit the fund managers and the underlying institution, not the investor. Though many cite the simplicity of an ETF solution, there is nothing simple about teasing apart the esoteric language of such a report.

Finally, the spectrum of risk widens with the ETF option due to “counterparty risk.” This risk comes from the decision to engage financially with another party. When the other party defaults or fails in any way to meet their obligations, you have succumbed to counterparty risk. Such risks are not hypothetical. The most recent example of counterparty risk occurred during the financial crisis sparked by defaulted collateralized debt obligations. With the purchase of a physical asset, the relationship is between you and the precious metal. Conversely, the decisions of the fund managers, rather than pure market movements, influence the ultimate value of the ETF. For many investors owning gold is about gaining control of their assets. This goal becomes difficult when it is dependent on unseen managers who are often not liable for damaged or stolen property.

If you want to own gold, then you must own gold. ETFs merely serve as an indirect and costly alternative to having the asset in hand.

Inflation Climbs at Fastest Pace in 5 Years

Posted on — Leave a commentData released last week showed that inflation, or the rate of price increases for goods and services in the US, climbed at its fastest pace in 5 years.

Rising gas prices, higher rent and medical care costs boosted the official Consumer Price Index for December, the government reported.

Most motorists have probably already noticed an increase in gasoline prices at the pump, and that trend is expected to continue. Motorists may get sticker shock in 2017, Gasbuddy.com warns. They predict that motorists will spend $52 billion more at the pump in 2017, as the yearly average for a gallon of gasoline rises 36 cents to $2.49 a gallon.

“Unfortunately, as OPEC tightened their grip on oil prices, Americans will be spending over $50 billion more on gasoline versus last, and unlike the Cubs winning the World Series, it may be years before some of the low prices we saw in 2016 come back.” – Patrick DeHaan, senior petroleum analyst at Gasbuddy.com.

Energy prices have a spill-over impact resulting in higher prices for all goods and services throughout the economy. (Example: Rising transportation costs for the gallon of milk to be delivered to the local grocery story will be passed along to consumers.)

There are other factors that will put upward pressure on consumer goods and services in 2017, including the following:

- A tight labor market is already putting upward pressure on wages.

- Many economists warn that the fiscal stimulus and spending proposals by President Trump will push inflation even higher.

- The high levels of liquidity in the economy after years of government money-printing leave the economy ripe for runaway inflation.

The federal government has been trying to spark inflation for the past several years by keeping official interest rates near zero. However, once inflation begins to surge throughout the economy it can become very difficult to control.

Inflation is a wealth-killer, and erodes individual purchasing power.

One way investors can prepare for its inevitable arrival is to invest in precious metals. It is well known that gold is a time-honored inflation hedge, and tends to rise as inflation creeps through the economy. What is less well known is that rare coins are an even better hedge as they tend to rise in price even faster than gold during inflationary periods.

According to the World Gold Council, “Inflation rates in major developed and developing economies are expected to rise, in part as a consequence of the financial crisis and subsequent mitigating actions such as quantitative easing. Historically, gold has been a hedge against inflation. It has retained its value through geopolitical shifts and market turbulence, outperforming most major currencies and many real assets.”

Diversifying your portfolio with even small amounts of gold can help hedge against inflation and protect your individual purchasing power in the future. Gold is a physical asset that individual investors can own outright. It is a highly liquid investment that is recognized and traded around the world. Unlike paper assets, holding physical gold has no credit- or counter-party risk. Protect your portfolio with gold now.

Contact Blanchard at 1-800-880-4653. We are a family-owned company that has helped clients protect and grow their wealth for over 40 years through investments in American numismatic rarities, and gold, silver, platinum, and palladium bullion.