Global Gold Demand Rose 3% in 3Q, As Money Supply Hits New Record

Posted on — Leave a commentGold demand just hit a new record high for the third quarter at 1,313 metric tons, the highest quarterly number on record, the World Gold Council said. Demand for gold is rising just as the U.S. paper money supply reaches a new record high.

Total investment demand for gold climbed 47%, demand for gold bars and coins surged 17% totaling 315.5 tons, and central bank buying jumped 10% to 219.9 tons in the third quarter.

So, who’s buying up all this gold?

It turns out it’s a mix of investors—from central banks beefing up their reserves to institutional investors looking to protect their portfolios, and everyday Americans buying gold as a haven against rising inflation, currency devaluation, and concerns over rising government debt levels.

Gold is the safest money

Ray Dalio, billionaire investor and founder of Bridgewater Associates, shared an essay on Oct. 30 called “Gold is the Safest Money.” Dalio believes that gold is the “most fundamental money over time, with the best track record of having its value track the cost of living over very long periods of time.”

Dalio points to the way currencies are structured as the key reason that gold has stood the test of time and remains the safest form of money.

Throughout history, currencies have either been “hard-backed” currencies or “fiat” currencies. Hard-backed currencies have been historically connected to physical gold or to something similarly limited in supply and globally valued, like silver.

People with hard-backed currencies could exchange their paper money for physical gold or silver at a fixed exchange rate. That compares to fiat currencies, which aren’t backed by anything and aren’t limited in supply.

The U.S. dollar is a fiat currency.

Today, the U.S. government debt continues to barrel higher, recently climbing above $38 trillion—a record high in October 2025, and at the same time our fiat money supply is expanding.

What’s the connection between fiat currencies and government debt?

Dalio studied past fiat currency systems when there was too much debt relative to the amount of money that was needed to pay it. Just like what we are seeing in America today.

To combat the rising debt levels, central bankers created a lot of money and credit, which typically led to higher inflation and higher gold prices. This is what we are seeing today as well.

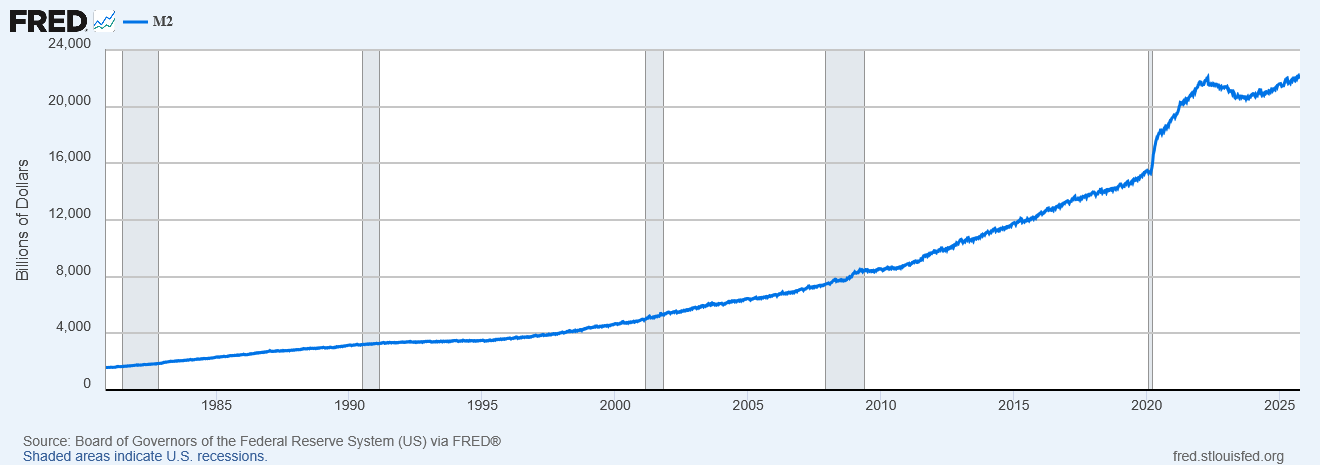

U.S. money supply hits record high: easy money is back

Money supply accelerated in 2025 and recently hit a record high above $22.2 trillion, as shown in the chart by the St. Louis Federal Reserve. Money supply refers to the total amount in circulation, including coins, cash, and bank-account balances.

Gold holds Its purchasing power

As central banks create more fiat currency, it loses value.

Dalio found that throughout history when governments with fiat currencies took on unsustainable debt levels, gold performed well. In fact, he found that over long periods of time, gold was the money with the best track record of holding its purchasing power. This is why it is now the second-largest reserve currency held by central banks today.

Gold trend still points higher

As central banks buy more physical gold to add to their reserves and the U.S. government prints more money and expands our fiat money supply, where does true value lie? Dalio says gold. This is just one of the many reasons investors are turning to gold to preserve and protect their wealth and purchasing power today.

Investors are buying heavily this year as the strong uptrend for gold continues. Spot gold is up over 50% this year, after hitting a record high at $4,373.20 on Oct. 16. You may be asking, can this rally in gold continue? Most say yes.

“The outlook for gold remains optimistic, as continued U.S. dollar weakness, lower interest rate expectations, and the threat of stagflation could further propel investment demand,” said Louise Street, senior markets analyst at the World Gold Council. “Our research indicates the market is not yet saturated.”

As government debt levels rise, fiat currency expands, and inflation increases—the value of your U.S. dollar is falling. Gold is a currency with a 5,000-year track record. The time is ripe to trade some of your paper dollars that are decreasing in value for gold. Throughout history gold has proven to be the safest money of all. Do you own enough?