Gold Leaps Over Euro to Become Second Largest Central Bank Reserve Asset

Posted on — Leave a commentIt’s no secret that global central banks have been stockpiling gold. But we just didn’t know how significant the central bank gold buying has been. Demand for gold bullion is so strong that the precious metal has surpassed the euro to become the second-largest asset held by central banks around the world.

For the last three years, global central banks have bought more than 1,000 tons of gold each year. Because of all that gold buying, today, gold is the world’s second-largest global central bank reserve asset, behind the U.S. dollar.

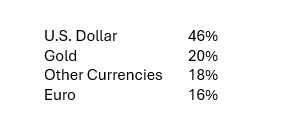

Gold pushed past the euro in 2024, taking second place, according to new data from the European Central Bank. Here’s the breakdown.

Global Central Bank Reserves

Source: European Central Bank, International Monetary Fund, Bloomberg

At the end of 2024, global central bank holdings of gold had climbed to around 36,000 tons, near the all-time high of 38,000 tons set in 1965.

Why are central banks buying gold? It’s simple. It turns out that central banks are buying gold for many of the same reasons that individual investors are piling into the precious metal.

Central banks are buying gold for diversification purposes and also to hedge against geopolitical risk, the European Central Bank report said. Reserve managers also value gold as a portfolio diversifier to hedge against inflation, cyclical downturns, and defaults.

Why does this matter to you? Central banks are long-term investors. They see value in gold at current levels and continue to buy and stockpile the precious metals in their global central bank vaults. If they are increasing their exposure to gold, maybe you should consider it too.

It’s been an epic rally in gold, and precious metals are still climbing.

The price of gold has climbed nearly 62% since the beginning of 2024. Silver is soaring too. Silver just jumped past $36.00 an ounce, and analysts are now pointing to $40 as the next big target. Platinum is also rocketing higher, climbing 35% since the start of the year. In fact, platinum, gold, and silver are the top three best-performing assets of 2025. Precious metals are in a strong uptrend, with huge momentum and are still climbing. A number of Wall Street forecasts point to gold at $4,000 an ounce and beyond.

For centuries, people have turned to precious metals as a store of value and as an asset to protect and grow their wealth. If you’ve been thinking about increasing your allocation to precious metals, don’t wait; the markets are moving, and gold at $4,000 will be here before you know it.