Will the Stock Market Crash This Year?

Posted on — Leave a commentAs Benjamin Franklin famously quipped, the only things certain in life are death and taxes. We could add one more to Franklin’s list: the stock market will crash again. Will it be 2026? Nobody knows. But just as the sun rises in the east and sets in the west, sooner or later the stock market will crash again.

But just as the sun rises in the east and sets in the west, sooner or later the stock market will crash again.

In the past 200 years, the U.S. stock market has seen 11 major crashes (drops of 40% or more). Since 1929, there have been 27 bear markets (drops in the stock market of 20% or more). The worst stock market crash occurred in 1929—which saw the Dow Jones Industrial Average drop 89% from peak to trough. What’s more—it took 25 years for the Dow to return to its pre-crash high—hitting that level in 1954.

More recently, during the dot.com crash from 2000-2002, the technology-heavy Nasdaq index lost 78% of its value. It took 15 years for the Nasdaq to get back to breakeven and climb above its 2000 high.

Could you wait 54 years or even 15 years for your stock positions to get back to break even? That’s a long time.

As an investor, there’s little you can do to prevent a stock market crash. Market timers have also proven over the decades, it’s also nearly impossible to predict when a crash will happen.

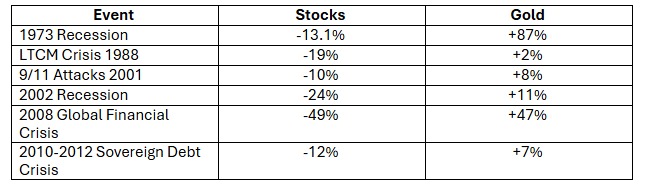

What you can do as investor is accept the idea that the odds are that another crash will happen—and you can prepare now for it with an increased allocation to precious metals. Gold has a proven history of climbing when stocks fall. Here’s a look at a few events in recent decades.

When crisis’s hit, investors exit out of risky assets like stocks and head to the safety and precious metals like gold and silver. When’s the best time to prepare for a storm that is coming? Not when the thunder and lightning is flashing in the sky—but before the storm comes. That means today is the best time to prepare for a coming downtown in stocks.

When crisis’s hit, investors exit out of risky assets like stocks and head to the safety and precious metals like gold and silver. When’s the best time to prepare for a storm that is coming? Not when the thunder and lightning is flashing in the sky—but before the storm comes. That means today is the best time to prepare for a coming downtown in stocks.

You can fortify your portfolio today with an increased allocation to precious metals to help protect and grow your wealth even when the next financial storm takes stocks sharply lower. Recommendations on how much to allocate to precious metals range from 5% to as high as 20-30% of your portfolio depending on your age, your risk tolerance level and when you will need to use the money. The sooner you may need to use the money, the higher your allocation to metals could be – as gold preserves your wealth when a stock market crash dissolves your wealth.

All the headlines warning that the stock market is in an AI bubble may or may not be true. There’s little you can do about which way the stock market will go this year. But, you can take action today to protect, preserve and grow your wealth no matter what lies ahead. Reach out to Blanchard at 1-888-528-3464 to talk with a portfolio manager about current market conditions, your investment options and if an increased allocation to precious metals is right for you. We’re here to help.