Inflation: Not Just an American Problem

Posted onConsumer inflation rose 7.1%, down from a summer peak of around 9% this year, according to the November consumer price index report. Yet, once you dig into the data, the cost of many things you buy are still rising – like groceries, dining out, recreation services and haircuts and other personal care services.

In 2022, inflation is not just an American problem – it’s a global problem. Heading into 2023, it’s unlikely this stubborn rising price problem will go away anytime soon.

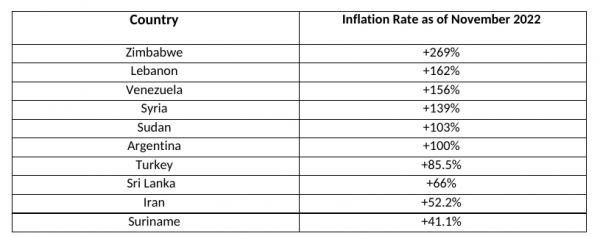

There is double-digit price inflation in almost half the world right now, with some countries even experiencing triple-digit inflation. Here’s a look at the top 10 eye-popping inflation rates around the world right now.

Source: TradingEconomics

This type of inflation is debilitating. While we hope the United States will never experience hyperinflation like the type that is hitting Venezuela, hope is not a plan. Here is a suggestion from a recent article: “How to prepare yourself for hyperinflation: tips from the Venezuelan experience.”

“Purchase a more stable currency: If the money in your bank account starts to lose purchasing power, buying another currency in which you can accumulate good savings is a must. I also recommend buying commodities like gold, but be careful where and how you store it. Purchasing real estate is not recommended since properties can lose their value quickly when distrust in the local economy collapses and people start fleeing.”

While gold is a precious metal, it is also a currency. In fact, it is a universal currency that is accepted in every country in the world today. There’s never been a better time to consider shifting some of your dollars into a more reliable currency like gold.

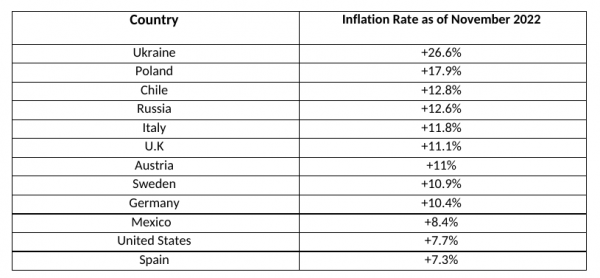

High inflation is not limited to emerging markets and developing nations – many developed nations are shouldering high levels of inflation in 2022. Take a look at the list below.

Source: TradingEconomics

Inflation Isn’t Going Away Soon

While the Federal Reserve embarked on a campaign to slow the economy and bring down inflation with sharply higher interest rates in 2022, once inflation is ingrained in an economy, or in this case the global economy, it doesn’t just disappear quickly.

Here’s what Time magazine said last month: “Economists and financial experts agree on one thing: Higher prices will likely last well into next year, if not longer. And that means Americans will continue to feel the pain of higher prices for the foreseeable future.”

How You Can Deal With Ongoing Inflation

As a consumer, it’s hard to avoid higher prices at the grocery store and restaurants – after all, we all need to eat. Many Americans are making choices however and choosing to cook at home more, eat out less and even cut back on expensive cuts of meats or eggs – which have suddenly rocketed higher in price.

Most Americans today aren’t used to shortages or sharply higher prices. We haven’t lived through an inflation crisis in 40 years. During this time, it’s important to maintain a cash reserves account – some experts recommend anywhere from 6 months to 2 years of living expenses, depending on your age and the reliability of your income. That sounds like a lot, but with a recession potentially around the corner in 2023, maintaining a healthy emergency fund could be your saving grace.

Use Gold as Your Emergency Fund

Holding your dollars in a bank account means they simply become worth less every day they sit there. Investors can consider holding their emergency fund in gold. If you need to tap your emergency fund for any reason, you can liquidate or sell your gold for dollars instantly – the same day.

Second, keep investing. In inflationary times, more than ever, it is important to keep investing – in order to prevent your purchasing power from eroding. Physical gold is up 9% since early November, with predictions it could climb as high as $3,000 in 2023.

Gold is one of the most liquid markets in the world, a reliable place to store, protect and grow your wealth. Inflation is here to stay for the foreseeable future and if you haven’t already, consider making an increased investment in gold today to protect and grow your financial future.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.