Krugerrand: Why This Coin Still Matters in 2025

Posted on — Leave a commentThe South African Krugerrand didn’t just enter the gold market in 1967: it created the modern bullion coin industry. By 1980, this coin commanded 90% of the global gold coin market. Today, the Krugerrand maintains its dominance through unmatched global liquidity and recognition. This article examines the technical specifications, investment advantages, and historical significance that keep the Krugerrand competitive in an increasingly crowded bullion market.

What Is a Krugerrand?

Before exploring its investment potential, here are the basics of what makes a Krugerrand. For additional insights into the fascinating history of the Krugerrand coin, watch this expert discussion from South African numismatic specialists.

Historical Origins

South Africa created the Krugerrand in 1967 to solve its very specific problem of marketing the country’s abundant gold reserves to private investors. At the time, South Africa produced 70% of the world’s gold, but private gold ownership was heavily restricted in most countries, and investors had limited options beyond bars and ingots. The solution was ingenious: create a coin with legal tender status that governments couldn’t easily ban, unlike gold bars which were often prohibited for private ownership.

The South African government, working with Rand Refinery and the South African Mint, designed the Krugerrand as the world’s first modern bullion coin. It was legal tender that could be easily bought, sold, and transported without the regulatory hurdles facing other gold investments. This timing proved perfect, as countries were abandoning the gold standard, where currencies were backed by gold reserves. This left individual investors seeking new ways to own gold directly rather than through government-backed paper money.

Design Significance

The Krugerrand’s visual design was carefully planned to represent South African identity while ensuring global recognition. The coin’s name itself combines “Kruger” (honoring Paul Kruger, the former president of the South African Republic from 1883 to 1900) with “rand” (South Africa’s currency unit). Kruger’s portrait on the obverse aims to represent South African heritage and political independence, while the reverse features a pronking springbok, South Africa’s national animal.

Image: A black and white historical portrait of Paul Kruger

Source: Kapstadt.de

The coin’s designer, Coert Steynberg, wasn’t starting from scratch with the springbok – he had already used this imagery on earlier South African coins, including the five shillings and 50 cents pieces. By adapting this familiar national symbol for the bilingual (English and Afrikaans) Krugerrand coin, it gained instant recognition both domestically and internationally.

Manufacturing Process

The Krugerrand’s manufacturing required several innovative decisions that would influence bullion coin production worldwide. Most importantly, the decision to use 22-karat gold (91.67% pure gold with 8.33% copper) was revolutionary for its time. While pure gold was traditional for bullion, the Krugerrand’s copper alloy made it significantly more durable than pure gold coins, which scratch and dent easily during handling and transport. The copper content also gave the Krugerrand its distinctive orange-reddish hue, making it instantly recognizable. To maintain exactly one troy ounce of pure gold content despite the alloy metals, manufacturers made the total weight slightly higher at 33.93 grams. This approach prioritized practicality without sacrificing the gold content that determines Krugerrand coin value for investors.

Global Impact

The Krugerrand’s success fundamentally changed the precious metals industry. By 1980, it accounted for 90% of global gold coin sales, proving there was massive demand for accessible gold investment vehicles. This success inspired other nations to create their own bullion coins: Canada’s Gold Maple Leaf (1979), China’s Gold Panda (1982), America’s Gold Eagle (1986), and Britain’s Britannia (1987). Each borrowed elements from the Krugerrand model: legal tender status, fractional sizes, and investor-friendly marketing. The Krugerrand’s pioneering role helped establish the modern bullion coin market, which has continued evolving alongside broader changes in global gold markets over recent decades. Even today, with dozens of competing bullion coins available, the Krugerrand’s first-mover advantage and widespread recognition keep it among the most liquid gold investments worldwide.

South African Krugerrand Specifications and Technical Details

The Krugerrand’s precise specifications have remained consistent since 1967, ensuring reliability for investors and dealers worldwide.

Physical Characteristics

The standard one-ounce Krugerrand measures 32.77mm in diameter and 2.84mm thick, with a total weight of 33.93 grams. The coin’s copper content makes it heavier and more durable than pure gold coins, while also creating the distinctive orange-gold color that sets Krugerrands apart from other bullion coins. The edge features 160 fine ridges – called reeded serrations – that help prevent counterfeiting and provide texture for handling. Proof versions have 220 serrations for enhanced detail. The matte finish of the Krugerrand coin helps conceal minor handling marks that would be more visible on highly polished coins.

Gold Content Breakdown

Each Krugerrand contains exactly one troy ounce (31.1 grams) of pure gold within a 22-karat gold alloy composition of 91.67% gold and 8.33% copper. To accommodate the copper while maintaining the full ounce of pure gold, the total coin weight increases to 33.93 grams.

Manufacturing Standards

The Krugerrand’s reputation for reliability stems from the South African Mint’s rigorous manufacturing standards, established over decades of precious metals production. The process begins with the Rand Refinery, one of the world’s largest gold refineries, which supplies gold that undergoes extensive purity testing before reaching the mint. During production, the South African Mint implements multiple quality control checkpoints, including precise weight verification and gold content analysis for every batch. This systematic approach ensures each South African Krugerrand meets exact specifications, which is crucial for maintaining investor confidence and global acceptance.

Size Variations

Beyond the standard one-ounce coin, the gold Krugerrand is available in fractional sizes. The half-ounce weighs 16.97 grams (15.55 grams pure gold), the quarter-ounce weighs 8.48 grams (7.78 grams pure gold), and the tenth-ounce weighs 3.39 grams (3.11 grams pure gold). All fractional sizes maintain the same 22-karat composition and proportional design scaling.

Image: A gold Krugerrand coin reverse showing a leaping springbok

Source: NGC

Understanding Krugerrand Variations

Not all Krugerrands are created equal. Understanding the different types helps investors determine Krugerrand gold coin value today and make informed choices.

Standard vs. Proof Versions

Production Differences

Standard bullion Krugerrands are struck once using regular dies in a mass production process focused on efficiency and metal content accuracy. Proof Krugerrands undergo a completely different manufacturing approach: they’re struck multiple times with specially polished dies that create mirror-like surfaces. The proof production process involves polishing both the coin blanks and the dies to achieve a frosted design against a mirror-smooth background, requiring significantly more time and labor per coin. Since 1995, proof Krugerrands have come with original presentation boxes and certificates of authenticity, adding to their premium positioning.

Visual Distinctions

The most obvious difference between standard and proof versions lies in surface finish. Bullion coins have a standard matte appearance designed for handling and stacking, while proof coins feature highly reflective, mirror-like surfaces with frosted design elements that create a dramatic visual contrast.

Another way to distinguish them is by counting edge serrations: bullion Krugerrands have exactly 160 reeded edges, while proof versions have 220 serrations.

Image: A 1967 proof Krugerrand in a PCGS graded holder with distinctive mirror-like finish and 220 edge serrations.

Source: PCGS

Mintage Numbers

Proof Krugerrands are produced in strictly limited annual quantities, typically ranging from a few thousand to tens of thousands depending on the year and denomination. These small production runs create natural scarcity that appeals to collectors.

In contrast, bullion Krugerrand production fluctuates dramatically based on global gold investment demand, with annual mintages ranging from as low as 24,000 in quiet years to over six million during peak demand periods like the late 1970s. This production flexibility means bullion coins from high-mintage years trade closer to gold spot price, while low-mintage years can command slight premiums even among bullion versions.

Fractional Krugerrands

Introduction Timeline

Fractional Krugerrands were introduced in 1980 in three sizes: half-ounce, quarter-ounce, and tenth-ounce denominations. This expansion aimed to make gold ownership accessible to investors who found the full ounce financially challenging. The smallest tenth-ounce size proved especially popular for gift-giving and as an affordable entry point into gold investing. Due to their accessibility, fractional sizes often achieved substantial mintages, with the tenth-ounce frequently recording some of the highest production numbers in given years. All three fractional sizes helped democratize gold ownership during a period when precious metals investing was gaining mainstream appeal.

Technical Specifications

As mentioned previously, fractional Krugerrands maintain precise proportional weights (the half-ounce at 16.97 grams total, quarter-ounce at 8.48 grams, and tenth-ounce at 3.39 grams), while preserving the exact 22-karat gold-to-copper ratio of the original. This consistency ensures that all sizes share the same durability and distinctive orange hue that makes Krugerrands instantly recognizable. Unlike some coin series where fractional versions compromise on composition, Krugerrands maintain identical characteristics regardless of size, ensuring consistent Krugerrand value today across all denominations.

Design Adaptations

All fractional sizes feature identical designs to the one-ounce coin, with careful scaling to preserve detail clarity even on the smallest 1/10-ounce version. The South African Mint’s precision scaling techniques ensure that Paul Kruger’s portrait and the springbok design remain sharp and recognizable across all denominations.

Krugerrand Investment Potential in 2025

The Krugerrand’s investment appeal in 2025 mainly comes down to proven liquidity advantages versus the practical costs of physical ownership.

Advantages

Global Liquidity and Recognition

The Krugerrand’s 58-year track record has created unmatched worldwide recognition among precious metals dealers. Unlike newer bullion coins that may require verification or face regional acceptance issues, Krugerrands can be bought and sold easily in virtually any gold market globally. This liquidity advantage becomes particularly valuable during economic uncertainty when quick asset conversion may be necessary.

Privacy and Regulatory Benefits

A key advantage of owning physical Krugerrands is the privacy they provide compared to other gold investment options. Physical Krugerrand purchases below certain thresholds typically don’t trigger government reporting requirements in most jurisdictions, unlike gold ETFs or mining stocks that automatically generate tax documents and paper trails. This allows investors to build gold positions privately without the regulatory paperwork that accompanies many financial instruments.

Proven Inflation Protection

Historical data shows Krugerrands have successfully preserved purchasing power during inflationary periods. From 1970 to 1980, when U.S. inflation averaged over 7% annually, gold prices rose from $35 to over $800 per ounce – a gain that far outpaced inflation and protected investors’ real wealth. Krugerrands, containing one full ounce of gold, delivered these same protective returns to holders. As a physical investment, the gold Krugerrand provides direct exposure to gold’s inflation-hedging properties without the management fees or tracking errors that can affect gold-based financial products.

For more details on why gold serves as an ideal portfolio complement and its performance compared to traditional investments, explore Blanchard’s gold investment insights.

Considerations

Storage and Security Requirements

Physical ownership requires secure storage solutions, whether through safe deposit boxes, home safes, or professional vault services. Insurance and security add ongoing costs that don’t exist with other gold investments like ETFs, making storage planning crucial for larger collections.

Market Timing and Premium Cycles

Premium levels fluctuate based on global demand, political uncertainty, and supply constraints. Buying during high-premium periods can reduce returns, making market awareness crucial for optimal entry and exit timing.

How to Buy and Sell Krugerrands

Krugerrands are available through various channels, with established precious metals dealers offering the most reliable combination of authenticity guarantees and competitive pricing. These dealers provide proper documentation and buyback policies, while online auction sites and unverified sellers present higher counterfeit risks.

Authentication Essentials

Authentic Krugerrands have specific specifications: 33.93 grams weight, 32.77mm diameter, and the correct edge serrations (160 for bullion, 220 for proof). The distinctive orange-gold color from copper alloy should appear consistent throughout. Professional dealers can verify authenticity using precision scales and testing equipment.

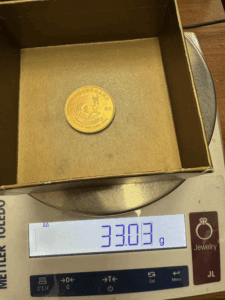

Image Description: A 1983 Krugerrand on digital scale showing 33.03 grams, demonstrating underweight coin that may indicate wear or authenticity concerns.

Source: Reddit

Selling Strategy

Krugerrands maintain strong global liquidity, making them relatively straightforward to sell when needed. Local coin shops, precious metals dealers, and established online platforms all provide viable selling options. Market timing during periods of high Krugerrand price appreciation or increased uncertainty can help maximize returns.

Professional Advantage

Blanchard’s decades of experience in precious metals ensures authenticity verification, competitive pricing, and reliable access to both buying and selling markets. With established relationships throughout the industry and comprehensive market knowledge, Blanchard offers investors the confidence that comes from working with a trusted precious metals specialist.

Conclusion

The Krugerrand’s enduring success stems from practical advantages that remain relevant in 2025: unmatched global liquidity, proven durability through its 22-karat gold composition, and a 58-year track record of market acceptance. Its distinctive design featuring Paul Kruger and the springbok, combined with specific technical specifications like weight and edge serrations, makes authentication straightforward for investors.

For modern portfolios, Krugerrands offer direct gold exposure without the complexities of ETFs or mining stocks, while maintaining the privacy and inflation protection that physical precious metals provide. Whether in standard one-ounce or fractional sizes, Krugerrands continue to represent one of the most liquid and widely recognized gold investments available.

Explore Blanchard’s selection of authentic Krugerrands and other world gold coins and discover how these iconic coins can strengthen your precious metals portfolio.

FAQs

1. How much is a Krugerrand worth today?

Krugerrand value fluctuates daily based on gold spot prices plus a small premium for the coin itself. You can track current gold spot prices to understand the base value of your Krugerrand’s gold content. For the most accurate pricing, contact Blanchard directly.

2. How much does a Krugerrand weigh?

A standard one-ounce Krugerrand weighs exactly 33.93 grams total, containing 31.1 grams of pure gold. The additional weight comes from copper alloy that makes the coin more durable. Fractional sizes maintain proportional weights: half-ounce at 16.97 grams, quarter-ounce at 8.48 grams, and tenth-ounce at 3.39 grams. Verifying these precise weights helps confirm authenticity.

3. What factors affect Krugerrand value?

Krugerrand values are primarily driven by gold spot prices, which fluctuate based on economic conditions, inflation expectations, and global demand. Additional factors include the coin’s condition, size, whether it’s bullion or proof, and current market premiums. Rarer years or special editions may command higher premiums, while standard bullion versions typically trade closest to gold content value.