10 Unique Rare Error Coins

Posted on — Leave a commentOffering a unique opportunity to diversify and enrich their numismatic collections, error coins are particularly appealing for collectors. Indeed, boasting intriguing backstories, they add depth and significance to any coin collection. This piece will explore rare coin errors and the history behind them, focusing on:

- Iconic US coin anomalies.

- Famous international error coins.

- Where to source unique error coins.

Watch this informative video to learn more about different types of coin errors:

Rare US error coins

Error coins, esteemed anomalies within the realm of numismatics, offer a glimpse into the intricacies and variations of the minting process. Each of the following rare US error coins showcases unique and intriguing types of errors, ranging from missing mint marks to striking anomalies.

1. The 1943 Copper Penny, with its incorrect planchet composition, stands out among rare US error coins.

One of the most sought-after rare coin errors in US numismatic history, the 1943 Copper Penny, is highly coveted by collectors for its scarcity and historical significance. Amid the pressures of World War II in 1943, the United States minted pennies using steel due to the shortage of copper, which was reserved for wartime needs.

However, a few copper planchets from the previous year’s production remained in the coining press hopper and were struck with the 1943 dies. This resulted in a small number of pennies being minted in copper, creating a rarity among the vast majority of steel pennies produced that year.

While the error was discovered shortly after production began, a handful of copper pennies managed to slip into circulation. Only a few dozen are known to exist, making this coin a prized possession among numismatists:

1943 Copper Penny

- Metal: Copper

- Year: 1943

Photo by PCGS

2. A prime example of rare error coins, the 1955 Doubled Die Lincoln Cent showcases prominent doubling.

A remarkable rare coin to look for is the 1955 Doubled Die Lincoln Cent, renowned for the prominent doubling effect on its obverse. During the minting process, four of the coin’s main design elements, i.e. President Lincoln’s profile, the inscriptions “LIBERTY,” “IN GOD WE TRUST,” and the date, were struck onto it twice instead of once.

This error happened due to a misalignment or misregistration of the coin die during the hubbing. As a consequence, the design elements were impressed onto the coin’s surface slightly offset from their intended position, causing a prominent doubling effect that is easily visible to the naked eye, distinguishing it from regular strikes.

Despite efforts to correct the error, a significant number of these doubled die cents entered circulation, making them highly desirable among collectors for their unique appearance.

1955 1 Cent Doubled Die Obverse

- Metal: Copper

- Year: 1955

Photo by PCGS

3. The 1982 No Mint Mark Roosevelt Dime ranks among rare US coin errors thanks to its notable absence of a mint mark.

Another one of the most intriguing rare US error coins is the 1982 No Mint Mark Roosevelt Dime. Typically, US coins bear a mint mark indicating where they were produced, such as “P” for Philadelphia or “D” for Denver. Mint marks are punched onto the coin die before striking, but in the case of this 1982 Roosevelt Dime, the mint mark was either omitted or the die used lacked the mint mark altogether.

Although the absence of a mint mark on the 1982 dime was unintentional and likely occurred due to a technical error during the minting process, the error’s exact cause remains uncertain. Some numismatists speculate that the absence of a mint mark on some 1982 Roosevelt Dimes could be attributed to the fact that 1982 was a transitional period for US coinage, where the US Mint transitioned from striking coins with a composition of 90% silver to a copper-nickel clad composition.

1982 10 Cents No Mintmark

- Metal: 75% Copper, 25% Nickel

- Year: 1982

Photos by PCGS

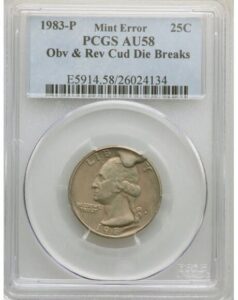

4. A prized find among rare US error coins, the 1983-P Washington Quarter is notable for its cud die breaks.

An extraordinary error coin, the 1983-P Washington Quarter with obverse and reverse cud die breaks, is a fantastic addition to any numismatic collection. This coin exhibits distinctive die breaks, or “cuds”, on both its obverse and reverse faces, setting it apart as a remarkable specimen.

The prominent cuds, characterized by raised areas or blob-like features near the edges of the coin, are a testament to the anomalies encountered during the minting process. These remarkable die breaks are believed to have resulted from damage or deterioration to the coin dies.

Beyond its high rare error coins value, this 1983-P Washington Quarter serves as a tangible reminder of the intricacies involved in minting coins, perpetually capturing the imagination of coin enthusiasts.

1983-P Washington Quarter with Obverse and Reverse Cud Die Breaks

- Metal: 75% Copper, 25% Nickel

- Year: 1983

5. A standout among rare mint error coins, the 2000-P Sacagawea Cheerios Dollar showcases a distinct tail feather design error.

The 2000-P Sacagawea Cheerios Dollar is a highly sought-after and valuable error coin that originated from a unique promotional campaign by General Mills. During the launch of the Sacagawea dollar coin, the American multinational food company General Mills distributed a small number of these coins encased in plastic capsules as part of a marketing promotion with boxes of Cheerios cereal.

These coins, often referred to as “Cheerios Dollars,” were minted using a unique method distinct from regular Sacagawea dollars. This resulted in a tail feather design error, noticeably different from the smoother, less defined tail feather pattern found on standard Sacagawea dollars.

Due to their limited distribution and distinct design, these error coins are considered rare and highly collectible among numismatists, representing a unique find for those seeking rare no date Sacagawea coins with errors and more.

2000-P Sacagawea Cheerios Dollar

- Metal: Copper

- Year: 2000

Browse through Blanchard’s extensive selection of rare US error coins here.

Rare mint error coins from all over the world

Shifting our focus to error coins beyond the borders of the United States, these international rarities offer a fascinating glimpse into the intricacies of coin production and the diversity of errors found in global currency.

1. One of the UK’s most coveted rare error coins, the 1983 ‘New Pence’ 2p coin is renowned for its misprinted inscription.

The 1983 ‘New Pence’ 2p coin is one of the most remarkable rare mint error coins in British numismatics. Amidst a transitional period in British coinage during 1982, the Royal Mint was in the process of updating the inscription on the 2p coin from “New Pence” to “Two Pence.” However, a peculiar occurrence arose when a fraction of the 1983-dated 2p coins were inadvertently struck with the outdated “New Pence” inscription instead.

The presence of the incorrect inscription renders the 1983 ‘New Pence’ 2p coin a rare and sought-after piece among collectors, highlighting the evolving nature of British currency during that time.

1983 New Pence 2p

- Metal: Bronze

- Year: 1983

Photo by The Britannia Coin Company

2. With its unusually large date, Canada’s 1969 10 Cents is a standout among rare mint error coins.

The 1969 Canadian 10 Cents coin stands out among Canadian numismatic treasures due to a unique error. Unlike standard issues, some coins from this year feature noticeably larger date digits.

This error likely occurred due to a misalignment or the use of a different die during the minting process. Notably, fewer than 20 examples of this coin exist, making it an exceptionally valuable find for collectors of Canadian rare error coins.

Elizabeth II 10 Cents 1969 Large Date

- Metal: Nickel

- Year: 1969

3. Featuring a distinctive curved clip, the 1981 Curved Clip 10 Cent is a special find among rare error coins.

A significant example of a rare Australian 10 Cent coin error is the 1981 Curved Clip 10 Cent, which features a pronounced curve along the edge, distinguishing it from standard issue of the coin. This anomaly happened when a portion of the coin’s metal strip was inadvertently clipped during minting, resulting in a distinctive curved shape along one edge of the coin. This clipping error is typically caused by the minting equipment improperly feeding the coin strip into the press.

Despite its small size, a curved clip significantly affects the appearance and value of the coin, and collectors eagerly seek out such error coins for their uniqueness, making the 1981 Curved Clip 10 Cent coin highly sought-after.

1981 Ten Cent Curved Clipped Planchet Error

- Metal: Copper Nickel

- Year: 1981

Photo by The Purple Penny

4. One of Australia’s most coveted rare mint error coins, the 2010 Upset Error 50 Cent demonstrates significant striking misalignment.

When it comes to rare australian 50 cent coin errors, the Australian 2010 Upset Error 50 Cent coin exhibits a fascinating anomaly in its design. During its minting process, a 30 degree misalignment of the obverse and reverse dies caused the coin’s design elements to be off-center or tilted. As a result, they appear tilted or askew in relation to the coin’s edge. Collectors are particularly drawn to this unique error for its unconventional and visually striking features.

2010 50 Cent Upset Error

- Metal: Cupro-Nickel

- Year: 2010

Photo by The Purple Penny

Learn more about Australian rare coins here.

5. A unique example of rare coin errors, the 1907 10 Centavos from Mexico features a lamination anomaly.

As one of the most important rare error coins in circulation that the Mexican government is in the process of withdrawing, this 1907 10 Centavos coin is considered a special stand in numismatic circles due to an unusual error. Struck on a laminated planchet, this error is visibly apparent on the coin’s obverse. The lamination process, involving layers of metal bonded together, resulted in a distinct appearance that differs from standard coins of the series, adding to the coin’s appeal.

1907 10 Centavos Lamination Error

- Metal: Silver

- Year: 1907

Photo by NGC Collectors Society

Where to buy rare coins

Error coins, both from the United States and around the world, hold a captivating allure for collectors and enthusiasts alike. From intriguing misprints to die breaks and incorrect planchet composition, each error coin tells a story of its own, showcasing the fascinating complexities of minting processes and the rich history of numismatics.

To enhance your coin collection with rare coins, Blanchard‘s unparalleled offerings are the perfect choice. Consulting Blanchard’s team of experts for further guidance and insights into rare error coins value and more.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

March Inflation Still High: 3 Portfolio Moves for Investors Now

Posted on — Leave a commentFor Americans living in the Atlantic basin, hurricane season starts soon. Yet, stormy weather appears to be descending on the U.S. economy and the stock market too.

The Federal Reserve got several doses of bad economic news in recent weeks—an uncomfortable combination of slower economic growth and rising inflation. Financial markets took notice. Stocks plunged and gold hit a new all-time record high. For investors, we offer three portfolio moves to consider now to batten down the hatches and help keep your wealth safe. First the numbers.

March Inflation Data Jumps

Americans still feel like prices on everyday goods and services are rising. Recent economic data confirms that is true.

The March Personal Consumption Expenditures inflation data came in stronger-than-expected as the headline number rose from 2.5% to 2.7%. This confirms the recent rise in the March Consumer Price Index, which rose on an annual basis to 3.5%, up from the February 3.2% reading.

The Fed can’t be happy that inflation is going in the wrong direction. This will most likely push out the timing of any interest rate cuts in 2024.

First Quarter Growth Slows

While inflation remains high, economic growth is slowing down. First quarter gross domestic product data revealed a sharply lower-than-expected 1.6% growth rate—well below the 2.5% consensus forecast. That shows the U.S. economy is growing at its slowest pace in nearly two years!

It’s no surprise, Americans are increasingly concerned about the fresh rise in inflation and slowing economy. The latest University of Michigan Consumer Sentiment survey revealed a drop in the Current Conditions sentiment index from 82.5 to 79.0.

Stocks Stumble: Bears Come Out of Hibernation

Meanwhile, stock market bears have come out of their caves from hibernation and they are growling, hungry and mad.

Investors began dumping stocks in April following this spate of worse than expected economic news. Disappointing earnings from big name tech stocks like Meta also dragged down the broader market in April. Meta’s shares plunged nearly 11% and other so-called “Magnificent Seven” stocks weren’t looking so magnificent as Alphabet, Amazon and Microsoft also saw heavy selling.

Gold Prices Touch Fresh Highs

In the midst of the disappointing economic news and stock market selling, gold prices rallied since mid-February in a historic and unprecedented fashion. After surging over 8% in March, gold climbed over 3% in April, touching a new all-time record high above $2,300 an ounce. Physical investment demand for gold bars and coins has been rising in anticipating of even further price gains in precious metals.

Portfolio Moves You Can Consider Now

Just as a farmer tends to his fields in the spring so he can reap his harvest later, taking care of your portfolio now can help keep your capital safe and your money growing. Here are three portfolio moves you can consider now.

- Rebalance your investments: Rebalancing simply means selling a portion of your stock allocation and buying more of other asset classes like gold and silver.

- Prepare for more stock market volatility ahead: Investing too heavily in the stock market can put you at risk if the stock market goes into a downturn or even a crash. Americans who need cash might have no choice but to pull money out of the stock market at a significant loss.

- Diversify with an increased allocation to gold and silver: Gold and silver bullion in physical form is an appropriate asset for a portion of any properly diversified investment portfolio and we recommend investing up to 10% of your overall portfolio in gold, depending on your financial goals and risk tolerance levels.

If you would like to discuss a personalized precious metals investing strategy tailored to your long-term investment goals, risk tolerance and time horizon, call a Blanchard portfolio manager today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

3 Most Valuable Morgan Dollars

Posted on — Leave a commentOften referred to as the “King of America’s coins,” the Morgan Dollar is a widely cherished numismatic treasure, fascinating collectors for decades. Despite their ubiquity, however, the values of these iconic coins exhibit an exceptionally diverse range. This article will explore why that is and answer the question “What are the most valuable Morgan Silver Dollars?”, highlighting:

- The origins of these legendary coins.

- The elements that make Morgan Dollars valuable.

- The three most valuable Morgan Dollars.

For a comprehensive list of which Morgan Dollars are valuable, watch this informative video:

What makes a Morgan Silver Dollar valuable

Before answering the question of “What is the most valuable Morgan Silver Dollar today?”, let us first review some fundamental attributes of this esteemed coin.

Where valuable Morgan Dollars were minted

Since their inception in 1878, Morgan Dollars have been minted at various locations across the United States, with each mint leaving its distinctive mark on these iconic coins. Exploring the regional nuances in production reveals subtle variations that enhance the individuality and desirability of Morgan Dollars. As most coin connoisseurs will know, these are the distinct mint marks that characterize valuable Morgan Dollars’ different production locations:

- Philadelphia: No mint mark.

- San Francisco: “S” mint mark.

- Carson City: “CC” mint mark.

- Denver: “D” mint mark.

- New Orleans: “O” mint mark.

Purity of the most valuable Morgan Silver Dollars

Morgan Silver Dollars minted between 1878 and 1921 were crafted from a durable composition of 90% silver and 10% copper. This alloy adhered to the specifications outlined in the Coinage Act of 1837, a law designed to ensure the consistency and reliability of coins by regulating their metal content. Essentially, the Act aimed to prevent fluctuations in the value of currency by establishing a standardized composition for coins.

Notably, a commemorative issue of the Morgan Dollar released in 2021 marked a departure from the coin’s traditional alloy with a composition of 99.9% pure silver. This adjustment aimed to acknowledge contemporary numismatic preferences while upholding the coin’s enduring legacy and intrinsic value.

Browse through more rare silver coins beyond valuable Morgan Silver Dollars.

What year Morgan Dollars are valuable?

With a substantial minting period spanning four decades, from 1878 to 1921, the Morgan Dollar series naturally encompasses several key dates. Numerous Morgan Dollar coins stand out as rare or significant, presenting collectors with a diverse range of numismatic treasures. Some examples of the most valuable Morgan Silver Dollar years carrying unique historical and numismatic importance include, but are not limited to, the following:

- 1878: Morgan Dollars produced in the series’ inaugural year hold a special appeal as the first standard silver dollars minted since the enactment of the 1873 Coinage Act. Struck in Philadelphia, three different reverse designs were created that year, with the first variety featuring an eagle with eight tail feathers being especially highly prized.

- 1879-CC: Carson City Mint has always held a certain mystique, due to its relatively brief operational period, adding to the desirability of the 1889-CC Morgan Dollar. With a low survival rate, this coin constitutes a particularly hard-to-find issue.

- 1884-S: The uniqueness of the 1884-S coin lies in its departure from the typical fate of Morgan Dollars. Unlike most of its counterparts, which were bagged and stored for future release, almost all of the 1884-S Morgan Dollars were circulated.

- 1892-S: The 1892-S Morgan Dollar, while minted in higher numbers compared to its Philadelphia counterpart, is considered exceptionally rare, particularly in mint state. This is because the majority of San Francisco coins either entered circulation or were melted in 1918.

- 1893-S: What makes the 1893-S coin a key date in the series is that only a mere 100,000 of it were struck, marking it as the lowest mintage for any business strike in the Morgan Dollar series.

- 1895: An anomaly in the series, the 1895 Morgan Dollar holds unparalleled value as one of the most valuable Morgan Dollars. With no official circulation coins minted that year, the few proof coins produced make it a numismatic gem.

- 1903-O: The 1903-O Morgan Dollar, once deemed the rarest in the series, gained legendary status due to its scarcity. Originally believed nearly extinct despite a mintage of 4.5 million, its unexpected resurgence in the early 1960s, when a cache of coins stored in Philadelphia vaults was discovered, astonished collectors.

- 1921: What makes a 1921 Morgan Silver Dollar valuable is that it was the final year of Morgan Dollar production, marking the end of an era. Coins from the Philadelphia Mint and especially the Denver Mint from this year carry historical weight, appealing to collectors drawn to the concluding chapter of the series.

Are Morgan Silver Dollars valuable for any other reasons?

As exemplified by the key date coins discussed above, Morgan Dollars command numismatic interest for a wide array of reasons. Among the factors that make Morgan Silver Dollar most valuable and contribute to their status as numismatic gems are the following:

- Historical significance: Morgan Dollars connect collectors to pivotal moments in American history, as they were minted during a transformative era in American history. Emerging in the aftermath of the Coinage Act of 1873, Morgan Dollars encapsulate the nation’s economic and social evolution.

- Noteworthy design: Crafted by George T. Morgan, Chief Engraver at the US Mint between 1876 and 1925, the Morgan Silver Dollar is celebrated for its elegant design. This features Lady Liberty’s profile on the obverse and the heraldic eagle on the reverse. Notably, the inaugural issue of the coin displays eight tail feathers on the eagle, with the fascinating 7 over 8 Tail Feathers variety adding a unique touch to certain coins.

- Limited production numbers: Morgan dollars exhibit varying mintage numbers throughout their production, with later editions often surpassing earlier releases. The factors influencing mintage, such as economic conditions and silver supply considerations, contribute to the rarity of specific years, irrespective of high production numbers.

- Survival rates: Numerous Morgan Dollars have low survival rates. Many coins were subject to melting, circulation wear, or hoarding, leading to a reduced number of well-preserved specimens and making the Morgan Dollar most valuable in the world of numismatics.

- Minting Errors and varieties: The Morgan Dollar series showcases complexity and diversity, captivating collectors with the thrill of numerous unique anomalies. Variations including double dies, overdates, and the distinctive Carson City mint mark contribute to the series’ rich numismatic tapestry.

3 most valuable Morgan Dollar coins

As mentioned earlier, the price spectrum for Morgan Dollars is extensive. On the lower end of the scale, collectors can acquire these iconic coins for as little as $30. This affordability renders them an excellent choice for entry-level collectors to begin their numismatic journey.

However, the coin series also allows numismatists with a bigger budget to explore more exclusive and rare specimens, with some Morgan Dollars reaching several thousand dollars or even more in the upper echelons of the market. For those seeking high-value acquisitions, we will now highlight three of the most valuable Morgan Silver Dollar value coins that will make a great addition to your collection.

1891-CC: one of the most valuable VAM Morgan Dollars

1891-CC Morgan $1 Top-100 VAM-3 Spitting Eagle NGC MS65

- Country: United States

- Metal: Silver

- Year: 1891

- Why it is valuable: Most coin connoisseurs will, beyond a doubt, give the same answer to the question “What are the most valuable Morgan Dollars?”, citing the 1891 “Spitting Eagle” variety of the coin. Minted in Carson City and considered a minting anomaly due to a die clash, i.e. where the dies clashed during the striking process, this coin is characterized by the fact the eagle on its reverse appears to have an open beak, creating an illusion that it is “spitting” feathers. The “VAM” designation of this specific coin signifies that it is a recognized variety by numismatists, adding to the coin’s historical and collectible value.

- Check our most current price here.

1892-CC: one of the most valuable CC Morgan Dollar coins

- Country: United States

- Metal: Silver

- Year: 1892

- Why it is valuable: The 1892-CC Morgan Silver Dollar is considered one of the most valuable Morgan Dollar coins for several reasons. Firstly, it was minted by the Carson City Mint in what were relatively low numbers for that year. Moreover, this coin boasts a storied history, with its scarcity shifting dramatically in the late 1950s with a Treasury release that prompted a surge in prices in the 1960s and 1970s. High-grade specimens of this coin are very rare, with estimates plummeting from MS-60 to MS-65 or better.

- Get our most current price here.

Photo by PCGS

1889-CC: one of the most valuable Morgan Dollar dates

- Country: United States

- Metal: Silver

- Year: 1889

- Why it is valuable: The 1889-CC $1 Morgan stands as a numismatic treasure with a compelling backstory. Minted in the final quarter of 1889 at the Carson City Mint, only 350,000 were struck, primarily entering circulation. As the most elusive Carson City Morgan and what many consider the most valuable Morgan Silver Dollar today, its scarcity is underscored by the low survival rate, making high-grade examples exceptionally rare.

- View our most current price here.

Photo by PCGS

To read more about the 1889-CC coin, i.e. one of the most valuable Morgan Silver Dollar dates, click here.

Where to buy the most sought-after Morgan silver dollars

With a rich and eventful history that traces its origins to the late 1800s, Morgan Silver Dollars have transcended their utilitarian origins to become cherished artifacts in the world of coin collecting.

To acquire the most sought-after Morgan Silver Dollars that have stood the test of time, consider using Blanchard. Renowned for its expertise in the field and unwavering commitment to authenticity, Blanchard stands as one of the most reliable sources for coin enthusiasts looking to enhance their collections. Blanchard’s long-standing presence in the numismatic community attests to its dedication to preserving the legacy of iconic rare American coins and providing collectors with genuine pieces of history.

Do not hesitate to reach out to Blanchard’s team of experts for valuable insights, including guidance on which Morgan Silver Dollars are valuable and more.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Fed fails to act at today’s meeting, Gold up 23% in 6 months

Posted on — Leave a commentStill-Rising Inflation Forced Fed to Keep Interest Rates at 23-Year High

The Federal Reserve failed to surprise anyone as it left interest rates unchanged at the end of its Wednesday meeting. Recent economic data has revealed inflation higher-than-expected for the past three months. What’s more, inflation levels are once again rising—not falling.

meeting. Recent economic data has revealed inflation higher-than-expected for the past three months. What’s more, inflation levels are once again rising—not falling.

The Fed’s long battle with inflation is far from over, and the road to get to a 2% inflation level could be a bumpy ride ahead. At it’s last meeting, the Fed hinted at plans to cut interest rates three times in 2024. Notably, the Fed’s post-meeting statement today failed to deliver any signs that it plans to lower interest rates anytime soon.

Wednesday’s inaction by the Fed leaves the benchmark rate at 5.25% to 5.5% for the sixth meeting in a row.

The Fed acknowledged that: “Inflation has eased over the past year but remains elevated. In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.”

The Fed added that: “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Market Reaction Muted

Financial markets didn’t show a strong reaction to the news, which was widely expected by most on Wall Street. Stocks were little changed from pre-announcement levels. The U.S. dollar index revealed the strongest reaction to the Fed news, tumbling sharply to fresh lows on the day. Gold hung onto gains achieved before the meeting ended, with spot gold recently trading at $2,320.70 an ounce. Silver was also trading higher after the Fed meeting concluded at $26.70.

Where is Inflation Right Now?

The most recent March Consumer Price Index rose on an annual basis to 3.5%, up from the February 3.2% reading. That’s well above the Fed’s stated 2% target rate and unfortunately for Americans going in the wrong direction.

The Labor Department delivered additional concerning news on the inflation front when it said that total compensation for U.S. workers increased 1.2% in the first quarter. That marks a 0.9% increase from the end of last year. Why does this matter? Increasing levels of wage growth could further stoke broad inflation if employers pass higher labor costs to consumers through price increases.

Gold Prices up Astonishing 23% in Last Six Months

In the face of the Fed’s struggling battle against inflation and amid broader worries around slumping stocks and slowing economy, gold has served as a safe-haven for investors.

Gold has climbed a remarkable 23% over the last six months, recently touching a new all-time record high above $2,300 an ounce. Physical investment demand for gold bars and coins has been rising in anticipating of even further price gains ahead in precious metals.

Today’s action reveals the Fed’s holster is empty and out of bullets in the inflation battle. The Fed meets next on June 12 and current market projections reveal only a 6% chance of a Fed rate cut at that meeting, according to the CME Fed Watch tool.

With few ways left to fight the still-rising inflation levels, gold will continue to act as a safe-haven for investors in this challenging economic environment.

Gold has served as a way to protect, preserve and grow wealth for 5,000 years. The time is ripe now for you to rebalance your portfolio and increase your allocation to gold. Wondering how much of an allocation to gold is right for you? Call Blanchard today and we can provide a personalized recommendation based on your long-term investment goals, your risk tolerance level and time horizon. We are here for you.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Top Five Unique U.S. Pattern Coins

Posted on — Leave a commentWithin numismatics, pattern coins are an intriguing and historically significant group of U.S. rare coins. Before striking new designs for circulation, the U.S. Mint produces a pattern coin to see how the proposed features work in three dimensions. Collectors are attracted to pattern coins as many boast unusual features that were never adopted for circulation. Let’s take a look at five of the most unique U.S. pattern coins:

- 1792 Copper Birch Cent J-4

- 1792 Cent J-C1792-1, Dickeson Restrike

- 1849 Gold $1 J-115

- 1860 Transitional Half Dime J-267

- 1866 Indian Head Cent J-456

1. 1792 Copper Birch Cent J-4

It is believed that Robert Birch, one of the original U.S. Mint employees in 1792, engraved the large copper pattern coins known today as “Birch cents.” This 1792 Copper Birch Cent with a Lettered Edge reveals two stars on the edge and this inscription on the edge: TO BE ESTEEMED*BE USEFUL*. This Birch Cent is a highly sought after and scarce pattern coin, with only seven or eight survivors.

2. 1792 Cent J-C1792-1, Dickeson Restrike

This pattern coin, also struck in 1792 is a privately issued token, known as the 1792 “Trial Piece” struck by Dr. Montroville Dickeson. This interesting coin features an eagle die from a revenue stamp with a reverse die inscription: TRIAL PIECE DESIGNED FOR THE UNITED STATES, implying it had been used at the U.S. Mint to produce the coins, which it had not!

3. 1849 Gold $1 J-115

What makes this gold dollar unique? It has a hole in the middle of it. In 1849, the U.S. Mint began striking $1 gold coins for circulation. However, they had a tiny diameter, because there wasn’t much gold in them. Soon after, the U.S. Mint began receiving complaints about the coin—specifically that its small size at 14.3 millimeters made it easy to lose. This pattern coin shows one of the ideas that Mint had to increase the coin’s diameter—putting a hole in the middle of it! It was a thinner, larger coin that still contained a dollar’s worth of gold. There are only a handful of these unique rarities know to survive today.

4. 1860 Transitional Half Dime J-267

In 1859, the U.S. Mint decided to move the inscription UNITED STATES OF AMERICA from the reverse of the half dime to the obverse. This transitional pattern coin minted in 1860 combined a Stars obverse with the new, larger wreath on the reverse. However, neither sides of the coin showed the name of our country! The reason? The inscription had been removed from the reverse die, but not yet added to the obverse! The omission of UNITED STATES OF AMERICA only adds to the intrigue around these ultra-rare pattern coins.

5. 1866 Indian Head Cent J-456

This 1866 Indian Head Cent pattern is made from copper and nickel. Yet, this coin should have been made of bronze! Even today, numismatic historians don’t fully understand how or why this coin was created. Since the last copper-nickel cents were struck in 1864, there is speculation this is an off-metal error coin. However, because there about half a dozen known survivors, another theory suggests this was an off-metal coin deliberately produced for sale to collectors. Either way, this 1866 Indian Head pattern is a highly desired coin by collectors of this series.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Internet Conspiracy Theories Abound About Fort Knox Gold

Posted on — Leave a commentFrom time to time conspiracy theories arise on social media and internet chat boards about the gold in Fort Knox. According to official records, the United States of America has the largest gold reserves by a long shot. No other country even comes close.

Today, questions are swirling around the Internet again about our nation’s gold reserves. So we dig into some of the facts to let you decide what you think.

There is fascinating history around Fort Knox in Kentucky—one of the most secure and secret places in America. After all, according to official records, Fort Knox stores an incredible 147.3 million ounces of our nation’s gold, more than half of our total gold reserves.

The government values that gold at a so-called “book value” of gold totaling $6.22 billion. That book value number is well below actual market value—as it is based on a fixed gold price that government officials set in 1973 at $42.22 per ounce.

Today’s Market Prices of Fort Knox Gold

At today’s spot gold price, that 147.3 million ounces of gold is worth over $338 billion. Here are other locations that our country stores gold.

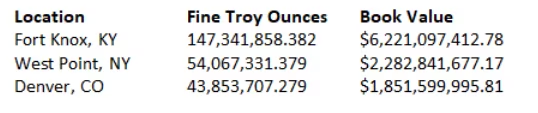

Top 3 U.S. Deep Storage Gold Holdings

Source: Treasury.gov

Conspiracy Theories Point Out That No One Has Seen This Gold Lately

The Theory: The gold must be missing because the government won’t let anyone into Fort Knox to check on it. Here are some of the theories behind the missing gold:

- The U.S. government moved our nation’s gold someplace else.

- The U.S. sold our gold to China.

- The gold bars in Fort Knox have been replaced with fakes filled with tungsten.

- The U.S. government secretly sold off our gold and replaced it with metal bars that are only painted gold.

- Aliens took it.

FDR Only President to Visit

It’s true that not many U.S. presidents have traveled to Fort Knox to see the gold. It was President Franklin Roosevelt who authorized the construction of the U.S. Bullion Depository in Fort Knox, and he was the only president to ever visit. Fort Knox opened in 1936. The next year, the facility received its first shipment of gold from the Philadelphia Mint and New York Assay Office. The bullion was shipped by train via the U.S. mail.

Today Fort Knox Is Closed to the Public

If you want to go into Fort Knox, you are out of luck. The last time there was an official visit was in August 2017. Then U.S. Treasury Secretary Steven Mnuchin paid a rare official visit to Fort Knox. He was the first Treasury Secretary to visit the U.S. Bullion Depository in 69 years.

During that visit, then-Senate Majority Leader Mitch McConnell accompanied Mnuchin. The 2017 visit was the first time Fort Knox opened its vaults to outsiders since 1975. A delegation totaling 12 congressmen and about 100 reporters were given admittance to view the gold.

The 1974 Audit

After the 1974 Congressional visit, an inspection of the gold was recommended and completed by a team of auditors from the U.S. General Accounting Office and the Department of the Treasury. In February 1975, the Office of the Comptroller General released a report stating the total amount of gold documented as being in the Fort Knox vault as of June 30, 1974, was still there.

Gold Stored In Sealed Drums

The gold in Fort Knox is stored in sealed drums, with signatures and dates stating when they were sealed. The drums are stored in the vault and, according to the audit, the seals are not broken.

See official government records for yourself here.

Gold Is the Ultimate Money

When former Federal Reserve Chairman Alan Greenspan was asked once why the government continues to hold its massive gold reserve: Greenspan reportedly replied: “Just in case we need it. You hold onto it because it’s the ultimate in money.” That begs a question we’ve asked before: Do you own enough gold?

So what do you think about the gold in Fort Knox? Leave a comment below.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

8 Most Desired El Cazador Shipwreck Coins

Posted on — Leave a commentWhen it comes to shipwrecks, few have had as profound an impact on shaping America’s history as El Cazador. This vessel’s story is not just one of maritime tragedy, but also of the extraordinary treasure it carried and the ripple effects of its loss. This piece will delve into the remarkable coin discoveries from this legendary vessel, exploring El Cazador shipwreck coin value, as well as:

- The captivating history of El Cazador.

- The consequences of the ship’s sinking.

- The premier destination for acquiring rare coins.

Watch an expert unveil clusters of silver coins salvaged from the El Cazador wreckage in this fascinating video:

Facts about El Cazador ship

Altering the course of American history, El Cazador holds a unique place in maritime lore. Discovered in 1993, this Spanish shipwreck serves as a poignant reminder of the profound impact of maritime trade on the development of the New World.

El Cazador ship model

Built in the late 18th century, El Cazador epitomized the Spanish brigantine — a hallmark vessel of the Age of Sail, prevalent in the 17th and 18th centuries for both naval and merchant ventures. Characterized by two masts, brigantines like El Cazador feature a towering mainmast alongside a subordinate foremast, each meticulously rigged with square sails attached to horizontal yards.

Additionally, these vessels often boast fore-and-aft rigged sails on the mainmast running parallel to the ship’s length. This dual rigging design not only bolsters propulsion but also enhances maneuverability, making brigantines versatile across diverse wind conditions and agile on the high seas.

El Cazador story

Known for its agility and versatility, El Cazador was a common sight along the trade routes of the Spanish Empire, ferrying goods and passengers across the vast expanse of the Atlantic Ocean. In the year 1784, the vessel was assigned a pivotal mission by the Spanish authorities: transporting a vital cargo of essential supplies and treasures, including hundreds of thousands of coins minted in Mexico City and other colonial mints, to bolster the economic prospects of the Spanish colonial authorities in Louisiana. Departing from the bustling port of Veracruz, Mexico, the ship embarked on a journey bound for the port of New Orleans.

With Captain de Campos y Pineda at the helm, the crew of El Cazador set sail with determination. The journey was fraught with challenges as the vessel navigated unpredictable waters and faced the ever-present threat of piracy lurking on the horizon. Despite the perils, the crew pressed on, driven by the promise of profit and the duty to serve their homeland.

However, as the ship ventured into the Gulf of Mexico, it encountered a fierce storm that proved to be its undoing. Notwithstanding the crew’s valiant efforts to weather the tempest, El Cazador ultimately succumbed to the fury of the sea, disappearing beneath the waves along with its precious cargo and the hopes it carried for the colony of Louisiana.

Passengers on El Cazador shipwreck

El Cazador served as a merchant vessel, primarily dedicated to transporting cargo rather than passengers. While there are no detailed historical records regarding passengers on the vessel, it’s possible a few merchants, cargo overseers, or Spanish colonial representatives were on board alongside the crew. Unfortunately, no survivors emerged from the tragedy of El Cazador’s sinking, leaving behind unanswered questions about its fate at sea.

El Cazador aftermath

The disappearance of El Cazador in 1784 had far-reaching consequences that reverberated across the Kingdom of Spain and the New World. The failure to locate the ship and its valuable cargo prompted Spain to relinquish control of Louisiana back to France in 1800. Subsequently, France sold the territory to the United States in 1803 for $15 million, significantly expanding American territory.

Some historians speculate that had the vessel successfully delivered its treasure to New Orleans, parts of the present-day United States might still be under Spanish sovereignty.

El Cazador shipwreck location

The wreckage of El Cazador was discovered in 1993 in the Gulf of Mexico, 50 miles southeast of New Orleans, by fisherman Jerry Murphy. While trawling for shrimp, Murphy hooked his net into an obstacle. This turned out to be a cluster of silver coins from El Cazador.

This chance encounter marked the beginning of the ship’s recovery efforts, which ultimately yielded a trove of artifacts, notably including a significant portion of the vessel’s cargo of Spanish colonial coins.

How many coins from Cazador ship are known

The coins retrieved from the El Cazador shipwreck unveil a window into the past, showcasing the bustling trade routes of yesteryears. Much like the Atocha shipwreck treasure, these coins offer tangible evidence of the thriving transatlantic trade during the colonial era, illuminating the economic exchanges that shaped the course of history.

1. 1783 8 Reales El Cazador coin

Created by the Mexican Mint and stamped with the assayer mark “F.F.”, this 1783 8 reales El Cazador Spanish wreck coin features the bust of the King of Spain Charles III on the obverse and the Hispanic arms design on the reverse. As the most common coin found among the wreckage, it is clear that it played a big role in shaping the economic landscape of the colonial era.

In fact, the use of this El Cazador shipwreck coin (“Spanish piece of eight” as it is often referred to) was so widespread in international trade during the 16th to 19th centuries that it became synonymous with the Spanish dollar and even served as legal tender in the U.S. until the Coinage Act of 1857.

1783 Carlos III 8 Reales

- Metal: Silver

- Year: 1783

2. 1781 El Cazador shipwreck coin 8 Reales

One of the rarer finds among the 8 Reales coins recovered from the El Cazador shipwreck is this 1781 piece. Minted in Lima, Peru under the reign of King Charles III, this coin is distinguished by its scarcity. Compared to its counterparts minted in Mexico, there were far fewer coins produced in Lima, and consequently, fewer found on the ship, making them highly sought after by collectors. As a result, the El Cazador 8 reales coin value of these pieces remains significant.

1781 Carlos III 8 Reales

- Metal: Silver

- Year: 1781

Photo by Numista

3. 1740 4 Reales El Cazador coin

Another fascinating El Cazador treasure coin is this 4 reales piece minted under the reign of Felipe V, a notable departure from the majority of coins on the vessel which were produced during Charles III’s reign. Distinguished by its unique design featuring a shield embellished with a regal crown on the obverse, this coin offers a captivating glimpse into Spain’s numismatic heritage during Felipe V’s rule.

1740 Felipe V 4 Reales

- Metal: Silver

- Year: 1740

Photo by Numista

4. 1783 El Cazador 2 Reales coin

A striking find, this 2 Reales 1783 El Cazador shipwreck coin was among the most frequently discovered artifacts in the wreckage. These coins held particular popularity across the Spanish colonies, valued for their versatility in everyday transactions. Their lower denomination allowed for easy exchange in a variety of purchases, underscoring their widespread use in daily commerce.

1783 Carlos III 2 reales

- Metal: Silver

- Year: 1783

Photo by Numista

5. 1768 El Cazador 2 Reales silver coin

The 1768 Carlos III 2 Reales coin is a notable discovery among the wreckage of El Cazador, distinguished by its rarity compared to other 2 Reales coins recovered. What sets this coin apart is the presence of the assayer mark “FM,” unlike the more commonly found “FF” mark on coins from a similar period. This unique marking adds to the coin’s historical significance and makes it a prized find for collectors, contributing to its high “El Cazador coins value”.

1768 Carlos III 2 Reales

- Metal: Silver

- Year: 1768

Photo by Numista

6. 1785 1 Real El Cazador silver coin

With a unique combination of design elements, this 1785 Carlos III 1 Real coin from El Cazador wreck is a prized addition to numismatic collections, reflecting the rich heritage of Spanish colonial coinage. The coin’s obverse is graced by an armored bust of Charles III, exuding regal authority, while a crowned arms shield flanked by pillars on the reverse symbolizes Spanish imperial strength.

1785 Carlos III 1 Real

- Metal: Silver

- Year: 1785

Photo by Numista

7. 1779 El Cazador shipwreck 1/2 Reale coin

As the second smallest denomination among Spanish colonial silver coins, half reales coins played a crucial role in everyday commerce throughout the colonies. This particular piece represents the most commonly found 1/2 reales El Cazador coins, distinguished by its assayer mark “FF.”

1779 Carlos III ½ Real

- Metal: Silver

- Year: 1779

Photo by Numista

8. 1744 ½ Real coin from shipwreck El Cazador

A prized rarity among El Cazador half reale coins, this 1744 ½ Real coin is greatly sought after by collectors for its earlier date of minting and the presence of the assayer mark “FM” that sets it apart as a distinctive find. Produced during the reign of King Felipe V, this coin represents a less common variety among the wreckage, adding to its numismatic allure.

1744 Felipe V ½ Real

- Metal: Silver

- Year: 1744

Photo by Numista

Browse a broader selection of rare coins beyond El Cazador coins for sale.

Where to buy rare coins

El Cazador played a pivotal role in shaping American history as a significant shipwreck. Its discovery revealed a treasure trove of valuable coins, each with its own compelling story, now highly sought after by collectors worldwide.

To begin or enhance your own numismatic journey with the acquisition of rare coins, trust Blanchard’s unmatched expertise and dedication to excellence. Do not hesitate to reach out to Blanchard’s team with questions about El Cazador shipwreck coins value and more. Blanchard’s expert numismatists are available to assist you at all times, ensuring a seamless and enriching numismatic experience.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

King Charles III Coronation Sovereign Proof

Posted on — Leave a commentThe coronation of King Charles III on May 6, 2023 was a seminal event in world history. The British monarchy had not crowned a new monarch since Queen Elizabeth II ascended to the throne in 1953. Many British subjects had lived their entire lives during the reign of Queen Elizabeth II, until she passed in September of 2022. The coronation took place at Westminster Abbey in London, as was typical of these important celebrations. It was a majestic and important event in world history.

The Royal Mint responded with a brand new portrait of the King, specifically designed for coinage. Queen Elizabeth II’s portraits faced to the right on all approved coinage and in keeping with tradition, King Charles III’s portrait now faced to the left.

The new portrait was accomplished by noted British sculptor, Martin Jennings. The King is seen wearing the Tudor crown and on the periphery of the coin is inscribed the Latin legend, “CHARLES III – DEI – GRA – REX – FID – DEF,” which translates to “Charles III, by the Grace of God, King, Defender of the Faith.” Below his neck are the small initials, “MJ” for the designer.

The reverse is the familiar design that has been used on all British gold sovereigns since 1817 – that of “Saint George slaying the Dragon.” According to ancient legend, the person of Saint George was actually a Roman soldier, who followed the Christian faith. Little is known about him other than he was born sometime during the 3rd Century AD and was condemned to death by the Roma Emperor Diocletian, for refusing to renounce his faith.

Over the centuries, from British monarchs to even William Shakespeare all honored and revered the legend of Saint George. By the 13th Century, Saint George was often seen with the “red crosse” of the Crusaders. His historic fight with the dragon was seen as Good fighting Evil and his legend continued to grow.

In 1348, then King Edward III named Saint George as the “Patron Saint of England.” His legend was, by that time, one of the most important and repeated legends of medieval history.

Even the “Bard” – William Shakespeare wrote of him when he ended the battle speech in his iconic play “Henry V” with the words, “Cry God for Harry, England and St. George!”

King Henry V also motivated British troops during the Hundred Years War with France by repeating “Once more into the breech, dear friends, once more,” a reference to the bravery of Saint George. This victory helped to ensconce England as the world’s military super power of the day,

Throughout British history Saint George’s image was depicted and revered in this timeless battle. King George IV, who reigned in the early part of the 19th Century wanted to introduce a new gold coin and he chose Saint George as the appropriate subject. The new gold sovereign was first dated 1817 and has been used on British sovereigns ever since. It was also displayed on the reverse of sovereigns that were manufactured and distributed in Canada, India, Australia, and South Africa as well.

This reverse was imaginatively designed by engraver Benedetto Pistrucci, he chose to portray Saint George on horseback slaying the beast, which was in sharp contrast to many earlier coins typically displaying shields with heraldic arms or other regal symbolism. The action and motion depicted in Pistrucci’s design helped make this design popular centuries ago and still today, This design is now synonymous with the British Gold Sovereigns.

The Royal Mint struck these gold Proof Sovereigns to honor King Charles III and limited the Proof version to a mere 15,000 coins worldwide. They were struck in 22 carat gold (.9167 Fine Gold). The coin weighs 7.99 grams (.2354 Troy Ounce).

Proof coinage from the British Royal Mint is of the highest quality that the Mint, and its master craftsmen, can produce. They are always struck in very limited quantities to assure the best impression of the design that is possible at all times.

The coin is encased in a protective capsule, and both are housed in a beautiful presentation box, as created by the Royal Mint. This offering is complete with a descriptive and historical booklet from the Royal Mint, describing coronation traditions and symbolism and containing information about this new British monarch.

You may know that this historic coin was completely and very quickly SOLD OUT at the Royal Mint. This is truly a unique opportunity to add this important and historical coronation gold proof coin to your collection.

Simply click the “Add to Cart” button now or call 1-866-827-4314 to speak to one of our highly trained numismatists, who will be very happy to assist you.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Copper Shortage Paves Way for Small Flying Eagle Cent

Posted on — Leave a commentThe Flying Eagle Cent, a perennially popular coin among collectors, has its origins in a copper shortage in the U.S. in the 1850s.

While copper has a rich history and was first used in coins around 8000 B.C.—in the United States in the 1850s—copper mining had yet to reach its heyday.

Compare these numbers for perspective. In 1845, copper production totaled a mere 13 tons in Michigan (the largest copper producer in America at the time). That number jumped to 7,170 tons in Michigan twenty years later!

So, in the 1850s, U.S. Mint officials reported difficulty breaking even while making large cent copper coins, as the price for the raw metal was climbing fast.

What’s more, Americans just didn’t like the large copper cents. People complained they were ugly, heavy and collected dirt easily.

The Passing of the Torch from the Large Cent to the Small Cent

A solution was put forward. The Treasury had been experimenting with a new small cent pattern coin in 1856. The small cent was about half the weight of the large cent, which would significantly reduce the Mint’s production costs.

While large cents weighed in at 10.89 grams, the new Flying Eagle pattern coin struck in 1856 clocked in at significantly lower 4.67 grams and was made from 88% copper and 12% nickel.

Congress and the Public Embraced the Flying Eagle Cent

Mint officials distributed the 1856 Flying Eagle cent pattern coin to Treasury officials, members of Congress and other VIPs as they considered the legislation. Additional 1856 proof pieces were struck for collectors and the early coins were snapped up quickly. While 2,000 pattern coins were minted in 1856, today survivors are extremely rare and highly desirable.

Since the coin met the approval of Congressional members, the Act of February 21, 1857 created official authorization for a new small cent made from a mixture of copper and nickel.

The same 1857 law created a provision where Americans could turn in their older cents, and also Spanish or Mexican coins that were commonly used in commerce at that time, for the new small cent.

When the Mint began official distribution of the Flying Eagle Cent in May 1857, long lines formed at the Mint as people wanted to trade in their old coins for the shiny new smaller cent.

Today, we consider Flying Eagle to be copper coins, but at their launch they were lovingly called “nicks” in reference to their nickel content. While the public clamored for these coins and adoption was swift, the Flying Eagle was only minted until 1858. Today, it is believed that striking problems were occurring with the high-relief on the design. The Indian Head cent replaced the Flying Eagle in 1859.

Mint Chief Engraver James Barton Longacre Designed This Delightful Coin

The obverse features a left-facing eagle with its wings outstretched in flight. Around the top, UNITED STATES OF AMERICA encircles the top two-thirds of the coin, with the date at bottom. The image of the eagle was influenced by work from Longacre’s predecessor, Christian Gobrecht. On the reverse, a detailed wreath comprised of leaves, corn seed heads, wheat, cotton and tobacco is wrapped in a ribbon. Centered on the reverse are the words ONE CENT. All coins were minted at Philadelphia and so there are no mint marks on the coins.

Collecting Flying Eagle Cents

The exciting history, arresting design and its stature as the first small cent make Flying Eagle Cents a highly collected series. Collectors typically want to acquire the 1856 pattern and the 1857 and 1858 coins. Additionally, there are three varieties in the series and collectors typically try to obtain all of them including the 1858 Double Die Obverse (1858/7), 1858 Large Letters and 1858 Small Letters. Are you intrigued? See this beautiful coin here.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How to Identify Rare Coins: Your Ultimate Checklist

Posted on — Leave a commentStumbling upon a potentially rare coin unexpectedly can be thrilling for collectors. Nevertheless, discerning rarity is no easy feat. This determination hinges on various factors that necessitate going beyond surface assessment, prompting a nuanced exploration of the coin’s characteristics. This article aims to answer the question “How do you find out if you have a rare coin?”, focusing on:

- Signs for spotting rare coins.

- Illustrative cases of rare coin identification.

- Tips for owners of rare coins.

Watch this video for more expert advice on spotting rare coins:

How to spot rare coins: 10 surefire signs

If you believe you’ve come across a rare coin, there are various clues that can help confirm this. These fundamental signs serve as an excellent starting point for recognizing numismatic rarities.

1. Check mintage figures to identify rare coins.

Checking mintage figures is a crucial step in identifying rare coins. Mintage refers to the number of coins produced during a specific time frame and at a particular mint.

Typically, coins with limited mintage due to historical events, errors in production, or special commemorations are likely to be more sought after by collectors. Numismatists looking to discern the scarcity of a coin by researching mintage data should be attentive to variations in mintage figures across different years and minting locations, as even a small discrepancy can significantly impact a coin’s rarity.

Exploring what mintage makes a coin rare becomes essential in the pursuit of understanding the factors that contribute to a coin’s desirability among collectors. To access mintage information, collectors can consult reputable numismatic resources, official mint reports, or online databases dedicated to coin mintage figures.

To illustrate this point, consider this coin, exemplifying the intrinsic connection between a limited mintage of 3,942 and collector allure:

1884 Indian Head Cent PCGS PR67 Red Brown CAC

- Metal: Bronze

- Year: 1884

2. Design variations and anomalies are key for rare coin identification.

Careful examination of design variations and anomalies is paramount when figuring out how to tell if a coin is rare. Design evolution in coins is shaped by changes in minting processes, advancements in technology, and shifts in artistic preferences, among other factors. Anomalies occur when unexpected errors like double strikes, off-center minting, or die cracks manifest.

When present, these variations and anomalies contribute significantly to a coin’s rarity, enhancing its uniqueness and desirability among collectors. To identify these distinctions, utilize reputable reference numismatic materials, or consult with experienced professionals.

3. Historical significance is integral to what makes coins rare.

A coin’s historical significance is another factor serving as a “rare coin identifier”. Rare coins often derive their scarcity from the circumstances surrounding their production or the historical context they encapsulate.

Coins commemorating significant events, personalities, or periods in history often hold a special allure for collectors. Moreover, coins minted during pivotal moments, such as war times or economic crises, tend to be scarcer due to limited production or subsequent withdrawals from circulation.

Researching the historical context of a coin, including its origin, purpose, and any associated stories, enriches a collector’s understanding of its rarity and can help determine its worth and importance within numismatic circles.

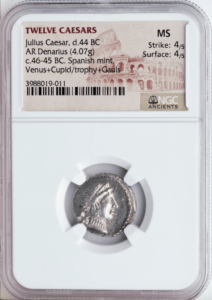

A case is this ancient Roman coin, a tangible artifact that vividly encapsulates the cultural, political, and economic nuances of its era:

Twelve Caesars – Julius Caesar

- Metal: Silver

- Year: c. 46 – 45 BC

4. A coin’s circulation history is a pivotal factor in how to identify rare coins.

Identifying rare coins requires a consideration of their circulation history. Coins with limited circulation, perhaps due to limited issuance or geographic distribution, are often deemed rarer by collectors. Additionally, understanding the patterns of coin withdrawals from circulation, whether due to economic changes or the introduction of new currency, helps collectors assess the availability of specific coins.

In the process of learning how to spot a rare coin, numismatists must delve into the historical context of circulation, tracking the coin’s trajectory from mint to hands of collectors. In this way, they can gain insights into the scarcity of well-preserved coins and recognize the impact of circulation on a coin’s overall rarity.

5. High prices serve as a reliable rare coin value checker.

The principle of supply and demand is particularly evident in the realm of rare coins, where heightened collector interest and limited availability drive prices upward. This means that high prices in the numismatic market serve as a reliable indicator when checking the rarity and value of coins. A coin’s market value often reflects its scarcity, historical significance, and overall desirability among collectors.

Collectors and investors alike frequently use auction results, price guides, and sales records to gauge the rarity of a coin. In the digital age, interested parties can easily find and use an app to identify rare coins or other online platforms and specialized marketplaces that facilitate the tracking of coin prices, enabling them to stay informed about market trends. Coins that consistently command high prices in the market, like the following one, are generally those with limited availability or possessing unique qualities that attract discerning collectors:

1795 $10 Draped Bust 13 Leaves PCGS AU58

- Metal: Gold

- Year: 1795

6. Investigate if rare coins that you might have were part of important discoveries.

Understanding the circumstances of a coin’s discovery can offer important guidance on how to know if you have a rare coin. Coins that were extracted from shipwrecks or unearthed as part of archaeological finds or historical excavations often carry an added allure for collectors. These discoveries not only contribute to the coin’s provenance but also provide a unique glimpse into the historical context and circumstances surrounding its burial or concealment.

The association with important discoveries can elevate the numismatic significance of a coin, making it more than a mere collectible. By delving into the stories behind these discoveries, collectors gain a deeper appreciation for the unique historical journey of a coin, enriching the overall experience of identifying and owning rare numismatic treasures.

A great example of a rare coin that provides a tangible link to history because of its discovery is this stunning piece, found on SS Central America:

1857-S $20 Liberty SSCA PCGS AU58

- Metal: Gold

- Year: 1857

If you are fascinated by historic discoveries, read about the Gairsoppa wreck here.

7. Regionality plays a role in what makes a coin rare and valuable.

Regionality plays a pivotal role in determining the rarity and value of a coin within the numismatic world. The geographic origin of a coin can significantly influence its scarcity, as mints in different regions may produce varying quantities of a particular denomination. Furthermore, coins specific to certain regions may have limited distribution or bear regional symbols and designs that resonate strongly with collectors interested in the heritage of a specific geographic area.

When figuring out how to tell if you have a rare coin, you should consider regionality as a crucial aspect, recognizing that a coin’s origin contributes to its distinctive value. The regional context enhances the coin’s story, making it a cultural artifact that reflects the history and identity of a particular locale.

An exemplary regional coin steeped in history is the 1855 $50 Wass Molitor, minted during the height of the Gold Rush:

1855 $50 Wass Molitor NGC VF35 CAC

- Metal: Gold

- Year: 1855

8. An indicator for how to know if a coin is rare is if it is exclusively part of a set.

An effective indicator for identifying rare coins is their exclusivity as part of a set, a key consideration for any rare coin checker. Whether issued for commemorative purposes, special occasions, or thematic collections, coins that can only be acquired as part of a set tend to be more sought after and rarer than standard issues.

The exclusivity of set-based coins is two-fold; it not only limits the individual coin’s availability but also enhances its desirability within the context of a comprehensive collection. Numismatists value the challenge of assembling complete sets, and the scarcity of specific coins within these sets adds a layer of difficulty to the pursuit.

9. Condition can offer valuable clues about rare coins you might have.

While the question “How old does a coin have to be to be rare?” often takes center stage, it’s essential to emphasize that age is just one consideration when it comes to rarity. Equally significant is the coin’s state of preservation, providing valuable insights into its history, wear, and overall scarcity.

Key indicators of a coin’s condition include the presence of luster, sharpness of details, and absence of scratches or discoloration. Numismatists carefully examine the surfaces, edges, and overall appearance of a coin to glean information about its rarity and historical significance.

Well-preserved coins, especially those in higher grades, are generally considered rarer and more desirable among collectors. Coins in exceptional condition often fetch higher prices in the market due to their scarcity. Understanding the language of coin grading and recognizing the significance of condition allows collectors to make informed decisions about the rarity and value of their coins.

10. Metal content and composition can be an effective coin rarity checker.

Examining the metal content and composition of a coin can also prove to be an effective strategy if you are looking for a way how to know if your coin is rare. The choice of metals used in minting coins can vary over time, and certain compositions may be specific to particular issues or historical periods.

Coins composed of precious metals, such as gold or silver, are often deemed rarer due to their inherent value. Historical coinage, especially from antiquity, might also boast unique compositions that reflect the economic and metallurgical practices of the time.

Understanding these metal details offers valuable insights into a coin’s scarcity. Numismatists meticulously study a coin’s metal content and composition, using this information as a valuable rarity checker.

Identifying rare coins: case study

What makes a 1971 2p coin rare?

The 1971 2p coin’s rarity stems from a design change when the Royal Mint transitioned from “New Pence” to “Two Pence.” A limited number of coins were mistakenly minted with the old inscription, making them highly sought after by collectors.

How can you tell if a 50p coin is rare?

To understand what makes a 50p coin rare, consider factors like mintage, design variations, and circulation history. An example of a rare 50p coin is the Kew Gardens 50p coin, minted in 2009 to commemorate the Royal Botanic Gardens, with a mintage of only 210,000.

What makes a 1979 dollar coin rare?

The rarity of a 1979 dollar coin is generally determined by specific minting variations. For example, some 1979 Susan B. Anthony dollars were struck with a wide rim, creating the “near date” variety. This variety is considered more scarce compared to the standard version with a narrower rim.

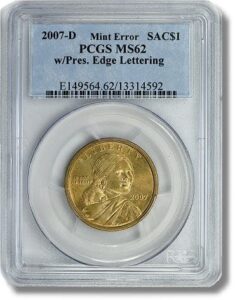

How do you know if you have a rare Sacagawea coin?

Everyone is familiar with the historical significance of the Sacagawea dollar, but the answer to the question “How to tell if a Sacagawea coin is rare?” lies beyond that. To ensure your coin is rare, check for minting errors, such as double strikes or planchet flaws, unique designs, or limited editions. The 2007 Sacagawea Dollar, with Edge Lettering, accidentally featuring a Presidential coin’s edge design, is exceptionally valuable due to its rarity, with only one known to exist.

Photo by Coin Week

How do you tell if you have a rare Susan B Anthony coin?

Link to the coin image: https://www.pcgs.com/coinfacts/coin/1981-p-sba-1/9578

To determine what makes a Susan B. Anthony coin rare, inspect features like mint marks, design variations, and unusual characteristics. Certain years or mintages, such as those from 1981 and 1999, tend to be scarcer, impacting the coin’s rarity.

Photo by PCGS

What to do if you think you have a rare coin

- Research: Conduct thorough research on the coin, including its mint year, mint mark, and any unique characteristics.

- Consult experts: Seek advice from experienced numismatists who can provide valuable insights into the rarity of your coin. Blanchard’s team of experts is always available to provide you with information on how to check rare coins.

- Extend your collection: Add more rare coins to your collection with Blanchard’s rare coins checker’s guidance.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.