The Blanchard Economic Report

Posted on — Leave a commentAs the New Year takes hold, concerns over global geopolitical instability have moved to center stage.

“This year marks the most volatile political risk environment in

the postwar period.” – 2017 Outlook Report from the Eurasia Group

Gold has climbed 5.89% since Dec. 15. The price of gold is already rising ahead of the Jan. 20 Inauguration as smart money investors buy physical metal to hedge against the numerous uncertainties around the globe.

Here are 6 risks smart money investors are concerned about in 2017…

Military Risks…

Trump has promised to “bomb the hell out of ISIS,” extend surveillance capabilities, and otherwise leverage US coercive power to punish enemies, the Eurasia report notes.

Instability in Europe…

The continent faces a series of elections from France to Germany and the Netherlands. A wave of populism is sweeping across not only America, but Europe and this year’s elections could destabilize the European Union.

Domino Impact of Rising Russian Influence…

There are expectations that Russia could meddle in European elections this year with the goal of destabilizing the traditional power base. Trump’s tepid support of NATO could weaken the alliance that has historically protected global order.

China’s Power Grab…

Chinese President Xi Jinping sees the current unrest in America as an opportunity to seize greater power on the world stage. His recent speeches are calling for China to become the new leader in globalization.

Inflation is Rising in the US…

On the economic front in the United States, recent data shows the economy near full employment with the December unemployment rate at a low 4.7%.

Wage growth is accelerating as average hourly earnings climbed 2.9% on a year-over-year basis in December, as employers struggle to find qualified workers to fill positions. Central bankers are already warning about the potential for higher inflation in 2017…

Another Bank Crisis…

Former U.S. Treasury Secretary Lawrence Summers told Bloomberg that the president-elect’s plans for deregulation were setting the stage for the next financial crisis.

Is Your Portfolio Properly Diversified?

Investors are loading up on the both gold and silver at bargain-level prices following the steep price slide after the presidential election. Overseas buying has been strong in gold, especially from China ahead of the Chinese Lunar New Year on Jan. 28.

Study after study has shown that precious metals can reduce overall volatility and protect your assets against equity market declines.

Act now to ensure your portfolio is properly hedged and diversified…

Blanchard believes that gold and silver bullion in physical form is an appropriate asset for a small portion of any properly diversified investment portfolio. We will take the time to learn your investment objectives, investment time horizon and risk appetite before recommending products for your consideration. Call us today at 1-800-880-4653 for a confidential consultation with a portfolio manager.

What to Know as Markets Reach Records

Posted on — Leave a commentAs the three main US indices (Nasdaq 100, S&P 500, & Dow Jones Industrial Average) continue to hover near all–time record highs, investor fear continues to hover near all–time record lows.

One of the most common ways to gauge investor fear in the market comes from the CBOE Volatility Index, commonly referred to as the VIX, which measures the implied volatility of S&P 500 options. The concept is simple: when turbulence is expected in the market, investors are willing to shell out more money to protect their portfolios by hedging with options, and when no turbulence is expected, investors don’t have the need or desire to protect their portfolios. A higher VIX = more volatility expected. A lower VIX = less volatility expected.

Recently, any small spike in the VIX has been abruptly quashed due to the relentless and steady rise of the major indices. Out of 252 equity trading days in the past year, there have only been 38 days where the VIX has been south of the $12 level. Therefore, based on the current low price of the VIX, equity market participants are pricing in virtually zero downside risk or fear, even at record market highs.

However, this is where the plot begins to thicken. Although the VIX suggests that there is essentially zero fear in the equity market, the gold market tells a slightly different story. Currently, gold is already up approximately 2.3% for the year, adding more than $50 since the low point of $1124.3 in mid–December. Analysts attribute the recent rally in the precious metal as a flight–to–quality amid lingering concerns about what 2017 has in store.

Perhaps the biggest cause of doubt and uneasiness for US financial markets comes form an unexpected presidential election result. This is not to say, however, that investors are not also keeping a careful watch on European political changes as well.

Adrian Day, the president of Adrian Day Asset Management, which oversees $190 million noted how “the euro zone has plenty of crisis triggers over the coming months; Indian and Chinese buying [of gold] remain strong and Trump’s policy threatens inflation. All this is positive for gold.”

This is likely why gold is off to a very solid start for 2017, because unlike the VIX in US equity markets, there are other factors besides fear that are pushing the precious metal higher.

With that said, US institutional investors are closely monitoring China’s mounting currency problem, because it was China’s government devaluation of the yuan back in August of 2015 that sparked a severe US equity sell–off and sent gold soaring.

Therefore, not only are investors from China buying gold to seek refuge from a drowning currency propped up by the government, but US investors are also purchasing gold as a heaven in case the yuan crisis worsens and the effects are felt in the US stock market, again.

Macroeconomic factors like China’s currency crisis, trepidation about new US politics, and complacency with stocks at record highs are all valid reasons to own gold, and this consequently explains the recent rally. Once again, this underscores the benefits of owning gold as an investment, because not only can market fear instigate a rally, but other underlying economic factors can as well – and this is precisely what is happening.

3 Factors That Can Boost Commodities In 2017

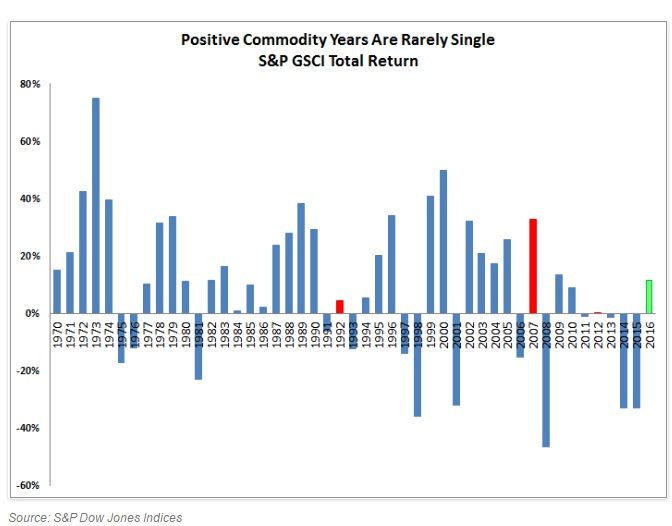

Posted on — Leave a commentThe commodity sector, as a whole, closed out its first positive year in 2016 since 2012. The good news for hard assets, including precious metals, is that positive years in commodities usually come in bunches.

Gazing into the crystal ball for 2017: Jodie Gunzberg, global head of commodities and real assets at S&P Dow Jones Indices, finds that the path upward could continue into 2017 and beyond.

She points to three key factors that could impact the commodity sector as a whole this year: inflation, a potentially weakening dollar and OPEC. Let’s take a look at each factor.

Trump and Inflation

Historically Republican presidencies are favorable for grains and gas which are key for rising inflation, Gunzberg says.

“Copper, lead and nickel have had their best performance with Republicans. That in itself does not promise growth since rising inflation from commodity prices can cause stagflation – but stagflation is less likely if Trump builds infrastructure and jobs growth which may propel GDP and help the metals.

“Also, industrial metals outperformed precious metals last month by the most in 26 years. This is considered extremely bullish,” Gunzberg says.

US Dollar

The US dollar has been on a tear –rising significantly in recent weeks, which in turn has pressured commodities including gold and silver. Precious metals are priced and sold in US dollars on the world marketplace and a rising dollar tends to depress the price of these and other commodities, as it makes them more expensive to foreign buyers.

Although the dollar theoretically should rally from rising interest rates, that relationship hasn’t held, Gunzberg says.

“So, even if rates rise more, there is a chance the dollar will revert after continually hitting new recent highs – that can lift commodities substantially. In fact, every single one of the 24 commodities we track rises from a falling dollar, especially industrial metals which can rise as much as 7% for every 1% the dollar falls.”

Watch OPEC

Crude oil prices are on an upward path. Since bottoming at around $26 per barrel in February 2016, crude oil climbed as high as $55 per barrel at the start of 2017.

Perhaps you’ve noticed higher gasoline prices at the pump? Get used to it. A significant impact of rising crude oil is higher inflation throughout the economy. Higher crude prices not only impact pump prices, but almost every good you buy from milk at the grocery store to that sweater at your favorite department store.

Why? Higher crude oil prices mean higher transportation costs for all goods in the economy, which usually are passed along to consumers.

OPEC’s decision to cut production in late 2016 has given a lift to the energy sector. In 2017, Gunzberg points to two factors to watch:

Whether all the participants follow through on the agreement.

How the U.S. producers respond.

Big Picture

Big Commodity Winners in 2016

Energy + 41.9%

Industrial metals +17.6%

These two sectors had their best years since 2007 and 2009, respectively Gunzberg says.

“The comeback in these two sectors is meaningful because they are the most economically sensitive, and the last time these two sectors were up this time together, they led commodities to return nearly 360% in the next eight years (1999-2007).”

Focus On Gold

Despite the sell-off in precious metals in the second half of 2016 –gold still closed out the year 2016 with an 8.5% gain.

Recent action: Since bottoming out at $1,2430 in mid-December, gold has gained 5.47%.

Do You Have An Investment Plan?

Gold prices are already starting to move higher. Is your portfolio properly diversified? Many investors are using the recent strength in stocks to book profits on the equity portion of their portfolios and use the proceeds to diversify into tangible assets. A Blanchard portfolio manager can help design an investment plan tailored to your personal goals. Call us at 1-800-880-4653.

Read More:

10 Coins That Gained More Than 100% In Value In 2016

Posted on — Leave a commentIt’s no secret that rare coins possess the ability to accrue in value more significantly than gold or silver bullion coins that are tied to the underlying price in the metals markets.

The price and value of bullion coins like the American Eagle and the Canadian Maple Leaf move closely with the price of spot gold, and can fluctuate daily.

That compares to the very limited supply of rare coins, which means demand for these assets can send prices skyrocketing at any time.

The Number One Gainer in 2016?

The 1964 Silver Kennedy Half-Dollar Today’s Price 12-Month Gain %

PCGS #6844 $13,500 285.7%

This data comes from the highly reputable Professional Coin Grading Service (PCGS). Prior to the mid-1980’s, dealers often graded coins. However, this created serious conflict of interest issues. The third-party grading services, like PCGS, were established to develop standards and practices that are now widely accepted. these organizations neither buy nor sell coins, so there are no conflicts of interest.

A Look Back

The number-two rare coin gainer in 2016 was the 1880 Morgan Silver Dollar, which jumped from $12,000 at the start of the year, to a $35,000 value by year’s end, for a 191.7% gain. The chart below, from the PCGS Price Guide, shows the complete list of the year’s top 10 coin gainers.

We Can Help You Find the Coins You Need

As 2017 starts fresh-now is the time to map out your rare coin acquisition wish list for the next 12 months. Metals prices have fallen in recent months, which has created a more affordable buying spot for coins.

Gold is one of the most negatively correlated assets to stocks-when stocks go down, gold prices go up. That is why we strongly recommend allocating up to 20% of your overall financial portfolio to precious metals and rare coins.

Breaking Down Your Investment Goals

Blanchard and Company recommends that investors allocate 30-40% of their total tangible asset investments to the rare coin sector-simply because that is where the most significant long-term price appreciation can occur.

For investors, looking to build long-term wealth–rare coins are an important diversification component and can provide opportunities for big price gains. We believe in the long term investment value of high end rare and ultra-rare coins.

Talk with your portfolio manager before you buy. High-grade coins typically outperform their lower-grade counterparts in terms of investment performance.

Work with the experts. We have hired the best numismatist in the country to personally purchase and curate every coin that we sell. Any coin that we sell has been reviewed and graded in advance, and we will buy back any rare coin that we have sold at any time, at the current market price. If we don’t have a coin that you are looking for in our inventory, we can help you locate and source coins from collections around the world.

It’s a New Year and a time to add those coins you’ve always wanted to own to your personal investment collection. Give us a call today at 866-764-9135. One of our portfolio managers would be happy to offer you insights on current trends in rare coins.

A Year in Review: Wild Ride for Global Markets in 2016

Posted on — Leave a commentThere’s no question that 2016 has been one of the most interesting and surprising years for every market across the globe. In US equity markets during the beginning of the year, January and February were home to some of the most consecutive violent selloffs and volatile trading days in history.

Major US indices plunged 10% in a matter of days, and this launched everybody’s favorite precious metal, gold, into a tremendous month long rally before it finally plateaued.

About five months later, in the early hours of June 24th, the United Kingdom voted in favor of withdrawing from the European Union which caused the British pound to suffer its worse intraday loss in history. Major US, European, and Asian stocks also suffered brutal beatings before US index futures temporally halted trading on the CME due to the relentless selloff.

Because an event like the UK leaving the EU (Brexit, as its colloquially called) has never happened before, volatility and gold saw some of their biggest rallies since the infamous collapse of Lehman Brothers in the midst of the 2008 financial crisis. After it was determined to be highly implausible for the UK to remain in the EU, gold rallied more than 8% while volatility spiked a whopping 70%.

Shortly after this Brexit induced selloff in global stocks and currencies, almost every large cap index fully recovered and made new highs within a matter of weeks; to many investors, this rally displayed the tremendous strength and resilience of an almost decade long bull market. Moreover, despite much of the fear rapidly draining out of the marketplace during the global equity rally, gold continued to make new yearly highs and stayed well above $1,300 until the beginning of October.

Markets around the world were fairly quiet until November 8th came around. Throughout the night of November 8th as votes slowly poured in to determine the next president of the United States, the main US stock index futures (S&P, Nasdaq, & Dow) began free-falling in unison before trading was eventually halted to stop the carnage; the similarities between Brexit and the US election are shocking.

Of course, investors flocked to gold for safety, and gold futures traded all the way up to $1,338, which was 20 dollars higher than the final closing price during Brexit. However, something very interesting happened in the middle of the miniature stock market crash that night. Sentiment completely changed when news broke that the famous billionaire activist investor Carl Icahn left a celebration party early to buy $1 billion in US stocks.

Like a volcano erupting from the ground, the S&P 500, Nasdaq 100, and Dow Jones futures all shot up with so much velocity that investors didn’t physically have enough time to cover their hedges and short positions. This 5% reversal in only a few hours was likely one of the biggest in recent history besides the flash crash in 2010. Needless to say, the rally in gold was short lived and the precious metal barely finished positive for the trading day. Additionally, in the fixed income market, the 30-Year US Treasury Bond futures plummeted as a result of the unexpected election outcome.

Since then, US stocks have enjoyed quite a healthy month-long rally with only a few negative days. As for the precious meals, gold and silver pared most of their event driven gains. For all of 2016, however, gold is still up around 9% which is an extremely decent year-to-date ROI.

Moving forward, many analysts and market pundits are completely unsure of what effect the new year and new president will have on markets. It is interesting to note, however, that in times of widespread uncertainty, like starting a new year with unprecedented political and economic forces, it pays (quite literally) to own risk averse assets like gold.

Investors! Take This Quick Quiz Now

Posted on — Leave a commentThere is a psychological phenomenon known as “Recency Bias.” Financial advisers have discovered that investors often fall prey to this tendency, where individuals remember most easily something that has recently happened as opposed to circumstances from awhile back.

How does this relate to investing and the markets? Investors sometimes have short memories.

Here’s a Quick Quiz: What do you remember most about the stock market in 2016?

The dramatic stock market plunge in January 2016 which saw the S&P 500 drop like a rock from the opening bell amid fears the Chinese economy could trigger a global recession?

A. The S&P 500 plunged from 2043 on Dec. 31, 2015 into the Feb low at 1810 a swift 11.40% decline in roughly six weeks

or

B. The rally to new all-time highs in the S&P 500 in December 2016

If you answered “B” you aren’t alone. For most investors the stock plunge 12 months ago is distant history.

Here’s another question: What do you remember most about the gold market in 2016?

A. The 29% rally in gold prices from January-July 2016

or

B. The post-presidential election sell-off in gold which tugged the market from a high at $1,341.00 per ounce on Nov. 9 to a low at $1,124.30 on December 15

Don’t fret. If you answered “B” you aren’t alone.

Investors easily remember the most recent history and sometimes erroneously make decisions about their portfolio based on that.

Solid Yearly Gains In Gold And Silver

Gold scored a solid 8.68% gain year-to-date through Dec. 30, while silver gained almost double that at up 16.04% on the year. It might not feel like that though since the markets have tumbled off their summer highs.

It is worth acknowledging the existence of the Recency Bias and more importantly using the information to make objective decisions about your portfolio.

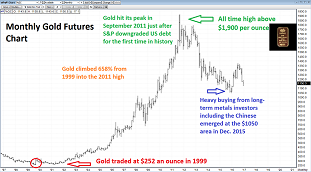

Gold: The Long-Term View

While nearby gold futures traded in a range from $1,055 -$1,387 per ounce in 2016 that is a far cry from where it traded in 2000 and 2011. Let’s take a look at Figure 1 below a monthly chart of nearby gold futures.

Gold is near levels where heavy physical buying emerged from long-term investors in 2015. That means metals could be approaching a good buying opportunity. Don’t get tripped up by the Recency Bias. Take the long-term view, especially when it comes to your investments.

2016: The Year Gold and Silver Bulls Roared Back

Posted on — Leave a commentDespite the pullback in gold and silver prices in the second half of 2016 both precious metals are still ringing up year-to-date gains for the year.

-Silver is the leader in 2016 scoring a 13.90% ytd gain

-Gold is closing out the year with a solid 6.75% increase

Precious metals investors may be disappointed by the price slide in the second half, but it is useful to take a look at the long-term view.

The significant rally which took gold from a low at $1,065 per ounce at the start of 2016 to a summer high just above $1,385 per ounce revealed a resurgence of long-term bullish investor in both gold and silver.

Gold had been declining from its all-time high above $1,900 per ounce (hit in September 2011) and 2016 was the year that broke the multi-year downtrend in the metals.

What Does This Mean For 2017?

Gold and silver are retreating to a long-term “value area” for buy-and-hold physical metals investors. The multitude of factors that woke up gold and silver bulls in 2016 largely remain intact and will provide a floor for the markets in 2017.

6 Factors That Will Support Metals Prices Ahead

-The Federal Reserve May Not Raise Rates As Much As The Market Expects

-Inflation Is Expected To Rear Its Ugly Head Next Year

-A Variety of Geopolitical Flash Points Are Heating Up

-A Number Of European Elections Could Leave The Stability and Future Of the EU In Question

-Negative Interest Rates Remain Intact in Europe and Japan

-Increased US Protectionism Policies Could Restrain American and Global Growth

2017 Growth May Under perform

Morningstar released its quarter-end insights report and projected an anemic 1.9% Gross Domestic Product pace in 2017. Has Wall Street overshot reality?

Don’t forget the current U.S. economic expansion phase began in June 2009 and is old at 73 months. That is well above the average 58.4 months of expansion seen during the 11 cycles since 1945, according to the National Bureau of Economic Research. It’s simply getting late in the cycle and markets will need to adjust in 2017.

As the year comes to a close, gold and silver have tumbled off their mid-year highs as stocks climb in what some say is another bout of irrational exuberance.

Investors should brace for a stock market correction in the first quarter of 2017. When those pullbacks in equity markets around the globe begin to unfoldthe rush toward silver and gold will begin anew.

The Standing Liberty Quarter: A Short-Lived Coin with Enduring Appeal

Posted on — Leave a comment The early twentieth century marked a sea change in American numismatics. Theodore Roosevelt spearheaded this effort, envisioning an American coinage that would rival the artistic qualities of ancient Greek coins. This resulted in such apexes of numismatic design as the gold Saint-Gaudens Double Eagle and the Indian Head Eagle.

The early twentieth century marked a sea change in American numismatics. Theodore Roosevelt spearheaded this effort, envisioning an American coinage that would rival the artistic qualities of ancient Greek coins. This resulted in such apexes of numismatic design as the gold Saint-Gaudens Double Eagle and the Indian Head Eagle.

By 1916, silver coins had become eligible for redesign and the Standing Liberty quarter was created. It succeeded the Barber quarter, which had been minted for 24 years and had suffered from poor public reception ever since its release.

A breath of fresh air for silver coin design, the Standing Liberty quarter was very nearly a stagnant continuation of the past. The first designs for the new quarter were submitted by Charles E. Barber (whose previous designs for the Mint had been in use for decades). The Commission of Fine Arts rejected his designs, however, and solicited designs from renowned sculptors Adolph Weinman, Hermon MacNeil, and Albin Polasek. MacNeil, who went on to design sculptures for the U.S. Supreme Court building, was selected to design the new quarter.

Aspects of the quarters design remain mysterious. The model for Liberty, for example, is unknown, but is rumored to have been Doris Doscher, who later became a silent film star. In 1972, newspapers reported that the model was actually Broadway actress Irene MacDowell and that her name had been withheld because her husband, who played tennis with MacNeil, disapproved.

MacNeil submitted two designs for the obverse. The first was a militaristic representation of Liberty, intended to show the world that America wanted peace but was prepared to fight (in World War I). The accepted design shows Liberty looking toward the viewers right, towards the war in Europe. Holding an olive branch, Liberty strides through an opening in a wall that is inscribed In God We Trust and bordered by 13 stars. She steps forward, as MacNeil said, in “the defense of peace as her ultimate goal.” Additional inscriptions are LIBERTY and the date.

The reverse shows an eagle in flight, with 13 stars to his left and right and below him. The reverse inscriptions are UNITED STATES OF AMERICA, E PLURIBUS UNUM, and QUARTER DOLLAR.

The quarter was struck from 1916-1930 at the Philadelphia Mint, except in 1922, when no quarters were struck. It was also less regularly produced at the Denver and San Francisco mints. The Mint produced the coin in 90% silver and 10% copper from 1916-1930 and followed it with the Washington Quarter, which is the quarter we still use today.

The quarter underwent several design changes throughout its minting history. In 1925, for example, the date was recessed into the design so that it wouldn’t wear off in circulation. An earlier change covered Liberty’s bare right breast with a chain-mail shirt not, allegedly, for reasons of modesty, but for reasons of symbolism. If Liberty was to vanquish her foes, she needed to do so fully protected, not artistically half-draped.

In 2016, the Mint released a commemorative edition of this historic coin proving that its enduring appeal has not waned. Blanchard is pleased to offer you a 1930 Standing Liberty Quarter in Mint State 67 condition with a Certified Acceptance Corporation seal. This coin has the additional distinction of being graded Full Head, a rare, valuable feature which denotes that 1) Liberty’s hairline is complete, 2) Liberty’s ear indentations are clear, and 3) the three leaves in Liberty’s hair are visible.

The Standing Liberty Quarter has been widely loved from its first appearance, and this coin will make an excellent addition to any investors American collection.

What are the risks in this overvalued stock market

Posted on — Leave a commentIn our latest economic report, we discussed overstretched valuations for U.S. stocks as an opportunity to take profits and purchase precious metals and collectible coins at reduced prices.

Were not the only firm noticing the risk of elevated valuations as stock market indexes continue to push higher. As one example, Cumberland Advisors, a registered adviser with $2.4 billion in assets under management, recently took profits from their equity positions and move the proceeds into cash. As firm chairman David Kotok wrote in a December 12 commentary: At best, stocks are fully priced. There is little margin for a stumble now.

Still, stocks continue to charge ahead into rarified air. Investor optimism is surging as the major equity indexes cross into record territory. Fund managers are moving sideline cash into stocks and raising equity allocations to two-year highs. This market rally is beginning to look like its running on emotional vapors.

Of course, stock prices alone cant tell you if the market is overvalued. Earnings matter in the equation too. The S&P 500s current price-to-earnings ratio of around 25 reflects the recent run-up in stock prices, although corporate earnings rebounded as well in the 3rd Quarter.

Yale economics professor Robert Shiller developed a different approach for calculating the P/E ratio, using a long-term moving average for earnings adjusted for inflation (rather than the 12-month trailing or forward earnings used in the basic P/E ratio.) Shillers cyclically adjusted price-to-earnings ratio, or CAPE ratio, is not a perfect tool and shouldn’t be used to predict future market returns. It can, however, be helpful for setting expectations when considered with other barometers of market valuation. (Here’s more about CAPE from the source and a discussion the ratios shortcomings.)

As of this writing, the CAPE for the S&P 500 Index sits around 28. That’s as high as its been since the bear market of 2000-2002. For a long-term perspective, the CAPE ratio average, going back to 1926, is 17.

Ben Carlson of Ritholtz Wealth Management recently analyzed CAPE at different ranges, looking at the annualized S&P 500 returns over the ensuing three-, five- and ten-year periods. When CAPE has been above 25, the S&P 500 has under-performed in the intermediate- and long-term. The best returns, on the other hand, have come when CAPE is at least below 15.

But average annualized returns don’t tell the whole story. Just because one gauge shows an overvalued market now doesn’t mean its due for a correction soon. Consider the range of returns when CAPE has been over 25: annualized returns over the next three years have been as high as 29%. But they’ve also been down as much as -42%.

Here’s another way to look at it; the lowest highs and the lowest lows for the S&P 500 Index have occurred when stocks have been at the highest valuation level (using CAPE as the barometer).

Here’s the takeaway for investors on looking at these valuation gauges: The stock market bulls may continue to run, even with valuations at their current nosebleed levels. If that’s the case, strong equity performance will likely come at the expense of gold and precious metals values.

But as long as the P/E readings stay elevated, the risk of stock market downturn remains high. And that downturn, if and when it happens, has the potential to be significant.

Such a reversal in momentum will likely swing investor sentiment back toward gold and other precious metals and tangible assets. That’s why we believe investors who maintain their gold allocations or even better, can add to them in this recent spell of price declines are positioned well for the current high-risk investment climate.

6 Things You Can Do Now To Maximize Your Wealth In 2017

Posted on — Leave a commentWhen it comes to building wealth, one of the most important factors in achieving that goal is setting a plan. Millionaires usually don’t just strike it rich through the purchases of a lottery ticket, it generally take hard work, following a plan and a proper investment diversification strategy.

Here is a checklist of 6 items you can do now to help make 2017 your best financial year ever.

#1. Pay Yourself First

When it comes to building wealth, you have to pay yourself first. Can you save 20-25% of your net take-home pay? Strive for that goal in 2017. Even if you just notch up the savings by 1% that can make a significant difference over a 20-year period.

#2. Define Specific Financial Goals And Set Dollar Amounts

Studies show that investors who set out specific financial goals are more apt to actually reach their goals. Whether your financial goals include, saving for retirement, stashing cash for your kid’s college education or wedding, buying a vacation home or an exotic vacation be specific and write them down.

Instead of just “saving for retirement,” define your actual goals. Example: “Retire by the time I’m 62, with $1.5 million in savings and live on a beach.” Attaching a dollar amount, and a time horizon to the goal can help you develop a plan to actually meet that goal.

#3. Get Professional Advice

You wouldn’t attempt to do surgery on yourself, you’d find the best surgeon available. Financial planning can be complicated. Smart investors lean on professionals who follow the markets every day for advice and counsel. At Blanchard and Company, we work with our clients for the long-term, building relationships that last decades. Each client is assigned to a portfolio manager who takes the time to listen and understand your long-term investment goals, your time horizon and risk tolerance. Relationships matter at Blanchard.

#4. Rebalance Your Portfolio At Least Once a Year

Many investors often forget to rebalance their asset allocations at least once a year. Here’s what that means. Let’s say an investor has a 60% allocation to equities, a 30% allocation to bonds and a 10% allocation to physical tangible assets like gold and silver bullion. The recent rally in the stock market likely means that your equity allocation now exceeds the 60% level and your portfolio may be exposed to more risk than you intended.

Take the time now to examine your current holdings and make adjustments to ensure that your portfolio still matches your target percentage allocations. Within your tangible assets allocation we have identified an asset allocation strategy that offers the best performance after five years. That includes exposure to numismatic rarities, mint state gold and bullion and investment grade gold. Learn more here.

#5 Make a Commitment to Stay Educated

Smart investors stay informed. Economic and financial market expectations have shifted dramatically over the past month. Many on Wall Street are now pricing in forecasts for faster economic growth and higher levels of inflation. However, there remains a great deal of uncertainty as to what types of proposals the new Administration will be able to enact and what their impact could be on the markets. At Blanchard, we offer high-quality market commentary, forecast and outlook several times a week on our website. Bookmark this page or sign up via our email newsletter to follow the analysis.

#6 Max Out Your Retirement Contributions Consider A Gold IRA

Did you get a year-end bonus? Instead of spending that on a trip to Hawaii or a new kitchen remodel funnel at least a portion of it into your retirement account. Fully fund your retirement accounts if possible. The experts say the number one thing you can do to improve your chances of meeting your goals is to increase your savings rate, and let the power of compound interest and time work in your favor. Individuals can contribution up to $18,000 to your 401k, or $24,000 if you’re over age 50, in 2016.

IRAs are easy with Blanchard: Many clients who are concerned about the purchasing power of their retirement funds choose to open up a Gold IRA. The IRS does allow individual investors to own certain gold and silver coins in an IRA account. Blanchard and Company is proud to offer a precious metals IRA option of its own. Visit our IRA page here, where you;ll find a brief one-minute YouTube video outlining the procedure of establishing the account.

Its an easy 3-step process: 1) Verify or create your IRA; 2) purchase bullion; and 3) deposit the bullion with your custodian.

Following these simple steps can help you on your journey to achieve your goals. Best wishes to you and your family during this holiday season.