Carson City Mint: Nevada’s Legendary Source of America’s Most Coveted Coins

Posted on — Leave a commentThe Carson City Mint operated for only 16 years of actual coin production. Yet, despite its brief existence, a “CC” mintmark can command premiums ranging from modest to extreme compared to identical coins from Philadelphia or San Francisco. Established in 1870 to process Nevada’s Comstock Lode deposits, the mint’s limited production and sporadic closures created inherent scarcity. Today, collectors worldwide pursue CC-marked coins for their combination of genuine rarity, Western frontier history, and enduring numismatic appeal.

Carson City Mint History and Operations

Although the Carson City Mint existed for over two decades, it produced coins in only 16 calendar years, creating the scarcity that defines CC-marked pieces today.

Establishment and Purpose

The Comstock Lode Discovery

In 1859, prospectors discovered massive silver and gold deposits beneath Virginia City, Nevada – a strike that became known as the Comstock Lode. The deposit proved to be one of the richest precious metal finds in American history. Over the following decades, Comstock mines extracted hundreds of millions of dollars in silver and gold bullion. This massive production created a logistical crisis. Miners were largely forced to transport their precious metals 150 miles west to the San Francisco Mint for conversion into U.S. coinage. The overland route exposed shipments to significant security risks, including robbery. Transportation costs cut directly into mining profits. As Comstock output surged through the 1860s, Nevada’s mining interests demanded a local minting facility.

Image: Comstock Lode mining operations in Virginia City, Nevada

Source: Western Mining History

Federal Response and Construction

Congress authorized a Carson City mint in 1863 to address the transportation crisis and process Nevada’s silver and gold locally. The authorization came quickly, but construction moved slowly. The building wasn’t completed until 1869 and the facility finally began coining operations on February 11, 1870. Nevada miners could now deliver Comstock bullion directly to Carson City for conversion into U.S. coinage, eliminating the dangerous 150-mile overland route to San Francisco and its associated costs.

Watch this demonstration of the original coin press in operation to see the 150-year-old machinery that struck these historic Carson City Mint coins.

Carson City Mint Years of Operation

First Production Period (1870-1885)

The Carson City Mint produced coins from 1870 through 1885. During these 16 years, the facility struck Morgan dollars, gold eagles, double eagles, and various smaller denominations. However, Comstock ore production peaked in the mid-1870s and began declining steadily afterward. By the mid-1880s, the lode’s output had fallen dramatically from its earlier levels. The reduced bullion flow made the mint’s operational costs increasingly difficult to justify. Political opposition to silver coinage added budgetary pressure. In 1886, the facility closed temporarily as Congress and Treasury officials debated its future. The mint remained shuttered through 1888 while Comstock production continued its decline.

Reopening and Final Closure (1889-1893)

Western silver interests pushed for renewed coinage as Comstock production showed brief signs of recovery in the late 1880s. Congress passed the Sherman Silver Purchase Act in 1890, requiring the federal government to purchase 4.5 million ounces of silver monthly, much of it destined for coinage. This legislative mandate created renewed demand for minting capacity. The Carson City Mint reopened in 1889 and struck coins through 1893. However, the arrangement proved short-lived. The Panic of 1893 triggered a severe economic depression. Silver prices collapsed as the government struggled with currency instability. Combined with the Comstock Lode’s depleted deposits, these economic pressures forced permanent closure in November 1893. The facility never reopened for coinage production.

The Carson City Mint Mark and Its Significance

The ‘CC’ mintmark denotes Carson City origin, and familiarity with its physical characteristics and authentication is essential for collectors.

Physical Characteristics and Variations

Carson City Mint coins carry their “CC” mintmark on the reverse, positioned below the eagle on Morgan dollars and on the reverse of Carson City gold denominations. The two letters appear in bold, easily identifiable style compared to the smaller mintmarks used by other facilities. However, the CC punch itself varied across different years of production. Die engravers used different punches and occasionally repunched mintmarks, creating subtle varieties that specialists actively pursue.

This variation also matters for authentication purposes. The Carson City Mint mark became one of the most frequently counterfeited identifiers in U.S. numismatics. Forgers routinely add fake CC marks to common Philadelphia coins, exploiting the substantial premium difference. Third-party grading through services like PCGS and NGC provides the most reliable authentication for valuable pieces.

Why Collectors Pursue Carson City Mint coins

Collectors pursue Carson City coins because their genuine scarcity drives numismatic value. The facility’s limited production created low mintages across most dates and denominations compared to Philadelphia, San Francisco, or New Orleans. This scarcity intensified when the 1918 Pittman Act authorized melting millions of silver dollars to support World War I financing. Carson City issues stored in Treasury vaults faced disproportionate destruction, permanently removing countless coins from circulation.

The Western frontier mystique adds appeal beyond pure rarity. Carson City Mint coins represent Nevada’s silver boom era, connecting collectors to the rough mining camps and instant fortunes that defined 1870s expansion. Owning a CC-marked piece provides tangible connection to Comstock Lode history and Wild West mythology that San Francisco or Philadelphia coins cannot match.

The challenge of assembling complete collections further drives demand. The mint’s sporadic 1870-1893 operation created permanent gaps in date runs. The 1886-1888 closure means certain years simply don’t exist with CC mintmarks. Collectors accept these limitations while competing for available dates across grade levels and auction appearances, knowing that completion requires both significant capital and years of patient pursuit.

Carson City Morgan Dollars

Morgan dollars represent the most actively collected Carson City denomination, with availability ranging from accessible to prohibitively expensive. Learn more about building a Carson City Mint Morgan dollar collection here.

Image: 1893-CC Morgan dollar obverse and reverse

Source: PCGS

Production Years and Key Dates

The Carson City Mint struck Morgan dollars from 1878 through 1885, covering the design’s inaugural years through the facility’s initial closure, then resumed operations for five final dates from 1889 to 1893. Production and survival rates varied dramatically across these 13 dates. The 1879-CC, 1889-CC, 1892-CC, and 1893-CC emerged as the lowest-mintage and lowest-surviving issues, commanding the highest premiums in today’s market.

Carson City Mint coins value varies widely by date and condition, with common issues such as 1882-CC, 1883-CC, and 1884-CC offering accessible entry points, while key dates and high-grade or DMPL examples command substantial multiples even within the same year.

GSA Hoard Impact

For decades, millions of Carson City Morgan dollars sat uncirculated in Treasury Department vaults. The government had stored these coins after their original minting, never releasing them into circulation. In the 1970s-1980s, the General Services Administration (GSA) sold these long-stored Carson City Morgans directly to collectors in their original government packaging. The GSA sales fundamentally altered the Carson City Morgan market. Certain dates flooded the collector market as thousands of specimens became available overnight. Other dates remained scarce because few examples existed in the Treasury holdings. Today, Carson City Mint coins retaining their original GSA holders command additional premium value, particularly for dates that weren’t heavily represented in the government sales. The GSA provenance provides both authentication and historical connection to these Treasury-stored pieces.

Carson City Gold Coinage

Carson City Mint gold coins represent the ultimate challenge for advanced collectors, with scarcity levels far exceeding even the rarest Morgan dollars.

Double Eagles ($20 Gold)

The Carson City Mint struck $20 gold pieces intermittently between 1870 and 1893, with production occurring during select years rather than continuously. All CC double eagles carry notable scarcity premiums, with most becoming extremely rare in high grades. The facility used the Liberty Head design throughout its entire production run, providing consistency across dates. These coins offer dual value: intrinsic gold content combined with substantial numismatic premiums that far exceed their bullion worth.

Image: 1891-CC Liberty Head Double Eagle obverse and reverse

Source: PCGS

Discover the rarest gold Carson City Mint coins here.

Eagles ($10 Gold)

Carson City $10 gold eagles generally saw lower production than double eagles, intensifying their scarcity. The 1870-CC, 1873-CC, and 1879-CC rank among the ultimate Carson City rarities across all denominations, with extremely limited surviving populations, particularly in higher grades. Institutional collectors and wealthy numismatists drive market demand, often pushing prices well into five- and six-figure territory.

Half Eagles and Quarter Eagles

The $5 half eagles and $2.50 quarter eagles represent Carson City’s smallest and rarest gold denominations. Production remained extremely limited across all dates. Many issues remain exceptionally difficult to acquire, even for well-funded collectors. Wealthy collectors compete intensely through registry set programs, bidding aggressively on the finest known examples whenever they appear at major auctions.

Other Carson City Denominations

Beyond Morgan dollars and gold coinage, the Carson City Mint produced silver denominations and rarities that attract specialized collectors.

Silver Coins Beyond Morgan Dollars

Trade Dollars (1873-1878)

The Carson City Mint struck Trade Dollars from 1873 through 1878, creating coins specifically designed for Asian export commerce during the period when Morgan dollars hadn’t yet begun production. These heavy silver pieces carry their own collector following, with CC-marked Trade Dollars commanding substantial premiums across most dates.

Seated Liberty Coinage

The facility also produced Seated Liberty denominations including quarters, half dollars, and dimes in limited quantities during portions of its operational years. Production numbers varied dramatically across dates and denominations. Some Seated Liberty issues rank among the rarest American coins, with surviving populations sometimes measured in dozens rather than hundreds. Others remain relatively accessible for collectors building type sets that include one CC-marked example from each denomination the mint produced.

Patterns and Rarities

Image: 1876-CC Seated Liberty dime die trial pattern obverse and reverse

Source: PCGS

Carson City occasionally struck experimental pieces that never entered regular production. Prooflike and specially struck pieces exist for certain dates despite the facility’s focus on circulation coinage. Pattern coins showing proposed designs or experimental compositions sometimes emerged from the mint.

Mint errors and die varieties add another collecting dimension. Repunched mintmarks, doubled dies, and other production anomalies create specialized varieties that command premiums beyond standard issues.

Transitional pieces struck during design changeovers carry particular interest, representing moments when the mint shifted from one coin type to another while retaining the distinctive CC mintmark.

Valuing and Collecting Carson City Mint Coins

Successful Carson City collecting requires authentication knowledge, strategic planning, and understanding market dynamics.

Authentication Essentials

Counterfeiters routinely add fake CC mintmarks to common Philadelphia coins, exploiting the substantial premium difference between mintmarks. Third-party grading through PCGS and NGC provides essential authentication for valuable pieces, with certification particularly important as values increase. Collectors should verify weight and specifications match government standards, as many counterfeits fail basic measurement tests. Learning authentic die characteristics for Carson City Mint coins helps identify genuine pieces: each year’s dies carried distinctive markers that forgers struggle to replicate accurately.

Building a Collection

Budget-conscious collectors can start with common-date CC Morgans in circulated grades, gaining Carson City exposure without five-figure commitments. Type set goals, i.e. acquiring one example from each Carson City denomination, offer achievable completion for most collectors. Date completion presents greater challenges, particularly for Morgan dollar runs requiring 13 different CC pieces spanning 1878-1893. Collectors face the fundamental quality versus quantity decision: fewer coins in higher grades or complete low-grade sets. High-grade examples tend to retain value more consistently but require significant capital concentration. Carson City coins fit within broader precious metals and numismatic investment strategies. Explore Blanchard’s asset options page to understand how CC pieces complement other tangible investments.

Market Timing and Acquisition

Working with specialists in Carson City coinage provides access to properly authenticated pieces and market knowledge. Major numismatic auctions feature CC rarities regularly, offering opportunities to acquire scarce dates that rarely appear in dealer inventory. Carson City premiums fluctuate with precious metal markets, though numismatic value typically exceeds bullion swings. Maintaining provenance records for significant pieces preserves historical documentation and can enhance future resale value when collections eventually change hands.

The Carson City Mint Museum Today

Today, the former Carson City Mint operates as the Nevada State Museum, preserving the historic facility and its original minting equipment. Visitors can view exhibits documenting the Comstock Lode era and Carson City coinage, and observe a functioning historic coin press producing commemorative medallions. The museum’s preservation efforts ensure this chapter of American numismatic history remains accessible to collectors and historians alike.

Image: Carson City Mint building exterior

Source: Visit Carson City

Conclusion

The Carson City Mint operated for just 16 years of actual coin production between 1870 and 1893, producing limited quantities of Morgan dollars, gold coins, and other denominations that transformed ordinary U.S. coinage into premium collectibles. Low mintages, reduced survival rates from melting programs, and Western frontier mystique combine to create genuine scarcity. Carson City pieces offer tangible connections to Nevada’s silver boom while commanding numismatic premiums ranging from modest premiums to substantial multiples depending on date, denomination, and condition. Explore Blanchard’s selection of rare coins, including authenticated Carson City coins, to add legendary products to your numismatic holdings.

FAQs

1. When did the Carson City Mint close?

The Carson City Mint closed permanently in November 1893 after operating intermittently for coin production from 1870.

2. What years did Carson City mint Morgan dollars?

Carson City produced Morgan dollars from 1878 through 1885, then resumed for a final run from 1889 to 1893, creating a total of 13 different dates.

3. Why did the Carson City Mint close?

The Panic of 1893 combined with depleted Comstock Lode deposits and economic instability forced permanent closure as silver production became insufficient to justify continued operations.

4. What coins did Carson City mint?

The facility produced Morgan dollars, gold denominations ($2.50, $5, $10, and $20), Trade Dollars, and Seated Liberty silver coins including dimes, quarters, and half dollars.

5. How much are Carson City Mint coins worth?

Carson City Mint coins value ranges from modest premiums for common-date circulated Morgans to substantial multiples for rare dates and high-grade examples, depending on denomination, date, and condition.

Swiss 20 Franc Gold Coins: Helvetia and Vreneli Fractional Gold Excellence

Posted on — Leave a commentFor investors seeking fractional gold without paying excessive premiums, Swiss 20 francs stand out as one of the most efficient options available. Each Swiss 20 franc gold coin contains 0.1867 troy ounces of pure gold and typically trades at just 3-5% over melt value, among the lowest premiums for fractional gold coins globally. That pricing efficiency stems from Switzerland’s participation in the Latin Monetary Union gold standard, which imposed uniform specifications on gold coinage across member nations. Understanding how this system shaped Swiss 20 franc issues helps explain their enduring liquidity, low premiums, and continued relevance for modern investors. This guide examines the Helvetia and Vreneli designs, their technical specifications, and practical considerations for acquiring these coins.

For readers who prefer a visual overview, this short video offers a clear look at a classic Swiss 20 franc gold coin, including its design details, specifications, and historical context within the Latin Monetary Union.

The Latin Monetary Union and Swiss Gold

Switzerland’s participation in the Latin Monetary Union established the foundation for its iconic 20 franc gold coins. Formed by treaty in 1865, the union introduced standardized gold and silver coinage across member nations, shaping Swiss fractional gold production for several decades under a unified European gold standard.

Switzerland’s Monetary Union Participation

In 1865, Switzerland joined France, Belgium, Italy, and Greece in forming the Latin Monetary Union, a monetary agreement designed to harmonize coinage specifications across participating countries. Coins of equivalent denominations were required to share identical weight, fineness, and precious metal content, allowing them to circulate freely throughout union territories.

This standardization produced immediate practical benefits. A Swiss 20 franc gold coin matched its French, Belgian, or Italian counterpart exactly, enabling merchants across Western Europe to accept these coins interchangeably. International trade became more efficient when gold coins from different nations carried guaranteed and identical gold content.

Gold Standard Implementation

Under the union’s rules, 20 franc gold coins were struck in .900 fine gold with a total weight of 6.45 grams, yielding a pure gold content of 0.1867 troy ounces. These specifications were deliberately chosen to balance durability for circulation with meaningful gold value, creating a practical fractional denomination for commerce.

Swiss mints adhered strictly to these standards. The Swiss 20 franc gold coin weight of 6.45 grams matched French 20 franc pieces precisely, while the .900 fineness ensured coins could withstand years of handling without excessive wear. This combination produced a widely recognized, standardized form of fractional gold – one that continues to appeal to modern investors seeking liquidity, consistency, and low-premium gold ownership.

Helvetia 20 Swiss Franc Gold Coin (1883-1896)

The Helvetia series represents Switzerland’s first contribution to Latin Monetary Union gold coinage. Produced at the Bern Mint from 1883 through 1896, these coins established a distinctly Swiss aesthetic within the standardized 20 franc format.

Image: Swiss Helvetia 20 franc gold coin obverse

Source: Numista

Design and Symbolism

Designed by Albert Walch and engraved by Karl Schwenzer, the 20 franc Swiss Helvetia gold coin features the head of Helvetia, Switzerland’s classical female national personification, facing left with her hair tied with a ribbon and wearing a diadem inscribed “LIBERTAS” and oak wreath. The obverse bears the legend CONFOEDERATIO HELVETICA. The reverse displays the Swiss coat of arms surrounded by a laurel wreath, with a five-pointed star above.

The design exhibits restrained elegance compared to the more ornate French 20 franc pieces of the same era. This aesthetic choice reflected Swiss cultural values: precision, clarity, and understated dignity. The Helvetia 20 franc created immediately recognizable Swiss gold coins that were widely accepted across Europe while maintaining the practical, standardized specifications required by the Latin Monetary Union.

Production Details

The Bern Mint struck the Helvetia 20 franc Swiss gold coin from 1883 through 1896, producing substantial quantities that ensure modern availability. Some years saw larger mintages than others, creating date variations that affect collector premiums, though most Helvetias trade primarily as bullion.

These coins survive in conditions ranging from heavily circulated to occasional Mint State pieces. The circulated examples typically carry minimal premiums over gold content, making them attractive to investors prioritizing cost efficiency over numismatic grade.

Vreneli 20 Swiss Franc Gold Coin (1897-1949)

The Vreneli series succeeded the Helvetia design in 1897, introducing a more personal and accessible aesthetic to Swiss gold coinage. This design would become Switzerland’s most recognizable gold coin, remaining in production, including postwar restrikes, for more than five decades.

Image: Swiss Vreneli 20 franc gold coin obverse

Source: Numista

Design Evolution

Fritz Ulysse Landry created the Swiss 20 franc Vreneli gold coin with notably different imagery from the earlier Helvetia series. The obverse features a profile portrait of a young Swiss Alpine girl, earning the affectionate nickname “Little Verena” or Vreneli in Swiss German. This feminine portrait replaced the formal standing Helvetia with a more relatable, human representation of Switzerland. The reverse maintained consistency with Swiss iconography, displaying the Swiss shield surrounded by oak leaves and Alpine roses. This combination of botanical elements reinforced Switzerland’s natural heritage while preserving the dignified simplicity characteristic of Swiss coinage. The Vreneli’s approachable design appealed to both investors and collectors, contributing to its enduring popularity.

Extended Production Run

The Bern Mint struck Vrenelis regularly from 1897 through 1935, producing tens of millions of pieces across nearly four decades. This massive mintage created the abundant modern supply that keeps premiums minimal today. Production ceased in the mid-1930s as Switzerland moved away from circulating gold coinage amid changing monetary policies and global economic disruption. Minting resumed briefly in 1947 and 1949 with restrikes using earlier dates, primarily to meet postwar gold demand rather than for circulation, which has led to some confusion about actual production years. Most Vreneli dates remain readily available at premiums barely above Swiss 20 franc gold coin melt value, making them among the most cost-efficient fractional gold coins for investors seeking widely recognized European gold.

Why the 20 Swiss Franc Coin Offers Value

Swiss 20 franc gold coins occupy a distinctive position in the fractional gold market, combining low acquisition costs with high recognition and liquidity. Their appeal is not driven by rarity or speculative premiums, but by structural factors that consistently favor investors seeking efficient gold exposure.

Low Premium Structure

One of the primary reasons Swiss gold francs remain attractive is their persistently low premium structure. Millions of coins were struck and survive today, creating a deep and competitive secondary market that keeps dealer markups modest. Unlike limited-issue bullion or modern fractional products, Swiss francs are widely treated as near-bullion items, with pricing closely tied to current gold spot prices rather than collector demand. This abundance allows investors to access fractional gold with minimal overhead, making Swiss francs among the most cost-efficient historical gold coins available. Their broad market recognition also supports strong liquidity, enabling straightforward resale through dealers, auctions, and private transactions.

Swiss Reputation Benefits

Beyond pricing, Swiss gold benefits from the country’s long-standing reputation for political neutrality, financial stability, and precision manufacturing – factors that have driven affluent investors to significantly increase their gold allocations in recent years. Gold coins produced by the Bern Mint reflect Switzerland’s emphasis on consistent standards and quality control, reinforcing confidence in authenticity and specifications. The association with Swiss banking traditions and conservative financial practices adds an intangible but meaningful layer of trust, particularly for investors who value credibility and long-term reliability in precious metals. The “Swiss” designation itself carries weight in global bullion markets, contributing to steady demand even during periods of market volatility.

Practical Fractional Gold Ownership

Swiss 20 franc coins also offer practical advantages inherent to fractional gold. Their smaller size allows for incremental accumulation and flexible liquidation, making them well suited to investors who prefer not to transact exclusively in full-ounce quantities. The compact format is efficient for storage and transport relative to gold content, while decades of international acceptance reinforce their role as a recognized monetary asset rather than a niche collectible. Together, these factors make Swiss gold francs a practical choice for investors seeking gold exposure through liquid, affordable fractional pieces with long-term consistency.

Other Swiss Gold Denominations

While the 20 franc gold coin remains the most widely traded Swiss gold issue, Switzerland has produced additional gold denominations that may appeal to investors and collectors depending on objectives, availability, and premium tolerance.

The 10 Swiss Franc Coin

Swiss 10 franc gold coins represent the half-size equivalent of the 20 franc denomination, containing 0.0933 troy ounces of pure gold. These coins were issued in both Helvetia and Vreneli designs, closely mirroring the imagery and specifications of their larger counterparts. Due to smaller mintages, 10 franc pieces are noticeably less common on the market than 20 franc coins. While they offer the same standardized gold content on a proportional basis, 10 franc coins typically carry higher percentage premiums. This is largely driven by lower availability rather than increased demand, making them less efficient for investors focused strictly on gold weight per dollar. Swiss 10 franc gold coin value therefore tends to reflect both gold content and a collectibility premium. As a result, 10 franc coins are often favored by collectors or investors prioritizing smaller denominations over premium efficiency.

Image: Swiss 10 franc gold coin obverse and reverse

Source: PCGS

Larger Swiss Franc Coin Gold Issues

Switzerland has also issued 100 franc gold coins, primarily as commemorative pieces rather than circulating currency. These higher face value coins were struck in more limited quantities and are generally priced with a stronger numismatic component compared to standard bullion-oriented issues. In the modern era, Switzerland has produced contemporary gold bullion and commemorative programs, often aimed at collectors rather than investors seeking low premiums. These include special editions and themed releases that may command higher premiums due to design, packaging, or limited mintages. While these larger or modern Swiss gold coins offer historical or collectible appeal, they typically lack the cost efficiency and liquidity that define the classic Swiss 20 franc gold coin.

Image: Swiss 100 franc gold coin reverse

Source: Numista

Swiss Silver Franc Coinage

While Switzerland is best known for its gold francs, silver franc coinage played an important complementary role within the country’s monetary system and remains of interest primarily to collectors today.

The Swiss 5 Franc Coin

Swiss 5 franc silver coins were struck in substantial size and weight, serving as the backbone of Switzerland’s historic silver currency. These coins appeared in a variety of designs, including standard circulating types as well as commemorative issues tied to shooting festivals, anniversaries, and national themes. Although they contain meaningful silver content, market value is often driven more by numismatic interest than by melt value. Common dates remain accessible, while scarcer issues and well-preserved examples can command significant premiums.

Image: Swiss 5 franc shooting thaler obverse and reverse

Source: PCGS

Smaller Silver Denominations

Smaller denominations, such as 2 franc silver coins, circulated widely and functioned as everyday currency. Earlier 1 franc and sub-franc issues were also struck in silver, though later versions transitioned to base metals as monetary standards evolved. In the modern era, Switzerland has issued an extensive range of commemorative silver francs, primarily aimed at collectors rather than bullion investors.

Investing in Swiss Gold Francs

Swiss 20 franc gold coins are widely used by investors seeking low-premium fractional gold, but realizing their full value depends on disciplined acquisition, basic authentication, and appropriate storage. Approached correctly, Swiss francs offer a straightforward, liquid form of historical bullion ownership.

Acquisition Strategies

Dealer Selection and Pricing Discipline

Most investors acquire Swiss gold francs through established precious metals dealers rather than private transactions. Reputable dealers provide transparent pricing, verified authenticity, and clear buyback policies, reducing counterparty risk. Because Swiss francs trade close to melt value, pricing differences between dealers are usually modest, making it worthwhile to compare premiums before purchasing.

Date and Condition Selection

From an investment perspective, common dates are generally preferred, as they carry little to no numismatic premium. Accepting circulated examples often maximizes gold-per-dollar efficiency, since light wear has minimal impact on bullion value. Investors focused on cost efficiency typically avoid scarce dates or high-grade pieces unless collecting is a secondary objective.

Authentication Considerations

Weight, Dimensions, and Gold Content

An authentic Swiss 20 franc gold coin adheres closely to the 6.45-gram standard, making precise weight measurement an effective first check against counterfeits. Diameter and thickness consistency provide additional confirmation. Non-destructive testing methods can be used to verify the expected .900 fineness without damaging the coin.

Visual and Market Awareness

Genuine Swiss francs display consistent strike quality and design characteristics associated with Bern Mint production. While large-scale counterfeiting is uncommon, familiarity with normal appearance and market pricing helps investors identify anomalies before purchase.

Storage and Handling

Proper storage preserves condition and resale value. Individual holders or capsules help prevent unnecessary wear, while tube storage is practical for investors holding multiple coins. Maintaining purchase records and organized storage supports insurance coverage and ensures coins remain accessible when partial or full liquidation is required.

Conclusion

Swiss 20 franc Helvetia and Vreneli gold coins combine low acquisition costs with exceptional recognition and liquidity, reflecting Switzerland’s long-standing reputation for quality and monetary stability. Produced under standardized conditions and struck in large quantities, these historic European gold coins remain widely available and consistently efficient for investors. Their practical size, reliable market acceptance, and minimal premium structure make Swiss gold francs a strong option for those seeking cost-effective fractional gold ownership. Explore Blanchard’s World Gold inventory to add Swiss gold francs to your precious metals portfolio.

FAQs

How much is a 20 Swiss franc gold coin worth?

Swiss 20 franc gold coin value generally tracks the price of gold, with the coins often trading close to their intrinsic gold value due to strong supply and liquidity.

What is the gold content of Swiss 20 franc coins?

Swiss 20 franc gold coins contain 0.1867 troy ounces of pure gold, struck in .900 fine gold under the standards of the Latin Monetary Union.

What’s the difference between Helvetia and Vreneli gold coins?

The difference between these coins is primarily in design and era of production, with Helvetia representing earlier issues and Vreneli later ones, while gold content and specifications remain the same.

Are Swiss gold francs a good investment?

Swiss gold francs are commonly favored by investors seeking low-premium, widely recognized fractional gold with strong liquidity and long-term market acceptance.

Fed holds steady: Gold and silver shine brighter than ever

Posted on — Leave a commentFederal Reserve Holds Interest Rates Steady

As expected, the Federal Reserve held interest rates steady at Wednesday’s meeting, as the dynamic rush into the safety of precious metals continues this week. Fed policymakers are grappling with above-target inflation and a weakening labor market, and decided to shift into a holding pattern on monetary policy after three interest rate cuts in 2025. The official Fed Funds rate remains at 3.50-3.75%.

Historic Run In Precious Metals Picks Up Speed

Gold raced to a new record high above $5,300 on Wednesday as the U.S. dollar – the world’s premier reserve currency – plunged to a four-year low. Silver set a new record above $115 this week.

Precious metals are in the midst of a spectacular uptrend, driven by political and military risks, macroeconomic uncertainty, a move away from U.S. assets, including the dollar and treasuries, and by investors hedging against stock market risk. These are long-term structural portfolio shifts that are driving metals higher.

Investor Flight From Treasuries Into Bullion

In today’s super-charged geopolitical environment, with Venezuela in the headlines one day, then Greenland, then Iran, gold has become the insurance policy that everyone wants to have. As the U.S. government drowns in debt, a structural shift in investment demand began last year. The U.S. dollar is weakening as some major investors begin to question the safety and reliability of assets like Treasuries and are switching to bullion, with strong precious metals demand coming from sovereign wealth funds and institutional investors.

What’s Next For Precious Metals

Gold is seen running further after topping $5,300 for the first time in history this week. Most analysts expect the record-setting run in gold to continue toward $6,000 this year, fueled by growing global tensions, relentless central bank demand, and strong demand from institutional and retail investors.

A meaningful end to the precious metal’s uptrend would require a dramatic shift to a more stable global geopolitical and economic environment, which isn’t in the forecast any time soon. So, what lies ahead?

The London Bullion Market Association’s annual precious metals forecast survey shows analysts projecting gold rising as high as $7,150 and averaging $4,742 in 2026.

Goldman Sachs raised its December 2026 gold price forecast to $5,400 from $4,900.

Bank of America says gold could reach $6,000 by mid-2026.

Looking at silver, Bank of America notes that current gold-silver ratio readings suggest silver can still outperform gold, with a first target at $135 an ounce.

Now Is Not the Time to Stand on the Sidelines

Current market conditions present a strategically sound opportunity to enhance your allocation to gold and silver. In a fast-evolving global landscape, precious metals remain one of the few assets with the proven ability to preserve and protect capital across generations. If you’ve been standing on the sidelines, now is the time to act. The world is changing fast. Call Blanchard today to discuss the options that are best for your unique financial situation and goals. We stand ready to assist.

The Norfolk Half Dollar and the Power of Civic Memory

Posted on — Leave a commentIn the early decades of the United States, coinage was more than a medium of exchange. It was a statement of identity. Long after independence had been secured, Americans continued to use coinage to define who they were, where they came from, and what they chose to remember. The 1936 Norfolk Bicentennial Half Dollar stands as one of the clearest examples of this tradition, using silver not simply to mark value, but to preserve the legacy of one of America’s oldest port cities.

been secured, Americans continued to use coinage to define who they were, where they came from, and what they chose to remember. The 1936 Norfolk Bicentennial Half Dollar stands as one of the clearest examples of this tradition, using silver not simply to mark value, but to preserve the legacy of one of America’s oldest port cities.

Struck during the height of the classic commemorative era, the Norfolk Half Dollar reflects a mature nation looking backward. It commemorates a city whose roots predate the United States itself, and it does so with symbolism that reaches deep into the colonial period. This is not a coin about expansion or conquest. It is a coin about continuity.

A City Older Than the Nation

Norfolk, Virginia traces its origins to the early 17th century, long before independence was imagined. Officially designated a borough in 1736, the city grew as a center of maritime trade, shipbuilding, and transatlantic commerce. Its location along the Chesapeake Bay made it a vital link between the American colonies and the wider world.

By the 1930s, Norfolk had become a modern American city, but its leaders sought to commemorate the deep historical roots that shaped its identity. The bicentennial of its borough charter provided the opportunity. Congress authorized a commemorative half dollar to mark the occasion, formally linking local history with federal coinage.

Commemorative Coinage Comes of Age

The Norfolk Half Dollar was authorized at a time when commemorative coins had become a popular means of funding celebrations and memorializing regional milestones. Unlike the experimental coinage of the 1790s, these issues were struck by an established Mint using standardized processes. Yet they retained a sense of purpose beyond commerce.

Although the coin bears the date 1936, it was struck in 1937, a reflection of the legislation that required all pieces to display the anniversary year. This detail, seemingly minor, reinforces the commemorative intent. The date on the coin is not about when it was made, but about what it was meant to remember.

Design as Historical Narrative

The design of the Norfolk Half Dollar functions as a visual history lesson. Every element was chosen to communicate the city’s economic foundations and civic authority. Rather than relying on abstract imagery, the designers embedded Norfolk’s story directly into the coin.

Obverse: The obverse features the official seal of Norfolk. At its center is a three-masted sailing ship under full sail, symbolizing the city’s maritime strength and its dependence on trade and navigation. Beneath the ship appear a plow and sheaves of wheat, representing agriculture and the wealth of the surrounding land. The Latin motto, translated as “Riches from land and sea,” ties these elements together. It is a concise statement of how Norfolk prospered, and why it mattered within the broader colonial and early American economy.

Reverse: The reverse presents one of the most striking and unusual symbols ever placed on a United States coin: the Norfolk Royal Mace. This ceremonial object, a symbol of municipal authority, dates back to the city’s colonial governance and prominently features a British crown. Its inclusion was intentional and provocative. Rather than erasing colonial history, the coin acknowledges it. The mace serves as a reminder that American cities did not emerge in isolation, but evolved from earlier systems of law and order that shaped their institutions.

Mintage, Distribution, and Survival

Congress authorized up to 25,000 Norfolk Half Dollars, but public demand proved softer than anticipated. Many unsold coins were eventually returned to the Mint and melted, leaving an estimated net distribution of approximately 16,900 pieces.

This limited survival places the Norfolk Half Dollar among the scarcer issues of the classic commemorative series. Unlike heavily circulated early federal coins, however, many examples were preserved in uncirculated condition, having been sold directly to collectors rather than released into commerce.

Why the Norfolk Half Dollar Still Matters

The Norfolk Bicentennial Half Dollar matters not because it filled a monetary need, but because it filled a cultural one. It represents a moment when Americans chose to honor local history through national coinage, embedding memory into metal.

For modern collectors, the coin offers more than silver content or aesthetic appeal. It provides a tangible link between colonial America and the federal era, between British authority and American independence, and between a city’s past and its continued presence.

Like the earliest coins of the Republic, the Norfolk Half Dollar tells a story. It reminds us that coinage has always been about more than commerce. At its best, it is about identity, continuity, and the decision to remember where we came from.

Stocks Plunge, Gold Rockets Over $4,800 As Wall Street’s Fear Gauge Jumps 8%

Posted on — Leave a commentThe Dow Jones Industrial Average sank 800 points Tuesday, over 1.5%, as a global stock sell-off deepened following intensifying U.S. threats over ownership of Greenland, which is a territory of Denmark, a NATO ally.

President Trump announced a 10% import tariff starting February 1 on all goods sent to the U.S. from eight NATO nations—Denmark, Norway, Sweden, France, Germany, the U.K., the Netherlands and Finland. Those eight nations recently sent troops to Greenland for military exercises there. On June 1, the U.S. tariffs are set to rise to 25%. European nations are considering retaliatory tariffs that could cover items from Boeing airplanes to Kentucky bourbon.

Markets React

Gold rocketed to a record high above $4,800, silver also reached a new all-time peak, while the U.S. dollar tumbled, and Wall Street’s Fear Gauge, the CBOE Volatility Index or “VIX,” jumped 8%, topping the 20 level.

The tech-heavy NASDAQ Index plunged 2%, and the S&P 500 lost 1.8%. Bitcoin also fell, dropping below $90,000, while smaller cyber tokens like Ether and Solana fell 7% and 5.3%.

All in all, investors around the world widely dumped stocks and U.S. Treasuries, while turning to the safety of precious metals as global markets adjust to a shifting political and military order. President Trump’s comments around taking ownership of Greenland have turned the post-war international rules-based order upside down.

What’s At Stake

Investors are piling into the safety of precious metals as a hedge against worst-case scenarios, including a breakdown of the NATO alliance, a full blown trade war between the U.S. and Europe or even a European inspired market volatility event intended to pressure the U.S. to back down from Greenland aspirations.

Global leaders are meeting in the Swiss alpine town of Davos this week for the annual World Economic Forum.

What Global Leaders Are Saying

At the forum this week, Canadian Prime Minister Mark Carney said middle-power countries need to stop pretending the rules-based order is still functioning. The Prime Minister urged nations to rally together against threats from great powers.

French President Macron warned of a shift to a “world without rules.”

European Commission President Ursula von der Leyen said of the new Greenland tariffs: “The European Union and the United States have agreed to a trade deal last July. And in politics as in business – a deal is a deal. And when friends shake hands, it must mean something.”

U.S. Treasury Secretary Scott Bessent downplayed claims that Europe would dump U.S. Treasuries in retaliation for the Greenland-inspired tariffs.

Why Investors Are Turning to Gold

For hundreds of years, people have turned to the safety and security of gold and silver during times of war, political unrest, and economic uncertainty. In today’s modern world, gold retains its status as a currency without a country. Gold has recognized value in every nation on the planet, is easily transportable, and is a highly liquid market, meaning it can be sold at any time. What’s more, gold—unlike the U.S. dollar—is not attached to any government’s monetary aspirations, printing presses or debts and liabilities.

That’s why central banks, hedge funds and individual investors have been pulling funds out of risky assets like stocks and moving money into the safety of metals. The latest geopolitical trigger point—Greenland—has driven a fresh up leg in the historic precious metals run.

Gold $5,000 the Next Big Target for the Precious Metal

Wall Street firms expect the record-setting run in gold and silver will continue this year. A recent survey of Wall Street firms projected an average of 17% gold gains in 2026. The next big target for gold lies at $5,000 an ounce. Several firms, including UBS, Yardeni Group, and Jeffries Group, see potential for the yellow metal to climb to $5,400 or even $6,000 or beyond this year.

Markets are moving. Stocks are selling off. There’s still time to rebalance your portfolio and reduce your exposure to stocks before today’s sell-off becomes a full-blown market crash. Gold and silver are in uptrends and are still climbing. Call Blanchard today to explore how an increased allocation to precious metals can help protect and grow your wealth for today and tomorrow. Explore the buying process here.

Metals Hit New Records in January, Explosive Rally Continues

Posted on — Leave a commentGold and silver stormed to new record highs in mid-January, as investors continue to look for alternatives to traditional assets. Gold hit another fresh record at $4,728.90 an ounce and silver touched $94.

Investors are trading paper dollars for precious metals as geopolitical uncertainty climbs as European troops are deployed to Greenland amid President Trump’s calls to take over the island, and violent protests continue in Iran. The post World War II order is shifting quickly, with the recent U.S. action in Venezuela and the strong interest in taking over Greenland.

Throughout history, precious metals have served as a safe-haven investment during times of political and military turmoil. Owning physical precious metals gives investors access to a liquid asset that is outside the traditional financial system and outside the U.S. sphere of influence. At a time when the U.S. dollar is falling and U.S. government debt is climbing, investors are trading out of dollars and into the known safety of gold and silver.

Renewed threats to Federal Reserve independence have also helped gold hit new highs this month. The Department of Justice threated the Federal Reserve with a criminal indictment. This boosted concerns the White House’s pressure campaign to lower interest rates could keep inflation higher for longer.

If the Federal Reserve were weakened as an institution and becomes susceptible to political pressions, it could open the door to a period of long-term U.S. dollar weakness and higher inflation—in that environment, precious metals are especially attractive as a store of value.

Looking ahead, the blistering precious metals rally shows no signs of losing steam. Numerous banks are calling for gold to hit $5,000 or higher in 2026 including HSBC, Bank of America and JP Morgan. The outlook for silver remains strong, with Bank of America projecting gains to $135 or even $309 per ounce, depending on how specific macro scenarios play out.

Gold and silver are hitting records as investors hedge against geopolitical stress, a weaker dollar, and concerns over bubbles in risky assets like the stock market. Central-bank and institutional demand for gold has been robust. Silver faces persistent supply deficits alongside strong industrial use, especially in energy and electronics, which will help support higher prices ahead.

The world is changing fast. Seemingly every day, old norms are slipping away, opening the door to a different world ahead. While uncertainty may reign on the global stage about what lies next, the certainty of owning precious metals comes with a 5,000 year track record of safety, store of value and wealth building opportunities. Markets are moving. Don’t delay. Acting today to increase your allocation to precious metals can help preserve and grow your wealth for tomorrow.

Will the Stock Market Crash This Year?

Posted on — Leave a commentAs Benjamin Franklin famously quipped, the only things certain in life are death and taxes. We could add one more to Franklin’s list: the stock market will crash again. Will it be 2026? Nobody knows. But just as the sun rises in the east and sets in the west, sooner or later the stock market will crash again.

But just as the sun rises in the east and sets in the west, sooner or later the stock market will crash again.

In the past 200 years, the U.S. stock market has seen 11 major crashes (drops of 40% or more). Since 1929, there have been 27 bear markets (drops in the stock market of 20% or more). The worst stock market crash occurred in 1929—which saw the Dow Jones Industrial Average drop 89% from peak to trough. What’s more—it took 25 years for the Dow to return to its pre-crash high—hitting that level in 1954.

More recently, during the dot.com crash from 2000-2002, the technology-heavy Nasdaq index lost 78% of its value. It took 15 years for the Nasdaq to get back to breakeven and climb above its 2000 high.

Could you wait 54 years or even 15 years for your stock positions to get back to break even? That’s a long time.

As an investor, there’s little you can do to prevent a stock market crash. Market timers have also proven over the decades, it’s also nearly impossible to predict when a crash will happen.

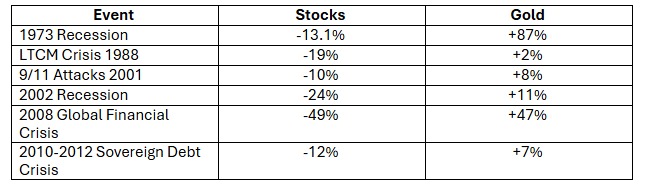

What you can do as investor is accept the idea that the odds are that another crash will happen—and you can prepare now for it with an increased allocation to precious metals. Gold has a proven history of climbing when stocks fall. Here’s a look at a few events in recent decades.

When crisis’s hit, investors exit out of risky assets like stocks and head to the safety and precious metals like gold and silver. When’s the best time to prepare for a storm that is coming? Not when the thunder and lightning is flashing in the sky—but before the storm comes. That means today is the best time to prepare for a coming downtown in stocks.

When crisis’s hit, investors exit out of risky assets like stocks and head to the safety and precious metals like gold and silver. When’s the best time to prepare for a storm that is coming? Not when the thunder and lightning is flashing in the sky—but before the storm comes. That means today is the best time to prepare for a coming downtown in stocks.

You can fortify your portfolio today with an increased allocation to precious metals to help protect and grow your wealth even when the next financial storm takes stocks sharply lower. Recommendations on how much to allocate to precious metals range from 5% to as high as 20-30% of your portfolio depending on your age, your risk tolerance level and when you will need to use the money. The sooner you may need to use the money, the higher your allocation to metals could be – as gold preserves your wealth when a stock market crash dissolves your wealth.

All the headlines warning that the stock market is in an AI bubble may or may not be true. There’s little you can do about which way the stock market will go this year. But, you can take action today to protect, preserve and grow your wealth no matter what lies ahead. Reach out to Blanchard at 1-888-528-3464 to talk with a portfolio manager about current market conditions, your investment options and if an increased allocation to precious metals is right for you. We’re here to help.

Why Physical Gold and Silver Still Matter in an Uncertain World

Posted on — Leave a commentFor many years, Blanchard has had the privilege of working with thoughtful, disciplined investors who take a long-term view of wealth. One of those clients is Dr. Doroghazi, a cardiologist, author, and the longtime voice behind The Physician Investor Newsletter. Dr. Doroghazi has worked with Blanchard and his portfolio manager, Stephen Davidson, as his trusted source for physical precious metals, relying on our guidance, access, and execution. That long-standing relationship reflects the disciplined, long-term approach Dr. Doroghazi brings to every aspect of investing. Dr. Doroghazi has spent decades studying markets, history, and human behavior. His book, The Physician’s Guide to Investing, earned rare praise from Warren Buffett, who said it “should be required reading at med schools.” Since 2006, his weekly newsletter has helped thousands of physicians think clearly about investing through cycles of boom, bust, and uncertainty.

We recently sat down with Dr. Doroghazi to discuss physical gold and silver, as well as what today’s markets may be signaling for investors.

A Conversation with Dr. Doroghazi

Blanchard:

You’ve written extensively about why gold and silver are rising. What do you think many investors misunderstand about these moves?

Dr. Doroghazi:

The biggest misunderstanding is thinking that gold and silver are becoming more valuable in real terms. They’re not. An ounce of gold still buys roughly what it always has over long periods of history. What’s changing is the value of paper currencies.

When people see gold up or silver up, they think something dramatic has happened to the metals themselves. What’s really happening is the purchasing power of fiat currencies is going down. That’s an important distinction, because it frames precious metals not as speculation, but as preservation.

Blanchard:

In your December newsletter, you compared gold to the Dow Jones Industrial Average. Why is that ratio so important?

Dr. Doroghazi:

It’s one of the most honest ways to compare financial assets over long periods of time. Over the last 130 years, it has averaged about 10 ounces of gold to buy the Dow.

At extremes, that ratio tells you a lot. In 1999, during the dot-com bubble, it took 45 ounces of gold to buy the Dow. In 1980, one ounce of gold bought the Dow. Today, we’re sitting around 11 ounces.

If we’re in a long-term commodities bull market, which I believe we are, that ratio is likely to fall again, and not because stocks collapse overnight, but because gold rises as confidence in paper assets erodes.

Blanchard:

You’ve been very clear that owning physical gold and silver is different from owning paper products. Why does that distinction matter right now?

Dr. Doroghazi:

Paper claims are only as good as the system behind them. ETFs, futures, and mining stocks all have their place, but they come with layers of counterparty risk.

What we’re seeing in this bull market is something different. Bullion has been outperforming the miners, which tells you the demand is for physical metal, not leverage or speculation. When people want insurance, they want the real thing.

That’s why I’ve been very direct: physical gold and silver, held in your possession or securely stored, should be part of a serious portfolio.

Blanchard:

You often describe precious metals as “insurance,” not just an investment. Can you expand on that?

Dr. Doroghazi:

Every investor should ask themselves a simple question: What happens if something breaks?

History shows that once or twice in a lifetime, something always does. Wars, inflation, currency debasement, political instability. You don’t prepare for those events after they happen.

Owning gold and silver isn’t about predicting the future. It’s about acknowledging uncertainty and building resilience into your financial life. That’s why I recommend allocating at least 10% of investable net worth to precious metals and quality collectibles. It’s not about maximizing returns; it’s about surviving what you can’t predict.

Blanchard:

You’ve also shifted your view on silver recently. What changed?

Dr. Doroghazi:

For many years, I favored gold almost exclusively because silver is bulky and harder to store in size. But markets evolve.

Silver has broken out of a base that lasted more than four decades. Industrial demand is strong, supply is constrained, and there have already been moments where futures markets signaled tightness in physical availability.

That’s why I now recommend owning some physical silver alongside gold. U.S. Silver Eagles are fine, and conversations I’ve had with Blanchard suggest that Morgan and Peace silver dollars are particularly compelling right now from a value standpoint.

Blanchard:

You also spend time discussing storage and personal security, which many investors avoid talking about. Why is that so important?

Dr. Doroghazi:

Because reality matters.

If all of your metals are stored somewhere you can’t access in an emergency, that’s a risk. But if too many people know what you have at home, that’s also a risk.

I generally suggest a mix, some in a safe deposit box, some at home, and always with discretion. Precious metals require responsibility. Ignoring that side of ownership is a mistake.

Blanchard:

Finally, how do you see this precious metals bull market ending?

Dr. Doroghazi:

There are a few paths. Governments could default. They could inflate their debts away. Or, less likely but most constructive, we could see some return to monetary discipline, possibly involving gold.

Even if the more optimistic outcomes don’t materialize, history suggests that owning real assets during periods of monetary excess is never a bad decision. Gold doesn’t need to be perfect. It just needs to do what it has always done, preserve purchasing power over time.

Blanchard Closing Note

Dr. Doroghazi’s perspective reflects why we’ve valued our relationship with him for so many years. His approach is thoughtful, disciplined, and rooted in history rather than headlines.

At Blanchard, we believe precious metals and rare coins play a meaningful role in well-constructed portfolios, not as speculation, but as long-term protection. Conversations like this one remind us that clarity, education, and experience matter, especially when markets feel anything but certain.

A complimentary offer for Blanchard clients

As a thank-you to the Blanchard community,

Dr. Doroghazi is offering a complimentary one-year subscription to The Physician Investor Newsletter for any Blanchard client who would like one.

The newsletter has been published weekly since 2006 and offers thoughtful, independent commentary on precious metals, markets, and long-term investing.

? To learn more about the newsletter, visit https://thephysicianinvestornewsletter.com/

If you’d like to take advantage of the free one-year subscription, simply mention it to your Blanchard portfolio manager.

Hawaii Plantation Tokens: Money of the Sugar Kingdom

Posted on — Leave a commentHawaii plantation tokens are among the most evocative and regionally distinctive forms of American exonumia. Issued during the late nineteenth and early twentieth centuries, these privately made pieces tell the story of sugar, labor, and life in the islands long before Hawaii became the fiftieth state. They were not coins in the traditional sense, yet for tens of thousands of workers, they functioned as money all the same.

Today, these tokens are studied, cataloged, and graded by leading numismatic authorities such as the Professional Coin Grading Service, and they remain highly collectible for the depth of history they carry.

The Rise of the Plantation Economy

Sugar plantations dominated Hawaii’s economy from the mid-1800s through the early 1900s. Large estates required massive labor forces, drawing workers from China, Japan, Portugal, the Philippines, and other parts of the world. Plantations were often remote and self-contained, operating almost like small towns with company-owned housing, stores, schools, and medical facilities.

Within this closed system, plantation owners needed a way to pay workers that also kept economic activity under their control. Plantation tokens emerged as a practical solution. Issued directly by plantation companies, these tokens were redeemable only at company stores or for services on the estate itself.

Unlike United States coinage, plantation tokens were not legal tender. Their value existed solely through agreement between employer and worker, which made them powerful instruments within the plantation economy.

What Are Hawaii Plantation Tokens?

Hawaii plantation tokens were typically struck in brass, copper, aluminum, or white metal. They were produced in a wide range of denominations, most often expressed in cents or dollars, though some pieces were marked only with a number or value indicator.

These tokens circulated locally and sometimes alongside U.S. coins, but their use was restricted. A worker could not take plantation tokens to a neighboring town or competing business. Their usefulness ended at the plantation gate.

This limitation is exactly what makes them historically important. Each token reflects a controlled labor system and a period when economic freedom for workers was tightly managed by employers.

Types and Shapes

One of the most fascinating aspects of Hawaii plantation tokens is their sheer variety. Unlike standardized federal coinage, plantation issues were highly individual.

Round tokens are the most common and closely resemble traditional coins. These typically include the plantation name, a denomination, and sometimes wording such as “Good For” or “Payable At.”

Holed tokens are also frequently encountered. The central hole served a practical purpose, allowing workers to string tokens together or secure them to clothing, reducing the chance of loss during long days in the fields.

Some plantations experimented with octagonal or irregular shapes. These made the tokens instantly recognizable and helped prevent confusion with official coinage.

Designs and Inscriptions

Designs on Hawaii plantation tokens are generally simple but deeply informative. Instead of national symbols or artistic allegories, these tokens emphasize function.

Most display the name of the plantation, mill, or operating company. Some include Hawaiian place names or abbreviated titles, while others rely on English-language inscriptions reflecting the business ownership of the era.

Denominations are usually straightforward, such as “5 Cents,” “10 Cents,” or “One Dollar.” A few tokens lack explicit denominations, suggesting use within a tally or credit system rather than direct wage payment.

Unlike circulating coins, plantation tokens were not meant to inspire pride or patriotism. They were tools designed for instant recognition and unquestioned acceptance.

Production and Issuers

Many Hawaii plantation tokens were struck by mainland manufacturers, particularly in California, where industrial token makers were well established. Dies were sometimes reused or modified, contributing to the wide stylistic variation seen today.

Because these tokens were privately issued, records are often incomplete or nonexistent. Some plantations produced multiple token types over time, adjusting materials or denominations as labor needs changed.

This lack of centralized documentation makes surviving examples especially valuable to historians and collectors. Each token helps reconstruct a fragment of plantation life that might otherwise be lost.

Life on the Plantation

To fully understand plantation tokens, it is essential to understand the world in which they circulated. Plantation stores sold food, clothing, tools, and household goods, all priced in company-issued currency. For many workers, wages paid in tokens created a closed economic loop tied directly to the plantation.

Some plantations allowed partial payment in U.S. coinage, particularly in later years, but others relied heavily on tokens. This system reduced cash outflow for plantation owners and ensured that economic activity remained internal.

Viewed through a modern lens, plantation tokens raise difficult questions about labor control and economic dependency. That complexity is part of what makes them such compelling historical artifacts.

Collecting Hawaii Plantation Tokens Today

Today, Hawaii plantation tokens are collected as exonumia rather than coins, yet they occupy an important place within American numismatics. Graded examples help establish authenticity, rarity, and condition, which is especially important given the crude manufacturing and heavy circulation many tokens experienced.

Collectors are drawn to these pieces not for precious metal content, but for their direct connection to Hawaii’s plantation era. Each token represents a specific place, employer, and moment in time.

Why These Tokens Matter

Hawaii plantation tokens are tangible evidence of a transitional period in Hawaiian history. They bridge the gap between the Kingdom of Hawaii, the plantation economy, and eventual United States statehood.

More than simple payment instruments, they are social documents struck in metal. Holding one is holding a piece of lived history shaped by labor, migration, and industry.

Collector FAQ: Hawaii Plantation Tokens

What are Hawaii plantation tokens?

Hawaii plantation tokens are privately issued pieces of exonumia created by sugar plantations in Hawaii during the late nineteenth and early twentieth centuries. They were used as a form of internal currency, redeemable only at plantation-owned stores or for services within the plantation community.

Are Hawaii plantation tokens considered coins?

No. Plantation tokens are not official coins or legal tender. They are classified as exonumia, meaning coin-like objects that are not issued by a government authority. Despite this, they are widely collected and studied within the numismatic community.

Why do many Hawaii plantation tokens have holes?

The central holes served a practical purpose. Workers could string the tokens together or attach them to clothing, reducing the risk of loss while working in the fields. Holed designs also helped distinguish plantation tokens from circulating U.S. coinage.

What metals were used to make plantation tokens?

Most Hawaii plantation tokens were struck in base metals such as brass, copper, aluminum, or white metal. Precious metals were not used, as the tokens were intended purely for local circulation and functional use.

How rare are Hawaii plantation tokens?

Rarity varies widely depending on the plantation, denomination, and survival rate. Some types are relatively available, while others are extremely scarce with only a handful of known examples. In many cases, exact mintage figures are unknown.

Why are plantation tokens collectible today?

Collectors value Hawaii plantation tokens for their strong historical context. Each piece represents a specific plantation, workforce, and economic system, offering insight into daily life in plantation-era Hawaii. Their regional nature and variety also add to their appeal.

Are Hawaii plantation tokens graded?

Yes. Many Hawaii plantation tokens are authenticated and graded by professional services. Grading helps confirm authenticity and provides a standardized assessment of condition, which is especially important given the crude manufacture and heavy circulation these tokens often experienced.

How should Hawaii plantation tokens be stored?

Like other numismatic items, plantation tokens should be stored in a stable environment with low humidity and minimal temperature fluctuation. Protective holders or archival-quality flips help prevent further wear or corrosion.

Do Hawaii plantation tokens have investment value?

While some plantation tokens can command strong prices due to rarity or condition, most collectors pursue them for historical and educational value rather than investment potential. Market value is influenced by scarcity, provenance, and overall collector demand.

GDP Growth Surprises with 4.3% Rate, Gold & Silver Trade At Record Highs

Posted on — Leave a commentGold and silver traded at or near record highs following news that third quarter U.S. gross domestic product (GDP) beat expectations with a 4.3% gain, marking the strongest growth level in two years. Precious metals have posted a blistering rally in 2025, with gold up 70% and silver up 124% this year, and are still climbing despite some pullback this week.

the strongest growth level in two years. Precious metals have posted a blistering rally in 2025, with gold up 70% and silver up 124% this year, and are still climbing despite some pullback this week.

The latest economic news, which was delayed due to the government shutdown, surprised Wall Street economists who expected growth to increase at a 3.2% rate. The strong third quarter performance also exceeded the 2.5% reading in the second quarter.

Strong consumer spending on items like healthcare and recreational vehicles helped boost GDP growth. However, the pace of business investment cooled in the third quarter to 2.8% from 7.3% in the second quarter. Other factors boosting third quarter GDP included a 5.4% jump in investment in equipment and intellectual property, which includes artificial-intelligence related spending.

Trade also boosted the 3Q GDP number by 1.59 percentage points, as exports grew and imports fell.

Jobs Market Weakening, Inflation Cooling—But Still Above Fed’s Target Rate

Despite the strong GDP number, recent data revealed the jobs market is weakening in the fourth quarter. The November unemployment rate rose to 4.6%, the highest level in more than four years. Inflation has cooled, but still remains above the Federal Reserve’s 2% target rate.

Looking into 2026, traders expect the Fed to pull the trigger on several interest rate cuts, possibly as early as January. Lower interest rates are positive for precious metals, as they lower competition from interest-bearing investments.

Fed rates cuts in 2026 are also expected to weaken the U.S. dollar, which has seen strong declines this year. A further weakening in the U.S. currency is a positive factor for gold, as there is a strong inverse correlation between the dollar and gold.

Precious Metals Closing Out 2026 with Historic Rally—And They are Still Climbing

Gold, silver and platinum have outperformed nearly all other asset classes in 2026 with massive price increases. The uptrend in precious metals is firing on all cylinders with silver hitting a new record high above $71 an ounce in late December. Gold is trading near record highs after smashing above the $4,400 level.

Investors continue to move to the safety of precious metals as geopolitical tensions are climbing with the U.S. starting an oil blockade against Venezuela. Geopolitical jitters are rising amid concerns that Venezuela’s allies including Russia and China could get involved if the conflict with the U.S. escalates. Precious metals have long-served as a safe-haven asset in times of war throughout history.

Another factor propelling precious metals higher are risks around government debt that continues to expand not just here in the U.S. but around the globe. Gold and silver are assets which are seen defending and protecting portfolios from the debasement of paper money as government debt levels climb.

Managing Risk in Your Portfolio

As we move into 2026, today is the ideal time to evaluate your portfolio and add more wealth protection to your personal situation. Even if you already own gold and silver, it may not be enough. For conservative investors, a 5 to 10% allocation to precious metals could be enough for capital preservation and a hedge against volatile markets. For moderate investors, a 10-15% allocation to precious metals can provide you a balanced approach to safety and growth. For risk-averse investors, a 15 to 20% allocation to precious metals can provide significant protection against stock market crashes, geopolitical tensions and financial crises.

With forecasts for $5,000 and even $6,000 gold, there is significant upside ahead when you act today. Increase your allocation to precious metals today. Protect and grow your wealth for tomorrow.