Which Way Will Gold Break Out Of Its Range? Fidelity Says Gold Could Hit $4,000

Posted on — Leave a commentThe lazy hot days of summer are upon us. Gold has settled into a sideways holding pattern, after climbing over 25% in the first half of the year. With hamburgers sizzling on the backyard barbeque grill, making portfolio moves might not be on the top of your to-do list. Consider this: taking action today to add physical gold to your portfolio gives you the opportunity to trade fewer dollars for more gold before the next up leg begins.

With hamburgers sizzling on the backyard barbeque grill, making portfolio moves might not be on the top of your to-do list. Consider this: taking action today to add physical gold to your portfolio gives you the opportunity to trade fewer dollars for more gold before the next up leg begins.

Fidelity joined Goldman Sachs with a forecast for gold to reach $4,000 an ounce. Fidelity pointed to expected Federal Reserve interest rate cuts, a weakening U.S. dollar and more central bank gold buying as factors driving gold to new record highs ahead.

Fidelity fund managers noted that some funds had doubled their 5% allocation to gold, in line with moves that affluent gold investors are increasing their allocations to the precious metal also.

While the U.S. stock market has been unnerved by the sweeping shifts to global trade policy in recent weeks, warnings are rising that a sharp pullback in stocks or even a crash could lie ahead.

“I expect an 80% crash when this is over. I just don’t think this is it. This is a trap,” Mark Spitznagel is the founder and chief investment officer of hedge fund Universa Investments, told MarketWatch.

CNBC host Jim Cramer warns of ‘Black Monday’ market crash over Trump tariffs rivaling record 1987 collapse –New York Post

Cantor Fitzgerald warns of a market pullback as S&P 500 flashes overbought signal—Seeking Alpha

2 big warning signs a correction in stocks may be looming, according to Goldman Sachs—Business Insider

From Wall Street to Main Street Stressors Are Showing

As corporate America reports its latest batch of earnings, cracks are already showing in profits due to protectionist tariff impact. General Motors reported a $1.1 billion profit hit from the tariffs. GM said it earned $2.53 per share, down from $3.06 a year ago.

Dow Inc. reported that the chemical company reported its first quarterly loss in five years as tariff uncertainties pressured the business.

PayPal Holdings stock fell the most in six months after executives reported slower growth in payment volume that the company said was a result of U.S. tariff policy.

Shifting to Main Street, new reports show that even Americans with high incomes are falling behind on credit card and car payments. Delinquencies on credit card and auto loan debts from upper income Americans climbed nearly 20% in the past two years, VantageScore said.

As financial stress and growing debt extends to even top earners, that leaves the U.S. economy more vulnerable in the months ahead.

What’s more, the U.S. economy is already slowing. U.S. Gross Domestic Product (GDP) grew at 1.9% in the first quarter of 2025, down from 2.9% in the final three months of 2024. The Atlanta Fed GDPNow forecast predicts that growth will slow to around 1% in the second quarter.

Bottom Line

Corporate profits are weakening. The stock market is vulnerable to a correction. Protectionist U.S. tariff rates are now at their highest levels since the 1930’s. The economy is slowing.

Gold is trading quietly, sideways right now. Don’t let the warm summer breeze lull you into complacency. Take action to protect your wealth with an increased allocation to physical gold now. In a few weeks or months, today’s gold price will seem like a bargain. Don’t kick yourself for not buying more today. Get started and explore your physical gold options here.

Photo from Unsplash

Fed Policymakers Reveal Cracks in Consensus

Posted on — Leave a commentThe Federal Reserve held its key interest rate steady today at 4.25-4.50% for the fifth meeting in a row. What wasn’t expected were dissents from two Fed Board Governors, which hasn’t happened in over 30 years.

dissents from two Fed Board Governors, which hasn’t happened in over 30 years.

Fed policymakers typically try to show a united front for its monetary policy decisions. Yet, heightened uncertainty over the impact of protectionist trade policies on our economy is beginning to divide them. Today’s meeting was the first time since 1993 that more than one Board Governor voted against the policy decision. Fed Board Governors Michelle Bowman and Christopher Waller voiced support for an interest rate cut.

Why is the central bank holding back on lowering interest rates? The Fed repeated today that uncertainty about the economic outlook “remains elevated” and that it is appropriate to hold interest rates at current levels since inflation remains above target.

In his press conference after the meeting, Fed Chair Jerome Powell said that keeping rates on hold was “appropriate to guard against inflation risks” as the tariff impact begins to appear in rising consumer prices. Some economists say that it takes time for the impact of protectionist policies to work their way through supply chains and onto store shelves. The Fed has stated it wants to continue to monitor the data in the weeks ahead.

There was little reaction to the Fed news, with stocks trading marginally higher and gold trading slightly lower in afternoon trading.

Gold has settled into a quiet, sideways holding pattern in recent months, after climbing to a record high above $3,400 back in April. Strong central bank buying, uncertainty over the economic impact from shifts to the global trading order, still-high inflation, and wars on several fronts drove safe-haven demand for the metal.

What’s Next for Gold?

Demand for gold remains strong. Central banks continue to diversify away from the U.S. dollar and are increasing their allocation to physical gold. In May, the latest data available, central banks bought 20 tonnes of gold, up from 11 tonnes in April, according to the World Gold Council. And, according to a recent HSBC survey, affluent investors have doubled their allocation to gold from 4%-11%. Finally, Fidelity has released a new forecast, echoing Goldman Sachs, that projects gold will reach $4,000 an ounce.

Gold is expected to break out of its holding pattern and climb to new record levels. The orderly and quiet summer markets create opportune buying periods for long-term investors who want to increase their wealth protection through a bigger allocation to physical gold.

The Fed next meets on September 16-17 and all eyes will remain on the central bank for its next moves. Don’t wait until then to make your next gold move. Consider buying more gold today, while prices are still low.

Photo by Joshua Woroniecki on Unsplash

Affluent Investors Double Allocation to Gold in 2025

Posted on — Leave a commentOne of the biggest investment trends in 2025 is that buying physical gold has gone mainstream. No longer is owning gold viewed as an exotic alternative; gold has become the standout asset class among affluent investors and has become a mainstream portfolio component for diversification.

Wealthy investors more than doubled their allocation to gold from 5% to 11% this year, according to a new HSBC survey.

The HSBC Affluent Investors survey revealed that among wealthy investors, allocations to cash and cash equivalents fell by 13 points, while gold saw the biggest jump, increasing by 6 points. Real estate investment allocation increased 3 points, while equities lost 2 points and private equity gained 3 points.

It’s not just the affluent who are buying gold; high net worth individuals are also shifting more heavily into gold. There has been a noticeable uptick among high-net-worth U.S. clients who want to diversify from the depreciating U.S. dollar, which has dropped 10% this year, Stephen Jury, J.P. Morgan Private Bank’s global commodity strategist, said.

Investors aren’t just buying more gold; they are shifting how and where they store it.

Some high-net-worth American investors are shifting geography for where they store their physical gold, diversifying their gold holdings across multiple countries like Switzerland and Singapore.

Investors looking for the utmost in security are choosing military bunkers turned vaults. Swiss Gold Safe has built two of these vaults deep in the Swiss Alps, according to COO Ludwig Karl. “Most of our clients are from first-world countries,” Karl said. “However, our clients have lower trust in government or financial systems or are trying to build a backup or insurance plan by holding precious metals outside of the banking system in a neutral and safe country.”

In a fast-changing and increasingly complex world, physical gold offers investors a degree of control and privacy that is unparalleled in today’s highly regulated and tracked financial system.

Unlike stock, bond, or real estate investments that are tied to a specific location or fiat currency, gold is universally accepted and can be converted into local currency in every country on the globe. It carries a standardized and recognized value for a one-ounce coin, no matter whether you are in Tokyo, London, New York or Sao Paulo.

The record price of gold this year reveals the heightened uncertainty around what could lie ahead, but owning physical gold provides a proven ballast to portfolios and the safety and security that only an asset with a 5,000-year track record can provide. Have you considered if it is time to increase your allocation to gold—do you own enough?

Silver Up 26% YTD. Could Climb More to $43 an Ounce, Citigroup Says

Posted on — Leave a commentPrecious metals have been the top-performing asset class in 2025, handily trouncing the U.S. stock market and bonds. Gold, platinum, and silver are all notching impressive double-digit gains, with platinum leading the way with a 54% gain year-to-date.

Gold soared to a record high above $3,400 an ounce and climbed 26% in the first six months of the year. Now, analysts say, silver could be ready to take the lead after hitting a 13-year high in June, up 25% in the first half.

Tightening physical supplies and increasing investment demand are set to push silver higher over the next several months.

Citigroup targets gains to the $40 an ounce level in silver in the next three months and then to $43 over the next 12 months. Interest rate cuts from the Federal Reserve could also help boost silver in the second half of the year, Citigroup says.

Around the world, retail investors continue to accumulate silver bars and coins. India, in particular, revealed a 7% year-over-year gain in retail silver bar and coin purchases in the first six months of 2025.

Why Buy Silver?

Silver benefits from both investment demand as a precious metal and industrial demand for many different uses in manufacturing. In industry, silver is utilized in manufacturing and technology, which keeps physical demand high. Silver is used to manufacture solar panels, electronics, batteries, nanotechnology applications, water purification systems, and many other products. Demand for solar power has increased significantly in recent years, which has created a new industrial input for the metal.

Timing Can Help

Precious metals investors typically take a long-term view to wealth building and precious metals accumulation. If you are considering if now is the right time to buy, the gold/silver ratio can offer insights as an effective timing mechanism. Here’s how that works:

The gold/silver ratio is a simple calculation – divide the price of an ounce of gold by the cost of an ounce of silver.

Spot gold $3,348 an ounce

Spot silver $38 an ounce

Gold/Silver ratio = 88

Gold/Silver Ratio at 88 Signals It Remains Undervalued Compared to Gold

Historically, there have been only a few occasions when the gold-silver ratio traded above 80. Readings above 80 signal that silver is severely undervalued and is a strong buy signal for the metal.

Higher Silver Prices Ahead

The trend for silver points to higher prices ahead. Citigroup is targeting a move to $43 an ounce over the next year. If you buy today with silver at $38 an ounce, you could lock in a 13% gain over the next 12 months. What’s in your portfolio now? Curious to explore how silver could help you to build wealth? Blanchard portfolio managers are available for a free, personalized portfolio check-up. Give us a call at 1-800-880-4653.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Photo by Zlaťáky.cz on Unsplash

The Highly Desirable 1841-O Seated Liberty Half-Dime

Posted on — Leave a commentThe 1841-O Seated Liberty Half Dime is a cherished numismatic gem minted at the New Orleans Mint during a formative period in United States history. American history buffs will recall that presidential transition and westward expansion as part of “Manifest Destiny” dominated the national scene in 1841.

1841: A Memorable Year in American Presidential History

In an unusual year, America saw three different U.S. presidents sit in the White House in 1841. President Martin Van Buren’s term ended, William Henry Harrison was inaugurated, only to die shortly after from pneumonia, and his Vice President, John Tyler, assumed the presidency.

In 1841, the American economy was still recovering from the Panic of 1837, and the nation was confronting controversial issues, including banking reform, states’ rights, and the debate over slavery. Against this backdrop, the U.S. Mint played a critical role in supporting commerce and the growing population by producing trusted gold and silver coinage.

New Orleans Mint Quickly Became a Critical Southern Institution

Congress authorized the New Orleans branch mint in 1835, and it quickly became a significant southern institution, producing millions of gold and silver coins for the rapidly growing population of the South. Its strategic location near the Gulf of Mexico facilitated the distribution of coinage throughout the Mississippi Valley and beyond. Today, the “O” mintmark is treasured within the numismatic community, especially among southern specialists. Coins minted at the New Orleans mint often saw heavy circulation in the dynamic port city and surrounding regions.

Seated Liberty Half Dime Series

The Seated Liberty Half Dime series was minted from 1837 to 1873. It replaced the earlier Capped Bust design. These half dimes were among the smallest silver denominations in U.S. coinage, valued at five cents—hence the name “half dime.” The half dime series is celebrated for its elegant portrayal of Liberty and its adaptability to changing artistic tastes and minting technology over the decades.

Christian Gobrecht, the Chief Engraver of the U.S. Mint, designed the Seated Liberty half dime, along with contributions from sculptor Robert Ball Hughes. The obverse features Liberty seated on a rock, holding a shield in one hand and a liberty pole in the other, symbolizing vigilance and freedom. The reverse displays a decorative wreath surrounding the denomination. Over the years of minting the Seated Liberty half dime series, slight modifications were made, such as the addition of drapery to Liberty’s elbow and changes to the number of stars.

The 1841-O Seated Liberty Half Dime is a prized collectible with high grades that are hard to find. The Seated Liberty Half Dime series is popular among collectors who aim to assemble complete date-and-mintmark sets. The 1841-O is an essential, yet elusive, piece in that collection. This coin, minted at the New Orleans Mint during an exciting time in our nation’s history, is a tangible link to the antebellum South and is a window into the history of America. The extremely low survival rate in high grades makes it an especially rewarding acquisition for collectors.

Blanchard recently placed this historic ultra-rarity. Here at Blanchard, we regularly place highly sought-after coins like the 1841-O Seated Liberty Half Dime with collectors. Blanchard has owned and sold more than half of the coins in Whitman Publishing’s 100 Greatest U.S. Coins list. If you are searching for a specific classic American coin, let us know today. We have deep roots in the numismatic community and are often able to source challenging and hard-to-find coins.

Gold Briefly Dips As Risk Aversion Fades on Israel-Iran Ceasefire, China Trade Deal

Posted on — Leave a commentGold briefly slipped to a four-week low as some investors rotated back toward riskier assets, such as stocks, following the Israel-Iran ceasefire deal, which appears to be holding for now. Stocks climbed after President Trump said a trade deal had been signed with China, as Beijing agreed to approve rare earth exports.

Investors and traders had piled into the safety of precious metals as missiles flew in the Middle East and amid concerns that trade was slowing between the world’s two largest economies. The ceasefire and trade deal alleviated some of the market’s most pressing geopolitical and economic concerns, prompting light profit-taking in gold.

Gold slid below $3,300 an ounce as short-term traders took profits on the recent double-digit rally in precious metals. The long-term trend remains positive for gold, and the metal remains well above its 200-day moving average, a technical signal that confirms the uptrend remains in place.

Gold and Silver Remain the Best Performing Asset Class in 2025

Even with the light pullback in gold prices, the precious metal is still notching a 21% gain since the start of the year, with silver up 20%, both handily beating the 4.41% gain in the S&P 500 this year.

Key Inflation Gauge Ticks Modestly Higher

The Federal Reserve’s preferred inflation indicator, the personal consumption expenditure (PCE), rose by 2.3% over the 12 months through May, the Commerce Department said. Excluding food and energy, core PCE inflation rose to 2.7% in May, from 2.6% in April. While the uptick in inflation is positive for the precious metals sector, gold and silver showed little reaction as the easing of the Middle East conflict, for now, has dampened fresh demand for precious metals.

Consumer Spending Drops for the First Time in 2025

Americans spent less in May on both goods and services as consumer spending fell 0.1%. Economists had expected consumer spending to gain 0.1% last month. Consumers bought fewer cars and spent less at restaurants and hotels.

Economists say that consumer worries about tariff hikes translated into weaker spending in the second quarter, which could have a broader impact throughout the year. Consumer spending is a major driver of the American economy, accounting for over two-thirds of all economic activity.

The Bottom Line

The price pullback in gold offers long-term investors an opportunity to accumulate precious metal at lower prices. Now is an opportune time to trade fewer of your dollars for more gold. A number of major Wall Street firms target gains to the $4,000 area and beyond in the months and years ahead. Today’s pricing on gold offers long-term investors an opportunity to increase their allocation to the safety and security of precious metals while they are effectively on sale. Use the summer complacency as your opportunity to make savvy market moves.

Photo by Zlaťáky.cz on Unsplash

Mid-Year Precious Metals Market Update

Posted on — Leave a commentWith a heat dome spreading across much of America this summer, it evokes images of kids running through sprinklers, days at the neighborhood pool, backyard barbecues, and fireflies at dusk. As we hit the halfway mark of 2025, it’s an opportune time to check in on the financial markets, key drivers for precious metals performance, and your portfolio.

The first six months of 2025 have been a whirlwind, marked by a fast-paced news cycle that began with the Inauguration of President Donald Trump for his second term in late January. So much has happened that we couldn’t possibly cover it all here, but we’ll touch on key developments impacting the precious metals and stock markets in the first half of the year.

Market Performance Since the Start of 2025

Gold +23%

Platinum +45%

Silver +21%

S&P +3.55%

International Stocks: MSCI ACWI ex-USA Index +16.28%

1-month Treasury Note Yield: 4.21%

5-year Treasury Note Yield: 3.84%

30-year Fixed Mortgage Rate: 6.82%

A few things jump right out.

- Precious metals are the best-performing asset class in 2025. Gold rocketed to a new record high above $3,400 an ounce in April and is trading quietly this summer above the $3,300 level.

- Foreign stocks are outperforming U.S. stocks by a significant amount.

- Mortgage rates remain higher than the low rates of the pandemic and the 2020-2021 era. In January 2021, 30-year mortgages hit a low at 2.65%. The high rates have priced many homebuyers out of the market for now.

The Big Picture

Liberation Day tariffs, geopolitical wars, a U.S. debt downgrade, and climbing national debt have been strong headwinds for the U.S. stock market this year and positive for precious metals. Investors flocked to the safety and security of gold, platinum, and silver amid the mounting uncertainties on many fronts, both military and economic.

Geopolitics Sends Investors Rushing to Precious Metals

Military action ramped up in June as the United States joined Israel with Operation Midnight Hammer, which involved U.S. Air Force B-2 stealth bombers dropping so-called “bunker buster” bombs on an Iranian nuclear site. Israel continues its war against Hamas in the Gaza Strip, and Russia continues its war in Ukraine.

While gold generally led the precious metals complex higher in the first half of the year, in June, both silver and platinum vaulted sharply higher. Precious metals investors saw opportunities to accumulate precious metals at bargain prices, and they swooped in. Silver climbed to a 13-year high, above the $37 an ounce level, while platinum climbed to $1,363.

Tariff Uncertainty

The stock market is eyeing a July 8 tariff deadline, which ends the 90-day pause on most of the steep Liberation Day tariffs if trade deals haven’t been set. Tariffs could climb as high as 50% against some nations. While the Administration is said to be negotiating with China, the European Union, Canada, Mexico, and more, only one trade deal has been finalized thus far, and that is with the United Kingdom. Investors flooded into precious metals throughout the spring months as uncertainty over the impact of tariffs on the economy sent stocks spiraling lower.

America Lost Its Last “AAA” Credit Rating Due to Rising Debt

In May, Moody’s stripped the United States of its last “AAA” credit rating. This was another warning signal that Washington D.C. policymakers have failed to address the unsustainable government debt problem our nation faces. Global investors fear that America is getting close to a point where our debt isn’t affordable anymore.

The news underscored the stability and security of gold in a world racked with government debt. For gold investors, this confirms that gold is in a long-term structural bull market. Analysts at JP Morgan issued a new research note in late spring outlining a scenario that could take gold 80% higher to $6,000 by 2029. They said this could occur if just 0.5% of U.S. assets held by foreign investors were reallocated to gold. Weak demand at Treasury auctions this spring already revealed tepid demand from foreign investors to buy new Treasuries.

Recommendations for Precious Metals Investors

In the dog days of summer, financial markets are relatively stable and quiet, for now. That makes it the perfect time to re-evaluate your portfolio, your asset allocations, and how much wealth protection you need for what may lie ahead. It’s a perfect time to trim your allocation to the stock market and funnel those funds to the safety of physical gold, silver, and platinum.

There is a step you can take to protect, preserve, and even grow your wealth, and that is to increase your allocation to physical gold.

If you aren’t sure what the appropriate amount is for your risk tolerance level, our Blanchard portfolio managers are here to help. Give us a call today at 1-800-880-4653 for a complimentary portfolio review with personalized recommendations to help you protect and grow your wealth. Precious metals are beating everything right now. We are in the midst of a historic gold run. Gold $4,000 will be here faster than you think, and once markets start moving again, you’ll have missed the chance to accumulate physical gold below $3,400 an ounce. It’s easy to add more wealth protection to your life. Why not call us today?

Lesher Colorado Dollars: An Intriguing Chapter in Private Mint History

Posted on — Leave a commentIn the 1870’s in Colorado, the discovery of huge amounts of silver ore in the mountains triggered a massive silver boom. Silver mining expanded significantly in the state over the next decade, and Leadville became known as the “Silver Capital of America.” Colorado mountain towns saw explosive population growth and prosperity driven by mining.

However, the silver boom period slid into a bust. Changes to the global international monetary systems relating to precious metals triggered a collapse in the price of silver, which directly impacted the Colorado silver mining towns.

In the 1870s, many countries, including Holland, France, Belgium, Italy, Switzerland, and Greece, stopped minting silver coins. The United States, which had been minting silver dollars, joined those countries and went on the gold standard. The amount of silver coined internationally dropped 50% in just two years. This led to a silver price collapse at a time when production was increasingly dramatically in Colorado.

Joseph Lesher, a successful Colorado miner turned mine owner, wanted to revive the local economy after the silver price decline dragged down growth. Lesher was a passionate advocate of the “Free Silver” movement, which advocated for the unlimited coinage of silver in America to expand the money supply and stimulate the economy.

Lesher took action. He started a private mint and struck octagonal silver coins—known as Lesher Referendum dollars in 1900 and 1901. These coins were intended to circulate locally and stimulate demand for silver, thereby helping to reopen idle mines and restore prosperity to the region.

Lesher’s minting operation was short-lived, running from late 1900 through 1901. During this period, he produced an estimated 2,000 to 3,000 pieces in total.

The fascinating design of many Lesher dollars reveals their important connection to Colorado’s silver mining boom era. Some Lesher Dollars feature a magnificent depiction of Pikes Peak, the iconic Colorado Mountain. The mountain’s image symbolized the region’s mining heritage and the aspirations of those who sought fortune in its shadow. Alongside Pikes Peak, the coins often bore inscriptions such as “JOS. LESHERS REFERENDUM SILVER SOUVENIR MEDAL,” the year of issue, and the name of the merchant or town that accepted the coin as currency.

Lesher Dollars are immediately recognizable by their distinctive octagonal shape and large size. The coins were hand-punched, resulting in unique variations and individual quirks for each piece. Today, Lesher Dollars are extremely rare, with just over 20 different types identified by PCGS. They are differentiated by the names of Colorado merchants and towns stamped on them. Some varieties are known by only a single surviving specimen. Their scarcity and historical importance make them highly sought after by collectors today.

Gold Leaps Over Euro to Become Second Largest Central Bank Reserve Asset

Posted on — Leave a commentIt’s no secret that global central banks have been stockpiling gold. But we just didn’t know how significant the central bank gold buying has been. Demand for gold bullion is so strong that the precious metal has surpassed the euro to become the second-largest asset held by central banks around the world.

For the last three years, global central banks have bought more than 1,000 tons of gold each year. Because of all that gold buying, today, gold is the world’s second-largest global central bank reserve asset, behind the U.S. dollar.

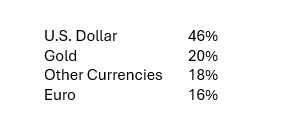

Gold pushed past the euro in 2024, taking second place, according to new data from the European Central Bank. Here’s the breakdown.

Global Central Bank Reserves

Source: European Central Bank, International Monetary Fund, Bloomberg

At the end of 2024, global central bank holdings of gold had climbed to around 36,000 tons, near the all-time high of 38,000 tons set in 1965.

Why are central banks buying gold? It’s simple. It turns out that central banks are buying gold for many of the same reasons that individual investors are piling into the precious metal.

Central banks are buying gold for diversification purposes and also to hedge against geopolitical risk, the European Central Bank report said. Reserve managers also value gold as a portfolio diversifier to hedge against inflation, cyclical downturns, and defaults.

Why does this matter to you? Central banks are long-term investors. They see value in gold at current levels and continue to buy and stockpile the precious metals in their global central bank vaults. If they are increasing their exposure to gold, maybe you should consider it too.

It’s been an epic rally in gold, and precious metals are still climbing.

The price of gold has climbed nearly 62% since the beginning of 2024. Silver is soaring too. Silver just jumped past $36.00 an ounce, and analysts are now pointing to $40 as the next big target. Platinum is also rocketing higher, climbing 35% since the start of the year. In fact, platinum, gold, and silver are the top three best-performing assets of 2025. Precious metals are in a strong uptrend, with huge momentum and are still climbing. A number of Wall Street forecasts point to gold at $4,000 an ounce and beyond.

For centuries, people have turned to precious metals as a store of value and as an asset to protect and grow their wealth. If you’ve been thinking about increasing your allocation to precious metals, don’t wait; the markets are moving, and gold at $4,000 will be here before you know it.

One of America’s Greatest Unsolved Mysteries: The Lost Colony of Roanoke Island

Posted on — Leave a commentThe enduring story of the Lost Colony of Roanoke Island remains one of the biggest mysteries in American history. Established in the late 1500s on Roanoke Island, present-day North Carolina, the colony was England’s first attempt to establish a settlement in the New World.

Yet, one day, the entire colony disappeared without a trace.

The unsettling disappearance of the entire colony triggered centuries of speculation, theories, and many investigations. None of these ideas has ever borne fruit and explained what really happened to these 120 brave English souls who traveled to the New World, but then disappeared.

A Coin to Remember It

The mystery and intrigue surrounding the lost colony have turned the 1937 Roanoke silver half-dollar commemorative coin into one of the most popular commemorative coins in American numismatics. After all, it represents a foundational episode in our nation’s history. For those who haven’t heard the story before, here are some of the basic facts that we do know to be true.

Setting Sail for the New World

In the late 1500s, there was a fierce competition among European powers to establish overseas colonies. The Roanoke exploration and colony were primarily financed by Sir Walter Raleigh, an ambitious Englishman. In 1584, Queen Elizabeth I granted Raleigh the right to explore and colonize lands not already claimed by Christian monarchs. Raleigh invested heavily in this venture, seeking both personal gain and national glory. The initial 1584 reconnaissance voyage reported abundant natural resources and friendly native populations, fueling hopes for a prosperous settlement.

In 1587, families including women and children joined the 1587 expedition to Roanoke Island led by John White, with the goal of building a permanent community in the New World. On August 18, 1587, White’s daughter Eleanor Dare gave birth to a daughter, Virginia Dare, who was the first English child born in a New World English colony. Her legacy endures today in American history.

When John White returned to Roanoke in 1590 after a three-year absence, he found the entire colony gone. The only clues he could find were the word “CROATOAN” carved into a post and “CRO” on a tree. The fate of the roughly 120 colonists, including his granddaughter, remains unknown to this day.

What Could Have Happened to the Roanoke Colonists?

- One of the most popular theories is that the British colonists sought refuge with friendly native peoples, such as the Croatan (now Hatteras) tribe. Perhaps they married into and assimilated into their native communities.

- Some believe the entire Roanoke colony perished due to food shortages, hostile conflicts with native tribes, or that disease spread and took the entire settlement out.

- Other historians have argued that the Roanoke colonists moved to another location, but no definitive archaeological evidence has been found.

- Another theory that has been put forth is that the Spanish forces destroyed the colony, since Spain and England were warring at that time.

Despite many archeological digs, the fate of the Lost Colony remains a mystery today.

What we do know is that the Colony of Roanoke Island is historically significant as it marked the first English effort to establish a permanent settlement in North America. And the brave souls who journeyed across the ocean gave their lives for a bigger cause.

Honoring the Lost Colony: A Special Coin

In 1937, to mark the 350th anniversary of the Roanoke Colony and the birth of Virginia Dare, the United States Mint issued a special silver commemorative half dollar. Congress authorized this coin to celebrate both the historical significance of the colony and the enduring mystery surrounding its fate.

Why Collectors Prize the Roanoke Island commemorative half dollar

This visually stunning coin commemorates a truly remarkable event in American colonial history, steeped in mystery and intrigue as well as historical significance.

The artistry of this coin will never be forgotten once you have seen it. Experts agree that the detailed and symbolic imagery on the coin makes it a standout among commemorative issues.

The obverse of the silver coin features Sir Walter Raleigh in period dress, shining a light on his role as the colony’s sponsor and visionary. The inscription includes “United States of America,” “Half Dollar,” and “Sir Walter Raleigh.”

The reverse of the coin portrays a dramatic image of Eleanor Dare holding her baby daughter, Virginia Dare, against the backdrop of a coastal landscape. This scene pays tribute to the first English child born in America and the families who braved the unknown.

In Memory…

The Lost Colony of Roanoke Island remains an enigma, a story of adventure and adversity at the dawn of English America. Its legacy is preserved in the form of a beautiful silver commemorative coin. The coin is a tangible reminder of both the optimism, bravery, and tragedy of the Roanoke colonists and is a prized numismatic gem for collectors and historians alike. Curious? Blanchard has one of these historical gems on offer now. See it here.