Feeling a Bit “Flat”? Here’s Why

Posted on — Leave a commentDespite surging GDP growth and a strong employment picture, some analysts are starting to feel a little “flat.”

The yield curve is the yield spread between long-term and short-term U.S. Treasury bonds. This graphed line has long been a popular economic indicator. Today, the curve is starting to flatten, and that has some worried. The reason: a flat yield curve brings us closer to an inverted yield curve, which, historically, has been followed by a recession.

The pattern unfolded during the dot com bust of 2000 and again during the global financial crisis starting in 2008. Financial forecasters call this “economic deceleration.” The rest of us call it “hard times.”

One fact is clear; the curve is not invented yet. It’s starting to get closer to that position, but for now, we aren’t there. The bending, and flexing of the curve has implications for gold investors because “investors have generally benefited from holding gold during periods of economic deceleration,” according to The World Gold Council.

However, some, like those at Morgan Stanley, are taking a contrarian position and explaining that the flattening curve “sends a weaker predictive signal about the future state of the U.S. economy than it has in the past. They continue, explaining that “we’re not worried about an impending recession since we believe that today the slope of the yield curve sends a weaker signal and it would therefore take more flattening than ordinary to have the same impact on future growth than it had in the past.”

Even if the “danger” signal isn’t blinking yet, gold investors may want to take note because historically, gold has experienced an upswing in value during periods of rising inflation. Recently, inflation has ascended to target levels with the US hovering around 2.5 percent and the Eurozone at about 1.9 percent. This upward movement has been long in coming. In recent years inflation has remained stubbornly low.

The World Gold Council suggests that recent decreases in gold’s value might increase customer demand given that lower prices support jewelry purchases. Simultaneously, they illustrate a historical seasonality to gold as illustrated by softer demand and diminished trading in the summer months with a clear uptick in September. This data, coupled with rising concerns of an inverted yield curve, might leave gold enthusiasts positioned for a window of opportunity.

As always, the appropriate plan is one with a long-term perspective. Whichever way the yield curve bends, gold has a place as a diversifier in any portfolio. Moreover, as future expectations for long-term equity returns start to cool, investors will need new ways to find growth. Consider that in the most recent, incomplete cycle, equities have returned only 5% annually, and “JPMorgan predicts returns of 3.3% for the S&P 500 over the next decade,” according to The Wall Street Journal.

Part of the reason for this tepid outlook is the currently high valuations. Companies will need to boost their already strong performance to validate and surpass these valuations. The yield curve, seasonality, and easing equity returns all give investors reason to consider gold.

3 Reasons You Should Ignore the Death Cross in Gold

Posted on — Leave a commentThe financial news networks have been abuzz talking about the “Death Cross” that appeared on the gold chart this summer. A Death Cross sounds pretty scary. Don’t worry, it’s not.

A Death Cross is just a term that traders use when the 50-day moving average falls below the 200-day moving average.

That was an invitation for Day Traders to jump on the short selling bandwagon, which pushed the gold market lower in recent weeks.

You’ve heard the saying: Markets Aren’t Rational. This is a classic example of where that applies.

The gold market is being driven by day traders who are running the market lower based on the Death Cross.

Here’s why you should ignore the Death Cross: the “fundamentals” are getting increasingly out of whack for the price of gold.

3 Trends to Drive Gold in the Second Half

The World Gold Council just released a new report pinpointing the three factors that will drive the price of gold in the second half of the year:

- Positive but uneven global economic growth

- Trade wars and their impact on currency

- Rising inflation and an inverted yield curve

A trade war could be one of the greatest risks to not only the American economy but the global economy in the months ahead. Read more on that here.

Inflation just hit a 6-year high, the Labor Department reported in mid-July. That wipes out wage gains for the average American, according to the Chicago Tribune.

An “inverted yield curve” is another technical term, but guess what? It’s also a solid Recession Indicator.

- The last seven out of seven times the yield curve went negative since the 1960s, a recession followed, according to CNBC.

It refers to when short-term interest rates rise above long-term interest rates. It’s starting to happen now!

The Day Traders who’ve pushed gold prices lower are doing Long-Term Gold Investors a big favor: they are creating better price levels to enter the market!

Here’s what the World Gold Council said: “Gold’s recent pullback is supportive of consumer demand, as low prices tend to spur buying; at the same, it may provide attractive entry levels for investors.”

The Gold Tide Is Turning

While for short periods of time, markets can become “irrational” and day traders can create market prices that are out of whack with the macro economic outlook. That is exactly what’s happened in gold this summer.

What’s next? “We believe that the confluence of key trends, as highlighted for the second half of 2018, could be supportive of gold demand,” the World Gold Council says.

Gold has fallen to what may well be the lowest levels of 2018. Momentum is beginning to turn. There are major economic developments at play that could drive gold prices sharply higher in the second half of the year. There’s never been a better time to buy gold. What are you waiting for? Give Blanchard a call today.

South Korean Explorers May Have Just Found $132 Billion in Gold

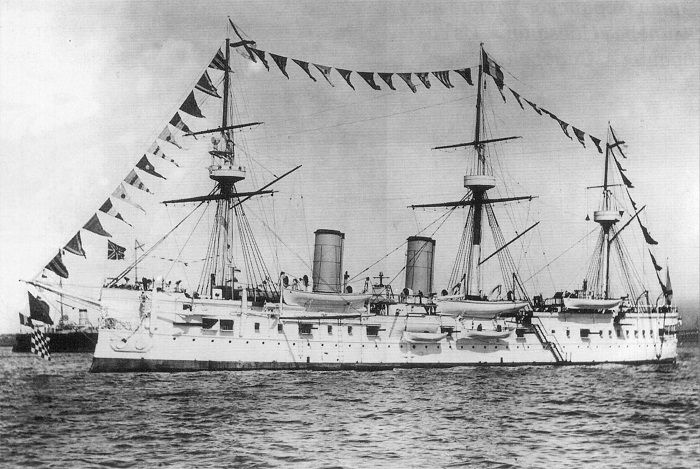

Posted on — Leave a comment113 years ago, a Russian cruiser called the Dmitrii Donskoi sank. Just days ago, a Singapore-based treasure hunting company called the Shinil Group released underwater footage from a depth of 1,300 feet which they claim reveals the near-mythical ship. The find could be a windfall for the Shinil Group because some believe that as much as 200 tons of gold may be on board representing $132 billion. Is the find really so valuable?

Experts suggest that Russians would have been more likely to transport such valuable cargo via train, rather than in uncertain waters during the Russo-Japanese war. Skeptics also point to the unethical practices of another company which previously claimed to have found the wreck. It was later determined that the company, Dong-Ah Construction, was simply trying to elevate their company’s share price.

Perhaps the most telling detail is the fact that the Shinil Group was only founded one month ago with less than $100,000 in capital.

If the find is real, the Shinil Group will need far more capital to salvage the wreck. South Korea’s Ministry of Maritime Affairs and Fisheries mandates that a company like Shinil first put down a deposit representing 10 percent of the value of the find. This deposit would total just over $13 billion. Not surprisingly, the Shinil Group has not yet filed an application to pursue the salvage.

How will Shinil get around this onerous deposit? They will likely argue that the value of the find is only the ship, not any possible gold which has yet to be located. This argument brings the value of the discovery down to $1 million. Reports indicate that the company will offer to deposit $105,540 to begin the salvage operation. A spokesman from the company has indicated that they plan to file the necessary paperwork in the coming days.

If Shinil raises the ship and discovers gold authorities will need to determine the rightful owners. For the time being, the company claims they will return half of the gold, if found, to Russia. Reuters reports that the company intends to use part of the remaining gold to popularize the newly launched “Donskoi International” cryptocurrency. According to the report, “The website said it would ‘share profits’ from the Russian wreck with the public by handing out its virtual currency to anyone who signed up to use the exchange.”

Meanwhile, regulators have warned investors against taking aggressive market positions in hopes of fast profits. Speculative investments on unproven finds like this are risky because “no proof exists that the ship carried gold, with academics raising doubts that a warship would carry such valuable cargo,” according to experts.

These warnings haven’t dissuaded all investors. Though Shinil is not a listed company, many have snapped up shares of Jeil, a Steel company owned, in part, by Shinil’s president. Jeil saw its share price rise by an astounding 30 percent shortly after the announced discovery of the ship. Not long after Jeil’s stock price dropped by 20 percent. Is the find real? Wait and see.

Gold Fever in the Amazon Rain Forest: Those Who Hope To Strike It Rich

Posted on — Leave a commentIt’s illegal. It’s also a shot at riches.

Open pit gold mining in the Amazon rain forest is path to a better way of life for maids, construction workers and farmhands who toil in hopes of finding a worldwide symbol of prestige and wealth: gold.

Known to Brazilians as Garimpos, these men and women work at unlicensed gold mines hidden deep inside the Amazon rain forest.

The Garimpos are often vilified in international news reports as the illegal gold mining has destroyed 1,700 kilometers of rain forest between 2003 and 2013. However, there is a human element to the story.

Gold, a valuable commodity that can be dug out of the ground, is the link for these Garimpos to the global economy and to greater wealth than they could have ever hoped for in their previous lives.

These wildcat mines are not sophisticated operations. The small crews work with basic tools to mine for gold that have been used for hundreds of years including pans, shovels and sluice boxes.

Near one frontier town called Crepurizao, miners in the area ship about 132 pounds of gold per month, according to a September 2017 article in the Independent. While that is worth millions on the global market, the high costs of basic staples in the remote areas and multiple layers of brokers in the back woods gold trading system leave most miners still living on the brink of poverty.

Professor Jeffrey Hoelle, an assistant professor of anthropology at UC Santa Barbara was part of a research project sponsored by the National Geographic Society aimed to learn more about the Amazon gold mines.

“I don’t think these guys are villains or heroes,” said Professor Hoelle. “I think they are part of the global economic system. They’re providing something that everyone, with very few exceptions, wants in some way. The miners get dirty producing this metal that makes people in faraway places shine and sparkle.”

“Many of these people are incredibly courageous to come to the rainforest to try to improve their lot in life, and many don’t ever make it out,” Professor Hoelle said.

One surprising discovery amid the destruction was the orderliness of the mining camps, Hoelle said.

In contrast to the seedy and often dangerous towns where the Garimpos went to sell their gold, the gold mining camps were relatively peaceful with a sense of structure, teamwork and trust.

“It has to be calm and orderly in the camps because you’re working with gold —something that has value from the moment you find it,” Professor Hoelle explained. “If you’re worried that someone is going to steal it or pocket a little bit of it, then it’s not going to work. You have to work in a team, and strong codes of conduct have developed in the mines over the years.

Putting It All Together

What’s unfolding in the Amazon rain forest today is a story that has been told over and over again.

For thousands of years, gold and silver have been recognized as currencies without geographical borders, a store of value and a means to build wealth.

From the ancient world of Croesus to the legendary dynasties of the Renaissance, to the American gold rush in the 19th century, to the Amazon rain forest today, man has acknowledged the intrinsic value associated with gold. And strived to own it.

Gold’s Role in the Third Industrial Revolution

Posted on — Leave a commentIn recent years, talk of the Third Industrial Revolution has reached the mainstream. Much of this discussion comes from economic and social theorist Jeremy Rifkin. He wrote the book on it, literally. His 2011 release, The Third Industrial Revolution: How Lateral Power is Transforming Energy, the Economy, and the World, lays out his theory on how the global economy will change in just a few decades.

He presents this idea as one consisting of five “pillars.” That is, the Third Industrial Revolution will will consist of:

- Renewable energy

- Micro-power plants

- Hydrogen storage technologies

- Internet-enabled energy grid

- Electric transport fleet

Rifkin explains, “The establishment of a Third Industrial Revolution infrastructure will create thousands of new businesses and millions of jobs and lay the basis for a sustainable global economy in the 21st century.” With such far-reaching implications, it seems reasonable to expect that the planet’s natural resources will undoubtedly have a role in this transformation. Here, we look at gold’s role in the Third Industrial Revolution.

A Renewable Resource

Recycled gold comprises an increasingly large portion of the global supply. Research from The World Gold Council shows that “Whilst newly mined gold has averaged approximately 70% of total supply over the last 10 years, annual mine production has been consistently less than 2% of total stocks of above-ground gold.” This trend fits squarely within the above pillars of the coming Third Industrial Revolution. Gold is constantly recycled. Moreover, recycled gold now makes up approximately 30 percent of the total annual supply according to the same body of research.

Lower Emissions

Given it’s scarcity, gold is extremely emission-intensive. Research from the World Steel Association, Global Market Intelligence, and others, show that gold represents a significantly greater emission intensity per unit mass than other raw materials like aluminum, copper, zinc, and lead. However, additional research shows that the total greenhouse gas emissions from gold are actually less than that of coal, aluminum, and steel. How is this possible? Because gold deposits and sources are so rare, there are far fewer mining operations. Therefore, the relative emissions are lower than those stemming from major industrial materials.

A Key Player in a Low-Carbon Future

Additional research from The World Gold Council finds that “if an investor holds an investment in newly-mined gold for nine years or more, the annualized GHG footprint of the investment is lower than the annual GHG footprint of an equivalent-value investment in the S&P 500.” This finding is important because more investors today are seeking opportunities to make the savings grow in ways that are sustainable and environmentally sustainable. In fact, in a recent study from Morgan Stanley, researches found that “71% of investors seek sustainability.” This drive not only comes from a sense of responsibility for the planet, it comes from the belief that companies with a focus on the environment will use their resources efficiently, thereby minimizing waste and boosting profitability. It’s not surprising to learn that green initiatives “saved $422 million and reduced electricity use by 5.8 billion kWh over a 12-year period,” according to Morgan Stanley.

The Third Industrial Revolution is coming. Be prepared.

The July Blanchard “Test Your Coin IQ” Quiz

Posted on — Leave a commentTest your coin IQ with July’s installment of this popular column.

- What is the name of the US Mint built during the Georgia Gold Rush?

Extra credit: What is the date range of the coins minted there?

Answer: The Dahlonega Mint in Georgia. Coins minted at the Dahlonega Mint are highly sought after by collectors due to the historical significance of the mint, low survival rates and low mintage of the coins produced there.

The Mint Act of 1835 established the creation of a branch in the state of Georgia to mint gold coins only. The Dahlonega Mint produced coins from 1838 through 1861. Denominations minted there include $1.00; $2.50 (quarter eagles); $3.00 (1854 only); and $5.00 (half eagles). In total, more than $6 million in gold coins were minted at Dahlonega.

The outbreak of the Civil War changed it all. The mint was closed and never reopened. In 1878, the building was destroyed by fire but the massive foundation remained intact. Visitors today can see North Georgia College’s Price Memorial Hall which was built on the original foundation. The building’s spire features an incredible 23 ounces of Dahlonega gold. At the Georgia State Capitol, visitors can admire 60 ounces of Dahlonega gold on its dome.

- In what country did authorities arrest the infamous thief who stole a bucket of gold in 2016 broad daylight from the back of an armored truck in New York City near Rockefeller Center?

Extra credit: How much was the gold worth?

Answer: The authorities arrested Julio Nivelo in Ecuador by local police and members of U.S. Immigration and Customs Enforcement.

The precious metal had been sitting unattended in a bucket in the back of an armored truck with its rear doors open wide. The thief saw opportunity as the two guards were distracted and talking by the front of the truck. Nivelo grabbed a five-gallon metal bucket out of the back and took off down the sidewalk as fast as he could go.

Nivelo stole nearly $1.6 million worth of gold.

- How much did an 1804 Dollar sell for at auction in 2017?

Extra credit: What year was the 1804 dollar actually minted?

An 1804 U.S. Silver Dollar sold for $3.29 million dollars in March 2017 at a public auction. The coin was graded by PCGS. Considered by many collectors to be the ultimate trophy coin it features a bust of a woman with flowing hair who represents liberty. The 1804 silver dollar is not only rare – only 15 are known to exist – but it boasts one of the most fascinating historical stories of any U.S. coin.

The 1804 dollar, despite its name, was first minted in 1834!

Back in 1804, the Philadelphia Mint did strike a total of 19,570 silver dollars, according to the official U.S. Mint report for that year. However, as Mint officials were more concerned about frugality as opposed to accuracy of the year on the coin. They used dies leftover from 1803 and possibly it is believed 1802 as well!

Then, silver dollar production was halted in 1804 to prevent arbitrage from savvy traders who were shipping them to the West Indies to exchange for heavier Spanish milled dollars, which contained slightly more silver. The traders then melted down the Spanish dollars back in the U.S. for a nice profit!

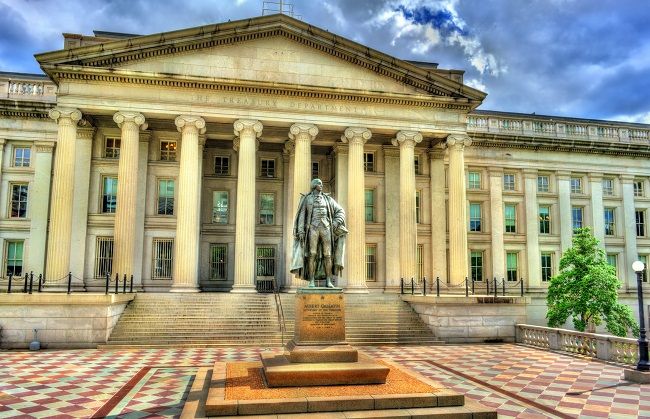

Fast forward a few decades to 1834. An important diplomatic mission was underway, ordered by President Andrew Jackson, to develop relations with several key Far and Middle East countries. The special agent, Edmund Roberts, was to deliver a set of U.S. coins as a gift to these foreign leaders. The State Department issued a special request to the U.S. Treasury to deliver sets that included coins of each type in use in both silver and gold. Two of the coins hadn’t been minted since 1804 – the silver dollar and eagle. Mint Director Samuel Moore made an executive decision to include those coins in the set.

Since no dies ever existed for 1804 silver dollars the Mint created new ones in order to strike the coins for the gift set. Numismatics can easily identify the 1804 dollars as those struck in 1834 from the telling feature on the rims. The 1804 silver dollars show 1834 style beads on the rim versus the tall tooth-like rims found on coins 30 years earlier. A rare piece of history indeed.

Read More:

The Blanchard “Test Your Coin IQ” Quiz

Trivia Questions For Coin Collectors: Do You Know The Answer?

Beyond Bullion: The Beauty and Allure of Pre-1933 Gold Coins

The Myth and Magic of “Touch Piece” Gold

Posted on — Leave a commentThe rarity of gold has always given the metal a mystical aura. There was a time when that aura felt real to most people. That time was the Middle Ages. Daily living was rife with disease. One of the more appalling ailments was lymphadenitis of the cervical lymph nodes, a disease associated with tuberculosis. Many called it “The Kings’ Evil.” Those suffering from the King’s Evil often searched for a cure from a monarch, not a doctor.

At the time it was believed that a touch from a monarch would cure the disease. One gentle touch from a sovereign of England or France promised freedom from the fever and malaise of sickness. Of course, getting this single touch wasn’t easy.

Few, if any, patients had access to such divine healers. Moreover, monarchs were fearful of catching the disease from contact. The solution: a coin. The Book of Common Prayer of the Anglican Church contained a ceremony describing how patients could receive the healing touch without meeting English and French monarchs. The king or queen would instead touch a coin, then offer the piece to a sufferer.

Appropriately, the coin was called an “angel.” Edward the IV introduced the coin in 1465. The relief artwork featured the archangel Michael slaying a dragon. This image represented the triumph of good over evil. At the time, the coin carried a value of 6 to 10 shillings. The popularity of the practice kept the coins in circulation through the early 18th century. Those who were sick were instructed to place the coin against the protruding abscess that was so common to the king’s evil. Minters struck the last such coin in 1634. Some patients kept the coin close to their skin wearing it around their neck at all times.

As medicine and our understanding of diseases advanced, people began to dismiss the practice. Others, supposedly cured by their touch piece went on to live long, productive lives. One such example is Dr Samuel Johnson, who helped establish the English dictionary. He was only an infant when he felt ill and received a touch piece from Queen Anne. Soon after he recovered and remained well.

Doctors of the time were largely silent on the topic of touch pieces. It’s now widely believed that physicians understood the futility of the treatment. They kept their disbelief to themselves. As author Marc Bloch writes in his book The Royal Touch: Sacred Monarchy and Scrofula in England and France, “…the idea of king’s possessing healing powers did not enter into the international literature of medicine until the sixteenth century.” At their height the coins were immensely popular. Officials minted copper and bronze versions to keep pace with demand. They were a common sight in churches and monasteries.

Eventually, in 1714, King George I deemed the practice as nothing more than superstition. The coin became another piece of currency to fall into obscurity, and out of circulation.

If you find one today, hold on to it!

Fireworks at the Gas Pump This Fourth of July

Posted on — Leave a commentAre you hitting the road this Fourth of July holiday? Here’s a tip. Leave early. And, expect to pay more at the pump.

A record 46.9 million Americans are expected to travel 50 miles or more away from home over the Fourth of July holiday, AAA predicts. The Tuesday before the holiday is expected to be the busiest day on the road, with travel times in many U.S. cities twice as long as normal. Ouch.

Drivers may get an unpleasant surprise when they fill up their tank. Gas prices are expected to hit a 4-year high this Fourth of July, according to GasBuddy. The national average is expected to climb to $2.90 per gallon.

The price of a barrel of crude oil surged to nearly $75 last week, the highest since Nov. 2014. The trend for crude oil points higher and many Wall Street analysts are forecasting a quick move to the $80 per barrel zone.

That spells trouble for drivers, with even higher prices at the pump ahead.

What Does This Mean For Gold Investors?

There is a correlation between crude oil and the price of gold.

Rising crude oil prices are inflationary. There tends to be a spillover impact from rising oil prices to rising prices throughout the broader economy.

Gold typically climbs in inflationary environments as investors turn to the hard asset as a vehicle to preserve and protect their purchasing power.

Right now, there is a divergence between crude oil and gold. That’s not normal. Gold has been falling in recent weeks, while crude oil has been climbing.

As crude oil picks up momentum and climbs to the $80 per barrel level, this will ignite inflationary concerns even more and may act as a lever to stall the recent price slide in gold.

The price of gold is falling toward a key technical chart support zone at the $1,250/$1,247 area. That area may act as a “hook” to stabilize the gold market, as inflation fears begin to filter into the marketplace.

As you pack up the car for your Fourth of July road trip, how much you pay at the pump can have a direct correlation on your investments. It’s not just an aggravation that it costs more for gas. It’s a warning signal that change is brewing. Higher prices are on the way. The stock market bears are growling in their caves. Inflation is not good for stocks either.

The higher gas price you pay at the pump will have repercussions through the economy and spillover impact onto the stock market. Buying physical gold is a proven method to protect your purchasing power against inflation, rising consumer prices and a bear market in stocks. Invest now. Buy online or give us a call at 1-800-880-4653.

Have a happy and safe Fourth of July!

The Future of Gold and Mining

Posted on — Leave a commentRecently the World Gold Council released a report on the relationship between gold and the natural environment. As the threat of ecological impact and global warming loom large, mining operations are seeking more efficient methods of sourcing gold. One company, Goldencorp, is at the leading edge of this trend with the “goldmine of the future.”

With new investments in technology, the company is preparing to open a mine designed to be the first all-electric underground operation. The plans include a significant departure from traditional diesel-fuelled equipment which will be replaced by Battery Electric Vehicles (BEV) which are three times more efficient. Changes like this are expected to reduce annual GHG emissions by 70 percent. Moreover, without the exhaust from diesel, Goldencorp’s newest mine will require half the ventilation of a traditional mine.

Goldencorp represents a continued shift to more ecologically responsible solutions. Other mining operations are sourcing their power from large solar panel arrays. Others have reduced their reliance on energy by using naturally-occurring geothermal properties. Mines designed this way require less heat. The Hemlo mine in Canada is an impressive example of how these designs can yield lasting results; even as the mine has expanded, it has seen relatively little change in levels of energy intensity.

Meanwhile, other mines have found ways to reduce dependence on energy with operational changes. The Kinross mining company has minimized fuel consumption with route optimization and more efficient driver training. As a result the company has saved over 15,000 hours of haulage since January of 2017.

These sweeping changes are part of an effort to align economic and ecological goals. Companies are motivated to seek energy efficiency which offers considerable savings and increased profitability. At the same time, the environmental impact from mining drops. One goal serves the other and vice versa.

Consider that for some mines fuel represents more than 20 percent of the commodity and service purchases. Even for operations that use electricity in lieu of diesel need sustainable ways to help generate wattage. The Kumtor mine in Kyrgyzstan uses hydropower supplied by local reservoirs. The result: “the mine’s specific GHG emission footprint resultant from electricity is relatively low,” according to the World Gold Council. Other companies aim to replicate this approach because analysts project the cost of solar, wind, and battery storage to drop by 50-70 percent by 2040.

With so many mining companies taking the initiative to develop more environmentally conscious methods some are hopeful that other industries will take note and introduce similar measures. In the meantime, companies like Goldencorp are leading the way.

These changes should buoy gold investors’ confidence that their decision to own the metal has favorable influences on the planet. As experts at the World Gold Council concluded, their research “suggests gold may have positive implications for long-term investors in helping them manage the carbon footprint of their portfolios over time.”

Gold and The Retirement Crisis

Posted on — Leave a commentThe retirement crisis is upon us. The numbers present a startling picture. A new analysis from The Wall Street Journal shows that “In total, more than 40% of households headed by people aged 55 through 70 lack sufficient resources to maintain their living standard in retirement.”

There are several reasons why this problem has developed. First, many investors saw half their portfolio value vanish during the global economic crisis of 2007/2008. Second, amid decades of wage stagnation, many simply never had the means to save. Third, the disappearance of pensions has put a greater burden on the individual to save more for retirement. Now, approximately 15 million households face an uncertain future. Some have resigned themselves to a sobering truth: they may need to work through their retirement years. One can’t help but ask if things could have been different.

In recent years scientists have taken steps to understand why humans struggle with money. They work within a branch of research called behavioral economics. This area of study suggests that economics don’t only follow rigid rules of supply and demand. Rather, these researchers argue that irrationality drives many outcomes because economics, after all, is the result of human behavior and humans are inherently irrational beings.

Of course, in some cases, like those cited above, the retirement problem is external (wage stagnation, economic policy, etc.) However, many problems are internal stemming from our psyche. That is, our biases and leanings lead us astray. For example, herd mentality is a powerful force which leads most of us to follow the crowd even when the crowd is headed off a cliff. This was a painful lesson for those swept up in the fervor of the dot com boom. Scientist have also learned that we attribute different value and different meaning to money based on its source. Perhaps this is why we often spend bonuses and unexpected windfalls with disregard for the future.

How does a gold investment play into the world of behavioral economics? The answer might be deceptively simple. Conventional investments like stocks and bonds are easy to trade online with the click of a button. This convenience carries a cost. It’s too easy for us to act on impulse. Our emotions have only a short way to travel from our head to our keyboard. Gold, however, is different.

With a physical holding like coins and bullion, investors have a more permanent relationship with the asset. They can hold the weight of their savings and feel its gravity. Moreover, liquidating physical gold presents more steps then those needed to liquidate a stock or bond. Simply put, it’s easier to be a disciplined long-term investor when you’re holding physical gold.

Unfortunately, this benefit is lost with modern alternatives like gold ETFs. These investments, like stocks, don’t offer the behavioral safeguards that come with tangible assets. Additionally, they don’t offer any claim to physical gold and cannot be redeemed for a piece of the precious metal.

As a nationwide retirement disaster looms large, one must ask what needs to change today for those that still have time to make a change and improve their future. A portfolio with exposure to gold is part of the solution. Gold keeps us anchored and has a low correlation to stocks and bonds. In uncertain times investors need more options.