Prominent Gold Watcher Forecasts Gold at $2,000 an Ounce

Posted onAs a new administration settles into the nation’s capital, the winds of economic change are blowing hard, which opens the door for significant moves in the financial markets ahead.

Gold is already on the move – as February Comex gold futures climbed 8.4% from Dec 15–Jan 17.

Is this the start of something big for gold?

A prominent gold analyst – Jeffrey Christian, managing director at New York-based CPM Group – forecasts record highs ahead for gold at $2,000 within the next decade. Christian is widely regarded as one of the most knowledgeable experts on precious metals markets, and has advised the World Bank, United Nations, International Monetary Fund, and numerous governments.

Equity Market Gains Are Not Sustainable

In a recent interview with the Canadian Financial Post, Christian called the recent stock market rally a “sugar high” and warned that many questions and uncertainties lie ahead regarding the actions of the new U.S. president.

Christian doesn’t believe Trump will be a major infrastructure investor, and instead will focus on easy-to-pass tax cuts for corporations and wealthy people, who are more likely to reinvest the gains in the stock market rather than spending in the economy, the Financial Post reported.

Overall, in the longer term that is a negative factor for long-term economic growth, and will add to the U.S. deficit and debt. That means the macro and long-term picture is bullish for gold.

Christian outlined three major bullish factors for the gold market ahead. These include:

- Investor demand – Investment demand for gold will return to between 30 and 40 million ounces per year, levels not seen since 2005, he projects.

- Continued strong central bank buying – Central banks will continue their recent strong buying trends of between 9 and 10 million ounces per year.

- Fall in mine production – Christian believes that supply will “plateau in the next 3 years and begin to drop off by 2020, due to a lack of investment in exploration and expansion,” the Financial Post reported.

Looking ahead, there are many more reasons to be bullish than bearish on gold. The World Gold Council recently issued a report outlining six major factors that will support rising gold prices in 2017:

Build Your Tangible Assets Position Now

On a relative basis, the current $1,200 per ounce for gold is “cheap” by historical comparisons. Gold traded above the $1,900 per ounce level in 2011. Silver currently offers a good buying opportunity as well – and offers many of the same portfolio diversification factors as gold. Silver currently trades at around $17.00 per ounce.

Blanchard portfolio managers follow the metals market closely each day, and are well positioned to offer you individualized investment advice to help you meet your long-term financial goals. Call for a free confidential consultation today at 1-800-880-4653.

How To Trade Trump’s Tweets

Posted onIf you are an auto maker, defense contractor or other major U.S. manufacturer you’ve probably already been consulting with your PR firm on how to handle potential Twitter talk from President-elect Trump.

Individual investors are getting in on the game too.

Brokerage firms have seen an increase in trading activity and companies that have been called out by President-elect Trump have seen trading volumes surge.

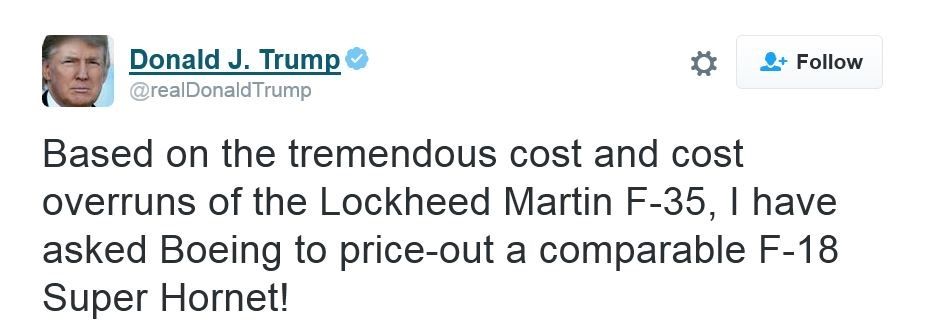

Here’s just one example:

Market reaction: This particular Twitter message drove Lockheed’s stock price into a nosedive in after-hours trading, and triggered a jump in Boeing’s

In an interview with the Wall Street Journal, TD Ameritrade Chief Executive Tim Hockey said trading surged following Mr. Trump’s win and continued to pick up whenever the president-elect targeted his tweeting at a specific company. TD Ameritrade said its average daily client trades surged 11% in the quarter ended Dec. 31.

The Tweets Are Moving Markets

A new ETRADE survey found that three-fifths of those between 25 to 34 had traded based on a tweet by President-elect Trump. The survey included more than 900 active investors, who had a minimum of $10,000 in an online-brokerage account.

How can investors trade Trump tweets?

The answer may well lie in buying physical gold as a hedge and safe-haven against broader stock market volatility and the greater unknowns of what could develop on the world political stage in the months ahead.

Some market strategists concede that investors really don’t have a choice – but must monitor the Trump twitter account – simply because the tweets are moving market. The President-elect is also making views known in the international arena regarding potential trade issues with China via the social media platform.

Rising Gold Demand Seen Ahead

The World Gold Council outlined 6 major trends in the global economy that will support gold prices in 2017. Part one of the Blanchard analysis focused on the first three factors. Read more on that here.

The second three factors – could well be triggered by the Trump twitter feed as well as new developments from the upcoming administration’s policies. Here’s a close look at them now.

Inflated Stock Market Valuation

The U.S. stock market is trading at all–time highs and, by most traditional measures, is overvalued. The current bull cycle in stocks is old – it started in March 2009 – and is vulnerable to a correction or cycle turn at any time. Bull markets don’t last forever.

Long-Term Asian Growth

Chinese and Indian investors have long shown an affinity to buying and holding physical gold. It is a cultural phenomenon backed by hundreds of years of action. The continued rise in the middle class of these growing global powerhouses means more money that can be funneled to their investment of choice – gold.

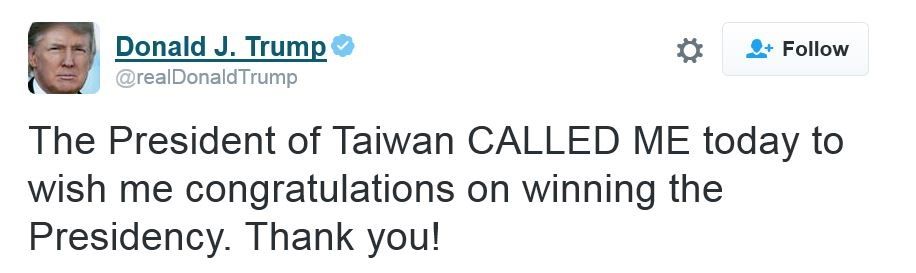

Trump’s twitter feed upset official diplomatic channels back in early December – when he messaged about his call with the Taiwanese president. He broke decades of precedent and said the “One China” policy was up for negotiation. China considers Taiwan a breakaway province, with no rights to any kind of diplomatic relations with other countries.

Tensions are running high at the start of the new Administration.

The Chinese president has already been making public statements and is poised to enter what may be a global void of leadership as the United States backs away from globalization. Look the Chinese to continue to grow their economy and to seize a greater footing on the global power stage in the months ahead. The global economy is shifting from West to the East and Trump’s policies may help speed that along.

“Macroeconomic trends in Asia will support economic

growth over the coming years and, in our view, this will

drive gold demand. In Asian economies, gold demand is

generally closely correlated to increasing wealth. And as

Asian countries have become richer, their demand for gold

has increased. The combined share of world gold demand

for India and China grew from 25% in the early 1990s to

more than 50% by 2016. And other markets such as

Vietnam, Thailand and South Korea have vibrant gold

markets too. “World Gold Council Report.

Opening of New Markets

Gold is becoming more mainstream, the World Gold Council says. While day traders may get bogged down by individual company-specific tweets, the better strategy may well be to build a physical gold position that can protect your wealth and your portfolio against a variety of risks.

What’s in your portfolio now? Call Blanchard today for a private consultation with a portfolio manager at 1-800-880-4653.

Stocks Pare Losses as Oil Jumps and Precious Metals Surge

Posted onYet again, U.S. equities managed to bounce back from a decline shortly after the opening of the market. Thursday’s strong rebound came amid a week-long string of sharp intraday sell-offs that made investors begin to question the vigor of the stock market after a prolonged multi-month rally. In fact, many analysts and investors thought the high point of the market had been reached, due to the fact that major indices were down almost 1% around noon.

Thursday’s scary stock slide didn’t last long, though. The Nasdaq and S&P rallied all the way back by the market close, consequentially evaporating volatility from the market. Since Trump’s unexpected victory on November 8, the S&P 500 has rallied about 6%, and most of the daily pullbacks along the way have been viewed as buying opportunities, and gobbled up by investors.

Although it may not seem like it, “Risk is to the upside [in stocks],” said Mark Connors, Credit Suisse’s global head of risk advisory in New York. “People want to get involved.” This certainly seems to be the case, because thus far, every decline in stocks has evidently been met with lots of purchasing.

This is not overly surprising, however. According to Credit Suisse, long positions among institutional money managers are 20% less than the 5-year average, so there is plenty of cash sitting on the sidelines waiting to be put to work – even at all-time market highs.

What is also likely contributing to the broader market resilience is the recent uptick in crude oil. Crude posted its biggest 2-day winning streak in 6 weeks as the Saudi Arabian Energy Minister, Khalid al-Falih, announced a reduction in oil production down to no more than 10 million barrels per day. Generally, higher oil prices are better for the economy, as foreign wealth inflows tend to increase, and energy companies in the US turn a bigger profit.

With all of this said, from energy to stocks and everything in between, there is one asset class that has undeniably stolen the spotlight since the beginning of 2017: precious metals.

Gold and silver are off to a tremendous start this year, and they are both outperforming virtually every other asset class, especially currencies. The U.S. dollar has had a pretty rocky start to the year so far, and this is one of the many reasons that investors are moving their assets into precious metals. For the year, gold futures have risen about 4%, and silver futures have risen about 5%.

Moving forward, January is peak-earnings season, with blue-chip companies reporting their financial results in the next few weeks. In addition to earnings catalysts, there are FOMC member speeches, overseas economic data that is due to be reported, and, of course, the biggest macroeconomic event in the past 4 years that’s set to make place on January 20 – a new president of the United States.

6 Trends That Support 2017 Gold Demand

Posted onIn a new report, the World Gold Council has identified six key trends that will support continued gold demand in 2017. These include:

- Heightened political and geopolitical risks

- Currency depreciation

- Rising inflation expectations

- Inflated stock market valuation

- Long-term Asian growth

- Opening of new markets

GEOPOLITICAL RISK

Political risk is rising around the globe. The World Gold Council pointed to a number of upcoming elections in Europe in 2017, including Netherlands, France and Germany.

Some market watchers have warned that the outcome of these elections could prove to be a destabilizing force for the European Union, depending on the votes. Rising waves are populism are seen in Europe and there is speculation that Russia could attempt to influence the European elections.

The Eurasia Group outlined top geopolitical risks in its 2017 outlook report > Read it here.

Closer to home, one of the worries for financial markets are trade policies. There is “a meaningful risk that negotiations on trade will turn belligerent” and suggests that “confidence in markets could be affected by geopolitical tensions triggered by the new administration,” says Jim O’Sullivan, Chief US Economist at High Frequency Economics, in the World Gold Council Report.

As a high-quality, liquid asset, gold benefits from safe-haven inflows, which could emerge from rising geopolitical risks in 2017.

CURRENCY DEPRECIATION

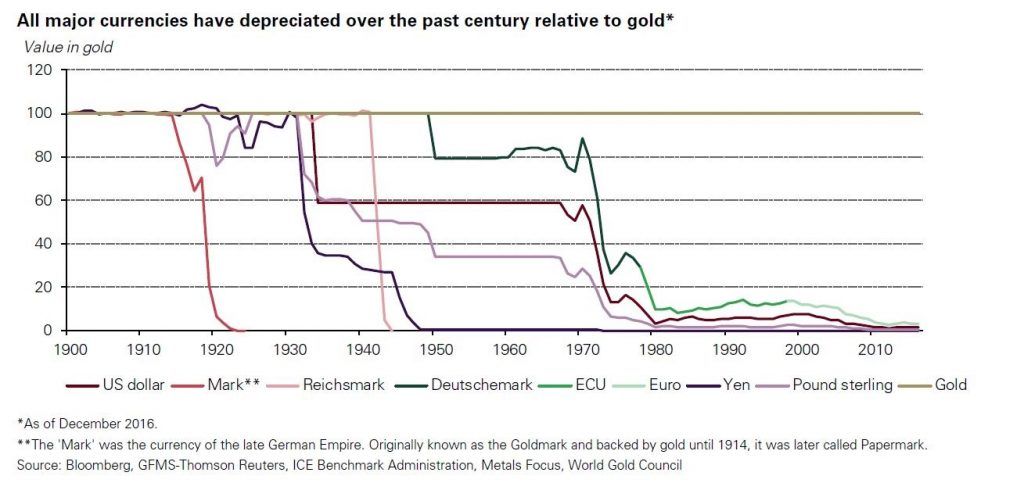

Paper (or fiat) money has fallen in value over the last century, while gold has vastly outperformed. See Figure 1 below.

Over the past century, gold has vastly outperformed all major world currencies as a means of exchange, the World Gold Council says.

A key reason for this is:

- The available supply of gold changes little over time, growing about 2% per year through mine production

- That compares to paper money, which can be printed in unlimited quantities to support monetary policies.

Since the global financial crisis, central banks around the globe have turned to quantitative easing or “money-printing” policies in an attempt to stimulate economic growth. At its heart – that devalues the paper money. It is simple economics – more supply of anything decreases its value.

Investors have turned to physical gold investments in recent years in an attempt to preserve the wealth and protect it from depreciating paper money values.

RISING INFLATION EXPECTATIONS

The World Gold Council points to expectations that inflation will rise in 2017 as another factor that is supportive to gold demand.

“An upward inflationary trend is likely to support demand for gold for three reasons. First, gold is historically seen as an inflation hedge. Second, higher inflation will keep real interest rates low, which in turn makes gold more attractive. And third, inflation makes bonds and other fixed income assets less appealing to long-term investors.” – World Gold Council report

It is well known that gold holds its value and often increases significantly during inflationary periods. What is not as well known is that rare coins are an even better hedge and tend to rise in price even faster than gold during inflationary periods.

Read more: Rare Coins Are An Excellent Hedge Against Inflation

Stay updated with the latest gold market news: Subscribe to the Blanchard Newsletter (scroll to bottom of the page).

Check back here on Thursday for part 2 of this report and a look at the final 3 factors that the World Gold Council believes will support gold demand in 2017.

Blanchard and Company has was founded in 1975 and has a rich legacy of helping individual investors access the gold and rare coin market. We believe that gold and silver bullion in physical form is an appropriate asset for a small portion of any properly diversified investment portfolio. Contact Blanchard at 1-800-880-4653.

Could Trump’s Inauguration Mean A Top For Stocks?

Posted onThe stock market has soared to new all-time highs following the election of Donald Trump to the White House. In the now infamous Trump Bump –traders have priced in a spate of good news including tax cuts, deregulation and massive infrastructure spending.

Wednesday’s press conference and the inauguration will see a switch in market drivers from speculation on what Trump may do to what he actually does.

Buy The Rumor, Sell The Fact

The stock market is notorious for a phenomenon called “Buy the rumor, sell the fact” in which traders price in news before it has happened and then dump stocks once it occurs. There are growing rumblings among market watchers and traders that Inauguration Day could mark a top in the stock market.

Analysts are warning that the stock rally and the massive gains in the U.S. Dollar have hit an “exhaustion phase” and are vulnerable to a correction. The recent rally in stocks has been accompanied by weakening stock market breadth, as the number of declining stocks outnumbers gainers. That is a weak signal for the stock market overall.

Gold Is Starting To Move Higher

Gold prices have been climbing in recent weeks as a small bottom has formed on the daily chart at $1,124.30 for Comex February gold futures. Gold hit a high at $1,190.50 in early trading Tuesday – a $66 per ounce move in just three weeks.

If you are a first-time gold buyer, or if you are looking to add to

your existing position, you may not want to wait any longer. Gold

prices are rising again, with higher levels seen throughout the year.

“We forecast gold prices to average $1,420 in 2017,” says Thomson

Reuters in their Gold Survey 2016 Q3 Update and Outlook

Call Blanchard at 1-800-880-4653 to discuss your investment goals

with one of our portfolio managers now.

Politics – The Next Big Trigger For Gold?

“As Mr. Trump’s inauguration date nears, we suspect gold investors will monitor political developments more closely. Any significant ratcheting higher in geopolitical tensions could help trigger safe-haven bullion demand. The market may be more sensitive than usual to political developments in the early days of a Trump Administration,” according to a January 9 HSBC research report.

Blanchard is the premiere tangible assets adviser in the United States for serious investors and serious collectors. Learn more about our firm here.

The Blanchard Economic Report

Posted onAs the New Year takes hold, concerns over global geopolitical instability have moved to center stage.

“This year marks the most volatile political risk environment in

the postwar period.” – 2017 Outlook Report from the Eurasia Group

Gold has climbed 5.89% since Dec. 15. The price of gold is already rising ahead of the Jan. 20 Inauguration as smart money investors buy physical metal to hedge against the numerous uncertainties around the globe.

Here are 6 risks smart money investors are concerned about in 2017…

Military Risks…

Trump has promised to “bomb the hell out of ISIS,” extend surveillance capabilities, and otherwise leverage US coercive power to punish enemies, the Eurasia report notes.

Instability in Europe…

The continent faces a series of elections from France to Germany and the Netherlands. A wave of populism is sweeping across not only America, but Europe and this year’s elections could destabilize the European Union.

Domino Impact of Rising Russian Influence…

There are expectations that Russia could meddle in European elections this year with the goal of destabilizing the traditional power base. Trump’s tepid support of NATO could weaken the alliance that has historically protected global order.

China’s Power Grab…

Chinese President Xi Jinping sees the current unrest in America as an opportunity to seize greater power on the world stage. His recent speeches are calling for China to become the new leader in globalization.

Inflation is Rising in the US…

On the economic front in the United States, recent data shows the economy near full employment with the December unemployment rate at a low 4.7%.

Wage growth is accelerating as average hourly earnings climbed 2.9% on a year-over-year basis in December, as employers struggle to find qualified workers to fill positions. Central bankers are already warning about the potential for higher inflation in 2017…

Another Bank Crisis…

Former U.S. Treasury Secretary Lawrence Summers told Bloomberg that the president-elect’s plans for deregulation were setting the stage for the next financial crisis.

Is Your Portfolio Properly Diversified?

Investors are loading up on the both gold and silver at bargain-level prices following the steep price slide after the presidential election. Overseas buying has been strong in gold, especially from China ahead of the Chinese Lunar New Year on Jan. 28.

Study after study has shown that precious metals can reduce overall volatility and protect your assets against equity market declines.

Act now to ensure your portfolio is properly hedged and diversified…

Blanchard believes that gold and silver bullion in physical form is an appropriate asset for a small portion of any properly diversified investment portfolio. We will take the time to learn your investment objectives, investment time horizon and risk appetite before recommending products for your consideration. Call us today at 1-800-880-4653 for a confidential consultation with a portfolio manager.

What to Know as Markets Reach Records

Posted onAs the three main US indices (Nasdaq 100, S&P 500, & Dow Jones Industrial Average) continue to hover near all–time record highs, investor fear continues to hover near all–time record lows.

One of the most common ways to gauge investor fear in the market comes from the CBOE Volatility Index, commonly referred to as the VIX, which measures the implied volatility of S&P 500 options. The concept is simple: when turbulence is expected in the market, investors are willing to shell out more money to protect their portfolios by hedging with options, and when no turbulence is expected, investors don’t have the need or desire to protect their portfolios. A higher VIX = more volatility expected. A lower VIX = less volatility expected.

Recently, any small spike in the VIX has been abruptly quashed due to the relentless and steady rise of the major indices. Out of 252 equity trading days in the past year, there have only been 38 days where the VIX has been south of the $12 level. Therefore, based on the current low price of the VIX, equity market participants are pricing in virtually zero downside risk or fear, even at record market highs.

However, this is where the plot begins to thicken. Although the VIX suggests that there is essentially zero fear in the equity market, the gold market tells a slightly different story. Currently, gold is already up approximately 2.3% for the year, adding more than $50 since the low point of $1124.3 in mid–December. Analysts attribute the recent rally in the precious metal as a flight–to–quality amid lingering concerns about what 2017 has in store.

Perhaps the biggest cause of doubt and uneasiness for US financial markets comes form an unexpected presidential election result. This is not to say, however, that investors are not also keeping a careful watch on European political changes as well.

Adrian Day, the president of Adrian Day Asset Management, which oversees $190 million noted how “the euro zone has plenty of crisis triggers over the coming months; Indian and Chinese buying [of gold] remain strong and Trump’s policy threatens inflation. All this is positive for gold.”

This is likely why gold is off to a very solid start for 2017, because unlike the VIX in US equity markets, there are other factors besides fear that are pushing the precious metal higher.

With that said, US institutional investors are closely monitoring China’s mounting currency problem, because it was China’s government devaluation of the yuan back in August of 2015 that sparked a severe US equity sell–off and sent gold soaring.

Therefore, not only are investors from China buying gold to seek refuge from a drowning currency propped up by the government, but US investors are also purchasing gold as a heaven in case the yuan crisis worsens and the effects are felt in the US stock market, again.

Macroeconomic factors like China’s currency crisis, trepidation about new US politics, and complacency with stocks at record highs are all valid reasons to own gold, and this consequently explains the recent rally. Once again, this underscores the benefits of owning gold as an investment, because not only can market fear instigate a rally, but other underlying economic factors can as well – and this is precisely what is happening.

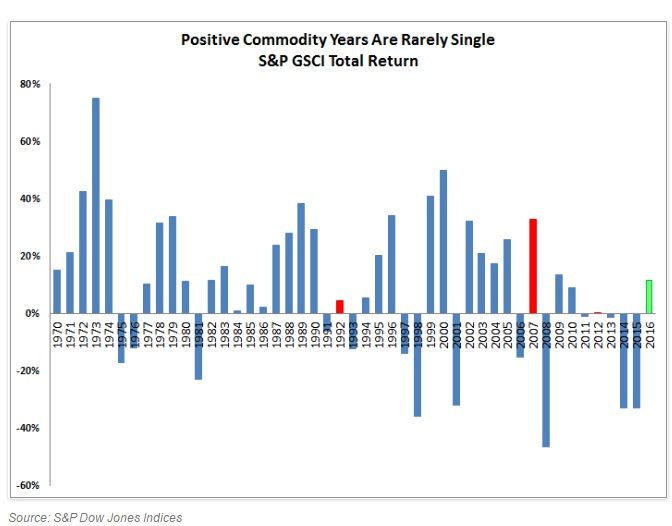

3 Factors That Can Boost Commodities In 2017

Posted onThe commodity sector, as a whole, closed out its first positive year in 2016 since 2012. The good news for hard assets, including precious metals, is that positive years in commodities usually come in bunches.

Gazing into the crystal ball for 2017: Jodie Gunzberg, global head of commodities and real assets at S&P Dow Jones Indices, finds that the path upward could continue into 2017 and beyond.

She points to three key factors that could impact the commodity sector as a whole this year: inflation, a potentially weakening dollar and OPEC. Let’s take a look at each factor.

Trump and Inflation

Historically Republican presidencies are favorable for grains and gas which are key for rising inflation, Gunzberg says.

“Copper, lead and nickel have had their best performance with Republicans. That in itself does not promise growth since rising inflation from commodity prices can cause stagflation – but stagflation is less likely if Trump builds infrastructure and jobs growth which may propel GDP and help the metals.

“Also, industrial metals outperformed precious metals last month by the most in 26 years. This is considered extremely bullish,” Gunzberg says.

US Dollar

The US dollar has been on a tear –rising significantly in recent weeks, which in turn has pressured commodities including gold and silver. Precious metals are priced and sold in US dollars on the world marketplace and a rising dollar tends to depress the price of these and other commodities, as it makes them more expensive to foreign buyers.

Although the dollar theoretically should rally from rising interest rates, that relationship hasn’t held, Gunzberg says.

“So, even if rates rise more, there is a chance the dollar will revert after continually hitting new recent highs – that can lift commodities substantially. In fact, every single one of the 24 commodities we track rises from a falling dollar, especially industrial metals which can rise as much as 7% for every 1% the dollar falls.”

Watch OPEC

Crude oil prices are on an upward path. Since bottoming at around $26 per barrel in February 2016, crude oil climbed as high as $55 per barrel at the start of 2017.

Perhaps you’ve noticed higher gasoline prices at the pump? Get used to it. A significant impact of rising crude oil is higher inflation throughout the economy. Higher crude prices not only impact pump prices, but almost every good you buy from milk at the grocery store to that sweater at your favorite department store.

Why? Higher crude oil prices mean higher transportation costs for all goods in the economy, which usually are passed along to consumers.

OPEC’s decision to cut production in late 2016 has given a lift to the energy sector. In 2017, Gunzberg points to two factors to watch:

Whether all the participants follow through on the agreement.

How the U.S. producers respond.

Big Picture

Big Commodity Winners in 2016

Energy + 41.9%

Industrial metals +17.6%

These two sectors had their best years since 2007 and 2009, respectively Gunzberg says.

“The comeback in these two sectors is meaningful because they are the most economically sensitive, and the last time these two sectors were up this time together, they led commodities to return nearly 360% in the next eight years (1999-2007).”

Focus On Gold

Despite the sell-off in precious metals in the second half of 2016 –gold still closed out the year 2016 with an 8.5% gain.

Recent action: Since bottoming out at $1,2430 in mid-December, gold has gained 5.47%.

Do You Have An Investment Plan?

Gold prices are already starting to move higher. Is your portfolio properly diversified? Many investors are using the recent strength in stocks to book profits on the equity portion of their portfolios and use the proceeds to diversify into tangible assets. A Blanchard portfolio manager can help design an investment plan tailored to your personal goals. Call us at 1-800-880-4653.

Read More:

10 Coins That Gained More Than 100% In Value In 2016

Posted onIt’s no secret that rare coins possess the ability to accrue in value more significantly than gold or silver bullion coins that are tied to the underlying price in the metals markets.

The price and value of bullion coins like the American Eagle and the Canadian Maple Leaf move closely with the price of spot gold, and can fluctuate daily.

That compares to the very limited supply of rare coins, which means demand for these assets can send prices skyrocketing at any time.

The Number One Gainer in 2016?

The 1964 Silver Kennedy Half-Dollar Today’s Price 12-Month Gain %

PCGS #6844 $13,500 285.7%

This data comes from the highly reputable Professional Coin Grading Service (PCGS). Prior to the mid-1980’s, dealers often graded coins. However, this created serious conflict of interest issues. The third-party grading services, like PCGS, were established to develop standards and practices that are now widely accepted. these organizations neither buy nor sell coins, so there are no conflicts of interest.

A Look Back

The number-two rare coin gainer in 2016 was the 1880 Morgan Silver Dollar, which jumped from $12,000 at the start of the year, to a $35,000 value by year’s end, for a 191.7% gain. The chart below, from the PCGS Price Guide, shows the complete list of the year’s top 10 coin gainers.

We Can Help You Find the Coins You Need

As 2017 starts fresh-now is the time to map out your rare coin acquisition wish list for the next 12 months. Metals prices have fallen in recent months, which has created a more affordable buying spot for coins.

Gold is one of the most negatively correlated assets to stocks-when stocks go down, gold prices go up. That is why we strongly recommend allocating up to 20% of your overall financial portfolio to precious metals and rare coins.

Breaking Down Your Investment Goals

Blanchard and Company recommends that investors allocate 30-40% of their total tangible asset investments to the rare coin sector-simply because that is where the most significant long-term price appreciation can occur.

For investors, looking to build long-term wealth–rare coins are an important diversification component and can provide opportunities for big price gains. We believe in the long term investment value of high end rare and ultra-rare coins.

Talk with your portfolio manager before you buy. High-grade coins typically outperform their lower-grade counterparts in terms of investment performance.

Work with the experts. We have hired the best numismatist in the country to personally purchase and curate every coin that we sell. Any coin that we sell has been reviewed and graded in advance, and we will buy back any rare coin that we have sold at any time, at the current market price. If we don’t have a coin that you are looking for in our inventory, we can help you locate and source coins from collections around the world.

It’s a New Year and a time to add those coins you’ve always wanted to own to your personal investment collection. Give us a call today at 866-764-9135. One of our portfolio managers would be happy to offer you insights on current trends in rare coins.

A Year in Review: Wild Ride for Global Markets in 2016

Posted onThere’s no question that 2016 has been one of the most interesting and surprising years for every market across the globe. In US equity markets during the beginning of the year, January and February were home to some of the most consecutive violent selloffs and volatile trading days in history.

Major US indices plunged 10% in a matter of days, and this launched everybody’s favorite precious metal, gold, into a tremendous month long rally before it finally plateaued.

About five months later, in the early hours of June 24th, the United Kingdom voted in favor of withdrawing from the European Union which caused the British pound to suffer its worse intraday loss in history. Major US, European, and Asian stocks also suffered brutal beatings before US index futures temporally halted trading on the CME due to the relentless selloff.

Because an event like the UK leaving the EU (Brexit, as its colloquially called) has never happened before, volatility and gold saw some of their biggest rallies since the infamous collapse of Lehman Brothers in the midst of the 2008 financial crisis. After it was determined to be highly implausible for the UK to remain in the EU, gold rallied more than 8% while volatility spiked a whopping 70%.

Shortly after this Brexit induced selloff in global stocks and currencies, almost every large cap index fully recovered and made new highs within a matter of weeks; to many investors, this rally displayed the tremendous strength and resilience of an almost decade long bull market. Moreover, despite much of the fear rapidly draining out of the marketplace during the global equity rally, gold continued to make new yearly highs and stayed well above $1,300 until the beginning of October.

Markets around the world were fairly quiet until November 8th came around. Throughout the night of November 8th as votes slowly poured in to determine the next president of the United States, the main US stock index futures (S&P, Nasdaq, & Dow) began free-falling in unison before trading was eventually halted to stop the carnage; the similarities between Brexit and the US election are shocking.

Of course, investors flocked to gold for safety, and gold futures traded all the way up to $1,338, which was 20 dollars higher than the final closing price during Brexit. However, something very interesting happened in the middle of the miniature stock market crash that night. Sentiment completely changed when news broke that the famous billionaire activist investor Carl Icahn left a celebration party early to buy $1 billion in US stocks.

Like a volcano erupting from the ground, the S&P 500, Nasdaq 100, and Dow Jones futures all shot up with so much velocity that investors didn’t physically have enough time to cover their hedges and short positions. This 5% reversal in only a few hours was likely one of the biggest in recent history besides the flash crash in 2010. Needless to say, the rally in gold was short lived and the precious metal barely finished positive for the trading day. Additionally, in the fixed income market, the 30-Year US Treasury Bond futures plummeted as a result of the unexpected election outcome.

Since then, US stocks have enjoyed quite a healthy month-long rally with only a few negative days. As for the precious meals, gold and silver pared most of their event driven gains. For all of 2016, however, gold is still up around 9% which is an extremely decent year-to-date ROI.

Moving forward, many analysts and market pundits are completely unsure of what effect the new year and new president will have on markets. It is interesting to note, however, that in times of widespread uncertainty, like starting a new year with unprecedented political and economic forces, it pays (quite literally) to own risk averse assets like gold.