How Rising Interest Rates Impact Your Wallet

Posted on — Leave a commentThe Federal Reserve raised interest rates three times in 2018. There could be more rate hikes on the way. Wondering how higher interest rates can impact your wallet?

Here’s the short answer.

Savers win. Borrowers lose.

Higher interest rates can affect Americans in a variety of ways, from simple bank savings and CD accounts to home mortgages and credit card interest rates. Here’s what you need to know.

Cash parked in savings accounts earns higher returns.

As the Federal Reserve raises interest rates, banks typically raise the interest rate they pay you on savings account and CDs.

Don’t get too excited. Banks move slowly, the returns are still low and barely keep up with inflation.

The national average for a 2-year CD stood at 0.94%, with a savings account interest rate at 0.09% in the week ending Oct. 19, according to Bankrate. Online banks typically offer slightly more competitive rates than brick and mortar banks. For example, Ally Bank currently shows a 2.50% return on a 2-year CD.

How does this compare historically? In 1984, a 1-year CD came with an enticing 11.27% interest rate.

Bottom line: Savers can generate a little more return on their cash. But, the amounts are small.

Borrowing costs are rising.

Anyone who borrows money pays more for that privilege in a rising interest rate environment.

- An interest rate is the amount of money a bank or credit card issuer charges you to borrow money.

Every time the Fed raises rates, credit card companies almost instantaneously increase their rates by the same amount. So, if you have an average 17% interest rate on your credit card, a .25% Fed rate hike will mean your credit card company will lift your APR to 17.25% soon after.

Anyone who carries a balance on their credit card from month to month, has already seen the interest on that debt rise at least three times this year.

Americans paid banks $104 billion in credit card interest and fees in 2018, up 11% from the prior year, and up 35% over the last five years, as Fed rate increases have been passed on to consumers, according to Magnify Money.

Bottom line: People who carry a balance on their credit cards pay higher interest.

Rising rates impact homebuyers and homeowners too.

- New homebuyers face higher mortgage costs than they did at the start of the year.

- Anyone with an adjustable rate mortgage (ARM) will likely see their rate adjust higher at the end of their fixed rate period.

Mortgage rates already jumped in 2018 and will likely continue to head higher as the Fed continues to hike rates.

- A 30-year fixed rate mortgage climbed to 5.10% in mid-October – an 11-year high.

Other real-life impacts for consumers in a rising rate environment? Any college student taking out a new student loan will pay higher interest rates this year.

Bottom line: Homeowners and students will pay more to borrow money.

Putting It All Together

On the face of it, higher interest rates sound bad.

They do, in fact, trickle down to consumers and businesses with very real impact. In the big picture, however, the Fed’s official interest rate at around 2.00% is still extremely low – and well below an average rate of around 3.5 or even 4.00% and higher during healthy economic periods.

The unique circumstances the U.S. economy faced after the 2008 global financial crisis delayed the Federal Reserve from raising interest rates in a normal manner. The Fed kept interest rates low for so long in an attempt to keep the economy afloat when growth levels were much lower than normal in an economic recovery.

Now, the Fed wants and needs to raise interest rates so the next time the economy sinks into recession, it will have some ammunition to help stimulate growth. Typically, when the economy turns south, the Fed lowers interest rates to improve the economy. The Fed won’t be able to do that during the next recession if interest rates stay low.

The best way for you to handle a rising interest rate environment is to understand the impact and make adjustments where you can.

Consider locking in a fixed rate mortgage (as opposed to a floating ARM). Pay off credit card balances every month, or shift debt to a 0% intro APR balance transfer card to get a break on interest. Rising rates can hurt in the short-term, but in the long-run they allow the Fed to get back to a normal situation, which will pay dividends during the next recession.

How to Find Your Anchor

Posted on — Leave a commentThis month the International Monetary Fund (IMF) decided it was less optimistic about future global growth. The members reduced their forecasts for economic expansion worldwide from 3.9% to 3.7%. They had two key reasons for the revision.

First, they explained that trade barriers are increasing and slowing international commerce. Second, they cited uncertainty in emerging markets as a result of capital outflows.

Simply put, “the global economic weather is beginning to change,” explained the IMF Managing Director.

Meanwhile, The Wall Street Journal reported that fund managers are equally concerned. A survey from Bank of America Merrill Lynch showed that these managers are as concerned as they were in 2008.

Investors appear to share this concern now that volatility is back in the equities market. The result: investors are considering safe havens. But, in an uncertain world traditional havens aren’t what they were. Consider, for example, the US dollar. For many years the dollar was a reasonable place to store and preserve wealth. As recently as this year the WSJ Dollar Index increased 9.4% from its low in February.

However, the value of the dollar has been relatively static during the recent equity market sell off according to the WSJ. This means that investors fleeing stocks don’t see the dollar as a place to “wait it out.” So, where are they going instead? They’re going for the gold.

Recently, the World Gold Council reported on gold’s “flight-to-safety” status amid an upheaval in asset classes like stocks and treasuries. They underscore the threat of high valuations in the stock market as a reason for caution. They explain that “US stock valuations are at their highest since the dot-com bubble and higher than Black Monday.” Moreover, global credit market debt has increased by massive proportions over the last 10 years.

With so much uncertainty, investors are more prone than ever to making emotional moves within their portfolios. Rather than constantly adjust the sails to catch changing winds, investors need confidence. Finding this confidence means finding an anchor to some amount of stability. For many this anchor is gold.

Gold, over the long-term, appreciates in value. However, what gold offers in peace of mind is equally valuable. As the sea becomes choppy, gold is an asset that offers a sense of stability. As a result, investors benefit in two ways.

First, they have reason to abstain from impulsive market moves that erode wealth and create tax burdens. Second, they preserve their wealth during the inevitable market swings that test the resolve of even the most seasoned investors.

The time to find this stability is now, before the currents change. Fund managers and the IMF agree that significant market movements and global economic shifts are ahead. Risk cannot be eliminated, but it can be managed.

Recently leaders at Pacific Investment Management Co offered a clear assessment of the future stating that, “Our models, like many others, see an increased risk in 2020.” They believe that the probability of a recession is “quite likely” within the next five years.

Mercury Dime History and Key Dates

Posted on — 16 CommentsYou can purchase a Mercury dime for a few dollars. Yet, some of the most coveted key dates and mint marks are worth north of $25,000. Not bad for a dime.

Collectors actively pursue this stunning coin for the exceptional design created by Adolph A. Weinman. The metal content is 90% silver and 10% copper. The mints include Philadelphia, Denver and San Francisco.

Coin description:

Weinman’s design shows the head of a youthful Liberty in profile. She wears a cap that has wings, which were meant to represent “Liberty of Thought.” The public, however, misunderstood Weinman’s intent, believing her to be Mercury, who wore a cap and sandals with wings. (This would make sense since Mercury is the god of commerce.) Weinman’s monogram AW sits on the right of the Liberty’s neck.

The reverse features an unusual (for those used to modern coinage) design: a fasces depicting unity and strength, and an olive branch symbolizing peace.

1916 is a special year in the history of U.S. coinage.

Mercury dimes debuted in 1916 – a groundbreaking and unique year in the history of U.S. coinage. In 1916, the U.S. Mint created three new silver coins and it marked the first year – ever – that different designs were used on the dime quarter and half dollar.

As a coin group, Mercury dimes aren’t rare. An incredible 2.5 billion were struck from 1916 through 1945. Mercury dimes were last struck in 1945, when a new dime was created to feature Franklin D. Roosevelt, following his passing.

During the depths of the Great Depression, no mercury dimes were minted from years 1932-1933.

Today, rare coin collectors classify Mercury Dimes into “early dates” (1916-1931) and “late dates” (1934-1945) categories. Nearly all late dates are common and can be easily acquired.

There are several key dates for Mercury dimes.

Their scarcity increases their value into the thousands.

The 1916-D is perhaps the most famous and sought-after dimes. The original mintage was around 250,000. Today, 1916-D is very rare in mint state.

Other Mercury dime key dates include 1921 and 1921-D and 1942-1 and 1942 -1D. The latter key dates show “overdates” with the number “2” struck over the number “1.”

Blanchard recently had not one, but two 1916-D Mercury dimes. They are gone now. They sold fast.

Precious metals and rare coin prices are turning up. If you are interested in acquiring a 1916-D Mercury Dime or any other rare coin, we can help you do that. Blanchard has tremendous reach and respect within the rare coin industry.

Building sets of Mercury dimes can be an exciting and profitable goal.

Many collections of rare coin sets have sold for more than the total value of the individual coins. Coin investors typically follow one of two sets: “type” and “series.” A type set is comprised of all of those coins sharing a single specific characteristic such as a design, designer or denomination. A series include one coin from each date and mint of a particular type.

Other investing strategies include collecting by mint mark, by individual year, or first and last year of the issue of a coin.

The Most Important Economic Measurement You’re Not Watching

Posted on — Leave a commentRecent weeks have left equity investors shaken. A selloff resulted in a 5% loss in the S&P 500 for the month. Until now, equity investors have taken global events, good and bad, in stride. Their confidence was only outpaced by the unstoppable market growth, but something has changed.

Many have cited interest rate hikes and slowing performance among tech stocks as reasons for the latest equity decline. While, these two factors are likely contributors, there’s more to the story.

There is a growing divergence between the east and the west. This divide is best illustrated by looking at something called the Economic Policy Uncertainty Index. This Index measure the uncertainty influencing today’s economy. The methodology draws on three measurements to calculate the index. Researchers examine:

- Newspaper coverage of policy-related economic uncertainty

- Soon-to-expire tax code provisions

- The level of disagreement among economic forecasters

The latest result of the measurement shows that the economic uncertainty policy index in the US and China is diverging. This measurement suggests a major disconnect between two global powers.

Today, this index for the US is at 53. In comparison, the same measurement for China is at 541. This difference should give equity investors a reason to revisit their long-term expectations for annual returns. The latest drop in the S&P 500 might be an echo of this looming divide. We haven’t reached official “market correction” territory. Therefore, investors are best suited to reposition their portfolios while they still can.

The diverging indexes may also suggest that those outside the US don’t share our optimism. The high expectations of equity investors is best illustrated by today’s high price/earnings (PE) ratios. The historic median for this traditional measure of stock’s value is about 15. Today, that same measurement is more than double that at 31.

This number means that investors are willing to pay much more for stocks than they have historically. Moreover, as PE ratios climb, future returns tend to diminish. For example, when PE ratios are in the 21-44 range, the average 10-year forward return (annualized) is just 5%. This tepid growth is a major difference from the 7% most equity investors use to project their long-term gains.

The time to consider alternative investments like gold is now. Gold serves as a hedge during periods of uncertainty. Recent market fluctuations and a widening gap between US and China outlooks could be early warning signs that investors will need to become more strategic about their methods for reaching their financial goals.

Despite differences in the economic policy uncertainty index, there is one area of agreement between the two nations. Both believe in the economic significance of gold. Both countries, and the rest of the world, assign the same value to gold and always will.

It’s not surprising to read that the head of research at foreign exchange trading form Pepperstone remarked that “We have seen a rapid shakeout of very crowded and over-owned U.S. assets.” He concluded, “Statistically, it feels as though convergence is due.”

2 Reasons This Is a Once in a Generation Opportunity to Buy Gold

Posted on — 2 CommentsGold fell just below $1,200 an ounce in August and many on Wall Street are now whispering that a bottom is in place.

A new MarketWatch article entitled: “Why Gold Prices May Have Already Bottomed” highlighted a few key reasons that Wall Street pros are picking up bargain basement prices in gold right now.

The good news is that you can too! (See our simple 3 step guide to buy gold at the bottom).

Here’s why many think gold is a good buy right now:

Central banks are buying gold in full force

In the first half of 2018, central banks added a net total of 193.3 tonnes of gold to their reserves – an 8% increase from the same period in 2017. This marks the strongest first half for gold central bank buying since 2015, a new World Gold Council report said.

As governments around the world seek to diversify their reserves away from the U.S. dollar, gold is increasingly becoming an important component of central bank purchases.

For decades the U.S. dollar has been the world’s “reserve currency.” For now it still is. But, history shows that reserve currencies do change over time. It’s not “If” but “When” the U.S. will lose the reserve currency status. When that happens, central banks will be less inclined to hold significant amount of U.S. dollar reserves, which means they will sell our currency, likely pressuring the value sharply lower.

- Previous reserve currencies included the British pound sterling, the Spanish dollar, and before that the gulden from the Netherlands and the fiorino from Florence.

Central banks are buying gold because it is a recognized currency and asset in all countries around the globe and is not tied to the rise or fall of any one nation’s fortunes.

Consolidation in the gold mining sector

This is another signal that the gold market may have already bottomed out. In late September, gold giants Randgold and Barrick Gold agreed to a merger that will create an $18.3 billion gold mining giant. Mergers are viewed as a signal that an industry is at a turning point.

Frank Holmes, chief executive and chief investment officer at U.S. Global Investors believes the gold merger is “positive for the industry” and signals a “once-in-a-generation buying opportunity” for investors, the MarketWatch article said.

3 Steps to Add Gold to Your Portfolio

1. Choose Your Weights

There are different weights of gold coins available, so investors can buy coins that are as little as 1/10 of an ounce up to the more standard one-ounce coins, in addition to larger bars for investors making a more sizeable investment.

2. Purchase easily online and Blanchard will ship directly to you.

3. If you’d like to speak with an expert before you buy, contact Blanchard and let us help you build a solid portfolio that matches your personal financial goals. Discuss your financial goals and risk tolerance level with a Blanchard portfolio manager. We will take the time to learn your investment objectives, investment time horizon and risk appetite before recommending products for your consideration.

The Unexpected Journey of the 1933 Saint- Gaudens Double Eagle

Posted on — Leave a commentIn late August of 2005 the US Mint seized ten 1933 Saint-Gaudens Double Eagle coins gold coins from a Philadelphia jeweler. Many consider the total value of the coins to be incalculable. They are among the rarest in the world.

The jeweler, Joan S. Langbord, immediately started a federal court lawsuit to recover the coins. At the same time, the acting director of the mint declared that Langbord, and her family, obtained the coins “in an unlawful manner.”

The story of Langbord and how her family came into possession of the coins dates back decades when they were first minted.

In the early 1930s the US was in the grip of a banking crisis. Banks started to fail as investment banking losses mounted. The problem worsened when panic set in causing bank runs in which vast numbers of account holders withdrew their funds simultaneously. As part of a solution, president Franklin D. Roosevelt issued an executive order. He demanded that citizens turnover any gold in their possession to the Federal Reserve bank.

Eventually, he passed the Gold Reserve Act in 1934 outlawing the circulation and private ownership of US gold coins. This new law meant that the recently struck 1933 Saint-Gauden Double Eagle coins were no longer legal tender. The mint melted the coins and reserved two for inclusion into the U.S. National Numismatic Collection. The US mint thought the Gold Reserve Act was the last chapter in the story of the Saint-Gaudens Double Eagle.

They were wrong.

Unknown to the mint, a number of these coins found their way into the hands of private collectors. In time, the Secret Service learned of the missing coins. They started an investigation. In the first year of their work agents recovered seven double eagle coins. Eventually, their investigation led them to an unexpected place: Egypt.

King Farouk of Egypt owned a double eagle coin. He purchased it in 1944 by applying to the US Treasury for an export license. The request was granted because at the time, the US mint was still unaware of the theft of the coins. The US attempt to recover the coin but World War II derailed efforts. Later, in 1952, Farouk fell from power after citizens staged a coup. Officials auction his possessions. The US requested the coin, and though the Egyptian government agreed, the piece mysteriously disappeared.

In 1996 law enforcement recovered the coin in a sting operation at New York’s Waldorf-Astoria Hotel. The coin was found with a British coin dealer who swore under testimony that the piece traced back to King Farouk. After its recovery US agents stored to coin in reserve vaults at the World Trade Center. Just two months before September 11th officials moved the coin to Fort Knox.

The fervor surrounding this particular coin kept agents on the lookout for more. Eventually they found what they were looking for in the hands of Joan S. Langbord. In the following years a series of trials resulted in the coins bouncing between the Langbord family and the US government. Today, they reside with the Federal government.

Some believe there are still original 1933 double eagle coins hiding in tin cans and basements. We’ll likely never know how many are out there. But, we do know they’re valuable. In 2002 an anonymous collector purchased one for $7.59 million.

Barron’s Cover Story: Why Gold Should Be Part of Your Portfolio

Posted on — Leave a commentIn case you missed it, Barron’s devoted its cover story to gold on September 21.

The title of the article: “Gold Is Cheap. Inflation Is Coming. You Do the Math.”

Kind of catchy, right?

The basic premise of the article is that gold has taken a hit this year (down about 8%), but more importantly – why gold deserves a spot in your portfolio.

The author, Andrew Bary, interviewed a number of portfolio managers and traders. Here is the key premise:

“Compared with stocks and other financial assets, gold looks inexpensive. More important, inflation is starting to pick up in the U.S. and in much of the world as central banks shrink their enormous balance sheets. And gold has represented a good defense against inflation eroding the value of a stock or bond portfolio. Over time, it has held its value against the dollar.”

There’s so many reasons to own gold and Bary hits on most of them in this article:

- Gold is cheap today. He compared an ounce of gold to the Dow Jones Industrial Average. Today it takes about 22 ounces of gold to buy one unit of the Dow. That compares to about 7.8 in 2011, when gold trades to its all-time high above $1,900.

- Gold is a traditional hedge against financial and economic crises. Most recently, after the collapse of Lehman Brothers in September 2008, gold rallied 17%. The S&P 500 fell 40%.

- Gold is rare and it’s difficult to quickly increase the supply of the precious metal. (Unlike a government printing press where the Fed can create trillions of dollars out of thin air.)

- Inflation is starting to pick up in advanced economies. Gold has long been a good defense against inflation erosion in dollar holdings.

While many U.S. investors currently own little or no gold, one of the biggest bulls out there is Jeffrey Gundlach, chief investment officer at DoubleLine Capital, a well-known bond market guru.

Gundlach has turned bullish on gold following the recent short-lived breach of the $1,200 per ounce level.

Here’s how the Barron’s reporter wraps up his conclusion:

“U.S. stocks are at record levels exactly at a time when global stress—trade tensions, populist nationalism, and the like—appears to be growing. This may be an opportune moment for investors to shift at least a portion of their portfolios to gold.”

There’s strengthening evidence that the 2018 low in gold has formed.

From cover story articles to major Wall Street gurus proclaiming themselves outright bullish on the market, the odds favor higher gold prices ahead.

Gold is the ultimate safe-haven asset. It’s only a matter of time before it spikes higher again.

Your Brain Likes Shortcuts, and That’s a Problem

Posted on — Leave a commentIn recent years, articles and videos promising “life hacks” have become popular. These tips and tricks are shortcuts for navigating life’s petty challenges and problems. We like these life hacks because our brain is wired to look for quick and easy solutions. We do so to conserve energy and cognition. At first glance it appears these shortcuts are a benefit which allow us to move fast and avoid overthinking. However, there is one problem:

These shortcuts unfold without our knowledge.

Behavioral economics has brought attention to these hidden influences. This branch of economics shows us how these approaches to problem solving, sometimes called “heuristics,” can undermine our goals. One prominent Duke University professor who has studied these heuristics and biases is Dan Ariely. In his experiments he has learned about a peculiar characteristic of human psychology, the “price placebo.”

The placebo effect is the phenomenon of taking a medication which, unknown to the patient, is artificial. Believing that the medication is in fact real, the patient feels better without having undergone any real medical treatment. Ariely’s insight was that this trickery also works with prices.

In his experiment, participants subjected themselves to small electrical shocks. Each delivered a painful sensation. Later, Ariely offered the participants a pain killer. If the subject wanted it, they would have to pay. Ariely’s price was $2.50. Nearly all who paid for the painkiller – nothing more than vitamin C – reported feeling better. At this point, all of the findings were predictable, after all, the placebo effect is a well-known phenomenon. Things changed, however, when Ariely altered the price.

Ariely started charging just $0.10 for the false painkiller. This time participants were much less receptive to the medication and remarked that is was ineffective. People really do believe that they get what they pay.

This finding has implications for equity investors today who are willing to pay much more than they have in the past. Perhaps the high stock prices of today have given way to a price placebo in which investors believe expensive stocks offer far more potential.

For example, since 2013, stock prices, as measured by their P/E ratios, have been in the highest quintile. This means that for five years stocks have been at the highest end of the “pricey” scale. Ariely’s research suggests that an expensive stock market has vaulted expectation to unrealistic levels. As Wall Street Journal columnist Jason Zweig recently explained, “Markets tend to lose their dominance right around the time it seems most irresistible.”

During this period of great expectations, gold has sat largely ignored. As more investors continue to flock to the stock market, gold has receded to much more affordable prices. These lower costs make it easier for incoming gold investors to realize a long-term profit because the cost doesn’t “price in” extraordinary expectations.

As Ariely explains, “Our irrational behaviors are neither random nor senseless- they are systematic and predictable. We all make the same types of mistakes over and over, because of the basic wiring of our brains.”

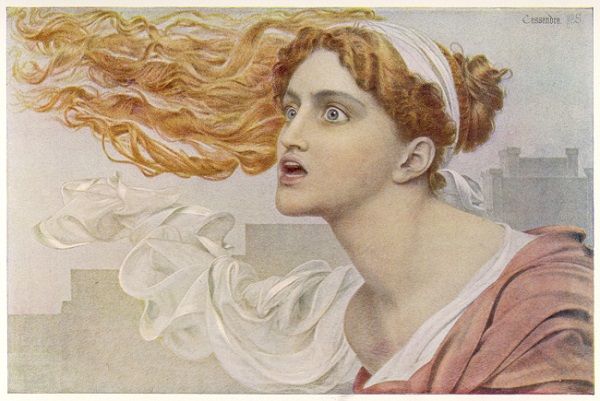

Ignore Cassandra’s Prophecy at Your Own Peril

Posted on — Leave a commentStudents of Greek mythology will recognize the tragedy that surrounds the words that Cassandra speaks.

Cassandra of Troy, was a daughter of King Priam and Queen Hecuba in Greek methodology. Attracted by her breathtaking beauty, Apollo gave her the power of prophecy and foretelling the future in an attempt to seduce her. Strong willed and defiant at times, Cassandra rejected Apollo. As the story goes, Apollo spat in her mouth triggering a curse that no one would ever believe her prophecies.

Sadly today, the yield curve (or the spread between the 10-year note and 3-month note yield) has become a modern day Cassandra.

An inversion of the yield curve is the best predictor of recession for the last 50 years. It has inverted before every single recession with no false positives.

An inverted yield curve means that the long-term Treasuries have a lower yield than short-term debt instruments.

Yet, economists and even Fed officials are questioning the predictive power of the yield curve.

They are falling into the dangerous trap of not listening to Cassandra. This has happened before.

In 2006, prior to the global financial crisis, the yield curve inverted. At that time, former Fed chairman Ben Bernanke argued the inverted yield curve may no longer be a strong recession indicator since bond markets have become global.

Well, the rest is history as the Great Recession soon followed.

Just as Apollo became lost in Cassandra’s beauty, Wall Street veterans have become entranced with the ever-growing U.S. economy. What could go wrong? Recession? No way, they say.

Don’t forget this juiced-up late stage expansion is fueled by one of the largest corporate tax cuts in history. The $1.8 trillion fiscal stimulus package passed last year is working. Here’s the rub. It only lasts so long. Congress can’t pass another tax cut next year and the economy will begin to run out of gas.

The yield curve hasn’t inverted yet. But, it is flattening noticeably. The 10-year note yield at 2.9% is still above the 3-month bill yield at 2.1%. But, it’s getting close.

As the Federal Reserve continues to hike interest rates, the inversion will become closer and closer.

This is a foolproof recession predictor.

In July 2000, the yield curve inverted. Not long after, the business cycle peaked, the Dot.Com stock market crash came and the recession started in March 2001. Then, the yield curve inverted in August 2006, and the Global Financial Crisis sparked a recession that began in December 2007. It has inverted before every recession back to 1953, when the data started.

It’s time to listen to Cassandra.

The yield curve is warning that the next recession is on the horizon, no matter how rosy the economy looks right now.

The S&P 500 lost roughly 50% of its value in the 2007-2009 bear market. Yes, 50%!

If you haven’t fully diversified your portfolio with tangible assets, the yield curve is warning that you should act now. Physical gold bullion typically surges sharply higher when stocks crash.

Owning physical gold is a simple strategy to protect your assets in the coming recession. Don’t make the mistake of discounting Cassandra’s warning. Ignore her at your own peril.

Life as a Legal Monopoly

Posted on — Leave a commentA central bank is a legal monopoly. What exactly does this mean? It means that a central bank is an institution that has the right to print money, whereas no other bank does. Therefore, the central bank controls the money supply. They set interest rates and act as an emergency lender. In the US, the central bank is the Federal Reserve. What does all of this mean for gold investors?

Central banks hold something called “Foreign Exchange Reserves.” These are assets held in a foreign currency. Central banks keep these foreign reserves on hand as an emergency measure. If the home currency fails, then at least the central bank will have this non-home currency to fall back on. These assets include foreign bonds, banknotes, government securities, and gold.

Recently, the International, Monetary Fund reported that gold represents approximately 10% of the total value of foreign exchange assets across the globe. Therefore, central banks are a key purchaser in the gold market. In fact, the World Gold Council reported that central banks represent 10% of total demand in the gold market.

Lately, they’ve been buying more.

In the first half of 2018, central banks bought 193 tons of gold. This total represents an 8% increase over purchases during the same period last year. Some of the biggest purchasers – representing 86% of the total – include Russia, Turkey, and Kazakhstan.

While the US economy is on solid ground for the moment, there are lingering geopolitical and economical concerns elsewhere. These conditions might be a factor in central banks’ decision to increase their gold holdings. As the World Gold Council explains, “Many emerging market central banks have a high degree of exposure to the US dollar and turn to gold as a natural currency hedge.”

More importantly, an increase in gold holdings by central banks makes intuitive sense. Why? Because these institutions need to have the flexibility to quickly liquidated positions if the global markets move a certain way. Gold allows this flexibility because it is a universal currency accepted in every country.

Though central banks are powerful and towering institutions, their strategy has relevance to everyday investors. Central banks buy gold because they want to be prepared for any scenario. Similarly, investors should consider the same approach.

For example, since 2013, stocks have exhibited high valuations. In fact, valuations in stocks today have never been higher with the exception of the 1999 dot com bubble.

High valuations should signal two things to investors. First, stocks might be overpriced, or nearing a point where they will soon be overpriced. Second, it suggests that the rapid growth seen in the stock market over the last 9+ years is nearing a point where it will have to come back to Earth. Liquidity is a key component to any portfolio safeguard. Gold offers this liquidity because dramatic drops in the stock and bond market are unlikely to precipitate similar drops in gold especially when central banks have such an appetite for the metal.

Take a page from the book of the biggest player on the field. Most will find that if gold is good enough for central banks, it’s good enough for them.