Take Three: What Tariffs, Space and Fair Trade Mean for Gold

Posted on — Leave a commentWant to make some gold? All you need are a few colliding neutron stars.

Tariffs

Call it the tariff tailspin. Trump has levied tariffs in an attempt to equalize the global trade playing field. The result: stocks plummeted. “Washington is going to dominate market action until Q1 earnings season kicks off in a few weeks,” remarked the co-founder of DataTrek Research. Meanwhile, the Volatility Index is rising as equity investors become fearful of what higher trade costs and muted growth will mean for stocks in the short-term and long-term. Their concern is well-founded; the moves could have implications for up to $60 billion of imports from China. The story for gold, however, has been different. Gold future increased 3% to $1,350 an ounce inching closer to its 52-week high of $1,362.40. “Further strength without additional dollar weakness would signal that bullion is becoming more sensitive to tariffs/trade war, and Trump’s recent cabinet replacements,” remarked an analyst with Institutional View. Additionally, silver picked up another 1.4% this week reaching $16.59 per ounce marking its highest price since March 9.

Space

Want to make some gold? All you need are a few colliding neutron stars. This was a recent scientific discovery coming from volumes of globally sourced data. In August of last year, researchers around the world made a united effort to observe a burst of gravitational waves in what one journalist calls “tiny ripples in the fabric of space.” They learned that when neutron stars crash into each other gold forms and is jettisoned into the universe. Scientist theorize that this natural phenomenon explains the origins of the precious metal on Earth. The immense force of these collisions is difficult to overstate. Each of the two colliding stars carries as much mass as the sun compressed into a sphere only slightly larger than six miles wide. “We estimate that the collision created about as much gold as the mass of the Earth,” remarked Professor Andrew Levan of Warwick University. That’s one serious pay day.

Fair Trade

Independent, non-profit organizations are leading the charge for more ethical standards in gold mining operations. They are offering certifications for companies that use both responsible working standards and pay fair wages. More jewelry manufacturers are taking note and converting their stock and production to fair trade gold only. This drive for sustainable gold has led some to delineate between traceable gold (that which can be proven to come from a certified source) and non-traceable gold. However, ensuring ethical practices carries a cost, in some cases certified gold costs an additional $4,000 per kilo. Today, fully certified mines can be found in Peru, Uganda and Kenya. As more retailers and consumers opt for fair trade the implications for all mines could be substantial given that approximately 78% of the world’s gold is turned into jewelry. For example, Swiss watch and jewelry maker Chopard has invested substantially in making their gold traceable. “The investment today will absolutely pay back in the long term,” remarked Caroline Scheufele, the co-president.

5 Surprising Facts about the Gold Standard

Posted on — Leave a commentThe history surrounding gold is centuries old. Gold coins were first struck on the order of King Croesus of Lydia, an area that is part of Turkey today. Gold coins were used long before paper money was ever introduced as a medium of exchange.

By the late 19th century, many currencies around the globe were attached to gold, or fixed at a set price per ounce. That is known as the Gold Standard.

Let’s take a quick look at the fascinating history and future of the gold standard.

- In 1971, the U.S. went off the gold standard under President Nixon. What many gold investors don’t know is that the classic gold standard that the U.S. was using included a 40% cover ratio.

What does that mean? The 40% cover ratio meant the U.S. government would only print money if it has gold in its Treasury equal to 40% of the currency in circulation. For example, if the U.S. had $10 billion of money in circulation, the 40% cover ratio meant the government had $4 billion of gold in the Treasury.

- With the current U.S. debt totaling $21 trillion, even though the U.S. has the most gold in the world, we don’t have enough gold in Fort Knox to pay off our debts.

That means a return to the gold standard is unlikely, or it would mean the government would need to “revalue” the price of gold about 400-500% higher than the current $1,350 an ounce.

- Economists say a return to the gold standard would choke off economic growth.

Modern finance includes the concept of a “growing money supply.” The Federal Reserve can flip the switch and print more dollars, just like the “quantitative easing” efforts that were seen in the wake of the 2008 Global Financial Crisis. You can’t print more gold. Money supply couldn’t grow faster than the supply of gold, which could force lending and economic growth to slow down, some economists say.

- All other countries of the world would need to join in too.

Many financial experts say a return to the gold standard could only work if other advanced nations did it too. Given the difficulty agreeing on trade issues alone, a global monetary agreement to the gold standard appears unlikely at current times.

- Gold is expected to continue to play a key monetary role in the future.

While advanced industrial economies continue to degrade the value of their paper money by money printing and deficit spending, there has been discussion about an eventual “basket” of currencies that could someday become the new world reserve currency and replace the dollar. Gold would play a key part in that currency basket, financial experts say.

The Bottom Line

While a return to the gold standard appears unlikely in our modern financial era. That in no way takes away the inherent power and value of owning physical gold. To the contrary, it only enhances the intrinsic value of gold – as an asset that can’t be degraded by a government printing press.

Gold is a traditional currency that is recognized as a store of value around the world.

Why else would countries from the U.S. to Germany to Italy to China to Russia to Japan to India and dozens more hold hundreds of tons of gold in their central bank vaults?

Owning gold is an appropriate investor for all investors. A properly diversified portfolio can include anywhere from 10 to 25% of gold, depending on your financial goals. If you haven’t developed a financial investing plan, call Blanchard to get started with an individualized financial consultation. Blanchard has a long history of helping individual investors hedge their assets and grow their wealth. You can get started with investments as small as $380 for a 1/4 ounce American Eagle coin, all the way up to rare coins in the thousands. No matter your budget or your financial goals, we can help you too.

Y2K: When Americans Stockpiled Gold

Posted on — Leave a commentThe latest Gold Rush wasn’t in the 1800s in California, but just a mere two decades ago.

In the months leading up to January 1, 2000, anxiety and fear was spreading among even the most educated and wealthy in the world.

Everyday Americans were stock piling canned goods, water bottles. Others were making escape plans, where would they go if their major urban city erupted into chaos and looting.

What was the culprit driving these fears?

Doom and gloom entered mainstream society in 1998 and 1999. Computer programmers were furiously working to fix the so-called “Millennium Bug,” also known as the Year 2000 or Y2K bug.

This all started decades ago when short-sighted computer programmers, were designing programs that control everything from your bank account to your 401k retirement funds to the electrical grid to municipal water management systems.

A programming short cut

Computer programmers adopted a universal short-cut date format that omitted the “19” as in 1980 or 1999.

Quite literally, it was feared that computer systems around the world would crash because programs would not be able to compute “20” for the year.

Can you imagine the feeling if you logged into your online bank account or retirement account to check your balance and all you saw was “00.00” or zero dollars. This was the fear, that no financial institution would really know who had how much money, as everything was digitized.

One senior executive at Barclays Bank, quoted anonymously said: “I’m going to plan for the absolute worst. I am talking about the need to start buying candles, tinned food and bottled water from mid-1999 onward.” He was one of many who saw gold as a safe investment in a time of uncertainty.

Flight to Gold: A Hard Asset

The banker also advised people stockpile their cash and buy gold in case the Y2K bug causes a global economic collapse, with currencies and stock exchanges tumbling into a computer-induced free fall.

The New York Times reported that “Another British banker, asked by the newspaper to comment on his rival’s seemingly daffy remarks, said investing in gold might not be a bad idea.”

Gold Sales Soared Ahead of Y2K

In mid-1999, an ounce of gold sold for a bargain basement price of $252 an ounce. Americans and Canadians stocked up aggressively on gold bars, coins and silver as protection of a meltdown of the global financial system. The Royal Canadian Mint reported a 20% increase in Maple Leaf gold coins, while the Mint also reported a $15 million sale of gold coins related to Y2K.

Others stocked up on silver coins in expectation that they could be used as barter units if the monetary system broke down.

Thankfully, the computer programmers fixed their short-sighted error. But, it was not known until just after the stroke of midnight on Dec. 31, 1999 what exactly would happen. Nonetheless, Americans and others around the world turned to hard assets – gold and silver, for protection against economic uncertainty.

Gold still plays an important part in portfolio diversification

Today, just as in yesteryear, gold is a universal currency, with recognized value around the world. Holding a portion of your assets in physical gold and silver makes sense for all Americans. While Y2K is not a looming threat, our financial system remains dependent on computer programming in the digital space. While most of your assets may be a number on a screen, having a portion in hard assets that you can hold in your hand brings a sense of security unmatched by a number on a screen.

Blanchard can help you get started or assist you in adding to your diversification strategy. Call Blanchard today at 1-800-880-4653.

[Editor’s note: This is one in an occasional series of posts on the history of gold. Read an earlier time in U.S. history when Americans were hoarding gold here: FDR to Americans: Stop Hoarding Gold.]

Fed Signals Three Rate Hikes In 2018

Posted on — Leave a commentThe Federal Reserve hiked interest rates by a quarter percent as expected on Wednesday. That lifted the benchmark Federal funds rate to 1.50-1.75%. That move was widely telegraphed by Fed officials for months and markets were well prepared for the news.

What surprised investors was an additional rate hike penciled in for next year.

Key takeaways for gold investors –

- Three not four rate hikes in 2018 – The Fed’s famous “dot-plot” chart, which shows the Fed policy maker’s anonymous rate forecasts, indicates the Fed is on track to hike rates twice more in 2018. Some on Wall Street had expected the Fed to hike more this year that encouraged gold investors in the wake of the Fed’s announcement.

- Stock investors were jolted by the Fed’s signals of a faster pace of interest rate hikes in 2019. Now, the central bank expects to raise rates three times next year, rather than two just previously forecast.

How did markets react to the news?

- Spot gold hung onto solid gains scored earlier in the day Wednesday, trading around $1,327 an ounce. That’s up from Tuesday’s London pm gold fix at $1,311 an ounce.

- The Dow erased gains and turned lower during Fed Chair Powell’s press conference. Apple stock shares fell sharply.

- The yield on the 10-year Treasury note jumped to 2.91% on Wednesday, up from 2.88% on Tuesday.

Big picture

This is the sixth interest rate hike in the current monetary tightening cycle, as the central bank attempts to lift the economy toward a more normal interest rate environment.

Despite all the drama and intrigue over rate hikes, the new 1.50-1.75% remains abnormally and historically low – well below more the 3.5-4.0% range seen during typical economic expansions.

Is it too little too late from the Fed?

The U.S. economy is growing, aided by a big dose of fiscal stimulus from the recent tax cuts. But, for how long? Some investment firms, like Capital Economics, expect economic growth to slow in 2019, which will mean the Fed will have to start cutting interest rates as early as 2020.

Fed cycles come and go

While interest rates nudge higher and lower, it has little impact on the long-term value of investing in physical gold, silver and numismatics. The long-term trend for gold remains up.

- Gold represents a hard asset, an alternative monetary outlet that is not degraded by any government or deficit.

- Gold offers investors a proven portfolio diversification tool, against the inevitable decline in the stock market.

Gold prices are climbing and will likely be more expensive next month.

Current levels offer investors perhaps the best buying opportunity of 2018. Contact your Blanchard portfolio manager today for an update on how you can maximize today’s opportunity to grow your long-term wealth.

Thrills, Spills, and Chills

Posted on — Leave a commentA Thrilling Ride…

On February 5th, the stock market fell out of bed and broke both legs.

The Dow Jones Industrial Average fell by 4.6%. While equity markets hit free fall, gold climbed. This dynamic illustrates once again the risk-mitigating characteristics of gold. “The stronger the market pullback, the stronger gold’s rally,” remarked The World Gold Council (WGC). Researchers have cited comparable events like Black Monday, the global financial crisis, and the European sovereign debt crisis. In fact, the hedging effect is even more pronounced during periods of prolonged corrections in stocks. Today’s equity markets, characterized by increased volatility, has illustrated, time and again, that gold can bolster overall portfolio performance during periods of uncertainty. Case in point: gold has been among the best performing asset classes year-to-date beating treasuries and corporate bonds.

Meanwhile, other investments, like cryptocurrencies, have not fared well. It’s worth noting that rising gold prices are not driven by short-term fears alone. For example, 90% of gold demand comes from outside the U.S. “As European currencies weakened against the US dollar during the week, gold’s price in those currencies strengthened. Gold rallied by 0.9% in euros and 1.8% in British pounds between Friday, February 2nd, and Monday, February 12th,” explains the WGC.

A Spilling Tide…

Ever wonder what 3 tons of gold scattered on a runway looks like? Wonder no more. A cargo plane loaded with 9.3 tons of gold took off down a Russian runway, but the door was not properly secured to withstand the weight of the shifting payload. 172 gold bars tumbled out the back and onto the ground over a 10-mile radius. Authorities shut down the runway and reportedly recovered 172 bars. The plane was headed for the Russian city of Krasnoyarsk. Other assets were scattered including various precious metals and diamonds.

The bars, known as dore, were semi-pure alloys of gold and silver. Such bars are often created at the site of a mine with the intention of further refinement at a plant. The value of the total payload was $398 million. After noticing the spill, the crew landed at another airport close to their original departure point. Authorities have started an internal investigation to understand why the accident occurred.

A Chilling Rise…

One of the coldest countries on the planet is going for the gold. Russia’s Central Bank Gold Reserves rose to 1,857 tons in January. This total surpasses that of the People’s Bank of China which holds 1,843 tons. The country added 18.66 tons in the month of January alone making them the fifth largest gold reserve in the world. These increases are just the latest in an ongoing trend characterized by fervent gold purchases. In fact, since June 2015, the Central Bank of Russia bolster their holdings with 576 tons. While the motivations for the purchases aren’t entirely clear, more gold would distance the country from the dollar at a time when U.S. sanctions are on the rise and tensions between the two countries rise.

Celtic Pride: Early Coinage as a Historical Record

Posted on — Leave a commentToday we associate gold with investments and stores of wealth. However, a look at history reveals that gold had even more pragmatic uses. Some of the earliest Irish coinage served as payments from convicted criminals to victims or victims’ families. These early pieces of gold were rings, rather than coins. Coinage was a natural step in the evolution of economies. Celtic coinage was produced from the late second century B.C. to, approximately the mid-first century A.D.

Much of the early Irish and Celtic gold coin features were influenced by the Macedonian coinage of Philip II and Alexander the Great. The coins featured the head of Apollo from classic Greek and Roman religion. Apollo, with his youthful representation, is widely associated with music, truth, healing, and prophecy. The reverse often featured a horse-drawn chariot. Other coins show more gruesome images.

Some Celtic coins include representations of giants and severed heads on a rope. Other more dramatic images show soldiers on horses entering battle, gods, thunderbolts, or even skulls. Other coins showed symbols of good luck (gold stater of the Eburones). Such coins came from a tribe of Celtics called the Eburones. In fact, part of our understanding of the Eburones comes from the fact that concentrations of their coins have been found in et eastern part of the Dutch river area. The methods for minting these coins was surprisingly sophisticated given the limited technology of the time. Historians often make the distinction between coins that were “struck” versus those that were cast.

A struck coin starts as a blank and is stamped with an image using a die. Often, the die was formed with iron or bronze to withstand repeated use. A strong smithing operation, consisting of many professionals, could strike as many as 20,000 per day. In fact, at the height of production, ancient Romans could produce an astonishing 17 million in a year. The process was a trade including blacksmiths and apprentices. Like methods today, a struck coin required two dies, one for the front image, the other for the reverse. Eventually, modern technology gave way to innovations like roller mills which created metal sheets of uniform thickness. Mechanical minting operations would punch coins from this sheet. Moreover, these processes also gave rise to superior methods of generating precision alloys to ensure uniformity across coins. A cast, however, involves pouring the liquid metal into molds, so the coin image and shape are achieved in one step.

As the practice of minting became more commonplace, the designs on Celtic coins became more sophisticated. Horses became a regular image. Boar designs also became common as hunting was a regular practice. While many of these coins were gold or silver, Celtic coinage also included potin pieces consisting of tin and copper.

In time, the coins started to follow Roman imagery. This came as a result of Romans invading Gaul. Today, the coins that remain preserve an account of history that extends across a series of images that act as a record of victories and defeats.

FDR to Americans: Stop Hoarding Gold!

Posted on — Leave a commentThe year was 1933. It was the height of the Great Depression. The average income of an American family had declined by 40 percent over the past four years. If you had a job you were one of the lucky ones.

Bread lines and soup kitchens were common. It is estimated that half of all American children did not have enough food, proper housing or medical care during the Great Depression.

After losing their jobs and unable to pay their mortgage or rent, hundreds of thousands of Americans lived in shanty towns made of cardboard and sheets nicknamed Hooverville’s. About 750,000 farming families lost their farms to bankruptcy. A full 20 percent of the population, or 15 million people at that time, were unemployed and could not find work.

It was the worst economic downturn to ever hit the industrialized world.

Paper Money Was Backed By Gold

In 1913 the Federal Reserve Act provided for the creation of Federal Reserve banks and a system overseen by the Federal Reserve Board. The U.S. was still on the gold standard at this time. The law required the Federal Reserve to hold gold equal to 40 percent of the value of the currency it issued. The Federal Reserve Notes were convertible into gold at the fixed price of $20.67 per ounce.

The Rush to Hard Money

During the Great Depression Americans were converting their paper money for gold, which sparked a massive outflow of gold from the Federal Reserve. Individuals revealed their preference to hold physical gold over paper money.

After several waves of banking crises, the U.S. government decided one of the solutions to the economic crisis would be to make it illegal for Americans to own a significant amount of gold. The government wanted to inflate the money supply, but was unable to do that if Americans were hoarding significant amounts of gold.

85 Years Ago

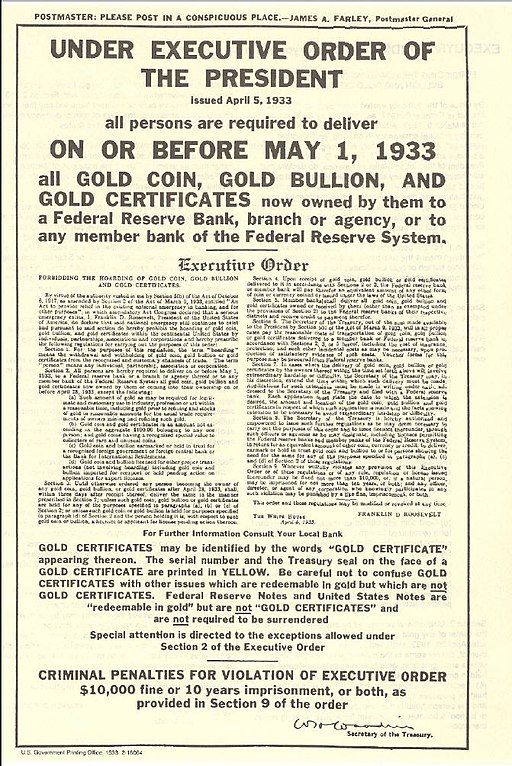

This April marks the 85th anniversary of when President Franklin Roosevelt proclaimed it was illegal for Americans to own a significant amount of gold.

In March 1933, the Federal Reserve Bank of New York could no longer honor its commitment to convert paper money to gold and President Franklin D. Roosevelt declared a banking holiday. FDR issued an Executive Order requiring all Americans to surrender all gold owned by them to a Federal Reserve bank and prohibited the private holdings of all gold coins and bullion.

The now infamous Executive Order 6102 was issued on April 5, 1933, states: “I, Franklin D. Roosevelt, President of the United States of America… hereby prohibit the hoarding of gold coin, gold bullion, and gold certificates.” Prior to this executive order, gold certifications could be easily exchanged at banks for physical gold.

President Roosevelt ordered Americans to sell their gold back to the government, or face jail time and fines. Exemptions were made for coin collectors, dentists, artists, and jewelers, and average citizens could own up to $100 in gold coins.

In 1934, the Gold Reserve Act became law, which required all gold and gold certificates to be surrendered to the U.S. government.

Bretton Woods

Fast forward two more decades and another historic moment in the history of gold was seen in 1958. The Bretton Woods system became fully functional and included the stipulation that U.S. dollars were convertible to gold at a fixed exchange rate of $35 an ounce. The United States was required to keep the gold price fixed and adjust the supply of dollars in circulation to retain confidence in the gold convertibility system.

The Bretton Woods agreement had first been ratified by Congress in 1944 to establish a gold exchange standard and the IMF and the World Bank. The system was set up to rebuild the global economy towards the end of WWII.

Fast Forward to the 1970s

In 1971, the balance of payments deficits made it impossible for the U.S. to fulfill its obligation to convert dollars to gold at that price. President Nixon officially terminated the U.S. dollar’s link to gold established under the Bretton Woods agreement.

In 1973, the United States devalued the dollar and major currencies were allowed to float freely no longer pegged to gold.

All during these decades, Americans were not allowed to own gold other than jewelry.

The Legalize Gold Movement

One of our company’s founders – Jim Blanchard rose to prominence as a supporter of American’s right to own gold in the early 1970s.

Jim Blanchard gained national attention when he arranged for a biplane to tow a banner proclaiming “Legalize Gold” over President Richard Nixon’s inauguration in January 1973. His lobbying efforts were a success and after more than 40 years, Congress once again legalized private ownership of gold bullion effective Dec. 31, 1974.

Throughout ancient history, gold and silver were prized for their intrinsic value. They remain hard physical assets, which have become even more valuable in our modern society. It is the right and privilege of every American to own gold in order to have a safe haven to protect, preserve and grow their assets. Perhaps it is even more important today than ever for all Americans to invest a portion of their assets in gold.

Will The Steel Tariffs Really Only Cost You A Penny?

Posted on — Leave a commentYou’ve probably heard the news.

Last week, President Trump signed off on two new tariffs of 25% and 10% on imported steel and aluminum, respectively.

The Commerce Secretary Wilbur Ross has been trying to sell these tariffs as “no big deal” to the U.S. public.

Mr. Ross recently appeared on TV holding a can of Campbell’s Soup (watch the video here). He says the new U.S. tariffs on steel and aluminum would only add less than a penny to the cost of the soup.

Is this true? The answer is probably a little more complicated than that.

The ABCs behind Tariffs

We get it. Tariffs don’t sound all that interesting. But here’s why you should care.

Tariffs are a charge on imports, or essentially a tax.

Here’s how this could play out: If a ton of steel costs $100, the 25% tariff means the seller now must pay $25 to the U.S. government, when they sell their steel here.

The seller can choose between selling the steel for $75 (and taking a hit) or raising the price to $125 to maintain their same level of revenue. Most economists expect sellers to raise prices. It is the rational response.

3 Ways Trade Tariffs Could Impact Your Pocketbook

Let’s hear what folks on Wall Street and business leaders have to say about what these tariffs could mean for your pocketbook.

- Higher Prices on Goods From Canned Goods to Cars

Americans should brace for higher prices.

“The problem is that they [tariffs] are bad for anyone else that uses that steel or aluminum, such as car manufacturers, builders, the energy industry, or really most of the economy. Their input costs have just gone up substantially. According to a UBS analyst, Ford’s costs just went up by $300 million, while GM’s went up by $200 million. Other companies will be similarly affected. Ford and GM (for example) have two choices here. They can raise prices, which will start to push inflation up higher, or they can eat the higher costs and make less money,” says Brad McMillan, Chief Investment Officer for Commonwealth Financial Network.

Others agree.

“A tariff is a tax, plain and simple. In this case, it’s an unnecessary tax on every American family and a self-inflicted wound on the nation’s economy. Consumers are just beginning to see more money in their paychecks following tax reform, but those gains will soon be offset by higher prices for products ranging from canned goods to cars to electronics,” said Matthew Shay, president and CEO of The National Retail Federation.

- The Steel Tariffs Are Bad For the Stock Market

“This is bad for the stock market, as it plays out across the economy. Both higher inflation and lower profits make stocks worth less,” McMillan says.

The stock market does not like uncertainty. “The tariffs may add only a penny in additional cost to Campbell’s Soup. But the cost to the macro economy via uncertainty and reduced investment could be much larger and highly relevant at the macro level. It could be a very expensive penny, so to say,” said Jens Nordvig founder and CEO of Exante Data.

- Are the Steel Tariffs The Tip of the Iceberg?

This could be just the beginning. “The fear is that these tariffs are just a start to a longer game of tit-for-tat tariff retaliations and pose a fundamental threat to the rules-based trading system,” said Satyam Panday, senior U.S. economist, global economics & research at Standard & Poor’s.

“The tariffs may also be a warning shot for China, as the Trump administration prepares to make a decision on the country’s alleged abuse of intellectual property rights,” says John Lynch, chief investment strategist for LPL Financial.

What’s Next?

“The next several weeks will be important for trade policy. First, we will be looking for how strongly foreign governments respond to the new tariffs, specifically whether the response is proportional and whether President Trump will further escalate, as he has threatened. Said Lewis Alexander, U.S. chief economist at Nomura.

The Bottom Line

The tariffs will mean higher prices in a number of consumer goods for Americans. That means rising inflation. The more serious threat will be if other countries strike back with retaliatory measures. Prices could spike significantly higher for many items Americans have gotten used to buying cheaply and it could be a severe negative shock to the stock market.

“In the face of other fading tailwinds and rising headwinds, the economy and markets really don’t need more sudden changes that could very well be damaging. But it looks as though that is exactly what they are likely to get,” said McMillan.

Gold Is a Smart Portfolio Diversifier

In today’s environment with rising trade tensions and accelerated levels of inflation, investing in gold makes more sense than ever. Gold is a hard asset that rises in price over time. Gold is also a hedge against economic uncertainty and political strife and inflation. A full-blown trade war could topple the stock market bear and in turn propel gold prices even higher. Now is the time to add gold to your portfolio. Risks are rising and gold is the answer to the economic storm that may lie ahead.

Storms, Treasure Hunts, and the Panic of 1857

Posted on — Leave a commentIn 1857, the S.S. Central America left the Panamanian port of Colón, sailing for New York City.

It never arrived.

The crew braced for a category two hurricane off the coast of the Carolinas. Winds exceeded 100 MPH. In the dark of the night, the ship sank killing 425 people. A few survivors remained afloat in lifeboats and were rescued. Onboard were 15 tons of Federal gold totaling nearly $300M in today’s value.

The lost gold represented enough value to incite what came to be known as the “Panic of 1857.” It was considered the first worldwide financial crisis. It was a time when people first recognized that economies around the world were increasingly connected. New York banks, anticipating the arrival of gold from the S.S. Central America, started to falter once the news of the sinking came to light. The recovery would not occur until after the Civil War.

Approximately one month after the sinking, at the depth of the crisis, banks began suspending payments which escalated fear into panic.

Onboard the Central America were thousands of gold coins. More than one hundred years would pass before they were found. Researchers used complex modeling based on Bayesian statistics to locate the sunken treasure. In 1988, with the help of a remotely operated vehicle, researchers recovered an estimated $100-$150 million in gold. One ingot, weighing 80 lbs, was later sold for $8M. At the time it was recognized as the most valuable piece of currency in existence.

Today, the recovered coins of the S.S. Central America are among the most desirable for collectors. The coins are known for their rich detail and almost pristine condition after surviving for so long in the depths of the ocean.

This level of detail is considered rare among coins coming from the San Francisco mint formed in the late 1800s. In their first year, they converted $4 million worth of gold bullion into coins. However, in 1906 a fire broke out.

The $300M held within represented a third of the United States reserves. Fortunately, they made a full recovery and reopened without damage to the gold. In later decades production was suspended as the Philadelphia mint took on more work. However, the San Francisco mint continued to strike supplemental coinage through the years. Dollars from the mint carry a mint mark “S” representing their origin. In recent years the mint has produced various commemorative coins.

The journey of these coins touches on so many chapters of our nation’s history from the disastrous sinking of the S.S. Central America to the panic of 1857. These coins are a way to hold some of the most incredible stories you never knew from our nation’s past. The coins reflect more than the rich yellow and gold colors for which they’re known. They reflect a history that’s still being written.

4 Questions for Coin Collectors

Posted on — 1 CommentPart of the fun of coin investing is the rich history that comes along with each unique coin.

- Who touched that coin?

- What was that coin used to purchase in 1909?

- Why are certain markings on different coins?

If you have been amassing your coin portfolio for some time, you may already know the answers to these questions. Just for fun, let’s test your coin IQ here. Dive in! Let us know your favorite fact about coins below!

- Name four foreign governments that the U.S. Mint forged coins for in 1944?

Answer: In the midst of WWII, the U.S. Mint produced roughly 800,000,000 coins for friendly nations amidst the pressures and demands for coins during war time. The U.S. Mint forged coins for:

- Ethiopia

These coins (four copper and one silver) featured the likeness of Emperor Haile Selassie, who refused to bow to Benito Mussolini.

- Greenland

The U.S. Mint produced copper kroners featuring the traditional polar bear seen on earlier Danish coins.

- Saudi Arabia

For the Arab nation, the U.S. Mint created silver riyals with intricate tracings.

- France

The Philadelphia Mint struck Franc coins made from melted down shell cases.

A little history: In 1874, the Mint was authorized to manufacture coins for foreign governments, but during WWII that production hit historic proportions. Foreign nations faced an acute shortage of coins, just as demand escalated for coins amid the presence of large numbers of allied troops.

The list of countries for which the United States made coins from 1940 to 1945 as part of a Good Neighbor policy includes Australia, Belgian Congo, Belgium, Bolivia, Cuba, Curacao, Dominican Republic, Ecuador, El Salvador, Ethiopia, Fiji Islands, France, Greenland, Guatemala, Indo-China, Liberia, Netherlands and her island possessions, Nicaragua, Peru, Philippine Islands, Saudi Arabia, and Surinam.

- What is the only circulating coin in which the portrait faces to the right?

Answer: The Lincoln penny.

- The likeness of President Lincoln is an adaption of a plaque by Victor David Brenner, a well-known sculptor and artist of the time. President Theodore Roosevelt was so taken by Brenner’s portrait of Lincoln that he recommended to the Secretary of the Treasury that the design be struck on a new coin issued in the Lincoln Centennial Year, 1909.

- The 1909 Lincoln cent replaced the Indian head penny.

- In 1959 the Lincoln Memorial was added to the back of the coin.

- Why was the small eagle added to the Benjamin Franklin Half Dollar?

Answer: The U.S Mint struck the Franklin half dollar from 1948 to 1963. The half dollar features Benjamin Franklin on the obverse and the Liberty Bell on the reverse. A tiny eagle was added to the right of the Liberty Bell in order to satisfy the legal requirement that half dollars include a representative of an eagle.

The Franklin half dollar and the Roosevelt dime were both designed by John R. Sinnock, and his initials appear below the shoulder.

- When did the Philadelphia Mint first add its mint mark to a coin?

Answer: During WWII nickel was removed from 5-cent coins. In 1942, the mint mark moved from the right of Monticello to above the dome to signify the substituted alloy. It was at this time that the Philadelphia Mint first struck “P” on coins forged in Philadelphia.

The practice of striking mint marks dates back to ancient Greece and Rome. In 1835, the practice began in the United States, as the nation’s growing economy demanded a fresh influx of coins. Early mints included:

- In 1838, the New Orleans mint opened (O).

- In 1838, the Dahlonega, Georgie (D) mint opened. It closed in 1861.

- In 1854, the San Francisco Mint (S) opened.

- In 1870, the Carson City, Nevada (CC) mint opened. It closed in 1893.

- In 1906, the Denver Mint (D) opened.

- In 1984, the West Point, New York (W) mint opened.

What’s Your Coin IQ?

What is the most interesting fact you’ve learned about coins during your time as a collector? Leave a comment below!

See Blanchard’s current rare coin inventory here. For serious collectors, we have tremendous reach and respect within the rare coin industry. If there is a particular coin or set that you are trying to build, our numismatists can help source your coins from collections around the world.