The Intriguing Story Behind the Nuestra Señora de Atocha Coins

Posted on — Leave a commentOf the many shipwrecks in history, the Nuestra Señora de Atocha stands out as one of the most important because of its remarkable legacy. This renowned vessel’s tale of loss and rediscovery has captured the imagination of countless adventurers, historians and numismatists alike. Among its treasures, the Atocha shipwreck coins hold a special allure that this piece will explore, delving into:

- The history of this Spanish galleon.

- The significance of the coins recovered from the wreck.

- Answers to collectors’ most frequently asked questions.

Watch this incredible Atocha shipwreck video to further explore the story of this renowned vessel:

Facts about the Nuestra Señora de Atocha shipwreck

From its tragic demise to the modern-day museum dedicated to its legacy, we reveal the captivating details that make the Atocha shipwreck one of the most iconic maritime tales in history.

The Atocha shipwreck history

Launched in 1620 in Havana, Cuba, the Nuestra Señora de Atocha was a formidable vessel tasked with transporting valuable cargo from the New World back to Europe as part of Spain’s treasure fleet. With a hull measuring approximately 34 meters in length, it was among the largest ships of its time.

In 1622, the Atocha was assigned the responsibility of serving as the rear guard ship, or ‘almiranta’, of a 28-ship fleet on a voyage from Cuba to Spain. Laden with gold, silver, jewels, and other precious commodities sourced from the Spanish colonies in the Caribbean, it was charged with protecting the fleet’s rear from attacks or other threats encountered along the journey.

Unfortunately, fate had other plans, and the Nuestra Señora de Atocha was never to fulfill its mission of delivering its riches to the Spanish Crown. Tragically, the Spanish treasure galleon’s journey met a catastrophic end when it encountered a powerful hurricane off the coast of the Florida Keys. The relentless storm battered the ship mercilessly, causing it to founder and sink, claiming the lives of most of its 265 crew and passengers amidst the tempestuous seas, and scattering its precious cargo across the ocean floor.

For centuries, the Atocha shipwreck story remained shrouded in mystery beneath the depths of the sea. It wasn’t until the 20th century that its legend sparked the interest of treasure hunters, with countless expeditions attempting to locate its fabled fortune.

In 1985, after years of tireless searching, Mel Fisher and his team made history when they finally discovered the Atocha’s resting place. The subsequent salvage operation was a monumental undertaking, revealing a trove of gold, silver, jewels, and artifacts worth hundreds of millions of dollars.

Photo by Marine Insight

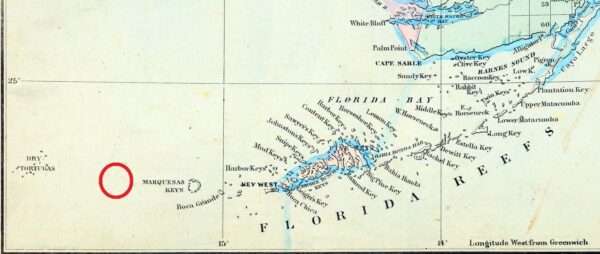

The Atocha shipwreck location map

Situated off the coast of the Florida Keys, the Atocha’s resting place lies approximately 35 miles southwest of Key West. The shipwreck is submerged in the crystal-clear waters of the Gulf of Mexico, nestled amidst the vibrant marine life of the area’s coral reefs.

The coordinates for the Atocha (24 degrees 31.5 feet North Latitude and 82 degrees 20 feet West Longitude) mark the exact spot where Mel Fisher and his team discovered the long-lost treasure trove in 1985. Researchers and enthusiasts can explore the precise location of the Atocha shipwreck using the detailed information provided on an Atocha wreck site map.

Approximate location of the Atocha shipwreck (indicated by a red circle)

Map by Florida Memory

The Atocha shipwreck depth

The Atocha shipwreck rests at a depth of approximately 55 feet (16.8 meters) below the surface of the Gulf of Mexico. This depth places the wreckage within accessible range for divers and researchers, allowing for exploration and study of the site’s historical significance.

Despite being submerged for centuries, the relatively shallow depth has also facilitated the preservation of the Atocha’s remnants, including its cargo and structural elements.

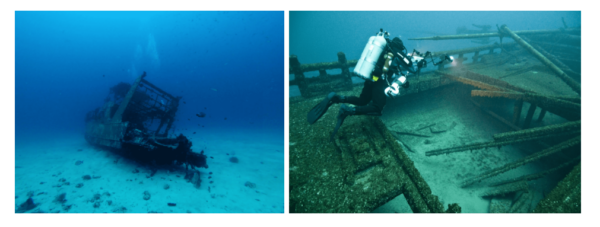

The Atocha shipwreck pictures

From close-up shots of artifacts to panoramic views of the underwater landscape, pictures of the Atocha shipwreck offer a unique perspective on its legacy.

Photos by Florida Keys Me

The Atocha shipwreck museum

Located in Key West, Florida, the Mel Fisher Maritime Museum, unofficially known as the Atocha shipwreck museum, provides visitors with a fascinating glimpse into the world of maritime archaeology and the story of Mel Fisher’s legendary quest.

Exhibits within the museum showcase artifacts recovered from the Atocha wreckage, including gold and silver bars, jewelry, pottery, and navigational instruments. Through interactive displays, immersive exhibits, and informative presentations, visitors can delve into the intricacies of the Atocha’s journey, its tragic fate, and the extraordinary efforts to recover its treasures from the depths of the sea.

Authentic Atocha coins

Unlike the SS Gairsoppa, where no coins were recovered, the discovery of the Atocha yielded a treasure trove of coins valued at an estimated total of hundreds millions of dollars. The salvaged Atocha coins, minted across the Spanish colonial period, present a varied collection of numismatic examples that encapsulate centuries of New World trade and commerce.

Atocha gold coins

1 Escudo Carlos and Juana Atocha shipwreck coin

Among the recovered Nuestra Señora de Atocha coins, one stands out as particularly noteworthy: a 1537 gold Carlos and Juana escudo. Holding a special place in numismatic history, this coin, produced at the Seville Mint during the joint reign of Charles I of Spain and his mother Joanna of Castile, marks the introduction of the escudo denomination in 1535/1537.

1 Escudo Carlos and Juana

- Metal: Gold

- Year: 1537

Burgos Mint 1 Escudo Carlos and Juana Atocha wreck coin

Another significant find among the shipwreck Atocha coins is the gold Carlos and Juana escudo minted by the Burgos Mint. While it was common practice for Spanish mainland mints to create currency for use in the colonies, Burgos’s production was comparatively limited, making its coins highly sought-after pieces by collectors.

1 Escudo Carlos and Juana

- Metal: Gold

- Year: Before 1545

2 Escudos Philip II Atocha gold coin

2 Escudos coins, also known as doubloons, derived from the Spanish word “doblón” meaning double, were a revered currency during the New World conquest. This particular one was minted during the era of Philip II, the first official king of a united Spain. Even though the mint and assayer are not explicitly visible on it, its design and characteristics align with coins produced by the Seville Mint during this period, adding to its immense historical significance among Atocha coins.

2 Escudos Philip II

- Metal: Gold

- Year: Before 1598

Atocha silver coins

Mexico Mint 2 reales Carlos and Juana Atocha silver coin

Minted circa 1556 at the Mexico Mint, this 2 reales coin holds significant value as the smallest denomination discovered on the shipwreck, making it a great find for those seeking Atocha coins for sale. Additionally, it stands as one of the earliest examples of coinage from the Americas, with the Mexico Mint pioneering coin production in the region in 1536.

2 reales Carlos and Juana (Assayer O)

- Metal: Silver

- Year: 1556

Mexico Mint 8 reales Philip III authentic Atocha coin

Made to commemorate the reign of Philip III, this stunning Atocha shipwreck treasure 8 reales coin from the Mexico Mint showcases the Shield of the Habsburgs of Spain on the obverse and the Cross of Jerusalem on the reverse. The presence of Assayer A’s mark indicates it was minted during the tenure of Antonio de Morales, dating it to the years 1608 and 1609.

8 reales Philip III (Assayer A)

- Metal: Silver

- Year: 1608 – 1609

Lima Mint 2 reales Philip II Atocha 1622 coin

This 2 reales 1622 Atocha coin, struck in the Peruvian capital during the reign of Philip II, showcases a crowned coat of arms on the obverse and crosses with lions and castles on the reverse. Its association with the short-lived Assayer Xines Martinez (X) makes it a highly sought-after piece among collectors.

2 reales Philip II (Assayer X)

- Metal: Silver

- Year: 1572 – 1573

Lima Mint 8 reales Philip II Atocha ship coin

Also crafted during the reign of Philip II of Spain, this beautiful 8 reales coin from Lima boasts an elaborate obverse featuring the numeral “VIII”, along symbols representing the mint, coat of arms, and assayer. Its reverse displays a design of lions and castles within the quarters of a cross, making it a desirable Atocha coin for sale to collectors.

8 reales Philip II (Assayer D)

- Metal: Silver

- Year: Between 1580 and 1588

Potosí Mint 8 reales Philip II Nuestra Señora de Atocha coin

Minted in Potosí, nestled in the Andes Mountains of present-day Bolivia, this 8 reales coin features the effigy of Philip II and the mark of Assayer B. This coin holds exceptional significance as one of the first minted in Potosí, using dies from Lima, making it one of the most extraordinary shipwreck coins Atocha has to offer to numismatists.

8 reales Philip II (Assayer B)

- Metal: Silver

- Year: 1575

Potosí Mint 8 reales Philip IV real Atocha coin

Also crafted at the Potosí Mint, a significant minting center during the Spanish colonial era in an area renowned for its vast silver mines, this 8 reales coin bears the effigy of Philip IV and the mark of Assayer T. A captivating artifact, its unearthing enriches the legacy of the Atocha shipwreck treasure.

8 reales Philip IV (Assayer T)

- Metal: Silver

- Year: 1622

Santa Fe de Bogotá 4 reales Nuestra Señora de Atocha silver coin

Among the most remarkable coins from the Atocha shipwreck is this 4 reales coin dated 1622. Initially shrouded in mystery with its mint of origin uncertain and lacking visible assayer marks, its significance became apparent when the coat-of-arms of Granada was recognized, linking it to the insignia of Santa Fe de Bogotá, Colombia.

4 reales

- Metal: Silver

- Year: 1622

For a selection of unique rarities, beyond Atocha treasure coins for sale, click here.

FAQ about the Atocha coin treasure

Here are the answers to people’s most common questions about the Atocha shipwreck and its treasures.

Where was the Atocha shipwreck found?

The Atocha wreck location was identified approximately 35 miles southwest of Key West, Florida, within the Gulf of Mexico’s waters.

Who found the Atocha shipwreck?

Mel Fisher and his team discovered the Atocha shipwreck in 1985 after years of dedicated searching and exploration efforts.

How deep is the Atocha shipwreck?

The underwater Atocha shipwreck rests at a depth of approximately 55 feet (16.8 meters) below the surface of the Gulf of Mexico.

What is an Atocha coin?

An Atocha coin refers to a coin recovered from the Atocha shipwreck, typically minted in Spain or its colonies during the colonial era. The Atocha coin meaning extends beyond its monetary value, embodying a rich historical significance due to its association with the legendary Spanish galleon.

Are Atocha coins a good investment?

Investing in Atocha coins can be lucrative, with their value steadily increasing over time. As historical artifacts with limited availability, Atocha coins going up in value make them an appealing investment option for collectors and enthusiasts alike.

The Atocha coins, with their rich history and intrinsic value, represent a unique opportunity for collectors and investors alike. For those seeking to invest in rare coins, Blanchard offers a comprehensive selection. Contact Blanchard with inquiries about the Atocha coin price and more and embark on your numismatic journey today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The World’s 8 Largest and Most Famous Coin Hoards Discovered to Date

Posted on — Leave a commentAvid coin enthusiasts will undoubtedly be familiar with the euphoria of stumbling upon a rare piece. This feeling, however, pales in comparison to the exhilarating sensation of unearthing an entire coin hoard. These hoards narrate captivating stories of bygone eras, encapsulating fortunes and monetary relics carefully preserved through time. This article explores the most renowned coin hoard discoveries globally, including the largest coin hoard ever found in the US, focusing on:

- The practice, history, and regulations of coin hoarding.

- Famous ancient and modern hoards worldwide.

- Sourcing hoarded coins for your collection.

If you’re captivated by the allure of lost and found coin hoards and treasures, don’t miss this fascinating video:

Coin hoarding

What is a coin hoard?

The term “hoarding” originated in archaeology, describing the intentional act of accumulating and burying valuable items – a practice aimed at safeguarding or concealing wealth for various reasons. In a numismatic context, a coin hoard mirrors this archaeological concept, signifying a substantial collection of coins intentionally gathered and, at times, concealed for reasons such as preserving value, avoiding economic instability, or responding to societal upheavals.

In contrast to organized collections meticulously curated by numismatists, coin hoards are amassed without a deliberate effort to curate or complete sets. The key distinction lies in intent: collectors carefully assemble sets for historical, legacy, or aesthetic purposes, while hoarders accumulate coins without a specific strategy. The defining characteristic of a coin hoard is the absence of a structured goal, distinguishing it from traditional coin collections.

Nevertheless, determining what constitutes a coin hoard isn’t rigidly defined. Size alone doesn’t categorize a collection as a hoard, with their scope varying widely. Some hoards consist of only a few dozen coins, while others number in the thousands, reflecting their diverse nature which defies a one-size-fits-all definition. Historical context, the intent behind accumulation, and the scarcity of the coins involved are some other factors that contribute to defining whether a collection qualifies as a coin hoard.

Hoard coin discoveries can occur in different ways, such as the original hoarder returning or unearthing by metal detectorists, archaeologists, or other members of the public.

Is it illegal to hoard coins?

In the United States, hoarding coins is not illegal and there is no coin hoarding law per se. However, the legal landscape governing this practice is intricate, varying across jurisdictions and contingent upon the collector’s intent.

Put simply, there exists a legal distinction between coin collecting and hoarding. Accumulating coins for the sake of a hobby or wealth-building is lawful, yet doing so with the aim of defrauding or manipulating currency transgresses legal boundaries.

Enthusiastic coin collectors, motivated by the joy of completing sets, differ from hoarders who amass coins without the intention of creating numismatic collections. The absence of a precise legal definition for hoarding introduces challenges, fostering diverse interpretations. Therefore, collectors should stay current with the legal framework to navigate the delicate balance between individual rights and legal considerations as far as coin possession is concerned.

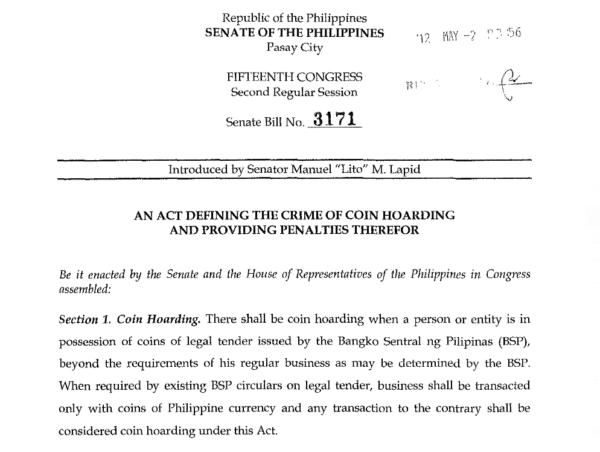

It’s also essential to note that regulations regarding the possession of large coin quantities vary between countries. For instance, the anti coin hoarding law Philippines proposed seems to be having a significant impact on nations globally and sparking numerous discussions.

Document by the Senate of the Philippines

To delve deeper into the historical limitations on Americans owning gold, read about FDR’s Executive Order, essentially an early version of an anti-coin hoarding bill.

Ancient coin hoards

Ancient coin hoards offer glimpses into the past, revealing stories of ancient economies and cultures.

Greek coin hoards

The birth of coinage, a pivotal development in the history of currency, is often attributed to ancient Greece. While the first standardized coins are generally credited to the ancient Lydians in present-day Turkey around 640 BC, Greece, as a country of immense historical importance and a hub of significant archaeological activity, has been a treasure trove for hoarding of coins discoveries. These discoveries shed light on important aspects of ancient economic systems, trade networks, and cultural practices, providing invaluable insights into the intricate tapestry of the country’s past.

Ancient Greek coin hoard findings continue to emerge even to this day, with one of the most significant ones occurring in 2021. Archaeologists, during the third season of the Phanagoria expedition by the Institute of Archaeology of the Russian Academy of Sciences, unearthed 80 copper staters dating back to the sixth century. This latest inventory of Greek coin hoards, found stashed inside an amphora, is believed to be linked to a series of Hun or Turk assaults that wrought destruction upon major sections of the city.

Ancient Greek coin

Coin hoards of the Roman Empire

The Roman Empire, an unparalleled juggernaut in the annals of human history, held sway over vast territories and diverse cultures, leaving an indelible mark on the evolution of Western civilization. Studying Roman coin hoards reveals details about trade networks, inflation responses, tax systems, and coin circulation in this colossal empire.

One notable discovery is the Frome Hoard, found in Somerset, England, in 2010. Comprising over 52,000 Roman coins, this spectacular Roman coin hoard dating back to the third century stands as one of the largest and most diverse Roman hoards ever unearthed in Britain. The Frome Hoard includes issues featuring notable emperors such as Carausius, Diocletian, Maximian, and Allectus, illuminating the turbulent times marked by political transitions during that time.

Uncover fascinating stories about Roman coins hoard discoveries and more here.

Anglo-Saxon coin hoards

Anglo-Saxon coin hoards serve as windows into the historical landscapes of early medieval England, preserving tales of kingdoms, trade, and societal changes.

Jersey Coin Hoard

The Jersey Coin Hoard, considered one of the most famous Anglo-Saxon coin hoards, is distinguished by its unique blend of Celtic, Anglo-Saxon, and hoard of Roman coins found. This extraordinary collection provides valuable insights into the complex historical interactions between these cultures.

Discovered in 2012 by metal detectorists Reg Mead and Richard Miles on the island of Jersey, the Jersey Celtic Coin Hoard is a remarkable archaeological find. Buried over 2,000 years ago, it consists of an estimated 70,000 to 80,000 coins, predominantly made of silver and gold.

This substantial collection is believed to date back to the 1st century BC, providing a unique glimpse into the late Iron Age and the period of Roman influence in the region. The coins bear intricate designs and symbols, including depictions of stylized horses and other Celtic motifs.

The Jersey Coin Hoard. Photo by Wikipedia

American coin treasures and hoards

American coin hoards, spanning from colonial times to the modern era, illuminate the economic and cultural transformations that have shaped the United States.

Kentucky Coin Hoard

The Great Kentucky Coin Hoard, discovered in 2023 by an anonymous individual in a Kentucky cornfield, is a staggering find of over 800 gold coins dating back to the Civil War era. The discovery, estimated to be worth millions, includes $1 gold Indian coins, $10 gold Liberty coins, and, notably, eighteen 1863-P $20 Gold Liberty coins, a super-rare date with significant value.

The NGC suggests that the coins may have been buried due to Kentucky’s declaration of neutrality during the Civil War, reflecting the state’s internal conflicts.

To procure a rare coin similar to those included in the gold coin hoard found in Kentucky, have a look at this piece:

- Metal: Gold

- Year: 1901

Baltimore Gold Hoard

The Baltimore Gold Coin Hoard refers to two coin hoards discovered in 1934 and 1935 by teenagers Theodore Jones and Henry Grob while digging in a cellar. Amazingly, these impressive collections of over 3,500 gold coins were unearthed in the same location, one year apart, adding to the intrigue of this historical find.

The hoard of coins ranged from $1 to $20 denominations, dating back to the 1830s – 1850s. Adhering to the 1933 U.S. Gold Act, when the boys found the coins the first time, they turned them over to the government due to private gold ownership being illegal. The second time, however, they gave the coins to their mothers, sparking a legal dispute. Ultimately, the boys were awarded $7,000 each in 1937.

Capture the essence of this legendary discovery with this rare coin:

1853 $20 Liberty PCGS XF45 CAC

- Metal: Gold

- Year: 1853

Nevada Coin Hoard

One of the most famous coin hoards ever discovered in Nevada was the Redfield Hoard, amassed by financier LaVere Redfield, found at his home after his passing in 1974. A truly iconic collection comprising over 407,000 silver Morgan and Peace dollars, which posthumously earned Redfield the nickname “Silver Dollar King”, the hoard exemplifies Redfield’s unique approach to wealth preservation. The multimillionaire was notorious for avoiding banks due to distrust in paper money and instead hoarding coins, choosing to hide significant portions of his fortune in unconventional places.

The hoard, sold to a large precious metals company for $7.3 million in 1976, showcases Redfield’s decades-long dedication to silver dollars, like the following one, making it a pivotal chapter in numismatic history:

1878 7 Tail Feathers Rev 1878 Morgan $1 PCGS MS64

- Metal: Silver

- Year: 1878

Saddle Ridge hoard coins

Discovered in 2013, the Saddle Ridge Gold Coin Hoard in California stands as the largest known buried coin discovery in the United States to date. Anonymous discoverers, a couple simply known as Mary and John for privacy reasons, stumbled upon this treasure while walking their dog on their property in the Sierra Madre Mountains. Comprising 1,411 coins dating from 1847 to 1894, with most originating from the San Francisco Mint, the hoard was valued at over $10 million.

Enclosed in eight metal cans, the immaculately preserved coins’ origins remain shrouded in mystery, fueling theories involving bank heists, the prudent actions of a wealthy individual distrustful of banks, or even gold miners working nearby stashing coins. The fortunate couple retained ownership of the coins, and eventually made them available for purchase on Amazon, under the listing “Saddle Ridge Hoard coins for sale”.

Embark on a journey through history with this unique coin reminiscent of the Saddle Ridge Hoard discovery:

1840-D $5 Liberty Small Date NGC AU58 CAC

- Metal: Gold

- Year: 1840

New York Subway Coin Hoard

Defying the traditional notion of a coin hoard found buried in the ground, the New York Subway Hoard was meticulously collected over three decades from subway turnstiles by New York City Transit Authority workers. A unique assemblage of 23,000 valuable U.S. coins, it included notable pieces such as 8 1901-S quarters, 45 complete sets of Barber dimes (with the exception of the 1894-S), 241 1916-D dimes, and more.

Acquired by Littleton Coin Co. in the 1990s, this collection represents a captivating chapter in numismatic lore, standing as one of the most unique American coin hoards of all time.

Delve into numismatic history with this captivating coin, echoing the era of the New York Subway Hoard:

1907 Barber Half Dollar PCGS PR65 CAC

- Metal: Silver

- Year: 1907

Explore Blanchard’s selection of fascinating rarities, extending beyond hoard coins, here.

Where to buy rare coins for your own hoard

From the legendary Saddle Ridge Hoard mystery to the unique collection of the New York Subway Hoard, coin hoards offer glimpses into the past. To unravel the stories behind these extraordinary finds and explore rare pieces, browse through Blanchard’s specially curated collection.

Whether you’re starting your numismatic journey or enhancing your already valuable collection, our team is delighted to assist you and offer expert guidance on coin hoards for sale and more.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Presidential Election 2024: It’s the Economy, Stupid

Posted on — Leave a commentBack in 1992, the U.S. was mired in a recession. Bill Clinton was mounting a presidential campaign to take the White House. And, incumbent president George HW Bush was seen as out of touch with the needs of everyday Americans.

Americans.

A Clinton advisor became famous for the phrase: “It’s the economy, stupid.” Indeed, the Clinton campaign highlighted the failing economy at every turn and won the White House, perhaps in part due to that strategy.

Fast forward to the 2024 presidential race. The election season is heating up fast, with an expected replay of the 2020 contenders: Joe Biden versus Donald Trump.

So, if it really is all about the economy, how is it doing today? Let’s take a look, explore the numbers, and what it could mean for gold.

Economic Growth

Despite widespread expectations for a recession in 2023, the U.S. economy is growing and Wall Street increasingly expects that the Fed could achieve a so-called “soft-landing” this year.

- In 2024, the United States economy is forecast to grow at a 2.4% pace.

- Compare that to 2024 economic growth forecasts of 0.7% for the Eurozone, 0.3% for the United Kingdom, 0.9% for Canada and 0.4% for Sweden.

Key takeaway: It may not feel like the economy is strong to some Americans. But our nation is leading the pack against other advanced economies in terms of economic growth. We are growing twice as fast or more than other advanced economies.

Job Market

The U.S. economy is creating new jobs at a fairly brisk pace. In February, employers created a total of 275,000 new jobs for Americans. The overall unemployment rate stood at 3.9%.

What kind of job creation did we see in February?

- Health care: 67,000 new jobs.

- Government: 52,000 new jobs.

- Restaurants and bars: 42,000 new jobs.

- Construction: 23,000 new jobs.

- Transportation and warehousing: 20,000 new jobs.

- Retail: 19,000 new jobs.

Key takeaway: U.S. employers have been creating a steady drumbeat of new jobs for Americans to fill. Over the last twelve months, new jobs have been created in every month ranging from 303,000 (May 2023) to as low as 146,000 (March 2023), according to the Bureau of Labor Statistics. If you want a new job, there’s a good chance you can find one.

Interest Rates

The Federal Reserve is holding its benchmark interest rate at a 23-year high in early 2024, as it maintains tighter monetary conditions in an attempt to battle back against inflation.

Key takeaway: The higher interest rates hurts American borrowers. This includes anyone who carries credit card debt, or wants to get a new car loan or mortgage. Would-be home buyers face a 6.9% 30-year fixed mortgage rate, according to Freddie Mac, which has priced some out of the housing market for now.

Inflation

The February core consumer price index (CPI) posted a hotter-than-expected reading, up 3.8% annually. The rising prices of rent, auto insurance, car repairs and airline tickets contributed to the stronger-than-expected inflation reading. Prices for used cars and clothing also climbed.

Inflation has fallen from its 2022 high at 9.1%. However, the February data shows that the Fed’s battle to rein in inflation is not over yet.

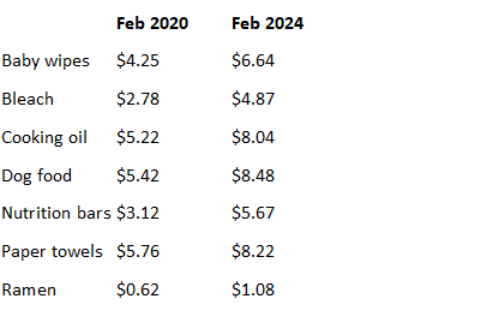

Prices are higher for everyday items and that sticks in Americans minds. Here’s a few price comparisons pre- and post-pandemic, from NielsenIQ.

Key takeaway: While inflation has dropped from over 9% to the latest 3.8% core reading, this still feels painful for many Americans. Prices on key everyday goods are sharply higher than before the pandemic and that “reference” point creates dissonance between the generally good economic data (strong labor market, growing economy) and what they pay for everyday items.

The Fed’s target rate of 2% inflation per year, means that prices would rise 2% every year. Instead we saw prices rise 9% on an annual rate in June 2022. That’s huge. Prices aren’t likely ever going to return to those levels, the Fed is just trying to keep annual price gains to a 2% pace.

What does this mean for gold?

These macroeconomic conditions created a perfect storm for gold. The price of gold has been climbing to a series of historic all-time new highs in recent months. Gold is up 30% over the past 16 months!

Inflation remains higher than the Fed’s target, which is supportive to gold. Yet the central bank is expected to cut interest rates three times in 2024, which will also boost gold even more and weaken the dollar. The stock market is climbing in bubble-like conditions that are being compared to the 2001 dot.com era. Only this time it is Artificial Intelligence stocks that are driving the stock market higher. This is creating new safe-haven buying in gold to diversify and protect portfolios.

Wall Street says gold can keep going higher. There are a series of gold price forecasts for 2024 that include $2,300 and $2,500 an ounce with a wildcard projection for $3,000 over the next 12 to 16 months.

The presidential election around the corner in November, will only increase economic, political and market uncertainty. While that political story has yet to unfold, one thing is certain, this historic run in gold is just getting started.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Most Valuable Australian Rare Coins List and Value

Posted on — 6 CommentsWhile the United States stands as a pioneer in numismatics, boasting a treasure trove of incredibly diverse rare pieces, the global landscape of rare coin collecting extends far beyond its borders. Venturing into international numismatic territory, this piece aims to provide readers with a most valuable rare Australian coins list and value insights, highlighting:

- Noteworthy high-value Australian coins.

- The historical and cultural nuances of these iconic coins.

- Prime online sources for the best quality rare coins.

Watch this insightful video to delve deeper into the world of valuable Australian coins:

Rare valuable Australian coins below $1

While Australian bullion coins often steal the spotlight in discussions about coin collecting, numismatists might be surprised at rare Australian coins’ values.

Rare Australian coins: half penny

Recognized as Australia’s rarest halfpenny and exemplifying the charm of rare old Australian coins, the 1923 halfpenny holds a revered status in Australian numismatics. Made of bronze, the coin’s obverse, designed by Bertram Mackennal, features the effigy of King George V, surrounded by the inscription “GEORGIVS V D.G. BRITT: OMN: REX F.D. IND: IMP:” denoting his titles. On the reverse, it bears the legend “COMMONWEALTH OF AUSTRALIA”, accompanied by the denomination “HALF PENNY” and the year of issue.

The elite numismatic status of the 1923 halfpenny stems from its limited mintage of approximately 15,000, making it one of the best rare Australian coins to look out for. A notable historical mix-up initially attributed the coin to the Sydney Mint due to an error in their Annual Report, which wrongly recorded the striking of 1,113,600 halfpennies in 1923. This led to the misconception that the 1923 Halfpenny was a common coin.

However, meticulous research by curator John Sharples, conducted decades later, clarified that the coin was actually struck at the Melbourne Mint. Sharples’ thorough analysis revealed that the 1,113,600 halfpennies produced at the Sydney Mint were dated 1922, not 1923. This correction solidifies the 1923 halfpenny as Australia’s rarest circulating halfpenny, adding an intriguing layer to its historical narrative.

1923 Halfpenny

- Metal: Bronze

- Year: 1923

Photo by PCGS

Rare Australian 1 cent coins

The 1968 one cent coin is a rare Australian coin that marks a significant chapter in the nation’s numismatic evolution, symbolizing Australia’s transition to a decimal currency system initiated on February 14, 1966. Before this, Australia used a pounds, shillings, and pence system inherited from its British colonial past. The intricate calculations required for everyday transactions were often cumbersome, leading to the decision to adopt a simplified decimal system that would align the nation’s currency with global standards.

Crafted by Stuart Devlin, this coin is a remarkable piece with a diameter of 17.65 millimeters and a weight of 2.6 grams. Showcasing a feathertail glider, an iconic marsupial, on the reverse and Queen Elizabeth II’s effigy sculpted by Arnold Machin on the obverse, it is renowned for having the lowest mintage in its series.

Adding to its exceptional rarity is the absence of a 1968 mint set release by the Royal Australian Mint, making it one of the most challenging dates to acquire, especially in uncirculated condition. Collectors often seek out this coin as part of their pursuit of rare Australian coins worth money.

Photo by Drake Sterling

Rare Australian 2 cent coins

The Australian two-cent coin, introduced with the Currency Act 1965, holds a distinctive place in the nation’s coinage. Unlike other denominations, the two cents didn’t directly replace a pre-decimal coin but rather represented a rounded equivalent to 2.4 pence. Notably, the halfpenny, penny, and threepence had no direct equivalent in the new system, setting the two cents apart.

While two-cent coins were minted from 1966 to 1991, the 1981 “NO SD” edition stands out as an exceptional Australian rare coin. A striking piece in copper-nickel, created during a period known for its distinctive coin designs, it features a frilled-neck lizard, an emblematic representation of Australia’s rich biodiversity, on the reverse, designed by Stuart Devlin.

However, despite the coin’s design typically featuring the designer’s initials, “SD,” positioned behind the lizard’s front feet, some issues from 1981 notably lack this distinctive element. Mysteriously echoing anomalies observed in coins from 1968 and 1967, this intriguing deviation contributes to the coin’s allure, raising questions among collectors seeking rare expensive Australian coins about the intricacies of the minting process during that specific period.

1981 2 Cent NO SD

- Metal: Copper

- Year: 1981

Photo by PCGS

Valuable rare Australian 5 cent coins

From its introduction with decimalization in 1966, replacing the pre-decimal sixpence while maintaining its size and mass, the five-cent coin has endured, today holding the status as the smallest denomination in Australian currency. One of the years that stands out the most in the coin’s long history, however, is 1972, a time when rare Australian coins’ value became particularly notable.

Crafted from nickel, this coin bears an echidna design on the reverse – a hallmark of Australian currency. On the obverse, it showcases Queen Elizabeth II’s effigy, known as the “Second Portrait.”

Though its design is beautiful and considered classic, what sets the 1972 edition apart from other rare 5c Australian coins is its low mintage and historical context. The year 1972 marked a pivotal moment in Australian coinage, due to a shift that occurred in the composition of the coin, transitioning from 75% copper and 25% nickel to pure nickel. Collectors cherish the 1972 edition for its connection to this transition and the evolving nature of Australian currency.

Rare Australian 10 cent coins list

Since its introduction in 1966, the Australian 10-cent coin has generally been characterized by uniformity in design and composition. Its exquisite design featuring the intricate impression of a lyrebird sculpted by Stuart Devlin has endured, remaining a constant source of aesthetic appeal and capturing the essence of Australia’s wildlife throughout the years. For this reason, some collectors might say that rare 10c Australian coins do not offer a particularly lucrative avenue for exploration.

Nevertheless, this notion may not hold entirely true, as certain 10-cent coins, particularly the 2011 issue, deviate from the norm. With an exceptionally low mintage of 1.7 million, the 2011 10-cent coin stands out as a key date for collectors, especially considering its scarcity compared to the average mintage of 45.80 million coins per year for the denomination. Speculation abounds regarding the reasons behind this unusually low mintage, with some enthusiasts suggesting a limited production run or a deliberate effort to create Australian rare coins worth money.

Valuable rare Australian 20 cent coins list

Since its inception, the Australian 20 cent coin has played a significant role as a staple denomination in daily transactions across the country. Among its diverse releases, the 1966 coin carries special importance, signifying the inaugural year of decimalization.

Despite a substantial mintage of 58.2 million, the 1966 20 cent coin is relatively widespread in circulation. However, within this release lies a rare and distinctive variant – the 1966 wavy baseline 20 cent coin, distinguished as one of Australia’s rarest decimal coins issued for circulation, commanding noteworthy value in the domain of Australian rare coin values.

Characterized by a subtle yet discernible wave in the baseline of the “2” on the reverse side, this variant sets itself apart from the standard 20 cent coins of the same year. The wavy baseline anomaly, while seemingly minor, has significant implications for collectors, especially those seeking rare Australian 20c coins. It adds a layer of uniqueness to the coin, making it a sought-after rarity in numismatic circles.

The cause of this design difference remains a topic of debate among experts, adding an element of mystery to the coin’s origin story. The scarcity of well-preserved specimens further elevates the 1966 wavy baseline 20 cent coin’s status as a prized collectible, offering enthusiasts a fascinating glimpse into Australia’s numismatic history and the intriguing anomalies that occasionally emerge within it.

1966 20 Cent Wavy “2”

- Metal: Copper Nickel

- Year: 1966

Photo by PCGS

To learn more about this special piece, consult this article’s “Rare Australian coins to look out for” section.

Most wanted valuable rare Australian 50 cent coins

In 1977, the Royal Australian Mint marked the 25th anniversary of Queen Elizabeth II’s accession with a distinctive circulating 50 cent coin. This coin, produced in the millions as part of the silver jubilee celebration, featured a unique design showcasing the Australia coat of arms.

While the sheer quantity may not initially suggest rarity, the narrative takes an intriguing turn with the unanticipated discovery of a limited number of 1977 50 cent coins bearing the non-commemorative Australia coat of arms design from preceding and subsequent years. This unintentional creation, identified as a “mule”, i.e. a coin that is struck with mismatched dies resulting in a combination of obverse and reverse designs that were not originally intended to be paired together, introduces a captivating dimension to the numismatic story of this rare Australian 50 cent coin. Notably, this specific coin, considered a mint error with fewer than 10 known examples, stands as a prized discovery for collectors.

1977 50 Cent Mule

- Metal: Copper Nickel

- Year: 1977

Photo by PCGS

Rare Australian dollar coins

Rare Australian $1 dollar coins list

Introduced in 1984 to replace the $1 note, the Australian $1 coin has become a staple in the country’s currency. Among its various releases over the years, though, some stand out and regularly feature in pieces compiling a list of rare Australian coins. A 2005 $1 coin error coin is a case in point.

The 2005 Australian $1 coin, a part of the revered “Mob of Roos” series, has garnered significant attention due to a distinctive error, transforming it into a highly sought-after collectible. Among the 5.1 million coins minted that year, only a few exhibit a striking off-center design, caused by a misalignment during production. This error, resulting in a rare Australian 1 dollar coin with about 10% or 2-3mm off-center placement, has left a portion of the design truncated, creating a visually captivating variety.

Photo by Finance.Yahoo

Rare $2 Australian coins

The Australian two-dollar coin, introduced in 1988, has undergone various transformations over the years, becoming an integral part of the nation’s currency. In recent years, limited edition rare Australian 2 dollar coins have garnered widespread popularity, reflecting the growing interest in numismatics.

A great illustration of this point is the 2012 Remembrance Day Red Poppy $2 Coin. Issued in two versions – one without a mintmark and the other featuring a ‘C’ mintmark – it holds a special place in collectors’ hearts with its low mintage of just 500,000 units.

Furthermore, the poignant symbolism of the red poppy, a powerful reminder of the sacrifices made by servicemen and women, means this rare $2 Australian coin strongly resonates with both collectors and those appreciative of the historical narratives embedded in currency.

2012-C $2 Remembrance Day Red Poppy

- Metal: Aluminum Bronze

- Year: 2012

Photo by PCGS

Explore a selection of rarities that extends beyond the most rare Australian coins.

Where to find rare Australian coins for sale

The realm of Australian numismatics is a fascinating and diverse tapestry of rare coins spanning various denominations and historical periods. Collectors who embrace these rare coins often discover that not only do these treasures enhance the aesthetic appeal of their collection, but they also add significant historical and intrinsic value.

To embark on or elevate your numismatic journey, use Blanchard. Connect with Blanchard’s team of experts for valuable insights and guidance on rare and valuable Australian coins and more.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Gold Hits New Record High in March. Here’s Why

Posted on — Leave a commentThe price of gold climbed to a new all-time record high in March.

Voracious buying from Chinese citizens and expectations for Federal Reserve interest rate cuts in the back half of the year helped fuel the latest run-up in gold. Also, investors around the globe continue to pile into safe-haven assets like precious metals to protect themselves in a world increasingly filled with military turmoil, economic instability and political uncertainty.

Gold extends its record run.

Gold traded to a new all-time high at $2,222 on March 21. That extends a remarkable 16-month climb in the precious metal, which has surged 30% from just above $1,600 in late 2022.

Gold flows east.

While the U.S. may actually dodge an economic recession, the Chinese economy is turning south. Real estate and stock markets have tumbled in China, triggering concerns that a full-blown commercial real estate crisis could develop and weigh down the broader economy.

In January, about half of all gold shipments were delivered to Hong Kong and mainland China, according to UBS. Chinese citizens are pouring their money into gold as a safe haven investment amid the increasing economic uncertainty there.

Geopolitical instability creates another demand stream.

Here in the U.S., investors are piling into gold to help protect and grow their portfolios amid the ongoing geopolitical instability including the Russian war in Ukraine and the Israel-Hamas war.

Domestic politics are heating up as the upcoming U.S. presidential election looms large with likely Republican presidential nominee Donald Trump already stating that the voting contest will be rigged.

All these events create economic and political uncertainty and are boosting demand and desire to own precious metal, which has no counter-party or government risk.

Fed rate cuts expected to boost gold.

Peering into the second half of 2024, investors expect the Fed to cut interest rates in the second half of the year, which will boost gold further. As interest rates fall, it reduces competition for non-dividend paying assets like gold.

Wall Street says gold can keep going higher.

Gold, the world’s oldest form of money, just keeps gaining in value—and Wall Street predicts even higher prices are ahead. In an early March research note, Citi called themselves “medium term bullion bulls” and pegged 25% odds that gold will hit a record $2,300 an ounce later in 2024. They reiterated a recent “wildcard” forecast that says gold could hit $3,000 over the next 12 to 16 months.

What about you—do you own enough gold? Don’t get left behind during this historic gold run.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

5 Key Date Morgan Silver Dollars

Posted on — 2 Comments-

1884-S Morgan dollar

-

1889-CC Morgan dollar

-

1893-S Morgan dollar

-

1895 Proof Morgan dollar

-

1903-O Morgan dollar

The Morgan silver dollar set is one of the most collected series of coins ever produced by the U.S. Mint. Yet, for serious collectors finding a key date coin to complete their Morgan dollar set can be an elusive and difficult challenge. Key date coins represent a date or a date and a mintmark in a certain series. Key date coins are typically lower mintage, harder to find and more expensive than other dates in the series.

Morgan dollars are named after its designer, George T. Morgan. Numismatics love its large size, vast supply in many dates and handsome appearance—all which make it an affordable and desirable series to collect.

Key date Morgan silver dollars are the most difficult to attain. However, when a collector does acquire the rarest and most expensive coin in a series, the feeling of accomplishment is indescribable.

The U.S. Mint produced Morgan dollars from 1878 through 1904 and then again in 1921. The Philadelphia, New Orleans, San Francisco, Denver, and Carson City branches all produced Morgan dollars. Looking for the mintmark on a Morgan silver dollar? You can find it for all mints except Philadelphia on the reverse of the silver coins below the ribbon bow of the wreath.

Here are five key dates for Morgan silver dollars. These 90% silver dollars are needed by every collector who seeks to build a complete date and mint mark collection.

1. 1884-S Morgan dollar

In 1884, the San Francisco Mint produced 3.2 million Morgan silver dollars. Out of those 3.2 million coins, there are only 20 known survivors. This is a one of the most memorable silver dollars with the S-mint and only the 1893-S would be considered more difficult to find and expensive to own.

2. 1889-CC Morgan dollar

Most collectors can only dream of only an 1889-CC Morgan Dollar. In 1889, the Carson City Mint resumed coin production after being shut down for four years. In 1889, the Carson City Mint produced 350,000 Morgan silver dollars. However, most of these coins met their fate in the melting pot, which makes them even rarer than the low mintage would suggest. On the open market, an 1889 CC Silver Dollars in pristine, uncirculated condition could command a selling price as high as $1,200,000.

3. 1893-S Morgan dollar

The San Francisco Mint only produced 100,000 Morgan silver dollars in 1893. Today, it is the rarest of all Morgan dollars in mint state, with only 18 survivors estimated in grade 65 or better. However, the 1893-S could still be an attainable coin for determined collectors given the survival rate in all grades at 9,948. This key date is a showpiece and considered the most desirable Morgan ever struck at a branch mint.

4. 1895 Proof Morgan dollar

Many collectors consider the 1895 Proof Morgan dollar to be the “King” of the Morgan silver dollar series. The reason this coin is so rare and in such high demand is that not one single business-strike 1895-P Morgan dollar is known to exist. According to Philadelphia Mint records, 12,000 mint state dollars were produced in 1895, however, none of them have ever surfaced. Many believe they were all melted and never even left the Mint. Because there are no known business strikes of the 1895 Morgan dollar, there is huge demand for the proof. Total mintage for the proof stood at 880 in 1895. However, due to the keen interest in owning one, collectors may need to pay tens of thousands of dollars for a specimen in any grade.

5. 1903-O Morgan dollar

In 1903, the New Orleans Mint produced a whopping 4.5 million circulation strike Morgan silver dollars. At that time, however, the coins were not needed in circulation, so most of the coins just sat in a vault! Only a few were released to the public. After the 1918 Pittman Act millions of Morgan silver dollars were melted down. In 1929, the few survivors that remained at the New Orleans Mint were shipped in a sealed vault to the Philadelphia Mint, where they were stored until October 1962.

In November 1962, the numismatic community was shocked and surprised by the announcement that a great Treasury hoard of Morgan silver dollars had been found in long-sealed federal vaults! From late 1962 into 1962, dozens of 1903-O Morgan silver dollars were released and sold to the general public. How many? No one knows for sure, but guesses range from 60,000 to over 1 million. Out of all the Morgan dollars, the 1903-O is the most famous of as it sat squarely in the middle of the great 1962-1964 Treasury release of silver dollars.

Get Started on Your Own Collection

Are you interested in starting a Morgan silver dollar collection? Popular collecting approaches include high-grade date sets or complete sets from low to high grade. A Blanchard portfolio manager can discuss other set building options with you as well. Explore our Morgan Dollar inventory here or call Blanchard if there’s a coin you see that you’d like us to help source for you. Get started today!

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Fed keeps rates at 23-year highs, gold surges

Posted on — Leave a commentFed Sees Three Rate Cuts in 2024

The Federal Reserve kept its key interest rate unchanged at Wednesday’s meeting, but signaled that three rate cuts are still expected in 2024. That leaves the Fed’s benchmark rate at a 23-year high of 5.25% to 5.5% for the fifth meeting in a row.

Deciphering the Fed’s “dot plot.”

The Fed released its latest rate cut projections, a chart known as the “dot plot.” Officials kept their forecasts in place signaling that they expect to lower the federal funds rates three times during 2024, dropping it to 4.5% to 4.75% by year’s end.

Markets react.

In the minutes immediately after the Fed meeting announcement stocks fell, gold surged higher, Treasury yields climbed, and the U.S. dollar headed south. Spot gold traded at $2,171.40 in afternoon action following the announcement.

Fed’s battle with inflation isn’t over yet.

While inflation has fallen from its 2022 high at 9.1%, recent date reveals that price increases are sticky and hard to eradicate. The latest consumer price index (CPI) data dashed hopes that the Fed had gotten price increases under control.

The February core CPI posted a hotter-than-expected reading, up 3.8% annually. The rising prices of rent, auto insurance, car repairs and airline tickets contributed to the stronger-than-expected inflation reading. Prices for used cars and clothing also climbed last month.

Inflation is still above the Fed’s stated 2% target.

At Wednesday’s Fed meeting, the central bank increased its 2024 core PCE inflation forecast to 2.6%, up from 2.4%. “Inflation has eased over the last year but remains elevated,” the Fed’s statement said. “The Committee remains highly attentive to risks.”

Gold in the midst of historic run higher.

Earlier this month, gold soared to a new all-time record high as voracious buying from Chinese investors, central banks and safe-haven investor buying keep the uptrend in the precious metal intact.

Gold has served as an asset to protect and preserve wealth for 5,000 year and investors today continue to pile into this asset, which has no counterparty or government risk.

Diversification is a prudent strategy, and those investing in gold have benefited handsomely, as gold has climbed 30% over the last 16 months. Looking ahead, Wall Street still expects more gold gains. With gold price forecasts at $2,300 and even $3,000 in the months ahead, investing in gold now could lock in significant price gains for you. Do you own enough gold? Don’t get left out during this historic gold run.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

1884 Indian Head Penny: A Tangible Piece of Early American History

Posted on — Leave a commentDuring the economic chaos of the Civil War, Americans hoarded any precious metal they could find. Even copper-nickel one-cent pieces virtually disappeared from circulation. The U.S. government came to the rescue with the Act of April 22 and authorized a new thin, bronze version of the Indian Head penny.

Indian Head pennies are an iconic, classic early American coin coveted by collectors. Minted from 1859 through 1909, Indian Head cents surged in popularity in the post-war era and were produced in large numbers in most years.

The exception is 1877 when a weak American economy decreased demand for new coinage, and only 852,500 Indian Head cents were minted, making it one of the rarest dates in the series. However, as coin operated machines became popular in the late 19th and early 20th centuries, the need for even more for Indian head pennies jumped and production topped 100 million in 1907.

Curious about this stunning early American coin? Blanchard has one 1884 Indian Head cent proof on offer. See it here. The 1884 Indian Head cent proofs had a tiny mintage totaling 3,942. Survivors are extremely scarce and hard to find. Like most Indian Head pennies, this proof coin from 1884 has seen its value climb in recent years, due primarily to the innate scarcity for a coin minted 140 years ago.

James Barton Longacre the Chief Engraver at the Philadelphia Mint designed this arresting early American coin, minted in Philadelphia. Longacre made his case for the new design featuring Lady Liberty in a traditional Native American headdress in a passionate letter to the director of the U.S. Mint James Snowden:

“From the copper shores of Lake Superior, to the silver mountains of Potosi from the Ojibwa to the Aramanian, the feathered tiara is as characteristic of the primitive races of our hemisphere, as the turban is of the Asiatic. Nor is there anything in its decorative character, repulsive to the association of Liberty … It is more appropriate than the Phrygian cap, the emblem rather of the emancipated slave, than of the independent freeman, of those who are able to say “we were never in bondage to any man”. I regard then this emblem of America as a proper and well defined portion of our national inheritance; and having now the opportunity of consecrating it as a memorial of Liberty, ‘our Liberty’, American Liberty; why not use it? One more graceful can scarcely be devised. We have only to determine that it shall be appropriate, and all the world outside of us cannot wrest it from us.”

The Indian Head penny features Lady Liberty on the obverse wearing a traditional Native American headdress. The design generated controversy as it appears that Lady Liberty is a Caucasian woman wearing a Native American headdress. In fact, legends claim the model for the coin is actually James Longacre’s daughter, Sarah! The handsome coin’s reverse features a lovely oak wreath with arrows at bottom and a shield at top.

1884 was an exciting time in American history. Imagine the stories this 140-year old Indian Head penny could tell!

In that year, a proclamation for the eight-hour workday in the United States was demanded by the Federation of Organized Trades and Labor Unions. In May 1884, Alaska became a U.S. territory. In July of that year, Dow Jones published its first stock market index: The Dow Jones Transportation Average, which is the oldest stock index still in use today.

In August, the cornerstone for the Statue of Liberty was laid on Bedloe’s Island in New York Harbor. In November, Democratic Governor of New York Grover Cleveland beat Republican James G. Blaine in a very close presidential election contest. In December, the Washington Monument was completed in Washington, D.C., which was the tallest structure in the world at that time.

Last but not least, in December, Mark Twain’s classic Adventures of Huckleberry Finn was first published in 1884.

In 1909, the Indian Head cent was replaced by the Lincoln cent, designed by Victor D. Brenner, closing an important era in U.S. numismatic history.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Carson City Morgan Dollars: A Favorite for Collectors across the Country

Posted on — Leave a commentFor many numismatists, a Morgan silver dollar set is a must-have for their collection—and this is one of the most collected series of coins the U.S. Mint has ever produced.

Within that series, the Morgan silver dollars minted at the legendary Carson City Mint in Nevada are highly sought after. And, there are only 13 coins in the Carson City Morgan dollar series. The exciting news? Building a Carson City Morgan dollar set is an attainable goal for most collectors.

History behind the Carson City Mint

Why are Morgan dollars with the famed “CC” mint mark so desirable? This storied western mint was in operation for a mere 21 years of remarkable Wild West history. Here’s how it all began…

In 1857, a miner named Henry Comstock laid claim to what became known as the Comstock Lode in Nevada. Prospectors struck it rich and earned massive fortunes. Word of the silver discovery spread quickly.

Nearby Carson City, Nevada grew fast as silver soon flowed out of the mine. The town was founded in 1858 and named after the iconic frontiersman: Kit Carson, a trapper, scout and guide. As more and more people flooded to the region, the need for coinage in everyday commerce skyrocketed. Demand for a second Mint in the West was strong.

At that time, Nevada was fairly isolated from the rest of the nation. And transporting raw precious metal to the San Francisco Mint was challenging. Railroads had not yet expanded to Nevada, which meant the only way to deliver gold and silver to San Francisco for processing was on horseback or a mule train. For many, that was a dangerous proposition in the rough and tumble Wild West, due to bandits and robbers on the open road.

So, only six years after Nevada became a state, the historic Carson City Mint began operations in 1870 order to process the huge amount of metal being mined in the area into sorely needed coinage.

Carson City Morgan Dollars

The Carson City Mint began producing Morgan dollars in 1878 and struck the silver dollars each year until 1885. Then, after a three year break, the Carson City Mint restarted production in 1889 and continued producing these coins until the Mint branch closed in 1893. There are a total of 13 issues highlighting the iconic “CC” Mintmark.

We list the Carson City Morgan Dollars below with their mintages.

Description Mintage

1878-CC 2,212,000

1879-CC 756,000

1880-CC 495,000

1881-CC 296,000

1882-CC 1,133,000

1883-CC 1,204,000

1884-CC 1,136,000

1885-CC 228,000

1889-CC 350,000

1890-CC 2,309,041

1891-CC 1,618,000

1892-CC 1,352,000

1893-CC 677,000

Generally speaking, Carson City Morgans were struck at low volumes. In total, the Carson City Mint produced only 13.7 million Morgan silver dollars.

To understand how truly low that number is, compare it to the amount of Morgans struck at the Denver Mint in 1921 alone – a whopping 20.3 million—in just one year!

If you want to build a Carson City Morgan dollar set, it’s worth knowing that the key date is the 1889-CC. The rarity of this coin stems from its incredibly low survivorship rather than its mintage.

Two other issues stand out in terms of mintage: the 1881-CC and 1885-CC, with low mintages of only 296,000 and 228,000 coins, respectively, which are the two lowest struck from Carson City.

The GSA Hoard

For collectors today, it is still possible to locate these coins as a large percentage survived in uncirculated condition through the “GSA Hoard.”

In case you aren’t familiar with this event, during the 1960s, the U.S. Treasury discovered bags of over 2.8 million Morgan Dollars, over 95% of which were minted at Carson City! In 1970, Congress directed the Treasury to transfer the coins to the General Services Administration in order to publicly sell the coins.

The GSA packaged the Carson City Morgan dollars in hard cover holders that said, “CARSON CITY UNCIRCULATED SILVER DOLLAR.” Each coin was sold with a certificate of authenticity that stated:

“This historic coin is a valuable memento of an era in American history when pioneers were challenging the West. The silver in this dollar was mined from the rich Comstock Lode, discovered in the mountains near Carson City, Nevada.”

Today, the surviving examples from the GSA Hoard that are still in their original hard cases are considered the most desirable of all.

George T. Morgan Designed the Beloved Silver Dollar

It’s easy to see why the Morgan dollar is beloved among numismatists. The large, nearly palm-sized heavy silver dollar is a joy to hold in your hand. George T. Morgan, an engraver at the Mint, designed the silver dollar.

The Carson City Morgan dollar features Lady Liberty’s head on the obverse. The reverse displays a stunning eagle. Morgan chose to depict Liberty as an American woman, rather than the typical Greek-style figures, and he used nature studies of the bald eagle to inspire him with his eagle design.

Carson City Morgan silver dollars represent a tantalizing combination of rarity and exciting Wild West history. Are you interested in building a Carson City Morgan silver dollar set? Even if you don’t see coins available for sale on our site, Blanchard has deep reach and connections within the numismatic community and are often able to source even hard to find coins. Give us a call and get started today!

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

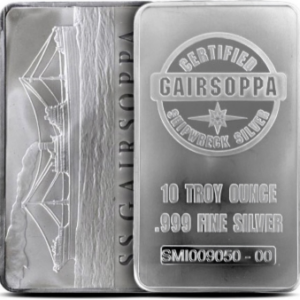

Top-5 Discoveries from the SS Gairsoppa: Silver Bars, Coins and More

Posted on — Leave a commentThroughout history, hidden gems often emerge in the aftermath of significant historical events. A prime example lies in shipwrecks, like the SS Gairsoppa. This ill-fated vessel became a testament to an intriguing chapter for coin and history enthusiasts alike. Investigating the findings following the ship’s sinking, this article explores the iconic SS Gairsoppa silver coins and bars born from the discoveries made, focusing on:

- The SS Gairsoppa’s dramatic history.

- A comprehensive catalog of the ship’s silver findings.

- Where to source salvaged SS Gairsoppa silver.

Watch this incredible video for an in-depth look into the Gairsoppa wreck:

https://www.youtube.com/watch?v=g4vV9I21ib4

A brief history of the S S Gairsoppa shipwreck

The SS Gairsoppa was a British cargo steamship. Commissioned in 1919, it was initially operated by the British India Steam Navigation Company. Its construction, with a gross tonnage of approximately 5,237 tons, reflected the maritime standards of its era. The vessel, with a sleek length of 412 feet and a substantial breadth of 53 feet, embodied both elegance and functionality.

The Gairsoppa began its maritime journey serving as a merchant vessel. For over two decades, it traversed the seas, transporting cargo and passengers between ports, significantly contributing to the global commerce of its time.

As the clouds of World War II gathered, the Gairsoppa found itself conscripted into service under the British Ministry of War Transport. Its role evolved from that of a commercial vessel to a vital cog in the war effort, tasked with transporting essential supplies, including iron ore, from India to Britain.

In February 1941, the SS Gairsoppa set sail from Calcutta, India, as part of a convoy bound for Liverpool, England. Sailing as part of a group of vessels, navigating together for mutual protection, was a common wartime practice to ensure safe passage across the treacherous North Atlantic.

However, misfortune struck when adverse weather conditions forced the Gairsoppa to veer off course, inadvertently separating it from the convoy’s protective shield. Alone and vulnerable, the vessel fell victim to a German U-boat lurking beneath the turbulent waves, the U-101, commanded by Captain Ernst Mengersen. A torpedo fired by the U-boat found its mark, and the Gairsoppa succumbed to the icy depths of the Atlantic, approximately 300 miles southwest of Ireland.

The sinking claimed the lives of the majority of the crew, with only one survivor, Second Officer Richard Ayres, managing to endure the harsh conditions of the open sea and reach the Irish coast after days adrift on a lifeboat. Despite Ayres’ survival, the fate of the Gairsoppa remained shrouded in mystery for decades, lost in the vast expanse of the ocean. It wasn’t until the early 21st century that the ship’s story experienced a resurgence, sparking renewed interest and exploration, particularly in the realm of Gairsoppa salvage, as the wreckage was discovered and efforts were made to recover valuable cargo from the ocean depths.

In 2010, a team led by the American exploration company Odyssey Marine Exploration located the wreckage of the Gairsoppa at a depth of nearly 15,000 feet. The discovery reignited interest in the ship’s history, shedding light on the circumstances surrounding its demise and the valuable cargo it carried, namely an estimated 7 million ounces of SS Gairsoppa shipwreck silver. This revelation sparked a salvage operation, marking one of the deepest and most challenging recovery efforts in maritime history.

Photo Courtesy of Library of Contemporary History, Stuttgart

Gairsoppa silver recovery

The recovery of the SS Gairsoppa’s silver from the ocean bottom was a formidable undertaking that required cutting-edge technology and meticulous planning. The first step in the recovery process involved the utilization of remotely operated vehicles (ROVs) equipped with advanced sonar and imaging technology. These ROVs descended to the ocean floor, providing a detailed survey of the wreckage site. This crucial step allowed the salvage team to assess the condition of the ship and the distribution of the cargo, particularly the S.S. Gairsoppa shipwreck silver that held historical and monetary significance.

Upon completion of the survey, the salvage team employed specialized robotic arms attached to the ROVs for the delicate task of lifting the silver from the ocean bottom. The challenging underwater conditions, marked by extreme pressure and darkness, necessitated precision and expertise in maneuvering the robotic arms to handle the valuable metal.

To ensure the safe recovery of the vessel’s silver cargo, Odyssey Marine Exploration implemented state-of-the-art techniques for retrieval. The use of specialized equipment, such as specially designed baskets and containers, facilitated the careful lifting of the precious metal from the ocean floor. These containers were then secured to the ROVs and slowly hoisted to the surface, minimizing the risk of damage to the valuable cargo during ascent.

The recovered silver, totaling millions of ounces, marked a historic achievement in maritime salvage. Found in the form of large ingots rather than Gairsoppa coins, these substantial pieces of silver added to the complexity of the salvage operation. The Gairsoppa silver’s extraction from the ocean depths not only brought closure to the story of the iconic vessel but also showcased the capabilities of modern underwater exploration and recovery technology.

Photo by Postal Museum

SS Gairsoppa silver bar findings

The silver recovered from the Gairsoppa shipwreck took the form of large ingots. More specifically, a total of 2,792 silver bars, each containing nearly 1,100 ounces of .999 pure silver, were salvaged. Today, collectors and silver investors keen on possessing a tangible piece of maritime history can acquire the following SS Gairsoppa silver bars.

1. Original SS Gairsoppa 1000 oz bar

Remarkably, contemporary silver collectors have the unique opportunity to acquire original ingots salvaged from the SS Gairsoppa, forging a tangible link to the wartime era. Among the 2,792 silver ingots recovered by Odyssey Marine Exploration, a select 462 were made available to the public, transforming them into authentic and coveted rarities.

Minted at His Majesty’s Mint in Bombay, each original Gairsoppa silver bar is distinguished by a unique serial number and the official stamp “HM Mint Bombay,” echoing the craftsmanship of a bygone era. While the ingots do not feature a date on them, their estimated production date falls between 1829 and 1919, i.e. the dates of the HM Mint Bombay’s operation.

A particularly intriguing facet of these large bars is the discrepancy in their marked and actual weight. Although stamped as 1,041.1 ounces, the average “SS Gairsoppa silver ingot 1000 oz” has a slightly lesser recovered weight, resulting from the impact of corrosion during the silver bars’ prolonged submersion in the ocean. This natural consequence, common in shipwreck recoveries, contributes to their deeply toned condition, enhancing their authentic charm. Collectors appreciate this nuanced history, reinforcing the allure of these Gairsoppa ingots as genuine artifacts from a significant maritime chapter.

S.S. Gairsoppa Shipwreck 1,036.6 Ounce Ingot

- Metal: Silver

- Year: Between 1829 – 1919

Photo by Great Collections

2. 10 oz Gairsoppa silver bar

Crafted as a tribute to the significance of the historic vessel, commemorative SS Gairsoppa 10 oz silver bars were made from the remaining 2,330 ingots that were not distributed to the public, offering a unique and affordable silver investment opportunity.

Meticulously produced by Sunshine Minting, a reputable private mint, each of these bars encapsulates approximately 10 ounces of .999 pure silver and bears distinctive markings attesting to its special origin. On one side, the “Gairsoppa silver bar 10 oz” features an intricate engraving of the SS Gairsoppa along the date of the shipwreck. On the other, it bears a detailed stamp indicating its weight and certification as recovered GAIRSOPPA silver. Combining a unique fusion of historical context, craftsmanship and intrinsic value, these bars constitute a prized addition to any collector’s portfolio.

10 oz. S.S. Gairsoppa Commemorative Bar

- Metal: Silver

- Year: 2013

To explore a broader array of silver options, beyond the offerings of Gairsoppa silver bars for sale, browse Blanchard’s extensive silver selection here.

SS Gairsoppa silver coin commemoratives

Unlike other famous shipwrecks, the Gairsoppa ship yielded no coins in its recovered cargo. However, following its legendary salvage operation, commemorative coins were produced to honor the historic vessel. These numismatic treasures stand as enduring tributes to the SS Gairsoppa’s unique legacy and are cherished by collectors looking for SS Gairsoppa shipwreck silver for sale.

1. 2013 50p Britannia – SS Gairsoppa silver coin

Shortly after Odyssey Marine Exploration’s salvage operation, the Royal Mint decided to issue commemorative SS Gairsoppa coins. The 2013 50p Britannia is a limited edition coin crafted with precision, featuring a quarter-ounce of pure .999 silver recovered from the sunken vessel. Its iconic obverse design by Philip Nathan showcases Britannia standing proudly with a shield, symbolizing the resilience of the British spirit. On the reverse, Ian Rank Broadley’s portrait of Her Majesty Queen Elizabeth II graces the coin.

Weighing 7.86 grams and measuring 22.00 mm in diameter, this SS Gairsoppa Royal Mint bullion coin bears a unique inscription, “S.S. Gairsoppa,” on its rim, paying homage to the ship and its crew. Limited in mintage and finished to the Royal Mint’s exacting standards, it serves as a tangible connection to the maritime history of the SS Gairsoppa, making it a prized addition to numismatic collections worldwide.

2013 50p Britannia – SS Gairsoppa

- Metal: Silver

- Year: 2013

Photo by PCGS

2. 2014 50p Britannia – SS Gairsoppa coin

Following the success of the 2013 Britannia 50p Gairsoppa coin, the Royal Mint continued this numismatic tribute in 2014. This limited edition coin, also weighing one quarter of an ounce of pure .999 silver recovered from the Gairsoppa shipwreck, features the iconic design of Britannia by Philip Nathan and Ian Rank Broadley’s portrait of Queen Elizabeth II as well.

When paired with the preceding year’s coin, Gairsoppa coins for sale offer collectors a compelling narrative of historical significance and artistic elegance, enhancing the completeness of a numismatic collection.

2014 50p Britannia – SS Gairsoppa

- Metal: Silver

- Year: 2014

Photo by PCGS

3. 1 oz S.S. Gairsoppa shipwreck silver round

First manufactured in 2014 by the Sunshine Mint in the United States, the Gairsoppa 1 oz silver round was also struck from silver salvaged from the Gairsoppa. A strikingly beautiful piece, it features a unique obverse design of the iconic ship cruising on calm waters, with a bright silver finish accentuating the scene and contrasting darker areas adding depth. Its reverse displays inscriptions for weight and purity, including “Certified Shipwreck Silver” around the central “Gairsoppa”, making it a prized collector’s item for those seeking an authentic Gairsoppa shipwreck silver round.

1 oz. S.S. Gairsoppa Shipwreck Round

- Metal: Silver

- Year: 2014

Photo by Canadian Coin Blog

Where to buy historically valuable silver coins and bars

The storied legacy of the S.S. Gairsoppa and the precious silver recovered from its depths offer not just historical value but a tangible investment in the enduring value of precious metals. To embark on this journey of acquiring a piece of SS Gairsoppa silver bars for sale, consider using Blanchard. The company’s unparalleled expertise, commitment to customer satisfaction, and comprehensive guidance make Blanchard a trusted and outstanding choice for navigating the intricate world of precious metals and rare coins. Contact Blanchard’s team of experts to explore the world of Gairsoppa shipwreck silver and other historic silver, where every piece tells a captivating tale and holds the potential for lasting investment value.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.