Is the Fed Panicking?

Posted on — Leave a commentThe Fed can’t stop the spread of COVID-19. But, it’s doing what it can.

In a shocking and aggressive move designed to boost consumer and business confidence, the Federal Reserve slashed interest rates by 50 basis points Tuesday morning, acknowledging economic risks from the fast-spreading coronavirus.

This is the first emergency interest rate cut since the 2008 Global Financial Crisis and only the ninth emergency cut in history.

Never before has the Fed responded to a health crisis with a monetary policy move, which continues to call into question the independence of the central bank in the current environment. The 0% level is closer and closer. The fed funds rate now stands in a range between 1% and 1.25%.

Gold prices shot nearly $50 an ounce higher on the emergency move, trading as high as $1643.90. Stocks rallied in a knee-jerk response, but then fell back to lower levels. The stock market remains in the midst of the sharpest sell off since the 2008 financial crisis.

Fed Chairman Jerome Powell admitted in a press conference Tuesday, “We do recognize a rate cut will not reduce the rate of infection, it won’t fix a broken supply chain.”

With financial markets in turmoil, the emergency rate cut was designed to inspire confidence. But, can it?

Public health officials are now warning that the global spread of the coronavirus cannot be contained. Economists are warning that a full-blown epidemic, which infects one-third of the American population, could push the US into a recession.

The Fed’s rate cuts may buy some time. But, with the zero-bound level closing in, the central bank is increasingly impotent, out of bullets and beginning to lose credibility on Wall Street.

Who does this hurt? Lower rates hurts savers and interest rates near zero weaken the fundamentals of the banking system. Driving rates to zero failed to rescue Japan and Europe’s economies in recent years. Can it really help here?

Investors are panicking. The Fed is panicking. Remember a quote from economist John Maynard Keynes: “The market can stay irrational longer than you can stay solvent.”

The Fed’s next scheduled meeting is March 17-18. Economists expect the Fed may slash interest rates another 25 basis points mid-month.

Gold is a safe haven in an increasingly irrational world. Even prior to this outbreak, it was clear that gold was in the early stages of a dramatic new bull market. Many on Wall Street are saying gold could climb above $2,000 an ounce over the next year.

Panic equals opportunity.

Before the Fed acts again, make some moves to ensure you portfolio is properly diversified with an allocation to tangible assets. Gold is heading even higher this year. Count on it.

Fear Drives Stocks Into Correction Territory

Posted on — Leave a commentThere is an old market saying: Stocks take the stairs going up and take the elevator down.

That was evident last week as the Dow Jones Industrial Average collapsed as much as 12.4%, falling into so-called correction territory (declines of 10% or more). The eye-popping stock selling marked the worse week since the 2008 Global Financial Crisis. Apple and Microsoft lost a combined $300 billion.

The coronavirus has now spread to 60 countries around the globe. Economists highlighted concerns about how quarantined towns reduce economic activity and global growth forecasts have been downgraded to 2.4% from closer to 3% in 2020. But, if the coronavirus officially becomes a global pandemic, economists warn the economic impact could be much worse with the potential for the U.S. to fall into a recession.

If you were rattled by the shockingly massive losses on Wall Street last week, you aren’t alone.

No one likes to see the account balance on their 401k or investment accounts fall by 10% in a week.

Successful investing involves a thoughtful diversification plan that is uniquely tailored to your risk tolerance level and takes into account your time horizon (when do you want to use the money) and your long-term financial goals.

If you became fearful last week, it could be a sign that you don’t have proper asset allocation in place for your portfolio.

One of the key benefits of portfolio diversification is the choice to own non-correlated assets. That simply means when one asset goes down (stocks for example), another asset goes up (gold for example).

The Dow Jones Industrial Average closed last week 10.96% lower for the year. After climbing to a new 7-year high, gold gave back a portion of its gains finishing last week about 3% higher for the year. That is what non-correlated assets means. Stocks down 10.96% and gold up 3%.

Investors who held a portion of their portfolio allocated to tangible assets like gold lock in better long-term return with less volatility during stock market declines.

Gold has what is known as a “low beta.”

From 1987-2019, a stern test, which included the 1987 and 1989 stock market crashes, the dot.com collapse, 9/11 and the subsequent recession and the 2008 Global financial crisis found that the volatility of returns on gold relative to the stock market was relatively low. The 4.9% average annual return on gold means that investors would have reduced the volatility of typical portfolios without sacrificing returns, according to a February 2020 study by Penn State University’s RL Associates.

If last week’s volatility was too much for you, it could mean your portfolio isn’t properly diversified. It’s not too late to adjust your allocation to allow you to successfully manage volatility going forward. If you’d like personalized recommendations, call a Blanchard portfolio manager at 1-800-880-4653 today.

Want to stay on top of the latest news? Subscribe today and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Celebrating Mardi Gras: The History of the New Orleans Mint

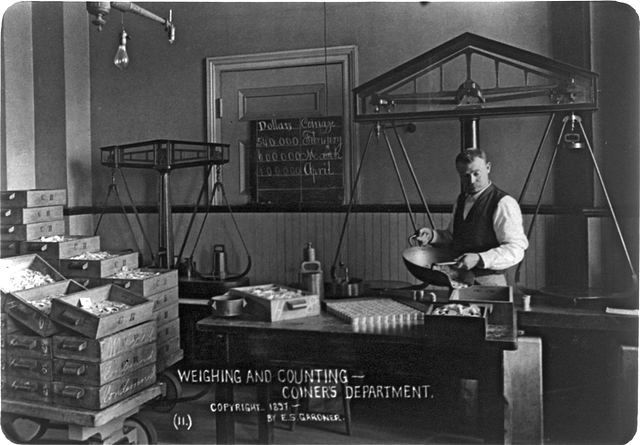

Posted on — Leave a commentIt was the year 1835. Large quantities of gold were being shipped overland to the East, only to be waylaid by bandits en route. So the U.S. Congress, in a moment of wisdom, declared that branch mints be established in three southern cities, including the grand dame herself: New  Orleans.

Orleans.

From its beginning, the New Orleans Mint was vitally important. One reason is New Orleans’ location at the mouth of the Mississippi River, which made it pivotal for trading throughout the Midwest. Additionally, more foreign trade was transacted in New Orleans at the time than in any other city in America. Vast quantities of gold and silver minted in Mexico and South America flowed into the city. And then there’s the fact that there was simply a woeful shortage of coins at the time. The Philadelphia Mint had been our nation’s only mint before 1838, the U.S. was rapidly growing, and—as we all know—paying for stuff in gold dust gets cumbersome after a while.

Things cranked along without great incident at the New Orleans Mint until, in 1861, the Confederate States of America seized the facility from the state of Louisiana, which had seceded from the Union. This was one of the South’s first acts of defiance (if you want to make an impact, hit ’em in the purse strings). The mint struck four half dollars with a Confederate design on one side, but all coin production quickly stopped, as the facility suffered from dwindling resources and increasing disarray.

After a little over a year of Confederate rule, the Union captured New Orleans and instituted a severe and unpopular period of martial law. The two-way hostility is perhaps best exemplified by this incident: a riverboat gambler climbed onto the roof of the mint, tore down the U.S. flag that hung there, and ripped the flag into shreds. The Union military governor of the city then had him hung—from a flagstaff projecting horizontally from the mint building.

The mint building served as an assay office for a while, until coin production resumed in 1879 with the Morgan Silver Dollar and continued until 1909. Today, the mint building houses a museum.

Apple Revenue Warning Sends Stocks Skidding, Gold Soaring

Posted on — Leave a commentApple’s (AAPL) unexpected warning to investors was bleak. The tech giant issued guidance last week that it won’t meet its first quarter revenue goals because of the coronavirus.

Gold surged to a 7-year high as investors around the globe began dumping stocks and buying precious metals as fears around the coronavirus economic impact, now known as COVID-19, spread further.

While economists have warned about the potential economic disruption from the pandemic, Apple’s stark warning was the first major U.S. business to confirm that the outbreak is damaging both production and sales in China. Apple manufactures the majority of its iPhones inside China. COVID-19 has forced the closure of manufacturing operations and also retail stores in China.

Apple is far from alone. Many multi-national U.S. corporations do big business in China. UnderArmour and Canada Goose also warned that the coronavirus will damage their profits.

Gold is showing the beginnings of a runaway bull market as a bullish breakout is emerging on the daily technical chart. Significantly higher levels are forecast, with gold over $1677 an ounce at the time this article was written.

Last week, Goldman Sachs told clients in a research note that gold could hit the $1,850 an ounce level if the coronavirus continues into the second quarter.

“We see such a rally being driven by the continued search for yield, increased demand for portfolio diversification and higher political uncertainty” with gold being “a strategic allocation to protect a portfolio from geopolitical risks such as the current outbreak, de-dollarization and negative real yields,” Goldman Sachs analysts wrote.

Citi analysts went even further, projecting that gold could climb above the $2,000 an ounce level – setting a new time record high – within the next 12 to 24 months.

It’s not just gold that is benefiting from the stock market selling and economic uncertainty, silver climbed sharply higher last week also, topping the 18.70 cents zone.

The coronavirus outbreak is still an unfolding situation. It’s unclear if it will continue to spread more rapidly outside of China. But, initial economic damage has already been done, as Apple told investors last week. How much more economic damage remains to be seen.

Is your portfolio fully diversified? Blanchard recommends holding up to 15% of your portfolio in tangible assets to protect and grow your wealth through all market cycles. The bull market in gold is just getting started. Gold climbed 18% last year. Don’t miss out on another round of gains this year. It’s not too late to add more gold to your portfolio. Get started here.

Stay up-to-date on the latest market news. Sign up for our newsletter and get our Tales from the Vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Three-Cent Silver: Solving the problem of scarcity

Posted on — Leave a commentThe US three-cent silver coin was one of the many repercussions of the California gold rush. The country experienced a surging supply of gold as new discoveries opened in the east. This development created an economic scenario in which the price of gold relative to silver dropped. Thus, silver could be traded for ever increasing amounts of gold. As a result, a shortage of silver developed in the country. This was the new setting in which the three-cent silver coins emerged.

To solve this problem of scarcity, New York Senator Daniel S. Dickinson, drafted legislation calling for a new coin. The piece would consist of .750 fine silver meaning that the composition would be three parts silver and one-part copper, making it the first American coin to contain metal valued significantly less than its face value. There were fractious debates over the legislation. However, the idea found momentum once Congress began considering dropping the postage rate from 5 cents to 3 cents. By 1851 the bill passed.

When it was time to design the piece, many considered simple images best. The reason: the coin was so small in size that it could only feature basic shapes, otherwise no one would be able to appreciate such small detail. For these reasons, it was decided that the obverse side of the coin would feature a star in reference to the national crest with the shield of the Union in the center, and the reverse side was an ornamental “C” with the Roman numeral “III” in the center. The perimeter featured a ring of thirteen stars.

Officials minted three types over the years. The bulk of the minting occurred in Philadelphia. At first, many recoiled from the uncommonly small size. Type I (1851-1853) was originally minted with 75% silver and 25% copper to discourage melting down of the coins for their silver content…and they quickly became dirty and discolored. This led to the nickname “fish scales” at the time. Type II (1854-1858) came as officials increased the portion of silver in the piece to .900. Other changes were aesthetic. The star featured a triple line around the perimeter, and an olive branch and bunch of arrows. Type III (1859-1873) included only minor changes to one side of the coin most likely to improve the striking process.

By 1870 President Ulysses S. Grant signed the Coinage Act of 1873. The direct result was the abolishment of two-cent, and three-cent pieces and other coins. This de-authorization meant that the US Treasury would need to withhold the piece they had already minted. Instead of circulating the currency they would melt the coins and use the metal for other pieces of currency.

Today, the 1851-O three cent silver remains one of the more sought-after versions of the coin because it was one of the few minted outside of Philadelphia. It is the only coin of this type struck at the New Orleans Mint. 720,000 pieces were issued. For most collectors the uncommon “O” mint mark is what makes the coin so collectable. Additionally, the coin represents an unusual period in US history in which the country was still finding its way and, in the case of the Type III coin, navigating the impending Civil War.

Want to read more articles like these? Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly. Sign up for our newsletter here!

Is Your Portfolio Ready For Super Tuesday?

Posted on — Leave a commentSenator Bernie Sanders still has a long way to go before he’d get the green light to move into the White House.

Yet, the recent Iowa Caucus, which appears to be a tie between Sanders and moderate Pete Buttigieg, reveals strong support for the Vermont Senator’s progressive policies.

The stock market continues to edge to new all-time highs and for now is shrugging off the Sanders surge.

Are stock investors complacent about the potential risks that lie ahead? Maybe.

Many on Wall Street warn that a Sanders presidency could be bad for the stock market, inflation and the deficit.

What about gold?

Gold had a great year in 2019, up 18%. But, that rally is far from over.

Wolfe Research recently predicted that gold would break out to a new all-time high. Others on Wall Street believe gold could shoot above $2,000 an ounce on Election Night if Sanders wins the presidency.

What’s behind these predictions?

- Raise corporate taxes. Sanders wants to reverse the Trump corporate tax cuts. He wants to hike the corporate tax rate back to its pre-2017 level of 35%, which could be a major drag on the stock market.

- Break up big firms. He wants to break up big firms like technology companies. Sanders backs stronger anti-trust policies and breaking up big companies could weigh on profit margins and would be negative for stocks.

- Extreme wealth tax. Sanders has called for an extreme wealth tax on the highest income Americans that would start at 1% on those with net worth over $32 million and rise to 8% on wealth over $10 billion.

- Cancel student debt and make college free. Sanders proposes to make tuition free at public colleges and to wipe out the $1.6 trillion in student loan debt.

- Medicare for all. All healthcare would be free for all Americans.

No matter your political leanings or views on the above issues, Wall Street and economists warn that policies like these could trigger a major sell-off in the stock market and create uncertainty.

Here’s what Capital Economics wrote on Feb. 7 about Sanders: “Several of his policies look very negative for US equities. If his support continues to climb that could start to weigh on the US stock market.”

How will our nation already saddled with $22 trillion in debt cover the ambitious proposals like health care and college for all? Less corporate friendly policies could sink stocks and mark an end to the current 10-year bull market in equities.

If you are looking to protect and grow your assets ahead of the 2020 U.S. presidential election, gold remains in an uptrend and could skyrocket higher if the Democrats appear to be gaining ground. Super Tuesday is just around the corner. Have you fully diversified your portfolio with tangible assets? We can help.

Want to read more articles like these? Get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly. Sign up for our newsletter here!

The Future of Gold Mining

Posted on — Leave a commentGold mines are becoming more difficult to source and maintain.

Consider that the global nonferrous exploration budget remains below the 2014 level. Moreover, between 2012 and 2016 this figure dropped each year.

The S&P Global Market Intelligence Report adds color to these numbers by explaining that, “our research has long shown that the mining industry is allocating an increasing proportion of its exploration spending to advanced projects and mines. This tends to become more pronounced during downturns, as juniors opt to spend scarce funding on proven assets rather than on riskier early stage exploration.”

It’s not surprising to learn that some of the biggest earners in the mining industry are allocating only small portions of their budget to exploration. In recent years there has also been a drop in the ratio of exploration spending to adjusted revenue. The S&P report continues, “it seems unlikely that the ratio will improve going forward, as consolidation at the top of the industry generally results in lower exploration.” Many major mining operations are in agreement that the best strategy is to become better at leveraging the value of mines they already have rather than source increasingly scarce deposits.

Put simply, the future of gold mining appears to be one of diminishing returns.

This forecast makes intuitive sense. After all, gold is a finite resource. Eventually, waning deposits will fall at a faster rate than the ascendance of the technological capabilities behind exploration and mining. This dynamic becomes even more acute as factors surrounding the industry experience upheavals of their own. Examples include the Coronavirus, geopolitical tensions, and waning fiscal stimulus.

These factors explain, in part, why the largest mining companies have allocated less than half of 1% of their budgets to what they call “grassroots” exploration. These are exploratory efforts aimed at finding fresh, new deposits. In fact, this portion of mining budgets is at a record low.

Those who monitor this industry often look at something called the Exploration Price Index (EPI). This number “measures the relative change in precious and base metals prices, weighted by the percentage of overall exploration spending for each metal as a proxy of its relative importance to the industry at a given time.” More simply, it is a single number offering insight into the state of the mining industry. For example, the EPI falls when financing activity declines in the mining industry as a result of diminished metal prices.

The dynamic between a record low grassroots exploration budget and the continued growth in the value of gold might explain why Thomas Rutland, the research analyst behind the S&P Global Market Intelligence Report stated “metal prices should trend upward during 2019, although volatility is likely.” A look back on 2019 shows that sentiment to be true.

As gold investors look to the future, they should look beyond market sentiment, and trending gold purchases. While important, these factors are only part of the picture. The S&P research, and data points like the Exploration Price Index are reminders that the eventual depletion of in-ground gold will also create influence on long-term process.

Want to stay updated on the latest market news, Tales from the Vault and our favorite stories from around the world? Sign up for our newsletter here.

Clearing Up Face Value Confusion: The Capped Bust Dime

Posted on — Leave a commentWhat’s that coin worth?

After John Reich designed the Capped Bust dime, citizens and foreigners no longer wondered what that coin in their hand was worth.

The Capped Bust dime was the first dime that stated its face value on the coin.

Minted from 1809 through 1837, Reich is credited with this important innovation of including the value “10C” on the coin.

Reich developed the popular ‘Liberty with a cap’ concept, which was struck on the half dollar, quarter, dime and half dime.

While the mintage totaled 1,190,000 in 1835 out of the Philadelphia mint, uncirculated specimens in higher grades are difficult to find. We have just one mint state, uncirculated 1835 Capped Bust Dime.

1835 – A Year to Remember

1835 was a significant year in United States history. That represents the year that President Andrew Jackson paid off the national debt. Jackson hated debt.

To accomplish this impressive goal Jackson took advantage of the real estate bubble occurring in the Western US and he started selling off federal land in the West. He also blocked spending bills left and right.

The national debt totaled about $58 million when Jackson took office and six years later in 1835 he paid it off.

Will the United States ever be debt free again? Nobody knows.

This dime is not only an exquisite specimen of the popular Caped Bust series in a high grade, it represents the year when our government paid its national debt off. That by itself makes this a special and unique rarity.

The Capped Bust Dime obverse features Liberty wearing a graceful cloth cap inscribed with the words LIBERTY. Her soft and curly hair flows to her shoulders. The coin features seven stars on the left and six on the right with the year at the bottom. The reverse showcases a proud eagle resting on a branch, holding a number of arrows. This silver coin has a reeded edge.

Want to stay updated on the latest market news, Tales from the Vault and our favorite stories from around the world? Sign up for our newsletter here.

One weird, 8-sided coin

Posted on — 2 CommentsThis coin is heavy and large, and it has eight sides.

Its face value is $50.

One side doesn’t have a portrait, Lady Liberty, or anything else you might expect on a numismatic rarity. No, it has a pattern, created through a process called “engine turning.”

It’s an odd coin. You might even call it weird.

Take a look at the eagle. It’s a bit scrawnier than our modern numismatic eagle, and it’s holding a ribbon in its mouth.

This is an unusual coin indeed.

Often called a “slug,” the 1852 Assay Office $50 gold coin is a heavyweight in the world of American numismatics. Only 23,800 were minted, and they were minted when the Gold Rush was in full swing. When you hold this coin, you can almost imagine a gold miner, a buccaneer, or a cowboy slapping it down on a counter for a big purchase. This coin, in fact, would have been a week’s wages for a gold miner.

Few of these 8-sided coins survive today because many were minted down later, when the San Francisco Mint started operations.

This U.S. Assay coin was minted before there was a West Coast Mint at all. Thanks to the Assay Office, gold like this no longer had to be shipped to Philadelphia on dangerous, bandit-ridden journeys for minting.

These $50 gold slugs were so popular and evoked such a romantic period in American history that facsimiles were later made for state expos and centennials.

1852 Historical Events Timeline

March – Uncle Tom’s Cabin Is Published

Harriet Beecher Stowe’s anti-slavery novel sells 300,000 copies in only three months and so informs public opinion that Abraham Lincoln reportedly says, upon meeting Stowe, “So this is the little lady who made this big war.” In 1863, when Lincoln announces the end of slavery, Stowe dances in the streets.

May – Calamity Jane Dies

Raised in a Gold Rush town, Calamity Jane had a fondness for menswear and adventure. A hard drinker and carouser, she attracted attention for stunts like riding a bull down the main street of town.

July – Congress Authorizes the San Francisco Mint

Congress approves legislation authorizing a second U.S. Mint, and the Treasury Secretary chooses San Francisco for the location. This allows gold from the California Gold Rush to be minted locally, rather than transported on dangerous journeys to the Philadelphia Mint.

December – Emma Snodgrass Is Arrested for Wearing Pants

Emma Snodgrass, 17, is the daughter of a New York City police officer. She shows up in Boston wearing pants, is arrested and sent home to her father, and does it again. And again. And again. Snodgrass becomes national news.

What Could China’s Coronavirus Mean For You?

Posted on — Leave a commentInvestors woke up on Monday morning to stock markets sinking around the globe. Growing fears that the China coronavirus could slow global economic activity sent stocks tumbling.

The fast-spreading pneumonia-like virus was first identified in China on December 31, 2019 and has now spread outside mainland China. As of January 27, a total of 2,700 confirmed cases are known inside China with 80 deaths. That number is rising every day. Currently, 5 cases are known in the U.S.

The virus is a big deal and we don’t yet know how long it will take to contain it. The ultimate impact to global economic growth is also a big unknown, which triggered the Monday morning stock market sell-off.

Despite the scary headlines, for now, the World Health Organization has not designated this a global public health emergency. Yet, some are comparing this to the last major disease that began in China – SARS in 2003.

Scientists say this new coronavirus, which is believed to have jumped from animals to humans, is about 70% similar to the SARS virus seen 17 years ago.

A key differentiator is that the incubation period for the new coronavirus is longer. Some scientists believe it could be as long as 14 days, which means anyone who comes in contact with an infected individual during that period could also get sick. The longer “contagious period” means this virus could spread more easily.

The good news is that the initial response with travel restrictions and other efforts to contain the spread has been faster and more effective than the world saw in 2003 with SARS.

Realistically, this event is still just getting started. The human toll could be high. It remains to be seen how effectively governments around the globe will ultimately be able to contain the virus.

Here in the U.S. we have two sets of concerns. First, will this virus impact us or our loved ones? Second, what could this mean for our investment portfolio?

Fortunately, inside the U.S., the situation appears to be under control. Early reports suggest the new coronavirus has a mortality rate lower than the SARS outbreak at only 3% versus 9% back in 2003.

For your investments, there could be a real impact, at least in the short-term.

Looking at the SARS example, the S&P 500 dropped 12% in the 5-month period starting in mid-November 2002 until mid-March 2003. In 2014, the MSCI index of global equities fell 8% at the height of the Ebola concerns.

In the short-run, economic activity could slow in China as consumers stay home and don’t spend. The South China Morning Post estimates a decline in economic activity between 0.5%-1% from an overall 5.9% reading. The impact is meaningful, but not devastating.

Looking back at history, once the diseases were under control, economic activity returned and the stock markets recovered. In the short-run, this could be a trigger for a 10 or even 15% decline in stocks. It could prove to be short-lived if the coronavirus is quickly contained. We still don’t have all the answers.

The price of gold firmed early Monday as investors turned the precious metals as a safe-haven and hedge. On Monday, gold traded around $1,580 an ounce – over $250 an ounce higher than it was trading in January 2019.

The early response to this coronavirus from governments around the globe is an important and reassuring development. For your portfolio, this is just another argument for diversification into tangible assets. Gold is already in an uptrend and if the stock market remains under pressure, more upside is expected.

Want to stay updated on the latest market news, Tales from the Vault and our favorite stories from around the world? Sign up for our newsletter here.