Cats & Dogs: Can Equities and Gold Coexist?

Posted on — Leave a commentToo often investors think of rising gold prices and a surging equities market as mutually exclusive. Are they right? A look at recent market fluctuations seems to indicate they aren’t.

Gold has long been deemed a “safe haven” asset; if the stock market falters or crashes gold will save them. If this is true, it stands to reason that the inverse is also the case. That is, if stocks are on fire, as they have been during the current multi-year bull run, then gold must drop. However, on a year-to-date basis gold has risen approximately 4.72%. How is this possible?

The answer might be that investors are willing to entertain two, separate outlooks simultaneously. For example, capital inflows to stocks likely stem from optimism surrounding tax reform, U.S. economic growth, international growth, and a low unemployment rate. At the same time, political tensions are on the rise. Unease about North Korea looms large.

For example, in late August of 2017, gold saw an increase amid saber rattling between Trump and North Korean leader Kim Jong Un. “Gold is being supported by the war games and the uncertainty in Washington,” remarked one analyst with Saxo Bank at the time.

Simultaneously, these gold investors have an eye on the value of the dollar. As the U.S. dollar falls in purchasing power relative to other currencies, gold often increases exhibiting an inverse relationship. Today, gold is up about 6% since mid-December. Some are citing increased concerns of looming inflation. Traditionally, gold has been something of a hedge against inflation. Therefore, despite its increase over the last few months, some expect it to go higher.

All of these various factors are supporting a “perfect storm” characterized by strong opportunities for both gold investors and equity investors. Meanwhile, just as political tensions have some equity investors hedging their bets, many are also questioning valuations as an already hot market grow hotter. Research firm Advisor Perspectives asked investment advisors about their outlooks for stocks and “Among the 505 who provided estimates, more than half expect large U.S. stocks to earn an average of at least 5% annually over the next decade. More than an eighth of these advisers expect stocks to return at least 8% annually” Simply put: the party might not be over just yet.

More importantly, the life of the equities party doesn’t mean the death of the gold party. Investors are learning they can have both.

Even if this curious case of synergy ends, well-diversified investors with a long-term outlook are likely to be pleased. With a long enough horizon anyone can outlast tumultuous, unpredictable markets. This is important to remember because the unpredictability of a rising equities/gold market can be as fun as a falling equities/gold market can be depressing. Clearly this is a time to be in the market and off the sidelines.

The Ultimate Double Take: The 1955 Lincoln Double Die Coin

Posted on — 1 CommentErrors are something to be avoided unless of course, you’re a coin collector. Error coins represent rare instances of oversight in the minting process. Often, such coins are rare because officials catch the mistake before the currency finds its way into circulation. However, the 1955 Lincoln double die error is an exception. It’s also one of the most sought-after error coins from The United States Mint.

The error comes from the Philadelphia mint. It started with an improperly formed die which is the stamp the creates the impression on the coins. Forming the die requires multiple impressions. During this process, however, workers didn’t align the die correctly. The result: the words “in God we trust,” “liberty,” and the year “1955” all appear as double text on the error coins. The profile of Lincoln, however, is correct.

Typically, an error this glaring would never make it off the production line. However, during the minting process, it’s believed that normal quality control procedures lapsed during an overnight production shift. Additionally, the coin went into production during a penny shortage. This shortfall prompted the Philadelphia mint to ramp up production. This, in turn, led to 12-hour days characterized by rapid-fire minting. The original cause of the shortage: a one-cent tax added to cigarette sales in 1955.

Interestingly, a pack of cigarettes at the time cost 23 cents. With a one-cent tax, the price came to 24 cents. However, vending machines were only equipped to accept quarters. Therefore, customers were expected to pay 25 cents; then inside the cigarette packs, they would find one penny as change for their purchase. Many of the 1955 Lincoln double die cents ended up in these cigarette packs.

While there is no official count, estimates indicate that between 20,000 and 24,000 double die pennies found their way into a batch of nearly 10 million cents, the rest of which were correct.

Not long after the mistake, the error coins appeared in circulation. Given their point of origin in Philadelphia, many of them were found on the east coast in areas like New York, Boston, and Massachusetts. As word spread, citizens became eager to find and keep these coins knowing that their rarity would add to their value over the long-term. Today, many believe that no more than 15,000 have survived.

Some enthusiasts still pour through cheap bags of wheat pennies in hopes of finding one. Some collectors, initially excited, are disappointed when they realize they’ve come across what’s called the “poor man’s” double die. This is not the same as the 1955 Lincoln double die. A “poor man’s” double die is the result of a much less visible double impression that occurs when a worn die creates a distorted image. In 1955 some people paid 25 cents for the real thing. Soon the price went up to $10. Today, of course, they’re worth far more. The next time you see a penny, pick it up.

The Power of Inflationary Hedging

Posted on — Leave a commentThe hot topic in the financial world today is inflation, namely which way it’s going to go. For years it has been curiously low, but that might be changing and if so, implications for gold are significant.

Since December 2015 the Fed has increased the benchmark short-term rate five times ranging between 1.25% and 1.5% Meanwhile, inflation remains stubbornly low as Fed officials continue to attempt to reach their 2% goal. Recent numbers, however, indicate they might be making progress.

“Prices excluding volatile food and energy categories rose 2.6% in January on a six-month annualized basis, up from a 1.1% gain in July and one of the strongest periods in years,” explains the WSJ. The result: “We think that it is a good time to own the precious metals,” remarked the president of EverBank World Markets. “We are seeing a burgeoning middle class and more disposable income in India and China, which should lead to more physical demand,” he continued. However, for many, the motivation to hold gold as an inflationary hedge against anticipated rises in inflation is just one part of the picture. Recent stock market volatility has prompted many to revisit their asset class allocation.

While analysts’ outlooks for the medium term are still largely positive, the pervasive expectation is that we’re entering a period of increased volatility. Equity investors will probably see gains, but the terrain they must cross to get there will be rocky.

Some of the volatility we’ve already seen stems from wage data. That is, payroll reports showed a 2.9% gain in average hourly earnings marking the highest annual rise since 2009. This news incited a sell-off in the equities market. Investors, it seems, fear that rising labor costs will defray corporate profits and temper share price appreciation. As a result, gold experienced a 1.6% increase on Wednesday while gold futures began trading at multi-year highs.

Meanwhile, many expect the Fed to make a minimum of three more interest rate increases this year. These expectations, however, are somewhat obscured by uncertainty surrounding the new Fed chairman Jerome Powell. Just weeks into his position, many are waiting to see how he behaves in response to the markets and broad economic data. At the same time, few expect any wild moves. Jerome and his staff have cited their intention to rigorously review all data before making any impactful decisions regarding rates.

“The market is starting to fall in love with inflation trades again. Gold could be the standout performer this year if that’s the case,” remarked the head of portfolio management services at Adroit Financial Services.

In these modern times, however, we have other options like headline-grabbing Bitcoin. Can the digital currency also act as an inflation hedge? Likely not. As the Financial Times puts it, gold is “Universally accepted as a global and long-term store of value and one that doesn’t demand a password when you want to dig it out from under your bed. It’s pretty; it’s useful; it’s really hard to fake; it’s easy to change into a fractional currency; and, crucially, it has history. An ounce of gold has, give or take, hung on to its purchasing power for thousands of years.”

The Power of Inflationary Hedging

Posted on — Leave a commentThe hot topic in the financial world today is inflation, namely which way it’s going to go. For years it has been curiously low, but that might be changing and if so, implications for gold are significant.

Since December 2015 the Fed has increased the benchmark short-term rate five times ranging between 1.25% and 1.5% Meanwhile, inflation remains stubbornly low as Fed officials continue to attempt to reach their 2% goal. Recent numbers, however, indicate they might be making progress.

“Prices excluding volatile food and energy categories rose 2.6% in January on a six-month annualized basis, up from a 1.1% gain in July and one of the strongest periods in years,” explains the WSJ. The result: “We think that it is a good time to own the precious metals,” remarked the president of EverBank World Markets. “We are seeing a burgeoning middle class and more disposable income in India and China, which should lead to more physical demand,” he continued. However, for many, the motivation to hold gold as an inflationary hedge against anticipated rises in inflation is just one part of the picture. Recent stock market volatility has prompted many to revisit their asset class allocation.

While analysts’ outlooks for the medium term are still largely positive, the pervasive expectation is that we’re entering a period of increased volatility. Equity investors will probably see gains, but the terrain they must cross to get there will be rocky.

Some of the volatility we’ve already seen stems from wage data. That is, payroll reports showed a 2.9% gain in average hourly earnings marking the highest annual rise since 2009. This news incited a sell-off in the equities market. Investors, it seems, fear that rising labor costs will defray corporate profits and temper share price appreciation. As a result, gold experienced a 1.6% increase on Wednesday while gold futures began trading at multi-year highs.

Meanwhile, many expect the Fed to make a minimum of three more interest rate increases this year. These expectations, however, are somewhat obscured by uncertainty surrounding the new Fed chairman Jerome Powell. Just weeks into his position, many are waiting to see how he behaves in response to the markets and broad economic data. At the same time, few expect any wild moves. Jerome and his staff have cited their intention to rigorously review all data before making any impactful decisions regarding rates.

“The market is starting to fall in love with inflation trades again. Gold could be the standout performer this year if that’s the case,” remarked the head of portfolio management services at Adroit Financial Services.

In these modern times, however, we have other options like headline-grabbing Bitcoin. Can the digital currency also act as an inflation hedge? Likely not. As the Financial Times puts it, gold is “Universally accepted as a global and long-term store of value and one that doesn’t demand a password when you want to dig it out from under your bed. It’s pretty; it’s useful; it’s really hard to fake; it’s easy to change into a fractional currency; and, crucially, it has history. An ounce of gold has, give or take, hung on to its purchasing power for thousands of years.”

4 Things You Might Not Know About the San Francisco Mint

Posted on — Leave a commentOn a late January morning in 1848, James. W. Marshall spotted flakes of yellow metal at the bottom a stream at Sutter’s Mill in Coloma, California. The shining substance, of course, was gold.

Despite the mill owner – John Sutter’s – attempt to keep the gold discovery a secret, the news spread like wildfire and as many as 300,000 gold-seekers descended upon the area over the next seven years.

Miners pulled an incredible 750,000 pounds of gold

out of the ground during the California gold rush.

Moving the Gold from California to the Philadelphia Mint

Henry Wells and William Fargo, saw huge opportunity and founded a banking and express transportation: Wells Fargo & Co. in 1852. They quickly established offices in San Francisco and near most of the major gold mining towns.

Wells Fargo began transporting gold from California to the Philadelphia Mint by stagecoach.

Those stagecoaches quickly became targets of robberies.

“I wish you and Nellie could see the coach that brought us to Bodie. It is a four-horse Concord stage. A shotgun messenger, with a sawed-off shotgun, sits up on the high seat in front with the driver. He has the Wells Fargo Express box between his feet. Going out it is full of gold bullion; coming in it is full of gold coin.”– From Doctor Nellie, the autobiography of Helen MacKnight Doyle, M.D., 1879.

The United States Mint became overwhelmed with the massive job of turning that gold bullion into coins. Transporting it to Philadelphia was not only time-consuming, but dangerous, as no railroads existed yet.

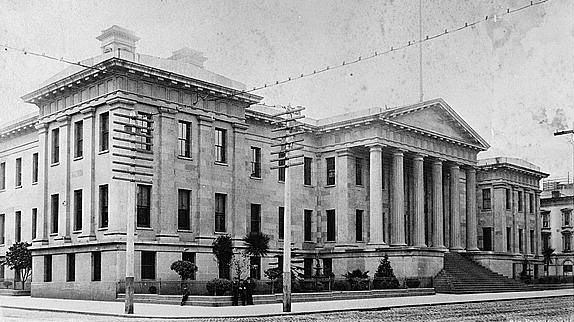

Thus, President Millard Fillmore in 1850 asked for the creation of a California branch of the United States Mint. In 1852, Congress approved the plan and the San Francisco Mint opened in 1854. The mint quickly outgrew its first facility, resulting in a new mint in 1874, affectionately called “The Granite Lady.”

Facts about the San Francisco Mint

- It produced over $4 million in gold pieces in its first year of operation in 1854.

- It Survived the Massive 1906 Earthquake and Fire. The San Francisco Mint was the only financial institution left standing after the devastating earthquake. Every bank in the city was destroyed or made unusable and their vaults could not be opened. The Old SF Mint served as a depository for all the disaster relief funds. A group of bankers came together and approved the Old Mint as a place were basic banking functions could take place for all citizens at a time of dire need.

- Collectors prize San Francisco Mint Coins. The generally lower production runs at this mint, versus the Denver or Philadelphia mint increase the allure of S-Mint coins.

- The San Francisco Mint is the only mint to produce the famous Morgan Silver dollar during every year of its production from 1878 to 1921. Learn why this coin is a great choice if you are building a collection on a budget.

The Highly Coveted “S” Mint Mark

These are just a few of the prized San Francisco Mint coins.

- The 1893-S Silver Dollar has the lowest mintage of any of the Morgan Dollars issued, which makes it one of the most coveted coins for collectors.

- The 1909-S Indian Head cent has a very low mintage of only 309,000 pieces.

- The 1912-S Liberty Head nickel is the first nickel minted in San Francisco and has the lowest mintage in that entire series.

What’s The Next Coin You Want to Own?

If there is a particular coin or set that you are trying to build, Blanchard has tremendous reach and respect within the rare coin industry

Do you have a wish list? Don’t see that coin on our site? Call Blanchard today and our numismatists can help source your wish list from collections around the world.

How Do You Mint a Coin? Start with a Contest

Posted on — Leave a commentSometimes you just need a fresh look. This was the thinking of the U.S. Mint in 1890. In fact, they decided everything needed a new look. In September of that year, legislation was signed which made all denominations of U.S. coins available for a redesign.

Chief engraver Charles Barber decided to hold a contest. Participants could submit low relief models of their designs for the half dollar. Next, they drafted a list of invitees. While the competition was open to the public, officiants wanted to encourage a few specific, New York-based artists to submit. The winner would receive $500 and the joy of having their work in every American’s pocket. Barber would be one of the judges.

Interestingly, many of the artists contacted about submitting designs responded with a counter offer to the terms set. They wanted the finalists to be judged by a group of peers. They also wanted the same artist to design both sides of the coin, and finally, they wanted more time. Leech declined these terms. It’s worth noting that this friction may have dissuaded more talented artists from entering designs.

Before long, the design submissions came in. What did mint director Edward Leech think of them? A “wretched a failure” he remarked. He continued that “only two of the three hundred suggestions submitted were good enough to receive honorable mention.” It’s possible that the failure of the contest stemmed from the stylistic differences of some of the judges. That is, the designs may not have been uniformly bad. Rather, it’s likely that infighting among the judges led to friction in settling on a winner.

Leech then turned back to Barber leaving the redesign task to him. They would need a new look for the half dollar, quarter, and dime.

Leech rejected Barber’s first design. Barber’s next submission was met with disappointment as Leech wrote that the lips on Lady Liberty were “rather voluptuous.” The argumentative back and forth continued until, finally, a design emerged. Upon their release, the reviews were largely positive.

Among the new collection were very few Barber dimes. Today the coin is considered among the rarest minted coin in the U.S. They have a history of selling for small fortunes. In 2005 one sold for $1.3 million. In 2007 another sold for $1.9 million. Much of the appeal comes not only from its rarity but its mystery; no one knows why so few were minted.

As with most coins, the Barber collection went through a redesign. In 1900 Barber changed the dies to produce thinner coins. Part of this change was motivated by collectors complaining that the originally issued coins would not stack properly. In time, many of the Barber coins were melted down into bullion amid an increase in the price of silver in the late 1970s and the 1980s. In total, the coin was minted between 1892 and 1915. They were produced at four mints, Philadelphia, Denver, New Orleans, and San Francisco

Gold Is a Safe Haven in the Stock Market Storm

Posted on — Leave a commentIn a flash the stunning January stock market gains disappeared. The S&P 500 erased the exuberant returns achieved since the start of the year as the stock market turned negative this week.

Price quotes that flashed green, turned to a sea of red. The pounding is historic. The Dow Jones industrial average recorded its biggest one-day point drop in history, collapsing over 1,000 points on Monday. Fear. Panic. Stock investors are getting out fast.

Except for gold. Precious metals climbed this week as investors turned to the stalwart of safety and wealth preservation.

The Trigger

Last week’s employment report pulled the rug out of investor confidence. Sure, the economy still created jobs. But, the unexpected jump in wage inflation spooked stock market investors.

Fears of soaring inflation and higher interest rates triggered a sea-change in investor sentiment.

Market Action Ahead

This may be a much-needed correction in the stock market, or it could be the start of something more severe. No matter the answer, stock market volatility is expected to pick up this year. Significantly. And, 2018 is just getting started. The herd is running scared. Other investors are making panicked, emotional financial decisions. That doesn’t have to be you.

In the 2007-2009 bear market, the S&P 500 lost approximately 50% of its value. Is your portfolio properly positioned for a downturn? There is a way you can mitigate losses during an equity market decline. The answer is gold.

Call Your Blanchard Portfolio Manager

Stock market collapses can be scary. You don’t have to navigate the market roller coaster alone. There are simple investment moves you can make now to protect your wealth.

Rely on Blanchard to help you make objective and logical long-term investments so you can you reach your financial goals. And, you could sleep better at night too.

The numbers back it up. Diversifying your portfolio with gold helps improve long-term performance returns, and it smooths volatility. Over the past 43 years, Blanchard has helped over 450,000 clients protect and grow their wealth through investments in tangible assets including gold and silver bullion and numismatics. Call us today.

Gold Sinks on Rising Dollar, Strong Jobs Data

Posted on — Leave a commentFriday was a rocky day for the gold market.

On Friday, nervous sellers knocked the price of gold sharply lower as the latest U.S. jobs data came in better-than-expected and also revealed upward pressure on wages.

Jobs, Jobs and More Jobs

The U.S. economy added 200,000 jobs in January, the Labor Department reported on Friday. That beat analyst’s forecasts of an 185,000 job gain last month. That signals the 88th month in a row that the U.S. economy had created new jobs.

Higher Wages Too

The key factor that spooked the stock market and boosted the U.S. dollar was a big jump in average hourly earnings of 9 cents to $26.74. That marks year-over-year wage growth at 2.9% and highest rate of growth since June 2009. Why is this important? It signals that finally – inflation may be starting to accelerate.

What about Gold?

Spot gold ended Friday at $1,331.15 per ounce, down from the previous London PM gold fix at $1,341.35. Stay up to date on current gold market action via live prices from Blanchard here.

But, wait, you might be asking – why did gold fall – if the economic data showed that wage inflation is rising? Good question!

In the zero-sum game of finance, often times when one asset climbs, another falls. Gold, which is priced in U.S. dollars, often moves in the opposite direction of the dollar. When the dollar goes up, gold typically falls. And, vice versa, when the dollar falls, gold usually gains.

That inverse relationship kicked into high gear on Friday and pressured gold lower, as the U.S. dollar gained.

Blame it on the Fed

The U.S. dollar strengthen on Friday, after the latest jobs report, as traders bet that the Federal Reserve may need to hike interest rates at an even faster pace in 2018, due to a pick-up in inflation. That’s bad for the stock market, but boosted the U.S. dollar, and in turn hurt gold.

There are some on Wall Street who say the “Fed is behind the curve” or that the central bank has kept interest rates too low, for too long. Now, if inflation begins to accelerate, the Fed may be forced to hike interest rates at a faster pace in 2018. Some analysts believe the Fed could hike as many as four times this year, as opposed to the three that is already expected.

What about my portfolio?

In the big picture, rising inflation is bullish for gold. If widespread inflation begins to emerge, investors will turn to gold in droves, pushing the price of precious metals higher.

Friday’s action was a temporary blip lower for gold. In fact, for long-term precious metals investors, it creates an even better buying opportunity.

Buy low, sell high. Don’t wait to buy gold when it’s climbed sharply higher. Make your acquisitions now, at what may well be the lowest price point in 2018. Act now. 2018 is just getting started and things and markets are already heating up.

4 Reasons It’s a Great Time to Buy Silver Coins

Posted on — 1 CommentIt’s a great time to buy silver bullion. Silver gained about 6% in 2017, while the more expensive gold climbed about 12% last year. If you’ve been considering investing in gold or silver bullion, here’s four reasons why you should scoop up some silver right now.

- Industrial Demand is Forecast to Grow for Silver in 2018

Silver benefits from both investment and industrial demand. Among metals, silver boasts one of the highest levels of electrical conductivity. Silver is used across a diverse range of industries from automotive to medical devices to solar panel applications. “We expect the growth to continue this year and set another record for silver demand, driven by large scale solar capacity additions and continued strong demand uptake from individual households, particularly in China,” the Silver Institute said. Growing demand pushes prices higher. That means current levels of silver around $17.44 an ounce offer an attractive entry point for investors.

- From Rings to Bracelets to Necklaces, Consumers Love Silver Jewelry

About one-fifth of total global silver demand emerges from the jewelry sector. Silver jewelry demand grew about 1% in 2017 as consumers favor the neutral color and as a reasonably priced alternative to gold. Jewelry demand is forecast to rise by 4% in 2018. Again, more demand equals higher prices.

- Global Silver Mine Supply Is Falling

While demand for silver is growing from the industrial and jewelry sectors, global mine supply is contracting. Global silver mine supply fell 1% in 2016, shrinking for the first time in 14 years. That trend continued in 2017, as global mine supply fell another 2%. What about 2018?

“Production disruptions out of South America, along with a decline in capital expenditure among the primary producers in the past five years, is expected to constrain output again this year,” the Silver Institute said. Shrinking supply, alongside rising demand is a recipe for higher silver prices ahead. Don’t delay your investment plans. Current prices of around $17.44 an ounce could be the lowest price investors will see all year for silver.

- The Gold/Silver Ratio Is Flashing A Silver Buy Signal

The gold/silver ratio is about 79 currently.

- How is that calculated and what does it mean?

You can easily calculate the gold/silver ratio yourself by dividing the current price of gold by the current price of silver.

The ratio shows the number of ounces of silver needed to buy one ounce of gold. Investors have long turned to this ratio to identify attractive long-term entry points for precious metals purchases. A high ratio is generally viewed as a signal that silver is undervalued relative to gold. That is what we are seeing now.

The latest 79 reading is historically high, which means silver prices right now offers investors long-term value. Historically, this is what we’ve seen:

Gold/silver ratio 65 > or greater means silver is a relative bargain

Gold/silver ratio 50 < or lower means gold is a relative bargain

Getting Started

Silver bars offer investors an easy way to accumulate physical silver. For example, a 10 ounce silver bar currently is quoted at $184.63 (prices fluctuate daily).

Silver offers investors many of the same portfolio diversification benefits of gold, at a much less expensive price. How much silver do you own?

The Morgan Dollar Lost and Found

Posted on — 2 Comments1873 was the year that gave rise to the Morgan Dollar. The immensely popular coin came out of the Bland-Allison Act of the same year. The act required the U.S. Treasury to purchase an amount of silver then introduce it into circulation in the form of silver dollars. The amount to be purchased was between $2 and $4 million, largely from western mines. There were several motivating factors for the act. First, mines were yielding enormous amounts of silver. The output was beyond industrial needs at the time. Second, Germany dumped 8,000 tons of silver into the open market after converting to the gold standard.

In time, minting Morgan dollars became representative of the free-silver movement. This economic policy advocated the unlimited coinage of silver into money. Many of those supporting the free-silver movement subscribed to the concept of bimetallism. Under this system, the value of a monetary unit is based up its equivalent in gold or silver.

The Bland-Allison Act, however, was deeply unpopular with then-president Rutherford B. Hayes who had a personal financial stake in the banking industry. Though he vetoed the bill, Congress overturned the decision, and the act became official. Hayes, however, was able to limit the scope of the act by choosing to purchase minimal amounts of silver. It was a period in U.S. history when bimetallism appeared to be on the rise. However, problems occurred amid fluctuating amounts of mined silver. That is, as miners sourced increasingly large deposits, more silver entered the market eventually decreasing silver prices.

The Morgan dollar is truly unique. In fact, some argued it was too unique. The American eagle on the reverse side of the coin showed eight tail feathers. This caused a stir because all previous U.S. coins had an eagle with an uneven number of feathers. Surprisingly, the public pressure was enough to motivate a redesign. The mint would change the feathers from eight to seven. The change occurred fast because only one city – Philadelphia – minted Morgan coins. Officials collected all of the dies and restruck them with seven feather dies. As a result, some of the first new “corrected” coins had seven feathers on top of eight before the mint created entirely new, eight feather dies. Meanwhile, several of the 1878 eight feather Morgan dollars remained in circulation.

Meanwhile, the U.S. Treasury continued to purchase 140 tons of silver each month to mint coins. They made payments to the silver miners in gold. The U.S. Treasury amassed a towering stockpile of silver and, at the same time, gold stores were depleted. Before long the Treasury faced the possibility of default which ignited panic across the country. The resolution to all of this was the Sherman Act of 1893 which halted the Treasury’s gold purchases for silver production. Mints ceased production of the Morgan Dollar.

Then in 1921, they brought it back. The production lasted less than a year. Then they were done for good. The Morgan dollar was ready to fade into history.

Until 1960 when a surprising find was made.

The government executed a plan to account for all silver dollars in storage. In a dusty backroom of the main Treasury building in Washington was a forgotten hoard of uncirculated Morgan dollars totaling $2.8 million. Given the long-held demand for Morgan dollars, the government packaged the coins and sold them.

It’s reported that during the final sale in 1980 more than 200,000 orders of the 400,000 received were turned away. The demand far outpaced the find. Today the Morgan dollar is the most collected and coveted silver dollar in existence.