Do You Own These Coins? A Model Rare Coin Portfolio

Posted on — Leave a commentDo You Own These Coins? A Model Rare Coin Portfolio

As Bernard Baruch famously said around the turn of the 20th century: “Nobody ever lost money taking a profit.”

If you are like most investors, you probably have the majority of your assets invested in the stock market. The equity market has been riding high for several years now and your investment returns likely show impressive profits. Congratulations. Now, it’s time to listen to Mr. Baruch and take some profits on a portion of that massive equity run-up.

The tide is turning and cracks are emerging in the stock market bull cycle. Many Blanchard clients are cashing out a portion of those equity profits and shifting those profits into tangible assets including the rare coin market.

Rare coin values are on fire right now. Since mid-June, the $20 Saint Gaudens No Motto MS64 Certified surged an impressive 8.75% jump from mid-June.

History has shown that diversifying 30 to 40% of your tangible assets allocation to rare coins has produced the highest long-term investment returns. Rare coins show a faster and more significant price appreciation when gold bullion is rising, due to the rarity factor.

Are you interested in rare coins, but not sure how to get started? Or maybe you already have an investment in numismatics. No matter whether you are just getting started or a seasoned expert, it is always smart to consider the components of your investing strategy.

5 Major Coin Categories

There are five major coin categories:

- S. Gold Coins

- Morgan and Peace Silver Dollars

- Commeratives

- 19th Century Type Coins

- 20th Century Type Coins

Here are ideas for a Model Rare Coin Portfolio, focusing on U.S. gold coins. These sets can be used as a starting point. Your Blanchard portfolio manager can personalize a plan specifically for you, based on your financial goals and risk tolerance.

Build Sets to Create Greater Value for Your Rare Coin Portfolio

Six Piece Set

Consider investing in a 6-piece Double Eagle set which includes two of the most recognized and collected gold coin types ever struck — the Liberty and Saint-Gaudens:

1. Liberty Double Eagle Type I “Twenty D”

Minted: 1849–1866

2. Liberty Double Eagle Type II “With Motto”

Minted: 1866–1876

3. Liberty Double Eagle Type III “Twenty Dollars”

Minted: 1877–1907

4. High Relief Saint-Gaudens Double Eagle

Minted: 1907

5. Saint-Gaudens Double Eagle “No Motto”

Minted: 1907–1908

6. Saint-Gaudens Double Eagle “With Motto”

Minted: 1908–1933

14 Piece Set

If you already own these magnificent coins, set your sights even higher. Read about a 14-piece set here.

34 Piece Set

Beyond there, aim for the 34-piece gold set. This incredible collection contains all gold coins from the U.S. Mint that were intended for commerce and put into circulation. A complete sample of America’s coin history, the 34-piece set showcases how the coins evolved from 1795 to 1933.

Gold prices are rising and stock prices are falling. There’s never been a better time to take profits in stocks (to make sure you don’t lose money, like Mr. Baruch said). Investing those equity profits can keep your assets growing as volatility and cycle turns begin to impact the broader stock market.

War Chest: How Gold Performs in Times of Conflict

Posted on — Leave a commentAmid recent exchanges between Trump and North Korea, many Americans feel that they’re on uncertain ground. Moreover, the stability of that ground becomes more tenuous with each passing day as the rhetoric climbs. Escalating remarks are prompting investors to question assumptions about their long-term investments. Can history offer any clues to understanding how gold performs during war?

Though today’s threats of war involve the U.S. we can infer wartime price movements based on other international conflicts. Why? Because gold is an international currency and therefore responds to major upheavals across the globe.

A volatile period in the late 1970s brought many serious conflicts. In 1978, we saw the Iranian Revolution. Then, 1979 brought the Soviet Union’s invasion of Afghanistan and the Iran-Iraq war. During this same period gold rose 23% in 1977, then 37% in 1978. However, the real ascent came at the end of the 70s when gold shot up 123%.

Fast forward to 1990. Iraq invades Kuwait, the Gulf War starts and gold increases. Though as the conflict drew to a close gold returned to its pre-war levels. This pattern resurfaced shortly after the September 11th, 2001 terrorist attacks when gold increased again.

Interestingly, history shows that perceptions of war are as influential to gold prices as war itself. That is, when investors believe that a war will be short-lived gold responds with a downward movement despite lack of a peace agreement. This is intuitive as many people view gold as a safe haven asset which serves to preserve wealth in times of geopolitical conflict. For example some analysts have noted that as rumors of war grew amid U.S.-Iran tensions in November of 2007 gold surged to a then 27-year high.

Interestingly, gold can become a weapon, of sorts, during war. In 2012 Syria was forced to sell a portion of their 25.8-ton gold cache to buoy their efforts in the wake of heavy sanctions from Western and Arab nations. Occurrences like this are hardly isolated. Prolonged periods of war can hasten the evolution world finances as was the case when England and France dueled for nearly three decades spanning 1688 and 1756.

Chris Blackhurst, writing for The Independent explains “this led to the Financial Revolution, and the creation of The Bank of England in 1694.” The intention behind the bank was to raise desperately needed money for the government. In his review of Kwai Kwarteng’s book War and Gold: A Five-Hundred-Year History of Empires, Adventures and Debt, he explains “So began a curiously symbiotic relationship – of war and finance, both needing each other. Always, in uncertain times, there was gold itself to fall back upon. To the current period, and there are those who will maintain that our policy in the Middle East resembles those conquistadors.”

In uncertain times investors are wise to revisit their diversification plans. The road ahead is uncertain. Rather than attempt to predict outcomes it’s important to ensure that one’s portfolio is positioned for all eventualities.

Why Gold? Because Diversifiable Risk is Going Away.

Posted on — Leave a commentThe diversification game used to be a whole lot easier. Investors only had to choose a few stocks. Exposure to a few sectors across a dozen holdings was enough to be properly diversified. Today, the picture is different. The world is smaller.

Thomas Friedman, author of The World is Flat illustrated this phenomenon explaining, “In Globalization 1.0, which began around 1492, the world went from size large to size medium. In Globalization 2.0, the era that introduced us to multinational companies, it went from size medium to size small. And then around 2000 came Globalization 3.0, in which the world went from being small to tiny.” This concept is the reason diversification is becoming more difficult to achieve. As the world shrinks the interconnectedness of our industries increases. What impacts one, impacts another.

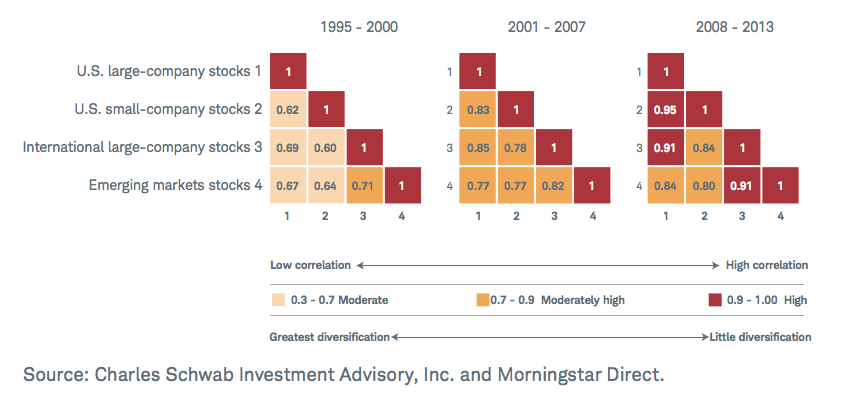

Many of the largest corporations in the U.S. have turned to emerging markets abroad for growth opportunities. This is a symbiotic relationship as these emerging markets depend on U.S. demand in their manufacturing arena. Data from Charles Schwab shows that equity correlations have been rising since 1995. This trend has prompted savvy investors to abandon the long-held notion that stocks, bonds and cash are the only tools available to the diversified investor.

Today, investors are learning that they can become diversified by expanding into international holdings, real estate and commodities like gold. The same body of research from Schwab explains that “commodities tend to perform differently in various market conditions than stocks and bonds – making them desirable from a diversification perspective.” This diversification, not seen with a traditional stock/bond portfolio, is critical in certain situations. For example, between 1973 and 2013 “commodity returns increased as inflation increased.” This dynamic is not true for stocks.

Detractors may cite that gold is a more volatile asset. However, it’s important for investors to consider this characteristic in relative terms. That is, gold, should represent one piece of a larger portfolio strategy that includes a variety of assets. The concept of viewing the risk profile of an investment (e.g. gold) within the broader context of a complete portfolio is the underpinning to Modern Portfolio Theory. The ideas behind this theory were first explored in 1952 when Harry Markowitz published his seminal work. He argued that the key to making this approach work is selecting a group of investments that, in aggregate, represent less risk than any of the assets alone. The key: the risks of these different holdings cannot be related.

As outlined earlier, culling a group of investments that have differentiated risks is more challenging than ever thereby putting the tenets of MPT further out of reach. Gold helps investors get closer to true diversification in the midst of our narrowing world. Why? Because there’s only about 183,000 tons of gold above ground. That total is unlikely to increase as mining operations are forced to work harder and spend more to extract the increasingly scarce resource. Corporate boards cannot simply issue more shares or split the stock.

Give consideration to what amount of gold is the right proportion for your portfolio.

Stocks Dive Amid North Korea Tensions

Posted on — Leave a commentLast week was home to one of the worst days for stocks of the entire year as tensions between the United States and North Korea escalated to new levels. Although the tensions resulted from only a verbal conflict, it was enough to send markets into a tailspin.

However, earlier in the week, both the S&P 500 and Dow Jones Industrial Average made new all-time highs on Tuesday.

S&P 500 futures traded as high as $2,488.5 while Dow Jones futures rallied to $22,132 during Tuesday’s session. But the rally didn’t hold. Gains were rapidly reversed when President Trump explicitly stated that the United States would respond with “fire and fury” to any additional missile threats from North Korea.

North Korea has been testing and threatening missile strikes for months, and it seems to have finally reached a boiling point.

Markets around the world immediately declined after the “fire and fury” comments but managed to rebound slightly on Wednesday as the fear of a North Korean missile strike seemed to lessen.

However, everything changed when North Korea surprised the world when it released a plan on Thursday to send several missiles targeted directly at the small US territory of Guam by mid August.

As the reality of a possible nuclear war between North Korea and the United States sunk in, investors dumped stocks and flocked to the usual safe haven assets of gold and bonds.

Gold futures for September delivery soared more than $14 per ounce to trade around $1,292 on Thursday with additional gains on Friday. The yellow metal traded just shy of the key psychological level of $1,300 during Friday’s trading session and flirted with making a new yearly high.

The CBOE VIX Index, also known as Wall Street’s “fear gauge” soared to it’s highest level since election day after the North Korean news. At it’s peak on Thursday, the VIX was up 44% and printed as high as 17.28. Nevertheless, volatility declined on Friday as investors had more time to digest the news.

“From a geopolitical perspective, we understand why the escalation in tensions will have shaken some of the complacency out of investors,” said Eric Wiegand, senior portfolio manager at U.S. Bank Private Client Wealth Management.

However, the possibility of a global conflict doesn’t necessarily change the valuations of companies. “While the risks remain elevated from a geopolitical perspective, valuations are not necessarily excessive, though full. But we’re in a low inflationary environment, which can help valuations remain elevated for longer than they would otherwise,” Mr. Wiegand went on to say.

The low inflationary environment and strong fundamentals likely prevented further panic selling on Friday. Nevertheless, an all-out nuclear war between the US and North Korea, if it were to occur, would likely make Thursday’s trading action look like a warm-up.

Despite Friday’s rebound, stocks still closed largely in the red for the week while gold closed with an impressive weekly gain of over 2%. Last week is a quintessential example of why it pays to own precious metals as a form of diversification in an investment portfolio as well a hedge against extreme times of uncertainty and potential global conflict.

Since 1975, Blanchard has successfully helped 450,000+ clients invest prudently in precious metals and rare coins. Our team of experts are always here to help you make the right investment decisions and capitalize on opportunities in the precious metals market.

Call us today at 800-880-4653

The Straw House Stock Market

Posted on — Leave a commentWe live in a world of ever-present data and accessible analytics. At any given time investors can delve into endless metrics to distill insights on the stock market. But what if everything we need to know about investing were encapsulated in a story we heard as children? In many ways today’s market is making this idea a reality.

We all remember the three little pigs and their houses of straw, sticks and bricks. We of course remember which of those homes fell to huffing and puffing. The problem? Today’s stock market isn’t one of bricks. It isn’t even one of sticks. We’re in a straw house and the huffing and puffing could start soon.

Traditional measures of risk have encouraged a pervasive sense of calm among investors today. Volatility measures remain low. Meanwhile, the VIX index, commonly called the “Fear Index” remains at a near all-time low signaling a cavalier attitude towards investing. The problem, however, stems from the cause of these metrics. The soaring stock market performance of late appears less rooted in sound company fundamentals promising steady growth. Instead, the market is growing amid massive inflows to passive strategies.

Researchers have published findings forecasting that by the start of 2018 “passive investments, such as index and exchange traded funds, are expected to make up more than half of equity assets managed in the US.” Investors have long touted low costs and the difficulty of beating the market as reasons for adopting a passive approach. While these arguments have merit, they ignore a growing problem.

As more money flows to passive strategies the same group of companies found within S&P 500 and other index funds grows irrespective of the fundamentals. This trend “guarantees that the most valuable company stays the most valuable and gets more valuable and keeps going up. There’s no valuation or other parameters around that decision,” remarked Timothy O’Neill, the global co-head of Goldman Sachs’ investment management division. Moreover, the companies included in these funds are often the largest as measured by market capitalization which is simply the number of outstanding shares multiplied by the share price. Therefore, the single criteria for inclusion in these benchmark funds is size, not strength of management, liquidity, or value.

This trend is building to a market that sits atop a foundation of heightened valuations. Meanwhile, volatility can increase dramatically once the market undergoes a long overdue correction. This is where gold enters the picture.

As we’ve discussed previously on this site, gold has proven to be a remarkable effective hedge in time of steep market downturns. During the tech bubble burst occurring between 2000 and 2002 the S&P 500 lost close to half its value. During the same period the CBOE Gold Index increased by 16.34%. This same phenomenon played out during the global financial crisis when, again, the S&P 500 sank by more than half. The Gold CBOE Index rose to the occasion delivering a return of 26.53%. Moreover, during a bear market, like the two referenced above, stocks often become highly correlated. This tendency means less of the risk incurred is diversifiable. Exposure to a broad array of companies won’t help. This fact is especially true of strategies that seek to balance U.S. and foreign equities. The reason: those two groups have seen their correlations with one another more than double between 1980 and 2015.

The time to reconsider gold is before you really need it, not after.

S&P Global Says No More Fed Rate Hikes This Year

Posted on — 1 CommentCould it be? Is the official fed funds interest rate stuck at the paltry 1.00-1.25% level?

According to one well-respected Wall Street firm, the answer may be yes.

Continued soft wage gains in the latest jobs report, along with subdued inflation data give the Fed a reason to hit the pause button on any more interest rates hikes this year, says S&P Global Ratings.

If you haven’t gotten a raise in a while, you aren’t alone. Wage growth has been exceedingly soft in the years following the 2008 global financial crisis. That’s not normal. In a typical economic cycle, as the economy adds jobs and the labor market becomes tighter, employers must compete for good workers and raise pay levels. We haven’t seen that trend this time around, notes the economists at S&P Global.

S&P Global now expects the Fed to announce its balance sheet reduction (a form of policy tightening in and of itself), and then stand pat on any further interest rate increases this year. That’s bullish for gold.

In the meantime, the Dow made history last week as it crossed the 22,000 mark. Andrew Karolyi, professor of asset management and finance at Cornell SC Johnson College of Business, warns of headwinds for the stock market ahead.

“Another milestone for the Dow means another chance to ask the hard questions about fundamentals that might justify it,” Cornell’s Karyoli says.

“There are serious headwinds, including fiscal policy uncertainty (tax reform, infrastructure), political stasis, turbulence in international trade and investment relationships, and many geo-political risks,” Karyoli warns.

“A 22,000 point Dow may be just the prompt investors need to book a sit-down with their financial advisors for that regular financial health checkup,” Karyoli concludes.

Here’s something else to consider. The stock market is heading into its seasonally bearish time – late August through October.

“Investors might be better off adopting a dose of caution to their optimism during this traditionally challenging period of the year by reminding themselves not to go too far out on the risk curve,” says Sam Stovall, chief investment strategist at CFRA.

Is Your Portfolio Properly Protected?

You may be more concerned with vacations this time of year, than your portfolio. However, we urge you to take the time to analyze your allocations and if needed buy some additional protection.

Gold typically rises and often dramatically during stock market corrections. Current levels in gold offer a great buying opportunity. Take the time now to beef up your portfolio protection, with a greater allocation to physical gold and silver. Rare coins offer the opportunity for even greater price appreciation.

Read more:

Learn more about the right time to buy “insurance” here.

Reversal of Fortune

Posted on — Leave a commentAmid the fervor of a surging stock market there remains a less discussed data point lurking. The U.S. dollar has dropped 9% year to date against an index of other currencies. Some have attributed this slide to an early April comment from President Trump who lamented that “our dollar is getting too strong.” Eventually, he concluded, “that will hurt ultimately.” Meanwhile, it’s also likely that the gradual interest rate hikes we’ve seen have contributed to the decline.

Interestingly, some have posited that this definitive fall in value portends a brighter future for gold. In examining this phenomenon, one can turn to a 10-year comparison chart of The London Bullion Market (LBMA) fix gold price in relation to the daily closing price for the broad trade-weighted U.S. dollar index. The long-term picture reveals a clear inverse relationship.

For example, in mid-May of 2008 the dollar had sunk to one of its lowest points in recent history. At the same time gold was on a strong ascent choosing to rise as the dollar fell. Less than one year later the dollar began to make a sharp recovery while gold descended. Through the entirety of the 10-year span the relationship follows this “X” pattern where a rise in one asset begets a fall in another.

It’s important to note that this relationship, like nearly all in finance, is not a law of physics. There are periods when the two move in the same direction. In fact, Citi Research has gone as far as to state, unequivocally that “Commodity prices have traded in a strong inverse relationship with the U.S. dollar over the past decade or so, but this relationship broke down in late 2016 and the breakdown looks here to stay.”

Some may argue that data from just 2016 onward is insufficient to reach a conclusion that contradicts a decade of patterns. The main underpinning to their argument is that a reduction in volatility in the commodities market as well as a broad recovery from the global financial crisis has brought the negative relationship to an end.

Today we’re witnessing the dollar close at values nearing a 13-month low and investors are beginning to turn their attention, once again, to gold. Those asking how this trend will play out are looking to political headlines for clues. Economic policies designed to spur growth have not yet materialized amid a new administration. “”There seems to be very little progress being made on a number of ‘pro-growth’ Trump initiatives, all being net bullish for gold,” remarked an analyst with INTL FCStone.

In the meantime, investors are leaning on comments from the Fed for clues on gold’s direction. While additional rate increases are certainly possible it’s also likely that such expectations have already been priced into the market. Some analysts have remarked to The Financial Times that they hold a near-term target at $1,300 per ounce after weighing all the conditions.

Today, the correlation between commodities like gold and the dollar continue to evolve. However, for the long-term investor this holds little sway. The gradual, but significant rise in gold over an extended period always offers value.

The Dow Jones Just Made History

Posted on — Leave a commentStocks finished the first week of August mostly higher as strong earnings reports and upbeat economic data kept lingering bullish sentiment alive. The Nasdaq 100 index did not perform as well as its two other benchmark index peers, the S&P 500 and the Dow Jones Industrial Average.

For the week, Nasdaq 100 futures posted a small decline of 0.35% while S&P 500 futures had minimal gains of 0.05%. The Dow Jones stole the spotlight as it made its 8th all-time record high on Friday and closed out the week with impressive gains of 1.07%.

Although much of the week’s gains came from robust earnings reports, a stronger-than-expected July jobs report released by the Bureau of Labor Statistics provided a moderate boost to stocks on Friday. Analysts on Wall Street were forecasting an increase of 175,000 jobs for the month of July. The report blew those expectations away as it stated employers added 209,000 new jobs.

Moreover, the unemployment rate touched a fresh 16-year low of 4.3%. Both of these metrics are seen as indicators that the labor market is healthy and improving.

However, it’s not only market analysts who are obsessed with jobs reports. The Federal Reserve closely monitors every jobs report to gauge whether the economy can tolerate interest rate alteration.

One of the key events that will affect the prices of stocks and everyone’s favorite precious metal, gold, will undoubtedly come later this year when the Federal Reserve announces their much-anticipated interest rate decision.

Many market participants are expecting one more rate hike before the end of the year. However, with the exception of July’s jobs report, much of the economic data recently released has been relatively weak. This is leading some folks to speculate that the Federal Reserve may not increase their benchmark lending rate after all.

Referring to the jobs report data, Jeff Zipper, the managing director of investments at U.S. Bank Private Client Wealth Management, noted how “the number came in above consensus, but in the ballpark we were expecting, so we’re taking it in stride. There were no big surprises, and net-net, I think the Federal Reserve remains on track for one more interest rate hike this year after this.”

As a general rule, rising interest rates are somewhat detrimental to stocks and commodities because the increased cost of borrowing. When the cost of borrowing rises, investors like to purchase yield-bearing assets like Treasury bills, bonds, and other forms of fixed-income investments.

Despite the strong jobs numbers buoying markets, individual stocks played a major role in last week’s gains as well.

Apple Inc., the largest company in the world by market capitalization, posted outstanding Q3 earnings as it topped iPhone sales estimates and quashed any fears that smartphone market is slowing.

Apple’s stock, which trades under the symbol AAPL, soared more than 6% to make an all-time high of $159.75 in after-hours trading.

Apple’s earnings are particularly important because it is the largest company in the world by market capitalization.

For the Dow Jones Industrial Average Index, which made an all-time high on Friday, Apple’s portion of the index is a significant 4.84%. Since Apple traded approximately 6% higher, strong gains in the Dow were in order. The Dow Jones made fresh all-time highs every day of last week marking eight consecutive record closes.

On the commodities front, gold fell almost $12, or -0.91%, in the wake of the strong jobs report but still remains well above $1,250 per ounce.

For now, it seems the two expected driving forces of the market are the remaining earnings reports from large-cap companies and additional economic data that might alter the Fed’s monetary agenda. However, dramatic market moves are always unexpected, and August is historically a poor month for stocks and consequentially a strong month for gold. As such, even with stellar company earnings, investors are staying on their toes, especially with the market at all-time highs.

Since 1975, Blanchard has successfully helped 450,000+ clients invest wisely in precious metals and rare coins. Our team of experts are always here to help you make the right investment decisions and capitalize on opportunities in the precious metals market.

Call us today at 800-880-4653

Gold Hits 6-Week High on Slow Growth Report

Posted on — Leave a commentInvestors piled back into the gold market last week, propelling the yellow metal to its highest level in six weeks. Increased worries about slower-than-expected economic growth helped boost precious metals prices.

Gold climbed as high as $1,271.50 an ounce, while silver hit $16.84 an ounce.

Precious metals got a boost last week after the Labor department announced slightly weaker-than-expected second quarter gross domestic product growth at 2.6%, compared to Moody’s forecast of a 3.00% growth rate. The “animal spirits” have yet to emerge to propel the economy forward to the 3% range. The slower growth could delay future Fed rate hikes, which is a gold-bullish factor.

The stalled legislative agenda in Washington D.C. also increased gold’s appeal last week after Republicans failed to repeal the Obama Care health law. The inability of the Republicans to push through health care legislation is reducing optimism that significant tax reduction or infrastructure spending will occur to stimulate economic growth.

All Eyes on Jobs Report

This Friday’s release at 8:30 am ET of the July employment report will be the next key economic report for investors. The median estimate for July non-farm payrolls is a 183,000 increase, which could add downward pressure to the overall unemployment number. “Another strong month of employment growth should have been enough to push the unemployment rate back down to 4.3% in July, and the surveys suggest it will fall even lower,” according to Capital Economics.

The labor market remains tight. For any businesses who have been trying to fill open positions, the tight labor conditions have made hiring qualified workers a challenge.

Investing Tactics

If the jobs data were to come out weaker-than-expected it would likely provide a lift to the gold market. Conversely, stronger-than-expected data would likely pressure the market.

If you are looking to add to your precious metals holdings, using any “dips” or short-term pullbacks in price is a smart way to build your position at more favorable prices. You can monitor current prices here.

Storm Brewing?

Gazing into the crystal ball, there could be a storm brewing on the horizon. With a stalled legislative process seen in Washington, what could this mean for the debt ceiling limit?

Treasury Secretary Steven Mnuchin has said that the government probably has enough available cash to meet obligations through September. The latest projections from the CBO suggest the debt ceiling limit will be hit in October.

“That means the mid-September FOMC meeting could come amidst a disruptive fight in Congress over raising the debt ceiling. Markets have already begun to price in some risk of default, with the yield on three month Treasury bills recently rising above that on six month bills,” Capital Economics said.

Noteworthy: markets are taking notice earlier this time. “Investors have started worrying about a debt ceiling stand-off much earlier than during previous crises. Back in 2012 and 2013, markets showed little sign of panic until a week or two before the debt ceiling deadline, Capital Economics said.

If a stand-off in Congress rattles markets, gold will be a key beneficiary. It was the debt ceiling crisis in 2011 that sent gold to its all-time high above $1,900 an ounce.

Current levels offer a great buying opportunity for gold. In just a few months, headlines could be reading “Gold Hits 6-Month High.” Smart investors buy low and sell high. Current levels in gold are rising, but still remain relatively low. Call Blanchard today to discuss your investment plans.

America’s Silver Workhorse

Posted on — Leave a commentToday we bring you the history of a workhorse coin. For 54 years, this small-but-mighty coin was an essential component in the engine of American commerce. Countless millions saw this design every day for over half a century, and for many, it represented a honest hour’s work. While this coin doesn’t get the attention of, say a $20 St. Gaudens, it represents a breakthrough in both design and technology.

The Seated Liberty Dime was minted 1837-1891, starting at the end of Andrew Jackson’s presidency. Jackson’s presidency inaugurated what would come to be known as the “Jacksonian era” in American politics. The era saw an expansion of suffrage to non-landowning white men, and increased public participation in government—seen, for example, in the election (rather than appointment) of judges.

At the same time, the country was rapidly expanding through war and settlement. Many Americans believed in Manifest Destiny, the idea that America was destined to stretch from Pacific to Atlantic, with settlers paving the way. The idea of the wild, dangerous frontier and its place in the American character grew in prominence.

The era, in other words, was one of expansion, populism, and national myth-making.

A Bold New Design for American Coinage

In the midst of all this, in 1837, America became ready for a new, bolder coinage. Mint Director Robert Maskell Patterson requested an image of the goddess Liberty inspired by the Britannia of English coinage. The resulting design was immediately praised for its artistic qualities and symbolism.

Liberty, in a flowing dress, sits on a rock while holding a Liberty pole in her left hand. The Liberty pole originated in ancient Rome as a symbol of the people’s freedom from Caesar’s tyrannical rule, and liberty poles were frequently erected in colonial town squares before and during the American Revolution. Liberty’s right hand rests on a Union shield inscribed with the word LIBERTY. The reverse features the words ONE DIME surrounded by a wreath of not just the traditional laurel leaves, but the American symbols of corn, wheat, and maple leaves as well.

While the design represented a shift in American coinage, so too did the coin’s manufacture. The Mint had long aimed to create coins resistant to counterfeit, and made a major leap forward with the Seated Liberty coinage. The reverse was manufactured 100% by machine—without any elements needing to be added by hand. By increasing uniformity among coins, this technological breakthrough discouraged counterfeiting.

For all its positives, the Seated Liberty Dime did run into some trouble in the court of public opinion. Namely, why didn’t it have the usual 13 stars for the first 13 colonies? One year later, stars were duly added, and the rest of the design was adjusted to make room for them. Quite a few other major and minor design changes were made over the coin’s 50-year history, creating numerous opportunities for collectors. One particularly unusual variant is the 1859 transitional design, which lacks reference to the coin’s issuing nation!