Five of the Most Interesting Rare U.S. Coins in the Smithsonian

Posted on — Leave a commentThe National Numismatic Collection at the Smithsonian Museum in Washington D.C. is the home to the rarest of the rare coins in the world. The treasured collection houses more than 1.6 million monetary objects in total and is considered the largest collection of money in the world. The coins are sourced from every inhabited continent on the globe and span more than three millennia. Today we highlight five of the most interesting U.S. rare coins in the Smithsonian collection.

1. 1804 Silver Dollar

Although dated 1804, the silver dollars which bear this date were minted in 1834. President Andrew Jackson himself requested the U.S. Mint create these coins for diplomatic gifts to world leaders – gifts that would literally be fit for a king. Celebrating U.S. history, the front of the 1804 Silver Dollar features Liberty’s bust, the date “1804” and the word “liberty.” The back of the coin highlights an eagle and 13 stars that represent the original American colonies.

In November 1834, the Philadelphia Mint struck eight 1804-dated silver dollars for the gift sets. One was given to the Imam of Muscat and another to the King of Siam. The other six quickly landed in private collections and remain numismatic legends today. There are three ‘classes’ of these silver dollars and the Smithsonian owns all three varieties.

2. 1838-O Half Dollar Proof

In 1835, Congress made numismatic history with the establishment of three new U.S. mint branches. The first two facilities were at Charlotte, North Carolina and Dahlonega, Georgia, which were created to coin gold from nearby mining activity. The third branch at New Orleans was admittedly far from any mining activity, but as a major port of entry for gold and silver coin shipped in from Mexico and Latin America, it was well positioned to mint both gold and silver coins.

The 1838-O Half Dollar was the first coin struck at the New Orleans Mint – and only 20 coins were made as proofs. Yellow fever struck the New Orleans area and the rampant disease, combined with technical issues at the mint limited coin production that year. The result is a highly prized numismatic treasure in the 1838-O Half Dollar piece. The 1838-O Half Dollar from New Orleans is ultra-rare and historic. There are only eleven known survivors, one of them is housed at the Smithsonian and this coin is considered one of the most important American rarities in existence.

3. 1849 $20 Gold Coin

Before the California Gold Rush, the largest U.S. gold coin denomination was $10. Following the enormous amount of bullion that was coming out of California, a decision was made to authorize a new larger denomination coin: the Double Eagle. The artist, James B. Longacre, designed the new gold coin and, in late December, the first two pattern double eagles were struck at the Philadelphia Mint. There remain questions on whether the second 1849 $20 pattern coin was actually struck as there is no evidence in the numismatic community today about its whereabouts.

Widely considered to be the most valuable coin in the world, the 1849 $20 gold coin housed at the Smithsonian is the first Double Eagle and the only one with known whereabouts. As the story goes, in 1909, J.P. Morgan unsuccessfully offered to pay the then enormous sum of $35,000 for this gold coin in the Mint Collection. It has been estimated if this coin were up for auction today it would sell for a multi-million dollar amount.

4. 1907 Saint-Gaudens Ultra High Relief Double Eagle $20 Pattern

Quite simply, President Theodore Roosevelt wasn’t happy with the nation’s coinage. As the story goes, at a Washington dinner party one evening, Roosevelt tasked Augustus Saint-Gaudens, a brilliant sculptor of that time, to redesign America’s gold coins. Both men admired Greece’s ancient coins and agreed that U.S. gold coins developed in that fashion would be a monumental achievement. This coin was the result of those endeavors. Today, the Saint-Gaudens Double Eagle is often considered the most beautiful American coin ever made.

Fewer than 24 of these pattern coins were struck with the ultra-high relief, which were never meant for circulation. The minting process was complicated due to the unusually high relief featured on the pattern coins. It took nearly a dozen tries through the hydraulic coining press to achieve the ultra-high results. In 1907, President Roosevelt surprised his daughter with this pattern coin as a Christmas gift. Later, in 1961, Roosevelt’s daughter donated this coin to the Smithsonian.

5. 1913 Liberty Head Nickel

Last, but not least, the 1913 Liberty Head Nickel is one of the most celebrated coins of the 20th century. Only five are known to be in existence today and one is at the Smithsonian.

These nickels come with a bit of intrigue and scandal. In 1912, the U.S. Mint retired the Liberty Head Nickel and replaced it with the Indian Head Nickel design. However, five Liberty Nickels were still secretly struck. The existence of the coins remained a secret until 1919 when the statute of limitations for prosecuting the mint official expired.

It became public that Samuel W. Brown, of North Tonawanda, New York, had possession of the five nickels. He had previously served as Storekeeper of the Mint. Despite already having them, Brown placed an advertisement in the periodical: The Numismatist, offering to pay $500 each for 1913 Liberty Head Nickels. Later he raised the offer to $600. Brown knowingly was creating hype around these coins, which he later displayed at the 1920 ANA convention before selling the pieces to a Philadelphia dealer.

All five of these legendary coins are among the greatest numismatic treasures in the Smithsonian collection, which continue to be studied and enjoyed by visitors from around the world.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

The Original Meme: Hard Times Tokens

Posted on — Leave a commentDesperate times call for desperate measures. And hard times call for Hard Times Tokens.

Hard Times Tokens were copper tokens that were either one cent or half a cent in value. These pieces served as unofficial currency between 1833 and 1843. The coins were privately minted in response to an ongoing shortage of small changes in the US resulting from an economic depression.

One major contributing factor to this setting was the decision from President Andrew Jackson and his Treasury secretary, Levi Woodbury, to enact a law – referred to as Specie Circular – which demanded that banks only accept gold and silver as forms of payment for the purchasing of public lands. This decision had major implications because public land speculation reached new heights at the time.

This law prompted panic as people began hoarding coins that consisted of precious metals. As a result, banks had an inadequate supply of gold and silver as Americans rushed to retrieve their savings. Consequently, many banks failed.

The size of the Hard Times Tokens was similar to the cents they were intended to replace. Many of the designs took the difficulty of the situation as an opportunity to poke fun at Jackson and his vice president, Martin Van Buren.

Here we look at a few of the most amusing designs.

Running Boar Hard Time Token (1834)

This token, minted from copper in 1834, reads My Substitute for the US Bank. My Currency. My Glory. Experiment. The obverse lettering reads, Perish Credit Perish Commerce My Victory My Third Heat Down With The Bank 1834. The wording of this token perfectly captures the sense of anger prevalent in the US at the time. For example, Jackson and Van Buren were often ridiculed for the tokens as seen by another design which included a quote from Van Buren’s inaugural speech, “I follow in the footsteps of my illustrious predecessor,” with an image of a running jackass meant to represent Jackson.

Millions For Defence Token (1837)

This piece is a reminder of how many Americans felt about the British at the time. The lettering reads, Millions for Defence Not One Cent For Tribute which expresses support for building up defense capabilities in the US instead of giving in to British demands amid an ongoing border dispute over Canada.

This copper token contrasts the stability of the constitution with the peril of Van Buren’s “experiment.” The obverse includes the name “Webster” referring to the pro-Whig Democrat Daniel Webster who was a vocal opponent of Jackson’s policies. Webster disagreed with Jackson’s anti-bank stance which resulted in Jackson’s decision to remove federal deposits from The Second Bank of the United States, the second federally authorized national bank in the United States. Jackson diverted federal revenue into selected private banks by executive order. This ended the Second Bank’s regulatory role.

The coins are a reminder that even in the 1800s there was a level of divisiveness in the country that so many associate with only our current era. Many of these tokens are very affordable. They are a great way to include truly unique and individualistic pieces in a collection.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

What the Debt Standoff Ceiling Means for Gold

Posted on — Leave a commentFor the first time in 100 years, it took more than one round of voting in early January to select the Speaker of the House of Representatives. In fact, it took a historic 5-day, 15 rounds of voting for the members of the U.S. House to choose Representative Kevin McCarthy as their leader.

What does this have to do with gold?

Well, the early signs from the contentious inner workings of the U.S. House of Representatives early this month bode poorly for a seamless approval to raise our nation’s debt ceiling limit.

The last time Congress held the debt ceiling hostage and took the U.S. to the brink of default was in August 2011 – gold soared to its then all-time high above $1,900 – as global investors turned to gold as a safe haven. Standard & Poor’s downgraded the U.S. credit rating and the stock market tanked.

Could it happen again? The early political in-fighting in the House of Representatives has plenty of folks wringing their hands in worry.

Failing to raise the debt ceiling could lead to an “unmitigated disaster,” said David Kelly, chief global strategist at JPMorgan Funds, told investors in a client note.

The U.S. is slated to reach its $31.4 trillion debt ceiling limit this month – and the U.S. Treasury will resort to extraordinary measures to keep paying the nation’s bills – until they run out of cash.

What are extraordinary measures? Think about someone rummaging through couch cushions or jacket pockets looking for extra cash to pay for the pizza delivery.

Yes, it’s true – without an increase to the debt limit, the U.S. Treasury will run out of cash to pay everything from interest payments on our nation’s Treasury debt to Social Security payments to America’s elderly.

What isn’t always clear in the media articles about raising the debt limit is this: The U.S. has already borrowed and spent the money. In fact, the spending was already approved by Congress.

Failure to increase the debt ceiling is like someone who refuses to pay their credit card bill – after they have already bought the stuff.

It’s only in recent years that the debt ceiling has become a political tool.

In fact, since 1960, Congress has acted 78 times to raise, temporarily extend or revise the definition of the debt limit, according to Treasury. The debt limit was changed 49 times under Republican presidents and 29 times under Democratic administrations, CBS News reported.

What would happen if Congress doesn’t raise the debt ceiling and the U.S. defaults on its debt payments?

It would destroy the global market’s confidence in American Treasuries and the U.S. Dollar as the reserve currency. It would trigger a recession in the U.S., cause millions of Americans to lose their jobs and the stock and bond markets would crash. Social Security checks would stop coming. Interest rates would soar because in order to continue funding the massive U.S. debt – America would be forced to pay extremely high rates of interest on new bonds – because no one would trust Treasuries anymore.

Gold could easily climb to new all-time highs – as it did in 2011.

The House speaker fight was merely a preview of how Congress is hamstrung by political in-fighting. The future of the global economy’s faith in the full credit of the U.S. government – is at risk. The stakes couldn’t be higher.

Gold is already gaining ground every day as investors are seeking the safety of gold. Do you own enough?

Gold Trades at 10-Month High After Fed Rate Hike

Posted on — Leave a commentFed Hints Rate Hike Cycle Is Almost Over

The Federal Reserve hiked interest rates by 0.25% on Wednesday in its ongoing battle to bring inflation down. The big change in today’s Fed announcement was new forward guidance suggesting that they are near the end of the current Fed rate hiking cycle.

Investors continued the recent rush into the safety of precious metals. Gold ticked higher after the Fed move, trading as high as $1,947 on Wednesday afternoon.

The Fed’s rate hike today was a smaller amount than recent rate hikes and brought the Fed’s benchmark interest rates to a 4.50%-4.75% range. Last year, the Fed hiked interest rates seven times, and four of those included a super-sized 0.75% rate increase.

Reading between the lines

As Fed watchers on Wall Street scoured the official statement for clues on what could lie ahead, there were hints that the rate hike cycle could be ending.

Today, the Fed said they “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” when determining the extent of future increases in interest rates. That’s a change from past Fed statements which said those factors would impact the “pace” of future increases.

Walking a fine line between inflation and recession

The Fed has been trying to thread a needle between busting inflation without causing a recession. Many economists now believe a recession is inevitable in the U.S. in 2023, as the aggressive rate hikes seen last year begin to filter through the economy. It is well known that the impact of Fed rate hike changes take months to actually impact the economy. Just like a fully loaded tanker going full steam in the ocean, it takes time to turn the ship.

Gold posts double digit gains

In recent months, gold surged sharply higher, climbing 19% from November into the late January high, as the precious metal recently approached $1,950 an ounce level. With a recession on the horizon, gold could easily climb to new all-time highs in the weeks ahead – recent forecasts called for gold climbing as high as $3,000 an ounce. Today’s gold level offers an attractive buying opportunity for long-term investors who seek to preserve and grow their wealth. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

Top 5 Rare Coins You Should Collect

Posted on — Leave a commentIf you are looking to expand your coin collection this year, this list contains some of the most sought-after coins for beginners and advanced numismatists alike. With an eye toward long-term investment value, if you seek to acquire the highest quality rare coin available that fits in your budget, you will never be disappointed. Here is our list of the top five rare coins you should collect.

1. 1909-S V.D.B. Lincoln Cent

In 1907, President Roosevelt wanted a new coin to honor the 100th anniversary of Abraham Lincoln’s birth (1809-1909). Roosevelt explored the idea of featuring an image of President Lincoln on the coin and ultimately accepted a coin design proposal submitted by Victor David Brenner, a sculptor, and engraver.

Americans eagerly anticipated the release of the new Lincoln cent in 1909, this was the first ever regular issue coin in American history to feature a real person. On release day – August 2, 1909 – the police were called in for crowd control, as the coin was distributed for the first time on Wall Street. Newsboys famously took advantage of the huge demand, nearly doubling their money after braving long lines selling their Lincoln cents at three for a nickel.

Quickly, however, public controversy and scandal broke out over the design, specifically the inclusion of Brenner’s initials “V.D.B” on the reverse of the coin. Internal complaints emerged over the size and placement of the initials. A few days later, Treasury Secretary Franklin MacVeagh sent a message: “Stop the mints!” He halted production of the coin and ordered the initials removed.

By then, almost 28 million cents were struck in Philadelphia and 484,000 at the San Francisco Mint. Today, this beloved coin featuring the V.D.B. initials is essential to any Lincoln cent collection.

In 1918, the initials returned, albeit smaller and on the obverse, rather than reverse. That this occurred so soon after the death of Charles Barber led to rumors that Barber, the Mint’s chief engraver, was the person who made the original complaint about the initials.

2. $4 Gold Stella

Named for the five-pointed star featured on its reverse, there is a $4 gold coin known famously as a Stella. The gold coin was minted in 1879 and 1880 and originated as a prototype to closely approximate the value of common foreign gold coins. Stellas were never produced for circulation, but there was immediate collector demand for these awe-inspiring coins.

While it was said that no coin collector could obtain a Stella from the U.S. Mint, the Congressman who had received a special order for prototype viewing apparently used them as gifts and perhaps even payment. It was said that these great works of numismatic art were seen in special necklaces adorning the bosoms of Washington’s top madams, whose brothels were said to be patronized by those same Congressman.

Today, these coins are scarce and expensive. In fact, this ultra-rarity may be beyond the reach of many collectors. But, for those who have the resources, this is a gem to be treasured. The $4 Stella is a historic gem from an exciting time in American history.

3. $20 Saint-Gaudens Double Eagle

Affectionately known as “Saints,” these are often called one of the most beautiful coins ever produced by the U.S. Mint. These lovely coins exist due to the partnership between two monumental historical figures of their day.

President Theodore Roosevelt decided that the nation needed a more classical design on its gold coins. Roosevelt began his vision to reshape the nation’s coinage by unleashing the majestic talent of Augustus Saint-Gaudens, a brilliant sculptor of that time. As the story goes, at a Washington dinner party one evening, Roosevelt tasked Saint-Gaudens with the grand undertaking to redesign America’s gold coins.

Both men admired Greece’s ancient coins and agreed that U.S. gold coins developed in that fashion would be a monumental achievement. They were right. Today, these stunning coins still take your breath away. The obverse showcases a dramatic full-length portrait of Liberty in a flowing gown, heralding a torch in her right hand and an olive branch in her left. She is featured in full stride with rays of sunlight behind her. Above her, the word LIBERTY sits atop the coin.

The original high-relief version was stunning but impractical to produce and difficult to stack. Subsequently, the relief was reduced and production continued.

The $20 Saint-Gaudens gold piece was minted from 1907 to 1933, except for the years 1917-1919, when World War I resulted in rising bullion prices and an influx of American gold coins from Europe.

4. Morgan Silver Dollar

Many collectors consider The Morgan Silver Dollar to be the premier coin design created by George T. Morgan. The Morgan Dollar is a U.S. coin that was minted between 1878 and 1904, and then again in limited production in 1921. During the initial production phase between 1878 and 1904, there were over 500 million Morgan Dollars minted.

Over 270 million silver dollars were melted down in the U.S. in 1918, in efforts to help finance World War I, the majority of those were Morgans. It was the Pittman Act that called for their replacement, which opened the door to the last production cycle of Morgans ever minted in 1921.

On the coin’s obverse, Lady Liberty’s head dominates the striking face of the coin and is surrounded by the date, 13 stars, and the phrase E Pluribus Unum, which is Latin for “Out of Many, One.” On the reverse: the American bald eagle sits on a branch with his wings spread out dramatically, while gripping arrows in one of its talons. The work of art is surrounded by a 3/4 wreath and the motto “In God We Trust” is emblazoned above the eagle’s head. If there is a mint mark, it sits below the wreath.

It’s easy to see why the Morgan dollar is beloved among numismatists. The large, nearly palm-sized heavy silver dollar is a joy to hold in your hand.

5. Mercury Dime

You may already be familiar with the Winged Liberty Head Dime, popularly known as the “Mercury” Dime. The U.S. mint struck this popular coin from 1916 until 1945. This is one of the iconic coins that numismatics acquire for sets. Easy availability for most of the years is one reason that even beginning collectors can tackle the satisfying goal of owning a Mercury Dime set.

Within the Mercury Dime series, there are only a few absolute rarities and there is only one that is hard to find. The 1916-D is the scarcest major key date and rarity within the Mercury Dime series. Only 264,000 were struck. Other key dates include 1921 and 1921-D and 1942-1 and 1942 -1D. The latter key dates show “overdates” with the number “2” struck over the number “1.”

Some Americans confused the depiction on the reverse of the coin of a young Liberty with the Roman god Mercury, which is how its popular name caught on. The coin’s design received positive reviews within the artistic community. However, some modifications were required as the coin did not perform well in vending machines.

Collectors actively pursue this stunning coin for the exceptional design created by Adolph A. Weinman. The metal content is 90% silver and 10% copper. The mints include Philadelphia, Denver, and San Francisco.

Getting started

If you are interested in starting or adding to your collection, contact a Blanchard portfolio manager today. We will take the time to learn your investment objectives, investment time horizon, and risk appetite before recommending rare coins for your consideration – to help you meet both your collecting and investment goals.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world, and the latest tangible assets news delivered to your inbox weekly.

State of the Economy and Gold: Leading Economic Indicators Signal Recession

Posted on — Leave a commentAs the economic data turns south, investors are rushing into gold and silver – favored safe-haven assets in an economic downturn. Gold charged out the starting gates in recent months, climbing at a dizzying pace. While gold vaulted a breathtaking 18.8% from its October 2022 low to the January high, silver is also showing a double digit increase – with a 21% gain over the past three months. Here’s what we are seeing in the economy now.

LEI warns recession is imminent

In December, the Conference Board’s Leading Economic Indicators (LEI) fell for the 10th month in a row – signaling a recession ahead. The 1% decline in December was driven by weaker new orders and shorter average workweeks which spelled weakness for the economy ahead.

What is the LEI? The LEI is made up of 10 indicators that cover a wide range of economic activity, including job growth, housing construction, and stock prices. The LEI can be used to predict turning points in the business cycle and is considered a predictor of turning points because it includes a consensus of forward-looking indicators from different areas of the economy.

“The U.S. LEI fell sharply again in December – continuing to signal recession for the U.S. economy in the near term,” Ataman Ozyildirim, the Conference Board’s senior director for economics, said in a statement.

What this means for gold: Expect gold and silver to continue to climb in this environment. “Gold and silver are go-to assets when traders are bearish on stocks and the economy,” David Russell, VP of market intelligence at TradeStation told FOX Business. “Both metals could also benefit from a recession and the Fed halting interest-rate hikes,” Russell added.

Consumers spend less

December retail sales fell over 1%, driven by weaker spending on autos and gas. Consumers are hamstrung by still-high inflation, rising interest rates and a weakening labor market – with mass layoffs occurring at major corporations including Google, Spotify, Microsoft, Amazon and Meta.

“With the war in Ukraine and all the world in, or entering into recession, their companies are trenching as demand is falling, belt tightening is going on,” John Van Reenen, the Ronald Coase School Professor at the London School of Economics told Time magazine.

What this means for gold: Weakening retail sales is another sign that economic growth is slowing and a recession is around the corner. Weaker retail sales will also translate into lower corporate earnings, which will continue to pressure the stock market. Gold is a non-correlated asset to the stock market and when stocks go down, gold typically climbs.

Debt ceiling could trigger global financial crisis – if Congress fails to increase the limit

In late January, the United States government hit its current $31.4 trillion debt ceiling limit set by Congress. Now, the Treasury Department is resorting to so-called “extraordinary measures” to continue paying America’s bills including interest payments on Treasury security debt, Social Security checks and the U.S. military troop’s paychecks.

The debt ceiling includes obligations that Congress has already approved. Now, the Treasury is backed into a corner trying to find a way to pay its bills, until Congress increases the debt limit.

While politicians in Washington D.C. are turning this event into a political football, in fact, the U.S. debt ceiling has been raised over 70 times since 1960, under both Democrat and Republican presidents.

While politicians want to force a debate on future spending, in order to raise the debt ceiling, if the Treasury were to default on our debt – it could trigger a global financial crisis, U.S. Treasury Secretary Janet Yellen warned. She added it would mean borrowing costs would rise sharply for all Americans, it would cause a U.S. recession, global financial crisis and the U.S. dollar would lose its reserve currency status.

What this means for gold: Gold could easily climb to new all-time highs – as it did in 2011, the last time Congress played political football with our nation’s full faith and credit in the dollar and Treasury securities.

If you have questions about the state of the economy or would like to discuss how you can protect your wealth in the current environment, talk to a Blanchard portfolio manager today. We have been helping clients grow and preserve their wealth through diversification into tangible assets since 1975 and we can help you too.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Key Takeaways from Latest World Gold Council Report

Posted on — 2 CommentsDays ago, the World Gold Council released their latest Gold Market Commentary. Here, we distill their analysis to a few important takeaways that can help investors understand what has happened with gold and where it might be headed.

Wham, Bam, Thank You GRAM

The World Gold Council’s Gold Return Attribution Model (GRAM) is a function used to quantify how the various drivers of gold’s performance contribute to monthly price changes. The model also assesses how the influence of these drivers change over time. GRAM was helpful in understanding the cause of gold’s 3% gain in December of 2022 which helped the metal end the year on a positive – albeit slightly – gain. The data within GRAM suggests that this positive return was largely due to a weaker US dollar.

Retail and Central Bank Demand Lifted Gold

Strong demand for gold from both retail and central banks was enough to offset weak demand seen among institutional investors. As the World Gold Council explains, “an unrivaled surge in real yields (coupled with a strong US dollar) failed to drag gold down in 2022.” This outcome is an example of why diverse sources of demand are critical to the long-term performance of gold especially in years that threaten to bring price per ounce down.

Gold Continues to Offer Low Correlation and Low Volatility

Gold’s correlation to a traditional 60/40 portfolio – while higher than average – was still low at 20. This is an important benefit of gold for most retail investors seeking to bring stability to a portfolio that continues to face the uncertainty of a looming recession and interest rate increases. Additional data showed that gold’s volatility was in line with its long-term average while the 60/40 portfolio experienced one of its most volatile years since 1972.

Gold Buyers Likely Want Protection From Inflation

Analysts at the World Gold Council concluded that the increasing gold purchases seen among retail investors was likely due to concerns about inflation. This was especially true within Emerging Markets according to their research. This segment of the market, which represents 60% of all retail investors, has fewer ways to counter rising inflation. Central bank purchases added to this purchasing activity as 673t was added to reserves by the end of Q3 which is a historic high.

2023 Could Bring a Mild Recession

The World Gold Council sees a “stable but positive outlook for gold prices.” Additionally, their analysis forecasts a weaker US dollar, pressure on equity prices, slightly higher bond yields, and continued geopolitical risk stemming from the uncertainty surrounding the war in Ukraine. Finally, the World Gold Council noted a seasonal rebound in gold demand in China at the end of 2022. Much of this buying was due to consumer activity being driven by the Chinese New Year. While this seasonal surge was low in comparison to historical figures, analysts at the World Gold Council expect it to improve as China continues to find its way out of their zero COVID policy.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Inflation Update: Gold Surges above $1,900

Posted on — Leave a commentThe price of gold exploded higher last week, climbing to a fresh 9-month high above $1,900 an ounce. Gold is shining once again as investors believe that a minor drop in the headline inflation rate in December will slow the pace of Federal Reserve interest rate hikes, which is already boosting demand for the precious metal.

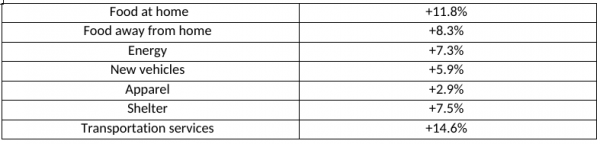

Gold traded as high as $1,921.50 last week as investors are flocking to the precious metal following the release of the December consumer price index (CPI) report. While the overall inflation rate fell to 6.5%, many key categories continued to see double digital price gains in December.

According to the Bureau of Labor Statistics, these categories continued to rise sharply in December.

How Much More You Are Paying Now

That means you are still paying sharply higher prices for everyday goods from eggs, milk, butter, and bread to homes, rent, new cars, and even the energy to heat your home and keep you warm during the cold winter months.

Slower Fed Rate Hikes Ahead

The inflation news unleashed a fresh round of gold buying as investors expect the modest decline in the headline number from 7.1% in November to 6.5% in December, will allow the Fed to slow down its aggressive interest rate hikes – which at this point are expected to trigger a recession in the United States in 2023. Despite the 2022 rate hikes, core inflation remains well above the Fed’s 2% inflation target.

The CME Group’s FedWatch Tool now reveals that 91.2% of traders expect the Fed to hike by only 0.25% — which would reveal a massive slowdown from the 0.75% interest rate hikes seen in 2022.

Recession Ahead

The damage from the Fed’s 2022 aggressive interest will soon show in the form of a recession. There is a well-documented lag between monetary policy and its impact on the economy. Here’s what Wells Fargo Economics says: “We expect a recession to begin in the United States in the second half of the year.”

Gold Is In an Uptrend

What does this all mean for gold? You can expect even higher prices ahead, with gold possibly at $2,000 an ounce, just around the corner.

“This year the global economy is facing a serious slowdown, and in many countries a recession. That could make gold more appealing now that yields and the dollar are less of a negative factor,” Craig Erlam, senior market analyst at OANDA told CNN.

In the face of stubbornly high inflation and the potential for a recession in the U.S., investors are flocking to the safety and security of gold. Precious metals have served as a store of value for thousands of years. If you are seeking a safe haven and also an asset that will grow your wealth, consider increasing your allocation to gold and silver today before prices move sharply higher.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How Oil Could Influence Gold Prices in 2023

Posted on — Leave a commentOil prices have a meaningful influence on gold prices. Understanding why means first examining how dollar-denominated assets work.

A dollar-denominated asset is any asset priced in US dollars. Gold is an example of a dollar-denominated asset as well as oil. This means that a rise in the value of the dollar is likely to drive down the price of those assets.

The rise and fall of gold and oil prices often occurs in tandem because both assets share this characteristic. However, this relationship is complicated by inflation which is often defined as too much money chasing too few goods.

An increase in oil prices contributes to a rise in inflation. This happens because a rise in oil increases the cost of inputs. This relationship has weakened somewhat in recent decades as oil has become less integral to manufacturing but the influence is still there. Moreover, the transportation of finished goods requires oil which also impacts the prices of those products.

This connection between oil and inflation matters to gold investors because gold tends to increase in value as inflation increases according to research showing that “there is a clear co-movement between the prices of the two strategic commodities, both in nominal and real terms.” This connection is so strong that even a dramatic short-term movement in oil prices reverberates throughout the gold market. The same body of research determined that “the signs of the instantaneous impact of oil price shocks on gold returns are all identically positive.”

This link makes sense. An increase in oil prices will hinder economic growth. Running a business becomes more expensive. This slowing of economic activity often flows through the equities market. As a result, investors tend to move towards “safe haven” investments like gold.

One of the most direct connections between the prices of gold and oil can be seen in mining. The resource-intensive process of mining demands oil for the operation of industrial machinery.

A rise in oil prices can force a mine to go off-line or shut down entirely. Even exploration requires substantial oil resources. This relationship is present within other mined resources. For example, Barron’s explains “the correlation between the daily iron ore price and oil price has been 72%.”

Other academic research supports this link. One study found that “oil is one of the main factors in causing variations in stock prices, exchange rate and gold prices.” Countries experiencing the strongest economic growth are often the largest drivers of immediate surges in oil demand. Consequently, it is plausible that emerging economies have a disproportionately large influence on gold prices in the short-term.

All of this leads to one question for gold investors: where is oil likely to go in 2023?

Today, West Texas Intermediate oil is trading at approximately $80/barrel. Analysts at JPMorgan forecast this to rise to $90 in 2023. Bank of America projects an average of $94/barrel in 2023.

Many of these forecasts are influenced by the uncertainty surrounding the war in Ukraine.

The key takeaway for gold investors is this: there are many factors influencing the price of gold and oil is among the most consequential. A rise in oil prices in 2023 – a likely scenario – should bode well for gold.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Massachusetts Coins: The First Silver Coins Struck on American Soil

Posted on — Leave a commentThirty two years after the Mayflower landed on Cape Cod with 101 adventurous souls, Bostonians began minting silver coins. At this time the American colonies were, of course, ruled by England. And the colonial governments were run according to the charters granted by England’s king. A few of the charters permitted the colonial governments to mint coins, but most did not.

Massachusetts Bay was the first English colony to challenge this prohibition when the Massachusetts General Court in 1652 ordered that silver three pence, six pence and shilling could be struck in the English Americas.

The Massachusetts Bay government was simply trying to fill a huge need for standardized currency. Before this, the New England settlers were using “wampum” as a medium of exchange. Wampum was created from shells ground to the size of a kernel of corn. A hole was drilled through each piece so wampum could be hung on a strip of leather for convenience.

The early mint, located in Boston, was run by Mintmaster John Hull and his assistant Robert Saunderson. The first Massachusetts silver coin designs were simplistic with one side punched with a small NE for New England and the other side punched with the coin’s denomination in Roman numerals. For example, a shilling would show XII.

Surprisingly, the original legislation authorizing these coins required them to be square, not round. However, another subsequent law changed the shape to be round. Soon after, the Boston minters began creating additional varieties known today as the Willow, Oak and Pine Tree series. The Willow Tree silver coins were struck from 1653 until 1660, the Oak Trees from 1660 to 1667 and then the Pine Trees from 1667 to 1682.

These historic silver pieces were struck on handmade dies that were often individually distinct. That created a great number of die varieties for today’s advanced collector seeking levels of rarity. Nonetheless, all of these early colonial coins are scarce to rare today. The Pine Tree coinage survives in larger numbers than the Willow or Oak issues, making them the easiest to source and locate of the group.

Collectors today may find some surviving Massachusetts silver pieces to be slightly bent. At that time, due to superstitions, many of these silver pieces were bent and then straightened back out. Some people believed that bending the coin would ward off evil spirits. Many of these early Massachusetts silver coins were also holed and worn as a pendant for the same reasons.

A group of these 128 rare Massachusetts Colonial coins were sold for $2.9 million in a 2022. The coins were from the collection of numismatic researcher Christopher J. Salmon The top lot was a 1652 Willow Tree Sixpence graded NGC AU 55 that realized $312,000.

If you are intrigued by this story, reach out to a Blanchard portfolio manager today. Some of the early Massachusetts silver pieces are scarce and affordable while others are ultra-rare and costly, meaning a coin from unique and exciting era in early American history could be within your grasp, no matter the range of your investment level.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.