The #1 Leading Indicator for Gold Prices

Posted on — Leave a commentBy David C. Zanca, Senior Portfolio Manager

Winter follows fall, and summer follows spring.

The seasons of nature act as a leading indicator for what comes next. After the leaves drop from the trees in September and October and the temperatures fall – winter follows. After months of snow and shorter days, warmer temperatures and longer days announce the arrival of spring.

In the economic realm, employment and consumer spending are considered leading indicators. These important data points signal whether the economy will grow or shrink in the months ahead.

Since the 2008 financial crisis, a leading indicator emerged for the price of gold. This gold signal offers a perfect and obvious timeline.

What is this leading indicator for gold prices, you wonder?

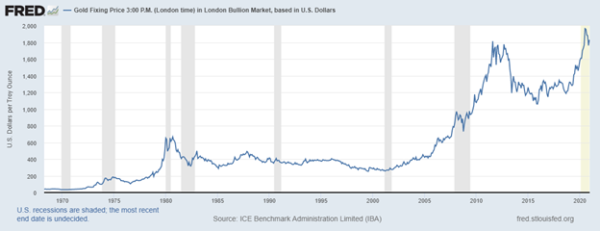

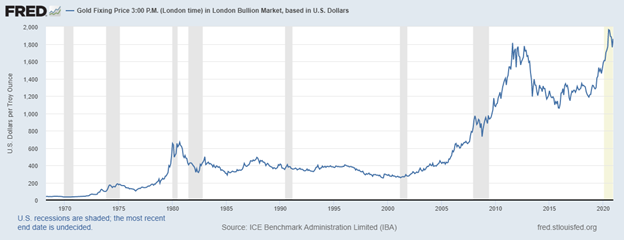

Let’s take a look at this chart of the price of gold from the St. Louis Federal Reserve. The red circles highlight key Fed actions we will describe below.

Fed Began QE1 in December 2008

In response to the Global Financial Crisis, the Fed announced a new program called Quantitative Easing (QE1) in late November 2008. The Fed stated it would purchase up to $600 billion in mortgage backed securities and agency debt.

Quantitative easing is a policy by the Fed in which they buy government bonds, corporate bonds and other assets in an attempt to inject liquidity into the economy and stimulate economic growth.

What did gold do? Gold bottomed just prior to this announcement at $731.50. By November of 2010 gold climbed to $1375 per ounce.

Fed Began QE2 in November 2010

In early November 2010, the Fed revealed it would purchase $600 billion of longer dated treasuries, at a rate of $75 billion per month. QE2 was announced in November 2010 and ran until June 2011.

What did gold do? During QE2 the price of gold soared from $1,375 to nearly $1,900.

Fed Began QE3 September 2012

In mid-September 2012, the Fed signaled it was launching yet another round of quantitative easing known as QE3. This new round included an open-ended commitment to buy $40 billion agency mortgage-backed securities per month in an effort to improve the labor market.

What did gold do? From a summer 2012 low around $1,600, gold climbed to nearly $1,800 in the fall of that year.

December 2015: First Fed rate hike in nearly a decade

Fed interest rates sat at 0% from December 2008 until December 2015.

In a historic move the Fed attempted to begin a new trend toward higher interest rates with a 0.25% basis point increase in the Fed Funds rate to 0.25-0.50%. In fact, at its December meeting, the Fed stated it planned to raise interest rates four times in 2016.

The stock market reacted violently to the removal of its punch bowl – and the Dow plunged over 2,000 points.

Investors knew the truth – the Fed would not be able to sustain interest rate hikes and begin to remove liquidity from the financial system.

What did gold do? In December of 2015 gold bottomed out at $1,070 per ounce. Gold began to climb in value right after the rate increase as the stock market plunged. Within a few months, the Fed backed away from its claims of continued interest rate hikes. Gold rose $300 per ounce over the next four months.

Bottom line: Zero percent interest rates have become an ingrained and integral part of our financial system, which allows the stock market bubble to perpetuate.

March 2020 – Fed’s emergency COVID actions

The Fed unleashed a historic and unprecedented round of monetary actions in March 2020 aimed at stemming the economic reaction to the COVID pandemic. The Fed slashed interest rates to 0% once again, announced new corporate bond purchases and printed trillions of new dollars throughout the year.

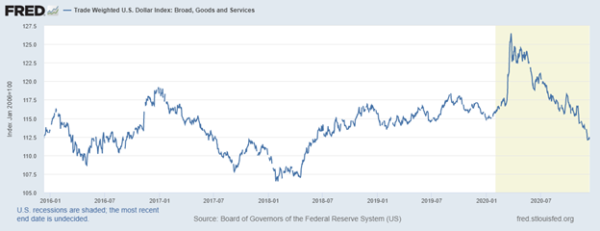

The Fed became both the buyer of last resort and the seller of last resort through emergency actions that ultimately devalued the fiat currency and pushed the U.S. dollar index lower by 10% last year. Overall, the Fed expanded its balance sheet by nearly $3 trillion in 2020 to a record $7.4 trillion.

What did gold do? Gold rallied to a new all-time record high at nearly $2,070 per ounce in 2020 – fueled by the Fed’s massive money printing, QE policies.

What is the number one leading indicator for gold prices?

It is easy to conclude that it is Federal Reserve quantitative easing policy.

The timeline we’ve discussed today reveals a direct connection between the Fed’s loose monetary policy and quantitative easing and a steady rise in the price of gold.

What’s next for gold? Heading into 2021, the Fed and the government appear poised to deliver more of the same – 0% interest rates and more quantitative easing.

Congress passed a new COVID emergency stimulus bill in December, which simply means more quantitative easing. Many expect more emergency stimulus in 2021 as well.

Using history as our guide, these forces will drive gold higher and higher in the months ahead. These Fed policies act as a leading signal for gold and indicate higher prices ahead. The Fed has already stated it won’t even consider raising interest rates in 2021. Do you own enough?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Future of Gold in a De-carbonized World

Posted on — Leave a commentRecently, President-elect Joe Biden announced a plan to spend $2 trillion during his first term in an effort to accelerate the adoption of clean energy in sectors like transportation and building. The plan is a major step in the renewed initiative to lessen, or even eliminate global warming.

The move is large enough to have ramifications across nearly every industry, including gold, because large scale mining operation require an enormous amount of electricity and fuel combustion.

It is difficult to envision a world that balances decarbonization with gold extraction, yet that is exactly what the mining industry is attempting to achieve.

A new report from the World Gold Council concluded that the emissions associated with gold mining are expected to fall by 35% over the next decade. This drop will come from a move away from coal, diesel, and heavy fuel oil to renewable resources. This transition presents some significant challenges. Numerous countries will need to work in cooperation. Therefore, regulations must change on a global scale to have a global effect.

A major factor in this plan is the number of mines which source power from the electrical grid. This part of the picture matters because the decarbonization of power grids could dramatically reduce the emissions of the numerous mines dependent on this source of power. In fact, in the World Gold Council’s analysis of 158 gold mines 57% relied on grid-sourced electricity. A change to the grid means a change to the emissions profile of many of the world’s mines.

An example of this phenomenon can be seen in Nevada where the emissions resulting from grid electricity are expected to drop by as much as 36%, due to a shift to greener resources. The report also concludes that the emission intensity of grid power will fall by 20% by 2030.

Given the scale of change needed, it is likely that any meaningful drop in environmental impact from mining will need to come in several moves. In addition to grid decarbonization, the emissions intensity of mines could also drop due to changes in asset mixes due to the gradual closing of mines that are particularly demanding of energy. It is inevitable that older mines will simple shut down as the cost of extraction rises while the available stores of gold fall. These closures may be accompanied by the opening of new mines which are likely to be built with greener energy resources from day one. Additionally, other mines will likely employ new technology to become more energy efficient. Finally, recent advancements in solar power technology will also enable mines to adopt hybrid energy sources which will reduce their overall emissions profile.

Gold mines understand that their success and survival is dependent on green resources. These new energy systems are not only imperatives for our future, they are fast becoming part of their business model. Green technology often presents opportunities to capitalize on lower operation costs in the long run.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

3 Quotes about Inflation You Must Read

Posted on — Leave a commentInflation is coming. Are you ready?

Listen to what these three luminaries said about inflation:

- Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man. – former president Ronald Reagan

- In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. – former Federal Reserve Chairman Alan Greenspan

- Inflation is taxation without representation. – Milton Friedman, Nobel Prize winning economist.

You can’t hide from inflation

Have you thought about what inflation could mean for your accounts in 20 or 30 years?

With average inflation, over 20 years, prices historically have doubled.

Everything you buy today – in 20 years will cost twice as much. Will you be able to maintain your standard of living when that happens?

And, that’s only if inflation stays at the low levels that we’ve seen in recent years. That’s not likely.

If – as experts believe – inflation picks up significantly due to the monetary policies from the Federal Reserve, in combination with skyrocketing debt levels and a weakening U.S. currency – prices could double or even triple much sooner than 20 years.

Peering into the future – the debt dilemma

The COVID pandemic in 2020 triggered massive government spending which sent the national government debt spiraling higher to new record highs above $17 trillion. Alarm bells are going off – yet policymakers just spend more. The ballooning government debt is out of control and exposes are nation to a dangerous economic future.

How high could our nation’s debt go?

Right now – it’s on a vertical climbing path – straight up.

“By the end of 2020, federal debt held by the public is projected to equal 98 percent of GDP. The projected budget deficits would boost federal debt to 104 percent of GDP in 2021, to 107 percent of GDP (the highest amount in the nation’s history) in 2023, and to 195 percent of GDP by 2050,” according to the non-partisan Congressional Budget Office (CBO).

Here’s what else the CBO said: “High and rising federal debt makes the economy more vulnerable to rising interest rates and, depending on how that debt is financed, rising inflation. The growing debt burden also raises borrowing costs, slowing the growth of the economy and national income, and it increases the risk of a fiscal crisis or a gradual decline in the value of Treasury securities.”

Inflation and Investments

Hard assets will soar

As government debt continues to climb, inflation will grow and the value of hard assets like physical gold, silver and real estate will soar.

Looking back to early 1980 – when consumer inflation surged to nearly 15 percent, what did gold do? “Gold more than kept pace, hitting a then-record $666.75 an ounce after a fifteen-fold rise over the previous decade,” according to a Reuters article.

Gold is already in the midst of a historic bull market – up 24% this year – with a new all-time record high. The experts predict even higher prices ahead in 2021 – with $3,000 an ounce forecast. In the coming years, gold is set to soar.

Inflation hurts stocks

Investing in stocks is riskier than any point in history – especially for those looking to preserve their nest egg.

Here’s what billionaire investor Warren Buffett wrote about inflation in his classic piece for Fortune magazine in 1977: “The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital. … If you feel you can dance in and out of securities in a way that defeats the inflation tax, I would like to be your broker — but not your partner.”

Stocks fall (or plunge) during rampant inflation because it reduces how we value future income – as inflation eats away at that future value. A stock’s price is a risk-adjusted value of a company’s future cash flow – and inflation reduces that to fall in value.

Stocks are not the answer in an inflationary environment. Inflation destroys stock market wealth and breeds fear among stock investors.

Inflation can cause interest rates to skyrocket

History is quite clear on what inflation does to interest rates – it sends them shooting higher. In fact, we saw double-digit interest rates in the early 1980s.

With inflation raging as high as 11.6% in 1980, Fed Chair Paul Volcker took action.

He raised the Fed funds rate to nearly 20% — which sent 30-year mortgage rates to a high of 18.63% in 1981, according to data from the Federal Reserve Bank of St. Louis. How could you ever buy a house with mortgage rates that high!

These double-digit numbers may sound unbelievable. But, it wasn’t that long ago – only 40 years. You bet it could happen again – and in fact the Fed is creating the environment for that now!

Inflation: what happens to your money in the bank?

Rising inflation also severely impacts any money you have sitting in the bank.

While you may get a tiny amount of interest from a CD, savings or money market account, the growth of inflation overtakes that interest – meaning your actual money, the purchasing power of it – is falling in value. Inflation destroys the value of your money.

You can protect your accounts against future inflation

Inflation is a deadly, scary and corrosive economic force. And, the government and Fed are setting this country up for another bout of severe inflation in the years ahead.

There are ways you can protect your financial future, even in an inflationary environment.

You need to buy assets that rise in value – as inflation climbs – and that is exactly what gold does.

Here’s what one of Donald Trump’s top economic advisors during his 2016 presidential campaign said about gold.

- Historically, gold has always been a safe haven against inflation and a safe haven in times of political instability. – John Paulson, billionaire hedge fund manager

Protect your assets with gold bullion

The U.S. economy’s instability is like a ticking time bomb. Are you looking for a way to protect your savings and investments from inflation?

Owning physical gold and silver is a time-tested, historic hedge against inflation. It’s a simple solution that can protect your financial future. Do you own enough?

If you have questions about how future inflation could impact your investments or finances – please contact a Blanchard portfolio manager. We can also provide customized recommendations on tangible assets best suited for your personal circumstances, goals and investing time-horizon.

Read Part 1 of our inflation series here:

Are You Prepared for the Inflation Tax?

Read Part 2 of our inflation series here:

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

1853 Seated Liberty Quarter – Arrows and Rays

Posted on — 2 CommentsThe 1853 Seated Liberty Quarter was part of U.S. currency that began in the mid-1830s and extended to the late 1890s. The obverse shows the Goddess of Liberty grasping a pole. On the top of the pole is a Phrygian cap. This detail was meant to convey freedom.

The cap is recognized by a distinct fold in the top. Originally, the hat signified the Roman goddess of liberty. In time, this symbolism later appeared in English and French art. While the cap is small piece of the imagery on the 1853 Seated Liberty Quarter, it carries meaning that looms large. In the early days of the United States, the cap was a powerful signal of anti-monarchical sentiment. Even the U.S. Army has used the cap as representation of freedom since 1778. In this context the cap is often seen perched on the tip of a sword.

The theme of liberty is also represented on a small, striped shield with the word “liberty” on the front. Liberty’s hand is caressing the shield to further draw attention to the symbolism. The shield is intended to convey that liberty must always be protected and defended whenever under threat.

The reverse design shows an eagle preparing to fly. Here, the striped shield is seen again. More symbolism is present with the olive branch of peace in the eagle’s right claw and a bundle of arrows in the left claw. It would not be until later in 1866 that the words “In God We Trust” were added to the coin.

The year 1853 brought significant changes to the design. An arrowhead appeared on both sides of the date shown on the obverse. Additionally, rays were added around the eagle on the reverse. These changes were not merely for aesthetic reasons. The U.S. Mint had changed the weight of the coin from approximately 103 grains to 96 grains. The intention behind the change was to discourage hoarding and melting of recently issued coins. The Mint needed a way to visually distinguish these lighter pieces from those that came before. The arrows and rays were the solution.

The rays were short-lived and only appeared in the 1853 version of the coin. The following year the rays were removed, resulting in a version with arrows only. More than 90% of the 1853 minting occurred in Philadelphia with the remaining minted in New Orleans.

While bold in its time, the imagery of the Seated Liberty eventually became the object of criticism. Many cited that the coin looked ordinary and uninspiring due to its minting for more than 50 years. Citizens saw it as merely commonplace. By 1891, a new design was approved, and the U.S. Mint adopted the “Barber Head” image. This replacement, however, was short-lived in comparison to the Seated Liberty coin given that it was only minted between 1892 to 1916.

The Seated Liberty design appeared on the half dime, dime, the quarter, the half dollar, and the silver dollar. The quarter versions are slightly scarcer than dimes or halves of the same date ranges.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Inflation and “Good” Money

Posted on — 2 CommentsIn early societies items like shells, beads and even clay tokens were used as money.

Ancient societies then advanced to using precious metals including bronze, gold and silver as the basis for their monetary systems.

What defines “good” money?

The key element that is essential to good money is something that maintains its purchasing power over time.

Whether it’s a shell or a dollar bill, good currencies retain their value against a basket of consumer goods over time.

That’s important – because inflation – or the steady increase in goods and services has climbed higher over the past 50 years.

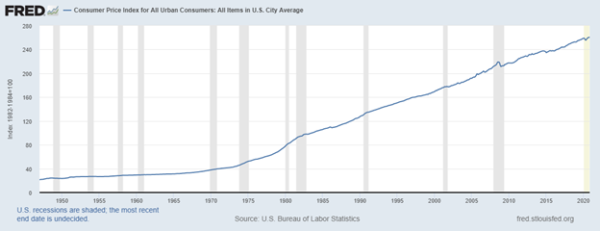

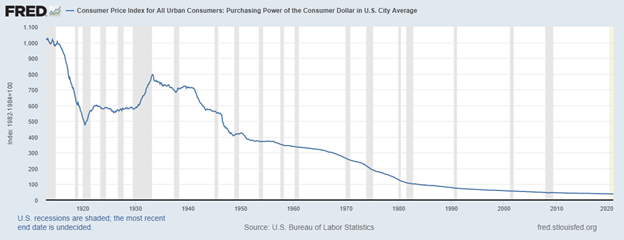

Figure 1 below represents the Consumer Price Index for city dwellers for items in U.S. cities.

There’s no getting around it – prices of everything simply rise over time.

If you think inflation won’t impact you, we’d like to walk you through some important charts to reveal what is happening in today’s unprecedented times and how inflation and decreased purchasing power could severely impact what you can buy in the future.

Declining purchasing power

When the currency you are paying for your goods and services falls in value – and prices rise – you can buy even less with the same dollar.

Figure 2 shows the U.S. Dollar Index. Note its spotty performance over time – and how the value of the U.S. dollar plunged lower throughout 2020 (shaded in yellow on right side).

Gold and silver are currencies too.

Central banks around the globe still hold and actively purchase gold for their vaults. Why? Because it is a currency. Precious metals have recognized value in every corner of the globe.

Figure 3 below shows the value of gold. Note especially the sharp rise in value over the past 20 years. Gold hit new all-time highs in 2020 and many firms forecast more new all-time highs next year as well.

Gold is in rising or bull market.

Why is gold rising?

One of the drivers of the bull market in gold are policies from the U.S. government – that includes Congress, the Treasury and the Federal Reserve.

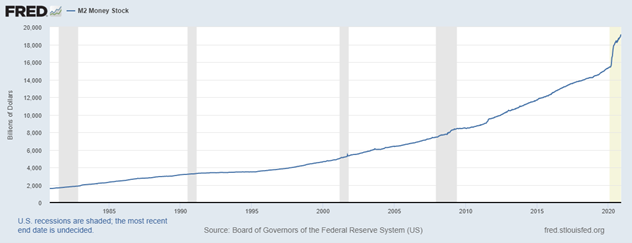

Chart 4 below shows the U.S. national debt – which hit a new all-time record high in 2020 –above $27 trillion!

You’ve heard about our record levels of government debt, right?

You can see the most recent debt statement from the Treasury here – yes, over $27 trillion.

That’s one big credit card bill.

Sadly, as we mentioned last week – foreigners no longer have the appetite to buy as much of our Treasury debt. Foreign buyers used to hold more than half of outstanding U.S. Treasury debt.

Now, the Federal Reserve has had to step in and buy Treasury debt.

If this reminds you of a pyramid scheme – you wouldn’t be too far off.

This is how it works. Congress spends the money. The Treasury issues debt like 30-year bonds, 10-year notes and 1-year T-bills to pay for the spending.

If foreigners and Americans don’t buy enough of this debt in the weekly Treasury auctions – the Federal Reserve steps in and buys the debt.

How does the Fed pay for the debt? With its newly printed money.

In fact the Fed has printed over $1 trillion in new money in 2020 to purchase Treasuries, according to USA Today.

It’s just like when someone moves personal debt from one credit card to a new 0% APR card, runs up the bill on that one then does the same thing over again. The government is just moving the debt around and it doesn’t actually get it paid off.

If this worries you, you aren’t alone.

These policies set the stage for dramatically higher inflation ahead here in the United States – while the value of our dollar decreases with ever-more money printing.

Why are investors turning to gold and silver today?

It’s simple. The purchasing power of precious metals is rising.

Consider this.

In 1921 a 1 ounce silver Morgan Dollar would put about half a tank of gas in a car. Today that same Morgan dollar would FILL your gas tank! A paper dollar bill today barely would put enough gas in the car to get you from the gas station to the grocery and back home.

The purchasing power of gold and silver is increasing, while the value of fiat – or paper money – is decreasing due to rising government debt and money printing.

What’s in your portfolio?

Many American investors and savers have limited currency diversification – meaning the majority of your assets are held in the U.S. dollar – through stocks, bonds and savings accounts.

Yet, very few savvy investors would hold a portfolio with 100% exposure to a single stock. Yet, in essence – when you hold a portfolio with just one type of money – U.S. dollars – you are in fact doing just that.

Here’s what one economist says:

“There is a lot of heated debate about governments’ inability to keep the money safe. But many investors/savers nevertheless have one-sided exposure to their own country’s money. The US is the most extreme example of that, with a large proportion of investors only holding USD assets.

This is odd (and different to how investors handle currency risk in emerging markets). Very few prudent investors would hold a portfolio with 100% exposure to one stock. But at the same time, they are happy (or not sufficiently concerned) about holding a portfolio with just one type of money, such as dollars. This is a particularly risky proposition in a time with historically large fiscal deficits, and increasingly experimental monetary policy,” said Jens Nordvig, founder & CEO at Exante Data Inc.

The time is right to increase your diversification to gold and silver.

Precious metals are commonly known as hedges against inflation. And, these tangible assets will benefit from the skyrocketing government debt. The current environment makes gold and silver important choices to protect a portfolio.

What are you doing to protect your financial future?

Follow Our 3-Part Series

Read Part 1 of our inflation series here:

Are You Prepared for the Inflation Tax?

Check back next week for the third installment of our inflation series. We will discuss how much debt our country could have in the future, what will happen to hard assets, other assets and interest rates and what happens to your money in the bank?

Gold Estimates for 2021

Posted on — Leave a commentThe value of gold surged in 2020. This performance has left many wondering how much further it can go in the coming year. Many believe there is room to run.

Given strong a strong previous 12 months, one might ask what could propel additional growth. The two factors that are most likely to drive gold prices up are low interest rates across the globe and the weakening US dollar.

In recent reporting from Societe Generale analysts projected that gold could reach as high as $2,340 per ounce within 2021 representing more than a 20% increase from prices today. In describing the basis for this estimate, the analysts remarked that “negative real rates, record levels of negative-yielding assets, expanding U.S. debt, a strengthening CNY and, eventually, potential flows into E.M. assets will pressure the U.S. dollar and be supportive for gold.”

Commodity analysts at ING share this bullish outlook. They believe that gold will increase further when a new stimulus package is authorized. They also believe that pent-up demand coupled with an increase in oil prices could lead to rising breakeven inflation which, in turn, is also supportive of rising gold prices.

Moreover, lockdowns earlier in the year, and those starting again, have likely prevented would-be gold purchasers from buying gold. Once the COVID vaccine begins to reach more of the global population throughout the first half of 2021 more people will finally be able to buy. ING expects gold to rise by about 9.4% in the forth quarter of 2021. Outside the US this demand is expected to be particularly strong as people buy for festival and marriage events.

Goldman Sachs has similarly high expectations for gold next year. Analysts there have a $2,300-per-ounce price target for gold. Part of the reasoning for this forecast is the fact that the Federal Reserve has indicated it is willing to allow inflation to rise above 2%. In this setting inflation may prompt people to hedge against the diminished buying power of the dollar. Finally, Goldman Sachs sees the incoming Biden administration as supportive of gold. The reason: a relaxed trade policy should support gold prices.

Finally Bank of America is also optimistic about future gold prices. Their team expects gold to reach $3,000 per ounce citing that “the Fed can’t print gold.” This quote summarizes their perspective which is that gold will remain an attractive store of wealth as many factors diminish the power of normal currency.

The forecasters have made their outlook clear: even with a strong 2020 behind us, gold can still climb in value through 2021. Societe Generale, ING, Goldman Sachs, and Bank of America are all predicting a considerable rise in gold prices as the global economic picture for the next 12 months comes into focus. Clearly the time is now for those who felt they missed the opportunities of 2020. While the run-up has been substantial there is still time to participate in the continued rise of prices.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Are You Prepared for the Inflation Tax?

Posted on — Leave a commentInflation affects us all.

If it feels like a dollar doesn’t go as far as it used to, you aren’t imagining it. You are experiencing the powerful impact from inflation.

Inflation is the steady rise in price for everyday goods and services – things like groceries, cars and homes – that’s known as the rising cost of living.

When inflation causes prices to rise, but our paychecks don’t, it reduces our purchasing power, and thus reduces our quality of life.

Inflation erodes your purchasing power over time.

A simple example is the price of milk. In 1913, a gallon of milk cost 36 cents. In 2013, a gallon of milk cost $3.53, nearly ten times higher in 100 years. The higher price of milk reflects, not a scarce supply, instead it represents the steady decrease in the value of money over time – due to inflation.

Inflation, while deadly to your pocketbook and portfolio, is silent and slow right now. It creeps steadily higher over the years almost without your noticing. Yet, over the course of years and decades – the power of inflation is profound. It severely reduces your purchasing power of your money.

Brief history of inflation in the U.S.

In recent years, inflation has been low. It hasn’t always been this way in our country.

The period from 1965-1982 is known as “The Great Inflation” in the United States. In 1964, inflation measured at 1% per year. By 1980, inflation climbed to an astounding 14%.

Notably, during this period, President Nixon halted the exchange of dollars for gold, severing the U.S. dollar’s link to a physical hard asset. That set the stage for easy money policies from the Fed and rampant inflation.

Looking back what have economists learned about the Nixon era: “Their larger error was that most often they wanted to increase money growth to reduce the unemployment rate,” according to the Federal Reserve Bank of St. Louis.

Fast forward to today. We are seeing the Federal Reserve doing the same and more!

U.S. money supply growth has skyrocketed.

Figure 1: Rising Money Supply Growth

Look what rising money supply growth has done to the purchasing power of the U.S. dollar in Figure 2.

Figure 2: Falling U.S. Dollar Purchasing Power

It’s not rocket science. As the Fed creates more and more U.S. dollars, their value decreases.

For you – that is inflationary. You need more dollars to buy the same good or service.

What can you do to protect your financial future?

For thousands of years, gold has been a proven store of value. While the purchasing power of your dollar declines, the value of gold is rising. See Figure 3.

In 1975, one ounce of gold cost $35. In 2020, one ounce of gold costs $1,875.00.

The value of your dollars is decreasing.

Gold is a proven store of value. For thousands of years gold has not only held its value , it’s become more valuable – the exact opposite of U.S. dollars! Gold has a limited supply, it is very difficult to mine and experts say we are close to peak gold, or simply running out. While the Federal Reserve simply prints more U.S. dollars – all the time!

Could we see higher inflation ahead?

Yes. History guarantees it. Even more, the Federal Reserve’s policies over the past decade have created the perfect storm, not only for run of the mill inflation, but hyperinflation.

The national debt now stands at over $27 trillion. Who’s buying all that debt? Indeed, it used to be China and Japan, but no more. Foreign buyers used to hold more than half of outstanding U.S. Treasury debt. Times have changed. In 2020, the Federal Reserve stepped in to be the buyer of last resort.

How is the Fed funding its bond-buying purchases? It’s printing new dollars out of thin air. Yes, that’s right. Essentially, the U.S. Treasury is selling bonds (issuing debt to raise money) and the Fed is printing money to buy them.

What could go wrong with this? Stay tuned. Next week we’ll show you the charts you need to see.

It’s surprising how many investors today disregard the impact of inflation on their retirement savings, their portfolios and their financial future. Don’t make that same mistake.

What are you doing to protect your financial security?

These unprecedented economic times call for action. The Fed’s money printing and the rising federal debt is a ticking time bomb for your financial future.

If you want to protect your retirement savings, your hard-earned dollars, consider increasing your allocation to physical gold. Why keep your wealth in an asset that is declining in value like dollars?

If you are unsure how much you need to allocate to physical gold to protect your financial future, please talk with a Blanchard portfolio manager today for a personalized portfolio review and recommendation matched to your unique personal situation.

Follow Our 3-Part Series

Check back next week for the second installment of our in-depth three part series on inflation. The causes, the impact and what you can do to protect your financial future.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Weekly Wrap Up – December 3, 2020

Posted on — Leave a commentLooking into the Crystal Ball for 2021

It’s that time of year again.

This is when investment firms begin to roll out their forecasts and projections for 2021.

Degussa recently unveiled its 2021 outlook report. Their take on gold? Look for gold to climb to $2,500 an ounce by mid-2021, they say.

“It appears that the savvy investor has quite some reason to expect that interest rates will remain very low in the foreseeable future, simply because overall indebtedness has become too high. Central banks are unlikely to withdraw their support for the economies and financial markets in particular,” the analysts said.

Here’s another. The Wells Fargo Investment Institute released a report on Nov. 25 stating: “our projection through year-end 2021 calls for gold prices to hit a new all-time record high.”

A weaker dollar, low real interest rates and government deficit spending should support gold prices, the Wells Fargo strategist said.

With these bullish gold forecasts as a backdrop, you may be wondering why gold fell last week.

It’s simple. The stock market remains divorced from the economic realities – just as it has throughout much of 2020’s wild ride.

Premature optimism

Investor risk appetite surged last week. While COVID vaccine optimism drove stocks higher, safe haven assets including the U.S. dollar and gold weakened. Indeed, three pharmaceutical companies have now developed successful COVID-19 vaccines, with AstraZeneca the latest company to report positive findings.

Yet, the manic stock market action reveals frothy sentiment and on-going divergence with underlying health and economic situation.

Vaccines could eventually end the COVID pandemic. But the economic impact will be with us for years to come. Consider this.

One hundred thousand small businesses closed permanently. Over eleven million Americans remain out of work. It’s not just small businesses that shut down. Big companies like luxury department store Neiman Marcus, JC Penney, Pier 1 Imports, Hertz, Brooks Brothers and Ruby Tuesday filed for bankruptcy this year.

Despite the positive vaccine news, it still could take up to six or seven months before there are enough vaccines for the entire American population. And, the big question remains – will Americans take the vaccine? Would you?

As COVID infections now rise exponentially throughout the United States, America leads the world with the highest number of infections at over 13 million, according to Johns Hopkins University. COVID vaccines are unlikely to be widely available until summer 2021 – and the economy still faces severe distress. This isn’t over yet.

Frothy sentiment gauges – red warning flag

Key sentiment surveys reveal that the stock market ebullience is poised for a fall.

The widely watched Investors Intelligence U.S. Advisors’ Sentiment Report saw the number of stock market bulls climb to 59.6%, just below the extreme level of 60%. That marks a 3-year high.

The last time stock market bulls registered a reading this high was August 2020 – right before a 10% crash in the S&P 500.

Fed’s cure leaves big hangover

Big picture, the Fed’s prescription for the COVID crisis this year – printing trillions of new dollars out of thin air – leaves behind a severe hangover that no vaccine can cure.

The Fed’s policies continue to devalue our dollar – there’s no cure for that. Inflation is coming. Count on it.

Gold: the building block for a strong portfolio

Despite the recent pullback, gold remains 17% higher on the year – that’s still stronger than most major assets.

Looking ahead, gold is one of the key components of building a balanced portfolio designed to provide stability and long-term growth.

Once the current stock market mania subsides, investors will pile into gold again – as investors look for an asset which is a proven hedge against the debasement of fiat currency, has a reliable track record of producing returns and an asset that can be owned outright with no government liability. Lastly, because the world gold supply is limited – gold has nowhere to go but up – over the long-term.

I would like to personally wish you and your loved ones a very happy and safe holiday season. Here’s hoping for a less chaotic 2021!

Best,

David

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Shipwreck that Triggered an Economic Crisis

Posted on — Leave a commentIt was September 1857. A 280-foot, wooden-hulled steamer named the S.S.Central America set sail for New York from San Francisco.

Known as the Ship of Gold this steamer carried 578 souls and over two tons of gold and coins from San Francisco.

Unwittingly, this legendary ship sailed straight into a Category 2 hurricane off the coast of the Carolinas.

She took on water fast and the 105 mph winds shredded her sails. Steam pressure fell and the bilge pumps failed. The crew flew the ship’s flag inverted – a distress signal. They bailed water all night long valiantly fighting back against the monster storm. Two ships came to their rescue and transported 153 of the passengers to safety in lifeboats. Eventually, the captain fired his final rocket – a signal the ship would soon go under. Tragically, 425 passengers died as the ship sunk.

Complete devastation – the human and economic toll was high in this disaster.

In its time, the S.S.Central America shipwreck was as famous as the Titanic in the twentieth century. Historians describe the ship’s demise as the greatest economic catastrophe in U.S. maritime history.

Indeed, the loss of the ship’s gold triggered the infamous Panic of 1857 and the subsequent economic recession that reverberated around the globe.

For 131 years, her treasure worth $2 million in 1857 – that’s $300 million in today’s dollars – sat at the bottom of the ocean.

In 1988, a team using a remotely operated vehicle discovered the ship 160 miles off the coast at a depth of 7,200 feet. Gold estimated to be worth $100 million to $150 million was recovered.

Thirty-nine insurance companies filed lawsuits – attempting to claim rights to the gold. They said because their firms had paid damages in the 19th century for the lost gold – they had the right to it. Eventually, after a lengthy legal battle – the courts awarded the majority of the gold to the discovery team in 1996.

David Hall, founder of PCGS, calls the S.S. Central America “one of the greatest treasures in United States numismatic history.”

Blanchard proudly presents 1857 $1 SS Central America 1.5 Grams Gold Nuggets from one of the most famous shipwrecks in all of history. See these stunning pieces of history here.

Owning a shipwreck coin is special in many ways. They are rare. Thousands of ships have sunk throughout history, only a very few have their treasure recovered. They are also spectacular historical artifacts – a tangible piece of America’s earlier era. Last but not least, shipwreck coins typically retain fine details, luster and strikes – despite spending over a century on the ocean’s floor.

For a limited time, we’re offering 10% off historic gold nuggets recovered from the S.S. Central America. Just add the coupon code GOLDNUGGETS when you order online.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Gold Standard Could Gain New Momentum

Posted on — Leave a commentWith the presidential election results under investigation, gold investors turn their focus to the Senate this week.

Judy Shelton, an economic advisor to President Trump, is most famous for her advocacy for a return to the gold standard. And, her long-standing criticisms of the Federal Reserve.

This week – there is a historic opportunity for President Trump – to put his personal stamp on the Federal Reserve with his nomination of Judy Shelton to the central bank.

If, as expected, the Senate votes to confirm her this week – she’ll have her chance to reshape the long-term direction of the Federal Reserve.

Throughout her career as an economist for institutions including the Hoover Institution, the Sound Money Project and the European Bank for Reconstruction and Development she has been a staunch conservative voice in the economic community.

In fact, Shelton has long advocated that the United States return to the gold standard – which would tie the value of the dollar to physical gold.

Notably, Shelton has called into question the underlying mission of the Federal Reserve which is to promote maximum employment, along with stable prices. She has also called for closer ties between the White House and the Federal Reserve on policy making measures, which would be a break from a long-standing tradition of central bank independence.

Now, Republican Senators appear poised to vote to confirm her to the nation’s most important monetary policy board. Republication Senator Lisa Murkowski from Alaska, often considered a key swing vote, announced late last week that she had decided to support Shelton.

Republication Senator Pat Toomey from Pennsylvania, agreed to vote for Shelton after she pledged in writing that she “would not advocate for the devaluation of U.S. currency” and agreed the Federal Reserve does not have authority to use monetary policy to devalue the dollar,” according to The Hill.

If the Senate votes to confirm Judy Shelton to the Federal Reserve Board this week – a strong voice for gold will have a seat at our nation’s monetary policy making table.

A little history

The U.S. went off the gold standard under President Nixon in 1971. Currently, the U.S. does have the largest official gold reserves in the world at 8133.5 tons, according to the World Gold Council. Just for comparison, Germany is a distant second with 3,362.4 tons and the IMF in third place at 2,814 tons.

So, the U.S. has a lot of gold, but is it enough to back our nation’s $27.2 trillion government debt? Not even close.

Here’s some back of the envelope numbers to consider. One ton of gold equals 2,204.62 pounds. One pound of gold equals 14.58 ounces. Even if we liquidated the entire nation’s gold supply, it would not come close to covering our nation’s debt.

The next step to return to the gold standard would be for the government to revalue gold – it could make gold go up as much as 1,000% by some estimates.

Advocates of the gold standard note that it would give our country the fiscal discipline – it would force all of us, governments and citizens alike, to be more fiscally responsible.

However, a return to a pure gold standard may not be feasible because of the dollar amounts we are talking about.

It is more likely that a new system – a hybrid gold standard could be put in place. This would mean that the government would peg a portion, say 25% of the dollars out there, would be tied to gold.

The upside of this type of hybrid plan? This would give the dollar some sort of protection that it can only lose this amount, because it is backed by gold. Right now it is backed by a promise.

Many economists do believe that the odds are remarkably high that we will see gold play an increasing role in the monetary system over the next ten years.

If the Senate votes to confirm Judy Shelton this week, expect to start hearing more about the gold standard in the months ahead.

For gold investors, this means that owing a small portion of your portfolio in gold protects you and also puts you in a position for a financial windfall if we do see a return to the gold standard.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.