How “Relativity” Plays into Gold Investments

Posted on — Leave a commentThe world is complex and it’s getting more complicated. The global marketplace is increasingly interconnected. What impacts one economy impacts another. This dynamic is also true of investment vehicles. Assets as different as equities and gold influence on one another.

This concept is important in today’s stock market because a dimming equities picture is forcing investors to remember that holding onto stocks means forgoing the opportunity to own precious metals that have long been undervalued during the recent years of surging stock prices.

As a result, investors are no longer judging gold in a vacuum. They’re judging it, consciously or not, against all other options. That is, they’re considering the “opportunity cost” of investing in gold. The opportunity cost is the value an investor foregoes when they choose one asset over another. For example, a choice to purchase stocks instead of gold means that the investor is not only spending money on the shares, they’re spending their opportunity to own another appreciable asset like gold.

Today, gold is strong relative to equities. Over decades we’ve seen the two assets trade the status of a rising investment. In the late 1990s we saw gold dip in value as equities increased in value. By 2007 this trend reversed. The S&P 500 fell, and gold began a meteoric rise from approximately $664 per ounce in late 2007 to $1,774 in late 2014, a gain in value of 167%.

For a period in 2018 this trend reversed again. Now, we’re seeing gold on the rise once more as investors cool on equities amid increasing tariff concerns, tempered financial forecasts, and diminished optimism among US business leaders. Gold looks favorable relative to stocks.

Additionally, gold is favorable relative to lower risk assets like US government bonds. In late October the value of the 10-year treasury started to drop. This matters to potential gold investors because bonds are yield-bearing investments unlike gold. Therefore, bonds often represent competition for dollars that might otherwise go towards gold.

Relative measurement in investing is important because it helps investors understand opportunity costs. Moreover, it underscores the importance of diversification. Many misunderstand this word and assume that owning a diverse portfolio of stock is a diversified approach. In reality, many stocks are highly correlated. In fact, even US and international stocks have become more correlated over the decades. Consider that between 1990 and 1999 the correlation between these two groups was 0.56. From the period ranging from 2000 to 2017 this figure grew to approximately 0.87. Many equity investors are unaware of how little diversification exists in their portfolio.

Moreover, this same research shows that over a 10-year period a portfolio consisting of 60% stocks and 40% bonds “had a correlation of 0.99 to a portfolio that was invested entirely in stocks.”

As we move into a new chapter of the global economic story investors need to think more strategically about conventional tactics for growing their savings. Gold offer not only value, but relative value.

Understanding the Connection Between Gold Prices and the Dollar

Posted on — Leave a commentGold prices have increased by 9 percent since hitting a 19-month low in August of this year. Investors are noticing this trend as equities continue to approach bear market territory. However, for some, the factors driving up the price of gold are just as obscure as those pulling equities down.

Historically, many cite mining activity, or demand from the jewelry and tech industries as reasons for price growth in gold. While these factors play a role, too often we overlook the U.S. dollar as a major influence on gold prices. “A lower U.S. dollar index today is also working in favor of the precious metals market bulls,” remarked a senior analyst.

Gold and the dollar have an inverse relationship. When the value of the dollar falls, the price of gold increases. When the value of the dollar rises, gold prices fall. Part of this relationship is because the dollar acts as the benchmark price for gold. Therefore, as the dollar rises, gold becomes more expensive in other currencies. Consider this chart which shows the rise and fall of the dollar overlaid onto changing gold price from the start of 1995 to the present.

Today, the value of the dollar is falling. This drop means gold becomes cheaper from the perspective of those holding non-U.S. currency, and there are a lot of people holding non-U.S. currency. In fact, 95 percent of the global population uses a currency that is not the dollar. Therefore, the dollar has a disproportionately large influence on gold prices compared to other currencies.

If the value of the dollar has such sway on the value of gold, then what influences the dollar’s value?

Interest rates have a meaningful influence on the value of a country’s currency. Theoretically, higher interest rates will draw more foreign investment to the country. As a result, demand for the currency of the rising rate country also grows. The reverse is also true; when interest rates fall, foreign investors will look elsewhere for opportunities to increase their wealth. The result: the currency of the falling rate country diminishes.

This relationship may confuse some because the Federal Reserve is increasing rates. Therefore, logic dictates that foreign investment will follow and demand for the dollar will grow leading to depressed gold prices.

Gold is increasing despite interest rate hikes because some fear those same interest rate increases will weaken the economy and perhaps even set us on an accelerated path to recession. These fears are growing as additional factors surface concerns about long-term economic growth. Examples include the U.S. and China tariffs, Brexit, and a government shutdown that’s expected to be long.

This picture represents the uncertainty and unpredictability of today’s markets. Conventional rules do not apply. What would normally be down is up. The simplest takeaway is this: even rising Fed rates cannot dissuade most from the notion that turbulent economic times are ahead. As a result, more people are returning to the safe haven of gold. What’s your move?

How to Keep Your New Year’s Resolutions

Posted on — Leave a commentDo you want to eat healthier, exercise more or improve your finances in 2019?

You aren’t alone. The first step is to make your resolutions. The simple act of actually defining your resolutions is important.

People who made time to make resolutions were 10 times more likely to change their lives for the better after six months than people who aspired to make changes but didn’t make a formal New Year’s resolution, according to a University of Scranton Department of Psychology study.

Here are three simple strategies that will up your odds for resolutions success.

Write down your goals.

Even better talk about them with your spouse, family or friends.

The key is to make yourself accountable. Make your goals concrete.

Make your goals automatic.

When it comes to the financial arena, automating savings and investing is one of the best ways to actually hit your goals.

For example, if you want to build a portfolio of “X” amount of physical gold by the end of 2019, do it incrementally – each month. Plan right now how much you can allocate each month and depending on your budget, purchase fractional gold coins, silver coins, or, for larger purchases, consider gold bars as an effective way to build your tangible asset holdings.

If you set up a monthly purchase plan now, you will be surprised at how easy it is and 12 months from now you will own “X” percent amount more physical gold or silver.

Set process goals, instead of outcome goals.

Instead of focusing on the big picture goal like saving $1 million for retirement. Set a monthly goal, a “process” goal that if you achieve that consistently can help you get to your long-term goal. While it is great to shoot for the moon, success breeds success. Keep your goals realistic so you can actually achieve them.

Happy New Year! We hope to talk with you soon

As the calendar flips to 2019, a New Year means a new beginning. What do you want to change in your life? Get started today. January is a smart time to re-balance your portfolio and construct your financial goals for 2019. A one-on-one consultation with a Blanchard portfolio manager can get you started on the right financial foot for 2019. Call 1-800-880-4653 or email us here to set up your free financial review.

The New World: A Bustling and Exciting Global Epicenter

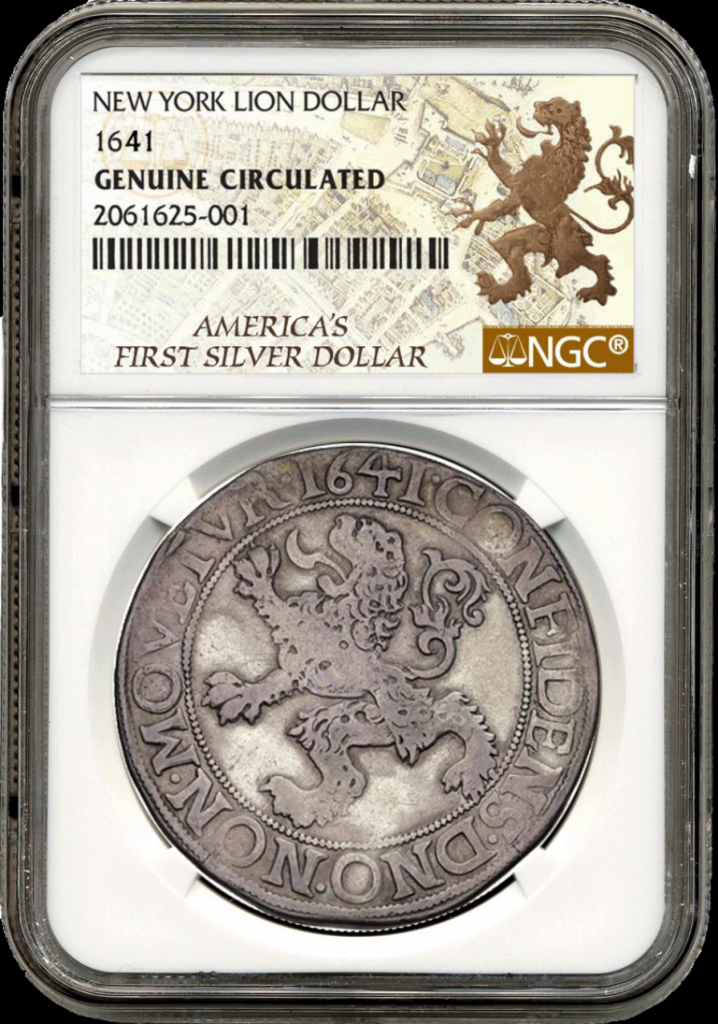

Posted on — Leave a commentImagine you are an early settler in the New World. How would you transact daily business? The answer is most likely the New York Lion dollar.

Long before the U.S. ever coined dollars, the Dutch Lion Daalder, affectionately known by collectors as the “Lion Dollar” reigned king.

The New York Lion dollar is America’s first silver dollar. This stunning and important coin holds a special place in Colonial history.

First minted by the Dutch Republic in 1575, the Lion dollar was produced to facilitate international trade. Ultimately, this regal coin represented the silver standard for 17th century world trade.

The lion dollar was widely used around the globe from Europe to Africa, the Middle East and the Orient and soon became the currency of choice in the New World.

The Dutch built colonies and trading outposts around the world in the early 17th century including the New World, eventually which became the United States of America.

When Dutch merchants and adventurers arrived in the New World, they established a colony named New Amsterdam in 1624 at the mouth of the Hudson River on the southern end of Manhattan Island.

You may know it better by its current name — New York!

In order to legitimatize Dutch claims to the New Amsterdam area, the Dutch governor Peter Minuit formally “purchased” the island of Manhattan from the local Indian tribe in 1626. As the legend goes, the Manhattans Indians agreed to give up the island in exchange for trinkets valued at only $24.

New Amsterdam was the capital of the colony of New Netherland until 1664 when it was captured by the British and renamed New York.

Quickly, New York grew to become the global epicenter of finance, the standard for commerce, fashion, and culture and the entry point for Europeans looking for a better life in the New World.

By mid-17th century, merchants, craftsman, shipbuilders, soldiers and even pirates were using these coins to transact everyday business in New York.

This is old money at its best.

The Design

The Lion Dollar is struck in .750 fine silver with the predominant alloy being copper. The obverse features the rampant lion, “King of Beasts”, symbolizing bravery, nobility and royalty. The reverse features an armored knight holding the Dutch coat of arms.

Imagine the sense of history you’ll feel when you hold a stunning and important coin like this in your hand. Where might it have been spent? What were the dreams of the early New Yorkers who used it just as the New World was developing?

The Fall of Cryptocurrency Shows the Value of What’s Real

Posted on — Leave a commentThe party has ended. The promise that cryptocurrency will change finance and perhaps even the structure of our economy has faded. Within 2018 alone, Bitcoin, the most popular cryptocurrency, has lost more than 70% of its value. This dramatic drop has encouraged many to ask if the very concept of cryptocurrency is doomed.

Other cryptocurrencies like Ripple, Ethereum, Litecoin, and EOS have all fallen by double digits, with EOS performing best with “just” a drop of 66% year-to-date. Those who speculated on the rise of these “coins” have nowhere to hide. In fact, 91 of the top 100 traded cryptocurrencies have fallen on a year-to-date basis, most in the double digits. Simply put: when cryptocurrencies fall, they fall hard.

This turmoil among major coin offerings should be taken as a warning as the broader equities market begins to experience its own volatility. Geopolitical angst, rising rates, and unrealistic expectations have all driven share prices down across industries as 2018 looks certain to end in negative territory.

This market downshift is believed by many to portend either extended volatility or muted returns in comparison to what investors have experienced over the last decade.

The time is now for long-term investors to strategize for increased uncertainty.

Research has shown that precious metals like gold have “low correlations with stock index returns.” This finding is especially important as cryptocurrency investors and equity investors alike discover that much of their early enthusiasm was baseless.

Downturns, however, over the long run are inevitable part of investing. What is important is not attempting to buy and sell at the right times. Instead, investors entering this new market should be aware of moves they can make today to offset a faltering equities market.

Data shows that in seven of the eight largest S&P 500 declines, gold had a strong positive performance. Moreover, in three of these instances gold increased in value by double digits. Consider that between early October of 2007, and early March of 2009 when the S&P 500 lost 56.80%, gold earned a return, over the same period, of 25.5%. When the market “corrects” gold is there to help investors seven times out of eight. The inverse relationship between a steep drop in the S&P 500 and a rise in gold has been present in the 19702, 80s, and at three times in the 2000s.

Some will blame recent equity market downturns on the recent interest rate hikes from the Fed. Whether or not this argument is sound, the fact is that gold also performs well during rate increases. Since 1970, gold has risen in value during most of the Fed increases. The increased value of gold during these periods is not strongly correlated to the Fed’s movements. But the data shows that the common notion that Fed rates hikes are bad for gold are misplaced. In fact, the historic correlation between gold prices and Fed hikes is just 28%.

Gold helps ease bumps in the road and we’re headed for a rocky ride.

Fed signals fewer rate hikes in 2019

Posted on — Leave a commentThe winds are changing.

The big news out of Wednesday’s Federal Reserve meeting?

Fewer interest rate hikes are expected in 2019.

Yes. That’s right.

The Fed is almost done raising interest rates. And, that is positive for gold prices.

On Wednesday, the Fed did nudge interest rates higher by 25 basis points to 2.25-2.50%, a widely expected move.

The surprise twist at today’s meeting were hints the Fed would only raise interest rates twice in 2019, not the previously expected three.

How did gold react? Gold Prices soared to a 5-month high on Wednesday, hitting $1,258.80 an ounce, ahead of the Fed meeting.

Gold rallied on Wednesday because day traders started pricing in expectations of the Fed’s shifting gears. Signs of potential weakness in the economy later in 2019, alongside political pressure to stop raising interest rates are gold-positive.

Immediately following the Fed meeting, gold prices weakened in the classic “Buy the Rumor, Sell the Fact” type of trading action, as day traders took quick profits on the Fed’s big news. But, that’s just a short-lived pullback.

Bottom line? Wednesday’s news is positive for gold.

Gold is heading higher in 2019. The economy is expected to slow more in 2019 than the Fed previously thought. One major Wall Street firm is already warning the Fed will cut interest rates 3 times in 2020 amid a quick downturn in the economy.

- A new daily rising trend is developing for gold.

- Gold is poised for a run to the $1,300-$1,325.

- Gold price dips are buying opportunities.

Wednesday afternoon’s gold price dip offers an excellent buying opportunity in the new uptrend that formed off the August low around $1,175.

After nearly 10 years of economic growth and stock market gains due to unprecedented fiscal stimulus, the wind is shifting. We are at a key turning point.

Don’t ignore the economic winds. If you haven’t fully diversified and protected your portfolio with tangible assets, act now.

3 Investing Tips for the New Year

Posted on — Leave a commentThe recent stock market collapse has shaken investor confidence. Looking at your retirement portfolio isn’t fun anymore. It’s downright nerve wracking to see how much your 401k balance has eroded just over the past month. Heading into 2019, we outline three investing tips for your consideration.

It’s Time To Play Defense

After 114 months of economic expansion in the U.S. (the second longest in U.S. history), investor’s need to brace for chance. Recent economic growth was boosted and extended in this cycle by the tax cuts signed into law late last year. Also, the government’s budget included new spending which helped propel the economy forward.

Looking ahead, these expensive fiscal boosts to an aging economic cycle will come with a hangover. That hangover is called rising government debt and deficit – and also mean there’s less in the fiscal punch bowl to stimulate the economy once the next recession hits.

If you haven’t pared back on some of your risk assets, like stocks, it’s time to take a look at your portfolio and play defense.

One of the best proven ways to protect your portfolio is diversification into gold. Buying and holding up to 15% of your portfolio in physical gold is a proven method to improve total portfolio performance during hard times. When stocks fall, the price of gold rises – usually significantly. Gold has been a store of wealth for centuries. It’s time now to protect a portion of your asset in gold. Stop watching your 401k balance go down. Owning gold can offset those losses.

Consider Diversification Into Rare Coins

If you have a long term time horizon, some of the most significant price appreciation in the tangible asset arena usually occurs in the rare coin sector. The key to success is to purchase the highest quality coins you can afford. Just like in real estate where the mantra is location, location, location. In rare coin investing, its rarity, rarity, rarity. When you combine quality, with rarity the outcome can be quite financially rewarding.

Time for Your Quarterly Portfolio Review and Rebalancing

Once a quarter, or at least once a year, it is smart to review your overall portfolio. Here’s some items to analyze your assets.

- How much are you saving each month? Is it enough to reach your long-term financial goals?

- How much debt do you have – and what kind of debt is it? Financial pros say there are 2 kinds of debt – “good” debt – like mortgages, student loans or perhaps even business loans. These types of debt allow you to potentially build wealth over time through home ownership, or an educational degree that can open the door to higher lifetime income, or a business that could take off and allow you to be your own boss. Then, there’s “bad” debt, typically considered to be high interest credit card debt. If you are carrying high interest debt, it’s time to make a plan to pay that down in 2019.

- How are your portfolio assets diversified? There is a typical rule of thumb to take your age, minus it from 100 and that is the amount of money that you may want to invest in the stock market. The remainder should be invested in safe assets, like physical gold, or a mix of gold and fixed income bond investments. So, if you are 50, – you may be okay investing up to 50% of your portfolio in the stock market. The rest? Make sure you diversify into other assets like physical gold that will act to stabilize and improve portfolio performance over time.

Make 2019 your best financial year ever! Follow our three investing tips and get started today.

Read More

5 Reasons Gold Can Rally In 2019

Barron’s Cover Story: Why Gold Should Be Part of Your Portfolio

1973-1974 Aluminum Lincoln Penny

Posted on — 29 CommentsHow do you run a successful business? You make sure that costs don’t exceed revenues. However, in a 2014 biennial report to Congress, the U.S. Mint explained that it takes 8.04 cents to make a nickel and 1.66 cents to make a penny. This imbalance between manufacturing costs and face value is a problem.

This challenge is not new. In 1973 the U.S. Mint had the same problem. They decided to explore solutions. The prevailing idea was to make pennies from aluminum. Specifically, they intended to make them from an alloy of aluminum and trace metals. This approach would replace the copper-zinc composition in the traditional one-cent coin.

Rising copper costs made the traditional 1973 penny nearly equal in cost to its face value. This brought the topic of seigniorage into the fold. Seigniorage is a word used to describe the difference between the face value of a piece of currency and the cost to manufacture and distribute the money. To avoid a model in which costs exceed face value, the U.S. Mint decided on an alloy consisting of 96% aluminum. Aluminum was less expensive, more durable, and resistant to tarnishing. Additionally, aluminum takes less of a toll on the die used to mint coins which also brought manufacturing costs down.

The U.S. Mint went forward with their plan. They minted more than 1.5 million new aluminum Lincoln pennies in 1973 for intended release in 1974. Opposition to the plan, however, was immediate. Leadership in the copper industry rebuked efforts to abandoned the metal. Moreover, those in the vending machine industry became vocal about their concerns over the ability of machines to function with aluminum coins. There was an additional problem to all of this that no one foresaw: radiodensity.

Radiodensity is the inability of kinds of electromagnetic radiation to pass through a material. That is, pediatric radiologists cited the aluminum coins as a risk because they would be difficult to locate in an X-ray scan. An aluminum coin might be undetectable if a child ingested one. The coin might appear indistinguishable from human tissue on the images.

In time, the cost of copper declined. This, coupled with the growing voice of aluminum detractors left the initiative dead. The U.S. Mint recalled the aluminum coins. However, a small portioned were never returned, probably totalling 12 to 14 coins. These rare 1973 and 1974 aluminum pennies have remained hidden and unsold, therefore their value remains obscure.

However, in early 2014 a San Diego resident claimed to own a 1974-D aluminum coin. The “D” signifies that it was minted in Denver. The owner’s father was once a deputy superintendent of the Denver Mint. Some initial estimates put the value of the piece at $250,000 with some suggesting that the value could reach as high as $2 million.

Later that year PCGS certified the coin as authentic. The owner planned to auction the piece. At the same time the U.S. Mint requested that the owner return the coin. The issue went before a judge who “it is plausible that a Mint official, with proper authority and in an authorized manner, allowed Harry Lawrence to keep the 1974-D aluminum cent.”

Despite the ruling, the owner returned the coin to the U.S. Mint and the 1974 aluminum Lincoln penny remains a footnote in the history of the U.S. Mint.

5 Reasons Gold Can Rally In 2019

Posted on — Leave a commentThe gold market surged higher last week, hitting its highest level since mid-July.

Is this the start of a new rally phase in gold? The reasons to be bullish on gold are stacking up fast. Here are five:

- Global gold production growth has declined in recent years

Gold output in key producing countries, such as Australia and Peru, is set to slump to generational lows, according to S&P’s Gold Pipeline report. This is basic economics; less supply and growing demand will lead to higher prices.

Looking ahead, S&P forecasts a 9% fall in gold production for Australia in 2020, and expects the country’s production to reach a generational low of 6.8 million ounces by 2022. That is a 33% drop in only three years. Peruvian production is also expected to decline the most by 2022 — by a significant 1.9 million ounces. Notably, no new gold mines have begun production in the country since the start of 2017, according to mining.com.

- Emerging market consumer demand

China and India comprise over half the consumer demand for physical gold. Looking into 2019, the World Gold Council forecasts solid physical gold buying from these consumers bolstered by good economic growth in these countries.

- Technology demand for gold continues to grow

Gold is the preferred metal for a variety of electronics applications. Gold, for example, is used in “contacts” on semi-conductors which enable your smart phone to be smart. Copper and silver are also conductive metals and have been used as replacements, but both of those surfaces oxidize. Gold does not. Smart phones become more advanced with every new generation. Every new release involves new complexity, including facial recognition, wireless charging, and infrared sensors. All these tasks require advanced semiconductors. This means that, despite the costs, manufacturers are turning to gold for both bonding wire and contacts to ensure they work properly.

- Stock market volatility

The stock market volatility we witnessed last month is expected to heighten as we move into 2019 amid concerns over the aging economic cycle. Gold outperforms other asset classes when hard times come, and typically rises when paper assets like stocks crash.

- The U.S. dollar

Typically, gold and the U.S. dollar trade in an inverse relationship. That means when the dollar goes up, gold goes down and vice versa. Heading into 2019, expectations are for a weaker U.S. dollar, which is gold bullish.

Read More

How Rising Interest Rates Impact Your Wallet

2 Reasons This Is A Once In A Generation Opportunity To Buy Gold

Robbing Peter to Pay Paul, Then Robbing Paul

Posted on — Leave a commentEver whistled a tune? If so, then congratulations, you’ve committed to something for a longer period than the average hold time for a stock investment.

“Take any stock in the United States. The average time in which you hold a stock is – it’s gone up from 20 seconds to 22 seconds in the last year,” explains Michael Hudson, a former Wall Street economist at Chase Manhattan Bank.

Buy-and-hold might be a winning strategy, but for most, it’s not the one favored. Instead, investors move their money from one place to the next like robbing Peter to pay Paul, then robbing Paul. Each move incurs fees, and often losses.

This life-sized game of hot potato isn’t limited to just equities. Hudson continues, “The average foreign currency investment lasts – it’s up now to 30 seconds, up from 28 seconds last month.”

We see a trend towards brevity elsewhere. For example, the “average job tenure steadily declined, from 9.2 years in 1983 to 8.6 years in 1998,” according to research.

Much of the declining holding period for stocks is explained by high-frequency trading (HFT) which accounts for 70 percent of all equities trading. Moreover, “fundamental discretionary traders” – people who logon and make a trade like an ordinary human – only account for about 10 percent of all trades according to research from JPMorgan. Simply put, the wild swings seen in recent market activity has more to do with machine than man.

But the fact remains: man made those machines. Therefore, their high-frequency trades reflect our incessant need to change our minds, often at our peril.

This “flash dance” is the inherent problem with equities; even the most stalwart buy-and-hold investors suffer at the hands of faceless machines.

Is an investment in gold any different?

The answer is yes. Gold is, in fact, different. Researcher Joerg Picard wanted to understand what trades are most directly responsible for steering gold’s price. He examined the market and learned that ETF gold trades, which can be traded as easily as HFT equities, “do not contribute much to price discovery.” This finding illustrates why gold is a stable investment. It’s not subject to the violent convulsions of the HFT world that have come to dominate the markets.

Curious investors can take a look at the CBOE Gold Volatility Index (GVZ) over any period and see how rarely the metal gets spooked. However, looking at the same chart for equities (VIX) often called the “Fear Index” presents an entirely different picture. The bottom line: the equities market, as we’re seeing today, is highly emotional. Gold, however, enjoys more stability as if its weight is keeping it secured to the ground.

Meanwhile, the wild ride for equities will continue. As the global head of quantitative and derivatives research at JPMorgan remarked, “big data strategies are increasingly challenging traditional fundamental investing and will be a catalyst for changes in the years to come.”