A Stir in China: Rising Demand for Gold

Posted on — Leave a commentIn recent months something has reinvigorated China’s demand for gold. In fact, 2017 was the first year since 2013 in which China experienced a growth in jewelry demand. This increase marks a reversal of a worrisome trend that began just a few years ago.

Recently, the World Gold Council reported that demand for gold in China shrank by one-third between 2013 and 2016. What precipitated this drop? Decreasing gold prices drove accelerated buying. However, this fervor led to an over supply. Stores appeared everywhere. Merchandise piled up. This trend gave rise to price wars in which purchases fell with each year representing less than the one before. Despite the signs of a classic supply and demand problem, there was another underlying culprit to the downfall.

Too many sellers mistakenly believed that consumers only wanted gold jewelry for its valuable metal. Retailers accepted consumers as a purely pragmatic group. As sales dropped, merchants were forced to rethink their assumptions. They began understand that consumers want style. In time, retailers began to offer a wider array of gold products thereby appealing to the consumer’s aesthetic leanings.

This concept makes intuitive sense. Increasingly, China’s economy is driven by middle-class consumers. This group is seeking luxury goods. As more people enter the middle class the demographic is changing. More younger consumers populate this tier than ever before. This change means that sellers have had to expand beyond traditional 24ct products which appeal more to an older demographic.

Younger buyers want 18ct and 22ct gold which is considered, in China, more fashionable and is also more affordable. These lower ct offerings give the jewelry a distinct color that is more in keeping with younger tastes. This diverse product selection is the ultimate win-win. As the World Gold Council explains, “these products offer fatter profits for retailers. 24ct jewelry is usually sold by weight, with slim margins. K-gold is sold by piece, which allows the retailer to boost profit margins.”

Technology has also entered the picture. Makers now have the capability to use a chemical process to manufacture “3D” gold which is up to four times harder than 24ct gold while using only one-third of the amount of gold found in a traditional piece of jewelry that is the same size. Manufacturers and artists have designed new pieces that resonate with the growing consumer base.

Retailers are wise to react swiftly to changing times. Research shows that more than three-quarters of the urban population in China is expected to be middle-class by as soon as 2022. Consider that in 2000 only 4 percent of the urban population was middle class. These new households have greater income and more disposable wealth. Not surprisingly, spending from this group is projected to increase by 9 percent per year through 2020.

These figures illustrate opportunities not only for gold sales in China, but also for gold investors in the U.S. As demand increases, prices will rise and investors will be poised to capitalize on the rising tide.

What the Emerging Global Middle Class Means for Gold

Posted on — Leave a commentTo understand the future of gold you need to look at where the action is, and experts agree, the action is in emerging economies. Emerging markets are important when forecasting gold demand because these are the regions positioned to see the greatest population growth over the next decades. Research from Brookings projects that within the next 17 years, approximately 170 million people will enter the middle class every year.

The World Gold Council (WGC) suggests that the engine of this growth will be technological growth, institutional reform and organizational changes. People lead this change; therefore, demographic shifts will be critical to spurring the innovation necessary to deliver on these bold population forecasts. For example, the WGC expects the share of citizens to be of working age in Africa will rise from 13% to 40% by 2100 making the country a dominant player on the world stage. Interestingly, these projections don’t reflect the popular belief that China’s status as an economic powerhouse will continue unabated. In fact, they expect the country’s economic growth to shrink by 1% per year starting in 2050.

As the middle class grows, purchasing power grows with it. McKinsey expects that annual consumption within emerging economies to reach $30 trillion. The purchasing power of this group will be staggering. McKinsey continues, “As a result, emerging-market consumers will become the dominant force in the global economy. In 15 years’ time, almost 60 percent of the roughly one billion households with earnings greater than $20,000 a year.”

Middle class growth in these countries has implications beyond gold purchases as a status symbol of conspicuous consumption. Governments will likely increase their demand for the metal as technological developments increase. The same body of research shows that China’s commitment to technology will account for 50% of its economic growth by 2030. Gold will continue to be a major component in technological devices like tablet computers and smartphones snapped up by a growing base of voracious consumers. This trend will present an interesting phenomenon in which more people have access to technology which, in turn, gives them greater ability to buy gold.

Additionally, investors in many of these countries will opt to store their household wealth in gold. This choice comes from a long-standing belief that gold is a safer store of wealth than local currency or financial instruments like stocks and bonds. As globalism continues to advance, more citizens are likely to choose gold because it is valued and respected around the world unlike many paper currencies.

Moreover, citizens of developed countries are also likely to opt for gold more than they do today. Why? Because as emerging economies become more established there will be less variance between emerging market and developed market equity funds which will only spur investors to seek diversification in other areas like precious metals.

The emergence of a more populous middle class will be a significant influence over the future of gold and investors who seek to capitalize are starting to invest now.

U.S. Mint Gold Coin Sales Surge By 433% In May

Posted on — Leave a commentGold coin buying turned frenzied in May, as sales of American gold coins skyrocketed by a stunning 433% in May from April, according to U.S. Mint data.

May gold coin sales marked the highest level since 2015, as investors used the lower price levels as an opportunity to increase physical gold ownership, amid a time of rising geopolitical and economic tensions.

In May, the U.S. Mint sold 24,000 ounces of American gold eagle coins, up from 4,500 ounces in April.

- Premiums, or the different between the gold coin and spot gold prices is historically narrow right now, about 1-1.5%. That creates great buying opportunities for investors.

Spot gold prices slid since mid-April, pressured in part by a rising U.S. dollar and an initial jump in the 10-year Treasury yield. However, 10-year rates have slumped sharply in the past few weeks.

3 Reasons Gold May Have Found a Floor

The recent price dip toward the $1,300 an ounce in gold may be bottoming out. Why?

- Chinese and Indian buyers tend to be “price sensitive,” which means they tend to wait for price retreats to buy. The $1,300 an ounce level in gold is viewed as a good buying opportunity, which should attract physical buying from these two gold hungry nations.

- The U.S. dollar is expected to fall back, which in turn, should help gold prices recover. One factor that could weigh on the U.S. dollar are the rising concerns over the economic impact of a Trade War, which could derail expectations for a couple more Federal Reserve interest rate hikes in 2018.

- Increased interest in gold as an inflation hedge.S. inflation data and more importantly future inflation expectations have steadily increased since the start of the year. That increases demand for gold to hedge against the corrosive impact of higher prices on goods and services. Gold typically climbs during periods of rising inflation, which helps to protect purchasing power of one’s assets.

Bottom Line

The swift jump in American Eagle gold coins during May could just be a taste of what’s to come this year. Professional money managers turn to gold during times of economic uncertainty, crisis and rising inflation. The 2018 run toward gold may just be getting started. Is your portfolio fully protected?

What Does Italy Mean for Gold?

Posted on — Leave a commentRecently, gold prices have dropped due to fears surrounding political turmoil arising from Italy. Equity markets around the world have followed this same trend. The trouble began on Sunday when the President of Italy, Sergio Mattarella, blocked the appointment of the finance minister. Mattarella remarked that his decision surrounded “The uncertainty over our position in the euro.”

Concerns are growing as this decision marked the 84th day of Italy without a government. Moreover, the country is drowning is debt which now totals 2.1 trillion euros with more added daily. Historically markets have seen gold prices rise in uncertain times as the urge to retreat to “haven” investments increase. However, each scenario is a little different and as Edward Meir, a consultant at INTL FC Stone explains, “The stronger dollar seems to be offsetting the bullish impact coming out of Europe.” Now, the Euro is falling in value. This drop makes U.S.-traded commodities like gold more expensive for international investors. The one haven investment that’s increasing in value is the U.S. Treasury bond.

Trepidation isn’t limited to Italy. Many investors fear trouble in that country could pervade Europe. Meanwhile, sell-off fears are rising as more investors become less confident in the global political leaders of today. Perhaps this diminished trust is why “Gold has been behaving exceptionally well when measured across various major currencies, and it continues to maintain an uptrend against the U.S. dollar as well,” explained one portfolio manager at Sprott Asset Management.

More voting will likely occur this fall. However, investors aren’t excited about the event. Many fear that the ballots will strengthen the anti-Eurozone mood and ultimately lead to a fracturing of the currency. This outcome would wreak havoc on global financial markets. Equities and many bonds would fall in value as earning potential and confidence in credit worthiness decline.

In such a scenario gold offers a greater likelihood to preserve one’s wealth or even expand it. The problem, however, is more than Italy. Their exit from the Euro would likely precipitate other countries doing the same. Savvy investors might find clues to the future of gold in this scenario with a look to the not-too-distant past.

In the fourth quarter of last year we saw Catalonia’s parliament declare independence. This act was one of defiance in the face of the Spanish government. This event is a useful case study for investors facing Italy’s dilemma because “Catalonia is a small microcosm of the total European situation. But what it represents is the idea of an unstable European Union,” explained Dan Hussey, senior market strategist at RJO Futures in Chicago. Shortly after this move, gold prices increased.

Seasoned investors understand that the only certainty is uncertainty. Italy and Europe is top-of-mind for many at the moment. While this narrative unfolds, others are almost certainly beginning to take shape and in such early stages of development that we don’t see them. For this reason, gold remains an enduring investment that kicks into gear when you need it to.

Beyond Bullion: The Beauty and Allure of Pre-1933 Gold Coins

Posted on — 1 CommentIn 1904, President Theodore Roosevelt was a man on a mission.

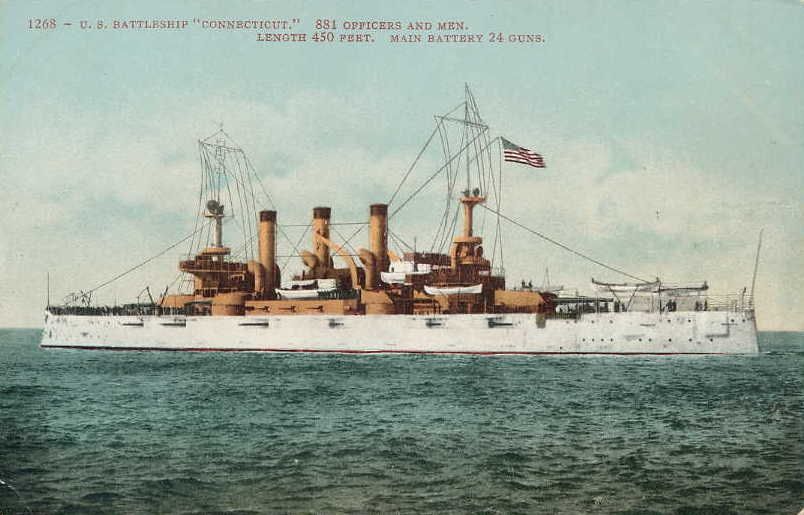

Intent on improving America’s image world-wide, Roosevelt was preparing the United States Navy battle fleet for an ambitious journey around the globe that began in 1907.

Nicknamed the Great White Fleet, 16 U.S. battleships made friendly goodwill visits to numerous nations around the world, while simultaneously showcasing the naval power and might of America.

President Roosevelt, well-schooled in the gorgeous high-relief designs on ancient Greek coins, decided that America needed better coins to represent the country on the world-wide naval tour. Roosevelt aimed to upgrade the coinage that would be utilized on the sea journey.

Roosevelt: U.S. coins are “hideous”

Roosevelt wrote to the Secretary of the Treasury lamenting: “I think the state of our coinage is artistically of atrocious hideousness. Would it be possible, without asking permission of Congress, to employ a man like (Augustus) Saint-Gaudens to give us a coinage which would have some beauty?”

As luck would have it there were five coin series that the President was authorized to change without Congressional approval. One of them was the $20 Gold Double Eagle, a coin actively used in international trade, which made it a perfect choice for the redesign.

Double Eagle history

The Liberty Head double eagle was struck as a pattern coin in 1849 and then for commerce from 1850 through 1907, designed by the Chief Engraver at the Mint for the United States James B. Longacre.

The making of a masterpiece

Augustus Saint-Gaudens, one of America’s greatest sculptors, was a personal friend of President Roosevelt and was receptive to the idea to redesign America’s coins. The two decided the new Double Eagle would feature a beautiful high-relief design with a high rim to protect the features.

The creation of this stunning coin that investors treasure today was not without controversy. The U.S. Mint Engraver Charles E. Barber fought back with concerns the Mint could not create the high-relief design in the quantities needed. While a coin design typically only took one year, this masterpiece took three to create.

Sadly, Saint-Gaudens passed away in 1907, after the designs were finalized for production, but before a coin was struck.

Congress intervenes

After the coins were finally struck, further controversy hit as the design lacked the words: “In God We Trust.” Congress stepped in and required those words be added to the legendary coin.

The Saint-Gaudens Double Eagle coin was minted and used primarily in international trade until 1933. The Double Eagle is just one example of pre-1933 gold coins, but is considered to be one of the most valuable coins of all time.

Gold coins melted down as the Depression hits

The U.S. government halted minting gold coins as a currency in 1933 and recalled coins from circulation.

- Many of those beautiful coins were melted down into bars that are stored in Fort Knox today.

Today’s opportunities

Every pre-1933 gold coin that you’ve ever seen managed to escape the gold coin recall in 1933.

- Because of the low survival rates, pre-1933 gold and silver coins are the most desirable area of the rare coin market.

Beyond bullion: adding pre-1933 gold to your portfolio

The most successful gold investors assemble a diversified and balanced portfolio, including multiple investments including gold bullion and rare numismatics.

- The combination of history, low mintages/survival rates and price appreciation increase the long-term profit potential for pre-1933 gold coins. The fact that many coins of those term were melted set this area of the market up for outsized gains during times of gold price appreciation.

- The $20 Saint Gaudens Liberty Double Eagles are rare in that they mimic the movements of gold bullion. When gold is up, so are $20 Liberty Eagles. Once gold starts a significant run, these coins tend to simultaneously outperform gold prices.

Work with experts you can trust

Not all pre-1933 gold coins are of the same quality. As with all coins, there are significant variations in strike, luster, number and severity of contact marks, and other factors which need to be considered.

Go for the best quality and best dates you can afford. Consult with a numismatic expert at Blanchard today if you are unsure about the best opportunities to meet your financial goals.

Our meticulous coin acquisition is unrivaled, and it reflects the union of our superior business principles and impeccable rare coin selection methods. Call Blanchard today at 1-800-880-4653.

The Next 30 Years in 3 Minutes

Posted on — Leave a commentRecently the World Gold Council released a long, in-depth report offering a dimensional view of gold’s future of the next 30 years. Industry analysts, experts, and engineers gave their perspective on how our changing world will influence the value, use and availability of gold. Here, we distill their findings to the three most critical takeaways so you can get the next 30 years in just 3 minutes.

How Investment Markets Will Drive Gold Valuations

Rick Lacaille, Executive Vice President and Global Chief Investment Officer at State Street Global Advisors suggests that continued demand for gold in countries like India and China will bode well for the asset. Cultural norms in both countries underpin a belief that gold is a safer, more durable store of value than other products like securities. With so many more people seeking to become gold owners it’s likely that gold-backed products like ETFs, notes, and certificates will grow which in turn should boost gold’s value. For this dynamic to playout, however, citizens will need to gain confidence in financial markets. This confidence can only develop with a strong, stable political environment. If this scenario unfolds it may also reduce the volatility seen in gold and silver over the last three decades.

How Mining Will Influence Availability

Mark Fellows, Head of Mine Supply at Metals Focus explains that while gold production has doubled in the last 30 years, that trend will almost certainly not continue. The basis for this assertion: gold production in recent years has become more dispersed. Historically, production was highly concentrated among the big four,” South Africa, the US, Australia and Canada. Now, the big four represent less than 30% of global production as compared to 60% in the late 1980s. These mines will need to work hard to capture their share of the remaining 55,000 tons of in-ground reserves. At today’s rates that amount represents just 15 more years of production. Fellows, however, also points out that approximately 110,000 tons of gold reside in mineral deposits. Getting to this gold will prove difficult. Currently the labor involved in sourcing this gold makes the prospect too expensive. This picture could change if gold prices ascend high enough in price for the economics to work.

Technology’s Role in the Gold Market

Dr Trevor Keel, a consultant for the World Gold Council shares research from Brookings which shows that the middle-class population is poised for explosive growth. Asia will be the hub of much of this expansion. This emergence will ignite spending on technology which relies on gold for bonding wires and connector plates. This trend has implications not only for consumer technologies like computers and smart phones, it also involves healthcare technology which depends on the metal. He cites research from WHO showing that as recently as 2016 more than 300 million gold-containing tests were employed to diagnose malaria in Africa and Asia. Finally, Keel explains how demand for gold will likely grow as clean technologies, namely solar panels, will become more commonplace. Keel explains, “Recent research has even suggested that many major countries could be completely fossil fuel-free by 2050.”

Why Oil Drives Gold Prices

Posted on — Leave a commentUnderstanding the correlation between oil and gold means understanding dollar-denominated assets. Any asset priced in US dollars is a dollar-denominated asset. Both oil and gold are dollar-denominated assets. Therefore, when the value of the US dollar rises, dollar-denominated assets often drop in price. Because both assets share this characteristic, the general ebb and flow of price fluctuations of gold and oil often occur in lockstep. This connection, however, is only part of the picture.

As oil prices rise inflation also rises. Inflation is a scenario in which too much money chasing too few goods. Rising inflation means demand is outpacing supply thereby boosting prices. Oil causes this scenario to unfold because oil is a major economic driver. That is, the economy runs on oil in a literal way. Many products and services require oil. Therefore, as the price of production and transportation increases so to will the end prices of those goods and services. These mechanisms connect to gold because gold tends to increase in value as inflation increases. The result: “there is a clear co-movement between the prices of the two strategic commodities, both in nominal and real terms,” according to research. In fact, even shocks to oil prices can reverberate throughout the gold market. The same research continues, “he signs of instantaneous impact of oil price shocks on gold returns are all identically positive.”

While the data proves the correlation the connection between the two assets makes intuitive sense. In other words, rising oil prices often impede economic growth. Operations become more expensive and profitability drops. As the economy slows other investments, namely equities, tend to also exhibit slow growth. As a result, more investors shift their money into “safe haven” assets like gold.

Perhaps the clearest link between gold and oil is seen in mining operations. Mining for gold is extremely resource-intensive. Industrial machinery, all of which runs on oil, becomes more expensive to use as oil prices rise. In such a scenario, many mines may go off-line or shutdown entirely. Even exploration requires substantial oil resources. We see this relationship playout with other mined resources. Barron’s explains “the correlation between the daily iron ore price and oil price has been 72%.”

Interestingly, with so much of the economy tied to oil, it’s not surprising to learn that “oil is one of the main factors in causing variations in stock prices, exchange rate and gold prices” according to one academic publication. Countries experiencing the strongest economic growth are often the largest drives of immediate surges in oil demand. As a result, it can be argued that, in the short-term, emerging economies can have an outsized influence on near-term gold prices.

These links illustrate the increasingly global nature of investing. Portfolio diversification is becoming more difficult as the factors driving profitability exhibit increasingly equal weight on companies across different industries and sectors. A more connected world is a more complicated world. Consider, for example that “A rise in oil price leads to an augment in inflation rate and this leads to an increase in gold prices as well.” Reaching diversification means understanding the interconnectedness of these factors and holding gold.

Gold Bullion or Rare Coins: Which Is Right For You?

Posted on — Leave a commentPeople gravitate toward gold and rare coin investing and collecting for many reasons. Maybe your father or grandfather collected coins. Or, maybe you are concerned about having too much of your retirement assets invested in the stock market.

No matter what sparked your interest – the numbers back it up. Investing in gold bullion and rare numismatics is a smart portfolio diversification play.

Which is right for you? We break it down here.

Gold Bullion: A Conservative Investment

No matter who you are, how much or how little money you have, gold bullion is smart investment for you. This is a conservative investment with the greatest short-term growth potential.

We believe that gold and silver bullion in physical form is an appropriate asset for a small portion of any properly diversified investment portfolio. How much? Anywhere from 5% to 25% of your total assets could be appropriate for you based on your risk tolerance level.

Hint: the lower your risk tolerance level is (ie. if you don’t want to suffer big swings in your portfolio due to declines in the stock market – increase your exposure to gold coins).

Getting Started

Investing in physical gold is very easy, and any investor can do it and should do it. There are different weights of gold available, so investors can buy coins that are as little as 1/10 of an ounce up to the more standard one ounce coins, in addition to larger bars for investors making a more sizeable investment.

Physical gold is the best way for investors to have long-term exposure to gold because they own the actual commodity – not a paper contract or proxy.

If you are new to gold coin or rare coin investing, start with bullion. Or, increase your exposure to physical gold. You can even save for retirement with physical gold through a self-directed IRA.

Once you’ve built up a comfortable portion of your assets in gold, it’s time to consider rare coins.

Rare Numismatics: An Aggressive Investment

Investing in rare coins, also known as numismatics, has historically produced the highest long-term investor returns. Very limited supply means the price of a rare coin can soar higher at any time.

If you are familiar with stock market sectors, think of gold bullion like utilities or consumer staples. These are dependable investments that create value. Rare coins are like “growth” stocks. Growth companies can see their stock price double or even triple in the course of a year.

Due to the limited supply (the U.S. Mint will never again be able to produce a pre-1933 rare coin, the prices of numismatics tend to appreciate swiftly during periods of crises and also during down markets in stocks and inflationary periods.

Many rare coin investors started out in the sector as a hobby, intrigued by the rich history, beauty and rarity of these historic coins. Soon after, many realized their hobby was a rich source of investment potential as well.

No matter whether you are an investor or a collector, it pays to choose rare coins with a collector’s mentality. That means choose the rarest coin you can afford to buy, in the best condition available. If you can start building “sets” of coins, you could increase the value of your collection to the point where the sum is greater than if the coins were sold off piecemeal.

Are numismatics right for you? This investment requires a longer-term horizon, with a minimum hold time of at least two years.

- Do you have capital that you can tie up for at least two years?

- Do you have risk appetite for potentially huge price gains?

- Are you willing to identify and choose rare coins that will be sought after by collectors in the years ahead to ensure continued value?

- Do you simply love old coins and want to own a piece of history?

If you answered yes to any of these questions then investing in rare coins could be a smart choice for you.

The Bottom Line

Investing in gold bullion makes smart financial sense. Investing in rare coins can be a great longer-term investment. But, numismatics also opens the door history. You can own a rare coin that may have been circulated during the historic, early building-block years of our nation, during the exciting years of the California Gold Rush or the challenging years of the Great Depression. And, rare coins historically have outperformed gold bullion during inflationary periods.

Inflation has been low in recent years. But, Federal Reserve officials recently warned that inflation is rising. If you have been meaning to add gold bullion or rare coins to your portfolio, act now before prices climb higher. Call Blanchard at 1-800-880-4653 to learn what’s moving markets today and how can you profit from tangible assets now and in the years ahead.

Coin Trivia Questions For Collectors: Do You Know The Answer?

Posted on — Leave a commentHere are four new questions to challenge coin collectors in our monthly trivia column. Test your knowledge with this coin collecting quiz. Then, let us know how you did in the comment section below!

- Can you name 4 types of error coins?

Error coins are prized by collectors and are often worth significantly more than the coin that has been minted correctly.

- Multiple strike – This means a coin has at least one additional image after it was struck again off center. The value of the coin increases with the number of strikes.

- Blank planchet – This is a blank disc of metal that was intended for coinage, but never struck with a die.

- Off center – this error occurs when a coin has been struck outside the collar and is not correctly centered and part of the design is missing.

- Defective die – This occurs when the die has cracked and the coin will show a raised metal area or a rim break.

- What was the first coin struck for the United States?

The 1776 Continental Dollar was the first coin pattern struck for the United States and has long captured the imagination and adoration of coin collectors. As the Founding Fathers met in Philadelphia to create the structure for the fledgling country, this coin represented a major step forward toward a new national identity and independence from Great Britain.

Designed in anticipation of a loan of silver bullion from France, this fascinating coin was struck at a standout moment in U.S. history – as the Continental Congress signed the Declaration of Independence on July 4 of that year. The French failed to deliver on the loan, but the Founding Fathers moved forward with minting, just in a smaller numbers. The coins were produced in silver, tin, brass and copper. These coins were meant to support the flailing value of the paper Continental money.

The Design: Benjamin Franklin is believed to have designed the reverse coin. The reverse side of the coin reveals a series of links around the outer edge, which represent a call for unity among the colonies.

Coin experts believe that Elisha Gallaudet of New Jersey designed the obverse, which features a sundial with the Latin legend FUGIO (I fly) and the motto MIND YOUR BUSINESS. The message, historians believe was to remind Americans that “time flies,” so it is important to take care of your business promptly. Wrapped around the outer edges are the words: Continental Currency 1776. One of the die combinations includes a misspelling of currency as CURENCY, while another read CURRENCEY.

One 1776 Continental Currency dollar graded Mint State 63 by Numismatic Guaranty Corp. sold for $1.41 million in 2014. That price tag was nearly three times larger than the previous auction record for a Continental dollar.

- Did the United States Mint ever issue a $100 gold coin?

For years, the Mint considered this but never did until 2017, with the trailblazing release of the American Liberty 225th Anniversary gold coin. This historic and show-stopping $100 gold coin was minted at the U.S. Mint at West Point and features a modern portrait of Lady Liberty.

Prior to that, in the 1870’s, the mint struck two $50 gold pieces following a petition from California businessmen. The 1877 $50 gold piece features a Head of Liberty facing left with a beaded coronet with the words LIBERTY. Thirteen stars surround her head.

Also, the U.S. government did begin minting $100 platinum coins in 1997: American Eagle Platinum Bullion Coins.

- True or False – The Canadian government minted a gold coin that weighs 220 pounds.

True! They call it the “Big Maple Leaf” and it weighs almost 221 pounds. It is made of 99.999 percent pure gold. The Royal Canadian Mint only produced six of these remarkable coins.

In 2017, thieves broke through bulletproof glass at the Berlin Bode Museum and absconded with one of these coins.

Read More from This Series

Attention Coin Collectors: Can You Answer These 4 Questions?

What Place Does Gold Have in Today’s Market?

Posted on — Leave a commentVolatility is surging back into the equities market with a vengeance. Morgan Stanley recently reported that in the first quarter of this year the S&P 500 moved at least 1% on twenty-three different trading days compared to just eight days throughout all of 2017. Increasing interest rates, fears of a trade war, and an undercurrent of geopolitical concerns are all driving this activity. Lately, gold bullion investors are asking “what’s my place in these turbulent markets?” The answer can be found with a look at history.

CFA Russ Koesterich, writing for BlackRock explains that “historically gold has outperformed equities by an even larger magnitude when volatility is rising from an already elevated level.” The research illustrates a compelling picture for bullion investors. Russ continues, “From 1994 to the present using Bloomberg data, during months when the VIX was already above 20 and rose even further, gold outperformed by an average of nearly 5%, beating the S&P 500 roughly 75% of the time.” These findings make intuitive sense; as volatility rises, so do investors’ trepidations about the future. These concerns, in turn, lead those same investors to seek “haven” assets, namely precious metals.

These concerns, however, are not spurred by volatility stemming from politics and shifting trade dynamics alone. Interest rates have always played a significant role. For example, consider that there were eight years between 1974 and 2008 in which U.S. inflation was more than 5%. In these periods, gold increased in value by 14.9% in real times. As a result, gold outperformed stocks, bonds, and other commodities.

Even over a more recent time horizon of March 1997 to May 2009, gold outperformed several other haven investments. Gold generated an annualized real return of 5.9% while the S&P Commodities Index (GSPI), real estate investment trusts (REITs), and US Treasury Inflation-Protected Securities Index (TIPS) each yielded a lesser annualized real return of -0.2%, -3.8%, and 3.7% respectively. Moreover, volatility was higher for all these other asset classes during the period excluding TIPS.

What do these numbers mean for today’s investor? They illustrate the value of gold as a portfolio hedge not only in times of rising rates or even in times characterized by fears of rising rates. These findings remind us that gold has a place in an investor’s portfolio even when rates are low and expected to remain low.

However, the current economic climate portends a different scenario; rates are on the rise and will continue to climb making gold an even more attractive investment.

These rising rates are just another step in the Fed’s long journey from their days of substantial quantitative easing which echoes the tumultuous years of the great recession. In such an environment gold continues to be an effective diversifier without the volatility which incites anxiety.

Too often we think of an investment in gold as a replacement for equities. Many investors shy away from the asset fearing the opportunity cost associated with equities rise especially over the last several years. In truth, gold offers not only a respectable return; it offers protective features other assets cannot. With more rate increases on the horizon, the time to act is now.