A Gold Investor’s Playbook to Survive and Thrive During Market Manias and Bubbles

Posted on — Leave a commentIt’s human nature to want more. It’s also human nature to not want to miss out.

Students of financial markets history are well aware that, going back hundreds of years, market manias or bubbles, occur time and time again. What is a bubble? A bubble is an increase in asset prices based more on emotion than fundamentals. Bubbles form because of human psychology. But, it’s important to point out that bubbles also form because of Federal Reserve money printing, or easy monetary policy – which helps to inflate the bubbles.

Why do bubbles pop? In recent market history – Federal Reserve monetary policy tightening like we are seeing now in 2022 – has caused bubbles to pop. Here are a few examples.

The Nifty Fifty Bubble. A U.S. stock market bubble formed in the mid-1960s led by the so-called “nifty 50,” these were 50 large-cap stocks on the New York Stock Exchange that investors flocked to because of their high returns. For five years up until 1972, the nifty fifty stocks returned nearly 28% per year and over 43% in 1972. That compares to S&P 500 returns averaging about 6.7% for those five years, and a return of just under 19% in 1972.

Why did this bubble pop? The Fed began hiking interest rates aggressively to combat inflation.

U.S. Housing Bubble. During 2001, the Federal Reserve cut interest rates 11 times, pulling the benchmark rate down to 1.75% from 6.00%. This opened the door for one of the greatest housing booms in American history. From 2002 through 2005, housing prices across our nation skyrocketed as homeowners and builders took advantage of ultra-low rates. The housing bubble grew more complex as institutional players got involved with risky and complicated investments based on mortgage-backed securities.

Why did this bubble pop? As the Fed began to hike rates throughout 2005-2007 that deflated the housing market, which only worsened with the 2008 financial crisis.

Cryptocurrency Bubble. The debate is still out on whether the current cryptocurrency market is indeed actually a bubble and we won’t take sides on that issue here. There is still a case to be made for blockchain technology and the future of fintech. However, many cryptocurrency investors in 2022 sustained devastating losses, depending on when they bought into the market. Bitcoin prices are currently hovering around $16,500, that’s down from over $64,000 in November 2021. Like other examples, the Fed raising rates in 2022 has had an impact derailing the massive gains in the crypto market.

U.S. Stock Market. There are many who argued that the broader stock market itself was in a bubble during the multi-year run-up into the January 2022 high – fueled by years of the Fed’s near zero percent interest rate policies. Now, here we are – after six interest rate hikes in 2022, the S&P 500 is down 16% and the NASDAQ composition index is down 29%.

Your Playbook to Surviving Bubble Booms and Busts

Emotions are part of investing. When it comes to bubbles, investors learn a hard lesson about speculation. There’s nothing wrong with speculation. A lucky few can get rich that way. However, when you are speculating you can lose up to 100% of your investment.

The path to long-term wealth building may not be sexy, but it is a proven method, and that includes diversification into non-correlated assets like physical gold and silver. Throughout history, gold has served investors well – acting as a safe-haven investment and store of value. Portfolios that include an allocation of gold perform better than those without. If you want to speculate with a small portion of your portfolio, recognize it for what it is – speculation.

Conversely, when you buy physical gold you are investing in a proven asset that has been a store of value for thousands of years.

Gold remains one of the best-performing asset classes in 2022 – down 5%. Compare that to the 16% decline in the S&P 500, the 29% decline in the NASDAQ composite index, and the 13% decline in the iShares Core U.S. Aggregate Bond ETF (AGG), which tracks the U.S. investment grade bond market.

The Fed isn’t done hiking interest rates. That means the stock market bubble from the past several years isn’t done deflating. Stocks have further fallen and gold has been climbing over the past month. Before the stock bubble pops even more – consider using current market levels to protect your wealth with an increased allocation to gold.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Lessons from History: High Inflation Can Last a Decade

Posted on — Leave a commentIs the inflation crisis over? When the government reported the October consumer price index (CPI) rose by 7.7%, slightly less than expected – the Dow Jones Industrial Average soared 1000 points on the news.

Despite the stock market’s jubilant reaction, the inflation fight is far from over, according to a new research paper.

Consider this.

- Before the October CPI reading, that inflation measure registered 8% or higher for seven consecutive months.

- The annual CPI hit 9.1% in June, marking the largest advance since November 1981.

- Overseas, the British just saw news that U.K. October CPI inflation hit a new 41-year high at 11.1%.

- The Federal Reserve’s inflation target stands at 2%. So, the October CPI is still 5.7% higher than the central bank’s goal.

While the stock market day traders pressed the “Buy” buttons on their online trading platforms the day CPI was released, history shows us that inflation is not that easy to erase.

High Inflation Historically Lasts 10 Years

New research shows that when year-over-year inflation climbs above 8%, like we saw for seven months in 2022, it doesn’t recede quickly, according to a paper from Rob Arnott, Research Affiliates founder and Omid Shakernia, a partner at the firm who leads its multi-asset strategies.

Their research found that inflation above 8% means that inflation tends to accelerate 70% of the time. Using data from 14 advanced economies going back to January 1970, they found the median time it took for those 14 economies to get inflation back down under 3% was 10 years. That’s right a full decade.

Don’t expect inflation to just quietly go away in 2023.

Inflation is now broad based across both goods and services in our economy. Once consumers are paying higher prices for these items and services, companies don’t just cut their prices. Why would they? Higher prices are more profitable for the companies. Giant corporations are now making record profits on the heels of increasing prices.

Here’s what CEOs have said recently on their earning calls.

Kroger CEO: We view a little bit of inflation as always good in our business, and we would expect to be able to pass that through.

AutoZone CEO: And as I’ve said before, you know, inflation has been a little bit of our friend in terms of what we see in terms of retail pricing.

Hostess CEO: We’re also seeing the consumers experience a lot of disruption. And they haven’t fully recognized there were absorbed pricing.

Wages have been rising. This has the potential to keep inflation on an upward trend.

In the second quarter, wages jumped 5.1% annually. Sure, that is below the inflation rate but worker pay is growing at the fastest clip since the data reporting began in 2002.

What does this mean? Economists call this a wage-price spiral. It’s like a feedback loop. A wage-price spiral is when higher prices cause workers to ask for higher wages, which in turn increases costs and pushes prices still higher, setting off a recurring loop of events.

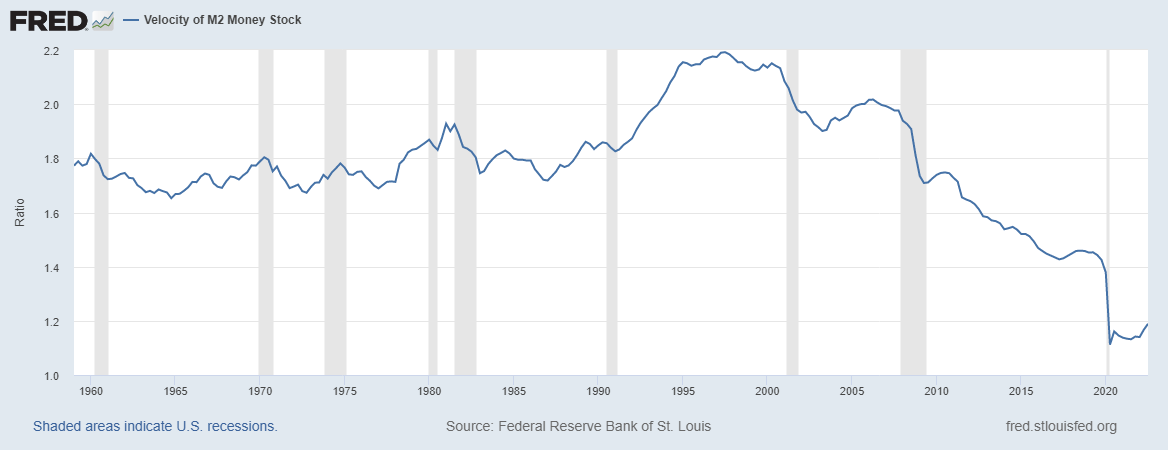

Money velocity is moving higher. After falling for 25 years, money velocity has turned higher.

What is money velocity? Here is how the St. Louis Fed defines it:

“The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.”

“Higher rates usually pushes velocity up as consumers look for opportunities to deploy their cash. Recently, we have seen an acceleration in money velocity. If this continues, inflation might remain elevated even if money supply falls,” Carlo Putti, fixed income investor director at the fund manager M&G told MarketWatch.

What does this means for gold?

History shows us that high inflation is likely here to stay for years. In 1979-1980, inflation was growing out of control and the Fed had simply lost its grip on controlling inflation. Then, gold skyrocketed to about $850 an ounce, equal to more than $3,000 today.

History is now repeating itself. Fed literally sat on its hands during 2021, failing to act, while inflation climbed to 7%, a 39-year high. The central bank is raising rates now – but once inflation gains traction it’s hard to eradicate as history shows.

As the economy slows and inflation remains high, gold historically has been one of the best-performing assets. At Blanchard, we recommend investors allocate 10-15% of their investment portfolios to gold. If you haven’t yet, consider doing it soon.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

5 Very Valuable Key Date Coins

Posted on — 3 CommentsDo you own any key date coins? If you do, you understand the feeling of triumph, pride and excitement of adding a key date coin to your collection. Key date coins are those with a low mintage or with mintages having few survivors, and they are prized in the world of numismatics.

The performance returns of key date coins have historically outpaced gold bullion and other rare coin markets. It comes down to supply and demand. Key date coins are one of the scarcest markets in all of tangible assets. At the same time, they offer all of the intrinsic benefits of gold. While key date gold coins are more expensive than common date rare coins, their excellent historical performance has more than justified the purchase price for countless numismatic investors.

Let’s dive in and explore five of the “rarest of the rare” key date coins in the numismatic world.

1907 $10 Rolled Edge Indian Head

The United States Mint struck Indian Head Eagles — a $10 gold piece — regularly from 1907 until 1916, and then irregularly until 1933. However, numismatists covet the 1907 $10 Rolled Edge key date of this spectacular series.

The obverse and reverse were designed by Augustus Saint-Gaudens, considered by many to be the greatest modern sculptor known today.

The Rolled Edge variety was actually struck in rather large quantities for circulation, but they were melted before ever being released to the public. The surviving examples are mostly high quality and were either saved as assay pieces or obtained directly from the Mint prior to the decision to melt the issue.

Experts believe that a mere 40 to 45 specimens exist today. Owning one of these coins would be a treasured highlight for any numismatic’s’ collection.

1861-S Paquet $20 Liberty Head

The 1861-S Paquet $20 Liberty Head coin exists today because of slow communication between Philadelphia and San Francisco that year. As the story goes, Anthony C. Paquet, assistant U.S. Mint engraver made a new design for the $20 Coronet Liberty Double Eagles. However, it was determined that his new design (tall lettering and a very narrow rim) wouldn’t wear well.

A telegraph was sent to the San Francisco Mint ordering a return to the James Barton Longacre style. Apparently, the telegraph was not transmitted quickly.

By the time the news reached the San Francisco mint, $385,000 worth of the new reverse 1861-S Double Eagles had been struck and released into circulation!

The 1861-S Paquet key date is truly the rarest Liberty Head Double Eagle produced by the San Francisco Mint. It would indeed be an incredible achievement to add one of these coins to your collection.

1889-CC Morgan Dollar

This key date coin can in part be attributed to the presidency of Democrat Grover Cleveland. President Cleveland strongly opposed the coinage of silver dollars, and in 1885 the Carson City Mint was closed for coinage operations.

The Carson City Mint received a new lease on life with the election of Republican Benjamin Harrison as president at the end of 1888. When the Mint reopened in the third quarter of 1889, crews had to clean the offices and machinery before production could begin. As a result, the Mint only had time to produce 350,000 coins in 1889, and all of these coins came out in the last three months of the year. The 1889-CC Morgan dollar was one of the lower mintage issues of the entire series.

To make these coins even scarcer, an estimated 250,000 to 325,000 1889-CC Morgan Silver Dollars were melted — for reasons that are unclear today. While the mystery remains, that ensured the 1889-CC Morgan is a key date for any Morgan Dollar collector.

1916-D Winged Liberty Dime

Commonly known as the Mercury dime, the Winged Liberty Head dime is one of the most popular U.S. coins in numismatic history. How shall we put it? The dime was not one of the Denver Mint’s priority denominations — and so begins the story of how this key date coin emerged.

In late November 1916, the Denver Mint received a large rush order for 4,000,000 Barber quarters. In order to meet that order, the Denver Mint immediately halted the production of dimes. At that time, only 264,000 Mercury dimes had been struck.

Thus, a legendary key date issue was born. These few coins were primarily distributed in Montana and the Upper Midwest that November. At that time, there were not many active coin collectors in that geographic region, which meant most survivors saw extensive circulation before they were found by numismatics.

The very significant 1916-D Mercury Dime specimen is highly sought after and would be a standout achievement for any investor to add to their personal collection.

1916 Standing Liberty Quarter Dollar

The 1916 Standing Liberty Quarter Dollar boasts one of the lowest mintages of any coin struck for circulation during the 20th century.

The 1916 Standing Liberty Quarter is the first issue in the series. These coins were not produced until the last two weeks of 1916 and were released in January 1917. The mintage is extremely low — only 52,000 coins, making this issue the lowest mintage by far in the Standing Liberty Quarter and the key date.

Today? It is estimated that only 500 specimens remain in grade 60 or higher, with a mere 50 in grades 65 or better.

The Bottom Line

Key dates are often a focus for advanced rare coin investors. They seldom surface in the marketplace and when they do, they don’t stay on offer for long. Demand is always strong for these legendary key date coins.

Do you have a key date coin? Are you looking for a key date coin? Contact the numismatic experts at Blanchard!

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Silver Jumps As Metal Held in London Vaults Sinks to Record Low

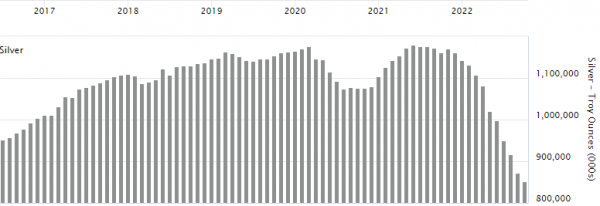

Posted on — 1 CommentThe price of silver jumped to a 4-month high this week fueled by massive investor demand for the metal. This investor demand for silver is now draining  the London vaults of their silver holdings – which fell to a record low in October, according to the London Bullion Market Association (LBMA).

the London vaults of their silver holdings – which fell to a record low in October, according to the London Bullion Market Association (LBMA).

In a year where Americans have faced shortages from items like baby formula to certain prescription drugs to gasoline, silver supplies are now running tight.

The amount of silver stored in London vaults slid to 26,502 tonnes of silver, a 2.2% decrease versus previous month and a record low, according to LBMA. That silver is valued at $16.3 billion, which equates to approximately 883,417 silver bars.

=

=

Investors from the U.S. and Germany to India Are Buying Silver

Strong demand is driving the reduction in London silver holdings. “The decline reflected the ongoing strength of coin and bar demand, especially in the key U.S. and German markets,” Philip Newman, the Managing Director of Metals Focus said.

It’s not just the Americans and Germans that are snapping up silver coins and bars this year. In India, silver consumption is forecast to increase by around 80% to a record this year, Bloomberg reported this week.

“Indian October imports appears to have still been sizable, albeit considerably lower than September’s near record high of 1,700t. The lower total for October may reflect the impact on the Indian market of higher rupee prices earlier last month. Our Mumbai team noted that silver demand eased somewhat during Diwali, in contrast to gold, which enjoyed double-digit gains during the festival,” Newman said.

Precious Metals Demand Surges in 2022

Around the globe, investors are turning to both gold and silver as a safe-haven investment in 2022 amid rampant decades-high inflation, rising interest rates and falling stock and bond markets. Gold demand is also rising, with a 28% jump seen in the third quarter, according to the World Gold Council.

The amount of gold stored in London vaults also fell last month. At the end October, the amount of gold held in London vaults stood at 9,308 tonnes, a 1.4% decrease on previous month. That is valued at $490.5 billion, which equates to approximately 744,662 gold bars, the LBMA reported.

The LBMA’s physical metals data includes the holdings of the London commercial vaults and the Bank of England’s gold holdings. The Bank of England does not currently hold silver. These figures provide an important insight into London’s ability to underpin the physical OTC market.

Silver Poised to Move Even Higher

What does this mean for silver prices ahead? “Silver is well positioned to continuing moving higher, underpinned by investor strong coin and bar demand,” said David Zanca. Senior Portfolio Manager at Blanchard. As supplies become tighter, the price will rise.

It’s not just furniture or appliances that have long wait times for delivery today, in India, metals investors are seeing wait times for sourcing the silver move sharply higher, with suppliers taking about 20 days to dispatch an order, Bloomberg reported.

Where Is Silver Heading?

The price of silver climbed to $21.82 on Thursday. The white metal is climbing out of a consolidation and basing phase that unfolded in recent months, which confirms a strong bottom in place. Looking higher, the first target for silver lies at $22.50 area with the $26.50 and $27.50 levels as a major multi-month objectives.

Supplies of silver have been getting tighter in recent months, which will continue to support higher prices as investors seek safety from the double-digital declines in paper assets seen in stock and bond markets this year.

This sharp drawdown in silver stocks reveals the on-going shortage economy Americans are navigating through today. Precious metals are an investment that acts as a store of value to preserve, protect and grow your wealth and – big and small investors are adding coins and bars to their portfolio. Consider trading some of your dollars, which are losing purchasing power to inflation into American Silver Eagles coins or Silver bars today.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Cashing In On Controversy: The Strange History of the 1909-S VDB Lincoln Cent

Posted on — 8 CommentsNever before have three little letters meant so much.

The 1909 Lincoln cent – designed to replace the Indian Head penny – was welcomed by Americans with enthusiasm, before quickly being discontinued due to one small detail.

Then President Theodore Roosevelt believed that US coins needed new imagery that would inspire Americans. At this same time, he found himself intrigued with the work of Lithuanian-born artist, Victor David Brenner. While meeting with the artist to have his portrait painted Roosevelt noticed Brenner’s relief sculpture of Lincoln and was instantly impressed.

He was not only taken with the quality of the work but also the subject. Roosevelt had long revered Lincoln and considered him a hero. Around this time Roosevelt got the idea to design a new penny showing Lincoln in Brenner’s style. The timing was perfect as Lincoln’s 100th birthday was approaching. This would be the first everyday US coin to feature a person who existed.

By August of 1909 the coin was ready to be released to an eager American public. Long lines formed as enthusiastic collectors waited for their turn to buy the coin. Part of this excitement may have come from pent-up demand as the pennies were to be released in June, but then were delayed when President Taft demanded that the words “In God We Trust” be included on the coin above Lincoln’s head. Americans loved the design.

But one man didn’t.

That man was Secretary of the Treasury Franklin MacVeagh. After the coin was released to the public he became aware of one small detail that he didn’t recognize earlier: the artist’s initials, “V.D.B.” appeared at the bottom of the reverse. He didn’t like this decision.

Just four days after the coin was released the Washington Post published an article announcing that the coin was doomed due to this one design element. Soon after, there were reports of Americans rushing to buy more Lincoln pennies because they knew they would soon be unavailable and might grow in value due to scarcity.

The first wave of last-minute buyers were newsboys who were the first to see the announcement. It was not long before the discontinued Lincoln pennies were fetching 25 cents a piece. By November of 1909 all of the minted “V.D.B.” coins were in the possession of the public.

Officials redesigned the dies to omit Brenner’s initials. Eventually the mint reversed this decision and in 1918 they put Brenner’s initials back on the coin. This version placed the letters on the obverse below Lincoln’s shoulder.

In total, the Philadelphia Mint produced 27,995,000 VDB pennies and the San Francisco Mint produced only 484,000 making those in the series particularly valuable.

Today the coin remains a key focus for collectors. As recently as 2019, a VDB penny graded MS67 sold for just over $50,000.

For many, the piece represents more than rarity, it also represents a new era in US coins when the real life figures of the nation’s history were elevated to a new status.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The State of Economy and Gold: U.S. Not Out of the Woods Yet

Posted on — 1 CommentGold has served as money and a store of value for thousands of years and it’s no surprise that demand for gold is rising in the current environment with record high inflation, rising interest rates, climbing U.S. debt levels and the potential for a recession. Indeed, in the first half of 2022, gold demand climbed by 12% year-over-year, according to the World Gold Council.

Let’s take a deeper look at the state of the U.S. economy and what it means for gold ahead.

Housing Market Is Slowing: Spillover Impact

In September, the pace of new single family homes sales tumbled by 10.9%, the Commerce Department reported. Thirty-year mortgage rates more than doubled in 2022 and now stand north of 7%, which is choking off buying interest and slowing home sales.

Why do home sales matter to economic growth? Consider this. When you buy a new home, you also usually buy new furniture, maybe some new appliances and items like lawn mowers and snow blowers, which spills back into the economy and drives economic growth forward. Thus, when the housing market slows, it is a contributor to slower overall economic growth.

- Across the U.S., the National Association of Realtors (NAR) estimates that each home sale at the median generated about $113,000 of economic impact in 2021.

- The NAR estimates that every home sale generates two jobs.

A deteriorating housing market, alongside troubling inflation levels and an aggressive Federal Reserve, place the economy on unsure footing for 2023.

Gross Domestic Product Growth

The latest GDP report revealed that the U.S. economy grew 2.6% in the third quarter, following the second quarter’s negative 0.6% decline. Improving export sales helped fuel the better-than-expected report. However, digging inside the data reveals a mixed view as consumer spending on goods fell for the third straight quarter – which reveals that the record high inflation is taking a toll on American’s everyday spending.

Yes, Inflation Still Rising

New reports on inflation show that prices are still climbing at a brisk pace. The widely watched Personal Consumption Index jumped 6.2% through September, while the U.S. Consumer Price index gained 8.2% in September.

Fed Still On Track to Raise Rates Again

The Federal Reserve already hiked interest rates five times in 2022 and is on track for another super-sized .75 basis point rate hike in early November. While third quarter GDP managed to trend higher, the fourth quarter and 2023 may not be so lucky if the Fed keeps its pedal on pushing rates higher – punishing Americans who are borrowing to buy homes, cars or even those with consumer debt.

Americans are getting hit on multiple fronts with the stock market careening lower, home prices falling and the price of consumer goods at a 40-year high. Inflation is destroying the purchasing power of your wealth and savings, while the value of financial assets including stocks and bonds is falling sharply this year.

What This Means for Gold

Gold demand is expected to remain high in this environment as investors look for safe havens in the current economic storm. While precious metals have slipped slightly lower, gold remains one of the best performing asset classes in 2022.

Peering just around the corner, with inflation stuck at 40-year highs and the potential for a recession looming, the macro situation is ripe for what economists call: “stagflation.”

Gold, it turns out, is the best stagflation performer since 1973 with a 12.8% annualized return, according to a Gold Hub investment update. At Blanchard, we recommend investors allocate 10-15% of their investment portfolios to gold. If you haven’t yet, consider doing it soon.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Central Bank Digital Currency Is Coming: Are You Ready?

Posted on — 2 CommentsCentral bank digital currencies are gaining steam all around the globe. A total of 105 countries are currently exploring a CBDC, and 10 countries have already launched a digital currency, according to the Atlantic Council.

If you are wondering what a Central Bank Digital Currency is and how it’s different from cryptocurrency, like Bitcoin, you aren’t alone.

Here’s a simple definition of a Central Bank Digital Currency: It is a government-regulated and a government sponsored electronic currency which would replace printed paper money.

Central Bank Digital Currencies are backed by the full faith and credit of the government. This differs from cryptocurrency, like Bitcoin, which is decentralized and not issued by or run by a government entity. Simply put, a CBDC is a digital replacement for government paper cash.

Many Governments Are Already Using Digital Currency

China, in fact, began testing its digital currency – the e-yuan – back in 2020. Here’s how the initial Chinese tests worked: Chinese citizens who were invited to try out the electronic yuan received a link they could click on to get a balance of 200 e-yuan – which was then displayed in their bank app.

To spend the money, Chinese citizens scanned a store’s QR code, or gave a QR code to a retailer to scan.

Consider this.

1. The digital currency expired in a few weeks.

2. They could only spend the e-yuan within city limits and at select stores.

The Dark Side of Central Bank Digital Currencies

Can you imagine if your money had an expiration date? And, you could only spend it within certain geographical borders or at specific places?

Digital currency creates the potential to ramp up surveillance of its citizens and also limit how, where, and when you can use your money. Here’s what a few experts say:

“In terms of anonymity, there would not be complete anonymity as there is with bank notes” — Christine Lagarde, European Central Bank, 2022.

“The right to transactional privacy and anonymity is a bedrock of political freedom and democracy, and should not be abandoned as we transition to a permanently digitally connected society.” – Law professor Rohan Grey in 2021 testimony before Congress. “It is not difficult to envisage a future in which political donations, even within the United States, become increasingly subject to censorship and monitoring by those in control over the technological means of payment.”

Yet, major nations are ramping up Central Bank Digital Currency efforts. Of the Group of Seven (G7) economies, the U.S. and U.K. are at the back of pack on CBDC development. The European Central Bank (ECB), meanwhile, has already announced it will launch a digital euro by the middle of this decade.

Another Look at the Privacy Tradeoff

Currently, the Chinese e-yuan program allows “Wallets with lower balance and transaction limits can keep their anonymity, but upgrades to transaction limits require higher identification and know your customer (KYC) standards. For example, to obtain a wallet with a balance limit of 10,000 e-CNY, transaction limits of 2,000 e-CNY per transaction and 5,000 e-CNY per day, customers only need to provide a registered phone number. However, upgrading to higher balance, as well as daily and individual transaction limits, requires ID and banking information,” according to the Atlantic Council.

Taken to an extreme, a CBDC with a digital ID creates the potential for a government to wield total financial and social control of its citizens. Governments could place permissions on what you can buy with your own money, add expiration dates and limits on where you can spend it.

The CBDC also creates a system where every transaction you make is recorded on an electronic ledger that the government owns.

Governments could also just cut you off from your digital money. A government could easily suspend the digital wallets of perceived political enemies or dissidents.

The U.S. Is Working On This Too

The Federal Reserve issued a white paper on CBDC earlier this year and it clearly stated: that any digital currency it issued “would differ materially from cash, which enables anonymous transactions.”

In September 2022, the U.S. Treasury took a big step forward as it recommended exploring the development of a digital dollar. Read the report here.

Wondering what you can do amid this changing landscape?

There is an often overlooked benefit of precious metals investment: Diversification into physical gold and silver offers extreme privacy.

Precious Metals and Rare Coin Ownership is Private

One of the many benefits of diversification into physical precious metals is private wealth accumulation, transactions, and wealth transfer. Gold bullion and rare coins are easily transportable and not tracked by any financial institution or government.

For estate planning purposes, with rare coins and precious metals, you can split your wealth among your heirs evenly, or in whatever proportions you prefer.

When you invest in physical gold, you can store your wealth in a way that is portable, secure, and private – and recognizable and liquid in any country in the world.

The Bottom Line

Advances in digital currency are coming. While you can’t change or stop these developments, when you invest in tangible assets like gold bullion and rare coins you get additional peace of mind that a portion of your assets are private. That can give you flexibility for private transactions, portability, or wealth transfer as needed in the future.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How Gold Might Benefit From Blockchain Technology

Posted on — Leave a commentThe value of Bitcoin has dropped by more than 55% year-to-date. Consequently, many investors have abandoned their hopes of Bitcoin becoming the primary currency in our economy. The digital currency, once heralded as the future of commerce, has failed to become a mainstay of finance since its inception more than a decade ago.

While Bitcoin may be a dream coming to an end it seems that the underlying blockchain technology that powers it has an unexpectedly bright future. More people are turning to digital ledger technology as a solution to challenges outside the world of Bitcoin. Blockchain technology supports practical technologies like smart contracts, decentralized title registry for real estate, and cyber security programs.

Recently, some have even suggested that blockchain technology can solve a problem in the gold industry. The idea is simple: use blockchain technology to track the complete transaction history of gold bars. The purpose of this project is to prevent the circulation of illicit gold.

The plan, titled the “Gold Bar Integrity Programme” is a collaboration between the World Gold Council and the London Bullion Market Association. Officials aim to use blockchain technology to track the place of origin for each bar and the chain of custody which would include information about transporters, exporters, miners, manufacturers, and processors.

The intent of the project is to prevent illegal mining. Such operations usually exist in conflict zones and are executed by criminal gangs. In many cases, these bars are given counterfeit stamps to gain the look of legitimacy.

Brian E. Nelson, the US Treasury Undersecretary for Terrorism and Financial Intelligence, explains that “conflict gold provides the largest source of revenue to armed groups in eastern DRC where they control mines and exploit miners.” Creating a digital ledger which tracks all legally mined gold would likely prevent or dramatically reduce this activity.

Today the plan is still in its early stages. Though the technology is borrowed from the Bitcoin world it will have some key differences. For example, the public will not be able to access information on all gold purchases. Instead, individuals at various stages of the transaction will be able to access the blockchain if given permission.

Many are hopeful that this new system will give gold buyers more confidence in their purchases. If individuals can be certain that they are buying a gold bar that was legally sourced they will have one less hesitation when it comes to investing in the metal. With transparency comes trust.

The blockchain solution is about more than investor trust. It is also about preventing bloodshed. In early 2022, the US Treasury Department placed sanctions on a Belgian businessman and his companies for taking ownership of gold that the US believed was directly tied to armed conflicts in the Democratic Republic of the Congo. Blockchain technology could soon become instrumental in preventing these operations.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Davy Crockett: “You May All Go to Hell and I Will Go to Texas”

Posted on — 2 CommentsThe Texas spirit is legendary. Those schooled in Southern history will recall that “Remember the Alamo!” was the heartfelt cry that lit a fire under Texans and drove them to finally defeat Mexico’s army and enable them to claim their independence as a republic in 1836.

In 1933, during President Franklin Delano Roosevelt’s administration, Congress passed legislation authorizing coinage of silver half dollars “in commemoration of the one hundredth anniversary in 1936 of the independence of Texas, and of the noble and heroic sacrifices of her pioneers, whose revered memory has been an inspiration to her sons and daughters during the past century.” The Texas Centennial half dollar commemorative coin was minted from 1934-1938 in honor of this historic event in the state’s history.

As the Centennial anniversary of Texas’ independence from Mexico approached, its citizens planned a monumental gala, culminating in the 1936 Texas Centennial Exposition at Dallas. A bill passed into law on June 15, 1933 authorized the coining of souvenir half dollars to be sold as part of the centennial observation. Proceeds from the sale of these coins supported the development of a memorial building.

Although Texas later surrendered its hard-fought independence to join the United States of America in 1845, the date: 1836 lives on even today in the hearts of Texans. As author John Steinbeck once quipped: “Texas is a state of mind. Texas is an obsession. Above all, Texas is a nation in every sense of the word.”

Pompeo Coppini, a Texan, designed this remarkable commemorative coin. The obverse features an Eagle perched elegantly on a branch in front of the Lone Star, the symbol of Texas. The top right reveals the words: IN GOD WE TRUST, and on the left: E PLURIBUS UNUM is seen. The words: UNITED STATES OF AMERICA encircle the top while the bottom states: HALF DOLLAR.

On the coin’s reverse a dramatic collage reveals the goddess Victory spreading her wings over the Alamo. The reverse highlights Sam Houston, a general who played a key role in the Texas revolution, to her left, and Stephen F. Austin, known as the Father of Texas, on her right. The Six Flags of Texas soar her head. Below her is seen: REMEMBER THE ALAMO. At top it reads THE TEXAS INDEPENDENCE CENTENNIAL.

Texas is a proud state like no other and this coin celebrates its unique heritage even today. As former President George W. Bush famously said: “Some folks look at me and see a certain swagger, which in Texas is called ‘walking.’”

Blanchard placed a 1937-D Texas Silver Half Commemorative coin recently with a collector. Take a look at this memorable coin here. Rare coin inventory is moving fast in today’s high demand marketplace. If you see a coin that piques your interest, act quickly before it’s gone.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Inflation Still Running Hot: Sept CPI Hits another 40-Year High

Posted on — 1 CommentInflation continues to batter American consumers left and right. And, despite the Federal Reserve’s aggressive interest rate hikes this year, the inflation fire continues to run hot.

Recently, the government reported that consumer prices rose 8.2% in September, versus year ago levels, hitting another 40-year high.

For investors, this means more stock market volatility and also raises the stakes for the Fed going forward. Expect to see large rate hikes continue, which could lead to further economic slowing and recession in early 2023.

What Determines the Inflation Rate?

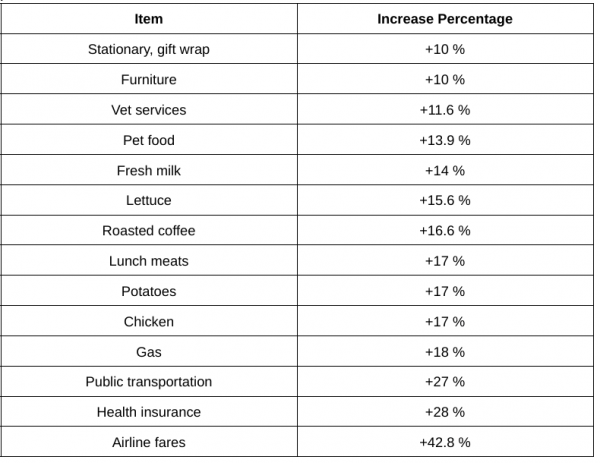

The government tracks a Consumer Price Index basket of 80,000 items. While the official CPI rate is up 8.2% year-over year, many of the items you buy everyday have jumped significantly more. Take a look at the data below – which includes just a selected few items.

Source: Wall Street Journal

Inflation data is going in the wrong direction. We continue to live in extraordinary times.

Inflation and Gold

If you are wondering what you can do, consider the history that gold has as a store of value. While your dollar’s purchasing power is declining as inflation rises, gold has been relied upon for a store of value for 5,000 years.

As the economy grinds slower under the weight of heavy-handed Fed rate hikes, weak economic growth and high inflation forecasts are dominating the macro landscape.

Jamie Dimon, chief executive officer of JPMorgan Chase, expects the U.S. economy to fall into a recession over the next six to nine months. What’s more? Dimon also warned that investors should not be surprised if the S&P 500 drops another 20%.

Is Your Portfolio Prepared for What May Lie Ahead?

It’s time to take another look at gold.

Gold is the best stagflation performer since 1973 with a 12.8% annualized return, according to a Gold Hub investment update.

“Real assets do well during stagflation, with commodities both fueling and feeding off inflation, while gold has tended to benefit from the elevated risk environment, rising inflation, and a lowering of real interest rates. Gold’s strong returns come despite a stronger US dollar typically seen during stagflation,” Gold Hub said.

That’s a track record you can count on in these uncertain times. Do you own enough precious metals?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.