Few Collectors Have Ever Seen This Rarity

Posted on — Leave a commentHave you had a chance to see an 1830 Quarter Eagle? Because the mintage of these great American coins was very small (4,540) and because many were melted down for their gold content, it is estimated that very few remain today.

The Quarter Eagle made its debut in 1796. Of the 10 denominations authorized by Congress in 1792, it was the last to be minted and only in small quantities. When introduced, the quarter eagle had the distinction of being the first precious-metal American coin lacking stars on its obverse.

After 1808, no more Quarter Eagles were minted until 1821. At this time, the Capped Head to the Left type made its appearance.

In 1830, the Mint made significant technological changes. Although the coin design is very much the same, the appearance of the coin is starkly different. This is the first quarter eagle to benefit from use of the Mint’s new closed collar. The collar is a part of the coin press that encircles the planchet to keep metal from flowing outward when struck by the dies. In its early years, the Mint used collars constructed of three pieces. The new closed collar was one piece and looked like a metal cylinder with a hole in it. Not only did this new technology standardize the diameter of coins but also, by being a stable barrier to metal flow, it improved the overall striking quality of coins. Coins now had a much more “finished” appearance. When minting coins with reeded edges, the reeds were engraved into the collar. When dies struck the planchet, reeding was instantly added to the coin, greatly increasing Mint productivity

Mint Director Samuel Moore said that the new closed collar technology created a “mathematical equality” to the coins.

Sadly, there were underlying market forces at work that conspired against the survival rate of these early stunners. This was a time when vast amounts of silver were being placed on world bullion markets. A resulting drop in silver value made gold more valuable. Gold coins of this era were worth more as bullion than as coins. Because of this, most gold coins ended up being either hoarded or exported for melting. This melting reached its peak in 1831, when records indicate a single melt in Paris consumed 40,000 half eagles. Gold coins disappeared from circulation. Finally forced into action, Congress passed the Coinage Act of June 28, 1834 which reduced by 6% the amount of gold in U.S. coins. This new standard would require a new design, which brought an end to the “Early Gold” era.

The survival rate for the 1830 $2.50 Quarter Eagle is low, with an estimated number for all grades being less than 150 coins. This is an inviting and historic early American gold coin that would make an impressive addition to an advanced collector’s cabinet.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Defining a Nation Through the Imagery of the Liberty Cap Half Cent

Posted on — 1 CommentThe US Mint issued their first half cent coin starting in 1793. Minting continued until 1797 at the Philadelphia mint.

Henry Voigt, who served as the Chief Coiner of the first United States Mint, engraved the coin, however, experts are unclear on whether or not he designed the piece. Voigt’s contribution to US currency is just one of his many ventures.

Voigt built steam engines, worked as a clock-maker, and even manufactured mathematical instruments. He was a close friend of Thomas Jefferson, who was a customer of Voigt’s, frequently in need of watch repair.

He also contributed to the design and manufacturing of the first operational steam boat that served in a commercial capacity. Reflecting on Voigt’s contribution, John Fitch, who also designed the commercial steamboat remarked, “He is a man most ready of mechanical improvements of any on earth, and I am persuaded that I never could have completed the steamboat without him.”

His role at the US Mint began in 1791 and by 1793 he oversaw the minting of the Liberty Cap Half Cent. The original obverse design showed the bust of Liberty facing left with flowing hair. Behind her is a pole with a Liberty cap resting on top. Officials decided to reverse this design the following year. Starting in 1794, Liberty faced right and the Liberty pole and cap remained behind her, now on the left side.

The reverse features a wreath with “United States of America” in an arc around the center which reads “Half Cent.”

While Voigt was likely the main contributor to the design, engraver Robert Scot was also involved and engraved the “Liberty Facing right” coin. He served as Chief Engraver at the US Mint from 1793 to 1823. His most famous work is the Draped Bust image which appears on many different US coins. The breadth of his work even expands beyond coinage.

Scot engraved rate stamp dies for every state. He also engraved more than 20 copperplate of various scientific illustrations for Thomas Dobson’s 1788 publication (reprint) Natural Philosophy. Most notably, Scot engraved the Great Seal of the United States in 1782. Today, Scot’s work is visible across nearly every branch of the government.

The Liberty Cap Half Cent is minted from pure copper. The rarest date of the series is 1796. The coin is an unusual opportunity to own part of the nation’s history. The design represents the country’s earliest attempts to define itself through imagery. It is also a reminder of the stark differences between living in the late 1700s and living today; the half cent value had relevance during a time when most working wages were $1 for a 10-hour day.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Silver Demand Forecast to Increase Five Percent in 2022

Posted on — Leave a commentSilver, sometimes known as the poor cousin to gold, due to its lower price per ounce – flexes its muscles mightily for those who choose to invest in it. While silver is a precious, monetary metal that has served as currency for thousands of years, it is also widely used industrial metal powerhouse.

In fact, industrial demand for silver – for use in manufacturing and electronics, accounts for roughly half of all demand for this metal. Other large demand drivers for silver include jewelry, investment and smaller components include photography and silverware.

Increasing industrial demand is a factor behind larger silver demand for 2022. Total silver demand in 2021 hit a 6-year high at 1.05 billion ounces. Rising demand in every single category pushed silver usage higher last year. This year, the outlook for silver demand remains bright, with a 5% increase seen due to industrial fabrication, according to Metals Focus. Meanwhile, the global supply is forecast to rise by 3%.

If you aren’t familiar with some of the many uses for silver in medicine, technology, electronics and more you aren’t alone. They are wide-reaching and new developments are discovered seemingly constantly.

Here’s a quick look at new and growing usages for silver in industrial application, reported in The Silver Institute’s latest Silver News.

Nano silver ink printing delivers higher print resolution. Austin, Texas-based Electroninks developed a particle-free, aerosol jet printing product that is capable of being printed at less than 15-millionth of a meter resolution while most silver nanoparticles are between 1-thousandth and 100-thousandth of a meter in size. The U.S. intelligence community has taken notice of this aerosol ink through a partnership from In-Q-Tel, a group that “invests in cutting-edge technologies to enhance the national security of the United States.”

Has your doctor prescribed a wound-care ointment to you containing silver? Don’t be surprised if they do. “Interest in silver antimicrobial coatings is rising rapidly as healthcare specialists and others seek more efficient and effective ways to tackle the spread of disease, especially in the face of growing resistance brought on by overuse of antibiotic drugs,” wrote Trevor Keel, Technical Director at The Silver Institute. Looking ahead, the global antimicrobial coatings market size is projected to grow from $3.9 billion in 2021 to $6.4 billion by 2026, at a compound annual growth rate (CAGR) of 10.5%, and silver-based antimicrobial coatings are projected to witness the highest CAGR during this period, according to a Research and Markets report.

Scientists are experimenting with how silver can be used in a trio of metals to reduce greenhouse gases. In an effort to mitigate global climate change, scientists are focusing on ways to capture and use carbon dioxide, a contributing factor to greenhouse gases. “The goal is to take carbon dioxide from the atmosphere and turn it into feedstock to produce useful industrial chemicals,” The Silver Institute said. Scientists have found that ethanol production hit maximum levels when a specific ratio of metals involving one atom each of gold and silver combined with five copper atoms were used.

Today’s Silver Price Is Attractive

Silver demand is growing. For long-term investors, today’s silver prices remain attractive at around $22.50 an ounce. Analysts at Bank of America are upbeat on the prospects for silver this year. According to a recent BofA Global Research report, the firm forecasts silver to $30 an ounce. If you are interested in exploring silver investments that could be right for you, learn more here.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Is a Recession Just Around the Corner?

Posted on — Leave a commentThe Federal Reserve raised its key interest rate by half a percentage point on Wednesday – the biggest rate increase in 22 years – as the central bank battles against runaway inflation in the U.S.

The Fed bumped up the Fed Funds rate by half a percentage point to 0.75% and 1% and also announced a reduction in its balance sheet by $95 billion.

The Fed bumped up the Fed Funds rate by half a percentage point to 0.75% and 1% and also announced a reduction in its balance sheet by $95 billion.

Gold climbed following the Fed’s announcement this afternoon, trading at $1,899 per ounce at the time of this writing.

What’s next? The large half-point interest rate hike will quickly ripple through the economy. Americans will face higher interest rates on everything from credit card bills, mortgage rates, auto loans and more.

Why Is the Fed Aggressively Raising Rates Now?

Inflation is robbing senior citizens who live on fixed incomes, and those with savings in the bank, by an outrageous amount, as the Fed stood idly by for many months. The latest consumer prices index (CPI) inflation number hit a shocking 8.5% in March. That number far exceeds the Fed’s stated goal of inflation at 2%.

While the Federal Reserve has been slow to act as inflation hit a 40-year high, the central bank must now play “catch-up” in its fight against skyrocketing consumer prices.

In order to slow down the pace of runaway inflation, the Fed will now be forced to raise interest rates more quickly and in larger increments than previously expected.

Normally, the Fed raises interest rates in smaller quarter point moves (.25) versus today’s half-percentage point (.50).

In its statement on Wednesday, the Federal Open Market Committee pointed to the Russian war in Ukraine as a factor impacting inflation. “The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity,” the Fed said.

What You Need to Know

It will be hard to put the inflation genie back in the bottle. The Federal Reserve is embarking on a journey that the U.S. central bank has never successfully accomplished in the past – trying to move inflation significantly lower without triggering a big uptick in unemployment.

The Fed could cause the economy to crash. While the Fed is aiming for a “soft landing” a “hard landing” for the economy is more likely. In fact, over the past 80 years, the Fed has never lowered inflation as much as it aims to do now (4 percentage points) without creating a recession, the Wall Street Journal reported on Wednesday.

How Gold Protects You Now and in the Future

The S&P 500 is already down 13% this year – officially entering correction territory. With a series of interest rate hikes guaranteed this year, the stock market will remain vulnerable to more declines – and even a crash.

Gold remains a rock-solid tangible asset that investors are turning to in order to protect and grow their wealth in these uncertain times. Research confirms that gold is a non-correlated asset to stocks and, historically, when stocks decline sharply, gold has posted significant gains.

With the threat of recession and further stock market declines on the horizon in 2022, the gold market offers proven portfolio diversification and store of value protection for investors. Wall Street firms like Wells Fargo and Bank of America forecast gold gains toward $2,100 and even $2,175 an ounce this year. That means current levels in gold offers investors an attractive buying opportunity. Have you considered if it’s time to increase your allocation to gold?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

What Do Rising Oil Prices Mean for Gold?

Posted on — Leave a commentThe rising price of oil is a concern for many Americans. The average price of a gallon of gasoline reached an all-time high just weeks ago.

Oil is becoming more expensive for three reasons.

- Demand is rising as the economy continues to return to normal as the country learns to manage COVID.

- The war in Ukraine has altered the supply chain. Energy companies like Shell, BP, and Exxon have all exited their energy deals with Russia. Meanwhile, President Biden has initiated a ban on Russian oil imports.

- US oil producers are still hesitant to expand production. The number of oil rigs in the country has been dropping in recent years as the economics of oil production become less favorable. Getting new rigs built and up to production is time consuming and expensive.

While the reason for rising oil prices seems, clear one question remains: What does this mean for gold prices?

Research from Resources Policy shows that there has been a positive price correlation between the price of oil and the price of gold for more than 80% of the last 50 years. One possible reason for this correlation is uncertainty.

A disruption to the global oil supply tends to be the result of unforeseen events like war, geopolitical tensions, or a recession. During times of uncertainty investors often seek assets that offer a degree of protection from wild swings in investing markets. Gold serves this need because it is often considered a “haven” asset which is less influenced by interest rates, supply chain constraints, and counterparty risks.

Researchers sometimes call this correlation the “spillover effect” which occurs when “a large information shock increases the return correlation not just in the market in question, but also in other markets” according to a publication in Energy Research Letters.

Interestingly, the degree of the spillover effect can intensify during periods. For example, one body of research discovered “more pronounced volatility spillovers across commodity futures markets, including oil and gold, in post-crisis periods, including the global financial crisis…and two European debt crises.”

The research from the publication also shows that oil returns have been more volatile than gold returns which seems to reinforce the notion that gold is effective at preserving wealth during periods of upheaval.

The research also shows that the spillover effect has been more pronounced in the setting of the COVID pandemic.

In aggregate this data is a reminder that investors can mitigate the effects of global uncertainty by allocating a portion of their investable assets to gold. This strategy is likely even more effective when instability impacts the oil market because rising oil prices are so salient. Every American that fills their car with gasoline is aware – on a near daily basis – of the rising price of oil.

The degree and duration of uncertainty in the world is of course not something an investor can control. They can only prepare for it and react to it. Research like this is a reminder that often the best way to do so is with gold.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Wells Fargo on Gold: “We Still Like It”

Posted on — Leave a commentGold is already shining brightly in 2022, compared to other investment asset classes. Yet, new research reports from the Wells Fargo Investment Institute and BofA Global Research reveal that gold has more room to run on the upside.

Let’s take a quick look at recent market performance. Through late April, gold is up 6% year-to-date, while the S&P 500 is down 6%, and the tech-heavy NASDAQ is down over 13%. Ten year Treasury yields nudged up recently as bond prices fell, but still only return a 2.91% yield.

Hands down, gold is performing well this year. But, according to new research, the best may be yet to come for gold and silver.

The Wells Fargo Investment Institute couldn’t be clearer on gold: “We still like it,” John LaForge, head of real asset strategy wrote in an April 18 report to clients.

What does Wells Fargo’s LaForge see as appealing? First, the fundamentals for gold look strong, especially on the supply side, he notes. Historically, when supply drops below the 5-year average (like it is right now), it has been a positive sign for gold prices ahead, opening the door to a multi-year gold price rally.

Second, as equity and fixed-income markets struggle in early 2022, Wells Fargo believes that “investors are actively looking for assets that can add diversification to portfolios.” They name gold as a store-of-value asset at the top of the list. Wells Fargo pegs a 2022 year-end gold price target in the $2,000-$2,100 range.

Analysts at Bank of America are also upbeat on the prospects for gold this year. According to a BofA Global Research report, the firm forecasts gold gains to $2,175 an ounce and silver to $30 an ounce.

What’s more? The recent retreat from above $2,000 offers investors a buying opportunity. “We like longs / buying dips near $1940/50 for tactical trades and if above $1888/oz for medium term trades,” the BofA Global Research report said.

Take a look at where gold is trading now. If you act quickly, there is still time to add to your tangible assets allocation at a price level that provides value and long-term price appreciation.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

When Diversification Disappears

Posted on — 1 CommentDiversification is the first rule investors learn. Spread your investment across a greater number of assets to avoid overexposure to risk in one area. The concept is simple and  intuitive. It is also becoming more difficult to follow.

intuitive. It is also becoming more difficult to follow.

Assets become more correlated as the economy becomes more globalized. This increasing globalization is more apparent than ever as sanctions against Russia take hold. In response, European countries are struggling to find energy alternatives. Simultaneously, countries are bracing themselves for higher food prices as grain from Ukraine becomes scarce.

This setting presents two challenges: First, a lack of resources from any one country is often felt globally. Second, as more countries become reliant on one another more investments tend to move in correlation with one another. This characteristic of today’s economy makes it more difficult for investors to diversify.

The rising correlation of assets is evident in research which points to “a rise of cross-asset correlation between select asset classes.” The research shows “an average correlation increase of 33% between the test periods 1990-2000 and 2006-2016.” This elevated correlation is a problem because, “a significant market event or correction can be compounded by a period of highly correlated assets across integrated financial markets.”

A “significant market event” is becoming more common in the unpredictable environment of today. Since the publication of the research the globe has seen a major pandemic and a war.

As correlation rises investors are struggling to safeguard their portfolio. More investments are beginning to look the same. What happens over here is more likely to happen over there as more businesses become reliant on each other. This conundrum has prompted investors to find diversification by taking a new look at asset classes like gold. This solution, however, leads to another question: What is the right amount of a portfolio to allocate to gold?

Research from State Street in cooperation with the World Gold Council determined that “gold has had low or negative correlation with major equity indices since 2000.” Additionally, their data shows that gold also has a low, or negative correlation to major bond indices.

Their findings also reveal that during nine of the last eleven “black swan” events gold has delivered a positive return. Examples of such events include the 2008 market crash, “Black Monday,” and the flash crash of 2010.

The bottom line is clear: As correlation rises it is becoming more difficult to diversify. Gold offers an important alternative to equities because it is far less reliant on supply chains, interest rate movements, and business operations in other countries.

State Street and the World Gold Council suggest that allocating anywhere from 2% to 10% of a portfolio to gold can improve the Sharpe ratio of the portfolio. The Sharpe ratio is a measurement that enables investors to gauge the risk/return balance of a given investment. Therefore, by holding more gold, investors can improve the risk profile of their total investment strategy.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How Early Commerce Started with Mormon Gold

Posted on — Leave a commentMany people believe the U.S. government was the first organization to mint gold mined in California. In truth, this historical touchstone belongs to Salt Lake City, Utah.

The origin of this story, however, does not begin in Salt Lake City. Instead, it starts in San Diego during the Mexican-American War. This was the destination of the Mormon Battalion. During their march some members of the battalion traveled north and eventually started working for James Marshall at Sutter’s Mill in Coloma, California. During this period the Mormon Battalion members assisted Marshall in discovering gold in early 1848. This find is part of what sparked the California Gold rush.

The origin of this story, however, does not begin in Salt Lake City. Instead, it starts in San Diego during the Mexican-American War. This was the destination of the Mormon Battalion. During their march some members of the battalion traveled north and eventually started working for James Marshall at Sutter’s Mill in Coloma, California. During this period the Mormon Battalion members assisted Marshall in discovering gold in early 1848. This find is part of what sparked the California Gold rush.

In time the Mormon Battalion founded their own mining town called Mormon Island. The location proved to be valuable leading to more gold discoveries.

In time, LDS president Brigham Young, and other officials John Taylor, and John Kay began work on dies to be used in the minting of the gold. By the end of 1848 Mormon members had their first gold coins. These original pieces had the words “Pure Gold” printed on one side and “Holiness of the Lord” on the other.

Eventually, the words “Pure Gold” were replaced with “S.L.C.P.G.” which is an abbreviation for Salt Lake City Pure Gold. These first coins included an image of a Phrygian cap which resembled the design of early coins minted by the US government. Below the cap was a design of the “eye of Jehovah” and a picture of hands shaking which symbolized friendship.

These designs changed over time. In 1860, Mormons minted pieces using gold sourced in Colorado. These coins included images of a lion and a beehive. Part of the reason for these new designs was to help territorial gold collectors identify them as belonging to a different sub type.

There were a total of six different coin designs. The first pieces minted in 1848 were $10 coins and were notated with a 1849 mint year. Other coins with this year were of $2.50, $5, and $20 values.

Other versions were minted in 1850 and 1860. The total number of minted coins was low, estimated to be approximately 4,000 pieces.

By 1861, Utah territory governor Alfred Cumming put an end to the minting of Mormon coins. People quickly found the coins to be wanting, as their weights were often below-grade. The $5.00 coin was estimated to hold only $4.30 in gold. These coins were thus accepted in trade at a discount and many fell victim to the melting pot.

These early coins have given credence to the argument that Brigham Young was a crucial part of developing the coin system that came to define commerce in the early days of the U.S. It is likely that these coins helped spark trade among the early territories and therefore accelerated the development of the country.

These pieces remain rare and are often sought after by collectors. They represent a pioneer spirit, industriousness, and the enduring power of friendship.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

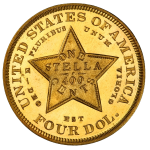

The Star of Any Collection

Posted on — Leave a commentIn the 1870’s, several nations began advocating for the creation of a universal coin that could be used in international trade. The idea gained traction in 1879.

That year, John A. Kasson, the U.S. envoy to Austria-Hungary proposed a U.S. $4 gold coin, which would state its metallic content in the metric system to make it simpler for Europeans to use. The proposed $4 coin would roughly equate to the value of the Spanish 20-peseta, the Italian 20-lire and the British sovereign.

That year, John A. Kasson, the U.S. envoy to Austria-Hungary proposed a U.S. $4 gold coin, which would state its metallic content in the metric system to make it simpler for Europeans to use. The proposed $4 coin would roughly equate to the value of the Spanish 20-peseta, the Italian 20-lire and the British sovereign.

This new coin could facilitate international trade and travel for U.S. citizens, its proponents argued.

Today, that $4 gold coin is reverently known as the Stella and the stories around this coin abound. How did it get its name? The Latin word for star is Stella and the coin features a five-pointed star on its reverse.

This ultra-rarity is beyond the reach of most collectors. Demand for these iconic coins far outstrips supply. On the rare occasions they surface for sale it’s typically from a time-honored, monumental collection of historic U.S. coins. Yet, these pattern coins never were created for circulation. The story continues…

Kassen’s idea intrigued members of Congress and they authorized the U.S. Mint to produce a small run of the $4 gold coins so that Congressman could review them and consider the proposal.

Two obverse designs were produced for the $4 gold piece. Chief Engraver Charles Barber created a design that featured a portrait of Liberty facing left with long, flowing hair on the obverse, known today as the Flowing Hair type. George T. Morgan, the creator of the famous Morgan silver dollars, developed the Coiled Hair type. The reverse of the $4 Stella reveals the motto DEO EST GLORIA, which translates into “God is Glorious.”

These coins are scarce. It is estimated that a mere 425 Flowing Hair coins were minted in 1879, with only 12 known Coiled Hair types from 1879. In 1880, there are only 17 known Flowing Hair types and 8 Coiled Hair.

While the quest for an international coin failed and none of these pattern coins ever became a regular issue, collectors then and for generations have coveted these illustrious and historic coins.

Even then, demand was high for these awe-inspiring coins. Yet, there were also scandals. After the limited run was produced, rumors surrounded the highly sought after Stellas. While it was said that no coin collector could obtain a Stella from the U.S. Mint, the Congressmen who had received the special order apparently used them as gifts and perhaps even payment. It was said that these great works of numismatic art were seen in special necklaces adorning the bosoms of Washington’s top madams, whose brothels were said to be patronized by those same Congressmen.

These coins were produced just over 100 years after America gained its independence to England. Our nation’s economy was growing rapidly and part of America’s historic Gilded Age. Wealthy industrialists and businessmen like John D. Rockefeller, Andrew Carnegie, J.P. Morgan and Cornelius Vanderbilt built storied empires and also contributed greatly to society through their philanthropy. The $4 Stella is a historic gem from this exciting time in American history.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Biden’s Billionaire Tax Aimed at More than Just Billionaires

Posted on — 1 CommentIf you are a successful entrepreneur, small business owner or a high net worth individual who has accumulated wealth through your innovation, hard work and smart investing, the government is coming for you.

The Biden administration rolled out a major tax reform proposal last week called the “Billionaire Minimum Income Tax.” This aggressive proposal would result in a huge tax hit on America’s high-net worth households if enacted, and it’s not just the billionaires who would feel the pain.

When you look at the details of this new tax championed by progressives – it turns out most of the people impacted are multi-millionaires. This extraordinary tax proposal attempts to redefine “wealth” and “income” and ultimately is a new form of taxation on the rich.

New tax proposals like this offer a reminder to all Americans that there are discreet and private methods to protect your wealth through investments in tangible assets like rare coins and bullion. These private precious metals assets can be stored in your home safe, a bank safety deposit box or even outside our country’s borders at a facility like the International Depository Services (IDS) of Canada, a precious metals depository in Toronto. Assets are stored here in an international personal custody account, which is off depository balance sheets and beyond the reach of the U.S. government. But, we’ll discuss this more later…

First…here’s how this new wealth tax would work.

The 20% minimum tax rate would apply to both your ordinary income and the increase of the value of your assets over the past year.

This is an entirely new structure of taxation that taxes your unrealized capital gains.

In today’s tax code, you aren’t taxed until assets are sold and you realize that income. You don’t pay taxes when an asset increases in value! This new tax proposal stretches the actual definition of wealth – and calls “unrealized gains” your income.

Under this new tax scheme, taxpayers would be required to report their assets to the IRS annually. Assets you own would be valued at their market value and that’s the amount you would owe taxes on.

It’s not just stock portfolios, this proposal would include assets including your businesses and real estate holdings. The market value of these non-tradeable assets would be calculated by a “conservative floating annual return” calculated by the five-year Treasury rate plus 2 percentage points.

What about losses in future years? It’s not clear in the current proposal if losses in future years would offset annual gains.

Here’s an example of what that could mean. Perhaps a high-net worth individual might have to pay a $2 million tax on an unrealized gain in 2022 of $10 million. But, then if the assets declined by $10 million in 2023, you are out of luck. The government has their take. You’ve paid taxes on an unrealized gain, which has now disappeared into thin air.

For now, the proposed tax will only apply to households with a net worth of $100 million or more.

Beware, these new taxes always start out applying to a few and then spread wider to impact more and more Americans in other brackets of wealth or income.

This proposed wealth tax has been put forth as a brand new revenue stream that would bring in roughly $360 billion over 10 years.

Gold is an excellent vehicle for the private preservation of wealth.

The tax tide is turning and the government is looking for more ways to tax wealthy Americans. If these proposals become law it is valuable to understand how it will affect you and why it could be useful to increase your allocation to gold and rare coins now before the tax plan passes.

Fortunately, there is time for you to diversify your wealth to get in front of these proposed tax changes to protect your assets.

Gold bullion and rare coins have long been touted by trust attorneys as an efficient and discreet method of transferring wealth from one generation to another. These tax proposals would significantly reduce the wealth you can give to your heirs – as the government will take a much larger portion of you and your family’s money with this unrealized capital gains tax.

If you or your family could be impacted by the proposed shift in the tax law, don’t wait. Contact a Blanchard portfolio manager for a confidential portfolio review – and to learn strategies to protect and preserve your wealth. Read more about options for storing your tangible assets here.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.