Quantitative Easing Expands To Emerging Market Nations

Posted on — Leave a commentIt turns out money printing isn’t just for rich nations any more.

Emerging market countries like Chile, Costa Rica, Croatia, Hungary, Indonesia, Poland, Romania, the Philippines, South Africa and Turkey are taking a page from the developed nation’s monetary policy playbook this year.

In an effort to combat the economic slowdown foisted onto the world by Covid-19, emerging market central banks are playing copycat to the United States by buying bonds of various kinds in a new asset purchase programs, also known as quantitative easing.

What is quantitative easing (QE)?

Quantitative easing, often called money printing, describes an unconventional monetary policy dreamed up by advanced nation central bankers a decade ago – to combat the 2008 global financial crisis.

In November 2008, the U.S. Federal Reserve began quantitative easing – extremely controversial at the time – in an attempt to keep the American economy afloat during the credit crisis meltdown.

Essentially, the Fed expanded its balance sheet (by creating new money) and then began buying bonds with that new money.

The Fed expanded its balance sheet from $870 billion in August 2007 to an all-time record high of $7.21 trillion today. That’s a lot of new money created over the past decade. Several trillion of that occurred in just the past few months as the Fed pledged to do whatever it takes to support the economy during the Covid crisis.

In our largely electronic banking system, the Fed simply adds money to its digital balance sheet and then uses that “money” to buy bonds. This, of course, dramatically increases our nation’s money supply.

Other rich nations like the UK and Japan also instituted these money printing policies back in 2008.

Fast forward to today

Not everyone thinks it is a good idea for emerging markets to join the money printing party.

“I don’t think it is either advisable or necessary for emerging markets to go into QE right now,” said Divvuri Subbarao, governor of the Reserve Bank of India from 2008-2013 told Reuters on May 6. “It is not necessary. They have enough conventional instruments available and they can still cut rates now,” he added. “And also, central banks are taking on a credit risk, and I don’t think emerging market central banks are in a position to take on such a credit risk.”

Our neighbor to the north

The Bank of Canada is also falling back on the ‘quantitative easing’ policy in an attempt to ease recessionary conditions inspired by Covid-19. In April, the Bank of Canada began buying $5 billion of Canadian government bonds each week. Similar to the U.S. Fed stance (whatever it takes), the bank of Canada pledged to continue to do this until the economy recovered.

What’s the big deal?

The 2008 global credit crisis was the first time that central banks got involved in “credit creation” or money printing.

The big concerns by many mainstream economists?

Hyperinflation and people needing wheelbarrows full of money to buy a loaf of bread.

What about gold?

Countries around the world are adding on more government debt and massively expanding their paper money supplies. This is a startling combination of questionable monetary and fiscal policies that leads many economists today to warn that our nation could be close to “monetizing our debt.” That would simply mean that when Congress spends more money, the Federal Reserve prints more money to buy the bonds to fund the deficit spending.

In the midst of this monetary policy shenanigans, the United States remains the world’s largest holder of gold, officially that is.

There are many mainstream policy watchers that believe that China’s official gold holdings are vastly under-reported and that China could indeed hold more gold than the U.S.

For now, all we have are official numbers.

June 2020

Tonnes

- United States 5

- Germany 6

- IMF 0

- Italy 8

- France 0

- Russian Federation 7

- China PR Mainland 3

- Switzerland 0

- Japan 2

- India 0

Source: World Gold Council

Central banks are buying gold in 2020

In the midst of the Covid-inspired money printing frenzy, central banks are buying gold, real money. In the first quarter of 2020, Turkey, Russia, India, UAE, Kazakhstan and Uzbekistan all bought gold.

It’s no surprise that the central banks that can are buying gold.

Why not trade paper money that is becoming increasingly devalued for gold, a tangible asset that can’t be desecrated by a central bank printing press.

In 2020, it’s becoming increasing clear that central bankers around the world have grown bolder since the 2008 global financial crisis.

Quantitative easing is becoming an accepted practice and money printing is spreading to emerging markets as Covid wreaks havoc on the global economy.

But, in the end, will we simply be awash in paper money that has increasingly less and less actual value?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

What is Happening to the Gold Supply Chain?

Posted on — Leave a commentGold prices are often cited as a simple example of how supply and demand works. However, beneath this basic dynamic is something far more complex: the gold supply chain. Supply involves more than just mining yields. It also involves intricacies like recycling operations, transportation, and refinery  activity. In the months following the COVID-19 outbreak, all three of these components have experienced significant shocks.

activity. In the months following the COVID-19 outbreak, all three of these components have experienced significant shocks.

Consider gold recycling, which commonly represents approximately 25% to 30% of the available supply. Of this total, an estimated 90% is considered high-value gold consisting of jewelry. The remaining 10% is industrial recycled gold sourced from electrical components. This portion of the total, while small, has great potential as technology continues to expand its out-sized role in our lives.

Research from the World Gold Council determined that even the high point of gold recycling (2009) captured only 1% of the above ground stock. The 2009 high point represents another characteristic of gold recycling which is that it tends to increase as economic conditions become unfavorable. The global economic crisis was taking its toll in 2009. Another example of this principle can be seen in the late 1990’s Asian Financial crisis which was responsible for a 19% boost in gold recycling.

By this logic, gold recycling should be increasing today given record high unemployment numbers. However, this is not the case. In fact, recycling activity fell to just 4% of the gold supply on a year-over-year basis in the first quarter of 2020. The reason: social distancing and shelter-in-place measures dramatically hindered activity.

Next, let’s look at transportation, which is necessary for moving gold from mining operations to refineries. This part of the supply chain relies on road, air, ship and rail activity. Again, social distancing and government mandated shutdowns put heavy pressure on these areas. Moreover, of the few flights occurring during the pandemic, many were reserved exclusively for medical supply transportation. This disruption has significantly increased the cost of moving gold as the number of commercial flights dropped from approximately 100,000 per day to roughly 30,000 a day.

Finally, refinery operations also experienced a downshift in operations as a direct result of the virus. By the end of March, three of the largest refineries in the world halted all activity in an effort to slow the spread of COVID-19. As the World Gold Council explains, “the consequent reduction in global refining capacity – approximately 1,500t of gold annually – meant that bars and coins could not be produced in the necessary forms as quickly as needed.” Other refineries in Africa and the U.S. also temporarily ceased operations in response to the global health crisis.

These three factors illustrate the complexity underpinning the gold supply/demand dynamic that, on the surface, appears so simple. The value of gold is tied to much more than miners ability to pull it from the ground and the consumer’s appetite. Gold prices hinge on the ability to get the raw material into the hands of buyers. In recent months, that chain has been disrupted. The good news is that easing restrictions are reintroducing activity into recycling, transportation, and refinery activity all of which will favor investors.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Monday Morning Wrap Up – June 8, 2020

Posted on — 1 CommentBig surprise!

The U.S. unemployment rate fell last month as more workers returned to work as the economy began to reopen! No doubt, the jobless rate remains exceedingly high historically. We are still in the double digits. In May, the jobless rate stood at 13.3%, down from 14.7% in April.

6 Key Takeaways as We Head into June

- The worst of the job losses may be behind us. Yet, it could take years for the unemployment rate to fully recover.

- The economy is reopening, with many people eager to return to normalcy. Others remain hesitant about returning to normal activities like air travel and large sporting or entertainment events, which could take time.

- Stocks rebounded strongly off the March low. Future gains could slow as many companies balance sheets were wrecked by the economic shutdown and some firms closed and will never reopen.

- A second Covid wave could hit this summer or in the fall. The thousands of Americans protesting could lead to a summer resurgence of the virus.

- S. – China tensions are bubbling high. This remains an issue that could topple the stock market’s recent exuberance if trade war woes hit high gear again. The stock market remains extremely vulnerable to negative trade related news.

- The U.S. Presidential Election remains a flash point. Social unrest in our country is at the highest level in decades. The U.S. presidential election remains a flashpoint for our country, the economy and the financial markets in a few short months. While the election has taken a backseat to the Covid pandemic, expect this to begin to take over headlines soon.

Digging into the Data

Some U.S. workers returned to work in May as the economy began its cautious reopening last month. Does this mean the worst is behind us? Some say yes. Some say no. We’ll explore the facts here. What do you think?

For perspective, the 13.3% number is still worse than the peak unemployment rate of 10% during the 2008 Great Recession. But, a falling unemployment rate is certainly better than a rising one. This report suggests the economy may be turning a corner.

On Friday, the Labor Department reported that 2.5 million new nonfarm jobs were added to the economy in May. Economists explain that part of that hiring was due to the funds from the Paycheck Protection Program, which requires businesses to rehire their workers in order to convert the loans into grants that don’t need to be repaid.

Market Response

Stocks soared on Friday on the unexpected sliver of good news. Gold and silver fell back modestly. Nonetheless, gold continues to trade at its best levels in eight years, around the $1,680 per ounce level.

The Long Road to Recovery

Does this mean the U.S. economy will storm higher in a “V” shaped recovery? Many are doubtful.

“The country has turned the corner from the pandemic and the recession it created for now, but all the workers who lost their paychecks will find it difficult to regain their place in society as many of these jobs are gone forever,” said Chris Rupkey, Chief Financial Economist at MUFG, a global financial group this week.

“It took years for the economy to grow enough to find jobs for those unemployed in the last recession, and it will take years again this time to do the same. The country is opening up, but the jobs will be slow to return,” Rupkey added.

He’s not alone in this view.

From a cover story of The Wall Street Journal on June 2, headlined “Economy Setback Seen Taking 10 Years to End” – the non-partisan Congressional Budget Office (CBO) predicted that U.S. GDP isn’t expected to return to the previously growth levels until the fourth quarter of 2029.

Stock Surge – Fear of Missing Out

The stock market has taken investors on a wild roller coaster ride in 2020, swinging over 35% lower into the March low.

From the March low, the S&P 500 recouped much of its losses in recent weeks, although the market remains in negative territory for the year. The S&P 500 now stands about 10% below its February all-time high.

Have you been surprised by the stock market’s actions? You aren’t alone.

The recent recovery in the stock market has surprised and perplexed even the most seasoned stock market traders.

The stock market rebound appears to be divorced from the realities of the double digit unemployment rate that means millions of Americans still have no paycheck each week.

Investors drove stocks higher amid expectations that the current economic downturn, while dramatically deep, will be short-lived.

FOMO – or the fear of missing out – helped the market recoup some of its losses in recent weeks as momentum traders and investors jumped on board, regardless of the actual economic fundamental situation in our country.

Many economists warn the “short-lived recession” is an overly optimistic view, as no vaccine has been found yet for the Covid virus and a secondary wave of mass infections could emerge this summer or this fall. There still remain many portions of the population who are hesitant to return to pre-pandemic activities in full force.

Where do you stand? Many are eager to get back to normal, while others remain cautious. We’d love to hear from you in a comment below.

China Tensions Bubbling Up – No More Flights

Last week, stock investors shrugged off the White House’s ban on Chinese airlines, which prevents them from flying into and out of the U.S. The White House retaliated with this restriction following a similar ban issued by the Chinese government. Expect things to get worse, not better.

In May, President Trump contemplated “cutting off the whole relationship,” between the U.S. and China, according to the Wall Street Journal.

The tensions between the world’s two largest economies remain a major issue for the global economy, the markets and our citizens.

Gold Investment Demand Hits Record High

Gold demand hit record high levels in the first five months of 2020, as investors turned to gold as a safe-haven, a hedge and portfolio diversifier in these uncertain times.

Gold backed ETFs added 154 tonnes of gold inflows in May to their coffers. That took global gold ETF holdings to a new all-time high at 3510 t. In just five months, investors bought more than any annual inflow seen before, ever.

The Fed and Gold

- The Federal Reserve meets this week to discuss its monetary policy options. Stay tuned for the latest from the central bank, we will send you an email alert on Wednesday.

Looking back, the Fed’s extraordinary response – major money printing – since the pandemic broke out is one of the major reasons the stock market recovered so quickly. The massive liquidity flow…are there consequences for that ahead? Many say yes…

Indeed, the Fed’s ability to create money is essentially unlimited.

What’s the risk? If “buyers of U.S. government IOUs decide our promises of repayment are worthless, that the creation of so much money removes the trust in the buying power of the dollar. If the world turns against the dollar, which is the key measure of global trade, the Fed’s game is over,” wrote Terry Savage, a registered investment advisor and best-selling author in her The Savage Truth column last month.

The Fed’s blatant disregard for the value of the U.S. dollar is why many investors are turning to the safety and security of gold in these extraordinary times.

Gold remains in the midst of a historic bullish run as investors rush into the safety of physical precious metals.

These are extraordinarily difficult and uncertain times. Our sincere hope is that we will all work together toward a better future. In the midst of this all, we take pride in offering individual investors, just like you, the opportunity to preserve, protect and grow your wealth with tangible assets.

Thank you for your trust.

Best,

David

Monday Morning Wrap Up – June 1, 2020

Posted on — Leave a comment

Welcome to summer. As the Great Lockdown ends and states continue to loosen Covid-19 restrictions, Americans are venturing out to shop, socialize, get their hair cut and eat at outdoor restaurants, tables spaced six feet apart. The U.S. economy is slowing returning to work.

While the reopening is encouraging for the economy, there remain many challenges for customer-facing businesses. This is likely to be a long process as social distancing measures remain in place limiting full capacity of restaurants, hair salons and other in-person businesses.

U.S. – China Tensions Flare

On the global stage, U.S. – China tensions flared last week, which could warn of a hot summer ahead, and we don’t mean the weather.

The latest escalations of friction between the U.S. and China remind us that the global power struggles that faced the world’s two largest superpowers before Covid-19 haven’t gone away.

Gold gained on news last week that China hardened its stance on Hong Kong democracy demonstrators, with a resolution to impose national security laws intended to suppress protests.

The Trump Administration, meanwhile, continues to seek a trade deal with China. The on-going trade talks could limit an American response that could anger China as long as talks continue.

Meanwhile, protests at home cropped up last week…

Nationwide Social Unrest

Protests were seen in 30 U.S. cities last week over the death of George Floyd, a black man, at the hands of a Minnesota police office. At least 25 cities were forced to impose curfews. In Washington D.C. clean up crews worked on Sunday to sweep up broken glass from storefront windows and office buildings and were cleaning graffiti off buildings near the White House.

The Economy and Markets

Over two million additional Americans applied for unemployment benefits last week, bringing the total to an unprecedented 40 million claims over last 10 weeks.

Second quarter U.S. GDP growth is estimated to be an unheard of 40.4% decline, according to the Atlanta Fed’s GDPNow model.

In the midst of this truly devastating economic news, the stock market rallied last week. The S&P 500 closed above its widely-watched 200-day moving average, in another sign of a major disconnect between Wall Street and Main Street.

It is often said the markets are not the economy. And, the economy is not the markets.

That is quite clear.

The market is pricing in perfection – a perfect reopening with a fast-tracked Covid-19 vaccine and a swift return to pre-pandemic activity.

Stock market investors are betting the economy will recover and corporate earnings won’t be far behind. They aren’t taking into consideration the true economic wreckage of 40 million lost jobs in ten weeks and a 40% decline in growth in the second quarter.

Companies can’t make money if people don’t have jobs and can’t spend. Even though the businesses are reopening, they are not at full speed. To think that corporate earnings will rebound to pre-pandemic levels is folly.

Expect to see tough economic numbers over the next several months.

What do we know? History shows us that financial markets overreach. They overreach on the downside and they overreach on the upside. The recent gains in the stock market are just one more overreach in a series of wild of swings that we’ve seen since the start of the year.

It’s All About the Consumer

Even with the reopening, the coronavirus has already had a significant impact on American’s everyday finances, from their paychecks to their spending habits. These trends are likely to stay in place even after the pandemic resolves.

It’s consumer spending that makes our economy go round, with roughly two-thirds of U.S. GDP driven by things you and your neighbors buy. The willingness of Americans to buy at a normal pace will be the key consideration on whether we have a “V” shape economic recovery or a lengthier, “U” shape recovery.

What’s Next?

This Friday, the Labor Department will release the May employment report.

Forecasts are calling for a 20% unemployment rate. That’s right. The unemployment rate in the Great Depression stood at 25%. We aren’t far behind. We’ll let you know how the numbers look and what it means for you, your portfolio and the economy in next week’s report.

The Bottom Line

In 2020, we’ve seen the Fed slash interest rates back to zero, making cash and bonds an unappealing alternative to investors. Make no mistake, gold’s relevance and importance to both global monetary bodies and individual investors is climbing every day.

As we entered 2020, gold was already showing the beginnings of a bull market, or rising market. There is growing evidence that this was indeed the Dawn of a new Bullish Decade for gold, with multiple forecasts for new all-time highs ahead.

New Study Shows Heightened Financial Worries

Over seven in 10 (72%) say the impacts of the COVID-19 pandemic are making Americans rethink how to protect their retirement savings from volatility, according to a new study released by Allianz Life Q2 Quarterly Market Perceptions Study last week. Other findings include:

- 58% of Americans say the economic impacts of COVID-19 are having a negative effect on their financial retirement plans.

- 54% of Americans are worried the market hasn’t bottomed out yet.

In the midst of these financial concerns, gold stands strong, with gains of over 14% since the start of 2020, acting as it has for centuries a safe-haven in the storm and a vehicle to preserve and grow your wealth.

David

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Warren Buffett Silver Trade

Posted on — 1 CommentKnown as the “Oracle of Omaha,” many believe Warren Buffett, Chairman of Berkshire Hathaway Group, to be the greatest investor of all time.

What many investors may not know about Warren Buffett is his big silver buying spree 20 years ago.

From 1997 until 2006, Berkshire Hathaway bought over 37% of the world’s silver supply. A keen value investor, Buffett saw silver’s collapse from $50 an ounce to under $10 an ounce as a buying opportunity. In 1997, Buffett bought 111 million ounces of silver, which equals about 3,500 tons.

Buffett did pretty well on that silver investment. In 1997, his company made $97.4 million (pre-tax) on his silver investment. Here’s what he said to shareholders:

“Our second non-traditional commitment is in silver. Last year, we purchased 111.2 million ounces. Marked to market, that position produced a pre-tax gain of $97.4 million for us in 1997. In a way, this is a return to the past for me: Thirty years ago, I bought silver because I anticipated its demonetization by the U.S. Government. Ever since, I have followed the metal’s fundamentals but not owned it. In recent years, bullion inventories have fallen materially, and last summer Charlie and I concluded that a higher price would be needed to establish equilibrium between supply and demand.” See the 1997 Berkshire Hathaway Letter here.

Fast forward to today.

Silver is outperforming gold in the second quarter, with gains of about 18% just this month.

Silver was shunned early in the Covid-19 crisis as industries around the globe shut their doors, which decreased industrial demand for this useful precious metal. As the lockdown ends, factories are opening their doors. Even more significantly, individual investors are rushing into the silver market as a safe-haven and wealth preservation tool.

The Covid-19 crisis has reshaped fiscal and monetary policy, opening the door to paper currency degradation, inflation, and the monetization of the U.S. government’s debt.

Several decades ago, Warren Buffett saw that silver has inherent value as both a monetary and an industrial metal – the same is true today.

Covid-19 is reshaping our daily lives, the economy, fiscal and monetary policy and the definition of what is money and a store of value. From the beginning of time, gold and silver were used as money. That’s one thing that Covid hasn’t been able to change.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Uncertain Path to the Barber Quarter

Posted on — Leave a commentCharles E. Barber, the sixth Chief Engraver of the United States Mint, set out to design a set of coinage consisting of a new dime, quarter and half dollar. While the coins would ultimately carry his name (“Barber coins”) he decided to invite artists to submit designs for the new pieces. Artists were asked to submit models in low relief for judging. Barber’s guidelines were more stringent than those of previous competitions. He required that each submission feature the lettering to be included on each piece so that he and others could get a sense of the final look of the complete piece.

While the competition was open to the public, Andrew Mason, the superintendent of the New York Assay Office, specifically called on ten artists to submit entries. The list included renowned sculptures and painters like Daniel Chester French, remembered for his 1920 statue of President Lincoln, and Kenyon Cox, known for his multi-disciplinary talents ranging from sketch work to poetry. The winner would receive a $500 cash prize. However, soon after initiating the competition problems surfaced.

The artists invited to compete responded with a list of amendments to the guidelines. They asked that each artist be paid for their submitted work. They also asked that the work be judged by their peers and that each coin would be designed by a single artist to ensure a consistent style within each piece. Finally, the artists requested more time to complete their work. Officials declined these terms. They cited limited funds explaining that they only had enough money to pay one winner.

In the meantime, the judges began receiving entries from the general public. After reviewing each they determined that none were suitable. Officials were disappointed by what they perceived as a lack of artistic talent displayed by the various attempts. Soon after, Barber took it upon himself to complete the design work.

Barber turned to French coinage for inspiration. Following these initial designs, Barber and Mint Director Edward O. Leech had several long communications with each other as they contentiously debated the best look for the coins.

The final design of each denomination shows the head of Liberty with a crown of olive branches. The reverse side of the quarter shows a heraldic eagle with a scroll inscribed with “E Pluribus Unum.” Gripped in the right claw is an olive branch and in the left is a bundle of thirteen arrows. Upon minting, the designs received mixed reviews. In time, changes were necessary, but not as a response to those who were critical of the design. Instead, the design adjustments were for a more practical reason; people complained that the coins would not stack properly.

As a result of the alteration, there is a “Type I” coin and a “Type II” version of the 1892 quarter. In 1900, Barber made additional changes to the quarter resulting in a thinner piece allowing for 21 coins to stack in the space of 20 of the previous version. Barber’s design was used from 1892 to 1916 with the 1901-S quarter remaining a considerable rarity, along with the 1896-S and the 1913-S.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Find Your Territory

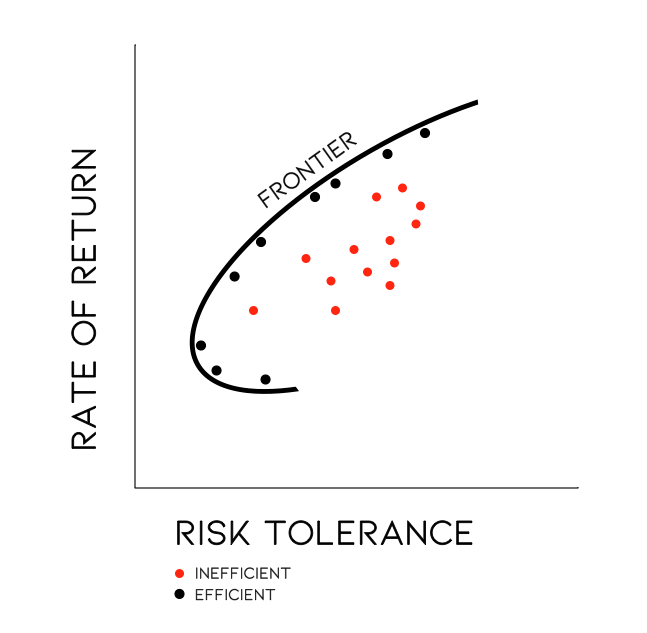

Posted on — Leave a commentAt the end of Mark Twain’s, The Adventures of Huckleberry Finn, the main character tells the reader that he is going to “light out for the territories.” That is, he is going to head out to the great frontier. In this new chapter of history, investors should consider how they will reach the frontier…the efficient frontier.

The efficient frontier is a concept that is part of modern portfolio theory, or MPT. The idea behind modern portfolio theory is that investors must seek the maximum return given the risk profile of their portfolio. The efficient frontier is a tool MPT practitioners use to assess if they are getting the largest possible return based on the level of risk they are taking on. Or, to put it another way, the efficient frontier is a way to ensure you are not taking any additional, unnecessary risk for the investment return you are receiving.

The “frontier” is a curved line that sits on an X, Y axis. The line represents the greatest possible return an investor can earn based of the level of risk represented in their portfolio. It is not possible to construct a portfolio that crosses this boundary. An optimal portfolio resides on the curve because it offers the most return for risk absorbed. If a portfolio sits anywhere below the curve it is “inefficient” because it represents a rate of return that could be increased without adding to the current level of risk. For example, an investor might be receiving a 7% annualized rate of return on a portfolio that exposes the holder to more risk than is necessary to achieve that same return.

This established concept in portfolio management has new resonance today as investors seek to ensure that there is no unnecessary risk in their portfolio given the return they are receiving. For many, rebalancing is necessary for returning to the frontier.

Research shows that gold plays an important part of that rebalance. Consider, the performance of gold in comparison to the S&P 500 during several, historic financial downturns. During the Great Recession, gold returned nearly 50% while the S&P 500 fell by almost the same percentage. In the previous 2002 recession gold gained while the S&P 500 fell. This inverse relationship has appeared many times including Black Monday, the Long-term Capital Management Crisis, and the September 11th terrorist attacks.

The present represents a critical juncture for investors. Over the last decade, many investors have enjoyed equities growth lasting for a historically long period. Over those years, many felt encouraged to overweigh their exposure to equities in what seemed like a “can’t lose” environment propelled, in part, by accommodative monetary policy.

Now, many are awakening to the fact that their portfolio has become a more aggressive play than they intended. As a result, they reside well beneath the frontier. With gold, they can rebalance the risk profile of their portfolio without severely impacting the return they have factored into their long-term plan.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Monday Morning Wrap Up – May 25, 2020

Posted on — 1 CommentHarold Hamm lost more than $3 billion in March.

The self-made billionaire is scrambling to survive the bust in oil prices, which saw New York crude oil trade below $0 a barrel last month. With no college degree, Hamm first hit it big by drilling in an overlooked North Dakota oil field over a decade ago. The coronavirus pandemic tanked global demand for crude oil, another market completely disrupted by the crisis.

While you probably didn’t lose $3 billion in the last few months (we hope), your portfolio is likely still suffering, which reminds us all about the importance of asset allocation and portfolio diversification.

The stock market has rebounded partially off its recent lows. Yet, the S&P 500 index remains down about 9% for the year, which could easily mean thousands of dollars in losses for you, depending on the size of your portfolio.

Speaking of billionaires, legendary hedge fund manager John Paulson, is still betting big on gold right now, CNBC reported last week. This is not surprising. Recent market action has reminded us all about the importance of portfolio diversification and investing in assets like gold and silver that go up when stocks go down.

Gold is one of the best performing asset classes in 2020, up about 13% for the year.

Now, silver is playing catch-up, as we’ve long expected, with a swift rally to almost an $18 an ounce level last week.

In the second quarter, silver climbed 27%, an impressive recovery from the sell-off earlier this year. Investors are piling into silver, amid expectations for a pick-up in industrial demand now that economies around the globe are beginning to reopen.

Looking Back at Last Week

Most of the 50 states have relaxed coronavirus lockdown restrictions. Economists expect a long road to recovery as many people remain cautious about resuming normal activities. Data like TSA airport screening levels and OpenTable restaurant bookings show demand for these services at well below normal levels.

Last week, another 2.4 million Americans filed for unemployment benefits, bringing the total to about 38 million Americans who have lost their jobs since mid-March, a staggering figure.

Existing home sales collapsed 17.8% in April, to a 4.33 million annual rate. No surprise really. Buying a home is a major purchase and it can be a little unsettling to make an offer on a property you have only see through a Zoom video app.

The stock market wasn’t fazed by the steady stream of Depression-like economic figures. The stock market mostly consolidated sideways last week in a wait and see mode. The unprecedented fiscal and monetary policy boosted the market off its lows. From here, however, additional stock market gains will be difficult to achieve as the economy remains mired in a massive slowdown.

There is a long economic recovery ahead. Consumer spending accounts for about two-thirds of the U.S. economy. With millions out of work and millions more hesitant to resume normal activities, the recovery will be slow.

‘Smart Money’ Players Are Buying Gold

Central banks intend to buy more gold this year, according to a new survey from the World Gold Council. Twenty percent say they will increase their gold reserves over the next 12 months, versus only 8% in 2019.

Why? Central banks purchase physical gold for the same reason individuals do – for diversification, liquidity and wealth preservation. Other reasons central banks want to buy more gold include concerns about negative interest rates, gold’s performance during a crisis, and gold’s lack of default risk, the World Gold Council said.

Here’s what Goldman Sachs said about gold two months ago…

“We have long argued that gold is the currency of last resort, acting as a hedge against currency debasement when policy makers act to accommodate shocks such as the one being experienced now,” said analysts at Goldman Sachs led by Jeffrey Currie, as quoted in a MarketWatch article.

The Bottom Line

The coronavirus pandemic is creating a new normal for us in many ways. However, the rules of successful investing have not changed.

This crisis reminds us all about the importance of diversification – especially into tangible assets, like gold, that are not correlated to the stock market. Other rules of investing include, regular rebalancing, understanding your risk tolerance level, defining your investing goals and measuring your success on a quarterly basis.

Wishing you and your loved ones a safe Memorial Day!

David

Who Decides What is Normal?

Posted on — 1 CommentApproximately half of the states in the US are starting to relax social distancing measures. This fractious approach to returning to “normalcy” has become the defining characteristic of the country’s response to COVID-19. Some states are extending aggressive stay-at-home measures. Others never fully embraced them in the first place.

Despite this asymmetry, there appears to be a uniform hesitance among Americans to embrace business as usual. While the government and states can issue formal re-opening declarations, they cannot force people to spend. This divergence is the reason so many expect that the economic recovery will take so long.

Consider survey data published in The Kiplinger Letter, which indicates that half of US consumers will not feel comfortable returning to their normal routines until a vaccine is ready. Such a vaccine will likely require a minimum of one year to develop and distribute, if ever. The same research shows that nearly one-quarter of consumers think that the pandemic will last another six months. Another one-quarter expect current circumstances to last for another year.

These survey findings underscore an important fact about our economy; consumers decide when the recovery begins, not the government. This fact has major implications given that 67% of the US GDP is made up of personal consumption expenditures. In short: until consumers feel safe enough to get back to shopping the economy will have a low pulse.

Equity investors are feeling these effects. Many of the companies included in the S&P 500 require a healthy level of consumer spending. For this reason, they are seeing a decline in share values. At the same time these companies are suspending their dividend payments. A defensive pivot is unlikely for many of these businesses who, like giant oil tankers, are simply too large to change direction and navigate a new course that is less dependent on consumer spending. They, like so many others, will have to make aggressive cost cutting measures and wait out the storm.

Individual investors, however, do not need to wait. They can make moves now. They can choose gold, an asset that is not beholden to the all-important consumer spending that governs our twenty-first century economy. Now it the time for investors to release themselves from the shackles of consumer sentiment.

Even as a recovery does begin to take shape it is unlikely that consumers will return to the spending levels seen before the pandemic. Family budgets will have long since contracted. Lower consumption will be the new normal as Americans become more accustomed to simpler living that involves less shopping. Some have suggested that pent-up demand will unleash a tidal wave of spending. This, however, is unlikely as more people struggle to cover ordinary living expenses in the wake of 20 million job losses in the month of April alone. Today, the unemployment rate is 14.7%, representing the worst figure since 1939. Recoveries happen in inches, not yards.

Forward-thinking investors are taking this opportunity to shore up their investible assets and preserve and even grow their wealth with an investment in gold.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Monday Morning Wrap Up: May 18, 2020

Posted on — Leave a comment

The days are getting longer. The sun is shining brighter. Flowers are blooming. Garden centers are reopening in many part of the country so people can begin their spring planting: seeds, tomato plants, annuals and more. Spring is a time of new beginnings.

We as a country are still mired in a great deal of uncertainty, yet there is so much to be hopeful about. In the midst of the economic distress, tragic health issues and yes the deaths of many Americans, there are green shoots. Take heart. Every day there is something to be grateful for, if you take the time to focus on it.

Vast sums of money are being poured into finding a vaccine for the coronavirus. Many families are spending more quality time with each other than ever before. Those separated geographically are connecting by video visits. While millions of Americans have lost their jobs, millions more are able to telecommute and work from home. This pandemic reminds us how strong we are as a nation, and as individuals.

Week in Review

Retail sales collapsed a record 16.4% in April. Consumer spending fell off a cliff last month as the lockdown kept Americans away from malls, barber shops, furniture stores and restaurants. COVID-19 has stolen the lives of many Americans, and the U.S. economy is also a victim of this treacherous virus.

The economic collapse we’ve witnessed in the past two months is mind-blowing. It defies anything we have seen in the last 100 years and is the fastest and deepest recession in American history.

Hopes for a V-shaped recovery are dissipating fast.

Economists are warning that we could be facing an unheard of 40% decline in GDP this quarter.

Every economic cycle is different. But, this particular COVID-19 recession and recovery will be especially different, given the cause. Revenues nosedived dramatically across many industries over the past two months and it will take time for those revenue streams to come back. It’s true, stocks are off their March lows right now. But, companies can’t make money if the economy has fallen off a cliff and can’t get back up very fast.

Attitudes are different regionally, of course. But, in some parts of the country, Americans are still afraid to go to the grocery store, let alone get on an airplane, rent a car and stay in a hotel.

There are now reports that a portion of the recent “temporary” layoffs will become permanent for millions of Americans as businesses make the difficult decision to shut down for good. Many Americans will not be returning to their old jobs because the businesses are closing down.

Fed officials warned last week of widespread business failures ahead.

“You will get business failures on a grand scale and you will be taking risks that you would go into depression” if shutdowns persist, Federal Reserve Bank of St. Louis President James Bullard said last week.

Meanwhile, Fed Chair Powell warned about the potential for lasting economic damage unless policymakers pass another economic stimulus plan.

But, we already have so much debt…

Staggering Debt

The U.S. Treasury announced a record $737.9 billion budget deficit in April, as the federal budget deficit continues to grow. That compares to a $160.3 billion surplus in April last year. The budget, of course, was destroyed by virus spending and the shift of the tax date, which is why April is usually a surplus month with the inflow of tax revenue.

While the COVID-19 pandemic is today’s crisis, the colossal debt load of our nation will be a crisis for the future that can’t be ignored. In this fast-changing world, gold is taking an increasingly strategic role in portfolio diversification.

Gold Shines Bright

Current gold investment demand remains at record high levels. As the stock market weakened last week, gold prices gained. Gold is trading at the highest level since late 2012. As the uncertainty over what lies ahead for the U.S. economy in the second half of the year, gold’s stellar performance shines a spotlight on its strategic role as a store of value, liquidity source and a wealth building vehicle.

Some money managers are comparing the current rising cycle in gold to the bull market of the 1970’s.

“Once the bull market started again in 1976, it went up for four years and it went up basically from $100 to $890, so nearly nine-fold. If you use the same ratio to today’s numbers, we would end up having gold, at some point in the future, $8,000, $9,000 gold, but we’re talking five to 10 years, I think,” Florian Grummes, managing director of Midas Touch Consulting said last week.

Silver Bull Run Is Beginning

The silver market climbed to a fresh 2-month high last week. Some analysts expect silver to outperform gold in the weeks ahead as industrial demand begins to pick up as countries begin to cautiously emerge from shelter-in-place and shutdown requirements.

Gold – A Replacement for Bonds

This pandemic is changing so many things. From the way we conduct our daily lives, to the interest rates offered at the bank, to debt levels our government is taking on…everything is different. It is also changing the attitude of investors toward bonds.

As we highlighted last week, but believe it is worth stating again, investors are turning to gold as a replacement for bonds in a world where central bank monetary policy is centered on ultra-low interest rates.

The Wells Fargo Investment Institute said in a recent report that gold is being utilized by investors as a substitute for holding long-term bonds as a perceived safe-haven investment. “With no particular ties to a government or other bond issuer, we believe gold looks attractive to long-term investors.”

Interest rates have been low since the 2008 crisis and never returned to normal levels. The COVID-19 recession and bear market ensures that near-zero interest rates could be a hallmark for the next decade too.

“In our view, more central banks will move towards explicit targets for government bond yields, a policy previously adopted in the US during the Second World War as debt surged,” Capital Economics said in a research note last week.

In this environment, it makes more sense than ever to consider increasing your allocation to tangible assets like physical gold.

Consider replacing a portion of your bond allocation with a hard asset like gold that 1) is increasing in value and, 2) is an asset that will preserve your purchasing power and, 3) is a financial asset that can’t be manipulated or weakened by central bank printing presses or governments besieged with enormous debt loads.

Best wishes,

David