What Does it Cost to Win in the Market Today?

Posted on — Leave a commentIn recent months retail investors have learned that the cost of winning is higher than it has ever been. The battle between hedge funds and retail investors has taken a toll on both sides costing billions and leaving many exhausted. By the end of the week each group was left distraught.

The fervor around GameStop offers many lessons. The most important of these lessons is this: things are not what they seem. Savvy investors who discovered this once undervalued stock have learned that there are far more forces at work in the market than previously realized. That is, the hedge funds have more weapons in their arsenal and more allies by their side than ever before. As a result, the latest chapter of the GameStop saga has the retail investors on unsure footing and the hedge funds battling catastrophic losses.

This story underscores the fact that the equities market is more complex than many ordinary investors realize. Fundamentals, once the key criteria for successful stock selection, have fallen out of favor as more investors seek momentum plays or opportunities to ride a wave of broad based investor optimism. Investing is a game that has only become more complex as the cast of characters grows to include social media, pundits, mainstream media, short sellers, and opportunistic hedge funds.

This tangle might explain why seasoned investors so often seek the relative stability of precious metals. Gold and silver offer a grounding force in a portfolio because they are often free from the kind of manipulation seen in equities and bonds.

Consider the example of counterparty risk. This is the risk that a person involved in a transaction may fail to deliver on their end of the agreement. Counterparty risk becomes a problem for bond investors when an issuer defaults and is unable to meet their obligations. Equity investors can also suffer from counterparty risk when the managers of the company fail to act in the best interest of the investors.

Gold is free from counterparty risk because it is an asset that does not require a group of people or board of directors to satisfy debt payments or to generate profits. The threat of counterparty risk to investors seems to be escalating today because managers of public companies face the distractions of dealing with competing groups of investors seeking ways to force share prices down or drive share prices up.

All of these new voices have become a roaring crowd that makes it more difficult for investors to single out the information needed to make a smart long-term decision. In contrast the value of precious metals are not tied to the ethos of a flashy CEO. They are not tied to the esoteric and sometimes underhanded strategies of monolithic hedge funds. As a universal asset recognized throughout the globe gold and silver have a value that is measured and understood by all nations rather than the whims of a marketplace characterized by a battle between retail investors and professional traders.

Simple solutions are best.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Blanchard Senior Portfolio Manager Separates Silver Facts from Fiction

Posted on — 1 Comment

The investing world spotlight shifted to silver this week. The same group of Internet day traders that drove GameStop dramatically higher in January turned their focus to silver. While the online message boards touted silver ETFs at first, the news triggered a rush into the physical silver market. The U.S. Mint’s silver coin sales jumped 24% to 4.775 million ounces last month – that was the highest for a January since 2017. Several U.S. major bullion dealers ran out of silver on the last day of January. The buying frenzy drove the price of silver to an 8-year high and unleashed massive market volatility.

As widespread commentary about silver – some true and some not true – circulated on websites, we spoke with David Zanca, a 25-year veteran of the precious metals industry and Senior Portfolio Manager at Blanchard and Company, to gain the inside scoop on recent silver market developments.

Editor: What type of misinformation are you seeing about the recent silver market volatility?

David Zanca: The most misleading statement is that there is no more silver available for investment in the United States. That’s not true.

I see dealers quoted stating that their demand over this past weekend was 10 times normal. That says nothing because their normal weekend demand could only be 10 ounces. It’s misleading.

Yes, there is a tremendous increase in a physical silver demand. But, do we know that it is 10 times? I don’t know.

Editor: What are you seeing in terms of silver pricing during the recent surge?

David Zanca: Some folks that are supposed to be legitimate firms are charging $12 and 15 over the spot price for silver products that can be had for only $6 over the spot price.

Editor: Let’s dive into what some of those terms mean in a minute. But, first, how are they getting away with that?

David Zanca: It’s because of the hype. There are many new, inexperienced and very excited investors – but they don’t know where to turn.

Editor: What drove silver prices to an 8-year high in the past few days?

David Zanca: The sleeping giant was awakened. The general public is concerned – and some are even fearful or angry – that the U.S. government is continuing to print money.

People work very hard to earn their money. Yet, the government devalues their hard work and their dollars by printing more money.

It’s not fair to anyone and especially to the average guy or the middle class.

Fear and anger are powerful motivators.

A new wave of investors is learning they can easily reduce their exposure to the U.S. dollar system – by trading their dollars for precious metals. We’ve seen the same phenomenon in bitcoin. Yet, metals are different because you can see it, you can hold it in your hands – gold and silver are tangible, physical assets. And, unlike the exploding paper money supply, precious metals have a very slowly increasing supply.

Editor: What was the trigger for this new wave of silver buying?

David Zanca: What happened is a lot of people started talking about it – and explaining how simple it was to trade dollars for metals. The Federal Reserve created the powder keg – by continuing to print money and devalue everyone’s wealth and work. And the Internet chat boards lit the fuse.

We are seeing more new clients than I have ever seen since 1994 when I first joined the precious metals industry.

People are scared. They read and hear about all this new money the Federal Reserve is printing and they know they need to protect themselves.

Now, it’s spreading like a wildfire. It’s spreading among people – how simple it is to trade your dollars for gold and silver.

Editor: Let’s talk about how the silver physical market is priced?

David Zanca: The basis for pricing a Silver American Eagle is the paper spot market.

When investment demand increases, those investors that own physical metals are rewarded because there is a limited amount of physical silver that can be used for investment.

When demand increases, the paper spot market price and the physical market price begin to separate and widen.

For example, the paper price could just move sideways in a narrow trading range. But, if physical demand increases – the physical price will continue to climb – and that separation will become greater. That is sometimes referred to as the “premium” over spot price.

A premium is typically about $4-8 over the spot price, depending on the product.

Editor: What’s happened to silver premiums lately and why?

David Zanca: The premiums have gone up. There is a tremendous increase in demand for physical investment silver. And, that demand rewards those who own the physical metal – they can demand more for the physical than what the paper spot price is reflecting. This is why investors should own physical metals rather than any form of paper like an ETF or gold mining stock.

Editor: What is the spot and physical price now?

David Zanca: The price of a one ounce American Silver Eagle is $34.46. The silver spot price is $26.78. The premium is the difference between those two prices. (Note: Current prices at the time of publication.)

When people see the spot price going down or not moving up as fast as the physical price – that is an indication that physical demand is rapidly accelerating.

Editor: Tell me again – how has the silver premium changed in recent days? It’s shocking.

David Zanca: As I mentioned, some folks that are supposed to be legitimate firms are charging $12 and 15 over spot for product that can be had for $6.00 over this spot.

Editor: How does Blanchard handle the premium?

David Zanca: We only move premiums when our costs rise. Any rise in price is due to our underlying costs to acquire the product.

Editor: How are Blanchard’s supplies?

David Zanca: Multiple products like fractional gold are completely sold out. Quarter ounce gold is sold out. Silver supplies are tightening quickly. Some product is in a delayed delivery status. Delayed delivery is inconsequential as long as your dealer – the source you are purchasing from – will allow you to liquidate even prior to delivery. Here at Blanchard – we do that. I’m not aware of any other firm that will do that for a client.

Editor: How can a metals investor find out what the fair pricing is?

David Zanca: New investors should try to actually speak on the phone to an advisor at the firm they wish to purchase from. At Blanchard, we create long-term relationships with our clients. We educate them and let them make an informed decision as to whether they want to invest or not.

Editor: What is the most important thing for new investors to know?

David Zanca: In years past, investing in gold and silver was regarded as a niche investment. Now, buying physical gold and silver has gone totally mainstream.

Precious metals are an incredible long-term investment appropriate for everyone’s portfolio. That importance is greater now than ever because of the actions of the Federal Reserve.

Supplies of silver have been getting tight for at least a year now. The Internet movement to buy silver only lit the fuse to the powder keg that the Federal Reserve built.

Precious metals should never be viewed as a short-term investment. Buying gold and silver bullion should be viewed as a vital portion of the long-term storage of your wealth.

Editor: What’s your outlook for silver over the next few years?

David Zanca: It’s incredibly positive, based on the massive increase that is taking place in the United States paper money supply.

The sleeping giant has been awakened. We are seeing new silver buyers coming from all areas of the country, all levels of income and all levels of wealth.

Yet, this is not just new investors. We are seeing this from long-term investors and high net-worth individuals that have that same frustration and concerns. They are trading out of dollars, out of bonds, out of CDs, out of money market funds, out of stocks they’ve sold, out of land they’ve sold and buying gold and silver bullion.

Many high net-worth investors tell me that they don’t trust the stock market right now. Bonds don’t pay anything, CDs don’t pay anything. Land, well, property ownership can be complicated.

Investors are concerned about a rapid rate of inflation.

They have no vehicle to protect themselves against that inflation other than physical gold, silver and rare coins, which have proven to be one of the absolute best hedges against inflation over time.

As long as the government continues to print money – there will be this intense demand for precious metals. The gold and silver that we are placing now may likely never come back to the market.

Editor: How can a new investor reach you or another portfolio manager at Blanchard?

David Zanca: Call 1-800-880-4653.

Editor: This was an enlightening interview. Thank you for your time.

David Zanca: My pleasure.

Blanchard is the nation’s largest and most respected tangible assets investment firm. Blanchard is family owned and has served clients for over 40 years.

Blanchard has deep roots in gold’s history in America. It was in 1933 that President Franklin D. Roosevelt prohibited private U.S. citizens from owning gold. Decades later, Blanchard’s founder, Jim Blanchard, rose to prominence as a supporter of American’s right to own gold in the early 1970s. Jim Blanchard gained national attention when he arranged for a biplane to tow a banner proclaiming “Legalize Gold” over President Richard Nixon’s inauguration in January 1973. His lobbying efforts were a success and, after more than 40 years, Congress once again legalized private ownership of gold bullion effective Dec. 31, 1974.

Once the gold restrictions were lifted, Jim Blanchard founded the company in 1975 and helped build it into one of the nation’s largest and most respected tangible asset investments firms.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The Odd Couple – Monroe Half Dollar

Posted on — Leave a comment What do Hollywood movie studios and the foreign policy declaration by President James Monroe, known as the Monroe Doctrine, have in common?

What do Hollywood movie studios and the foreign policy declaration by President James Monroe, known as the Monroe Doctrine, have in common?

No doubt it’s an odd pairing.

The answer is – a 1923 commemorative silver half dollar.

In the early 1920s, scandals were tarnishing the reputation of the motion picture industry. Within a span of a few months, actor Wallace Reid died from a drug overdose, director William Desmond Taylor was murdered under mysterious circumstances and “Fatty” Arbuckle was indicted for killing an actress.

The movie studios desperate to repair their image across America launched a public relations campaign. They founded a committee: the American Historical Revue and Motion Picture Historical Exposition, to tackle the project. Yet, they needed funding.

Call it creative financing?

The Exposition decided that a commemorative coin could serve them well – raising funds and also generating positive PR for the movie industry.

The committee members looked back in history 100 years and decided that the Monroe Doctrine of 1823 could make for a popular coin.

History buffs will remember this important foreign policy statement issued by President Monroe in 1823 which stated to the world in no uncertain terms that the U.S. would not tolerate European interference, control or influence in North and South America.

Thus, the idea for the Monroe Doctrine Centennial Half Dollar was born.

Ultimately, the commemorative coins were put on sale for $1 each. However, demand fell short of the total 274,077 silver coins that were minted.

Many Monroe Doctrine Centennial Half Dollars were released into circulation at face value after sales fell well short of that number – which is why collectors today will find this coin is typically offered in a circulated state.

A sculptor – Chester Beach – designed the elaborate silver coin. The obverse features the busts of Monroe and his Secretary of State in 1823, John Quincy Adams. Circling the coin are the inscriptions UNITED STATES OF AMERICA and HALF DOLLAR. On the left you will see: IN GOD WE TRUST, and on the right the date and mint mark.

Originally, the reverse was intended to be an image representing North and South America. However, instead, Beach created two female figures which were drawn in a rough approximation of the shape of each continent.

The North American figure holds a branch in her left hand in the area of northern Canada while passing a twig to South America through Central America with her right hand. The South American figure holds a cornucopia.

The coin also depicts the major ocean currents of the Atlantic and Pacific to signify the unimpeded flow of goods between the two continents thanks to the Monroe Doctrine. The inscriptions MONROE DOCTRINE CENTENNIAL and LOS ANGELES encircle the border of the reverse.

Are you curious? See the artistry of this truly unique coin here.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Regulators Are Paying Attention to Bitcoin

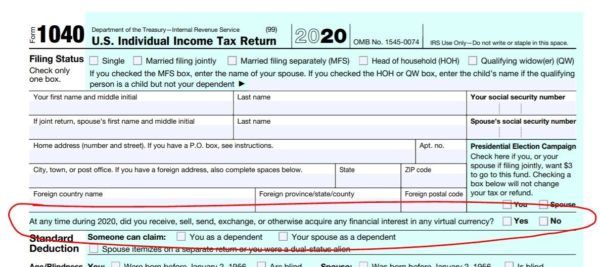

Posted on — Leave a commentYou bought Bitcoin because it was private. Now you have to check a box on page one of your IRS tax forms and show the government you have holdings.

What’s next from regulators?

Well, it turns out that central banks are going to create their own digital currencies! And not use Bitcoin.

Yes it’s true.

In recent months central banks have become increasingly engaged in digital currencies. They know they run the risk of becoming irrelevant if they don’t control digital payments – so they are working to create their own.

Central banks don’t want to cede control of the digital currency world to Big Tech firms – like the Facebook offering Diem (formerly known as Libra). Here are just a few examples of how central banks are getting into the digital currency action.

Central Bank Digital Currencies (CBDC) projects are going forward all across the world. Here’s a few examples:

- The Bahamas launched its CBDC, called the Sand Dollar, in late 2020. The Sand Dollar is a digital currency issued by the Bahamian central bank for use across the country via an app.

- The Bank of England is creating a settlement service to support a CBDC. It awarded Accenture a $200 million contract to build out a new payments service.

- The Bank of Japan appointed its top economist to oversee research on developing that nation’s CBDC.

- China is testing its digital yuan. China recently gave away $3 million of its digital currency, the e-yuan, through a lottery to its citizens. “Winners will receive a so-called “red packet” via an app containing a maximum of 200 yuan of the digital currency. A hundred thousand of these red packets will be distributed,” according to a Dec. 6, 2020 CNBC article. Those who receive the digital yuan can spend it on JD.com’s online shopping platform.

- Sweden is testing the e-Krona.

Don’t expect the Federal Reserve to be far behind.

Where does that leave Bitcoin?

Former Trump advisor Gary Cohn told CNBC he thinks the world will have a global cryptocurrency that is not Bitcoin.

“In my view, [Bitcoin] is not scalable, is not secure, is not decentralized, is not a currency, and remember, many central banks, starting now with the Chinese one, the Swedish, but even the eurozone, are starting to think about creating a central bank digital currency,” Nouriel Roubini, a professor of economics at NYU’s Stern School of Business said. “Once you have a central bank digital currency, every individual can use an account with the central bank to do payments.”

Legendary investor and Quantum Fund co-founder Jim Roger says if cryptocurrency succeeds in being used as money, instead of primarily for speculation, governments will intervene, making it illegal in order to stop its use.

For this reason, “I believe that the [value of] virtual currencies represented by Bitcoin will decline and eventually become zero,” Rogers said. “It is hard for us to move money without the control of the government. The government wants to know everything. Controllable electronic money will survive, and virtual currencies beyond the influence of the government will be eliminated.”

Central banks are now getting into the digital currency game. Does that spell the death knell for Bitcoin? Maybe. The experts warn that it might and Bitcoin could go to zero.

The evidence is building that if you’ve invested in Bitcoin, the time is right to liquidate, take your profits (while you still have them) and move to gold. Or, at the very least, scale down on your Bitcoin position.

You can then shift those profits into the other asset that central banks around the world continue to buy and hold – physical gold.

Gold. It’s in the midst of its own historic bull run – it’s an intrinsic store of value, a safe haven during crisis and a true hedge against the U.S. dollar and inflation.

We hope this Bitcoin article series has been useful. If you have questions, comments or would merely like to discuss this topic, please call a Blanchard portfolio manager today at 1-800-880-4653.

Part 1: Bitcoin Captures Imagination of Future Space Tourists

Part 2: Bitcoin at All Time Highs – What’s Next?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

4 Lessons from 2020

Posted on — Leave a commentLooking back on 2020 – it was an unprecedented year in so many ways. Yet, in other ways, we saw recurring themes that we’ve seen throughout history.

- Black Swan Events Can Happen Anytime

Rewind 12 month ago – back to early 2020 – the economy was strong and the stock market was climbing. Sure we’d heard about this virus in China – but we had no idea what kind of health, economic and financial carnage lay ahead.

Last year reminds us all that unexpected financial shocks can emerge at any time – without warning.

So-called Black Swan events “are characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight,” according to Investopedia.

Indeed – all those ring true for the Covid-19 crisis. Many state that world health officials have been bracing for a global pandemic for years. And, one hit last year – devastating our economy and markets for several quarters.

Did you see it coming? Most did not.

- Markets Continue to Break Records

Records are meant to be broken. In 2020, we saw gold climb to a historic, new all-time record high at $2,060 an ounce in August. While gold pulled back in a consolidation phase recently – as “risk on” attitudes drive stocks higher – the long-term uptrend in gold remains intact. Many Wall Street firms see potential for another record-breaking gold to unfold again this year. And, last year’s unprecedented actions by the Federal Reserve lay the seeds for a future inflationary crisis that could well be a major positive catalyst for gold prices in the years ahead.

- Don’t Fight the Fed

The old market adage, “don’t fight the Fed” worked. Despite massive unemployment and a huge reduction on GDP in several quarters last year – the stock market recovered from a bear market and hit new all-time record highs. Why? Don’t fight the Fed. The Federal Reserve unleashed its largest liquidity campaign in history – printing trillions of new dollars for quantitative easing and emergency spending measures. While the stock market may be one big asset bubble – hugely overvalued and at lofty heights – the Federal Reserve money printing successfully fueled a big risk rally – in a major economic disconnect between Wall Street and Main Street.

- The American Spirit Is Strong

Despite many health, political and economic challenges last year – the American spirit remains strong. The power of modern science delivered a COVID vaccine in record time – and while many challenges still lie ahead – those who bet on America are usually right.

Courage. Perseverance. Optimism. Rugged individualism. Compassion. Innovation.

Throughout history, Americans have dug deep, persevered and succeeded due to the strong American spirit in each one of us and our nation overall.

As we move into a new era – our American spirit will serve us well.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Bitcoin at All Time Highs – What’s Next?

Posted on — Leave a commentBitcoin climbed nearly 40% since the start of 2021 – breaking through the $40,000 mark. That was followed by a quick 10% slip the last two days, falling below the $32,000 level. This highlights the wild volatility of cryptocurrencies.

The escalating, hyperbolic, surge in Bitcoin has all the markings of a FOMO rally. That’s a term otherwise known as the ” fear of missing out.”

Yes, FOMO is running on full steam.

Are you thinking of investing in Bitcoin now?

Before you do, consider this.

“Bitcoin crashed hard in 2018, losing about 80% of its value. Investors still don’t really know why,” according to a Dec. 17, 2020 Bloomberg article.

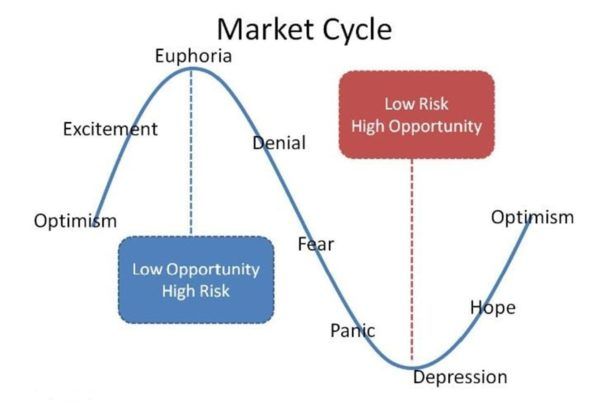

There’s an excellent chance that the Bitcoin boom is at a euphoric top. See the chart below.

Investors who buy into any market mania at this point in the cycle – often lose it all.

We’ve seen this before. And, no doubt we’ll see it again.

Tulip bulbs in 1637 in Holland. The South Seas bubble in 1720. The Dot.com bubble of the 1990’s which saw U.S. tech stocks crash 80% by October 2002. And the U.S. housing bubble which saw home prices nearly double from 1996 into 2006 and then crash in value by over 30% leading to the Great Recession of 2008.

What lies ahead for Bitcoin?

No one really knows.

Yet, we do know that smart investors take profits. There is an old market adage: “You can never go broke taking a profit.”

It’s not a true profit however, until you liquidate the position, sell it and get your money.

Don’t fall prey to recency bias

It is very common for investors to assume what has happened recently will continue to happen in the future.

Psychologists call this “recency bias.” It refers to the phenomenon where an individual more easily remembers recent events, compared to something that occurred in the past.

If you own Bitcoin right now, it could be easy to allow recency bias to impact your investing decisions. Beware. Simply put, the recency bias makes it easier for you to remember Bitcoin’s blistering rally in the first few days or 2021 versus the 2018 Bitcoin crash – where it lost 80% of its value.

Here’s the rub. Investors often mistakenly rely on recency bias to make investing decisions.

Don’t assume Bitcoin will continue to rise in value simply because it was soaring a few days ago.

There’s fear of missing out. There’s greed – hoping the price will go higher. There’s recency bias. None of these emotionally driven investing decisions usually work out well for investors.

It’s time to liquidate some or all of your Bitcoin position and move to gold. Take those profits as a gift – and turn them into something that can never disappear into thin air, get hacked, or crash to zero.

While there may be wild predictions for how high Bitcoin can climb, beware. There is still a significant lack of understanding on how the technology actually works, or how it could ever be used in commerce. And there are over 2,000 other cryptocurrencies – which means Bitcoin might not even be the right horse to bet on in the race.

Check back soon for our final installment in our Bitcoin series –where we will dig deeper into the regulatory environment which may trap investors in the future. And the solution that central banks see that could render Bitcoin useless. Please leave a comment or question below – we value your opinion!

Missed Article 1? Read it here: Bitcoin Captures Imagination of Future Space Tourists

We’d love to hear your comments and questions about Bitcoin below. Our portfolio managers are experts in the tangible assets field and are available to answer your questions and discuss the market outlook for gold and Bitcoin ahead. Please call Blanchard today at 1-800-880-4653.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Third Time’s a Charm

Posted on — Leave a commentIt took Congress three separate attempts – over a span of nearly 60 years – to approve the striking of a 2-cent coin.

The First Attempt

In the spring of 1806, Senator Uriah Tracy from Connecticut first introduced legislation to authorize the U.S. Mint to strike a two-cent coin.

Not everyone liked the idea.

Concerned about fraud, Mint Director Robert Patterson used his political might to stop the plan.

To illustrate his concerns, Patterson sent a brass button alongside two of the composite blanks for the proposed 2-cent coins to Senator Tracy to show how easy it would be to swap a button in the place of the proposed coin.

Senator Tracy backed down.

If at First You Don’t Succeed…

The idea of a 2-cent coin surfaced again in 1836.

President Andrew Jackson’s Treasury Secretary Levi Woodbury proposed a 2-cent coin for the second time. And, the mint assayer produced pattern coins for these pieces.

The Mint Director stepped in. Again.

Robert M. Patterson had taken the helm of the U.S. Mint – the son of Robert Patterson who had stalled the initial attempt back in 1806. Father like son! The young Patterson was also able to stop the 2-cent coin from becoming a reality.

Civil War Created a Third Opportunity

The onset of the Civil War in 1860 created a dramatic coin shortage throughout the divided nation. Citizens hoarded coins. The Treasury Department responded by issuing paper fractional currency – in denominations of 3, 5, 10, 15 and 25 and 50 cents to replace the nation’s silver coinage.

Congress passed the Act of April 22, 1864, which – after three tries – finally passed into a law a provision to create a bronze two-cent piece.

The 2-cent piece was the first coin to sport the motto IN GOD WE TRUST, backed by the support of Treasury Secretary Salmon P. Chase.

First minted in 1864, the 2-cent coin appeared as an initial success as the coin-starved public began to use and circulate the coins.

Yet, once the Civil War ended and regular coins reappeared in circulation, usage of the 2-cent coin dropped precipitously.

In the end, the short-lived circulation of the 2-cent coin was an experiment that failed.

The 2-cent coins were minted only from 1864 through 1873. These unique coins were greatly influenced by politics and war.

In 1865, the Confederate surrender ended the deadliest and most divisive war ever fought on American soil. Nearly 620,000 soldiers were killed, millions more were injured. We have a 2-cent coin from 1865, one of the most pivotal years in U.S. history.

You can see the intricate beauty of this historical masterpiece here.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Meet Me in St. Louis: The 1903 Louisiana Purchase Exposition Gold Dollar

Posted on — Leave a commentMany people forget how much of history is governed by chance. There is no better example of this than the circumstances leading up to the Louisiana Purchase. This enormous part of the U.S. passed through several owners before finally becoming a part of the nation’s identity.

Originally, the 530-million-acre section of land was owned by France because of French explorers who originally laid claim to the area in the late 1600s. During this time, the French built a few settlements near the Mississippi. However, by 1762 the French ceded the entire area to Spain via the Treaty of Fontainebleau. This agreement was conducted in secret as the French had recently suffered defeat in the Seven Years’ War. As a result, the territory west of the Mississippi fell to Spain while the territory to the east went to the British.

By 1799 Napoleon was in power in France. With his grand ambitions to revitalize the French empire he was able to reclaim, through formal agreements, the Louisiana territory from Spain. This arrangement was intended to be secret, however, President Thomas Jefferson learned of the transfer and immediately acted to secure the lower Mississippi area for the U.S. to ensure the port of New Orleans remained accessible to American shipping. The deal would end up being far more expansive, and expensive, than Jefferson imagined.

Napoleon was in fact prepared to sell all the territory. The reason: Napoleon believed that he was at risk of losing the region to the British. However, if he sold the area while it was still in his control, he could at least gain financial compensation for the territory. The U.S. paid $15 million for an area totaling 828,500 square miles. Officials signed the treaty in 1803. The result was the doubling in size of the United States.

Nearly 100 years later Congress authorized a $15 million budget for the Louisiana Purchase Exposition, which was popularly known as the St. Louis World’s Fair. The exhibition included participants from over 60 countries and nearly all the 45 states in existence at the time.

To commemorate the event Congress authorized the minting of 250,000 gold dollar coins. Farran Zerbe, the President of the American Numismatic Association at the time, proposed minting two designs to boost sales by enticing people to own the two-coin set.

Both coins would have the same design on the reverse, an olive branch, and the anniversary dates. The obverse of one coin would feature Thomas Jefferson’s profile, and the other would feature William McKinley’s profile. Initially, the intent was to sell the coins to those attending the World’s Fair for $3 each. This price made the coins relatively expensive given that it was triple the face value.

In total, 20 million people attended the fair and the popularity of the event inspired the song “Meet Me in St. Louis.” Today, the remaining exposition coins are a reminder of the earliest days of the nation and the chance events that gave rise to the expansive territory of the United States.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

Bitcoin Captures Imagination of Future Space Tourists

Posted on — Leave a commentWhat do an NFL player’s salary and paying for a hotel on Mars have in common?

The unlikely answer is Bitcoin.

Tech billionaire Elon Musk recently said any future economy on Mars could run on cryptocurrency.

But wait…will that cryptocurrency be Bitcoin?

No sir.

In fact, Musk suggested it could be the cryptocurrencies Dogecoin or Marscoin.

Many people don’t realize how many digital currencies there are!

As of January 2020, there are over 2,000 cryptocurrencies, Investopedia says.

That begs the question, if you are investing in crypto, how can you be sure you are betting on the right horse?

If you’ve been intrigued by Bitcoin and have even invested in it, you aren’t alone.

Everyone wants in on the action – even pro football players.

Russell Okung, a Pro Bowl tackle for the Carolina Panthers, tweeted back in May 2019 that he wanted to be paid a portion of his $13 million salary in Bitcoin.

While sports franchises do go to great lengths to keep their stars happy, this didn’t fly. “NFL players are paid in U.S. dollars,” a league spokesman said. However, Okung decided to convert 50% of his $13 million salary into Bitcoin.

Similarities and differences between gold and Bitcoin

For gold investors, it’s true. There may seem to be similarities between gold and Bitcoin. There are also important differences.

Scarcity

Gold. The physical metal has true scarcity – it is a physical commodity that must be mined from the ground. Eventually, we will run out of gold to mine, although when that will happen is still up for debate.

“While the growth in mine supply may slow or decline slightly in the coming years, as existing reserves are exhausted, and new major discoveries become increasingly rare, suggesting that production has peaked may still be a little premature,” Hannah Brandstaetter, a spokesman for the World Gold Council told BBC. As of now, the below-ground stock of gold reserves is currently estimated around 50,000 tonnes, according to the US Geological Survey.

Bitcoin. Scarcity has been one of the big drivers behind the recent speculative rally in Bitcoin.

Currently, the Bitcoin programmers have set a limit on the number of Bitcoins that can be mined at 21 million. But, unlike gold – there is no true scarcity.

“It’s possible that Bitcoin’s protocol will be changed to allow for a larger supply,” according to Investopedia. There’s nothing to stop the programmers from picking a new arbitrary number in the future.

A hedge against the U.S. dollar

Gold. Some gold investors are attracted to the metal’s proven diversification value and a hedge against the devaluation of the fiat currency. In the current era of Federal Reserve money printing, this is a legitimate concern.

Gold is an excellent choice to hedge against the U.S. dollar – as it is a proven store of value – with central banks and governments around the world recognizing that value. All major governments around the world themselves own tons and tons of gold.

Bitcoin. There’s no proof that Bitcoin will be a store of value, or that in fact governments won’t outlaw its use in the future – so it’s difficult to definitely say you can hedge against fiat currency with Bitcoin.

Privacy

Physical gold and rare coins offer investors the unique benefit of privacy. Indeed, many trust attorneys and retirement planning professionals recommend bullion and rare coins as an efficient and discreet method of transferring wealth to the next generation.

Bitcoin. Not so much anymore. The U.S. government is getting involved and they now ask you a question on page 1 of the 2020 U.S. Individual Tax Return.

The IRS wants to know:

“At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest, in any virtual currency?”

“When you sign the form, it’s under the penalty of perjury,” Ryan Losi, a certified public accountant at PIASCIK, a tax firm told Yahoo Finance. “The IRS is just gathering the data, changing the forms to expressly say you did or didn’t, and setting the trap, so in the coming years, the hammer can come down.”

Physical ownership

When you invest in gold, you take physical ownership. You can hold the gold in your hands. You can store it in your home safe or a safety deposit at a bank. Or, you can even elect to add physical precious metals to your IRA accounts.

Bitcoin. There is no physical ownership of anything. In fact, people have lost their Bitcoin to hackers, crooks and even by simply losing their Bitcoin private keys. Here’s just one story:

“A person in Switzerland had saved his Bitcoin private keys in a USB drive which he bought in 2009. In 2016, he transferred the file containing these private keys to his personal computer as the USB was on the brink of breaking. He thought he would buy another new USB and would save the files. However, before he could buy a new one and the software of the personal computer crashed and now, he had no back up of those private keys. The lost keys had the value of around $40000,” coinnounce reported.

Bitcoin isn’t real.

There’s no doubt there’s a speculative mania unfolding right now. But, remember the Tulip Bulb Mania in Holland in 1637. It is, of course, one of the most famous asset bubbles and market crashes of all time.

They were just tulip bulbs – just like you’d buy at your local garden center. Yet, “at the height of the bubble, tulips sold for approximately 10,000 guilders, equal to the value of a mansion on the Amsterdam Grand Canal,” Investopedia says.

Surely there are many predicting that Bitcoin will continue to climb in value. But, is this just hype?

Nouriel Roubini, a renowned professor of economics at NYU’s Stern School of Business, told Yahoo Finance in late December that Bitcoin and other cryptocurrencies have no place in retail or institutional investor portfolios. He stated that Bitcoin is not a stable store of value, it’s not an asset and has no intrinsic value.

Others warn that the Bitcoin boom may not hold up for much longer.

“For all the reasons it’s a strong developing asset class, it may fail,” Gary Cohn told Bloomberg last month.

Cohn served as President Trump’s first National Economic Council chief, holding the post until April 2018, spearheading the successful effort to roll back taxes. Prior to that, Cohn served as president and chief operating officer of Goldman Sachs for 26 years.

Cohn explained the Bitcoin “lacks some of the basic integrity of a real market.”

What’s your next move?

If you’ve invested in Bitcoin, you’ve likely made a significant profit. Given the uncertainty of what may lie ahead – including Bitcoin potentially crashing to zero, it may be worth considering cashing out of your crypto position – or taking a portion of those profits and turning them into a proven store of value – like physical gold.

Check back soon. We’ll continue to analyze the environment for Bitcoin and present our findings. Learn more about the government’s regulatory appetite to get involved in the crypto marketplace. And we’ll look at what central banks are doing now regarding digital currencies and what that could mean for Bitcoin ahead.

We’d love to hear your comments and questions about Bitcoin below. Our portfolio managers are experts in the tangible assets field and are available to answer your questions and discuss the market outlook for gold and Bitcoin ahead. Please call Blanchard today at 1-800-880-4653.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

How Gold Boosts Liquidity

Posted on — Leave a commentIn the U.S., gold is a often a means of storing, and growing wealth. In 2020 gold served this purpose well as its value climbed more than 24%. However, many gold investors in the U.S. are unaware of the unique ways that gold boosts liquidity for consumers abroad.

Gold ownership is common in Indian culture as it represents a level of economic status and often has cultural ties to special events, like marriage, in which it serves as a popular gift. As a result, India represents the highest demand for gold jewelry than any other country in the world. The popularity of gold in the country is one reason why so many people use it for more than ornamentation; they also use gold to boost liquidity.

It is common for gold owners in India to pledge their holdings as collateral for loans. Gold is an optimal asset for this purpose because its value is understood by all. Borrowers often enjoy faster loan processing times without onerous paperwork assuring income levels, or credit history. Moreover, a rise in the price of gold unlocks greater borrowing potential for loan seekers in the country.

Given the power of this relationship it is not surprising to learn that just over half of investors in India own some form of gold and that the average Indian household retains 11% of their wealth in gold. It is easy to see the appeal of gold ownership in a country where gold has generated an average annual return of 10.14% compared to an average annual return of 8.11% seen on the BSE SENSEX, an index of 30 companies on the Bombay Stock Exchange.

The relationship between gold and liquidity has increased in recent months as the pandemic continues to take a toll on personal finances. As gold-backed loans have soared so has competition among banks for the lending opportunities. Banks like HDFC, Federal Bank, Muthoot Finance, and Manappuram are all increasing the loans they issue in which gold serves as collateral and today India is home to a $46 billion gold loan industry.

To gain the full scope of this amount consider that as recently as late March of 2020 Muthoot and Manappuram together hold 248.4 tons of gold pledged by borrowers. This total equals nearly half of the European Central Bank’s reserves.

The ability to acquire short-term financial relief from gold underscores the far-ranging value of the asset. Gold can operate not only as a growth instrument and a reserve of wealth. It can also serve as an important bridge over the chasm that occasionally opens when the global financial picture fractures.

For the moment, it appears that the borrowing power unlocked by gold is a characteristic enjoyed abroad far more than it is in the US. Part of the reason for this difference is the fact that gold ownership among individuals is more normative in other countries. In the wake of the COVID crisis US households may awaken to the untapped potential of gold to provide financial security in the event of disaster.

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.